ca5e425964ff1eabe9a828f703b4ea26.ppt

- Количество слайдов: 28

Housing Finance in Uruguay The Role of the Public Sector Presentation prepared for the IADB organized seminar “Housing Finance : Latin American Issues and European Views” Based on Gandelman and Gandelman (2003) “El Mercado Hipotecario Uruguayo” Néstor Gandelman Universidad ORT Uruguay

Housing Finance in Uruguay The Role of the Public Sector Presentation prepared for the IADB organized seminar “Housing Finance : Latin American Issues and European Views” Based on Gandelman and Gandelman (2003) “El Mercado Hipotecario Uruguayo” Néstor Gandelman Universidad ORT Uruguay

Background n The Uruguayan Constitution states: n “Artículo 45. - Todo habitante de la República tiene derecho a gozar de vivienda decorosa. La ley propenderá a asegurar la vivienda higiénica y económica, facilitando su adquisición y estimulando la inversión de capitales privados para ese fin” n Article 45. Every Uruguayan has the right to a decent house. The law will try to secure access to hygienic and accessible housing, facilitating its acquisition and stimulating capital investments with this goal.

Background n The Uruguayan Constitution states: n “Artículo 45. - Todo habitante de la República tiene derecho a gozar de vivienda decorosa. La ley propenderá a asegurar la vivienda higiénica y económica, facilitando su adquisición y estimulando la inversión de capitales privados para ese fin” n Article 45. Every Uruguayan has the right to a decent house. The law will try to secure access to hygienic and accessible housing, facilitating its acquisition and stimulating capital investments with this goal.

Background Uruguayan housing finance market has always been dominated by the Banco Hipotecario del Uruguay (BHU). n The BHU is a publicly owned financial institution whose goal is to foster people house ownership. n It was created by law in 1912. n

Background Uruguayan housing finance market has always been dominated by the Banco Hipotecario del Uruguay (BHU). n The BHU is a publicly owned financial institution whose goal is to foster people house ownership. n It was created by law in 1912. n

Background Its three member government body is designated by the Parliament, often following political quotas. n Over much of history the BHU besides being a financial institution was directly involved in the building of houses. n Over the nineties several private institutions launched their our housing credit lines. n

Background Its three member government body is designated by the Parliament, often following political quotas. n Over much of history the BHU besides being a financial institution was directly involved in the building of houses. n Over the nineties several private institutions launched their our housing credit lines. n

Background n Currently the BHU is facing a severe restructure following what was stated in the letter of agreement with the IMF in August 2002. – “The mortgage bank (BHU) will be transformed immediately into a non-banking housing institution bringing forward the restructuring plan, which will be supported by accelerated disbursements form the World Bank. Its deposits will be transferred to the othe public bank, the Banco República (BROU)”

Background n Currently the BHU is facing a severe restructure following what was stated in the letter of agreement with the IMF in August 2002. – “The mortgage bank (BHU) will be transformed immediately into a non-banking housing institution bringing forward the restructuring plan, which will be supported by accelerated disbursements form the World Bank. Its deposits will be transferred to the othe public bank, the Banco República (BROU)”

