200871c535c01a0c66fd9a98c2d9cae9.ppt

- Количество слайдов: 44

HOT TOP LEGAL UPDATES FEDERAL FORECLOSURE MITIGATION: PROGRAM STATUS, RECENT CHANGES AND LIKELY IMPACT 1

HOT TOP LEGAL UPDATES FEDERAL FORECLOSURE MITIGATION: PROGRAM STATUS, RECENT CHANGES AND LIKELY IMPACT 1

SPEAKERS William M. Le. Roy - Moderator President & CEO American Legal & Financial Network “ALFN” Alan C. Hochheiser, Esq. - Panelist Managing Partner Bankruptcy Weltman, Weinberg and Reis Co. , L. P. A. John H. Kinney, Esq. - Panelist Senior Public Policy Advisor Baker, Donelson, Bearman, Caldwell & Berkowitz, PC Lisa A. Lee, Esq. - Panelist Attorney Goldbeck Mc. Cafferty & Mc. Keever 2

SPEAKERS William M. Le. Roy - Moderator President & CEO American Legal & Financial Network “ALFN” Alan C. Hochheiser, Esq. - Panelist Managing Partner Bankruptcy Weltman, Weinberg and Reis Co. , L. P. A. John H. Kinney, Esq. - Panelist Senior Public Policy Advisor Baker, Donelson, Bearman, Caldwell & Berkowitz, PC Lisa A. Lee, Esq. - Panelist Attorney Goldbeck Mc. Cafferty & Mc. Keever 2

Federal Loss Mitigation Policies: The Problem – Real and Perceived Shortcomings, real or perceived, have led to efforts by the Obama Administration and the Congress to improve federal loss mitigation policies “According to The Wall Street Journal last week, of the handful of homeowners who have now been so-called “helped” by Treasury out of the millions and millions that are in trouble, even Treasury’s reported that only one in four of the few helped to try to get their mortgage payment to be affordable have now been even more weeded out of that program. This is like the great shrinking blimp. You sort of promise them everything, but give them nothing, and the gas just drains right out of the balloon. ” – Representative Marcy Kaptur (Democrat, Ohio), sponsor of the Right to Rent Act of 2010, which would create a right to rent for homeowners facing foreclosure, May 24, 2010 3

Federal Loss Mitigation Policies: The Problem – Real and Perceived Shortcomings, real or perceived, have led to efforts by the Obama Administration and the Congress to improve federal loss mitigation policies “According to The Wall Street Journal last week, of the handful of homeowners who have now been so-called “helped” by Treasury out of the millions and millions that are in trouble, even Treasury’s reported that only one in four of the few helped to try to get their mortgage payment to be affordable have now been even more weeded out of that program. This is like the great shrinking blimp. You sort of promise them everything, but give them nothing, and the gas just drains right out of the balloon. ” – Representative Marcy Kaptur (Democrat, Ohio), sponsor of the Right to Rent Act of 2010, which would create a right to rent for homeowners facing foreclosure, May 24, 2010 3

Federal Loss Mitigation Policies: The Problem – Real and Perceived The Facts 2. 8 million foreclosure notices were issued in 2009 One in four homeowners have a home that is underwater and 50% of all underwater loans have a second lien. The number of prime loans in foreclosure has doubled in each of the past two years and now account for 71% of the increase in the total number of foreclosures Foreclosure filings in March 2010 were up nearly 8 percent from March of 2009, the highest monthly total since Realty. Trac began reporting the numbers in January 2005. 4

Federal Loss Mitigation Policies: The Problem – Real and Perceived The Facts 2. 8 million foreclosure notices were issued in 2009 One in four homeowners have a home that is underwater and 50% of all underwater loans have a second lien. The number of prime loans in foreclosure has doubled in each of the past two years and now account for 71% of the increase in the total number of foreclosures Foreclosure filings in March 2010 were up nearly 8 percent from March of 2009, the highest monthly total since Realty. Trac began reporting the numbers in January 2005. 4

Federal Loss Mitigation Policies: The Problem – Real and Perceived What to Do? Of the 10 to 12 million foreclosures that may occur over the next three years – the purpose now “is to deal with enough of the overhang for people who we believe whose foreclosures are preventable” –Diana Farrell, White House Deputy Director of the National Economic Council, March 26, 2010 The Likely Result? : The original goal was to address 34 million borrowers under the Make Affordable Home program, but only a portion will result in temporary modifications and an even smaller percentage in permanent five year modifications – Richard H. Neiman, Member, Congressional Oversight Panel, April 24, 2010 5

Federal Loss Mitigation Policies: The Problem – Real and Perceived What to Do? Of the 10 to 12 million foreclosures that may occur over the next three years – the purpose now “is to deal with enough of the overhang for people who we believe whose foreclosures are preventable” –Diana Farrell, White House Deputy Director of the National Economic Council, March 26, 2010 The Likely Result? : The original goal was to address 34 million borrowers under the Make Affordable Home program, but only a portion will result in temporary modifications and an even smaller percentage in permanent five year modifications – Richard H. Neiman, Member, Congressional Oversight Panel, April 24, 2010 5

Federal Loss Mitigation Policies Recent Program Changes Problem: Lack of Conversions to Permanent Modification Status Solution: Conversion Campaign (launched 11/30/09) The Effect: From 1. 26% conversion rate in October 2009 to 11. 84% as of February 2010 Problem – The Lack of Transparency in Loan Mod Rejections Solution: Formal Denial Letters/Denial Codes (issued 11/03/09 effective 01/01/10) 6

Federal Loss Mitigation Policies Recent Program Changes Problem: Lack of Conversions to Permanent Modification Status Solution: Conversion Campaign (launched 11/30/09) The Effect: From 1. 26% conversion rate in October 2009 to 11. 84% as of February 2010 Problem – The Lack of Transparency in Loan Mod Rejections Solution: Formal Denial Letters/Denial Codes (issued 11/03/09 effective 01/01/10) 6

