636fbc0ffc99959eec309d3231513f7b.ppt

- Количество слайдов: 44

Housing Market Outlook Silicon Valley Association of REALTORS® April 1, 2008 Robert A. Kleinhenz, Ph. D. Deputy Chief Economist California Association of REALTORS®

Housing Market Outlook Silicon Valley Association of REALTORS® April 1, 2008 Robert A. Kleinhenz, Ph. D. Deputy Chief Economist California Association of REALTORS®

Economic Outlook

Economic Outlook

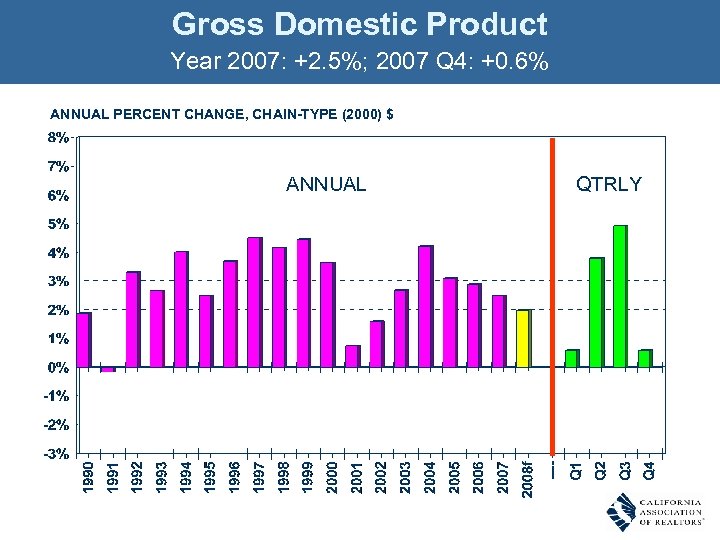

Gross Domestic Product Year 2007: +2. 5%; 2007 Q 4: +0. 6% ANNUAL PERCENT CHANGE, CHAIN-TYPE (2000) $ ANNUAL QTRLY

Gross Domestic Product Year 2007: +2. 5%; 2007 Q 4: +0. 6% ANNUAL PERCENT CHANGE, CHAIN-TYPE (2000) $ ANNUAL QTRLY

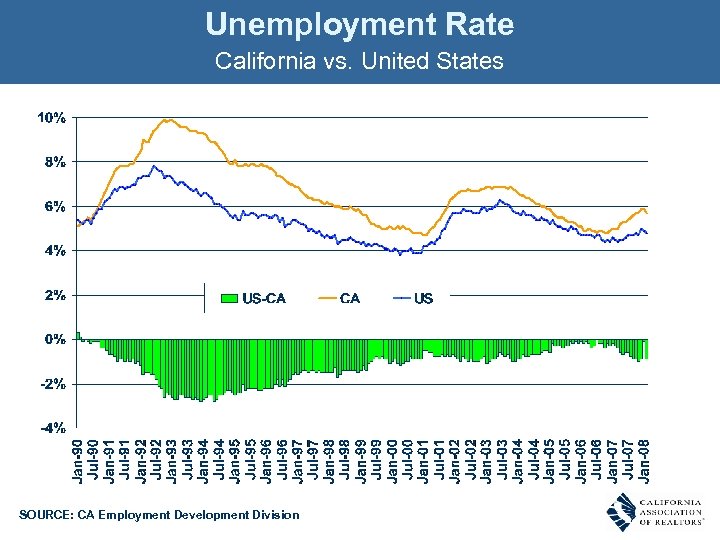

Unemployment Rate California vs. United States SOURCE: CA Employment Development Division

Unemployment Rate California vs. United States SOURCE: CA Employment Development Division

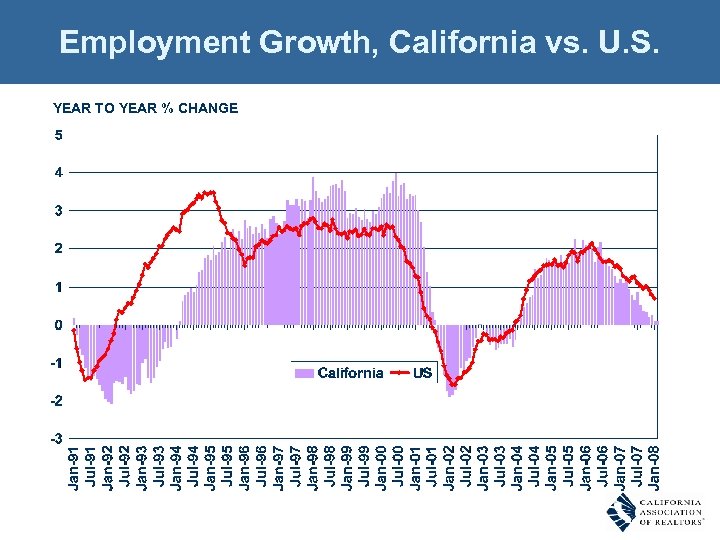

Employment Growth, California vs. U. S. YEAR TO YEAR % CHANGE

Employment Growth, California vs. U. S. YEAR TO YEAR % CHANGE

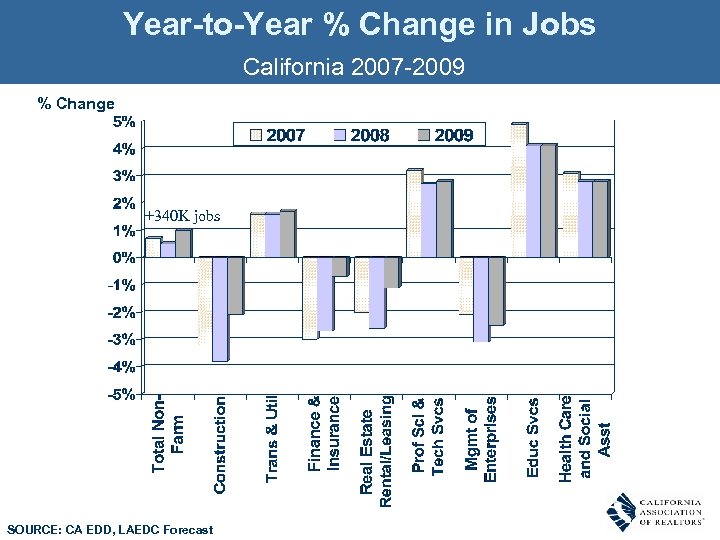

Year-to-Year % Change in Jobs California 2007 -2009 % Change +340 K jobs SOURCE: CA EDD, LAEDC Forecast

Year-to-Year % Change in Jobs California 2007 -2009 % Change +340 K jobs SOURCE: CA EDD, LAEDC Forecast

