200f26952635aa8d7c377cfbdca032c3.ppt

- Количество слайдов: 7

How asset managers can stay a step ahead of regulators Amin Rajan Email: amin. rajan@create-research. co. uk

How asset managers can stay a step ahead of regulators Amin Rajan Email: amin. rajan@create-research. co. uk

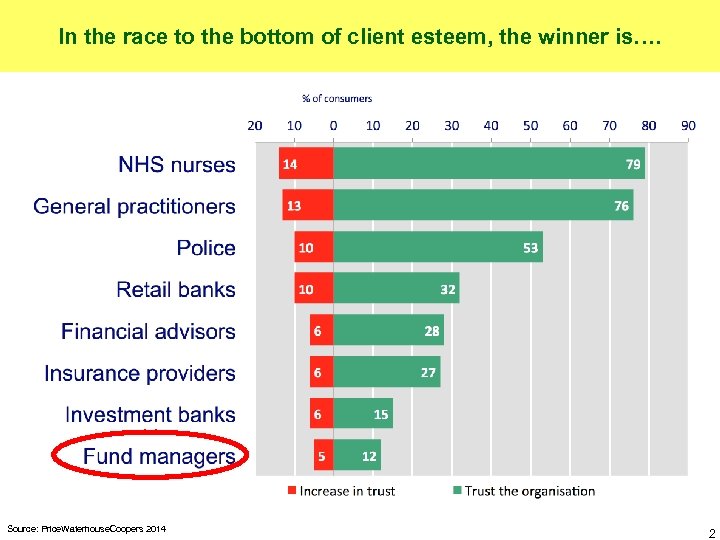

In the race to the bottom of client esteem, the winner is…. Source: Price. Waterhouse. Coopers 2014 2

In the race to the bottom of client esteem, the winner is…. Source: Price. Waterhouse. Coopers 2014 2

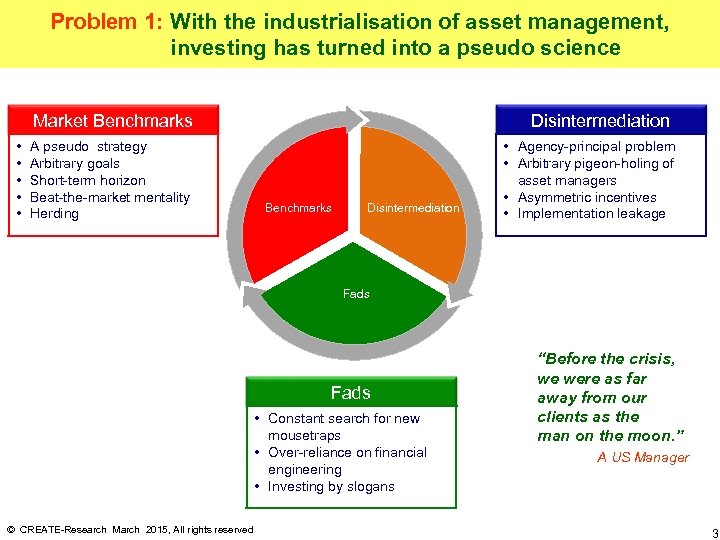

Problem 1: With the industrialisation of asset management, investing has turned into a pseudo science Market Benchmarks • • • A pseudo strategy Arbitrary goals Short-term horizon Beat-the-market mentality Herding Disintermediation Benchmarks Disintermediation • Agency-principal problem • Arbitrary pigeon-holing of asset managers • Asymmetric incentives • Implementation leakage Fads • Constant search for new mousetraps • Over-reliance on financial engineering • Investing by slogans © CREATE-Research March 2015, All rights reserved “Before the crisis, we were as far away from our clients as the man on the moon. ” A US Manager 3

Problem 1: With the industrialisation of asset management, investing has turned into a pseudo science Market Benchmarks • • • A pseudo strategy Arbitrary goals Short-term horizon Beat-the-market mentality Herding Disintermediation Benchmarks Disintermediation • Agency-principal problem • Arbitrary pigeon-holing of asset managers • Asymmetric incentives • Implementation leakage Fads • Constant search for new mousetraps • Over-reliance on financial engineering • Investing by slogans © CREATE-Research March 2015, All rights reserved “Before the crisis, we were as far away from our clients as the man on the moon. ” A US Manager 3

