bdd205dbead2b31b448b6b754c652759.ppt

- Количество слайдов: 51

Housing Affordability: has the great Australian dream ended? Judy Yates University of Sydney

Outline Current situation (and why different from US) How did we get there? Implications and explanations of changes that have occurred What is needed for a fairer housing system? What can we do about it?

Current situation In Australia • House prices declining - but • Initial house price correction occurred in 2003 -04 • Current and anticipated shortage of supply Factors specific to US house price declines • Excess supply of housing • Expansion of home ownership to ‘underserved’ minorities • High proportion sub-prime lending • Different financial system • Non-recourse lending • Fixed rate lending, widespread use of MBS • Weaker regulatory system

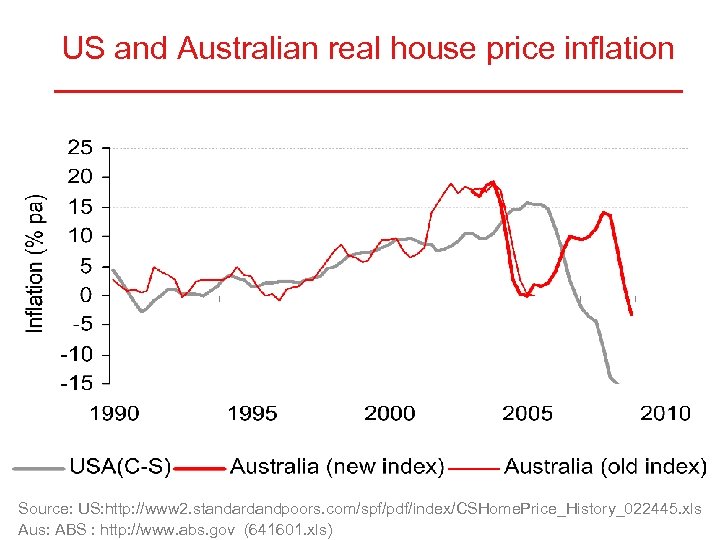

US and Australian real house price inflation Source: US: http: //www 2. standardandpoors. com/spf/pdf/index/CSHome. Price_History_022445. xls Aus: ABS : http: //www. abs. gov (641601. xls)

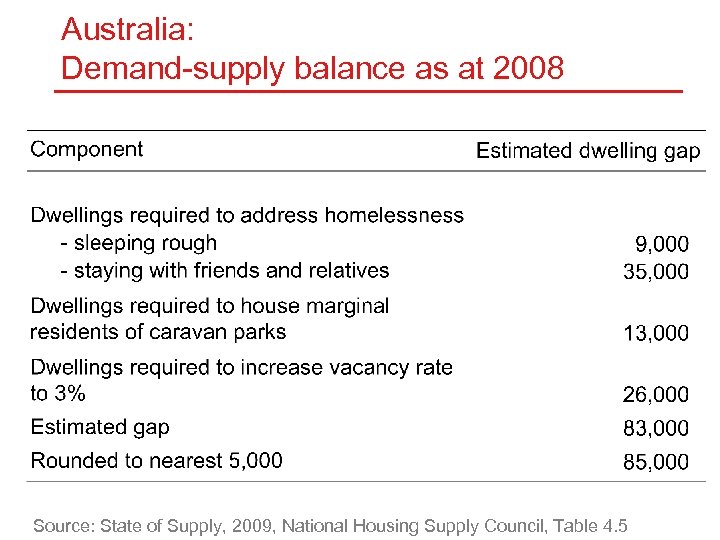

Australia: Demand-supply balance as at 2008 Source: State of Supply, 2009, National Housing Supply Council, Table 4. 5

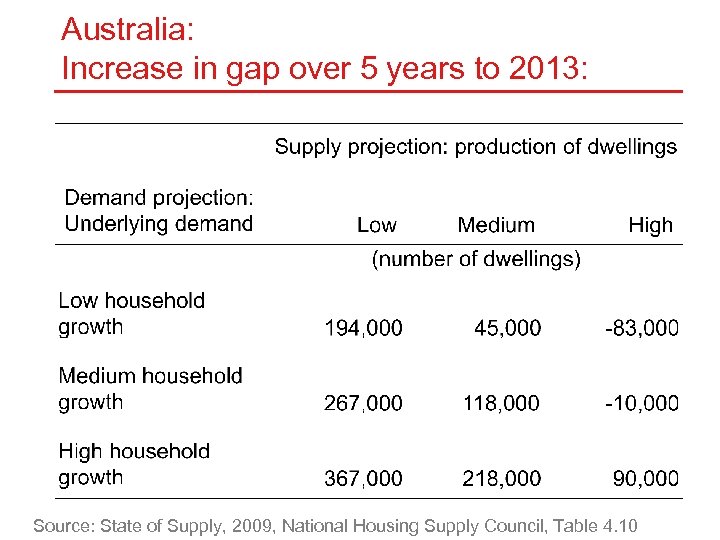

Australia: Increase in gap over 5 years to 2013: Source: State of Supply, 2009, National Housing Supply Council, Table 4. 10