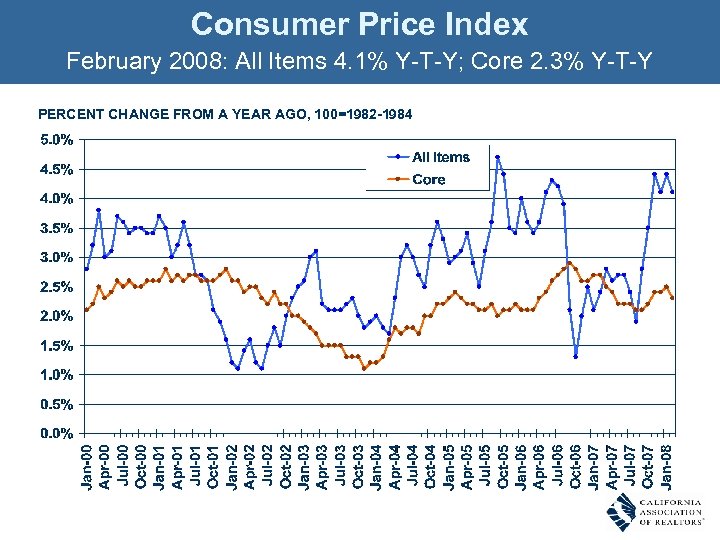

Consumer Price Index February 2008: All Items 4. 1% Y-T-Y; Core 2. 3% Y-T-Y PERCENT CHANGE FROM A YEAR AGO, 100=1982 -1984

Consumer Price Index February 2008: All Items 4. 1% Y-T-Y; Core 2. 3% Y-T-Y PERCENT CHANGE FROM A YEAR AGO, 100=1982 -1984

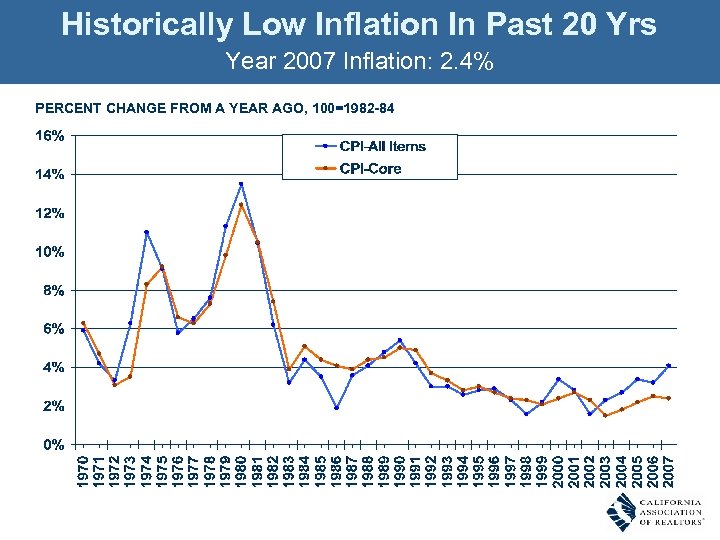

Historically Low Inflation In Past 20 Yrs Year 2007 Inflation: 2. 4% PERCENT CHANGE FROM A YEAR AGO, 100=1982 -84

Historically Low Inflation In Past 20 Yrs Year 2007 Inflation: 2. 4% PERCENT CHANGE FROM A YEAR AGO, 100=1982 -84

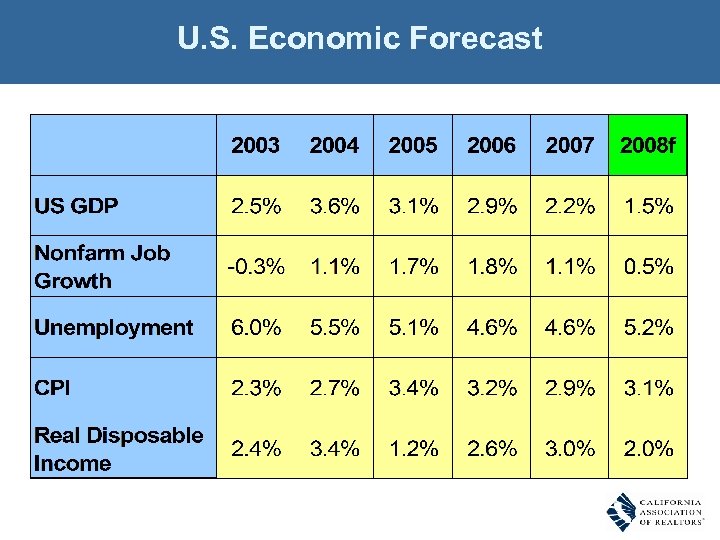

U. S. Economic Forecast SOURCE: California Association of REALTORS®

U. S. Economic Forecast SOURCE: California Association of REALTORS®

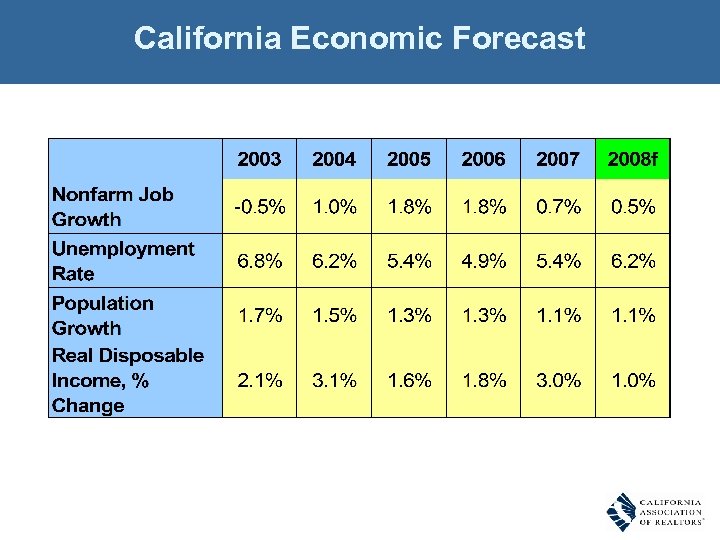

California Economic Forecast SOURCE: California Association of REALTORS®

California Economic Forecast SOURCE: California Association of REALTORS®

Economy through 2008 • GDP Growth below par: ~1 to 2% • First half of year weak, stronger in last half • Weak but positive job growth for US, CA, and its regions • Unemployment rate up slightly • Inflation a concern but in check • Uncertainty about economy, credit crunch, and housing market

Economy through 2008 • GDP Growth below par: ~1 to 2% • First half of year weak, stronger in last half • Weak but positive job growth for US, CA, and its regions • Unemployment rate up slightly • Inflation a concern but in check • Uncertainty about economy, credit crunch, and housing market

California Housing Market Outlook

California Housing Market Outlook

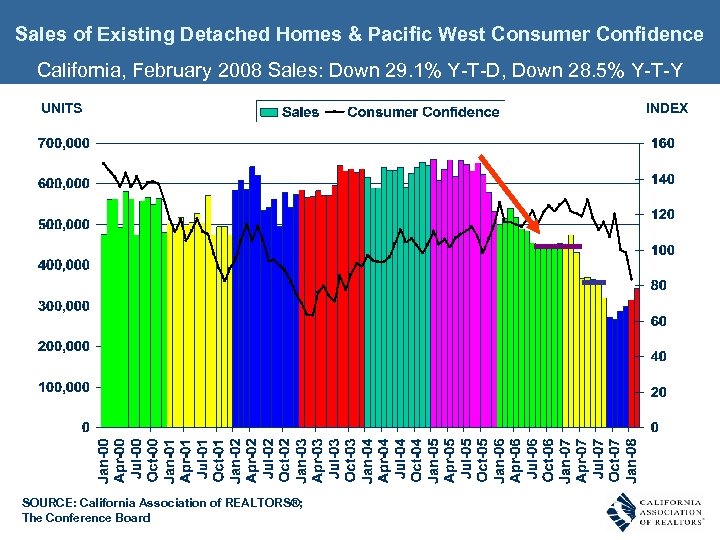

Sales of Existing Detached Homes & Pacific West Consumer Confidence California, February 2008 Sales: Down 29. 1% Y-T-D, Down 28. 5% Y-T-Y UNITS SOURCE: California Association of REALTORS®; The Conference Board INDEX

