9b057a7f810cbe1d2ddc922405f7cf73.ppt

- Количество слайдов: 19

Housing Demand Supply

Housing Demand Supply

Today • Return Exam • Second Paper – Discussion • Housing Services and Supply

Today • Return Exam • Second Paper – Discussion • Housing Services and Supply

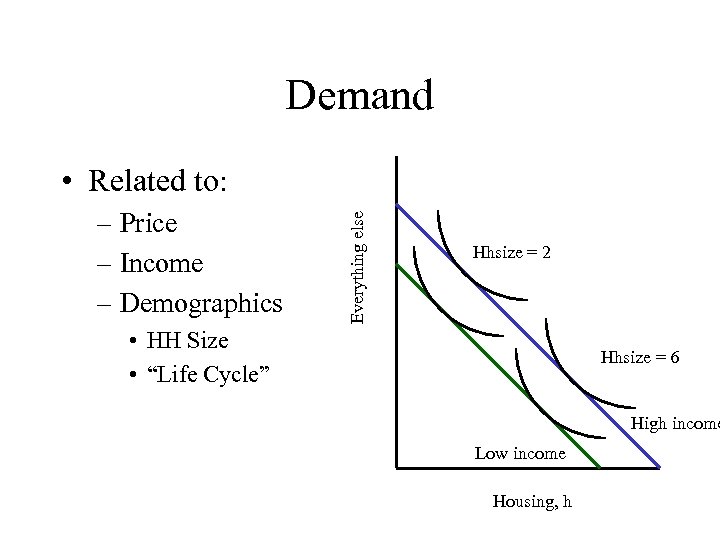

Demand – Price – Income – Demographics Everything else • Related to: Hhsize = 2 • HH Size • “Life Cycle” Hhsize = 6 High income Low income Housing, h

Demand – Price – Income – Demographics Everything else • Related to: Hhsize = 2 • HH Size • “Life Cycle” Hhsize = 6 High income Low income Housing, h

Income Elasticities • If our income increases by $500, do we move? Why? • Economists feel that the appropriate measure to use is “permanent income, ” related to wealth. • Permanent income elasticities are probably somewhere between 0. 5 and 1. 0. Best guess may be 0. 5 to 0. 7. Discuss.

Income Elasticities • If our income increases by $500, do we move? Why? • Economists feel that the appropriate measure to use is “permanent income, ” related to wealth. • Permanent income elasticities are probably somewhere between 0. 5 and 1. 0. Best guess may be 0. 5 to 0. 7. Discuss.

Price Elasticities • Think back. How did we get price of housing? • Is a $100, 000 house half as expensive (per unit housing) as a $200, 000 house? • Presumably price of housing decreases as you move further out. Why? • Most estimates of price elasticity of demand are less elastic than -1. 0 (between 0 and -1. 0)

Price Elasticities • Think back. How did we get price of housing? • Is a $100, 000 house half as expensive (per unit housing) as a $200, 000 house? • Presumably price of housing decreases as you move further out. Why? • Most estimates of price elasticity of demand are less elastic than -1. 0 (between 0 and -1. 0)

Price Elasticity and Expenditures • Price elasticity is probably around -0. 7 in absolute value. • Suppose you own a house worth $100, 000, and value is a straight multiple of rents (housing prices). • As you move further out, price of housing falls by 20%, and that price elasticity is -0. 7. What happens to expenditures? • E = (% D Q)/ (% D P).

Price Elasticity and Expenditures • Price elasticity is probably around -0. 7 in absolute value. • Suppose you own a house worth $100, 000, and value is a straight multiple of rents (housing prices). • As you move further out, price of housing falls by 20%, and that price elasticity is -0. 7. What happens to expenditures? • E = (% D Q)/ (% D P).

Price Elasticity and Expenditures • E = (% D Q)/ (% D P). • -0. 7 = (% D Q) / (-0. 2) -- Why? • 0. 14 = (% D Q) So, we’re buying 14% more housing, at 80% of the previous price. New house will cost: V* = 100 * (1. 14) * (0. 8) V* = 91. 2. Our expenditures .

Price Elasticity and Expenditures • E = (% D Q)/ (% D P). • -0. 7 = (% D Q) / (-0. 2) -- Why? • 0. 14 = (% D Q) So, we’re buying 14% more housing, at 80% of the previous price. New house will cost: V* = 100 * (1. 14) * (0. 8) V* = 91. 2. Our expenditures .

Moving Costs • Changing housing consumption is costly. Why? • You have to MOVE. – Search costs – “Adventure in moving” • O’Sullivan gives one graph. I’m going to give you a different one.

Moving Costs • Changing housing consumption is costly. Why? • You have to MOVE. – Search costs – “Adventure in moving” • O’Sullivan gives one graph. I’m going to give you a different one.

