210d705766ab5db3808674c17487bccf.ppt

- Количество слайдов: 21

How A Developing Economy Embraces IFRS: Malaysia 25 March 2006 1

How A Developing Economy Embraces IFRS: Malaysia n Embrace: “Integral part of …” n n Malaysia’s experience vs Asia’s experience n n Historical, structural, political (will) Looking back 1972 - 2001 n n IFRS an integral part of the capital market & corporate governance structure Strategy & Challenges Looking forward 2006 - beyond n Strategy & Challenges 2

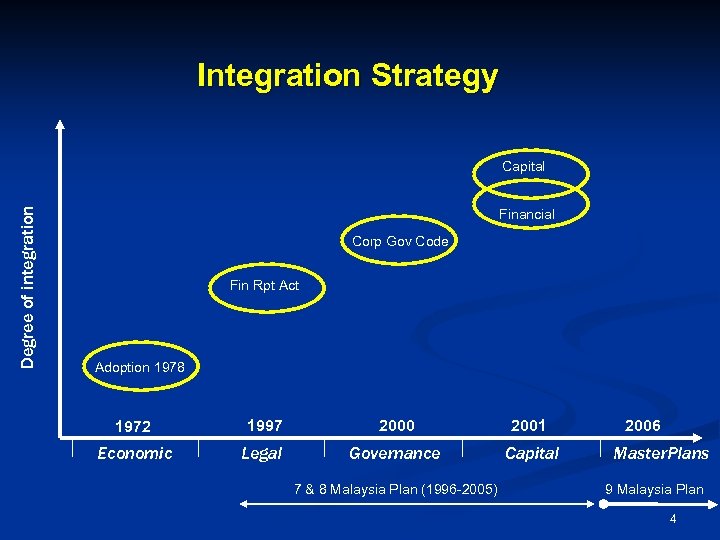

Integral part of the capital market & corporate governance structure n Malaysia has a history of a formal integration of accounting standards into the economic fabric since 1972 n Integration into law of the country in 1997, earlier than many others n Integration into governance structure in 2000 within Code of Corporate Governance n Integration into capital market in 2001 within: n n Capital Market Masterplan, and Financial Market Masterplan 3

Integration Strategy Degree of integration Capital Financial Corp Gov Code Fin Rpt Act Adoption 1978 1972 1997 2000 2001 Economic Legal Governance Capital 7 & 8 Malaysia Plan (1996 -2005) 2006 Master. Plans 9 Malaysia Plan 4

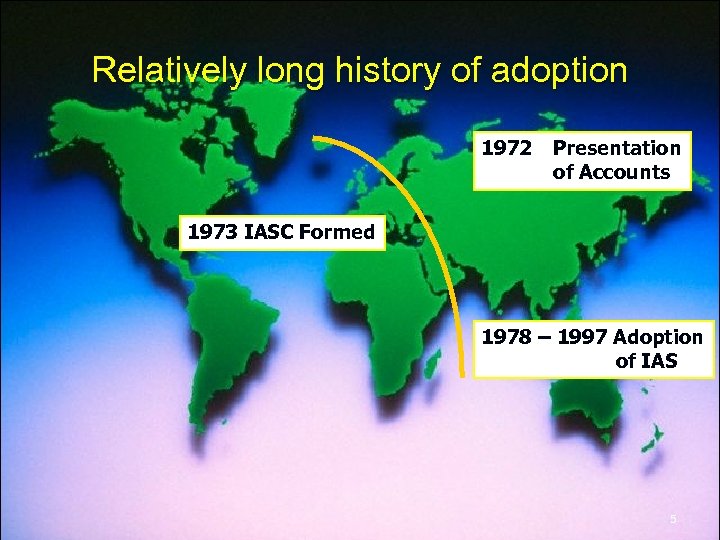

Relatively long history of adoption 1972 Presentation of Accounts 1973 IASC Formed 1978 – 1997 Adoption of IAS 5

om Econ ic 1978 - 1997 n 1978 Adoption of first 4 IAS by MACPA n 1986 Next 13 IAS adopted n 1992 All IAS adopted by MACPA and MIA n 1997 Accounting standards setting function taken over by Malaysian Accounting Standards Board under Act of Parliament 6