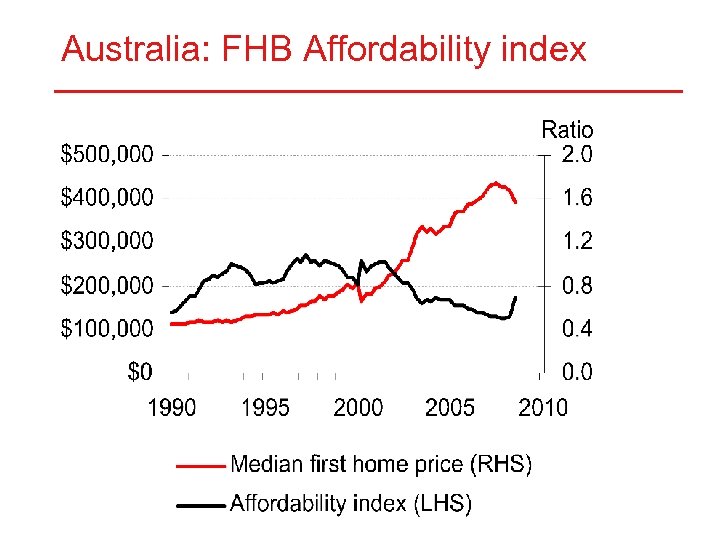

Australia: FHB Affordability index

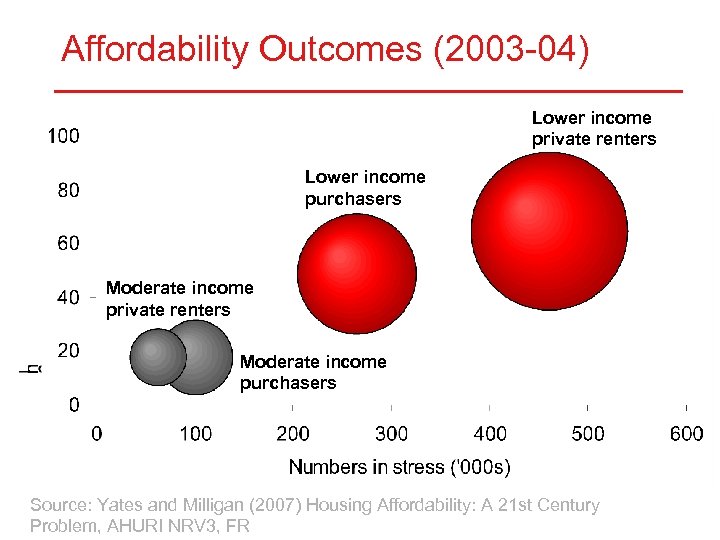

Affordability Outcomes (2003 -04) Lower income private renters Lower income purchasers Moderate income private renters Moderate income purchasers Source: Yates and Milligan (2007) Housing Affordability: A 21 st Century Problem, AHURI NRV 3, FR

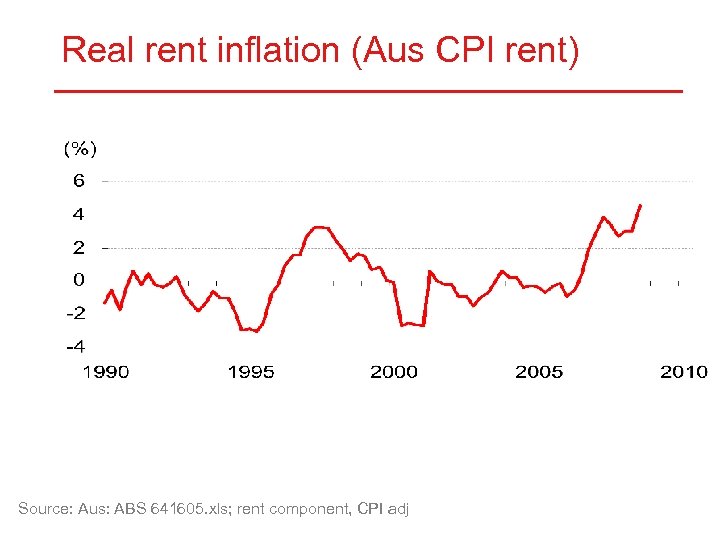

Real rent inflation (Aus CPI rent) Source: Aus: ABS 641605. xls; rent component, CPI adj

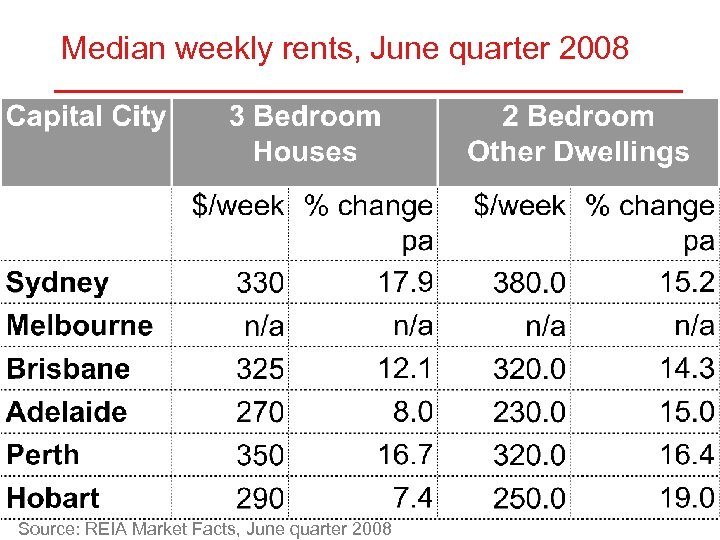

Median weekly rents, June quarter 2008 Source: REIA Market Facts, June quarter 2008