Federal Loss Mitigation Policies Program Changes Problem: Lack of Communication and Outreach to Borrowers Regarding Eligibility for HAMP prior to Foreclosure Mitigation Solution: Supplemental Directive 10 -02 issued 03/23/10 effective 06/01/10 Problem: Lack of Verified Income Solution: Supplemental Directive 10 -01 issued 01/28/10 effective 06/01/10 that would require servicers to obtain verified income before offering trial mods 7

Federal Loss Mitigation Policies Program Changes Problem: Lack of Communication and Outreach to Borrowers Regarding Eligibility for HAMP prior to Foreclosure Mitigation Solution: Supplemental Directive 10 -02 issued 03/23/10 effective 06/01/10 Problem: Lack of Verified Income Solution: Supplemental Directive 10 -01 issued 01/28/10 effective 06/01/10 that would require servicers to obtain verified income before offering trial mods 7

Federal Loss Mitigation Policies Program Changes Problem: Rising unemployment/declining home values (e. g. , underwater mortgages) has infected the prime market Solution 1: HAMP Help for the Unemployed (Supplemental Directive 10 -04 issued 05/11/10 effective 07/01/10) Solution 2: Principal write-down incentives (announced 03/26/10 but no supplemental directive issued at this time) Solution 3: FHA Refinancing Program (HAMP payments to encourage 2 nd lien extinguishment and the refinancing of underwater mortgages into FHA mortgages) – to be announced in Fall 2010 8

Federal Loss Mitigation Policies Program Changes Problem: Rising unemployment/declining home values (e. g. , underwater mortgages) has infected the prime market Solution 1: HAMP Help for the Unemployed (Supplemental Directive 10 -04 issued 05/11/10 effective 07/01/10) Solution 2: Principal write-down incentives (announced 03/26/10 but no supplemental directive issued at this time) Solution 3: FHA Refinancing Program (HAMP payments to encourage 2 nd lien extinguishment and the refinancing of underwater mortgages into FHA mortgages) – to be announced in Fall 2010 8

Federal Loss Mitigation Policies Program Changes Problem: Second liens tend to impair affordability of a modified first lien Solution: Update to Second Lien Modification Program Supplemental Directive 09 -05 issued 03/26/10 Problem: The Left Behind, Unsalvageable Borrower Solution: Update to Home Affordable Foreclosures Alternatives Supplemental Directive 09 -09 for shortsales/deed-in-lieu issued 3/26/10 effective 04/05/10) 9

Federal Loss Mitigation Policies Program Changes Problem: Second liens tend to impair affordability of a modified first lien Solution: Update to Second Lien Modification Program Supplemental Directive 09 -05 issued 03/26/10 Problem: The Left Behind, Unsalvageable Borrower Solution: Update to Home Affordable Foreclosures Alternatives Supplemental Directive 09 -09 for shortsales/deed-in-lieu issued 3/26/10 effective 04/05/10) 9

Federal Loss Mitigation Policies Program Changes HAMP Servicer Performance Measures Purpose – To impose more detailed reporting requirements on the largest servicers to better measure servicer compliance, program execution, and homeowner experience Servicer Compliance with Program Guidelines Program Execution Homeowner Experience 10

Federal Loss Mitigation Policies Program Changes HAMP Servicer Performance Measures Purpose – To impose more detailed reporting requirements on the largest servicers to better measure servicer compliance, program execution, and homeowner experience Servicer Compliance with Program Guidelines Program Execution Homeowner Experience 10

Federal Loss Mitigation Policies Congressional Recommendations The Congressional Oversight Panel (COP) has made the following recommendations to improve HAMP: To address transparency issues, greater oversight over Freddie and Fannie is needed to address the perceived failure of servicers to consistently and accurately provide valid reasons for canceling or denying a mortgage modification Create a web portal to allow borrowers to better track their loan modification requests and the basis for the denial and To address concerns about loan modification “sustainability” (e. g. , to avert long-term re-defaults), redefine “affordability” to include 31 percent DTI to include 1 st and 2 nd liens 11

Federal Loss Mitigation Policies Congressional Recommendations The Congressional Oversight Panel (COP) has made the following recommendations to improve HAMP: To address transparency issues, greater oversight over Freddie and Fannie is needed to address the perceived failure of servicers to consistently and accurately provide valid reasons for canceling or denying a mortgage modification Create a web portal to allow borrowers to better track their loan modification requests and the basis for the denial and To address concerns about loan modification “sustainability” (e. g. , to avert long-term re-defaults), redefine “affordability” to include 31 percent DTI to include 1 st and 2 nd liens 11

Federal Loss Mitigation Policies Congressional Recommendations The House and Senate have also offered proposed improvements to HAMP: The House passed regulatory reform bill would mandate servicers to provide borrower-related and mortgage-related input data used in any net present value (NPV) analyses performed in connection with the subject mortgage The House passed reform bill would require Treasury to publicly disclose all HAMP-related data that would allow the public to better evaluate program effectiveness The House passed bill would authorize an additional $1 billion in Neighborhood Stabilization Program funds from TARP 12

Federal Loss Mitigation Policies Congressional Recommendations The House and Senate have also offered proposed improvements to HAMP: The House passed regulatory reform bill would mandate servicers to provide borrower-related and mortgage-related input data used in any net present value (NPV) analyses performed in connection with the subject mortgage The House passed reform bill would require Treasury to publicly disclose all HAMP-related data that would allow the public to better evaluate program effectiveness The House passed bill would authorize an additional $1 billion in Neighborhood Stabilization Program funds from TARP 12

