ae846872b79914d1a335c76d1d1bb546.ppt

- Количество слайдов: 25

Housing Panel Discussion Momina Aijazuddin Program Manager, Microfinance, MENA Region International Finance Corporation (IFC) Tunis – May 2008

Housing Panel Discussion Momina Aijazuddin Program Manager, Microfinance, MENA Region International Finance Corporation (IFC) Tunis – May 2008

Table of Contents • • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

Table of Contents • • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

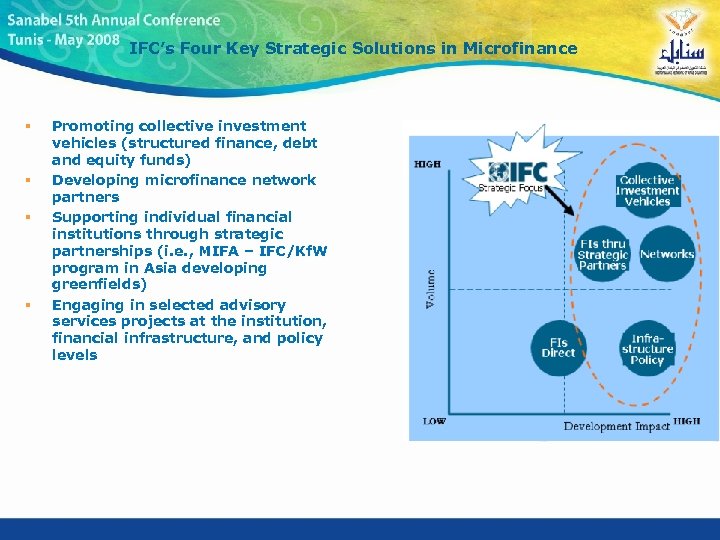

IFC’s Four Key Strategic Solutions in Microfinance § § Promoting collective investment vehicles (structured finance, debt and equity funds) Developing microfinance network partners Supporting individual financial institutions through strategic partnerships (i. e. , MIFA – IFC/Kf. W program in Asia developing greenfields) Engaging in selected advisory services projects at the institution, financial infrastructure, and policy levels

IFC’s Four Key Strategic Solutions in Microfinance § § Promoting collective investment vehicles (structured finance, debt and equity funds) Developing microfinance network partners Supporting individual financial institutions through strategic partnerships (i. e. , MIFA – IFC/Kf. W program in Asia developing greenfields) Engaging in selected advisory services projects at the institution, financial infrastructure, and policy levels

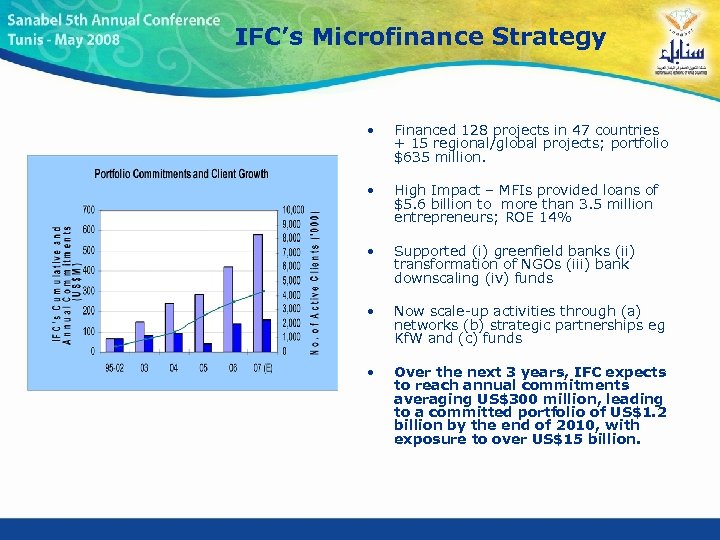

IFC’s Microfinance Strategy • Financed 128 projects in 47 countries + 15 regional/global projects; portfolio $635 million. • High Impact – MFIs provided loans of $5. 6 billion to more than 3. 5 million entrepreneurs; ROE 14% • Supported (i) greenfield banks (ii) transformation of NGOs (iii) bank downscaling (iv) funds • Now scale-up activities through (a) networks (b) strategic partnerships eg Kf. W and (c) funds • Over the next 3 years, IFC expects to reach annual commitments averaging US$300 million, leading to a committed portfolio of US$1. 2 billion by the end of 2010, with exposure to over US$15 billion.