Problem 2: Features of investment products that inadvertently give rise to client dissatisfaction • No predictable outcomes • No replicable outcomes • No definable shelf life • Can’t be pre-tested in a lab • No fit-for-purpose certificate “Client expectations and market environment are everything. ” A UK Asset Manager Source: Upping The Innovation Game In A Winner Takes All World, CREATE-Research 2015, All rights reserved

Problem 2: Features of investment products that inadvertently give rise to client dissatisfaction • No predictable outcomes • No replicable outcomes • No definable shelf life • Can’t be pre-tested in a lab • No fit-for-purpose certificate “Client expectations and market environment are everything. ” A UK Asset Manager Source: Upping The Innovation Game In A Winner Takes All World, CREATE-Research 2015, All rights reserved

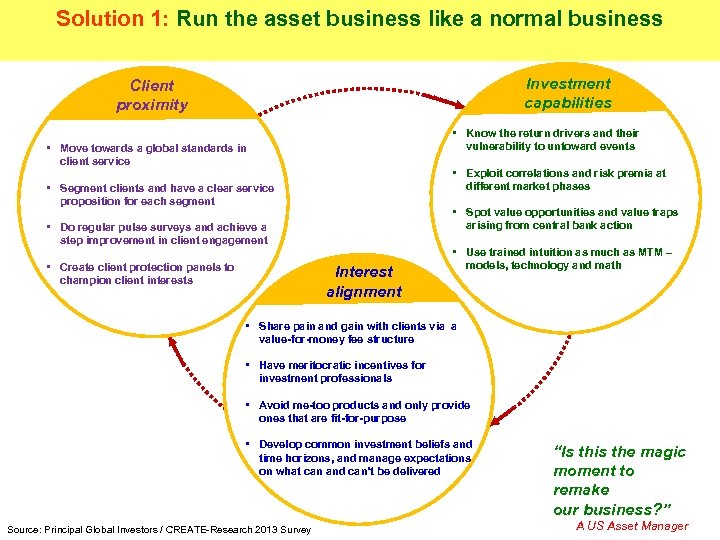

Solution 1: Run the asset business like a normal business Investment capabilities Client proximity • Know the return drivers and their vulnerability to untoward events • Move towards a global standards in client service • Exploit correlations and risk premia at different market phases • Segment clients and have a clear service proposition for each segment • Spot value opportunities and value traps arising from central bank action • Do regular pulse surveys and achieve a step improvement in client engagement • Create client protection panels to champion client interests Interest alignment • Use trained intuition as much as MTM – models, technology and math • Share pain and gain with clients via a value-for-money fee structure • Have meritocratic incentives for investment professionals • Avoid me-too products and only provide ones that are fit-for-purpose • Develop common investment beliefs and time horizons, and manage expectations on what can and can’t be delivered Source: Principal Global Investors / CREATE-Research 2013 Survey “Is this the magic moment to remake our business? ” A US Asset Manager

Solution 1: Run the asset business like a normal business Investment capabilities Client proximity • Know the return drivers and their vulnerability to untoward events • Move towards a global standards in client service • Exploit correlations and risk premia at different market phases • Segment clients and have a clear service proposition for each segment • Spot value opportunities and value traps arising from central bank action • Do regular pulse surveys and achieve a step improvement in client engagement • Create client protection panels to champion client interests Interest alignment • Use trained intuition as much as MTM – models, technology and math • Share pain and gain with clients via a value-for-money fee structure • Have meritocratic incentives for investment professionals • Avoid me-too products and only provide ones that are fit-for-purpose • Develop common investment beliefs and time horizons, and manage expectations on what can and can’t be delivered Source: Principal Global Investors / CREATE-Research 2013 Survey “Is this the magic moment to remake our business? ” A US Asset Manager