Federal Loss Mitigation Policies Congressional Recommendations To address the lack of a formal appeals process for rejected borrowers, the COP and Senator Al Franken (Democrat, Minnesota) have pushed for an Office of Homeowner Advocacy within Treasury to hear borrower appeals of loan mod denials or cancellations Response to Minnesota litigation The Franken Amendment failed during the Senate debate on regulatory reform 13

Federal Loss Mitigation Policies Congressional Recommendations To address the lack of a formal appeals process for rejected borrowers, the COP and Senator Al Franken (Democrat, Minnesota) have pushed for an Office of Homeowner Advocacy within Treasury to hear borrower appeals of loan mod denials or cancellations Response to Minnesota litigation The Franken Amendment failed during the Senate debate on regulatory reform 13

Impact of House and Senate Regulatory Reform Legislation on Servicers Senator Merkley’s (Democrat, Oregon) TILA Amendment that would enhance underwriting standards for residential mortgage loans Risk Retention 5 Percent Requirement in House 5 Percent Requirement in Senate, except for “qualified residential mortgages” 14

Impact of House and Senate Regulatory Reform Legislation on Servicers Senator Merkley’s (Democrat, Oregon) TILA Amendment that would enhance underwriting standards for residential mortgage loans Risk Retention 5 Percent Requirement in House 5 Percent Requirement in Senate, except for “qualified residential mortgages” 14

Impact of House and Senate Regulatory Reform Legislation on Servicers House passed reform bill (but not Senate version) would do the following: Require HUD to conduct an “extensive study of the root causes of default and foreclosure of home loans” to provide legislative recommendations to Congress as a result of the study Require HUD to establish a default and foreclosure database 15

Impact of House and Senate Regulatory Reform Legislation on Servicers House passed reform bill (but not Senate version) would do the following: Require HUD to conduct an “extensive study of the root causes of default and foreclosure of home loans” to provide legislative recommendations to Congress as a result of the study Require HUD to establish a default and foreclosure database 15

Outlook for Regulatory Reform Legislation Top priority Self imposed deadline of July 4 Resonates with Obama/Congressional Democratic agenda Derivatives and scope and scale of CFPA remain large issues 16

Outlook for Regulatory Reform Legislation Top priority Self imposed deadline of July 4 Resonates with Obama/Congressional Democratic agenda Derivatives and scope and scale of CFPA remain large issues 16

HAMP Help for the Unemployed Purpose -- The Unemployment Program will offer homeowners a forbearance period to temporarily reduce or suspend their monthly mortgage payments while they seek re-employment. Effective Date – July 1, 2010 Program Characteristics: The minimum forbearance period is three months (mortgage servicer may extend depending on the investor and regulator guidelines) If a homeowner becomes re-employed in that time, the forbearance period will end and the homeowner will be evaluated for a mortgage modification under HAMP/HARP/HAFA 17

HAMP Help for the Unemployed Purpose -- The Unemployment Program will offer homeowners a forbearance period to temporarily reduce or suspend their monthly mortgage payments while they seek re-employment. Effective Date – July 1, 2010 Program Characteristics: The minimum forbearance period is three months (mortgage servicer may extend depending on the investor and regulator guidelines) If a homeowner becomes re-employed in that time, the forbearance period will end and the homeowner will be evaluated for a mortgage modification under HAMP/HARP/HAFA 17

HAMP Help for the Unemployed Program Characteristics (Continued) During the forbearance period, a homeowner’s monthly mortgage payment must be reduced to no more than 31 percent (or less) of their gross monthly income (The servicer can decide to temporarily suspend payments in full and the payment amount and due dates will be decided by the servicer depending on investor and regulator guidelines) Servicers may not initiate foreclosure proceedings or conduct a foreclosure sale while a homeowner is being evaluated for the Unemployment Program or in the forbearance period. 18

HAMP Help for the Unemployed Program Characteristics (Continued) During the forbearance period, a homeowner’s monthly mortgage payment must be reduced to no more than 31 percent (or less) of their gross monthly income (The servicer can decide to temporarily suspend payments in full and the payment amount and due dates will be decided by the servicer depending on investor and regulator guidelines) Servicers may not initiate foreclosure proceedings or conduct a foreclosure sale while a homeowner is being evaluated for the Unemployment Program or in the forbearance period. 18

HAMP Help for the Unemployed Borrower Eligibility: To qualify, a homeowner must meet the following eligibility criteria: The mortgage must be a first lien mortgage, originated on or before January 1, 2009, and the unpaid principal balance must be equal to or less than $729, 750 for a one-unit property. The property must be the homeowner’s principal residence. The mortgage has not been previously modified through a Home Affordable Modification. The homeowner was ineligible for a Home Affordable Modification. The homeowner is either behind on payments (but not by more than three consecutive months) or it is reasonably foreseeable that the homeowner will fall behind. The total monthly mortgage payment is greater than 31 percent of the homeowner’s gross monthly income. If the payment is less, it is up to the servicer’s discretion if they will offer the program to the homeowner. The homeowner will be unemployed at the start of the forbearance period, and is able to document this because they will be receiving unemployment benefits in the month the forbearance period begins (even if the benefits expire before the forbearance period ends). 19

HAMP Help for the Unemployed Borrower Eligibility: To qualify, a homeowner must meet the following eligibility criteria: The mortgage must be a first lien mortgage, originated on or before January 1, 2009, and the unpaid principal balance must be equal to or less than $729, 750 for a one-unit property. The property must be the homeowner’s principal residence. The mortgage has not been previously modified through a Home Affordable Modification. The homeowner was ineligible for a Home Affordable Modification. The homeowner is either behind on payments (but not by more than three consecutive months) or it is reasonably foreseeable that the homeowner will fall behind. The total monthly mortgage payment is greater than 31 percent of the homeowner’s gross monthly income. If the payment is less, it is up to the servicer’s discretion if they will offer the program to the homeowner. The homeowner will be unemployed at the start of the forbearance period, and is able to document this because they will be receiving unemployment benefits in the month the forbearance period begins (even if the benefits expire before the forbearance period ends). 19

