c9c4fce82659e12300671cd9c93f065f.ppt

- Количество слайдов: 65

HOSPITALITY AND TOURISM ADVISORY SERVICES Aviation, International Markets and Tourism Growth Potential for Israel November 2006 e Quality in Everything We Do

HOSPITALITY AND TOURISM ADVISORY SERVICES Aviation, International Markets and Tourism Growth Potential for Israel November 2006 e Quality in Everything We Do

Agenda 1 Aviation Policy 2 International Markets and Tourism Growth Potential Quality in Everything We Do 1 e

Agenda 1 Aviation Policy 2 International Markets and Tourism Growth Potential Quality in Everything We Do 1 e

1 Aviation Policy Quality in Everything We Do 2 e

1 Aviation Policy Quality in Everything We Do 2 e

Aviation Policy Liberalization typically increases travel demand by producing: 1. Additional direct visitor source markets 2. Higher frequency for convenience 3. Better customer service 4. Competitive fares (especially with entry of low cost carriers) 5. Increased investment in tourism Quality in Everything We Do 3 e

Aviation Policy Liberalization typically increases travel demand by producing: 1. Additional direct visitor source markets 2. Higher frequency for convenience 3. Better customer service 4. Competitive fares (especially with entry of low cost carriers) 5. Increased investment in tourism Quality in Everything We Do 3 e

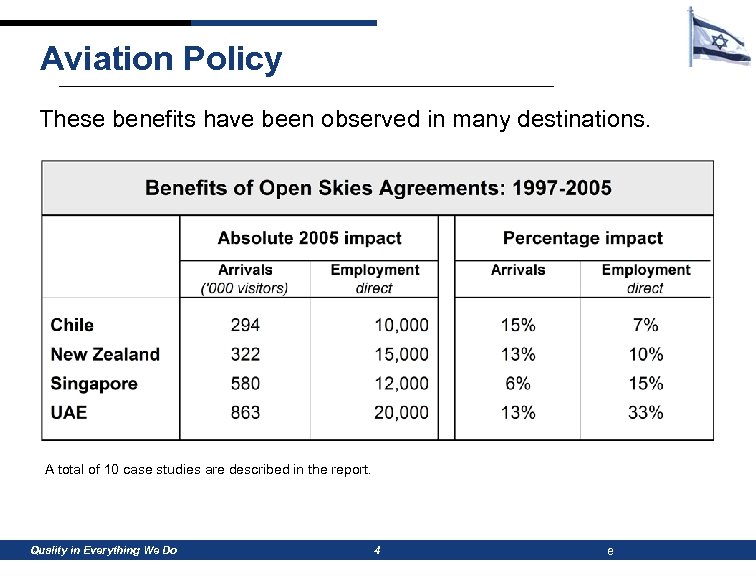

Aviation Policy These benefits have been observed in many destinations. A total of 10 case studies are described in the report. Quality in Everything We Do 4 e

Aviation Policy These benefits have been observed in many destinations. A total of 10 case studies are described in the report. Quality in Everything We Do 4 e

Aviation Policy § Aviation policy in Israel has stunted market development. § Policies regulate the number of scheduled flights, the number of airlines with designated carrier status, the frequency of flights, the number of seats on flights, and flying rights. § Some progress has been made with new carriers for New York, Atlanta, and Madrid. In the early summer of 2006, there were 20% more flights than in the summer of 2005. § However, a recent rejection of Germany’s application to increase flights highlights an environment where certain markets remain closely guarded. Quality in Everything We Do 5 e

Aviation Policy § Aviation policy in Israel has stunted market development. § Policies regulate the number of scheduled flights, the number of airlines with designated carrier status, the frequency of flights, the number of seats on flights, and flying rights. § Some progress has been made with new carriers for New York, Atlanta, and Madrid. In the early summer of 2006, there were 20% more flights than in the summer of 2005. § However, a recent rejection of Germany’s application to increase flights highlights an environment where certain markets remain closely guarded. Quality in Everything We Do 5 e