IFC’s Microfinance Strategy • Financed 128 projects in 47 countries + 15 regional/global projects; portfolio $635 million. • High Impact – MFIs provided loans of $5. 6 billion to more than 3. 5 million entrepreneurs; ROE 14% • Supported (i) greenfield banks (ii) transformation of NGOs (iii) bank downscaling (iv) funds • Now scale-up activities through (a) networks (b) strategic partnerships eg Kf. W and (c) funds • Over the next 3 years, IFC expects to reach annual commitments averaging US$300 million, leading to a committed portfolio of US$1. 2 billion by the end of 2010, with exposure to over US$15 billion.

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

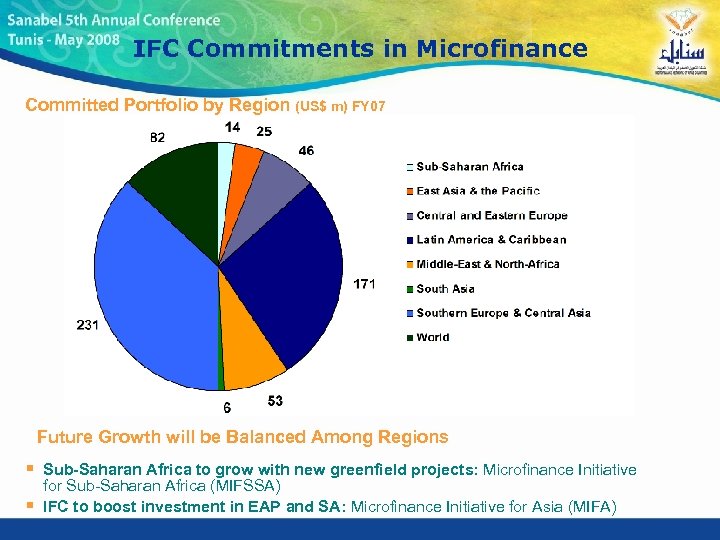

IFC Commitments in Microfinance Committed Portfolio by Region (US$ m) FY 07 Future Growth will be Balanced Among Regions § § Sub-Saharan Africa to grow with new greenfield projects: Microfinance Initiative for Sub-Saharan Africa (MIFSSA) IFC to boost investment in EAP and SA: Microfinance Initiative for Asia (MIFA)

IFC Commitments in Microfinance Committed Portfolio by Region (US$ m) FY 07 Future Growth will be Balanced Among Regions § § Sub-Saharan Africa to grow with new greenfield projects: Microfinance Initiative for Sub-Saharan Africa (MIFSSA) IFC to boost investment in EAP and SA: Microfinance Initiative for Asia (MIFA)

Microfinance MENA • • • # of Projects: 15 # of Clients: >1. 1 million Invested: US$70 million • Countries: Pakistan, Afghanistan, Yemen, Syria, Lebanon, West Bank & Gaza, Jordan, Tunisia, Algeria, Morocco Gross Loan Portfolio: US$520 million Women Borrowers: 825, 000 Instruments: Partial credit guarantees, dedicated country fund, Lcy, sovereign linked guarantees • •

Microfinance MENA • • • # of Projects: 15 # of Clients: >1. 1 million Invested: US$70 million • Countries: Pakistan, Afghanistan, Yemen, Syria, Lebanon, West Bank & Gaza, Jordan, Tunisia, Algeria, Morocco Gross Loan Portfolio: US$520 million Women Borrowers: 825, 000 Instruments: Partial credit guarantees, dedicated country fund, Lcy, sovereign linked guarantees • •

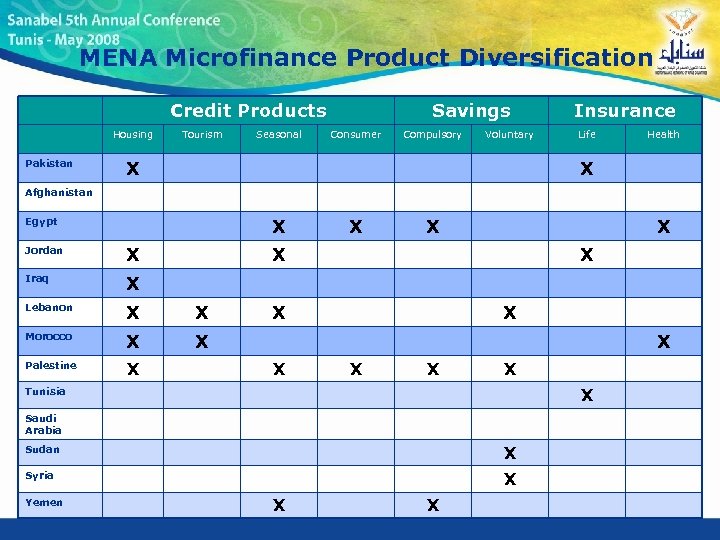

MENA Microfinance Product Diversification Credit Products Housing Pakistan Tourism Seasonal Savings Consumer Compulsory Voluntary X Insurance Life Health X Afghanistan X Egypt Jordan X Iraq X X Morocco X X Palestine X X Lebanon X X X Tunisia Saudi Arabia Sudan X Syria X Yemen X X