SUPPLEMENTAL DIRECTIVE 10 -02: HAMP AND BANKRUPTCY On March 24, 2010, the United States Treasury issued Supplemental Directive 10 -02 for the Home Affordable Modification Program-Borrower Outreach and Communication. This directive supplemented Supplemental Directive 09 -01 which set forth the eligibility, underwriting and servicing requirements for HAMP. The New directive becomes effective on June 1, 2010 and sets forth some additional requirements for Homeowners who have filed for Bankruptcy. The following are the key points that all servicers need to ensure that they are meeting. 20

SUPPLEMENTAL DIRECTIVE 10 -02: HAMP AND BANKRUPTCY On March 24, 2010, the United States Treasury issued Supplemental Directive 10 -02 for the Home Affordable Modification Program-Borrower Outreach and Communication. This directive supplemented Supplemental Directive 09 -01 which set forth the eligibility, underwriting and servicing requirements for HAMP. The New directive becomes effective on June 1, 2010 and sets forth some additional requirements for Homeowners who have filed for Bankruptcy. The following are the key points that all servicers need to ensure that they are meeting. 20

WHO IS ELIGIBLE -All borrowers who are currently in an active bankruptcy must be considered for HAMP if a request is made by the borrower, borrower’s counsel or the Chapter 7 or Chapter 13 Trustee. -The Bankruptcy Trustee can only submit the request with the borrower’s permission. -Servicers are not required to solicit the borrower -Borrowers who are currently in a trial period plan and then file a Chapter 7 or Chapter 13 may not be denied an HAMP modification based upon the bankruptcy filing. 21

WHO IS ELIGIBLE -All borrowers who are currently in an active bankruptcy must be considered for HAMP if a request is made by the borrower, borrower’s counsel or the Chapter 7 or Chapter 13 Trustee. -The Bankruptcy Trustee can only submit the request with the borrower’s permission. -Servicers are not required to solicit the borrower -Borrowers who are currently in a trial period plan and then file a Chapter 7 or Chapter 13 may not be denied an HAMP modification based upon the bankruptcy filing. 21

TRIAL PERIOD AND THE BANKRUPTCY CASE -Servicers are required to work with borrower’s counsel to obtain the required court approval if necessary to effectuate a HAMP modification. -Potential delays in trail period payments under a Chapter 13 plan or obtaining court approval a. Trustee’s not remitting payments until confirmation of plan b. Waiting for hearing date from Court or signed order. c. Servicers should extend the trial period plan as necessary to accommodate the non-controllable events in the bankruptcy case. d. Servicers are not required to extend the trial period further than two months. e. The Trial period should not exceed a total of 5 months f. The borrower is required to make a trial period payment for each month of the trail period including the extension months. 22

TRIAL PERIOD AND THE BANKRUPTCY CASE -Servicers are required to work with borrower’s counsel to obtain the required court approval if necessary to effectuate a HAMP modification. -Potential delays in trail period payments under a Chapter 13 plan or obtaining court approval a. Trustee’s not remitting payments until confirmation of plan b. Waiting for hearing date from Court or signed order. c. Servicers should extend the trial period plan as necessary to accommodate the non-controllable events in the bankruptcy case. d. Servicers are not required to extend the trial period further than two months. e. The Trial period should not exceed a total of 5 months f. The borrower is required to make a trial period payment for each month of the trail period including the extension months. 22

THE CHAPTER 13 PLAN -If a borrower is in an active Chapter 13 during the trial period and post -petition payments are being made on a first mortgage, the Servicer must not object to confirmation of the plan, move for relief from stay or dismissal on the basis that the borrower only made payments in the amounts due under the trial period plan as opposed to the regular monthly mortgage payments. -Permanent Modifications: Servicer may convert a borrower to a permanent modification without completing a trial plan under the following conditions: a. The borrower made all post-petition payments prior to the effective date of the HAMP Agreement and at least 3 of those payments are equal or greater to the proposed modified payment b. Court approval of the modification is obtained, if it is required c. The trail period plan waiver is permissible under applicable investor guidelines. -Pay for Success and Pay for Performance incentives eligibility will exist for the length of a standard HAMP Trial period if payments under the plan are used instead of a trial period. 23

THE CHAPTER 13 PLAN -If a borrower is in an active Chapter 13 during the trial period and post -petition payments are being made on a first mortgage, the Servicer must not object to confirmation of the plan, move for relief from stay or dismissal on the basis that the borrower only made payments in the amounts due under the trial period plan as opposed to the regular monthly mortgage payments. -Permanent Modifications: Servicer may convert a borrower to a permanent modification without completing a trial plan under the following conditions: a. The borrower made all post-petition payments prior to the effective date of the HAMP Agreement and at least 3 of those payments are equal or greater to the proposed modified payment b. Court approval of the modification is obtained, if it is required c. The trail period plan waiver is permissible under applicable investor guidelines. -Pay for Success and Pay for Performance incentives eligibility will exist for the length of a standard HAMP Trial period if payments under the plan are used instead of a trial period. 23

DOCUMENTATION -Bankruptcy schedules and tax returns may be used instead of the RMA and Form 4506 T-EZ to determine a borrower’s eligibility. -Servicer should request said documents from the borrower, counsel or the bankruptcy court -If the schedules are greater than 90 days old from the date the servicer receives them, the borrower must provide updated information. -Borrower must complete and execute a Hardship Affidavit or RMA. 24

DOCUMENTATION -Bankruptcy schedules and tax returns may be used instead of the RMA and Form 4506 T-EZ to determine a borrower’s eligibility. -Servicer should request said documents from the borrower, counsel or the bankruptcy court -If the schedules are greater than 90 days old from the date the servicer receives them, the borrower must provide updated information. -Borrower must complete and execute a Hardship Affidavit or RMA. 24