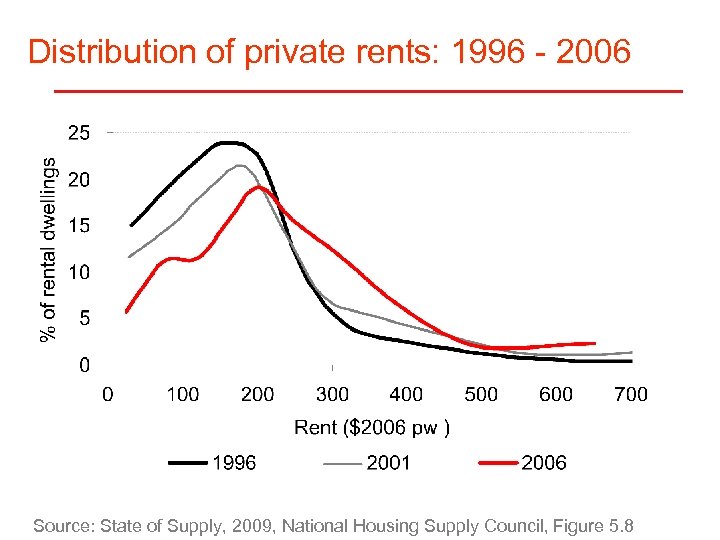

Distribution of private rents: 1996 - 2006 Source: State of Supply, 2009, National Housing Supply Council, Figure 5. 8

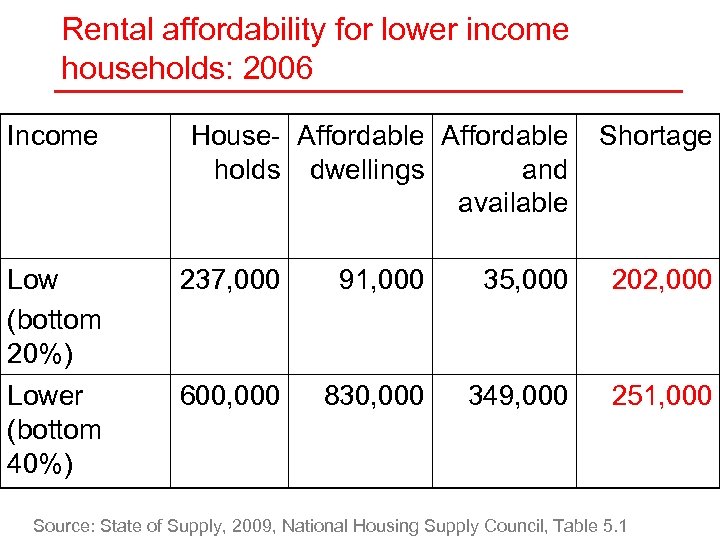

Rental affordability for lower income households: 2006 Income House- Affordable holds dwellings and available Shortage Low (bottom 20%) 237, 000 91, 000 35, 000 202, 000 Lower (bottom 40%) 600, 000 830, 000 349, 000 251, 000 Source: State of Supply, 2009, National Housing Supply Council, Table 5. 1

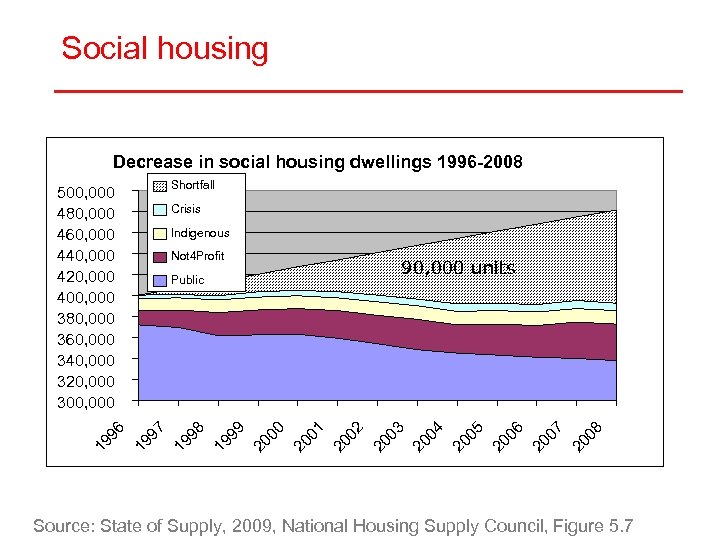

Social housing Decrease in social housing dwellings 1996 -2008 Shortfall Crisis Indigenous Not 4 Profit 08 20 07 20 06 20 05 20 20 03 20 02 20 01 20 00 20 99 19 98 19 97 04 90, 000 units Public 19 19 96 500, 000 480, 000 460, 000 440, 000 420, 000 400, 000 380, 000 360, 000 340, 000 320, 000 300, 000 Source: State of Supply, 2009, National Housing Supply Council, Figure 5. 7

Current state - summary Affordability for FHBs has improved in the past 6 months but is still worse than a decade ago Affordability problems worse for lower income renters • Associated with affordable housing shortages

How did we get there? Experiences of 3 generations of FHBs • 1950 s-1960 s • 1970 s-1980 s • 1990 s-2000 s Implications and explanations of changes that have occurred

