b3a8213a0dc481d36318cf5d74ecdd5e.ppt

- Количество слайдов: 22

Housing Financing in Islamic Law A Study of some products for Housing Financing and applicable to Islamic Law Dr. Salah Fahd Al-Shalhoob Assistant Professor Department of Islamic and Arabic Studies King Fahd University of Petroleum and Minerals & writer in Aleqtisadia Newspaper E-mail: sshalhoob@hotmail. com

Housing Financing in Islamic Law A Study of some products for Housing Financing and applicable to Islamic Law Dr. Salah Fahd Al-Shalhoob Assistant Professor Department of Islamic and Arabic Studies King Fahd University of Petroleum and Minerals & writer in Aleqtisadia Newspaper E-mail: sshalhoob@hotmail. com

Introduction n The aim of study Importance of the study The concept of housing finance

Introduction n The aim of study Importance of the study The concept of housing finance

The aim of study n To overview the forms of housing finance which are offered the financial institutions as forms which applicable to the principles of Islamic law

The aim of study n To overview the forms of housing finance which are offered the financial institutions as forms which applicable to the principles of Islamic law

Importance of the study n n n The Muslims needs of a place to live Many people today can not afford buying houses by cash Find out a way to finance Muslims without being involved in a conventional mortgage

Importance of the study n n n The Muslims needs of a place to live Many people today can not afford buying houses by cash Find out a way to finance Muslims without being involved in a conventional mortgage

The concept of housing finance n Housing finance is considered as contracts provided by the financial institutions for the purpose of personal finance to buy properties. There are many contracts have been discussed under the concepts of Islamic finance, such as mark up (al-murabaha), partnership (almusharaka), al-istisna and leasing (al-ijara). And we can derive from the contracts some products to finance people to get properties under the concept of Islamic law.

The concept of housing finance n Housing finance is considered as contracts provided by the financial institutions for the purpose of personal finance to buy properties. There are many contracts have been discussed under the concepts of Islamic finance, such as mark up (al-murabaha), partnership (almusharaka), al-istisna and leasing (al-ijara). And we can derive from the contracts some products to finance people to get properties under the concept of Islamic law.

Forms of housing finance n n n Deferred Sales (bay’ al-mu’ajal) Mark-up (al-murabaha) Diminution partnership (al-musharaka almutanaqisa) Commission to manufacturing (al-istisna’) Leasing ending with ownership (al-ijar almuntahi bi al-tamlik)

Forms of housing finance n n n Deferred Sales (bay’ al-mu’ajal) Mark-up (al-murabaha) Diminution partnership (al-musharaka almutanaqisa) Commission to manufacturing (al-istisna’) Leasing ending with ownership (al-ijar almuntahi bi al-tamlik)

Deferred Sales (bay’ al-mu’ajal) n Sales divisions in terms of time of payment n n n Ordinary Forward Deferred Ruling of deferred sales Scholars views in increasing the price due to deferment

Deferred Sales (bay’ al-mu’ajal) n Sales divisions in terms of time of payment n n n Ordinary Forward Deferred Ruling of deferred sales Scholars views in increasing the price due to deferment

