501e573e1c684781040152aa5d1e6828.ppt

- Количество слайдов: 26

Housing Options

Housing Options

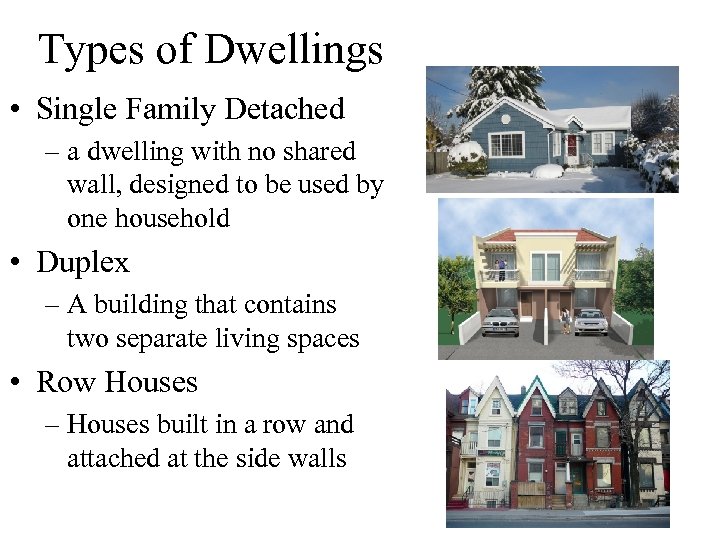

Types of Dwellings • Single Family Detached – a dwelling with no shared wall, designed to be used by one household • Duplex – A building that contains two separate living spaces • Row Houses – Houses built in a row and attached at the side walls

Types of Dwellings • Single Family Detached – a dwelling with no shared wall, designed to be used by one household • Duplex – A building that contains two separate living spaces • Row Houses – Houses built in a row and attached at the side walls

Types of Dwellings • Townhouse – Dwellings of two or more stories attached at side walls to other units in a multiple-family complex • Apartment – Rental units located in a variety of settings from older homes to high-rise buildings

Types of Dwellings • Townhouse – Dwellings of two or more stories attached at side walls to other units in a multiple-family complex • Apartment – Rental units located in a variety of settings from older homes to high-rise buildings

Types of Ownership • Condominiums – Individual ownership of a unit and shared ownership of common areas such as hallways and exterior grounds • Cooperative – Ownership of shares in a corporation that owns and entire property (like a timeshare)

Types of Ownership • Condominiums – Individual ownership of a unit and shared ownership of common areas such as hallways and exterior grounds • Cooperative – Ownership of shares in a corporation that owns and entire property (like a timeshare)

Buying a Home

Buying a Home

Understanding Home Financing • Very few people can pay for a house outright • Most home buyer take our a mortgage • Mortgage is a long-term home loan where the home is the collateral

Understanding Home Financing • Very few people can pay for a house outright • Most home buyer take our a mortgage • Mortgage is a long-term home loan where the home is the collateral

Cost of Buying a Home • Down Payment: part of the purchase price that is paid up front - 5% to 20% • Closing Costs: various fees that must be paid by the buyer or the seller at the time the purchase is finalized

Cost of Buying a Home • Down Payment: part of the purchase price that is paid up front - 5% to 20% • Closing Costs: various fees that must be paid by the buyer or the seller at the time the purchase is finalized

Cost of Buying a Home • Monthly Loan Payment: – At first, each of the monthly mortgage payment goes to pay for the interest on the loan – Only a small amount goes to pay down on the principal (original amount borrowed) – With each payment, the portion paid toward the principal increases. • Other Continuing Costs – Property Taxes - based on the value of the home – Insurance - Lenders usually will not issue a mortgage without proof of home insurance – Association Fees - up keep of common areas

Cost of Buying a Home • Monthly Loan Payment: – At first, each of the monthly mortgage payment goes to pay for the interest on the loan – Only a small amount goes to pay down on the principal (original amount borrowed) – With each payment, the portion paid toward the principal increases. • Other Continuing Costs – Property Taxes - based on the value of the home – Insurance - Lenders usually will not issue a mortgage without proof of home insurance – Association Fees - up keep of common areas

What Can You Afford • How much a person can afford to pay for a home – Income – Savings – Debt • General Rule: Principal, interests, property taxes and insurance should NOT exceed 29% of gross income (income before taxes) – If a buyer as too little savings or too much other debt then a lender may not approve a loan as high as 29%

What Can You Afford • How much a person can afford to pay for a home – Income – Savings – Debt • General Rule: Principal, interests, property taxes and insurance should NOT exceed 29% of gross income (income before taxes) – If a buyer as too little savings or too much other debt then a lender may not approve a loan as high as 29%