1950 s -1960 s • • Median house price: $7, 500 Average earnings: $2, 000 pa Maximum loan: $9, 000 Deposit gap: -ve Dream: owner-occupied housing provided shelter, security and stability Reality: housing affordable

1970 s – 1980 s • • Median house price: $32, 000 Average earnings: $ 8, 000 pa Maximum loan: $25, 000 Deposit gap: annual income Dream: wealth accumulation Reality: access problems emerging

1990 s – 2000 s • • Median house price: $350, 000 Average earnings: $ 50, 000 pa Maximum loan: $200, 000 Deposit gap: 3 x pa income Dream: ? ? ? Reality: housing unaffordable

Key factors: 1950 s – 1960 s Economic: • Stable, steady growth Social • Family focus, single male breadwinner Financial • Regulated housing finance sector • Significant government provision Role of housing • Shelter, security, stability

Key factors: 1970 s-1980 s Economic: • High unemployment and high inflation Social • Move to two earner households Financial • Increasing interest rates, emergence of deposit gaps • Decreasing government involvement Role of housing • Savings requirement, plus inflation highlighted wealth accumulation

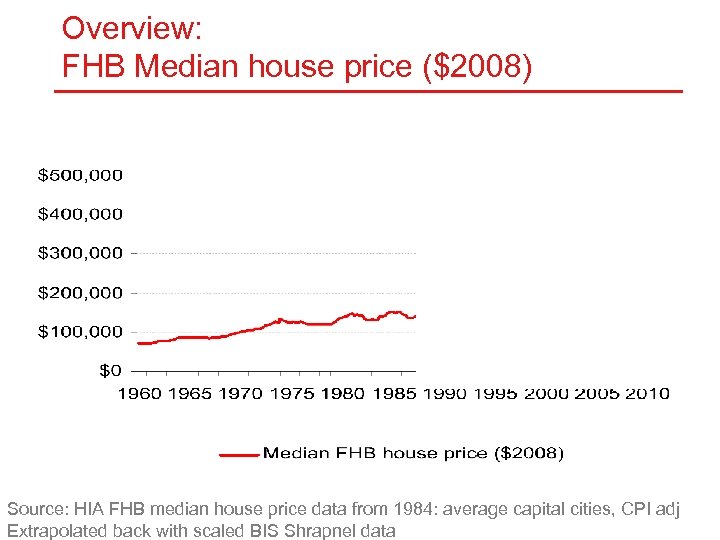

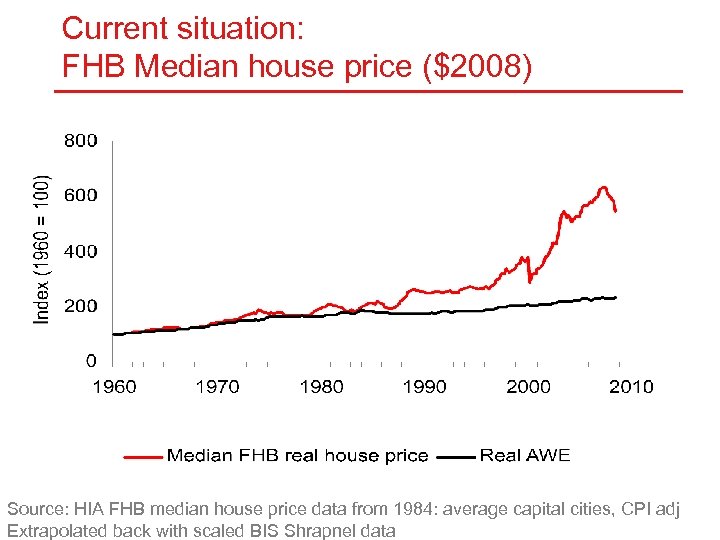

Overview: FHB Median house price ($2008) Source: HIA FHB median house price data from 1984: average capital cities, CPI adj Extrapolated back with scaled BIS Shrapnel data