MENA Microfinance Product Diversification Credit Products Housing Pakistan Tourism Seasonal Savings Consumer Compulsory Voluntary X Insurance Life Health X Afghanistan X Egypt Jordan X Iraq X X Morocco X X Palestine X X Lebanon X X X Tunisia Saudi Arabia Sudan X Syria X Yemen X X

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

Defining Housing Microfinance Micro/Small loans made for housing that are not backed by mortgages. • Point 1 • Point 2 • Point 3 Here is an example of text written in blue color…

Defining Housing Microfinance Micro/Small loans made for housing that are not backed by mortgages. • Point 1 • Point 2 • Point 3 Here is an example of text written in blue color…

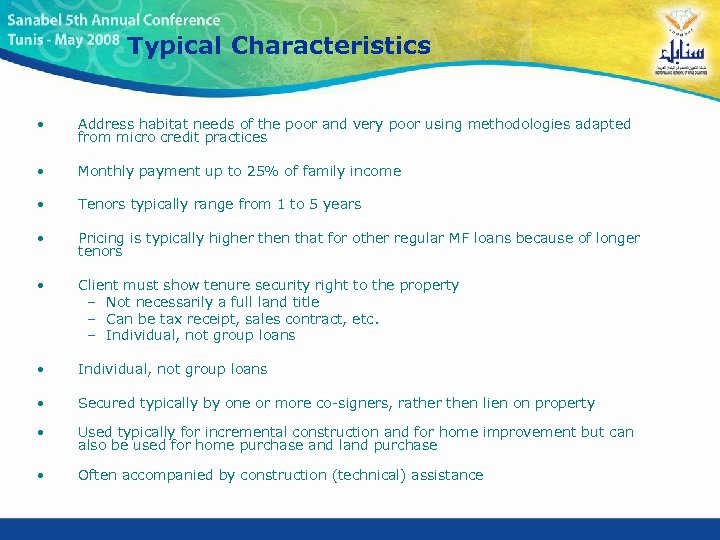

Typical Characteristics • Address habitat needs of the poor and very poor using methodologies adapted from micro credit practices • Monthly payment up to 25% of family income • Tenors typically range from 1 to 5 years • Pricing is typically higher then that for other regular MF loans because of longer tenors • Client must show tenure security right to the property – Not necessarily a full land title – Can be tax receipt, sales contract, etc. – Individual, not group loans • Secured typically by one or more co-signers, rather then lien on property • Used typically for incremental construction and for home improvement but can also be used for home purchase and land purchase • Often accompanied by construction (technical) assistance

Typical Characteristics • Address habitat needs of the poor and very poor using methodologies adapted from micro credit practices • Monthly payment up to 25% of family income • Tenors typically range from 1 to 5 years • Pricing is typically higher then that for other regular MF loans because of longer tenors • Client must show tenure security right to the property – Not necessarily a full land title – Can be tax receipt, sales contract, etc. – Individual, not group loans • Secured typically by one or more co-signers, rather then lien on property • Used typically for incremental construction and for home improvement but can also be used for home purchase and land purchase • Often accompanied by construction (technical) assistance

Commercial Reasons to Launch HMF • High demand • Amounts, payments and guarantees are accessible to low-income families • Reduces risk of financing housing within the microenterprise portfolio ― In some countries 20% to 25% of business loans used for housing • Builds client loyalty

Commercial Reasons to Launch HMF • High demand • Amounts, payments and guarantees are accessible to low-income families • Reduces risk of financing housing within the microenterprise portfolio ― In some countries 20% to 25% of business loans used for housing • Builds client loyalty