CHAPTER 7 PROCEEDINGS -If the borrower has obtained a discharge and the obligation was not reaffirmed and a HAMP modification is to be effectuated the following language must be added to Section 1 of the Modification “I was discharged in a Chapter 7 bankruptcy Proceeding subsequent to the execution of the Loan Documents. Based on this representation, Lender Agrees that I will not have any personal liability On the debt pursuant to this Agreement” Can only look to the real property on default Attempt to obtain reaffirmation agreements along with modification prior to discharge. Maintain Non-Recourse modifications separately after execution to avoid violating the discharge injunction. 25

CHAPTER 7 PROCEEDINGS -If the borrower has obtained a discharge and the obligation was not reaffirmed and a HAMP modification is to be effectuated the following language must be added to Section 1 of the Modification “I was discharged in a Chapter 7 bankruptcy Proceeding subsequent to the execution of the Loan Documents. Based on this representation, Lender Agrees that I will not have any personal liability On the debt pursuant to this Agreement” Can only look to the real property on default Attempt to obtain reaffirmation agreements along with modification prior to discharge. Maintain Non-Recourse modifications separately after execution to avoid violating the discharge injunction. 25

Mortgage Modification and Particular Issues Arising in Bankruptcy Relief from Stay Issues Some banks want relief from the automatic stay to do a loan modification The Courts appear to be willing to continue the Stay Relief hearing to see if the modification can be completed 26

Mortgage Modification and Particular Issues Arising in Bankruptcy Relief from Stay Issues Some banks want relief from the automatic stay to do a loan modification The Courts appear to be willing to continue the Stay Relief hearing to see if the modification can be completed 26

Particular Issues Arising in Bankruptcy Another Relief from Stay issue When the debtor has begun the modification process and becomes delinquent on their mortgage payments after being advised to do so by the Lender/Servicer so they would qualify for consideration for a loan modification It is very common for a loan modification to become null and void after filing a bankruptcy 27

Particular Issues Arising in Bankruptcy Another Relief from Stay issue When the debtor has begun the modification process and becomes delinquent on their mortgage payments after being advised to do so by the Lender/Servicer so they would qualify for consideration for a loan modification It is very common for a loan modification to become null and void after filing a bankruptcy 27

Particular Issues Arising with Chapter 13 Plan Inform your Trustee that the debtor and mortgage lender have agreed on a loan modification Your need permission from the Chapter 13 Trustee and/or the Court Trustee may want the extra income generated from the modification paid into plan for benefit of unsecured creditors 28

Particular Issues Arising with Chapter 13 Plan Inform your Trustee that the debtor and mortgage lender have agreed on a loan modification Your need permission from the Chapter 13 Trustee and/or the Court Trustee may want the extra income generated from the modification paid into plan for benefit of unsecured creditors 28

Particular Issues Arising with Chapter 13 Plan During a Chapter 13, the debtor’s monthly mortgage payments increase (or decrease) because: Variable interest rate, A change in property taxes A change in insurance 29

Particular Issues Arising with Chapter 13 Plan During a Chapter 13, the debtor’s monthly mortgage payments increase (or decrease) because: Variable interest rate, A change in property taxes A change in insurance 29

Particular Issues Arising with Chapter 13 Plan The monthly payment the Trustee is sending may not be enough to cover the increase Be diligent in tracking the actions of the mortgage company Send a QWR ever year of a Chapter 13 to stay on top of what is happening on the mortgage account 30

Particular Issues Arising with Chapter 13 Plan The monthly payment the Trustee is sending may not be enough to cover the increase Be diligent in tracking the actions of the mortgage company Send a QWR ever year of a Chapter 13 to stay on top of what is happening on the mortgage account 30

HAFA - THE FEDERAL GOVERNMENT’S PUSH FOR MORE GRACEFUL EXITS Home Affordable Foreclosure Alternatives Program 31

HAFA - THE FEDERAL GOVERNMENT’S PUSH FOR MORE GRACEFUL EXITS Home Affordable Foreclosure Alternatives Program 31

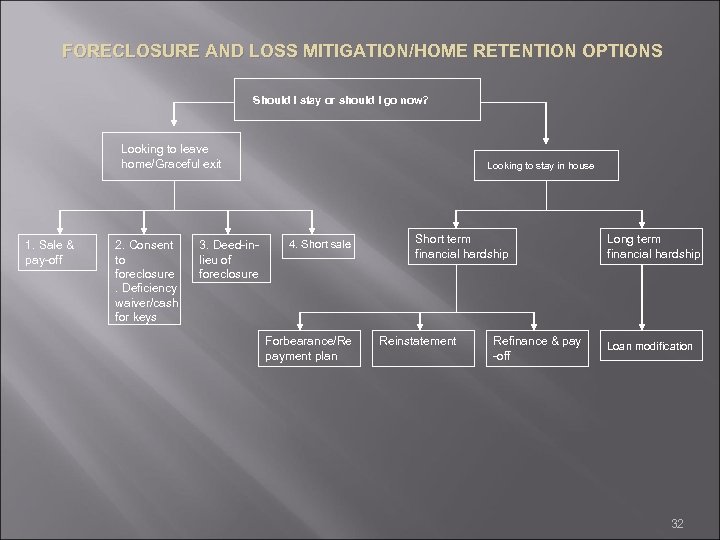

FORECLOSURE AND LOSS MITIGATION/HOME RETENTION OPTIONS Should I stay or should I go now? Looking to leave home/Graceful exit 1. Sale & pay-off 2. Consent to foreclosure. Deficiency waiver/cash for keys 3. Deed-inlieu of foreclosure Looking to stay in house 4. Short sale Forbearance/Re payment plan Short term financial hardship Reinstatement Refinance & pay -off Long term financial hardship Loan modification 32