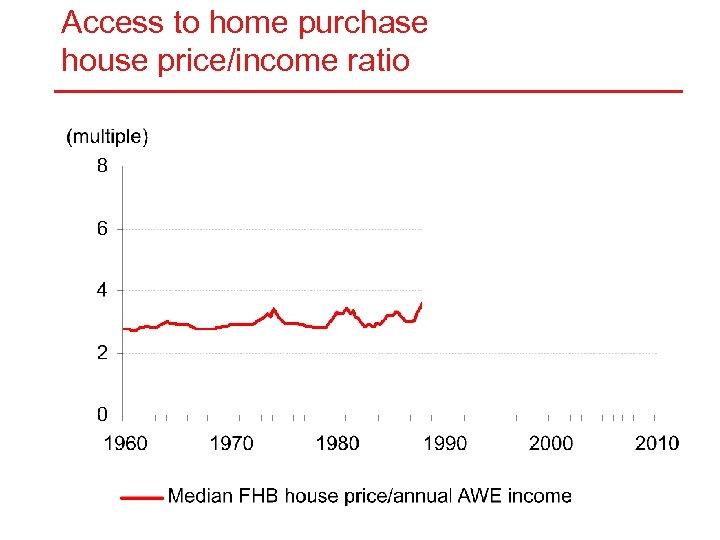

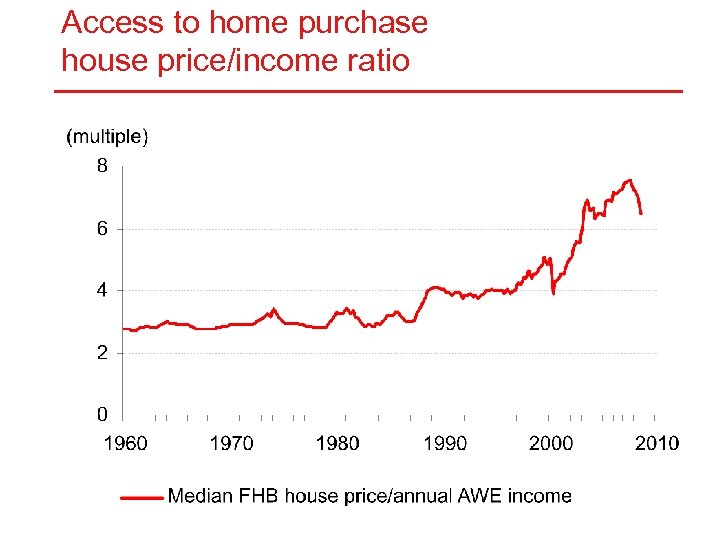

Access to home purchase house price/income ratio

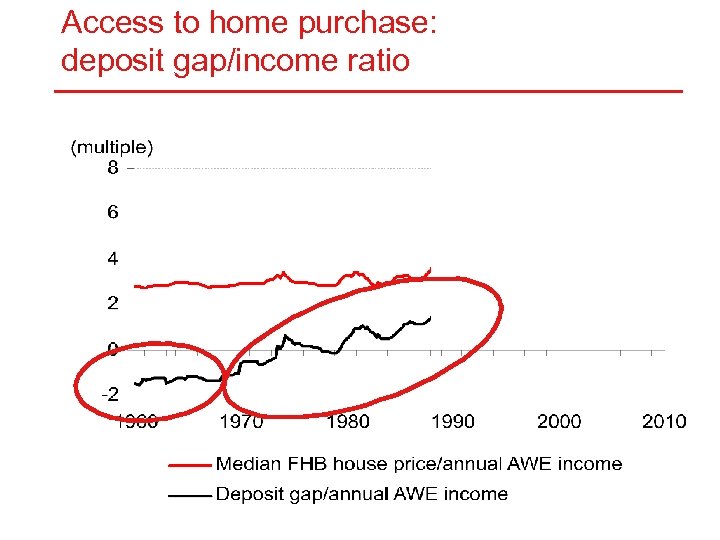

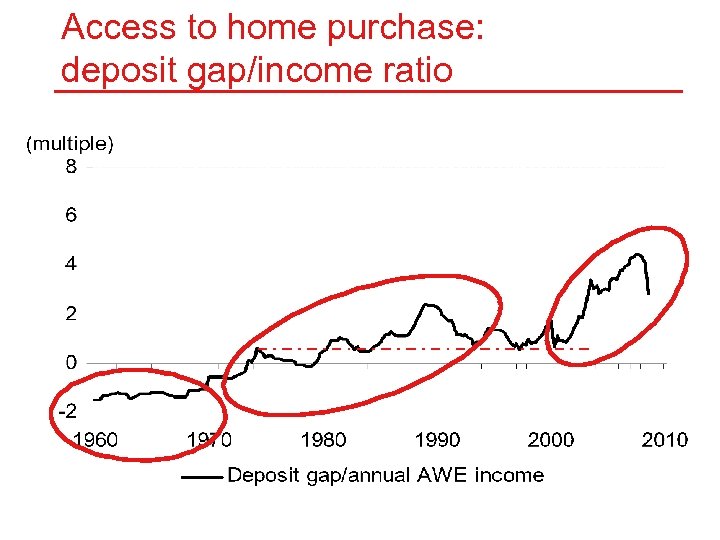

Access to home purchase: deposit gap/income ratio

Key factors: 1990 s-2000 s Economic: • Labour market deregulation, income polarisation Social • Delayed marriage and child bearing Financial • Financial deregulation and liberalisation Role of housing • Tax advantaged investment • Need for inheritance for FHBs

Current situation: FHB Median house price ($2008) Source: HIA FHB median house price data from 1984: average capital cities, CPI adj Extrapolated back with scaled BIS Shrapnel data

Access to home purchase house price/income ratio

Access to home purchase: deposit gap/income ratio

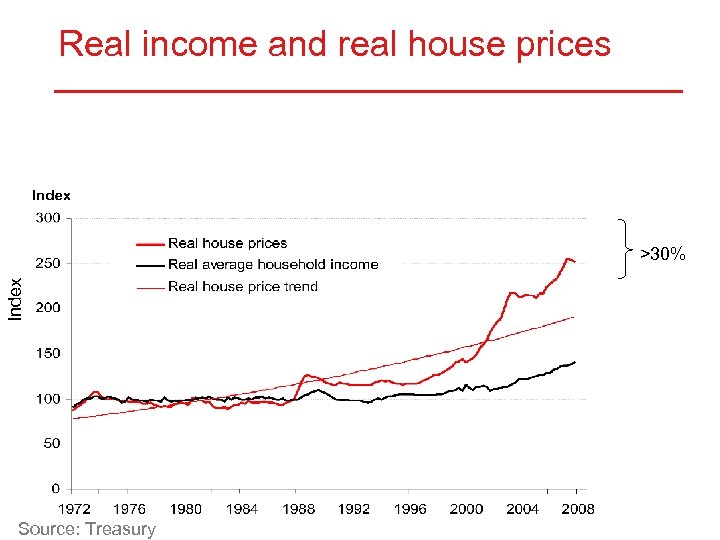

Access to home purchase Two periods where access has declined 1. 1970 s: Structural – has not been reversed; associated with • rise in inflation and interest rates from 1970 through to 1990 2. 2000 s: Structural or cyclical? associated with • divergence of rise in house prices from rise in incomes from 1990; exacerbated by rises from 2000 • reduced cost and increased availability finance

