f1c3762bef58cce117423ca4176ea19c.ppt

- Количество слайдов: 16

Housing: Bubble or Boom? Steve Keen www. debtdeflation. com/blogs www. keenwalk. com. au

“Great Debate”, or talking past each other? • House price debate a welter of confusing stats – Prices high relative to incomes? – Or prices reflect supply & demand? • Each side supports case with selective statistics • My approach: Housing a side-issue – Main issue: what’s driving the economy – House prices a symptom of this… • Economic growth debt-dependent – Debt-induced downturn caused GFC – Housing market main target of Ponzi Lending – Australia avoided crisis by piling on yet more debt – Housing will suffer fate of debt-dependent economy

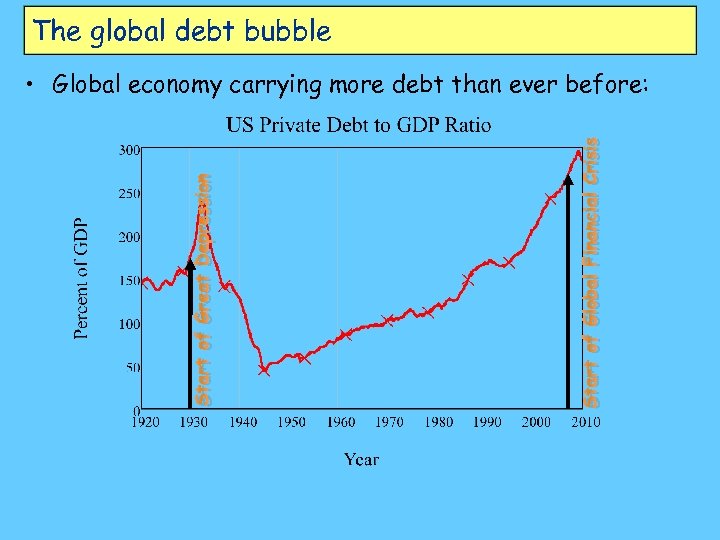

The global debt bubble Start of Global Financial Crisis Start of Great Depression • Global economy carrying more debt than ever before:

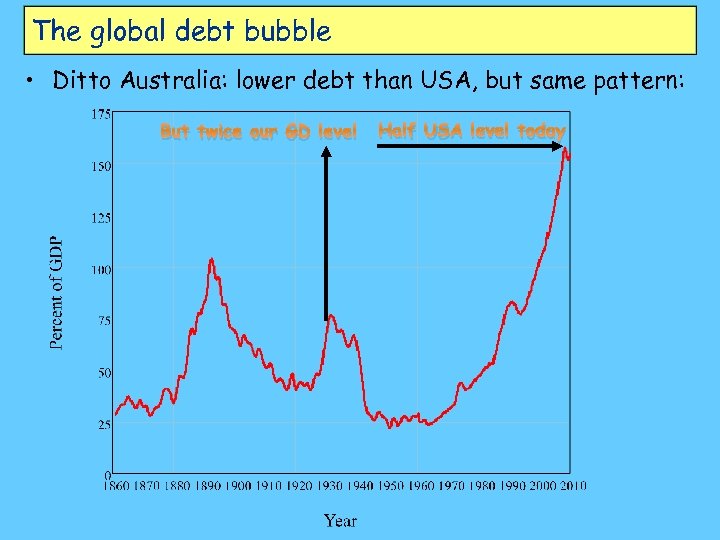

The global debt bubble • Ditto Australia: lower debt than USA, but same pattern: But twice our GD level Half USA level today

What’s wrong with debt? • Debt for productive purposes good – Working capital for firms – Loans for new technology, factories, markets… • But debt for speculation on asset prices – Drives up asset prices • “Positive feedback loop” between debt & price – Doesn’t add to capacity of economy to service debts – If debt high relative to GDP, change in debt dominates economy • Crash inevitable when debt stops growing • Above ignored by conventional “neoclassical” economics • Main explanation of Great Depression by mavericks Irving Fisher & Hyman Minsky…