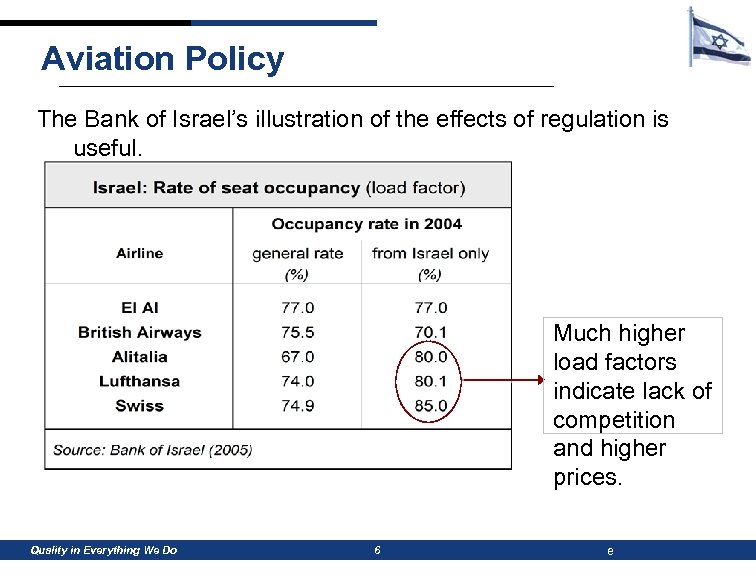

Aviation Policy The Bank of Israel’s illustration of the effects of regulation is useful. Much higher load factors indicate lack of competition and higher prices. Quality in Everything We Do 6 e

Aviation Policy The Bank of Israel’s illustration of the effects of regulation is useful. Much higher load factors indicate lack of competition and higher prices. Quality in Everything We Do 6 e

Aviation Policy Recommendations § Allow for increases in international airline activity to BGA, easing restrictions on airlines, capacity and frequencies. § Provide extended rights for a second Israeli airline to fly international routes within the framework of existing Bilateral Agreements. § Relax restrictions on connection flights. § Pursue charter and low-cost airlines to operate international flights to BGA. § Explore extending airport hours. Quality in Everything We Do 7 e

Aviation Policy Recommendations § Allow for increases in international airline activity to BGA, easing restrictions on airlines, capacity and frequencies. § Provide extended rights for a second Israeli airline to fly international routes within the framework of existing Bilateral Agreements. § Relax restrictions on connection flights. § Pursue charter and low-cost airlines to operate international flights to BGA. § Explore extending airport hours. Quality in Everything We Do 7 e

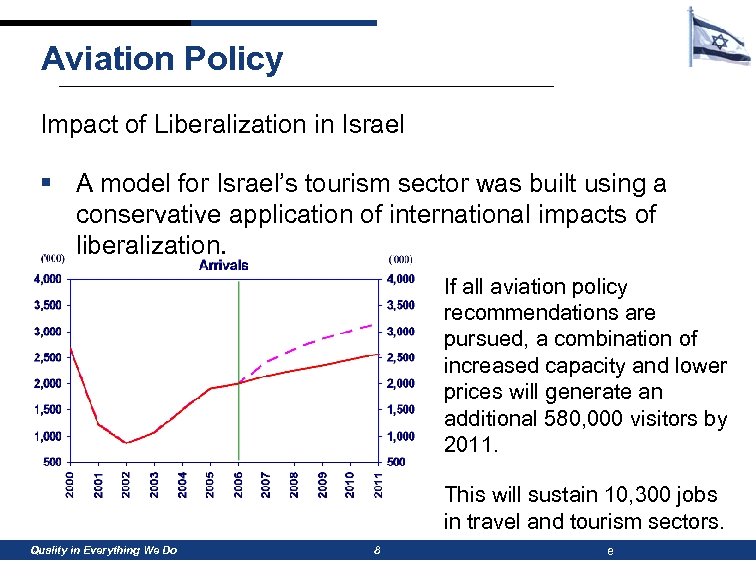

Aviation Policy Impact of Liberalization in Israel § A model for Israel’s tourism sector was built using a conservative application of international impacts of liberalization. If all aviation policy recommendations are pursued, a combination of increased capacity and lower prices will generate an additional 580, 000 visitors by 2011. This will sustain 10, 300 jobs in travel and tourism sectors. Quality in Everything We Do 8 e