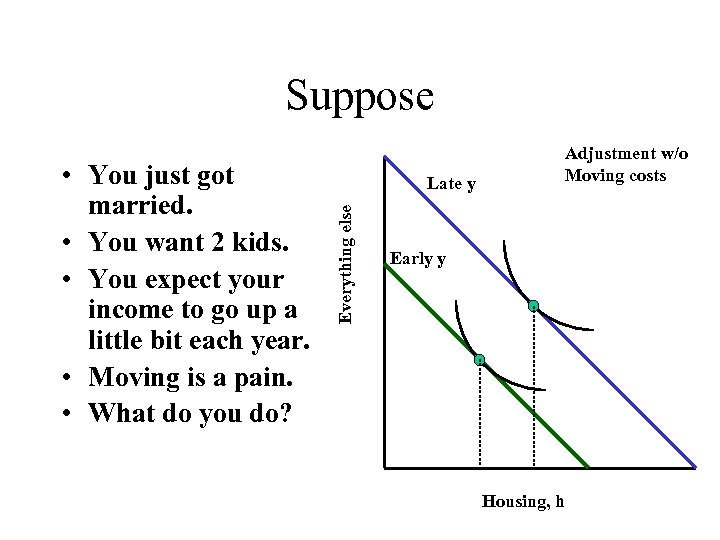

Suppose Late y Everything else • You just got married. • You want 2 kids. • You expect your income to go up a little bit each year. • Moving is a pain. • What do you do? Adjustment w/o Moving costs Early y Housing, h

Suppose Late y Everything else • You just got married. • You want 2 kids. • You expect your income to go up a little bit each year. • Moving is a pain. • What do you do? Adjustment w/o Moving costs Early y Housing, h

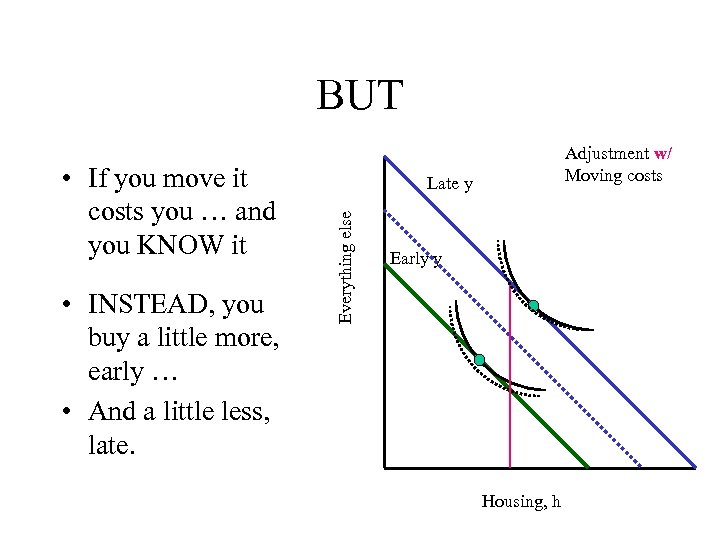

BUT • INSTEAD, you buy a little more, early … • And a little less, late. Late y Everything else • If you move it costs you … and you KNOW it Adjustment w/ Moving costs Early y Housing, h

BUT • INSTEAD, you buy a little more, early … • And a little less, late. Late y Everything else • If you move it costs you … and you KNOW it Adjustment w/ Moving costs Early y Housing, h

What happens? • You avoid the moving costs. • Point here, is that households don’t move every time their incomes change … • Or every time the housing price changes. • We want a story that is realistic.

What happens? • You avoid the moving costs. • Point here, is that households don’t move every time their incomes change … • Or every time the housing price changes. • We want a story that is realistic.

Supply • Think, for now, of housing as entirely rental stock. • What do we know? – It is durable. Dwellings can last for 100 years or more. – Most of our housing supply comes from “used” stock, rather than new stock. – Supply of services is pretty inelastic. Only 2 to 3% of the housing on the market in any year is new.

Supply • Think, for now, of housing as entirely rental stock. • What do we know? – It is durable. Dwellings can last for 100 years or more. – Most of our housing supply comes from “used” stock, rather than new stock. – Supply of services is pretty inelastic. Only 2 to 3% of the housing on the market in any year is new.

