Host country effects Overview Why do we want inward FDI? Dunning, chapter 10, 13 -14, 18 -19; Caves, chapter 5, 8 -9;

Host country effects Overview Why do we want inward FDI? Dunning, chapter 10, 13 -14, 18 -19; Caves, chapter 5, 8 -9;

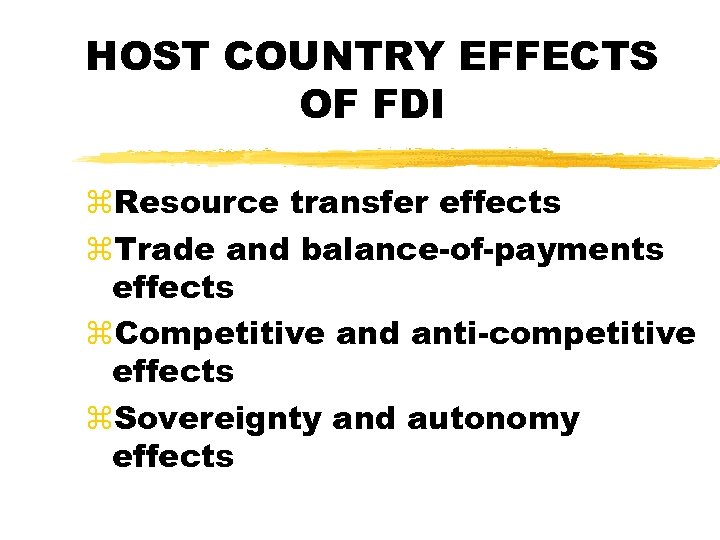

HOST COUNTRY EFFECTS OF FDI z. Resource transfer effects z. Trade and balance-of-payments effects z. Competitive and anti-competitive effects z. Sovereignty and autonomy effects

HOST COUNTRY EFFECTS OF FDI z. Resource transfer effects z. Trade and balance-of-payments effects z. Competitive and anti-competitive effects z. Sovereignty and autonomy effects

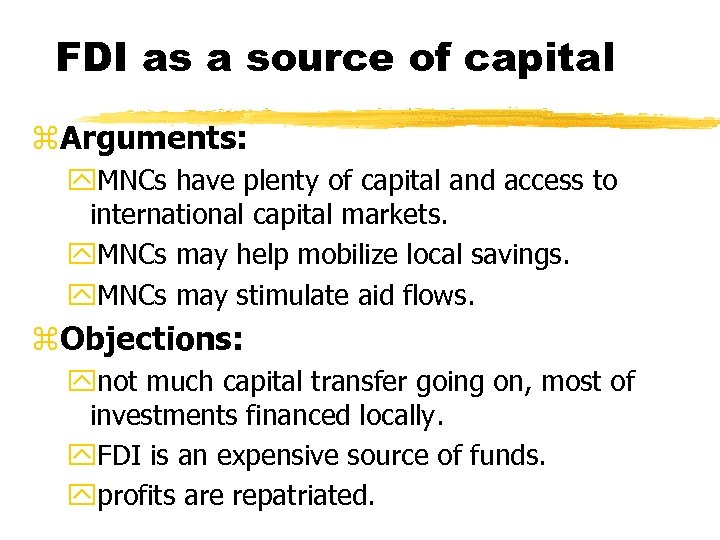

FDI as a source of capital z. Arguments: y. MNCs have plenty of capital and access to international capital markets. y. MNCs may help mobilize local savings. y. MNCs may stimulate aid flows. z. Objections: ynot much capital transfer going on, most of investments financed locally. y. FDI is an expensive source of funds. yprofits are repatriated.

FDI as a source of capital z. Arguments: y. MNCs have plenty of capital and access to international capital markets. y. MNCs may help mobilize local savings. y. MNCs may stimulate aid flows. z. Objections: ynot much capital transfer going on, most of investments financed locally. y. FDI is an expensive source of funds. yprofits are repatriated.