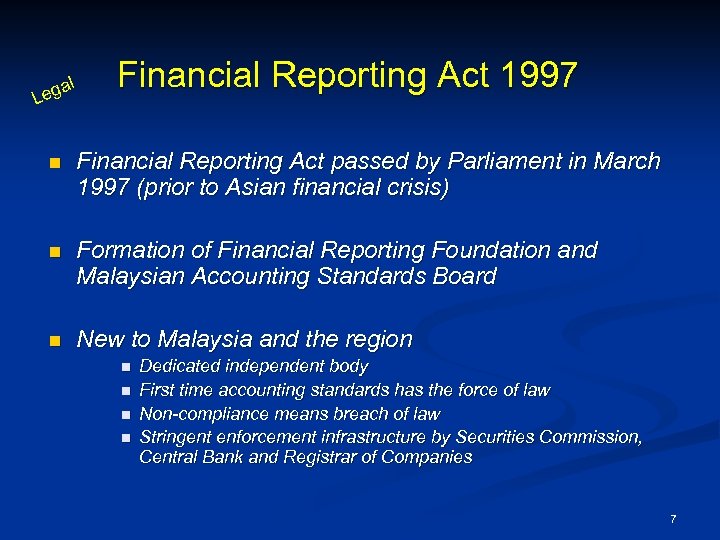

l ega L Financial Reporting Act 1997 n Financial Reporting Act passed by Parliament in March 1997 (prior to Asian financial crisis) n Formation of Financial Reporting Foundation and Malaysian Accounting Standards Board n New to Malaysia and the region n n Dedicated independent body First time accounting standards has the force of law Non-compliance means breach of law Stringent enforcement infrastructure by Securities Commission, Central Bank and Registrar of Companies 7

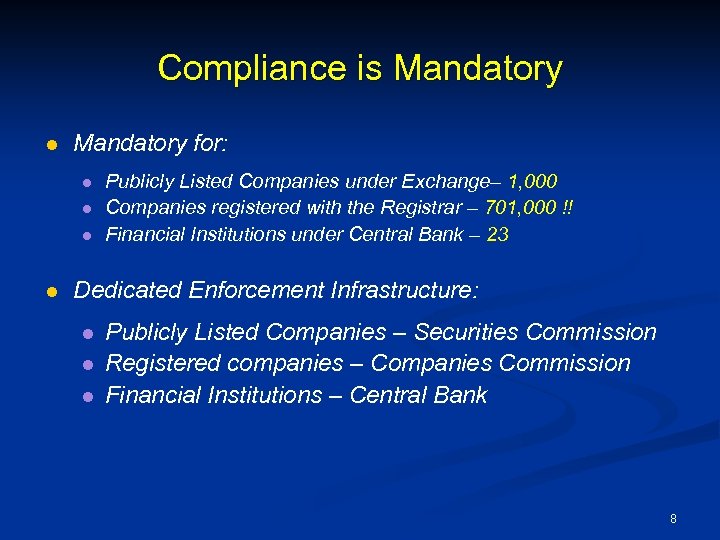

Compliance is Mandatory l Mandatory for: l l Publicly Listed Companies under Exchange– 1, 000 Companies registered with the Registrar – 701, 000 !! Financial Institutions under Central Bank – 23 Dedicated Enforcement Infrastructure: l l l Publicly Listed Companies – Securities Commission Registered companies – Companies Commission Financial Institutions – Central Bank 8

Malaysian Accounting Standards Board n Mandate: n n n Develop Islamic accounting standards n n Develop financial reporting standards Extensive consultative process Philosophy: independence Funded by: n Securities Commission (1/3) n Securities Exchange (1/3) n Ministry of Finance (1/3) n Public, accounting firms, NGOs (Nil) Indep e nden ce 9

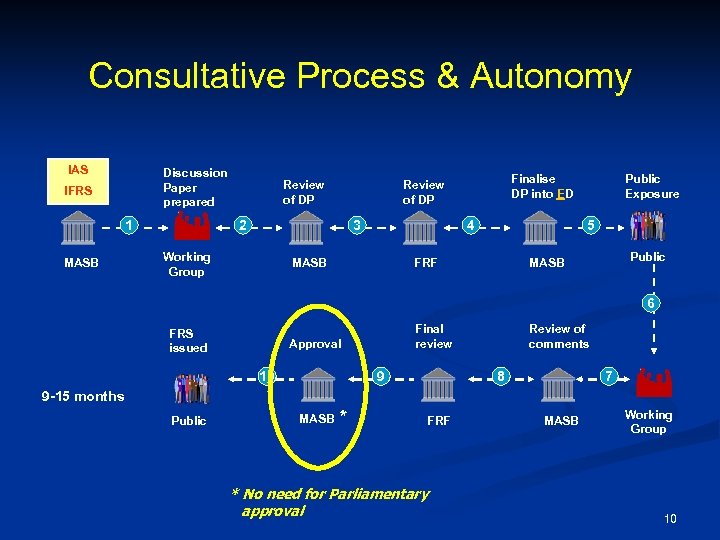

Consultative Process & Autonomy IAS Discussion Paper prepared IFRS 1 MASB Review of DP 2 3 Working Group Finalise DP into ED Review of DP 4 MASB Public Exposure 5 FRF Public MASB 6 FRS issued Final review Approval 10 9 Review of comments 8 7 9 -15 months Public MASB * FRF * No need for Parliamentary approval MASB Working Group 10