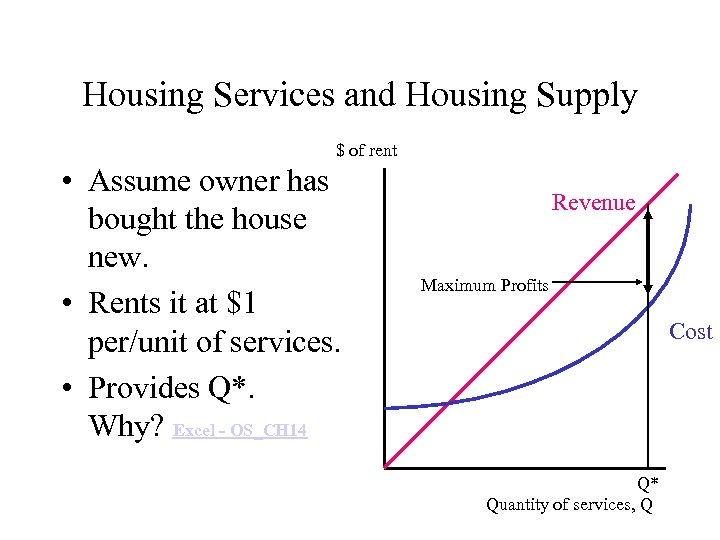

Housing Services and Housing Supply $ of rent • Assume owner has bought the house new. • Rents it at $1 per/unit of services. • Provides Q*. Why? Excel - OS_CH 14 Revenue Maximum Profits Cost Q* Quantity of services, Q

Housing Services and Housing Supply $ of rent • Assume owner has bought the house new. • Rents it at $1 per/unit of services. • Provides Q*. Why? Excel - OS_CH 14 Revenue Maximum Profits Cost Q* Quantity of services, Q

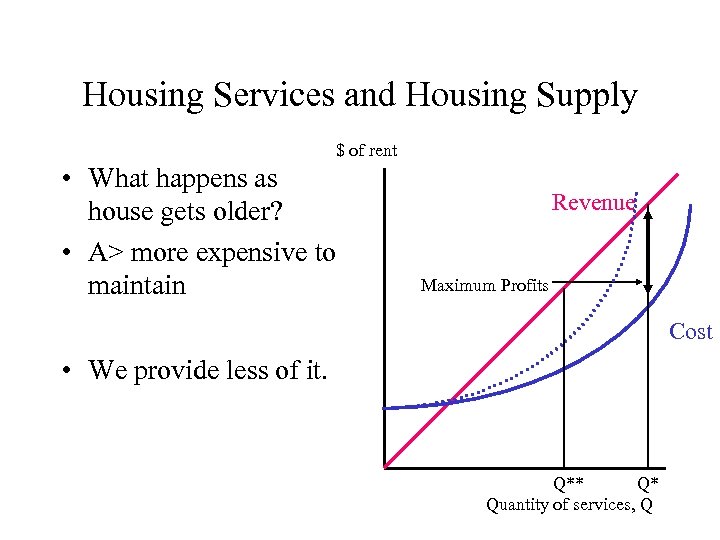

Housing Services and Housing Supply $ of rent • What happens as house gets older? • A> more expensive to maintain Revenue Maximum Profits Cost • We provide less of it. Q** Q* Quantity of services, Q

Housing Services and Housing Supply $ of rent • What happens as house gets older? • A> more expensive to maintain Revenue Maximum Profits Cost • We provide less of it. Q** Q* Quantity of services, Q

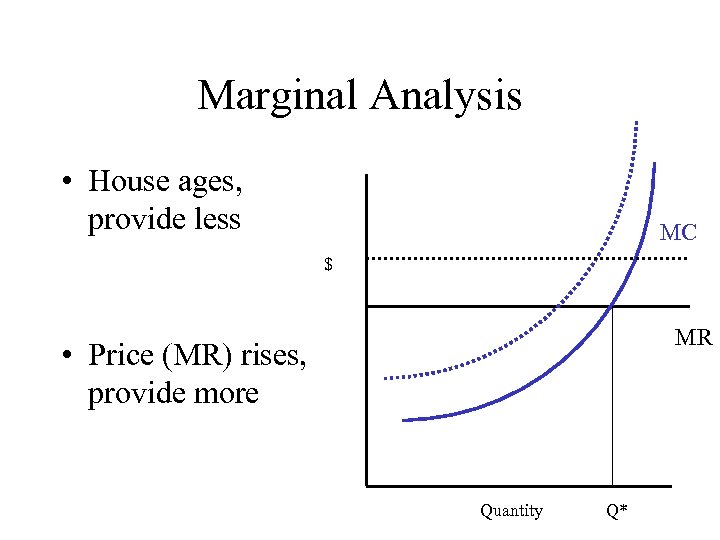

Marginal Analysis • House ages, provide less MC $ MR • Price (MR) rises, provide more Quantity Q*

Marginal Analysis • House ages, provide less MC $ MR • Price (MR) rises, provide more Quantity Q*