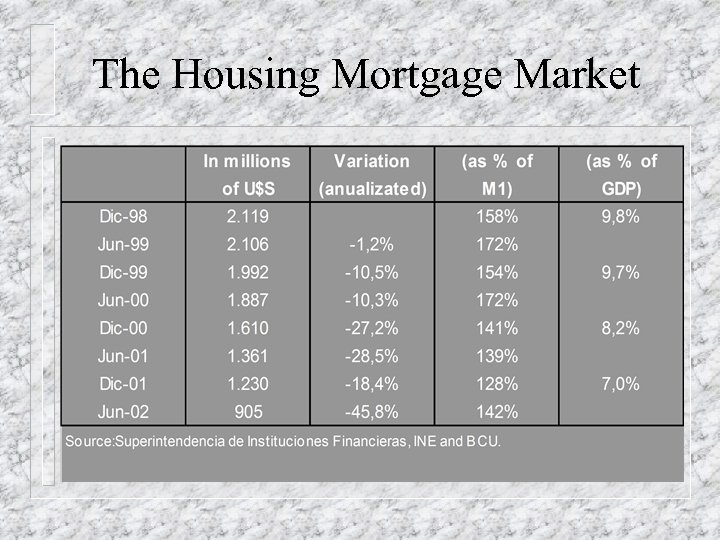

The Housing Mortgage Market n n n Data for the whole market is available only since July 1998. At the end of 1998 Uruguay enter in a recession that will end up in 2003 with a cumulative GDP decline of 20%. Naturally, housing credit decreased (measured in real terms, US$ or as a fraction of GDP). This phenomenon is part of tighter credit restrictions in the whole economy.

The Housing Mortgage Market n n n Data for the whole market is available only since July 1998. At the end of 1998 Uruguay enter in a recession that will end up in 2003 with a cumulative GDP decline of 20%. Naturally, housing credit decreased (measured in real terms, US$ or as a fraction of GDP). This phenomenon is part of tighter credit restrictions in the whole economy.

The Housing Mortgage Market

The Housing Mortgage Market

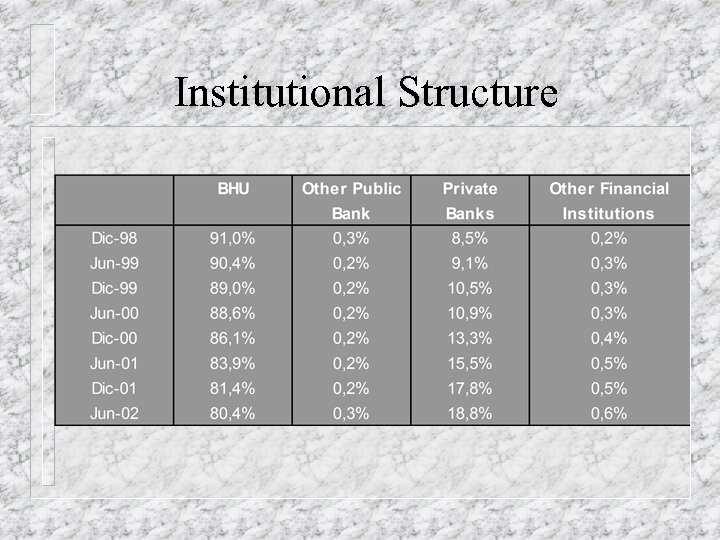

Institutional Structure n The BHU concentrates more than 80% of total loans. n At least since 1998, the private sector market share increases continuously.

Institutional Structure n The BHU concentrates more than 80% of total loans. n At least since 1998, the private sector market share increases continuously.

Institutional Structure

Institutional Structure

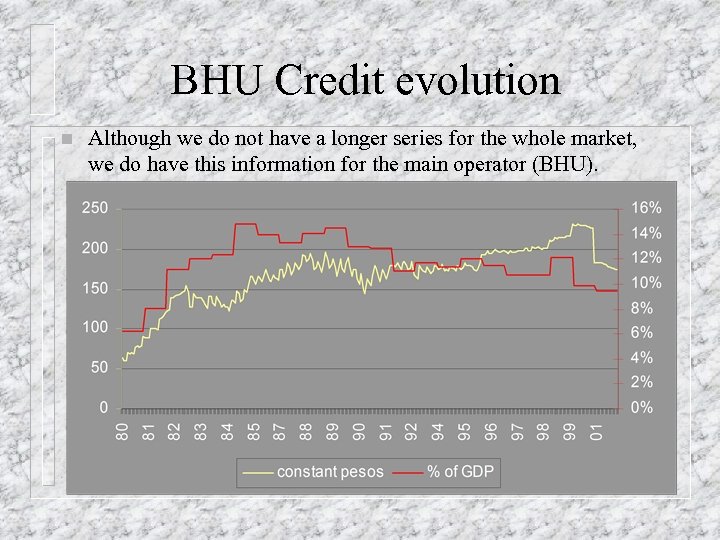

BHU Credit evolution n Although we do not have a longer series for the whole market, we do have this information for the main operator (BHU).