FORECLOSURE AND LOSS MITIGATION/HOME RETENTION OPTIONS Should I stay or should I go now? Looking to leave home/Graceful exit 1. Sale & pay-off 2. Consent to foreclosure. Deficiency waiver/cash for keys 3. Deed-inlieu of foreclosure Looking to stay in house 4. Short sale Forbearance/Re payment plan Short term financial hardship Reinstatement Refinance & pay -off Long term financial hardship Loan modification 32

Unique Features of HAFA Complements HAMP by providing viable alternatives for borrowers who are HAMP eligible Uses borrower financial and hardship information already collected thru HAMP, eliminating the need for additional eligibility requirements Borrower can receive pre-approved short sale terms prior to the property being listed Prohibits the servicer from requiring, as a condition of approving the short sale, a reduction in the real estate commission agreed upon in the listing agreement Borrowers are fully released from future liability for the debt Standard processes, documents and timeframes Financial incentives to borrowers, servicers and investors 33

Unique Features of HAFA Complements HAMP by providing viable alternatives for borrowers who are HAMP eligible Uses borrower financial and hardship information already collected thru HAMP, eliminating the need for additional eligibility requirements Borrower can receive pre-approved short sale terms prior to the property being listed Prohibits the servicer from requiring, as a condition of approving the short sale, a reduction in the real estate commission agreed upon in the listing agreement Borrowers are fully released from future liability for the debt Standard processes, documents and timeframes Financial incentives to borrowers, servicers and investors 33

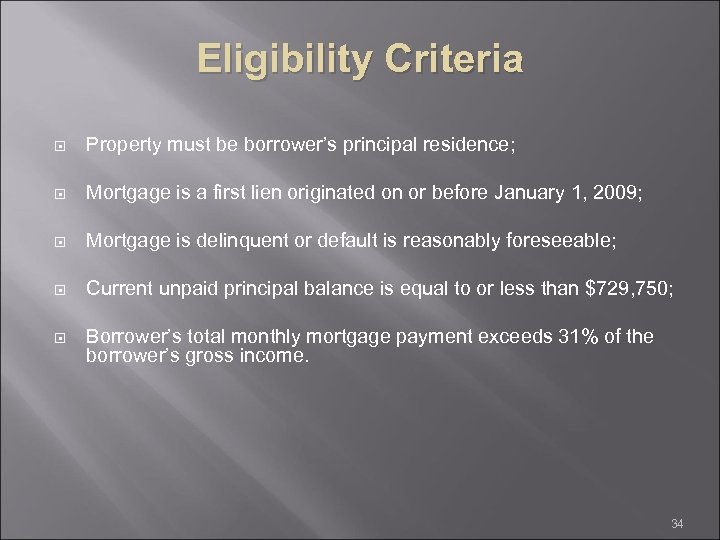

Eligibility Criteria Property must be borrower’s principal residence; Mortgage is a first lien originated on or before January 1, 2009; Mortgage is delinquent or default is reasonably foreseeable; Current unpaid principal balance is equal to or less than $729, 750; Borrower’s total monthly mortgage payment exceeds 31% of the borrower’s gross income. 34

Eligibility Criteria Property must be borrower’s principal residence; Mortgage is a first lien originated on or before January 1, 2009; Mortgage is delinquent or default is reasonably foreseeable; Current unpaid principal balance is equal to or less than $729, 750; Borrower’s total monthly mortgage payment exceeds 31% of the borrower’s gross income. 34

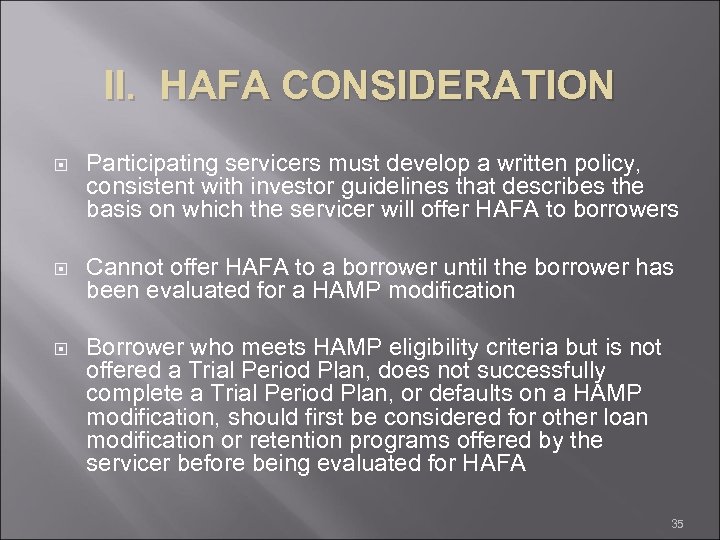

II. HAFA CONSIDERATION Participating servicers must develop a written policy, consistent with investor guidelines that describes the basis on which the servicer will offer HAFA to borrowers Cannot offer HAFA to a borrower until the borrower has been evaluated for a HAMP modification Borrower who meets HAMP eligibility criteria but is not offered a Trial Period Plan, does not successfully complete a Trial Period Plan, or defaults on a HAMP modification, should first be considered for other loan modification or retention programs offered by the servicer before being evaluated for HAFA 35

II. HAFA CONSIDERATION Participating servicers must develop a written policy, consistent with investor guidelines that describes the basis on which the servicer will offer HAFA to borrowers Cannot offer HAFA to a borrower until the borrower has been evaluated for a HAMP modification Borrower who meets HAMP eligibility criteria but is not offered a Trial Period Plan, does not successfully complete a Trial Period Plan, or defaults on a HAMP modification, should first be considered for other loan modification or retention programs offered by the servicer before being evaluated for HAFA 35