Prequalified Buyer • Buy presents info – Income, assets and debt • Lender calculated how large a loan is LIKELY to be approved • No legal obligation - just a general letter of willingness to loan a certain amount to a person

Prequalified Buyer • Buy presents info – Income, assets and debt • Lender calculated how large a loan is LIKELY to be approved • No legal obligation - just a general letter of willingness to loan a certain amount to a person

Types of Mortgages • Fixed Rate Mortgage: Interest rate and monthly payment amount remain the same for the life of the loan. (Also known as a “conventional loan”) – May pay higher rate but cost will NOT change • Adjustable Rate Mortgage (ARM): Interest rate changes to reflect changes in the economy. – Initial rate is usually lower than that for a fixed rate mortgage. But the owner doesn’t know whether their monthly payment will increase. • Gradual Rate Mortgage: Payments start low and increase in the later years of the loan

Types of Mortgages • Fixed Rate Mortgage: Interest rate and monthly payment amount remain the same for the life of the loan. (Also known as a “conventional loan”) – May pay higher rate but cost will NOT change • Adjustable Rate Mortgage (ARM): Interest rate changes to reflect changes in the economy. – Initial rate is usually lower than that for a fixed rate mortgage. But the owner doesn’t know whether their monthly payment will increase. • Gradual Rate Mortgage: Payments start low and increase in the later years of the loan

Special Loans • FHA Loans: Federal Housing Administration insures loans to low and moderate income families who might not otherwise qualify for a mortgage • VA Loan: Dept. of Veteran Affairs insures loans to people who served in the armed services • Loans for Rural Home Buyers: Loan through the Dept. of Agriculture’s Rural Housing Service • 1 st Time Buyer Program: loans for 1 st buyers with lower interests rate

Special Loans • FHA Loans: Federal Housing Administration insures loans to low and moderate income families who might not otherwise qualify for a mortgage • VA Loan: Dept. of Veteran Affairs insures loans to people who served in the armed services • Loans for Rural Home Buyers: Loan through the Dept. of Agriculture’s Rural Housing Service • 1 st Time Buyer Program: loans for 1 st buyers with lower interests rate

Comparing Mortgage Terms • Compare various loan options at different institutions (banks, credit unions, etc) • Comparing the interest rates of different loans • Since mortgages are long term, even a fraction of a percentage point can save thousands of dollars over the years

Comparing Mortgage Terms • Compare various loan options at different institutions (banks, credit unions, etc) • Comparing the interest rates of different loans • Since mortgages are long term, even a fraction of a percentage point can save thousands of dollars over the years

Comparing Mortgage Terms • Length of the Loan Term – 15 to 30 years • 15 Year: Lower interest rate but higher monthly payments • 30 Year: Higher interest rate but lower monthly payments • 30 year mortgages can be paid off sooner by making additional payments towards the principal • Points: one-time finance charges paid at the beginning of the loan. Each point in 1% of the loan amount

Comparing Mortgage Terms • Length of the Loan Term – 15 to 30 years • 15 Year: Lower interest rate but higher monthly payments • 30 Year: Higher interest rate but lower monthly payments • 30 year mortgages can be paid off sooner by making additional payments towards the principal • Points: one-time finance charges paid at the beginning of the loan. Each point in 1% of the loan amount

Finding a Home • Classified Ads: newspaper have sections devoted to homes • Open Houses: walk through a house that is for sale and ask questions about it • Internet: Real estate companies have their own websites

Finding a Home • Classified Ads: newspaper have sections devoted to homes • Open Houses: walk through a house that is for sale and ask questions about it • Internet: Real estate companies have their own websites

Finding a Home • Working with an agent: agents have access to a multiple listing service (MLS) • Agents usually don’t charge a fee to work with them • Agents receive a commission from the seller usually based on the value of the house.

Finding a Home • Working with an agent: agents have access to a multiple listing service (MLS) • Agents usually don’t charge a fee to work with them • Agents receive a commission from the seller usually based on the value of the house.