BHU Credit evolution n Although we do not have a longer series for the whole market, we do have this information for the main operator (BHU).

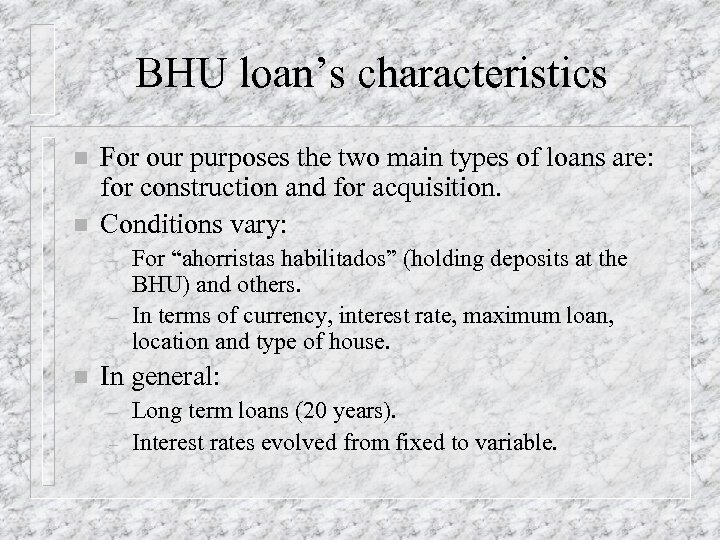

BHU loan’s characteristics n n For our purposes the two main types of loans are: for construction and for acquisition. Conditions vary: – – n For “ahorristas habilitados” (holding deposits at the BHU) and others. In terms of currency, interest rate, maximum loan, location and type of house. In general: – – Long term loans (20 years). Interest rates evolved from fixed to variable.

BHU loan’s characteristics n n For our purposes the two main types of loans are: for construction and for acquisition. Conditions vary: – – n For “ahorristas habilitados” (holding deposits at the BHU) and others. In terms of currency, interest rate, maximum loan, location and type of house. In general: – – Long term loans (20 years). Interest rates evolved from fixed to variable.

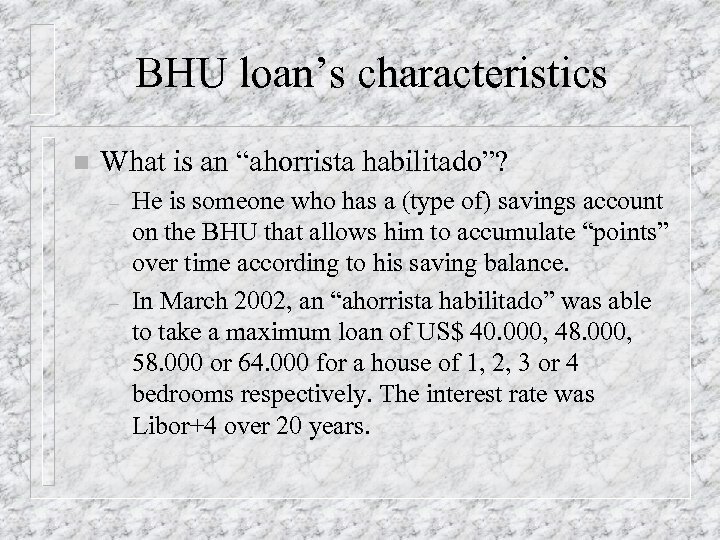

BHU loan’s characteristics n What is an “ahorrista habilitado”? – – He is someone who has a (type of) savings account on the BHU that allows him to accumulate “points” over time according to his saving balance. In March 2002, an “ahorrista habilitado” was able to take a maximum loan of US$ 40. 000, 48. 000, 58. 000 or 64. 000 for a house of 1, 2, 3 or 4 bedrooms respectively. The interest rate was Libor+4 over 20 years.

BHU loan’s characteristics n What is an “ahorrista habilitado”? – – He is someone who has a (type of) savings account on the BHU that allows him to accumulate “points” over time according to his saving balance. In March 2002, an “ahorrista habilitado” was able to take a maximum loan of US$ 40. 000, 48. 000, 58. 000 or 64. 000 for a house of 1, 2, 3 or 4 bedrooms respectively. The interest rate was Libor+4 over 20 years.