Key point 1 Current housing affordability problems are structural (as well as cyclical) • began 30 -40 years ago (when inflation switched focus on housing from providing shelter security to providing wealth security) • exacerbated by changes in CGT (in 1986 favouring owner-occupiers; in 1999 favouring investors) and financial deregulation and liberalisation that increased availability of, and access to, housing finance.

Implications Housing serves a dual role • Consumption – provides shelter • Investment – provides wealth Affordability problems arise because • Role as asset for wealthy crowds out • Role of shelter for less well off

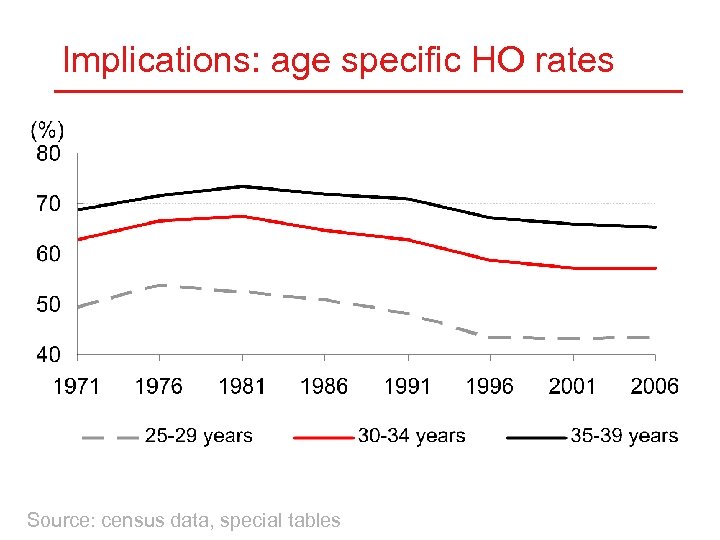

Implications: age specific HO rates Source: census data, special tables

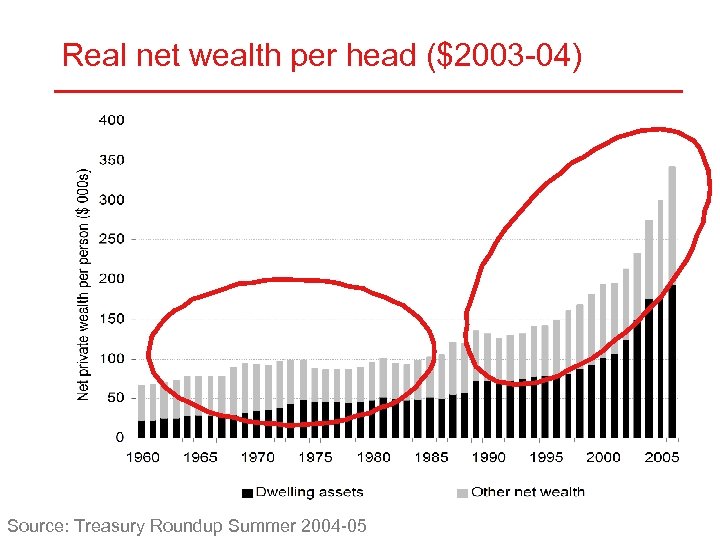

Real net wealth per head ($2003 -04) Source: Treasury Roundup Summer 2004 -05

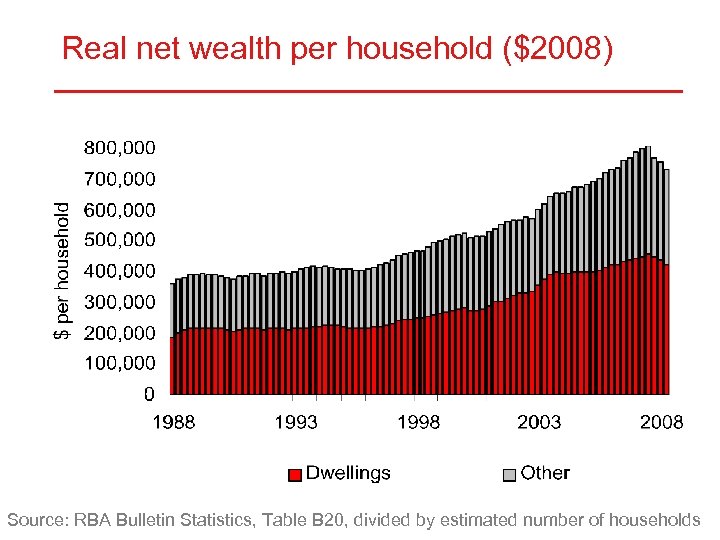

Real net wealth per household ($2008) Source: RBA Bulletin Statistics, Table B 20, divided by estimated number of households