Sales of Existing Detached Homes & Pacific West Consumer Confidence California, February 2008 Sales: Down 29. 1% Y-T-D, Down 28. 5% Y-T-Y UNITS SOURCE: California Association of REALTORS®; The Conference Board INDEX

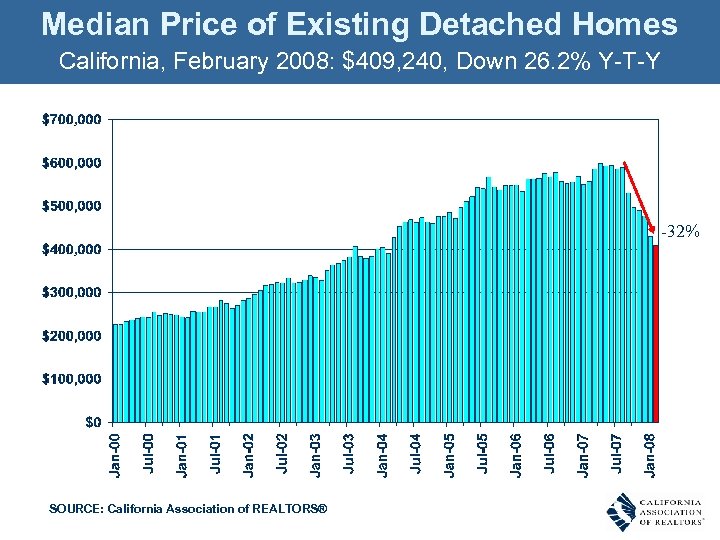

Median Price of Existing Detached Homes California, February 2008: $409, 240, Down 26. 2% Y-T-Y -32% SOURCE: California Association of REALTORS®

Median Price of Existing Detached Homes California, February 2008: $409, 240, Down 26. 2% Y-T-Y -32% SOURCE: California Association of REALTORS®

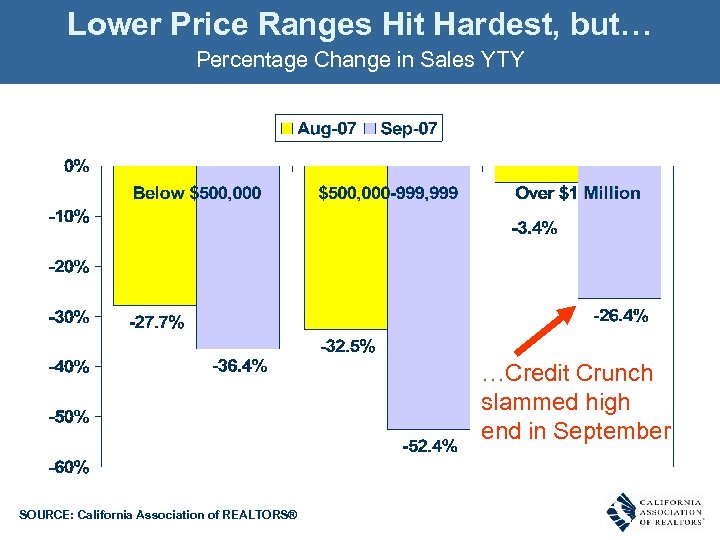

Lower Price Ranges Hit Hardest, but… Percentage Change in Sales YTY …Credit Crunch slammed high end in September SOURCE: California Association of REALTORS®

Lower Price Ranges Hit Hardest, but… Percentage Change in Sales YTY …Credit Crunch slammed high end in September SOURCE: California Association of REALTORS®