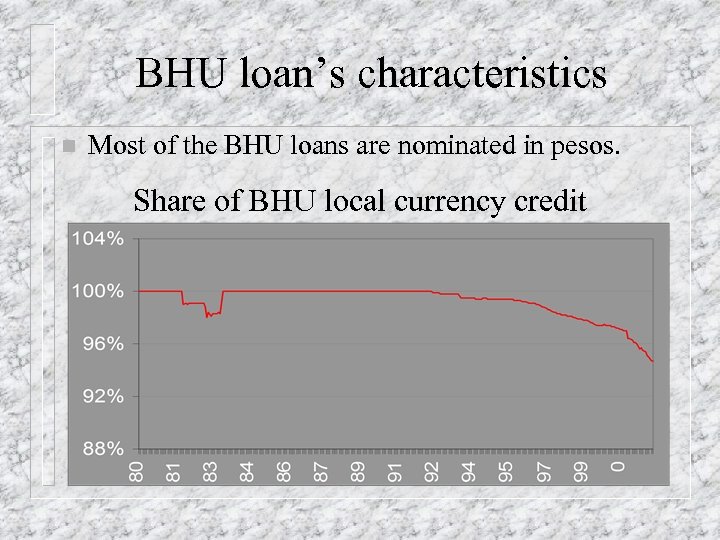

BHU loan’s characteristics n Most of the BHU loans are nominated in pesos. Share of BHU local currency credit

BHU loan’s characteristics n Most of the BHU loans are nominated in pesos. Share of BHU local currency credit

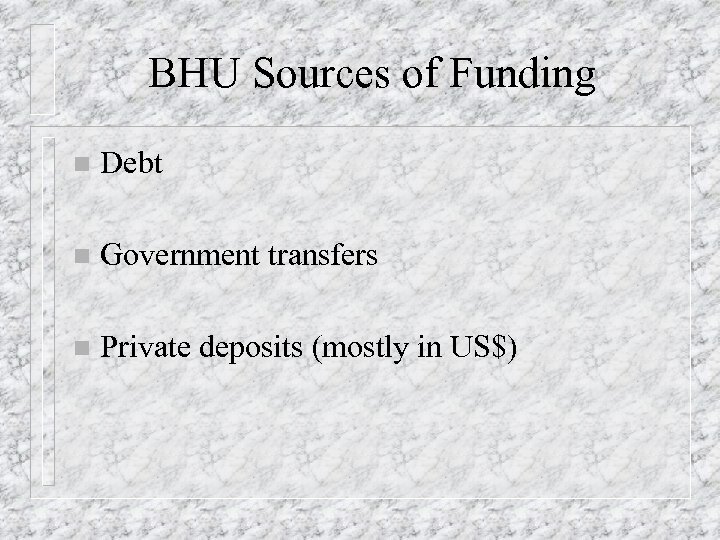

BHU Sources of Funding n Debt n Government transfers n Private deposits (mostly in US$)

BHU Sources of Funding n Debt n Government transfers n Private deposits (mostly in US$)