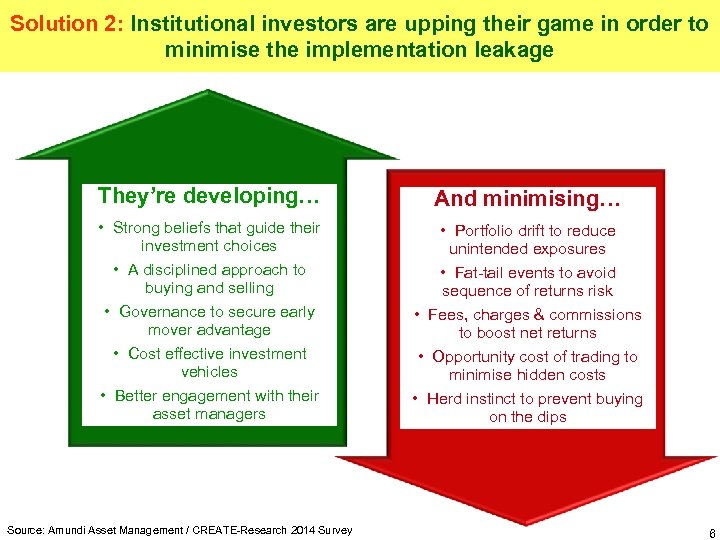

Solution 2: Institutional investors are upping their game in order to minimise the implementation leakage They’re developing… And minimising… • Strong beliefs that guide their investment choices • A disciplined approach to buying and selling • Governance to secure early mover advantage • Cost effective investment vehicles • Better engagement with their asset managers • Portfolio drift to reduce unintended exposures • Fat-tail events to avoid sequence of returns risk • Fees, charges & commissions to boost net returns • Opportunity cost of trading to minimise hidden costs • Herd instinct to prevent buying on the dips Source: Amundi Asset Management / CREATE-Research 2014 Survey 6

Solution 2: Institutional investors are upping their game in order to minimise the implementation leakage They’re developing… And minimising… • Strong beliefs that guide their investment choices • A disciplined approach to buying and selling • Governance to secure early mover advantage • Cost effective investment vehicles • Better engagement with their asset managers • Portfolio drift to reduce unintended exposures • Fat-tail events to avoid sequence of returns risk • Fees, charges & commissions to boost net returns • Opportunity cost of trading to minimise hidden costs • Herd instinct to prevent buying on the dips Source: Amundi Asset Management / CREATE-Research 2014 Survey 6

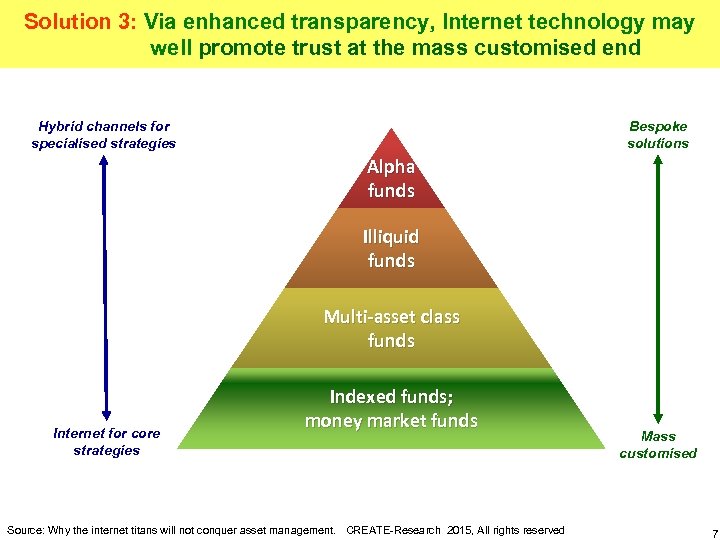

Solution 3: Via enhanced transparency, Internet technology may well promote trust at the mass customised end Hybrid channels for specialised strategies Bespoke solutions Alpha funds Illiquid funds Multi-asset class funds Internet for core strategies Indexed funds; money market funds Source: Why the internet titans will not conquer asset management. CREATE-Research 2015, All rights reserved Mass customised 7

Solution 3: Via enhanced transparency, Internet technology may well promote trust at the mass customised end Hybrid channels for specialised strategies Bespoke solutions Alpha funds Illiquid funds Multi-asset class funds Internet for core strategies Indexed funds; money market funds Source: Why the internet titans will not conquer asset management. CREATE-Research 2015, All rights reserved Mass customised 7