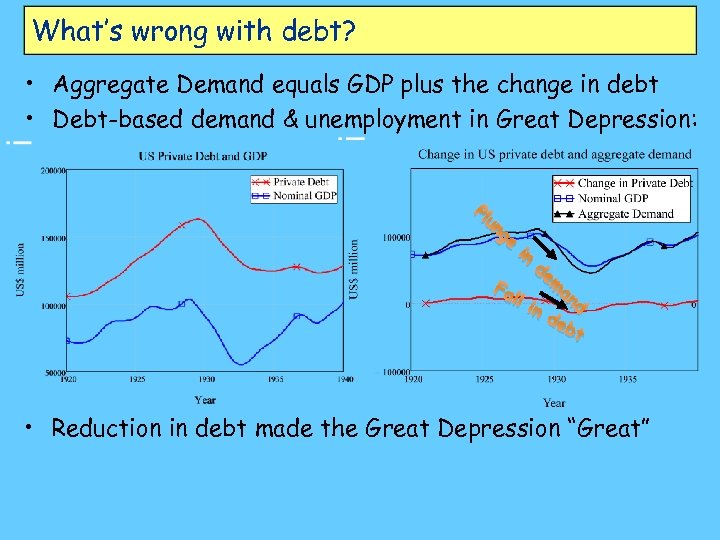

What’s wrong with debt? • Aggregate Demand equals GDP plus the change in debt • Debt-based demand & unemployment in Great Depression: Pl un ge in Fa ll de m in an d de bt • Reduction in debt made the Great Depression “Great”

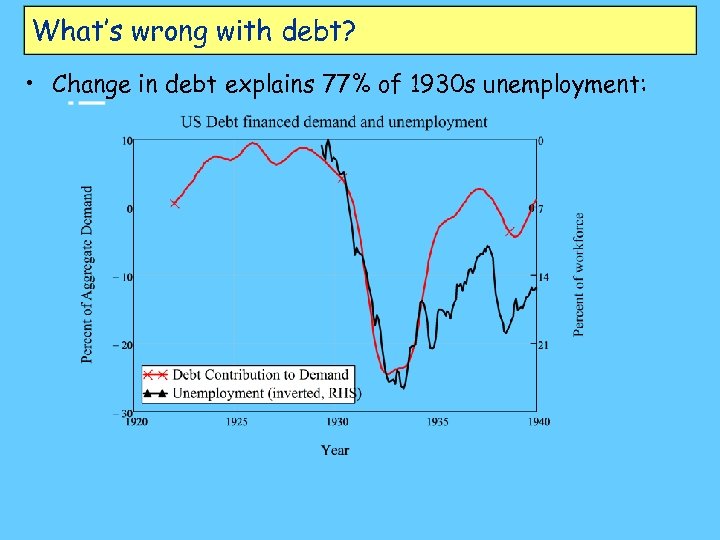

What’s wrong with debt? • Change in debt explains 77% of 1930 s unemployment:

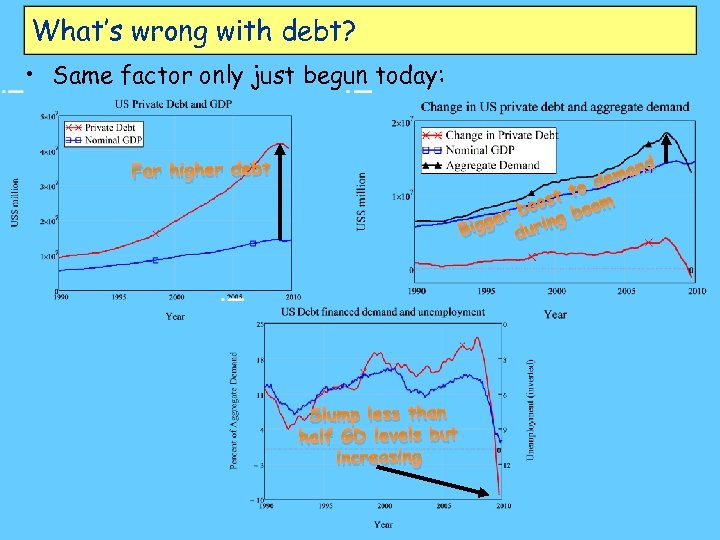

What’s wrong with debt? • Same factor only just begun today: nd Far higher debt a dem to ost oom o er b ring b Bigg du Slump less than half GD levels but increasing