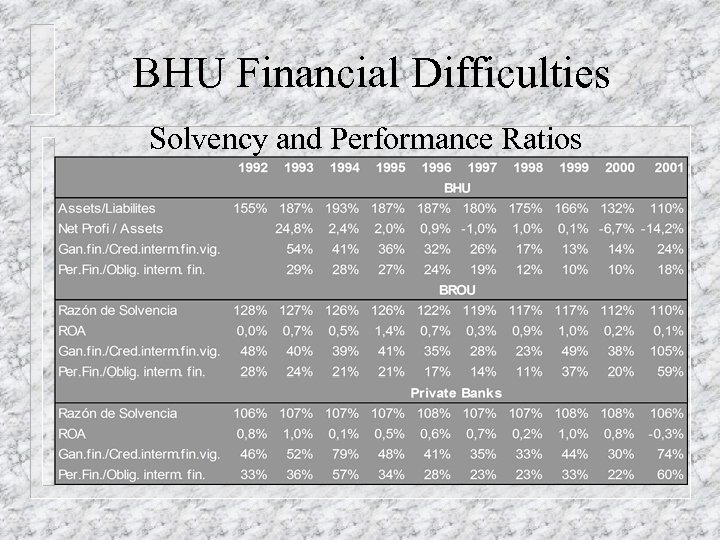

BHU Financial Difficulties Solvency and Performance Ratios

BHU Financial Difficulties Solvency and Performance Ratios

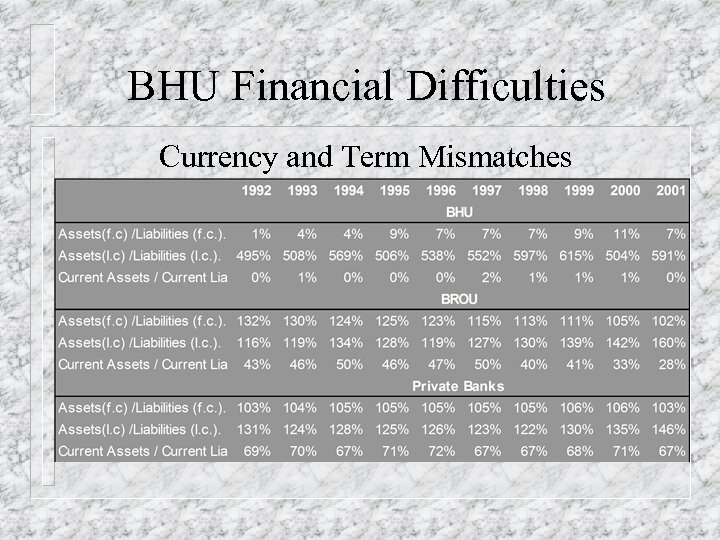

BHU Financial Difficulties Currency and Term Mismatches

BHU Financial Difficulties Currency and Term Mismatches

A Special Unit of Measure Actually, the peso denominated loans are measured in a special unit created by law in 1968. n The “Unidad Reajustable” (U. R. “adjustable unit”) varies up to 4 times per year following the evolution of the Mean Salary Index. n

A Special Unit of Measure Actually, the peso denominated loans are measured in a special unit created by law in 1968. n The “Unidad Reajustable” (U. R. “adjustable unit”) varies up to 4 times per year following the evolution of the Mean Salary Index. n