Aviation Policy Impact of Liberalization in Israel § A model for Israel’s tourism sector was built using a conservative application of international impacts of liberalization. If all aviation policy recommendations are pursued, a combination of increased capacity and lower prices will generate an additional 580, 000 visitors by 2011. This will sustain 10, 300 jobs in travel and tourism sectors. Quality in Everything We Do 8 e

2 International Markets and Tourism Growth Potential Quality in Everything We Do 9 e

2 International Markets and Tourism Growth Potential Quality in Everything We Do 9 e

Method & Data Pool Recap § IPK’s World Travel Monitor® (500, 000 annual interviews) § 18 Focus Groups § Representative Population Surveys (8, 400 Interviews) § Tour Operator Interviews (51) A very comprehensive data pool for all important outbound markets Quality in Everything We Do 10 e

Method & Data Pool Recap § IPK’s World Travel Monitor® (500, 000 annual interviews) § 18 Focus Groups § Representative Population Surveys (8, 400 Interviews) § Tour Operator Interviews (51) A very comprehensive data pool for all important outbound markets Quality in Everything We Do 10 e

Importance of Int'l Tourism 600 million outbound trips are taken around the globe every year, resulting in earnings of 700 billion US$ International tourism is one of the largest and fastest growing economic sectors in the world Source: IPK International – World Travel Monitor 2005 / official statistics Quality in Everything We Do 11 e

Importance of Int'l Tourism 600 million outbound trips are taken around the globe every year, resulting in earnings of 700 billion US$ International tourism is one of the largest and fastest growing economic sectors in the world Source: IPK International – World Travel Monitor 2005 / official statistics Quality in Everything We Do 11 e

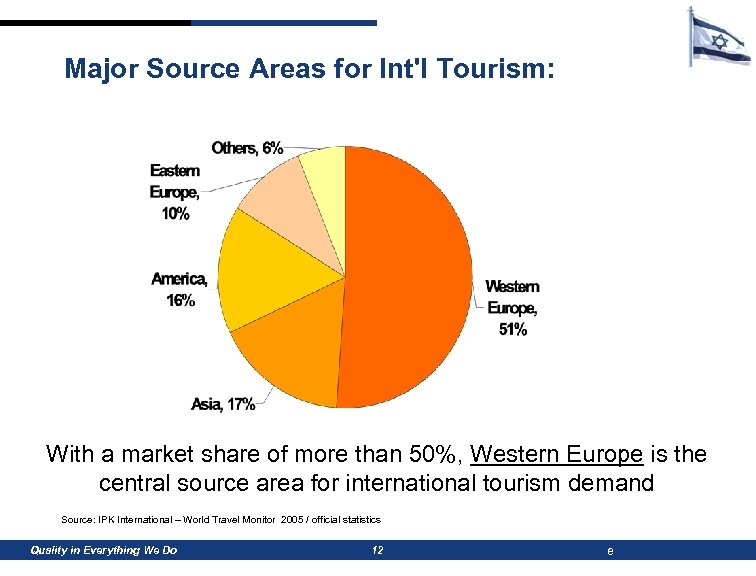

Major Source Areas for Int'l Tourism: With a market share of more than 50%, Western Europe is the central source area for international tourism demand Source: IPK International – World Travel Monitor 2005 / official statistics Quality in Everything We Do 12 e

Major Source Areas for Int'l Tourism: With a market share of more than 50%, Western Europe is the central source area for international tourism demand Source: IPK International – World Travel Monitor 2005 / official statistics Quality in Everything We Do 12 e