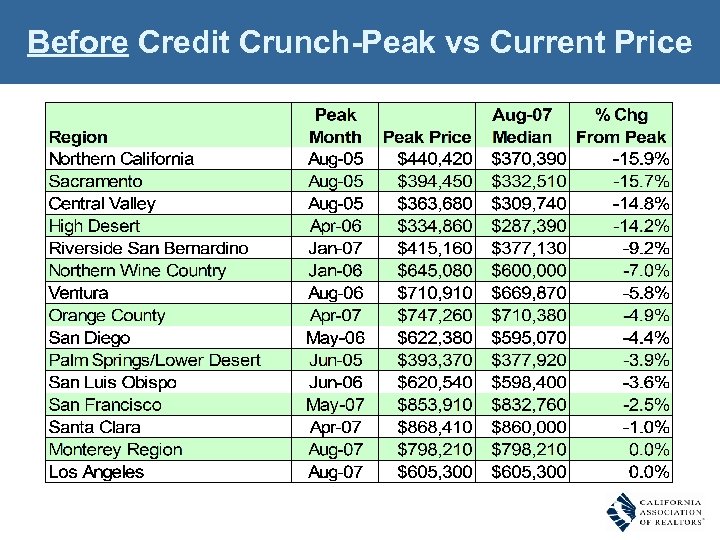

Before Credit Crunch-Peak vs Current Price

Before Credit Crunch-Peak vs Current Price

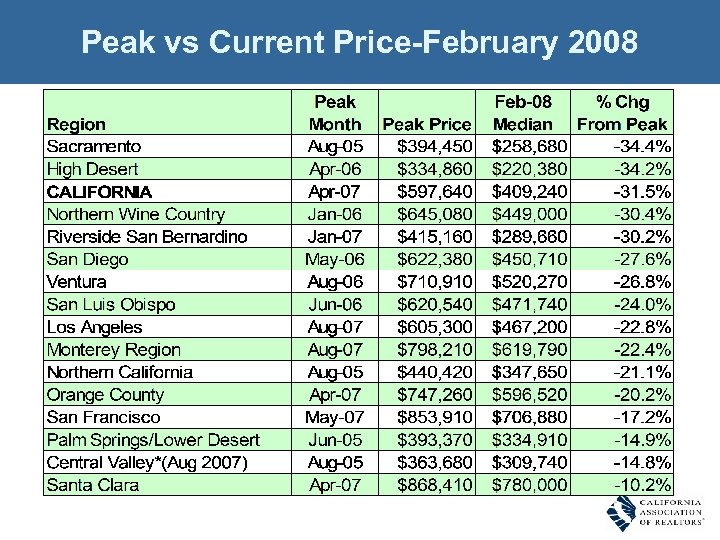

Peak vs Current Price-February 2008

Peak vs Current Price-February 2008

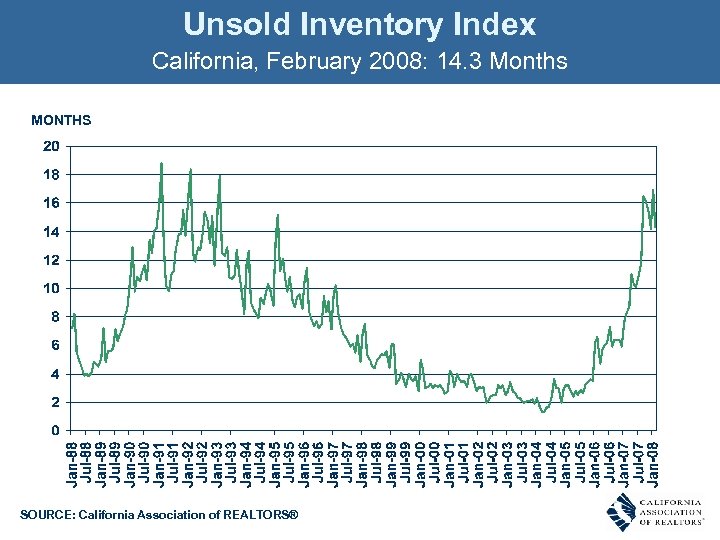

Unsold Inventory Index California, February 2008: 14. 3 Months MONTHS SOURCE: California Association of REALTORS®

Unsold Inventory Index California, February 2008: 14. 3 Months MONTHS SOURCE: California Association of REALTORS®

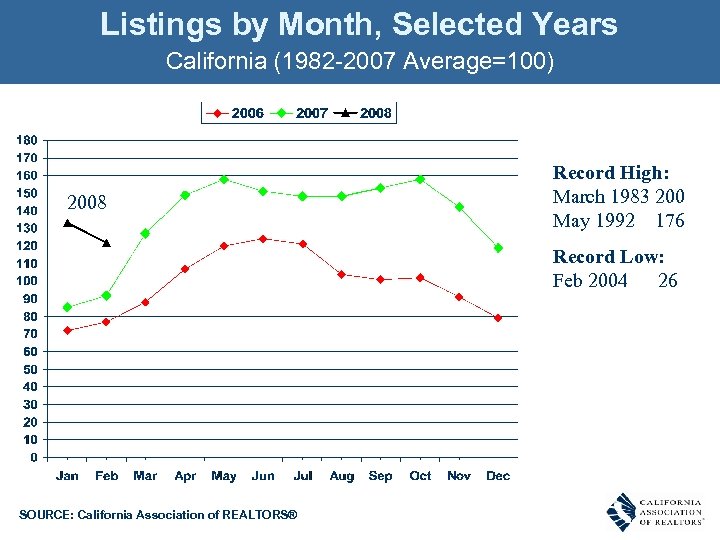

Listings by Month, Selected Years California (1982 -2007 Average=100) 2008 Record High: March 1983 200 May 1992 176 Record Low: Feb 2004 26 SOURCE: California Association of REALTORS®

Listings by Month, Selected Years California (1982 -2007 Average=100) 2008 Record High: March 1983 200 May 1992 176 Record Low: Feb 2004 26 SOURCE: California Association of REALTORS®

Credit Crunch ≠ Tighter Underwriting Standards • Subprime and other less-qualified borrowers initially. • Later spread to well-qualified borrowers. Credit or Liquidity Crunch • Investors who normally provide funds to Lenders on sidelines. Source for jumbo loans. • $$$ in safe havens (Treasuries) because of risk elsewhere. • Fewer $$$ available, even for well-qualified borrowers in recent months.

Credit Crunch ≠ Tighter Underwriting Standards • Subprime and other less-qualified borrowers initially. • Later spread to well-qualified borrowers. Credit or Liquidity Crunch • Investors who normally provide funds to Lenders on sidelines. Source for jumbo loans. • $$$ in safe havens (Treasuries) because of risk elsewhere. • Fewer $$$ available, even for well-qualified borrowers in recent months.

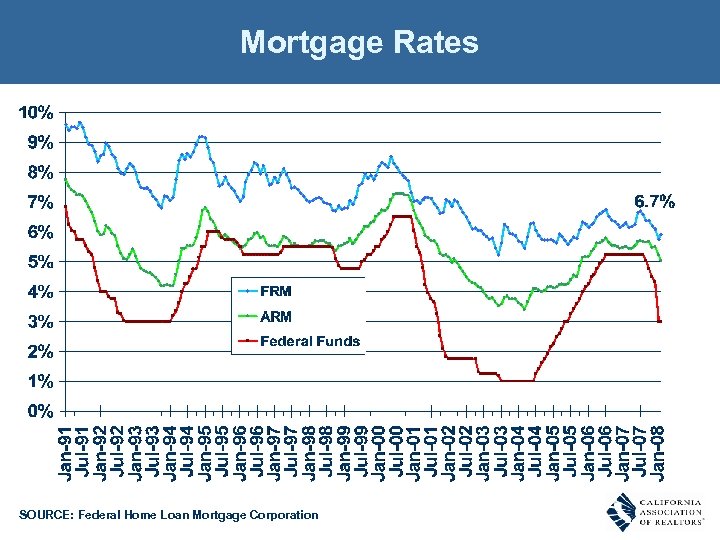

Mortgage Rates SOURCE: Federal Home Loan Mortgage Corporation

Mortgage Rates SOURCE: Federal Home Loan Mortgage Corporation

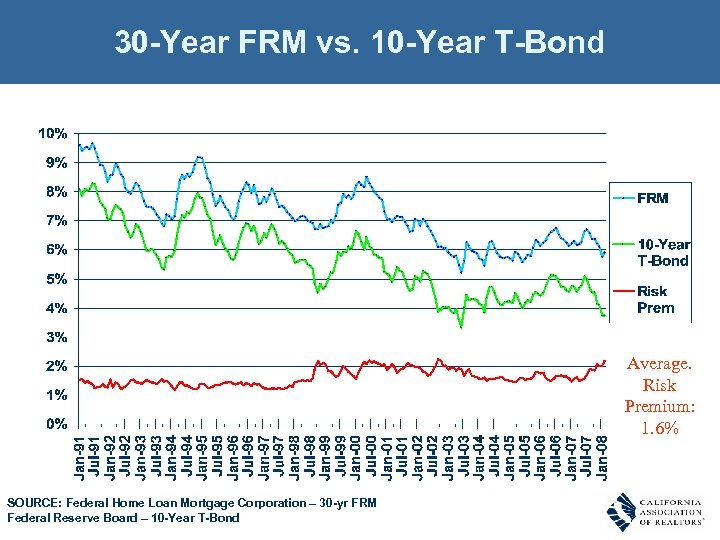

30 -Year FRM vs. 10 -Year T-Bond Average. Risk Premium: 1. 6% SOURCE: Federal Home Loan Mortgage Corporation – 30 -yr FRM Federal Reserve Board – 10 -Year T-Bond

30 -Year FRM vs. 10 -Year T-Bond Average. Risk Premium: 1. 6% SOURCE: Federal Home Loan Mortgage Corporation – 30 -yr FRM Federal Reserve Board – 10 -Year T-Bond