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

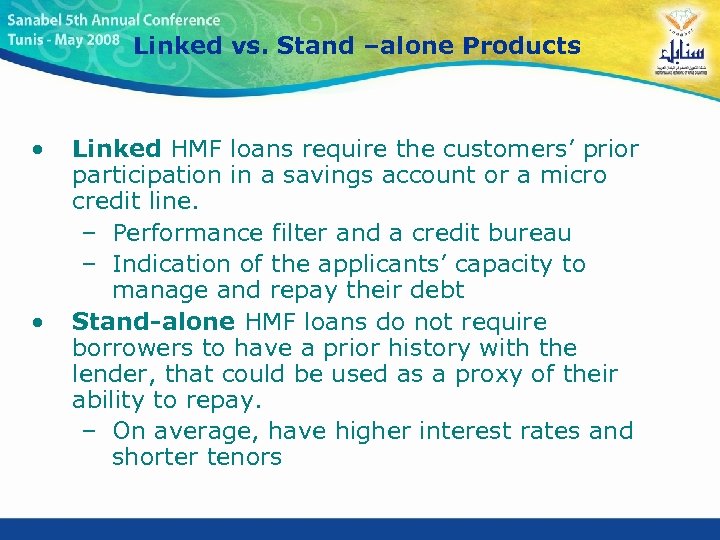

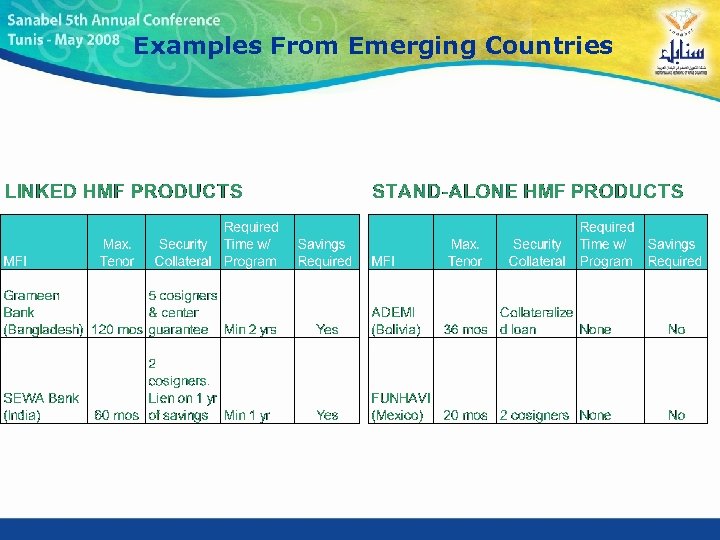

Linked vs. Stand –alone Products • • Linked HMF loans require the customers’ prior participation in a savings account or a micro credit line. – Performance filter and a credit bureau – Indication of the applicants’ capacity to manage and repay their debt Stand-alone HMF loans do not require borrowers to have a prior history with the lender, that could be used as a proxy of their ability to repay. – On average, have higher interest rates and shorter tenors

Linked vs. Stand –alone Products • • Linked HMF loans require the customers’ prior participation in a savings account or a micro credit line. – Performance filter and a credit bureau – Indication of the applicants’ capacity to manage and repay their debt Stand-alone HMF loans do not require borrowers to have a prior history with the lender, that could be used as a proxy of their ability to repay. – On average, have higher interest rates and shorter tenors

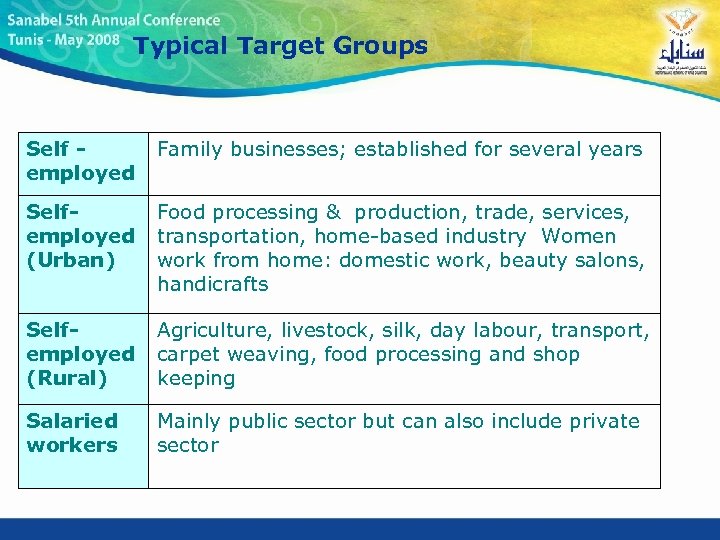

Typical Target Groups Self employed Family businesses; established for several years Selfemployed (Urban) Food processing & production, trade, services, transportation, home-based industry Women work from home: domestic work, beauty salons, handicrafts Selfemployed (Rural) Agriculture, livestock, silk, day labour, transport, carpet weaving, food processing and shop keeping Salaried workers Mainly public sector but can also include private sector