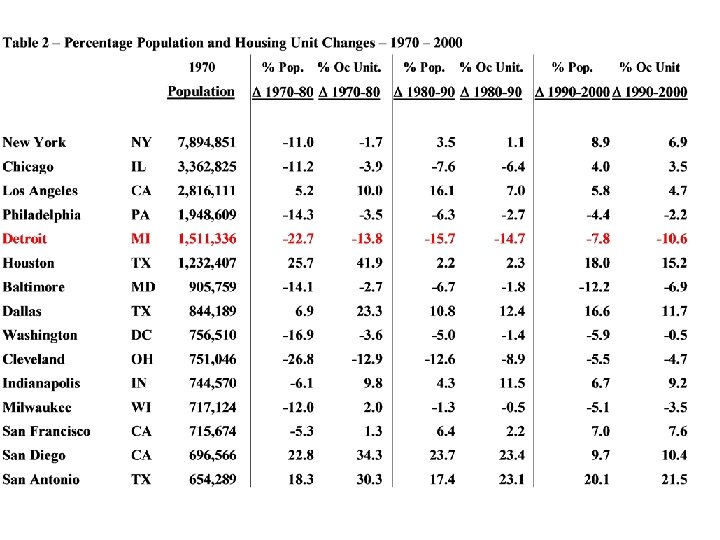

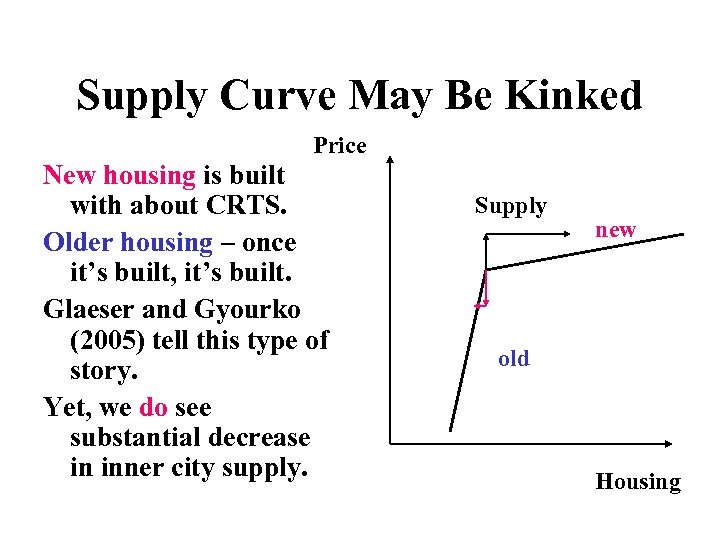

Supply Curve May Be Kinked Price New housing is built with about CRTS. Older housing – once it’s built, it’s built. Glaeser and Gyourko (2005) tell this type of story. Yet, we do see substantial decrease in inner city supply. Supply new old Housing

Supply Curve May Be Kinked Price New housing is built with about CRTS. Older housing – once it’s built, it’s built. Glaeser and Gyourko (2005) tell this type of story. Yet, we do see substantial decrease in inner city supply. Supply new old Housing

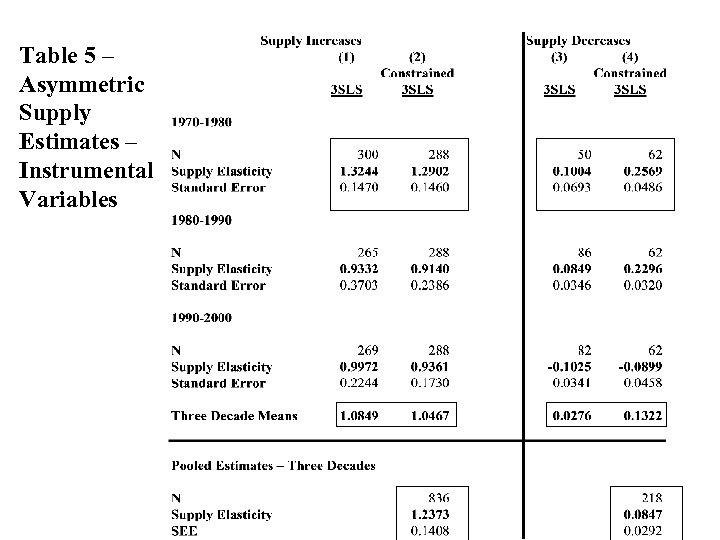

Table 5 – Asymmetric Supply Estimates – Instrumental Variables

Table 5 – Asymmetric Supply Estimates – Instrumental Variables

Sources Goodman, Allen C. , “The Other Side of Eight Mile, ” Real Estate Economics 33 (2005): 539569 Goodman, Allen C. , “Central Cities and Housing Supply: Growth and Decline in U. S. Cities, ” Journal of Housing Economics 14 (December 2005): 315 -335

Sources Goodman, Allen C. , “The Other Side of Eight Mile, ” Real Estate Economics 33 (2005): 539569 Goodman, Allen C. , “Central Cities and Housing Supply: Growth and Decline in U. S. Cities, ” Journal of Housing Economics 14 (December 2005): 315 -335