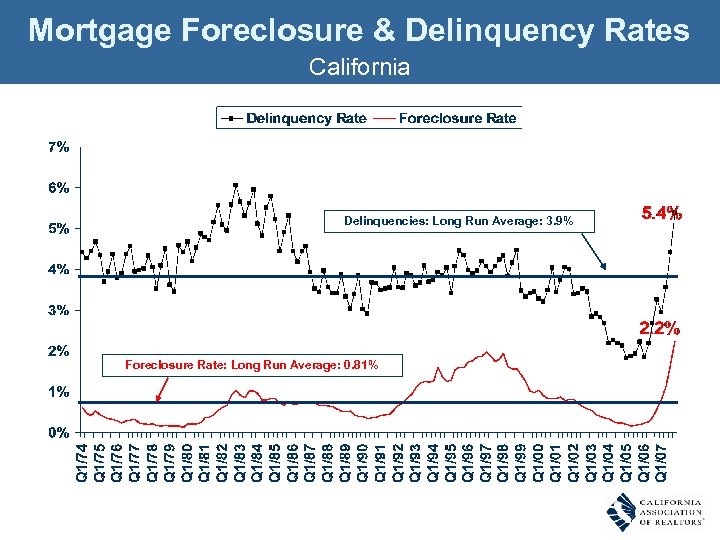

Mortgage Foreclosure & Delinquency Rates California Delinquencies: Long Run Average: 3. 9% Foreclosure Rate: Long Run Average: 0. 81% SOURCE: Mortgage Bankers Association

Mortgage Foreclosure & Delinquency Rates California Delinquencies: Long Run Average: 3. 9% Foreclosure Rate: Long Run Average: 0. 81% SOURCE: Mortgage Bankers Association

Framing the Sub-Prime* Situation Right $$$ House & Right Mortgage • Not in trouble - no fix necessary Right $$$ House but Wrong Mortgage • Can refinance out of problem Troublesome Wrong $$$ House and Wrong Mortgage • Defaults, workouts, foreclosures, etc. * Really should be “Non-Prime” Situation Categories

Framing the Sub-Prime* Situation Right $$$ House & Right Mortgage • Not in trouble - no fix necessary Right $$$ House but Wrong Mortgage • Can refinance out of problem Troublesome Wrong $$$ House and Wrong Mortgage • Defaults, workouts, foreclosures, etc. * Really should be “Non-Prime” Situation Categories

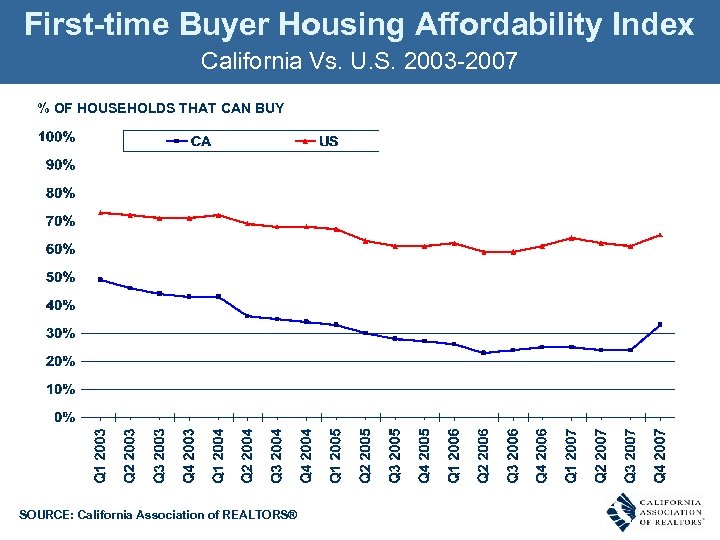

First-time Buyer Housing Affordability Index California Vs. U. S. 2003 -2007 % OF HOUSEHOLDS THAT CAN BUY SOURCE: California Association of REALTORS®

First-time Buyer Housing Affordability Index California Vs. U. S. 2003 -2007 % OF HOUSEHOLDS THAT CAN BUY SOURCE: California Association of REALTORS®

Local Outlook

Local Outlook

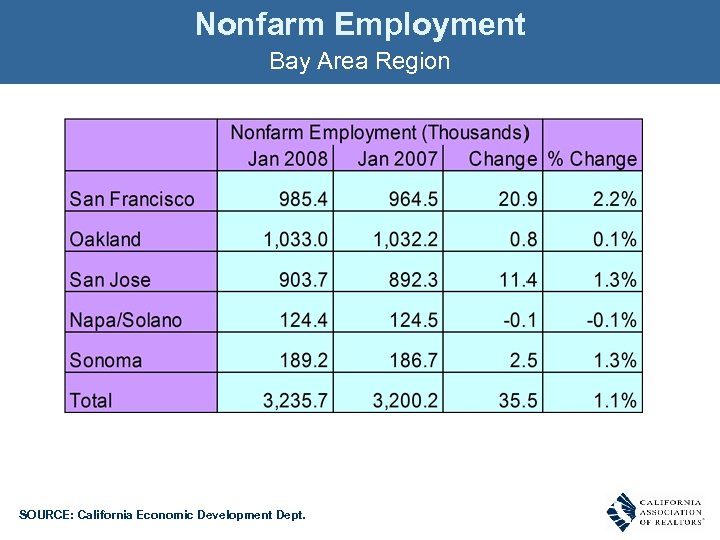

Nonfarm Employment Bay Area Region SOURCE: California Economic Development Dept.

Nonfarm Employment Bay Area Region SOURCE: California Economic Development Dept.

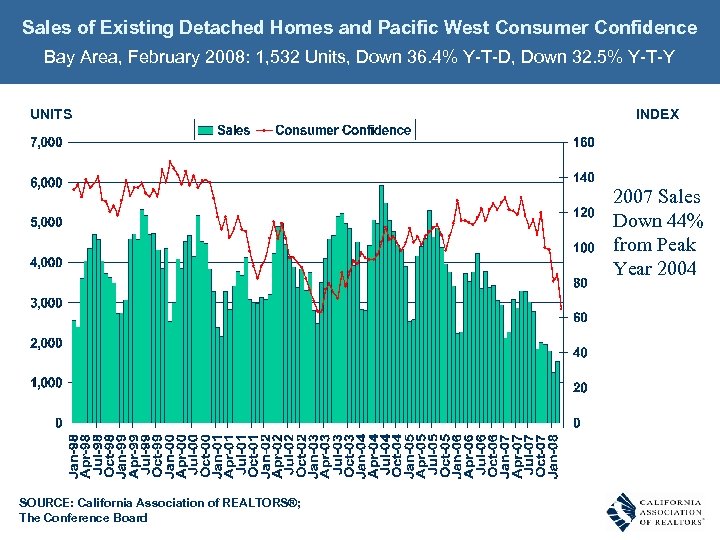

Sales of Existing Detached Homes and Pacific West Consumer Confidence Bay Area, February 2008: 1, 532 Units, Down 36. 4% Y-T-D, Down 32. 5% Y-T-Y UNITS INDEX 2007 Sales Down 44% from Peak Year 2004 SOURCE: California Association of REALTORS®; The Conference Board