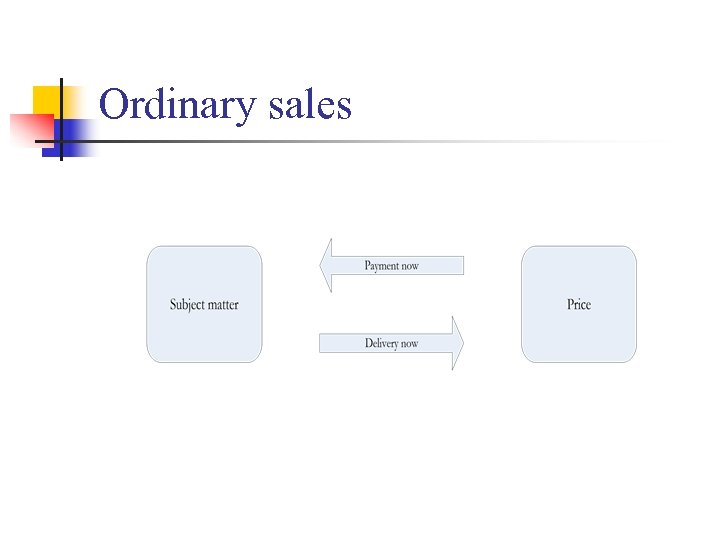

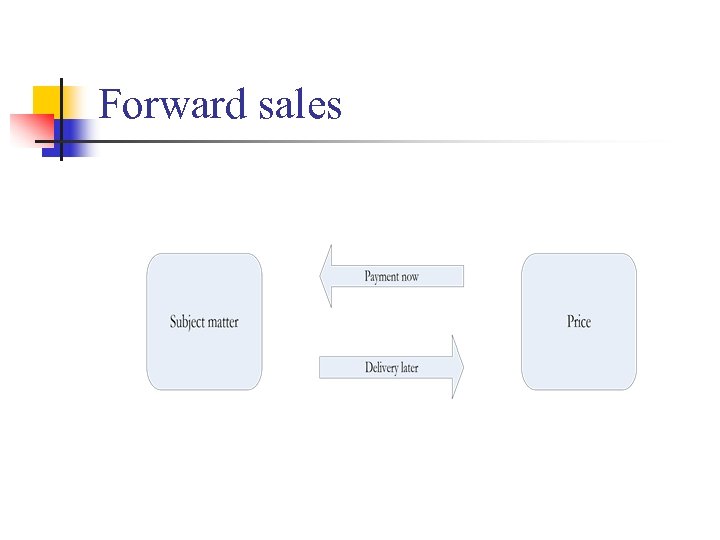

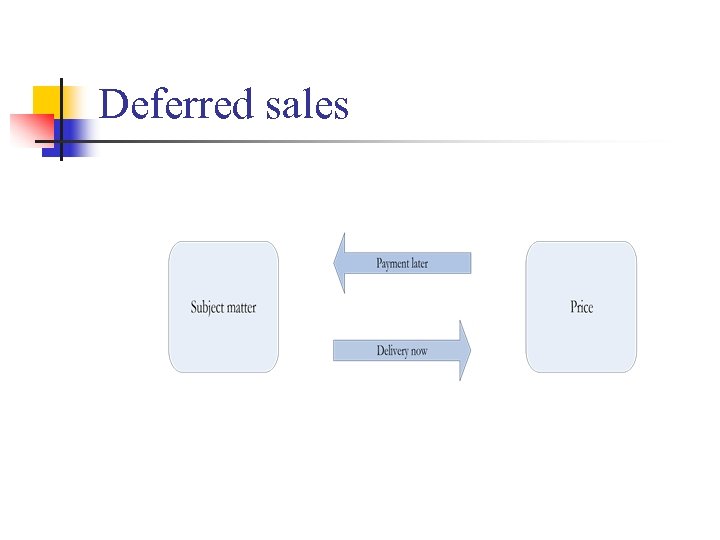

Sales divisions in terms of time of payment n Ordinary sales n Forward sales n Deferred sales

Sales divisions in terms of time of payment n Ordinary sales n Forward sales n Deferred sales

Ordinary sales

Ordinary sales

Forward sales

Forward sales

Deferred sales

Deferred sales

Ruling of deferred sales n The general permission of sales n The prophet practiced it

Ruling of deferred sales n The general permission of sales n The prophet practiced it

Scholars views in increasing the price due to deferment n The majority say it is permissible n The minority say it is prohibited

Scholars views in increasing the price due to deferment n The majority say it is permissible n The minority say it is prohibited

Mark-up (al-murabaha) n Definition of mark-up n Simple form of mark-up n Mark-up the orderer of the purchase

Mark-up (al-murabaha) n Definition of mark-up n Simple form of mark-up n Mark-up the orderer of the purchase