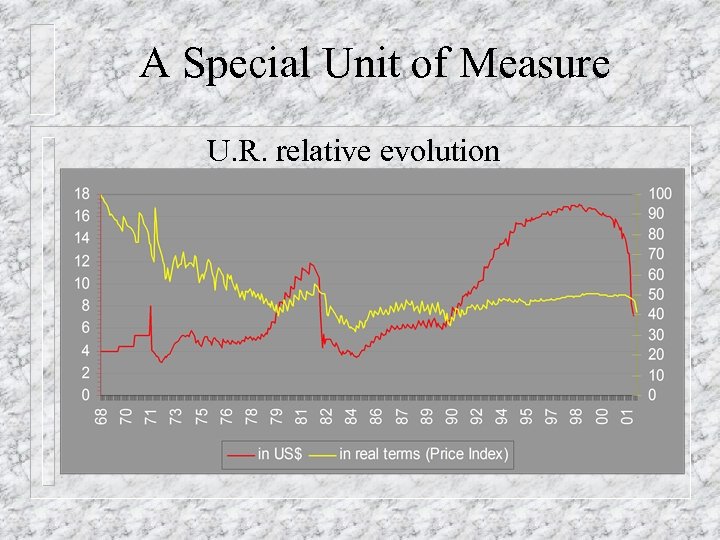

A Special Unit of Measure U. R. relative evolution

A Special Unit of Measure U. R. relative evolution

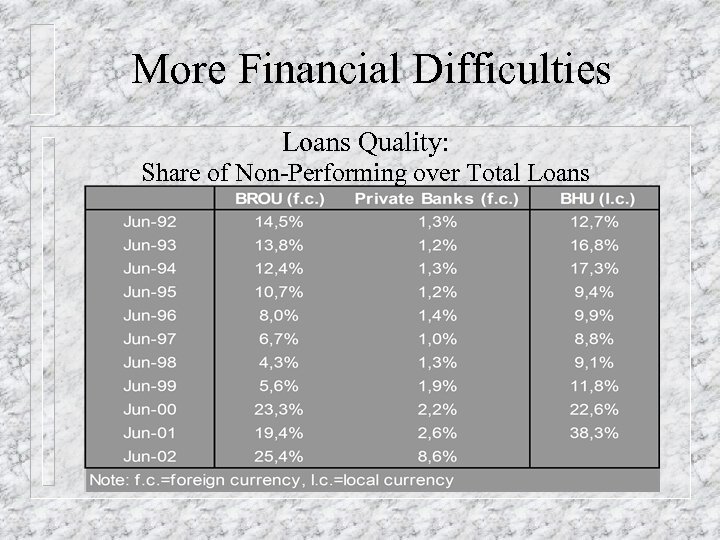

More Financial Difficulties Loans Quality: Share of Non-Performing over Total Loans

More Financial Difficulties Loans Quality: Share of Non-Performing over Total Loans

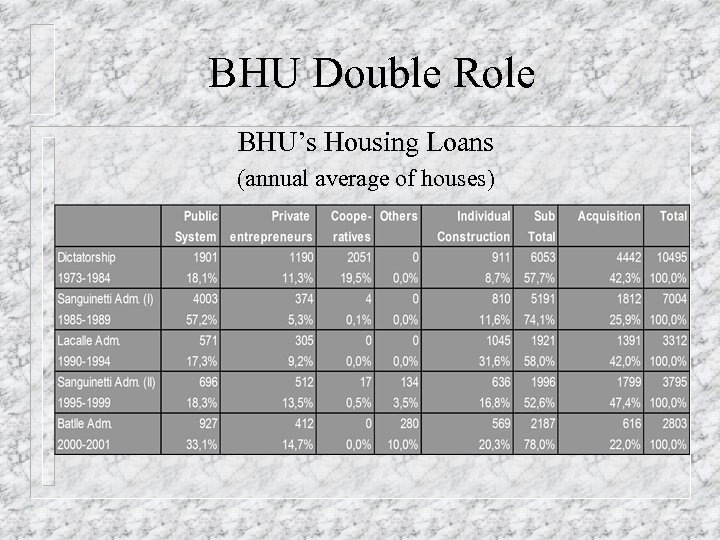

BHU Double Role n House Construction – – – n Public System Private Entrepreneurs Cooperatives Others Individual Construction House Acquisition

BHU Double Role n House Construction – – – n Public System Private Entrepreneurs Cooperatives Others Individual Construction House Acquisition

BHU Double Role BHU’s Housing Loans (annual average of houses)

BHU Double Role BHU’s Housing Loans (annual average of houses)

The Private Sector Why there is not a stronger private sector? n Although there may be several explanations, I would like to stress one: n – n DIFFERENT LEGAL TREATMENT In case of default, to take over the collateral the BHU does not need to go through the courts while the private sector has.

The Private Sector Why there is not a stronger private sector? n Although there may be several explanations, I would like to stress one: n – n DIFFERENT LEGAL TREATMENT In case of default, to take over the collateral the BHU does not need to go through the courts while the private sector has.