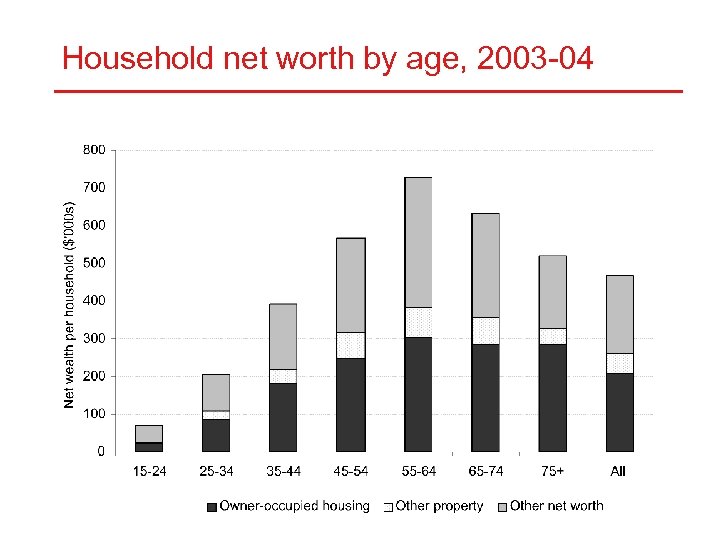

Household net worth by age, 2003 -04

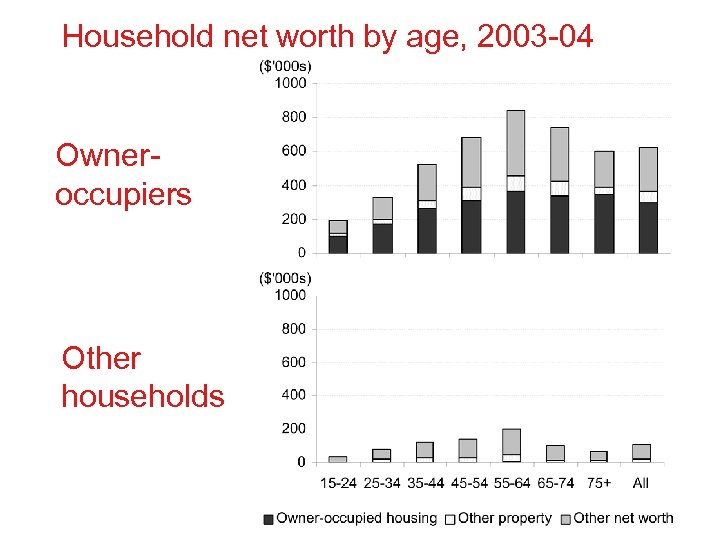

Household net worth by age, 2003 -04 Owneroccupiers Other households

Key point 2 Within family intergenerational transmission of wealth is inequitable • Children and grandchildren of owners can be assisted • Children and grandchildren of non-owners can’t be assisted

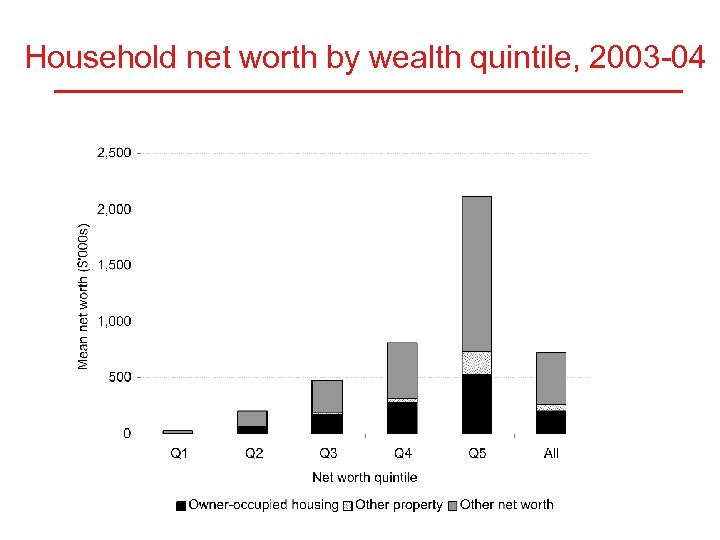

Household net worth by wealth quintile, 2003 -04

Key point 3 Within family intergenerational transmission of wealth is inequitable • Wealthiest households have disproportionately greater capacity to assist their children and grandchildren

A fair housing system? An adequate supply of dwellings for all households within their capacity to pay • With market focus, outcomes will reflect inequalities of income and wealth • Within housing framework, can assist only by making housing assistance fairer

A fairer housing assistance system? Outright owners • nothing Purchasers/would be purchasers • address failures that result in marginal FHBs paying more • provide insurance to protect marginal FHBs • funded by purchasers or lenders • no rationale for deposit assistance to assist wealth accumulation by advantaged households

A fairer housing assistance system? Renters • rent assistance for those unable to meet costs of minimum acceptable standard of housing available • ensure adequate supply of affordable housing Landlords • subsidise provision of affordable housing