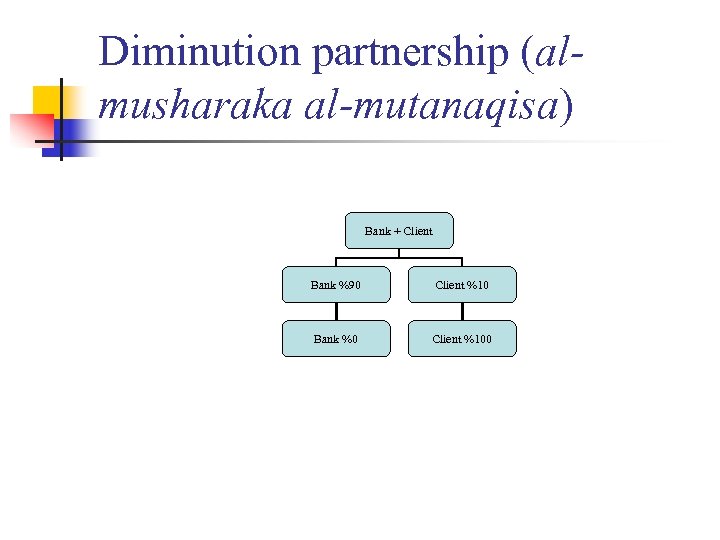

Diminution partnership (almusharaka al-mutanaqisa) Bank + Client Bank %90 Client %10 Bank %0 Client %100

Diminution partnership (almusharaka al-mutanaqisa) Bank + Client Bank %90 Client %10 Bank %0 Client %100

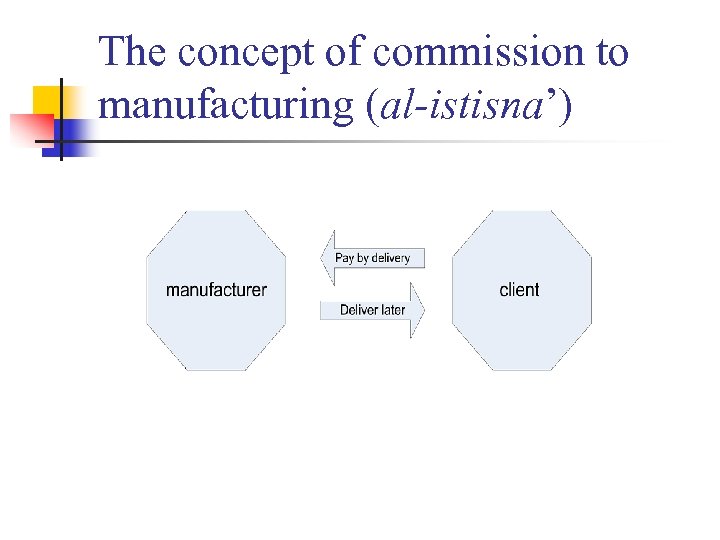

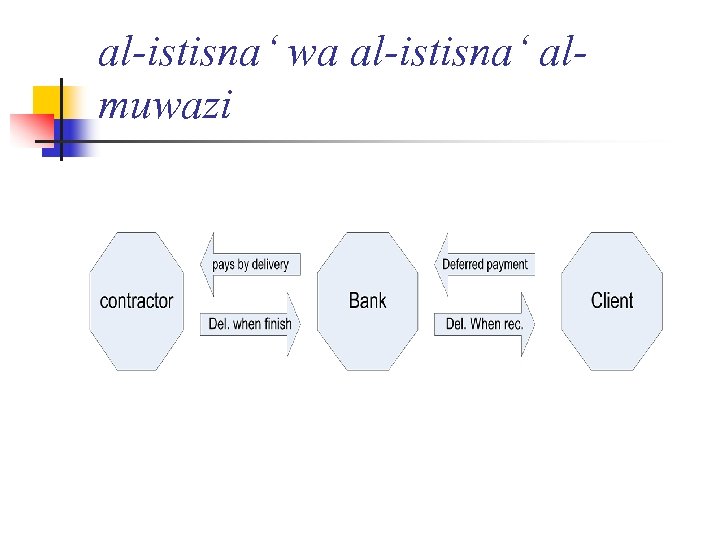

Commission to manufacturing (al -istisna’) n n The concept of commission to manufacturing (al-istisna’) al-istisna‘ wa al-istisna‘ al-muwazi