Sales of Existing Detached Homes and Pacific West Consumer Confidence Bay Area, February 2008: 1, 532 Units, Down 36. 4% Y-T-D, Down 32. 5% Y-T-Y UNITS INDEX 2007 Sales Down 44% from Peak Year 2004 SOURCE: California Association of REALTORS®; The Conference Board

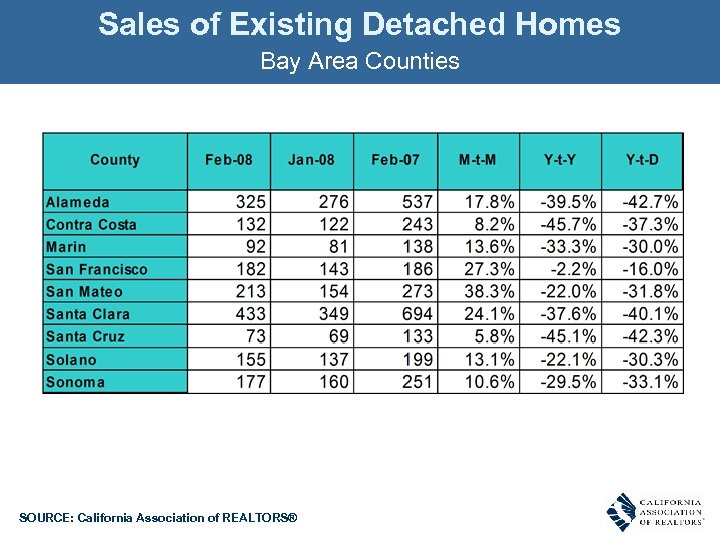

Sales of Existing Detached Homes Bay Area Counties SOURCE: California Association of REALTORS®

Sales of Existing Detached Homes Bay Area Counties SOURCE: California Association of REALTORS®

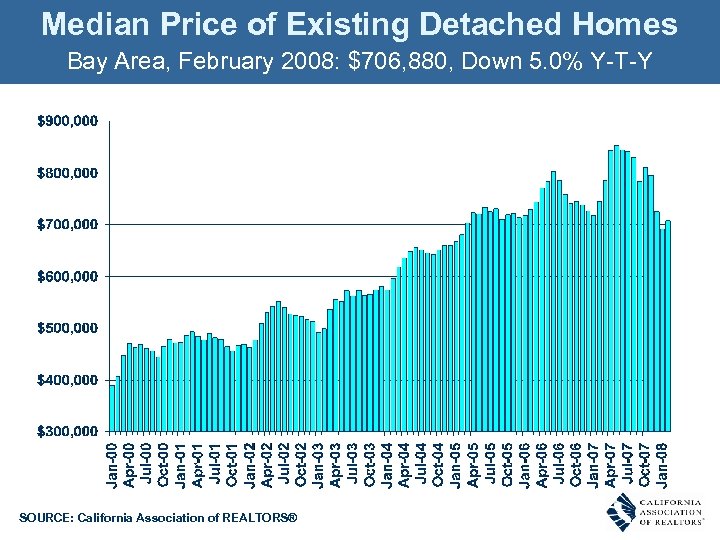

Median Price of Existing Detached Homes Bay Area, February 2008: $706, 880, Down 5. 0% Y-T-Y SOURCE: California Association of REALTORS®

Median Price of Existing Detached Homes Bay Area, February 2008: $706, 880, Down 5. 0% Y-T-Y SOURCE: California Association of REALTORS®

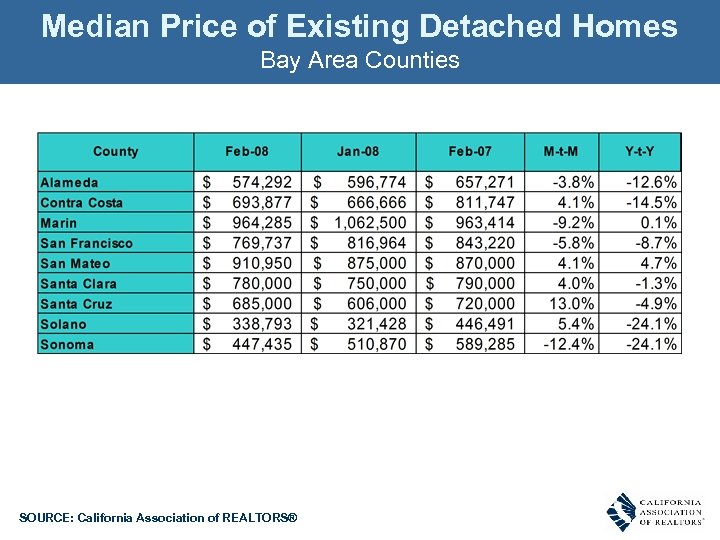

Median Price of Existing Detached Homes Bay Area Counties SOURCE: California Association of REALTORS®

Median Price of Existing Detached Homes Bay Area Counties SOURCE: California Association of REALTORS®

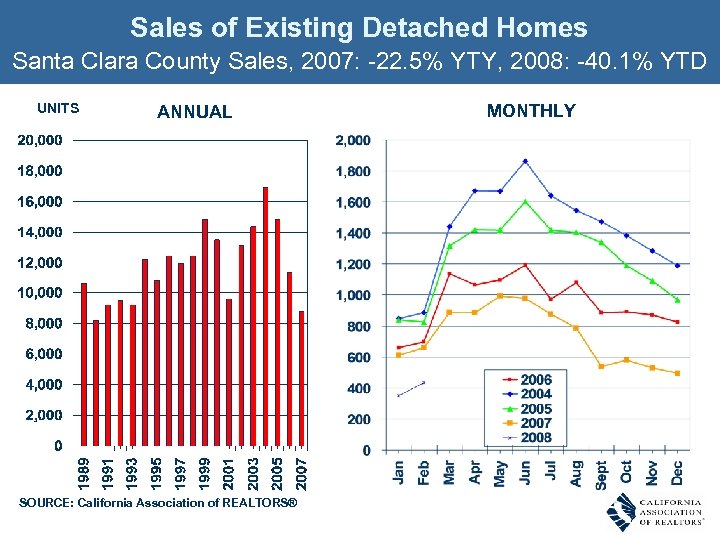

Sales of Existing Detached Homes Santa Clara County Sales, 2007: -22. 5% YTY, 2008: -40. 1% YTD UNITS ANNUAL SOURCE: California Association of REALTORS® MONTHLY

Sales of Existing Detached Homes Santa Clara County Sales, 2007: -22. 5% YTY, 2008: -40. 1% YTD UNITS ANNUAL SOURCE: California Association of REALTORS® MONTHLY

Median Price of Existing Detached Homes Santa Clara County, February 2008: $780, 000, Down 1. 3% Y-T-Y SOURCE: California Association of REALTORS®

Median Price of Existing Detached Homes Santa Clara County, February 2008: $780, 000, Down 1. 3% Y-T-Y SOURCE: California Association of REALTORS®