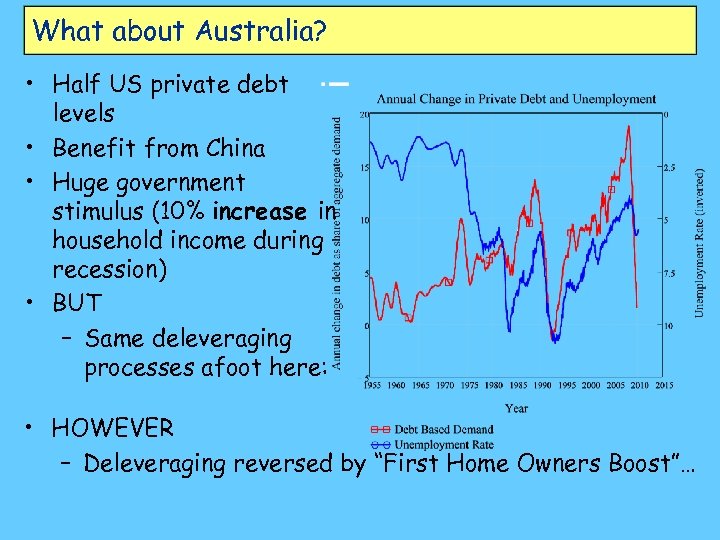

What about Australia? • Half US private debt levels • Benefit from China • Huge government stimulus (10% increase in household income during recession) • BUT – Same deleveraging processes afoot here: • HOWEVER – Deleveraging reversed by “First Home Owners Boost”…

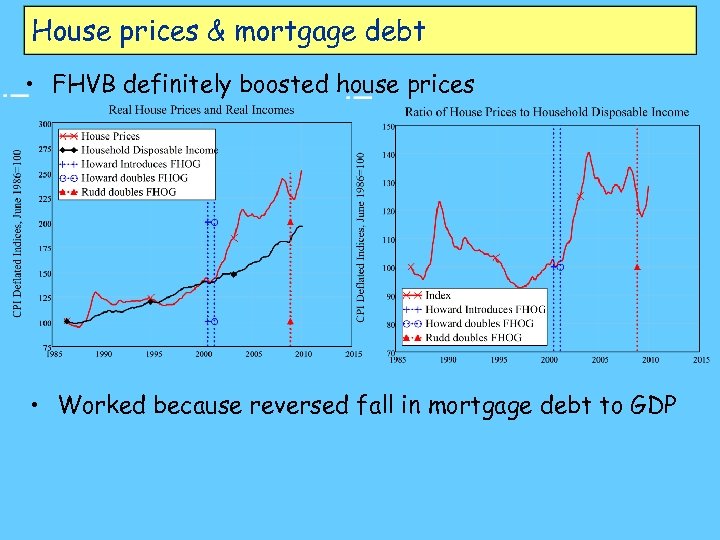

House prices & mortgage debt • FHVB definitely boosted house prices • Worked because reversed fall in mortgage debt to GDP

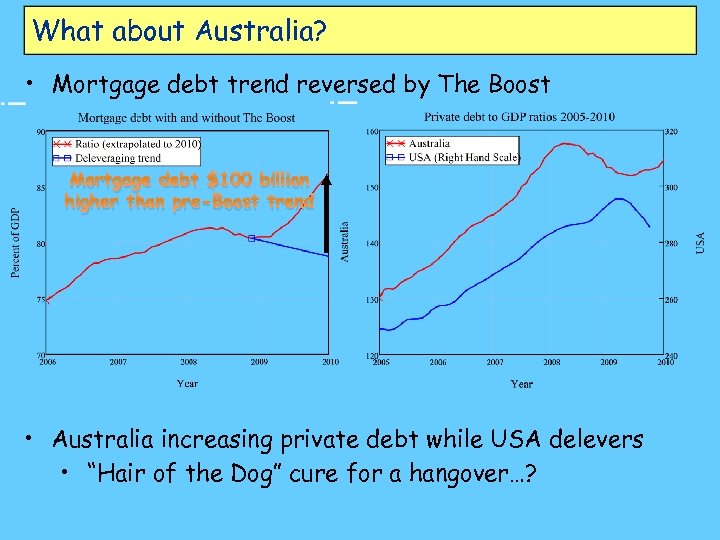

What about Australia? • Mortgage debt trend reversed by The Boost Mortgage debt $100 billion higher than pre-Boost trend • Australia increasing private debt while USA delevers • “Hair of the Dog” cure for a hangover…?