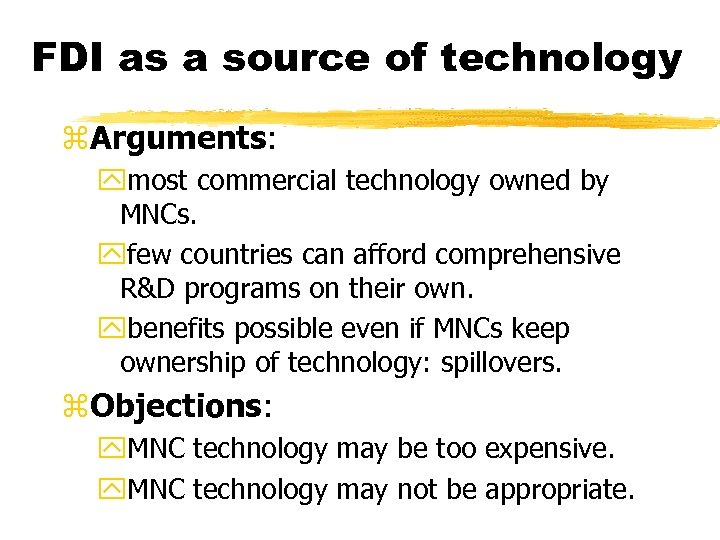

FDI as a source of technology z. Arguments: ymost commercial technology owned by MNCs. yfew countries can afford comprehensive R&D programs on their own. ybenefits possible even if MNCs keep ownership of technology: spillovers. z. Objections: y. MNC technology may be too expensive. y. MNC technology may not be appropriate.

FDI as a source of technology z. Arguments: ymost commercial technology owned by MNCs. yfew countries can afford comprehensive R&D programs on their own. ybenefits possible even if MNCs keep ownership of technology: spillovers. z. Objections: y. MNC technology may be too expensive. y. MNC technology may not be appropriate.

Balance-of-payments effects z. Arguments: yshortage of forex for imports of investment goods a common development problem. yboth export-oriented and importsubstituting FDI should improve Bo. P. z. Objections: y. MNCs import a lot. Import-substituting MNCs, in particular, may create import dependence. y. MNCs repatriatiate profits.

Balance-of-payments effects z. Arguments: yshortage of forex for imports of investment goods a common development problem. yboth export-oriented and importsubstituting FDI should improve Bo. P. z. Objections: y. MNCs import a lot. Import-substituting MNCs, in particular, may create import dependence. y. MNCs repatriatiate profits.

Competitive and anticompetitive effects z. Arguments: y. MNC entry may stimulate competition, efficiency, and development. y. MNCs often enter industries where entry barriers for local firms are high. z. Objections: y. MNCs are stronger and may outcompete local firms. Risk foreign oligopolies and monopolies.

Competitive and anticompetitive effects z. Arguments: y. MNC entry may stimulate competition, efficiency, and development. y. MNCs often enter industries where entry barriers for local firms are high. z. Objections: y. MNCs are stronger and may outcompete local firms. Risk foreign oligopolies and monopolies.

Sovereignty and autonomy effects z. Arguments: y. Foreign ownership always carries a cost. Foreign MNCs may push for policies that are good for them but not necessarily for the host country. z. Objections: y. Who cares if the Americans own our factories, as long as we get jobs and tax revenue.

Sovereignty and autonomy effects z. Arguments: y. Foreign ownership always carries a cost. Foreign MNCs may push for policies that are good for them but not necessarily for the host country. z. Objections: y. Who cares if the Americans own our factories, as long as we get jobs and tax revenue.

Other effects z. Negative externalities from FDI, e. g. on the environment? z. Cultural imperialism? z. Inappropriate consumption patterns Camel, Heineken, and Yves St. Laurent in poor countries? z. FDI may create dependence on foreign capital - see Asian crisis

Other effects z. Negative externalities from FDI, e. g. on the environment? z. Cultural imperialism? z. Inappropriate consumption patterns Camel, Heineken, and Yves St. Laurent in poor countries? z. FDI may create dependence on foreign capital - see Asian crisis