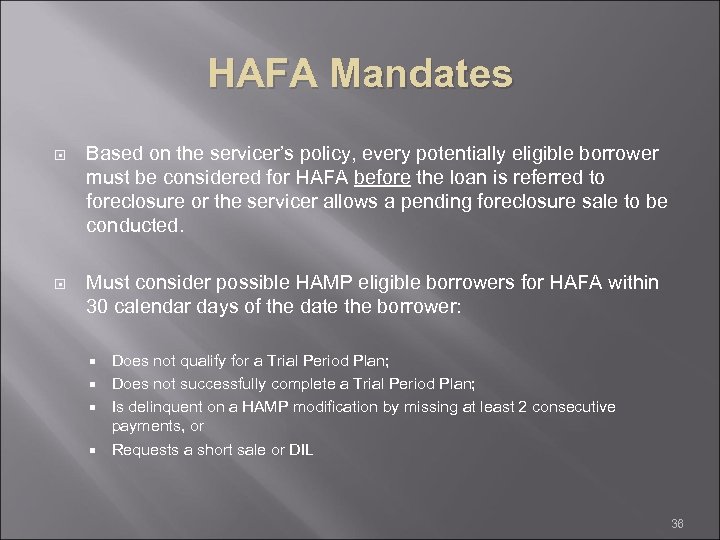

HAFA Mandates Based on the servicer’s policy, every potentially eligible borrower must be considered for HAFA before the loan is referred to foreclosure or the servicer allows a pending foreclosure sale to be conducted. Must consider possible HAMP eligible borrowers for HAFA within 30 calendar days of the date the borrower: Does not qualify for a Trial Period Plan; Does not successfully complete a Trial Period Plan; Is delinquent on a HAMP modification by missing at least 2 consecutive payments, or Requests a short sale or DIL 36

HAFA Mandates Based on the servicer’s policy, every potentially eligible borrower must be considered for HAFA before the loan is referred to foreclosure or the servicer allows a pending foreclosure sale to be conducted. Must consider possible HAMP eligible borrowers for HAFA within 30 calendar days of the date the borrower: Does not qualify for a Trial Period Plan; Does not successfully complete a Trial Period Plan; Is delinquent on a HAMP modification by missing at least 2 consecutive payments, or Requests a short sale or DIL 36

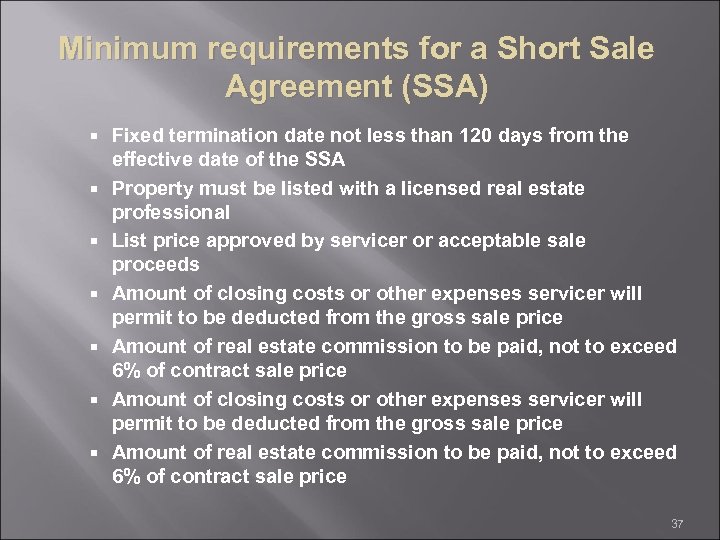

Minimum requirements for a Short Sale Agreement (SSA) Fixed termination date not less than 120 days from the effective date of the SSA Property must be listed with a licensed real estate professional List price approved by servicer or acceptable sale proceeds Amount of closing costs or other expenses servicer will permit to be deducted from the gross sale price Amount of real estate commission to be paid, not to exceed 6% of contract sale price 37

Minimum requirements for a Short Sale Agreement (SSA) Fixed termination date not less than 120 days from the effective date of the SSA Property must be listed with a licensed real estate professional List price approved by servicer or acceptable sale proceeds Amount of closing costs or other expenses servicer will permit to be deducted from the gross sale price Amount of real estate commission to be paid, not to exceed 6% of contract sale price 37

Minimum requirements for a Short Sale Agreement (SSA) Borrower statement authorizing the servicer to communicate the borrower’s personal financial information to other parties as necessary to complete the transaction Cancellation and contingency clauses to be included in the listing and sale agreements Notice that the sale must be an arm’s length transaction Agreement that upon successful closing borrower is released from liability for repayment of the first mortgage debt Agreement that upon successful closing borrower will receive a relocation incentive of $3, 000 which will be deducted form the gross sale proceeds at closing 38

Minimum requirements for a Short Sale Agreement (SSA) Borrower statement authorizing the servicer to communicate the borrower’s personal financial information to other parties as necessary to complete the transaction Cancellation and contingency clauses to be included in the listing and sale agreements Notice that the sale must be an arm’s length transaction Agreement that upon successful closing borrower is released from liability for repayment of the first mortgage debt Agreement that upon successful closing borrower will receive a relocation incentive of $3, 000 which will be deducted form the gross sale proceeds at closing 38

Minimum requirements for a Short Sale Agreement (SSA) Notice that the servicer will allow a portion of gross sale proceeds to be paid to junior lienholders in exchange for release and full satisfaction of their liens Notice that short sale may have income tax consequences and/or a derogatory impact of borrower’s credit score Amount, if any, that borrower will be required to pay during the term of the SSA Agreement that if the borrower complies with the terms of the SSA the servicer will not complete a foreclosure Terms under which the SSA can be terminated 39

Minimum requirements for a Short Sale Agreement (SSA) Notice that the servicer will allow a portion of gross sale proceeds to be paid to junior lienholders in exchange for release and full satisfaction of their liens Notice that short sale may have income tax consequences and/or a derogatory impact of borrower’s credit score Amount, if any, that borrower will be required to pay during the term of the SSA Agreement that if the borrower complies with the terms of the SSA the servicer will not complete a foreclosure Terms under which the SSA can be terminated 39