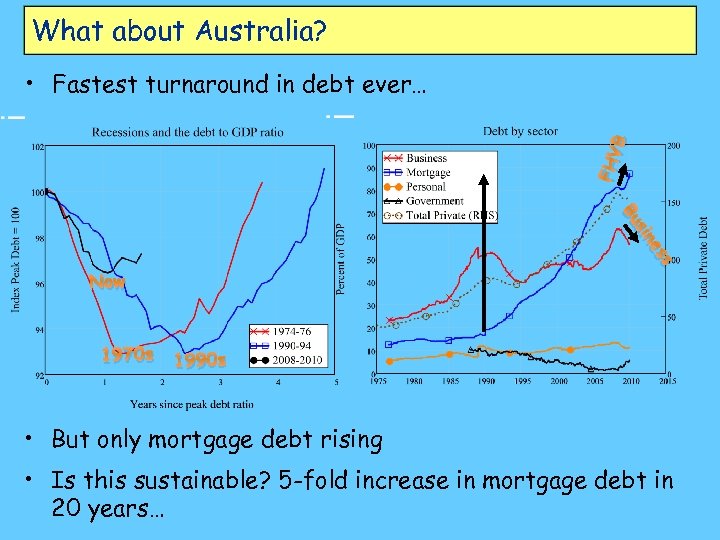

What about Australia? FHV B • Fastest turnaround in debt ever… ss e sin Bu Now 1970 s 1990 s • But only mortgage debt rising • Is this sustainable? 5 -fold increase in mortgage debt in 20 years…

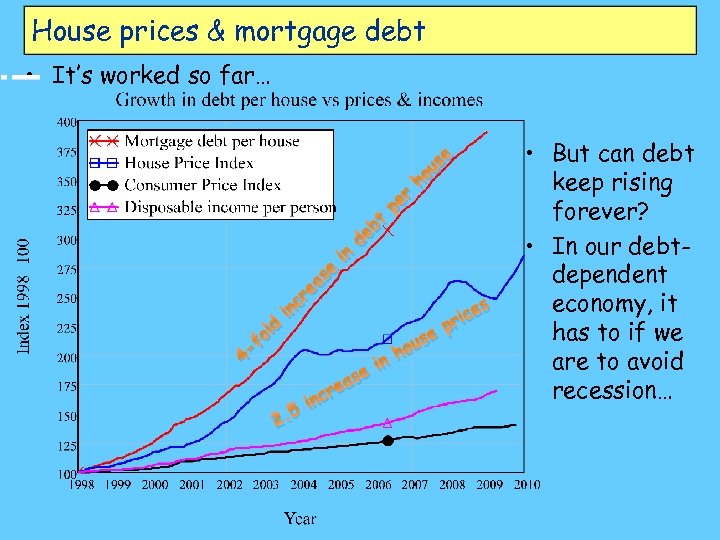

House prices & mortgage debt • Aim of House price speculation is unearned income • Sources of unearned income are – Someone else’s income – Increased debt • If everyone tries to do it… – Either offshore income (Chinese buyers? ) or – Increased debt • House prices rise so long as debt rises faster… • Real problem with economy is it is debt dependent – Continued prosperity now dependent on ever-rising debt

House prices & mortgage debt • It’s worked so far… e as e d 4 - l fo in bt e r pe 5 h d cr in 2. e us o n ei as re inc s h use o e ric p • But can debt keep rising forever? • In our debtdependent economy, it has to if we are to avoid recession…

The real problem with Deleveraging • Hypothetical economy Year 0 – GDP $1 trillion, growing at 10% p. a. – Debt $1. 25 trillion at start of year • Increase in debt in $250 billion – Total spending on all markets: $1. 25 trillion • Hypothetical economy Year 1 – GDP $1. 1 trillion – Increase in debt zero – Total spending on all markets $1. 1 trillion – $150 billion fall in demand because debt stabilises • Markets must “take a hit” from fall in turnover • Similar but smaller effect even if debt grows 10% – No growth in nominal demand—rise in unemployment

The real problem with Deleveraging • Problem with large debt isn’t just servicing it • When debt – Grows faster than economy for many years – Becomes much larger than GDP • Then debt has to keep growing faster than GDP to sustain economy – Servicing crisis inevitable – Then slowdown in debt growth causes recession – Turnaround in debt causes Depression • Deleveraging delayed by government policy here to date • When it hits, all markets will suffer—including housing • For more information, see www. debtdeflation. com/blogs

f1c3762bef58cce117423ca4176ea19c.ppt