Typical Target Groups Self employed Family businesses; established for several years Selfemployed (Urban) Food processing & production, trade, services, transportation, home-based industry Women work from home: domestic work, beauty salons, handicrafts Selfemployed (Rural) Agriculture, livestock, silk, day labour, transport, carpet weaving, food processing and shop keeping Salaried workers Mainly public sector but can also include private sector

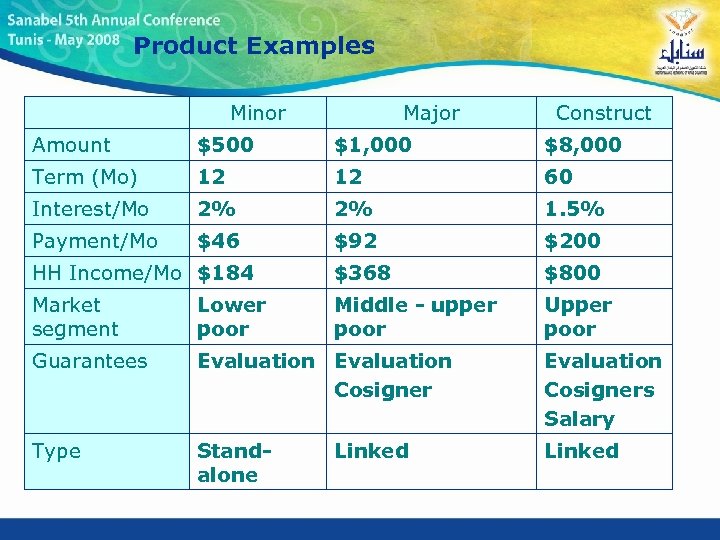

Product Examples Minor Major Construct Amount $500 $1, 000 $8, 000 Term (Mo) 12 12 60 Interest/Mo 2% 2% 1. 5% Payment/Mo $46 $92 $200 HH Income/Mo $184 $368 $800 Market segment Lower poor Middle - upper poor Upper poor Guarantees Evaluation Cosigners Salary Type Standalone Linked

Product Examples Minor Major Construct Amount $500 $1, 000 $8, 000 Term (Mo) 12 12 60 Interest/Mo 2% 2% 1. 5% Payment/Mo $46 $92 $200 HH Income/Mo $184 $368 $800 Market segment Lower poor Middle - upper poor Upper poor Guarantees Evaluation Cosigners Salary Type Standalone Linked

Examples From Emerging Countries

Examples From Emerging Countries

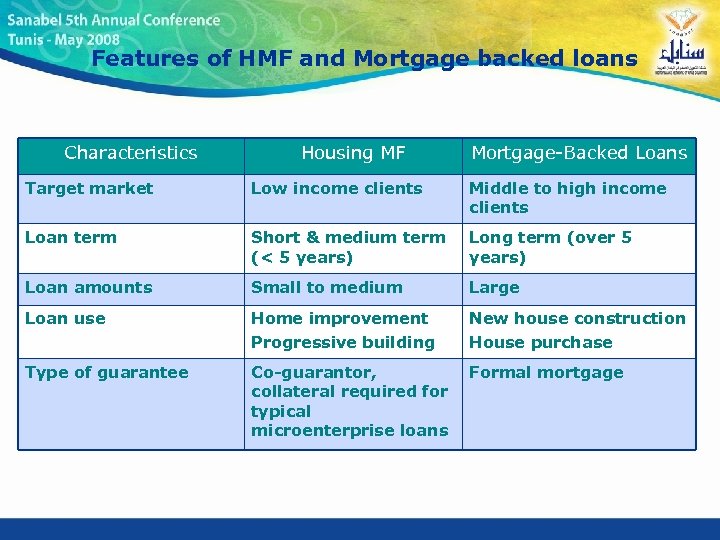

Features of HMF and Mortgage backed loans Characteristics Housing MF Mortgage-Backed Loans Target market Low income clients Middle to high income clients Loan term Short & medium term (< 5 years) Long term (over 5 years) Loan amounts Small to medium Large Loan use Home improvement Progressive building New house construction House purchase Type of guarantee Co-guarantor, collateral required for typical microenterprise loans Formal mortgage