1997 – 2001: Harmonization • MASB Standards vs International Accounting Standards Harmonization • MASB Standards are IAS Plus • Similar to IAS, plus • Guidance added, plus • Other requirements added 11

al an & ce rn ve C it ap Integration with Master Plans Go n Malaysia’s 5 -year Master Plans n Code of Corporate Governance issued in 2000 n Capital Market Masterplan n Financial Sector Masterplan n “Recommendations for achieving highest standard for financial reporting for corporate governance among capital and financial market players in Malaysia” Issued in 2001 12

2005: Convergence Harmonization Convergence 13

Strategy n Malaysia n n n n Support convergence. IFRS Convergence not an issue. Question of managing implementation Participate early in standards setting development Objective: Ownership. Strictly adhere to due process, buy-in Discretion on implementation date for each standard Alliance with recognized bodies, lead if necessary Asia n Developing economies seem to have no choice but to converge n participate in free trade/globalization n funding for industrialization n No choice but to participate regionally, greater representation n No choice but to have regular discourse to identify commonalities, or diversities 14

Challenges n Malaysia n n n Changing mindset – old habits die hard, price for having long history Interpretations Managing change Cost of complex standards vs benefits to owner manager companies Region n n Lack of regional participation Lack of voice, representation n Where problems are common, countries must be forthcoming Where problems are not common, endeavour to find a consensus IASB n n n Developed economies focus Board representation Changing goalpost 15

Addressing Challenges – Changing mindset n Convergence impact: n n n Tough for many countries Suddenly have to migrate to new environment Accounting standards are now law of these countries n n n Australia (2002) Spore (2003) Phil (2004) Europe (2005) Language matters Malaysia – not as bad …relatively n n n Have been on IAS all along We made standards a law in 1997 Standards in English, no need for translation 16

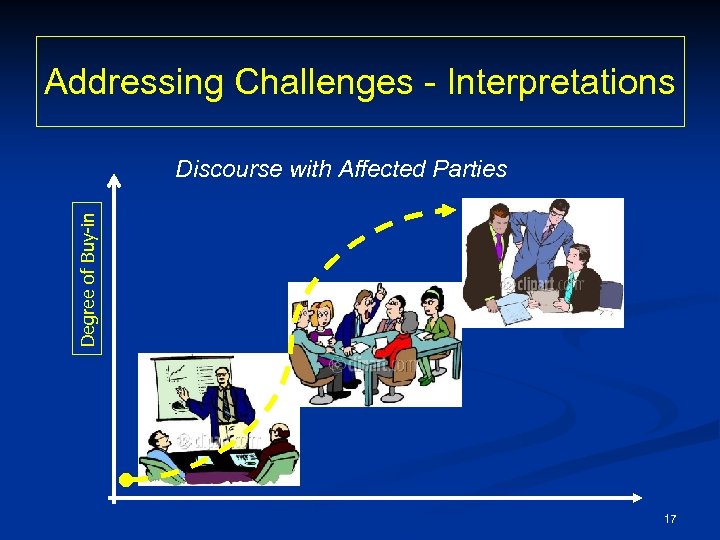

Addressing Challenges - Interpretations Degree of Buy-in Discourse with Affected Parties 17

Addressing Challenges – Sharing with others n n n Australia Hong Kong Hong. Kong NZealand Singapore Malaysia - eliminate choices redefine subsidiaries State controlled entities, leases agriculture, leases leasehold land implementation dates 18

Addressing Challenges – Costs vs Benefits n In Malaysia, 95% of 701, 000 companies are SMEs. Initial intent to cover ALL companies was noble. n But as Standards become more complex n Burden of compliance by SMEs becomes main issue n MASB announced 2 – tier reporting standard 1. 1. 2006 n PLCs, subsidiaries, assoc. , JV must comply IFRS n Other private entities: A choice of IFRS or MASB Standards (which are IAS compliant) 19

Moving Forward n Convergence is the way forward n Understanding the needs of developing economies important for significant buy-ins in the region n Challenges: Regional diversity remains a challenge n Help is needed: n n Goalposts keeps changing n n IFRS likely to remain complex Implementation on the ground Malaysia stands ready to offer: n Significant learning curve n Active in Islamic accounting standards n Common understanding about SMEs n Models to follow 20

Conclusion n Success of convergence contingent upon how developing economies “embrace” IFRS n Malaysia fortunate to have: n n a history infrastructure political will to drive international convergence n Others may not be as fortunate, but Asia can learn from each other n Asian diversity is a beauty n Malaysia stands ready 21

210d705766ab5db3808674c17487bccf.ppt