Completing the Purchase • Buyer makes an offer – Usually less than asking price • Seller usually counters the offer • Once a price is agreed upon, the buyer makes a deposit – If the buyer backs out, the seller may keep the deposit – If the buyer continues, then the it is applied towards the down payment

Completing the Purchase • Buyer makes an offer – Usually less than asking price • Seller usually counters the offer • Once a price is agreed upon, the buyer makes a deposit – If the buyer backs out, the seller may keep the deposit – If the buyer continues, then the it is applied towards the down payment

Completing the Purchase • Contingency: Conditions to be met in order forte sale to occur (ability to obtain financing, inspections for termites, asbestos, etc) • Once the buyer and seller sign the contract, it is legally binding

Completing the Purchase • Contingency: Conditions to be met in order forte sale to occur (ability to obtain financing, inspections for termites, asbestos, etc) • Once the buyer and seller sign the contract, it is legally binding

Obtaining a Loan • Once the loan application is completed, it can take weeks for it to be approved • Interest rate is locked in and cannot change before the deal is completed. – Even if the prevailing interest rate moves up or down

Obtaining a Loan • Once the loan application is completed, it can take weeks for it to be approved • Interest rate is locked in and cannot change before the deal is completed. – Even if the prevailing interest rate moves up or down

Closing the Deal • A meeting of the seller, buyer and agents at which the property sale become final • Ahead of time the buyer… – Receives written statement itemizing the down payment and closing costs – Obtains a cashier’s check and brings it to the closing meeting • After the legal documents are signed and money is exchanged, the buyer is finally the owner of the home!

Closing the Deal • A meeting of the seller, buyer and agents at which the property sale become final • Ahead of time the buyer… – Receives written statement itemizing the down payment and closing costs – Obtains a cashier’s check and brings it to the closing meeting • After the legal documents are signed and money is exchanged, the buyer is finally the owner of the home!

Home Maintenance

Home Maintenance

Benefits of Maintaining Your Home 1. Clean/pleasant environment for visitors 2. Healthy and safe 1. Especially in kitchen and bathrooms 3. Reduce wear and tear 4. Increase the value of your home

Benefits of Maintaining Your Home 1. Clean/pleasant environment for visitors 2. Healthy and safe 1. Especially in kitchen and bathrooms 3. Reduce wear and tear 4. Increase the value of your home

Daily Cleaning • “Clean as you go. ” • Examples – Dishes – Floors – Laundry – etc

Daily Cleaning • “Clean as you go. ” • Examples – Dishes – Floors – Laundry – etc

Long Term Maintenance 1. 2. 3. 4. 5. 6. Change furnace filter Clean oven Clean drapes Paint – esp. outside Pest inspection Clean drains and gutters

Long Term Maintenance 1. 2. 3. 4. 5. 6. Change furnace filter Clean oven Clean drapes Paint – esp. outside Pest inspection Clean drains and gutters

Safety 1. Water heater under 120 degrees 2. Cautious around heat 1. Pot handles turned away 2. Oven mitts 3. Guards around fireplace 4. Child safety items 5. Electrical 1. Frayed wires 2. Appliances away from water 6. Fire escape items 7. Dryer lint

Safety 1. Water heater under 120 degrees 2. Cautious around heat 1. Pot handles turned away 2. Oven mitts 3. Guards around fireplace 4. Child safety items 5. Electrical 1. Frayed wires 2. Appliances away from water 6. Fire escape items 7. Dryer lint

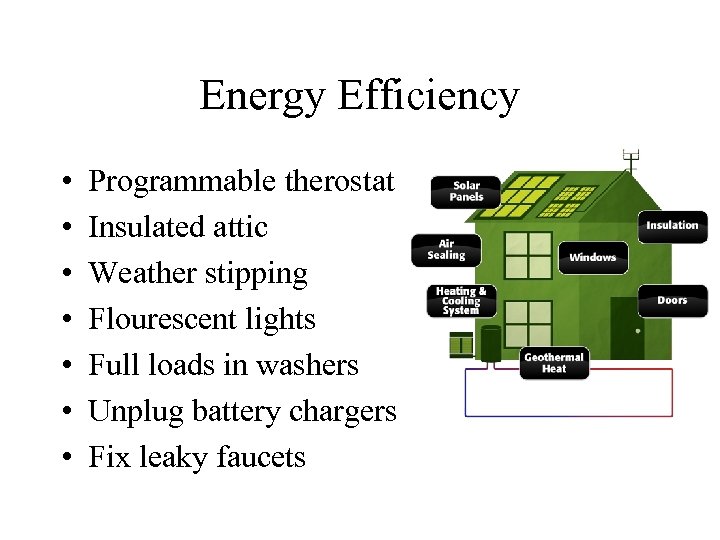

Energy Efficiency • • Programmable therostat Insulated attic Weather stipping Flourescent lights Full loads in washers Unplug battery chargers Fix leaky faucets

Energy Efficiency • • Programmable therostat Insulated attic Weather stipping Flourescent lights Full loads in washers Unplug battery chargers Fix leaky faucets