Features of HMF and Mortgage backed loans Characteristics Housing MF Mortgage-Backed Loans Target market Low income clients Middle to high income clients Loan term Short & medium term (< 5 years) Long term (over 5 years) Loan amounts Small to medium Large Loan use Home improvement Progressive building New house construction House purchase Type of guarantee Co-guarantor, collateral required for typical microenterprise loans Formal mortgage

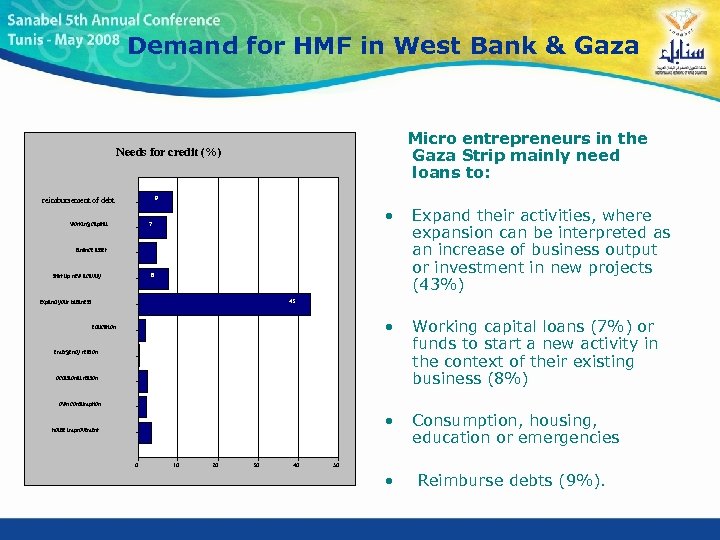

Demand for HMF in West Bank & Gaza Micro entrepreneurs in the Gaza Strip mainly need loans to: Needs for credit (%) 9 reimbursement of debt • Working capital loans (7%) or funds to start a new activity in the context of their existing business (8%) • 7 Expand their activities, where expansion can be interpreted as an increase of business output or investment in new projects (43%) • working capital Consumption, housing, education or emergencies • Reimburse debts (9%). finance asset 8 start up new activity 43 expand your business education emergency reason occasional reason own consumption house improvement 0 10 20 30 40 50

Demand for HMF in West Bank & Gaza Micro entrepreneurs in the Gaza Strip mainly need loans to: Needs for credit (%) 9 reimbursement of debt • Working capital loans (7%) or funds to start a new activity in the context of their existing business (8%) • 7 Expand their activities, where expansion can be interpreted as an increase of business output or investment in new projects (43%) • working capital Consumption, housing, education or emergencies • Reimburse debts (9%). finance asset 8 start up new activity 43 expand your business education emergency reason occasional reason own consumption house improvement 0 10 20 30 40 50

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

Challenges for MFIs • Financial services vs Subsidy • Limited Access to Medium/ LT funding • Revised individual lending methodologies • Capacity building for staff • Effective guarantee mechanisms • Unclear security of tenure in some countries

Challenges for MFIs • Financial services vs Subsidy • Limited Access to Medium/ LT funding • Revised individual lending methodologies • Capacity building for staff • Effective guarantee mechanisms • Unclear security of tenure in some countries

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

• • • IFC and Microfinance MENA Defining Housing Microfinance Products Challenges for MFIs Solutions

Potential Solutions • Market Research/Survey • Technical Assistance Program – toolkit, lending policies, training, pilots • Partnerships with banks and international agencies for 3 -5 year credit lines • Link to capital markets

Potential Solutions • Market Research/Survey • Technical Assistance Program – toolkit, lending policies, training, pilots • Partnerships with banks and international agencies for 3 -5 year credit lines • Link to capital markets

Example of linking MFIs to Capital Markets EFSE • Promoted by Kf. W, managed by Oppenheim Pramerica, advised by Bankakedemie • Leverages investors funds for up to 7 years in different risk tranches – IFC, EBRD, NDFC, Kf. W and private investors • Provides funds, capacity building and training, product development and market studies, and impact studies for partner lending institutions: Banks and MFIs • Recipients: MSEs and private households

Example of linking MFIs to Capital Markets EFSE • Promoted by Kf. W, managed by Oppenheim Pramerica, advised by Bankakedemie • Leverages investors funds for up to 7 years in different risk tranches – IFC, EBRD, NDFC, Kf. W and private investors • Provides funds, capacity building and training, product development and market studies, and impact studies for partner lending institutions: Banks and MFIs • Recipients: MSEs and private households

Thank you for your attention

Thank you for your attention