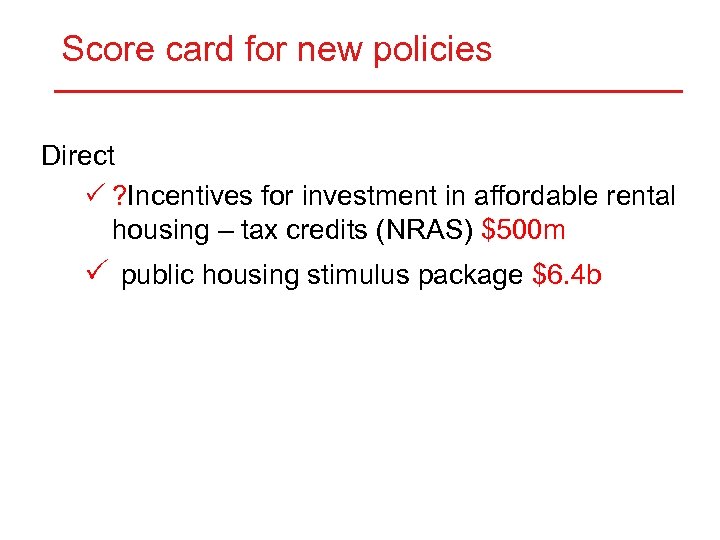

Score card for new policies Direct P ? Incentives for investment in affordable rental housing – tax credits (NRAS) $500 m P public housing stimulus package $6. 4 b

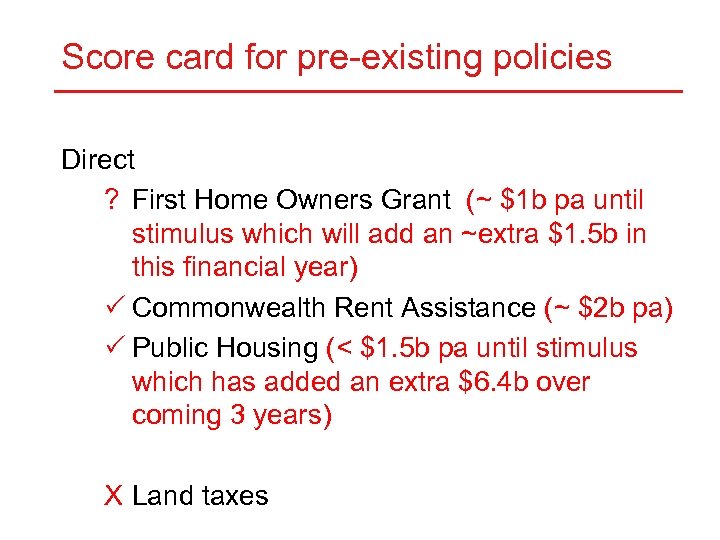

Score card for pre-existing policies Direct ? First Home Owners Grant (~ $1 b pa until stimulus which will add an ~extra $1. 5 b in this financial year) P Commonwealth Rent Assistance (~ $2 b pa) P Public Housing (< $1. 5 b pa until stimulus which has added an extra $6. 4 b over coming 3 years) X Land taxes

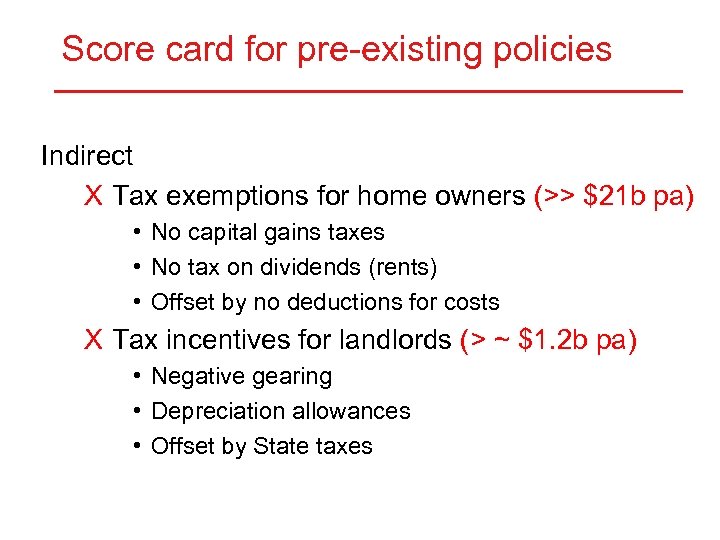

Score card for pre-existing policies Indirect X Tax exemptions for home owners (>> $21 b pa) • No capital gains taxes • No tax on dividends (rents) • Offset by no deductions for costs X Tax incentives for landlords (> ~ $1. 2 b pa) • Negative gearing • Depreciation allowances • Offset by State taxes

Score card for non-current policies Marginal or non-existent X Mortgage insurance schemes to protect borrowers not lenders • Small scale state based schemes exist • Could be a role for shared equity X Incentives for investment in affordable rental housing O Targeted depreciation allowances O Planning incentives O Institutional support for institutional investment X Land trusts

Conclusions Pre-existing system of housing assistance is generally perverse New initiatives generally in the right direction

Conclusions Has the great Australian dream ended? • Yes for many if emphasis remains on wealth accumulation • Not necessarily if emphasis returns to shelter and stability

Real income and real house prices Index >30% Source: Treasury

What can we do about it? 1. Make investment by wealthy less desirable by reducing scarcity of desirable land • Increase supply desirable land (infrastructure, transport etc) • Reduce desirability of scarce land (decrease tax incentives for owning land; increase density)

What can we do about it? 2. Increase housing available for shelter (and investment) for low to moderate income households • Increase supply affordable rental housing • Help marginal purchasers stay in their homes

Thankyou for your attention

bdd205dbead2b31b448b6b754c652759.ppt