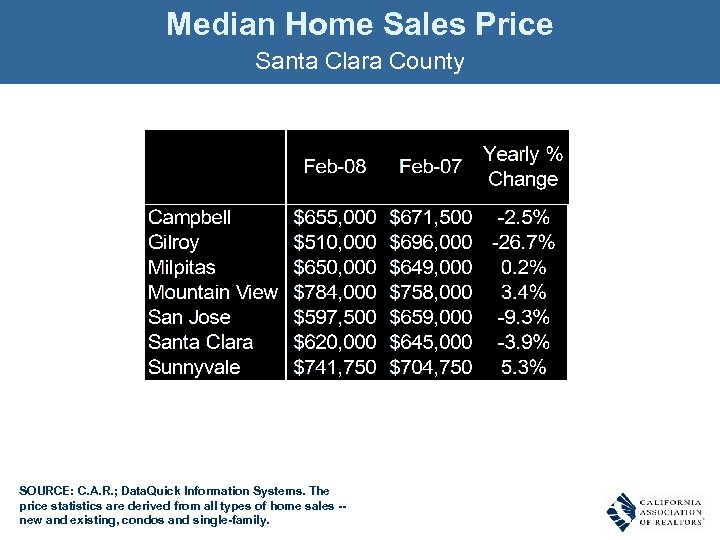

Median Home Sales Price Santa Clara County SOURCE: C. A. R. ; Data. Quick Information Systems. The price statistics are derived from all types of home sales -new and existing, condos and single-family.

Median Home Sales Price Santa Clara County SOURCE: C. A. R. ; Data. Quick Information Systems. The price statistics are derived from all types of home sales -new and existing, condos and single-family.

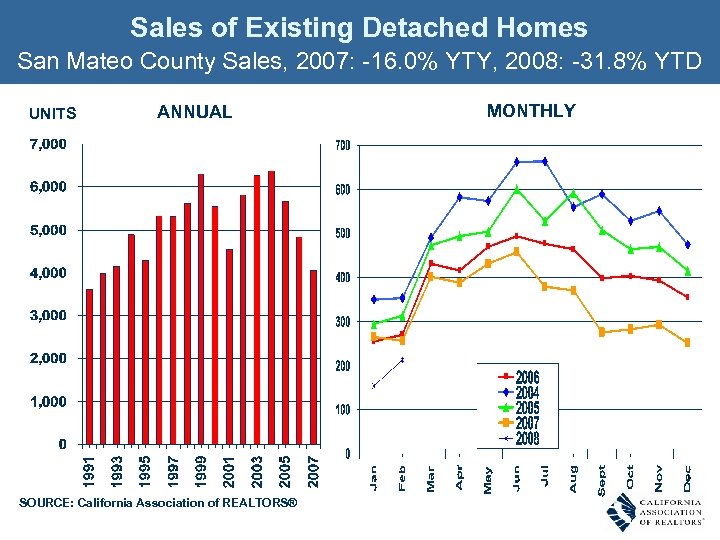

Sales of Existing Detached Homes San Mateo County Sales, 2007: -16. 0% YTY, 2008: -31. 8% YTD UNITS ANNUAL SOURCE: California Association of REALTORS® MONTHLY

Sales of Existing Detached Homes San Mateo County Sales, 2007: -16. 0% YTY, 2008: -31. 8% YTD UNITS ANNUAL SOURCE: California Association of REALTORS® MONTHLY

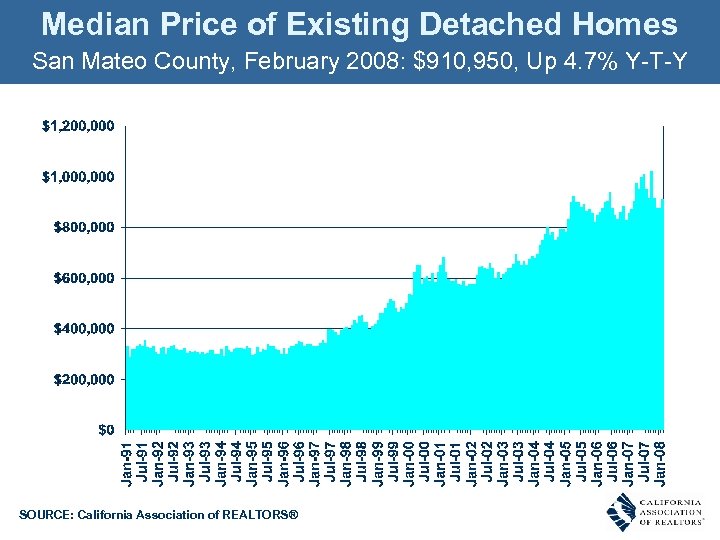

Median Price of Existing Detached Homes San Mateo County, February 2008: $910, 950, Up 4. 7% Y-T-Y SOURCE: California Association of REALTORS®

Median Price of Existing Detached Homes San Mateo County, February 2008: $910, 950, Up 4. 7% Y-T-Y SOURCE: California Association of REALTORS®

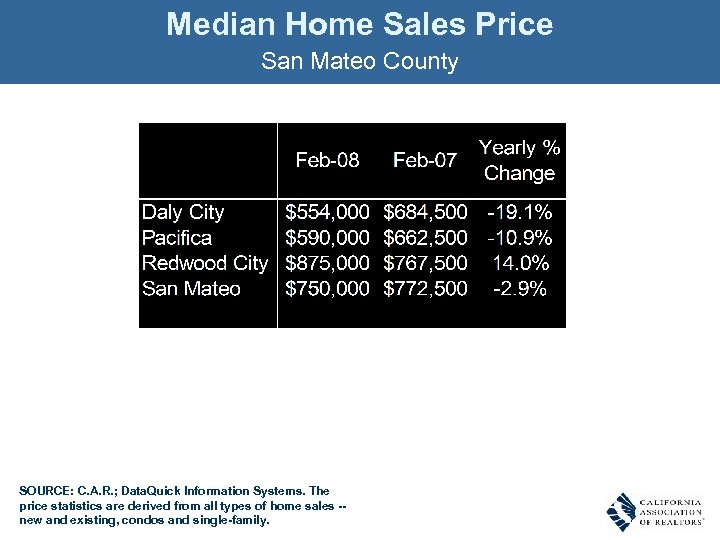

Median Home Sales Price San Mateo County SOURCE: C. A. R. ; Data. Quick Information Systems. The price statistics are derived from all types of home sales -new and existing, condos and single-family.

Median Home Sales Price San Mateo County SOURCE: C. A. R. ; Data. Quick Information Systems. The price statistics are derived from all types of home sales -new and existing, condos and single-family.