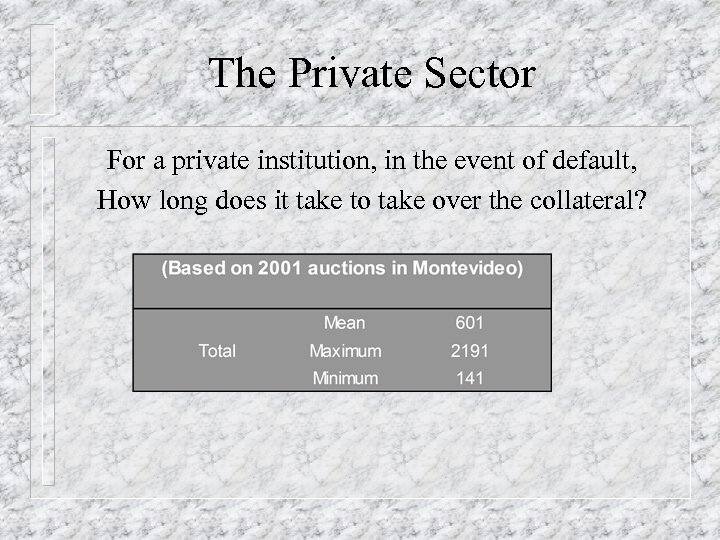

The Private Sector For a private institution, in the event of default, How long does it take to take over the collateral?

The Private Sector For a private institution, in the event of default, How long does it take to take over the collateral?

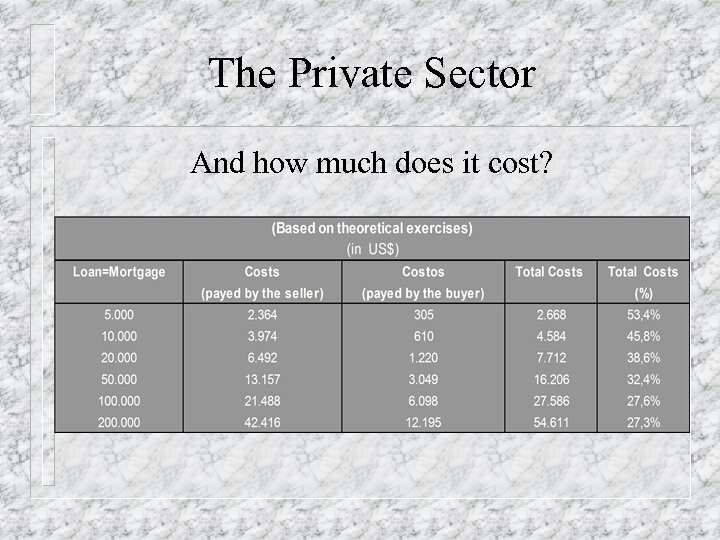

The Private Sector And how much does it cost?

The Private Sector And how much does it cost?

Probability of Access to Mortgage Credit n n We computed a qualitative response model and estimate the probabilities of access to a mortgage credit. The probability increases with: – – – the amount of household members household income stability of the family nucleus age of the household head and the household head working for the public sector

Probability of Access to Mortgage Credit n n We computed a qualitative response model and estimate the probabilities of access to a mortgage credit. The probability increases with: – – – the amount of household members household income stability of the family nucleus age of the household head and the household head working for the public sector

Probability of Access to Mortgage Credit n Prob(w=1/IPublic=1) - Prob(w=1/IPublic=0) n Why the probability is higher for Public Employees? There is a law called “Ley de Empleados Públicos” that basically implies that public servants can not be dismissed and have therefore they flow of income secured. The BHU is able through the public system to eliminate Principal-Agent type of problems. n n

Probability of Access to Mortgage Credit n Prob(w=1/IPublic=1) - Prob(w=1/IPublic=0) n Why the probability is higher for Public Employees? There is a law called “Ley de Empleados Públicos” that basically implies that public servants can not be dismissed and have therefore they flow of income secured. The BHU is able through the public system to eliminate Principal-Agent type of problems. n n

Final words The publicly owned BHU is the main operator in the Uruguayan Mortgage Market n It suffers from large term and currency mismatches n Very high proportion of non-performing loans. n

Final words The publicly owned BHU is the main operator in the Uruguayan Mortgage Market n It suffers from large term and currency mismatches n Very high proportion of non-performing loans. n

Final words n n n Behind BHU disastrous condition are probably the political pressures for specific actions and the designation of its authorities following political and not technical criteria. The Private Sector market share increase in the last part of the nineties. Its small size is at least partially associated to legal discrimination in favor of the BHU.

Final words n n n Behind BHU disastrous condition are probably the political pressures for specific actions and the designation of its authorities following political and not technical criteria. The Private Sector market share increase in the last part of the nineties. Its small size is at least partially associated to legal discrimination in favor of the BHU.