Commission to manufacturing (al -istisna’) n n The concept of commission to manufacturing (al-istisna’) al-istisna‘ wa al-istisna‘ al-muwazi

The concept of commission to manufacturing (al-istisna’)

The concept of commission to manufacturing (al-istisna’)

al-istisna‘ wa al-istisna‘ almuwazi

al-istisna‘ wa al-istisna‘ almuwazi

Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) n n n Concept of Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) Categories of Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) Ruling leasing ending with ownership (alijar al-muntahi bi al-tamlik)

Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) n n n Concept of Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) Categories of Leasing ending with ownership (al-ijar al-muntahi bi al-tamlik) Ruling leasing ending with ownership (alijar al-muntahi bi al-tamlik)

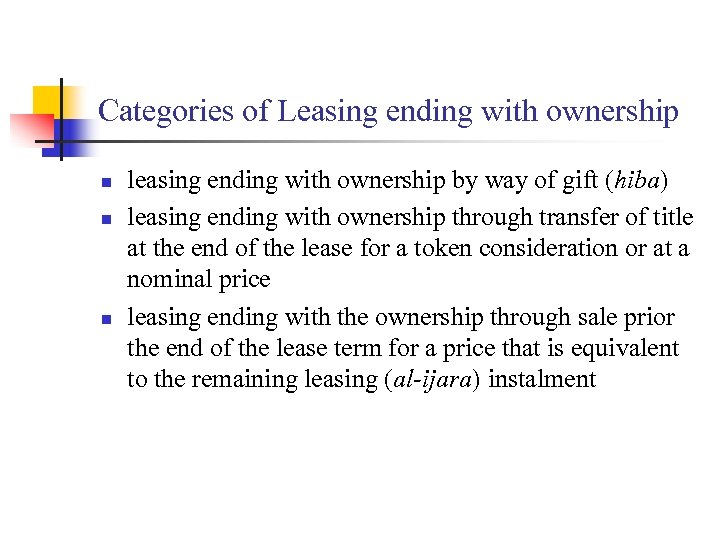

Categories of Leasing ending with ownership n n n leasing ending with ownership by way of gift (hiba) leasing ending with ownership through transfer of title at the end of the lease for a token consideration or at a nominal price leasing ending with the ownership through sale prior the end of the lease term for a price that is equivalent to the remaining leasing (al-ijara) instalment

Categories of Leasing ending with ownership n n n leasing ending with ownership by way of gift (hiba) leasing ending with ownership through transfer of title at the end of the lease for a token consideration or at a nominal price leasing ending with the ownership through sale prior the end of the lease term for a price that is equivalent to the remaining leasing (al-ijara) instalment

Ruling leasing ending with ownership n n n The contract under the concept of two transactions combined in one. The difference between al-muntahi bi altamlik and al-wa’d bi- al-tamlik. Scholars view in leasing ending with ownership.

Ruling leasing ending with ownership n n n The contract under the concept of two transactions combined in one. The difference between al-muntahi bi altamlik and al-wa’d bi- al-tamlik. Scholars view in leasing ending with ownership.

Thanks for you & for Al-eqtisadia Newspaper for the sponsorship ﻭﺍﻟﺴﻼﻡ ﻋﻠﻴﻜﻢ ﻭﺭﺣﻤﺔ ﺍﻟﻠﻪ ﻭﺑﺮﻛﺎﺗﻪ Dr. Salah Al-Shalhoob sshalhoob@hotmail. com

Thanks for you & for Al-eqtisadia Newspaper for the sponsorship ﻭﺍﻟﺴﻼﻡ ﻋﻠﻴﻜﻢ ﻭﺭﺣﻤﺔ ﺍﻟﻠﻪ ﻭﺑﺮﻛﺎﺗﻪ Dr. Salah Al-Shalhoob sshalhoob@hotmail. com