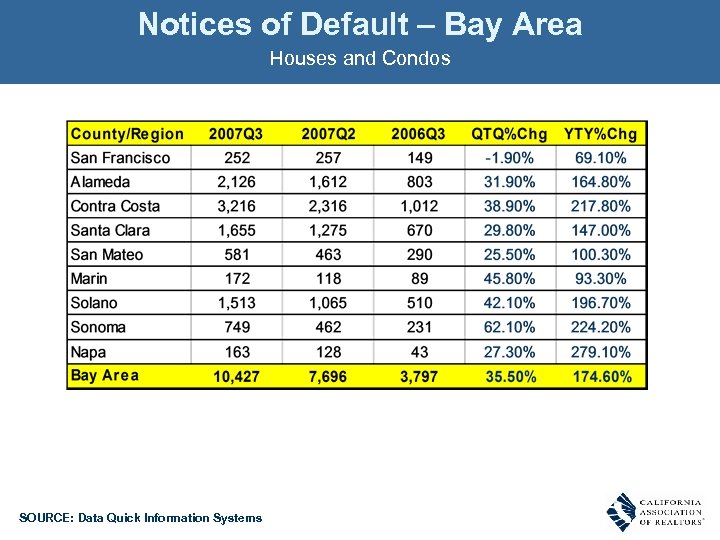

Notices of Default – Bay Area Houses and Condos SOURCE: Data Quick Information Systems

Notices of Default – Bay Area Houses and Condos SOURCE: Data Quick Information Systems

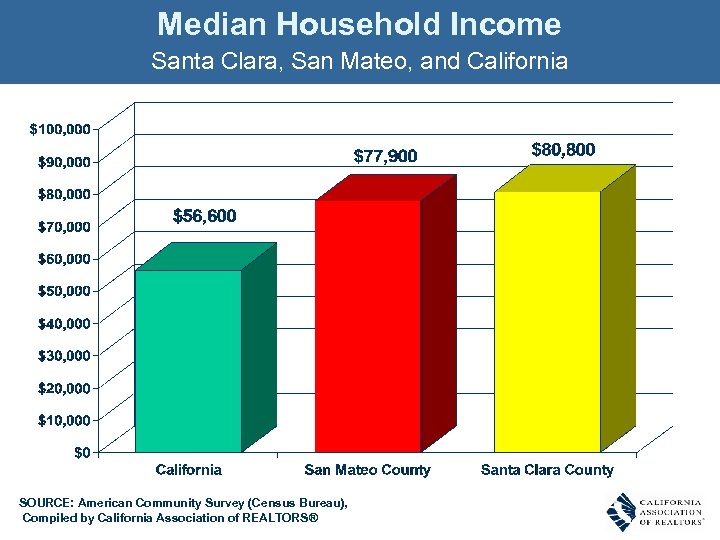

Median Household Income Santa Clara, San Mateo, and California SOURCE: American Community Survey (Census Bureau), Compiled by California Association of REALTORS®

Median Household Income Santa Clara, San Mateo, and California SOURCE: American Community Survey (Census Bureau), Compiled by California Association of REALTORS®

California Forecast

California Forecast

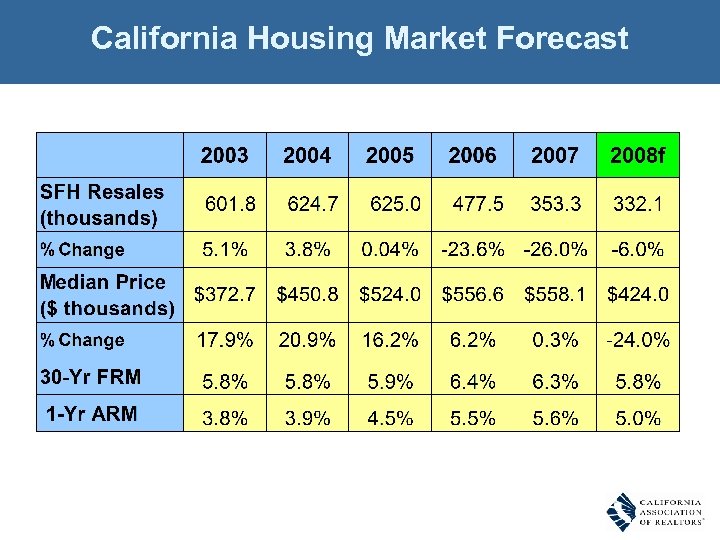

California Housing Market Forecast SOURCE: California Association of REALTORS®

California Housing Market Forecast SOURCE: California Association of REALTORS®

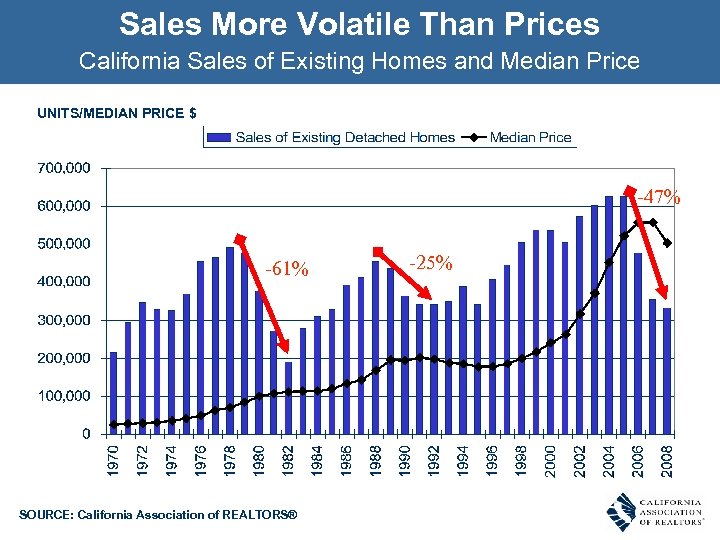

Sales More Volatile Than Prices California Sales of Existing Homes and Median Price UNITS/MEDIAN PRICE $ -47% -61% SOURCE: California Association of REALTORS® -25%

Sales More Volatile Than Prices California Sales of Existing Homes and Median Price UNITS/MEDIAN PRICE $ -47% -61% SOURCE: California Association of REALTORS® -25%

Summary • Existing Home Sales: 2007: -26%, 2008: -6% • Statewide Median Price: Continuing decrease (15 -25%) • Low end weak…Payment resets, Foreclosures • High end weak…Credit/Liquidity Crunch • Tighter Underwriting Standards…maybe too tight • Affordability to remain low, THEREFORE… • Stabilizing sales, no significant recovery in next 6 -12 months

Summary • Existing Home Sales: 2007: -26%, 2008: -6% • Statewide Median Price: Continuing decrease (15 -25%) • Low end weak…Payment resets, Foreclosures • High end weak…Credit/Liquidity Crunch • Tighter Underwriting Standards…maybe too tight • Affordability to remain low, THEREFORE… • Stabilizing sales, no significant recovery in next 6 -12 months

The Bottom Line for Households • Homeowners are generally in a positive equity position if bought before 2005, so don’t panic! • Sell if you must, hold if you can. • If you must sell, then price home to sell and not to sit. • Buyers should not expect bargains in all markets. Must do homework and consult with a REALTOR® • Find a home that meets needs and fits budget…buy it! • Opportunities for investors, but must do homework. Thank You!

The Bottom Line for Households • Homeowners are generally in a positive equity position if bought before 2005, so don’t panic! • Sell if you must, hold if you can. • If you must sell, then price home to sell and not to sit. • Buyers should not expect bargains in all markets. Must do homework and consult with a REALTOR® • Find a home that meets needs and fits budget…buy it! • Opportunities for investors, but must do homework. Thank You!