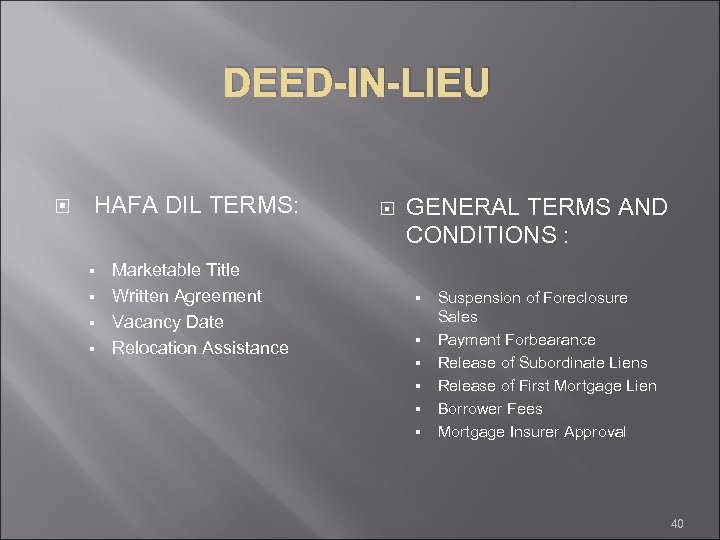

DEED-IN-LIEU HAFA DIL TERMS: Marketable Title § Written Agreement § Vacancy Date § Relocation Assistance GENERAL TERMS AND CONDITIONS : § § § § Suspension of Foreclosure Sales Payment Forbearance Release of Subordinate Liens Release of First Mortgage Lien Borrower Fees Mortgage Insurer Approval 40

DEED-IN-LIEU HAFA DIL TERMS: Marketable Title § Written Agreement § Vacancy Date § Relocation Assistance GENERAL TERMS AND CONDITIONS : § § § § Suspension of Foreclosure Sales Payment Forbearance Release of Subordinate Liens Release of First Mortgage Lien Borrower Fees Mortgage Insurer Approval 40

INCENTIVE COMPENSATION Borrower Relocation Assistance Servicer Incentive Investor Reimbursement for Subordinate Lien Releases 41

INCENTIVE COMPENSATION Borrower Relocation Assistance Servicer Incentive Investor Reimbursement for Subordinate Lien Releases 41

Web Resources www. hmpadmin. gov www. makinghomeaffordable. gov 42

Web Resources www. hmpadmin. gov www. makinghomeaffordable. gov 42

Conclusion Question & Answer Period If you have any further questions that were not addressed in this presentation, or want to contact one of our speakers, please email Matt Bartel, COO of ALFN, at mbartel@alfn. org. Thank you for your participation in this webinar. Please complete the brief survey which you will be directed to at the conclusion of this presentation. ALFN provides the information contained in these webinars as a public service for educational and general information purposes only, and not provided in the course of an attorney-client relationship. It is not intended to constitute legal advice or to substitute for obtaining legal advice from an attorney licensed in the relevant jurisdiction. Use of ALFN Webinar Materials The information, documents, graphics and other material made available through this Webinar are intended for use solely in connection with the American Legal and Financial Networks (hereinafter “ALFN”) educational activities. These materials are proprietary to ALFN, and may be protected by copyright, trademark and other applicable laws. You may download, view, copy and print documents and graphics incorporated in the documents from this Webinar ("Documents") subject to the following: (a) the Documents may be used solely for informational purposes related to the educational programs offered by the ALFN; and (b) the Documents may not be modified or altered in any way. Except as expressly provided herein, these materials may not be used for any other purpose, and specifically you may not use, download, upload, copy, print, display, perform, reproduce, publish, license, post, transmit or distribute any information from ALFN Webinars in whole or in part without the prior written permission of ALFN. 43

Conclusion Question & Answer Period If you have any further questions that were not addressed in this presentation, or want to contact one of our speakers, please email Matt Bartel, COO of ALFN, at mbartel@alfn. org. Thank you for your participation in this webinar. Please complete the brief survey which you will be directed to at the conclusion of this presentation. ALFN provides the information contained in these webinars as a public service for educational and general information purposes only, and not provided in the course of an attorney-client relationship. It is not intended to constitute legal advice or to substitute for obtaining legal advice from an attorney licensed in the relevant jurisdiction. Use of ALFN Webinar Materials The information, documents, graphics and other material made available through this Webinar are intended for use solely in connection with the American Legal and Financial Networks (hereinafter “ALFN”) educational activities. These materials are proprietary to ALFN, and may be protected by copyright, trademark and other applicable laws. You may download, view, copy and print documents and graphics incorporated in the documents from this Webinar ("Documents") subject to the following: (a) the Documents may be used solely for informational purposes related to the educational programs offered by the ALFN; and (b) the Documents may not be modified or altered in any way. Except as expressly provided herein, these materials may not be used for any other purpose, and specifically you may not use, download, upload, copy, print, display, perform, reproduce, publish, license, post, transmit or distribute any information from ALFN Webinars in whole or in part without the prior written permission of ALFN. 43

ALFN’s 8 th Annual Leadership Conference July 18 -21, 2010 Grand Hyatt Washington D. C. Contact Matt Bartel at mbartel@alfn. org to request the conference registration information, or you may Register Online at: https: //www. regonline. com/alfn_8 th_annual_leadership_conference 44

ALFN’s 8 th Annual Leadership Conference July 18 -21, 2010 Grand Hyatt Washington D. C. Contact Matt Bartel at mbartel@alfn. org to request the conference registration information, or you may Register Online at: https: //www. regonline. com/alfn_8 th_annual_leadership_conference 44