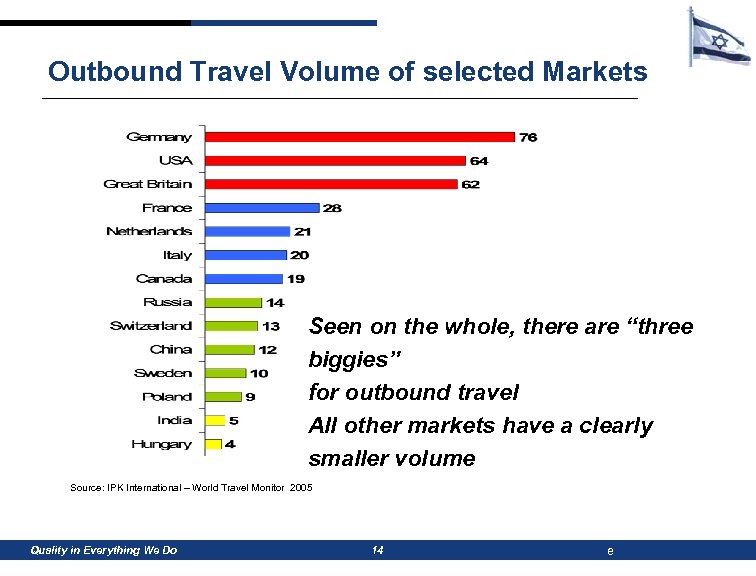

Major Source Markets for Int'l Tourism: § Germany – the world’s largest source market for outbound trips (76 million trips) § USA (64 million trips) § Great Britain (62 million trips) These three source markets alone account for one-third of worldwide outbound travel Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 13 e

Major Source Markets for Int'l Tourism: § Germany – the world’s largest source market for outbound trips (76 million trips) § USA (64 million trips) § Great Britain (62 million trips) These three source markets alone account for one-third of worldwide outbound travel Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 13 e

Outbound Travel Volume of selected Markets Seen on the whole, there are “three biggies” for outbound travel All other markets have a clearly smaller volume Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 14 e

Outbound Travel Volume of selected Markets Seen on the whole, there are “three biggies” for outbound travel All other markets have a clearly smaller volume Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 14 e

Major Destinations: § Spain – the world’s leading destination for international tourists (51 million international visitors / year) § USA (49 million) § France (46 million) Nearly one-fourth of all outbound trips worldwide are taken into these three destinations alone Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 15 e

Major Destinations: § Spain – the world’s leading destination for international tourists (51 million international visitors / year) § USA (49 million) § France (46 million) Nearly one-fourth of all outbound trips worldwide are taken into these three destinations alone Source: IPK International – World Travel Monitor 2005 Quality in Everything We Do 15 e

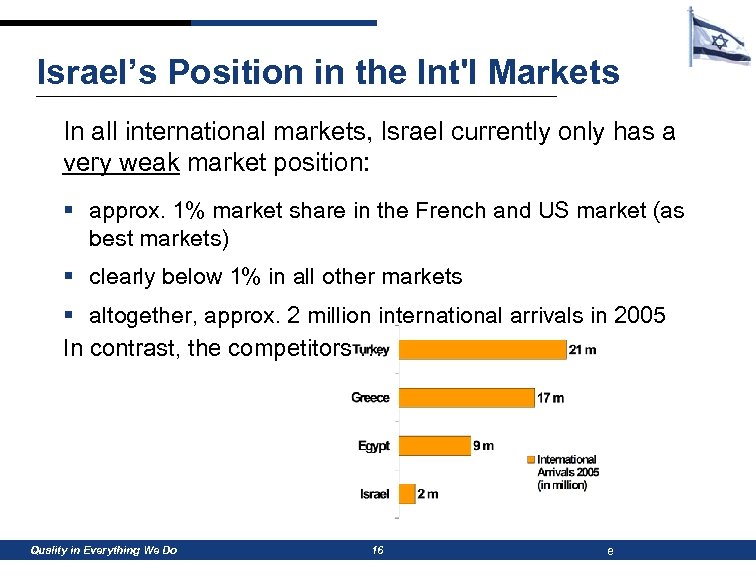

Israel’s Position in the Int'l Markets In all international markets, Israel currently only has a very weak market position: § approx. 1% market share in the French and US market (as best markets) § clearly below 1% in all other markets § altogether, approx. 2 million international arrivals in 2005 In contrast, the competitors … Quality in Everything We Do 16 e

Israel’s Position in the Int'l Markets In all international markets, Israel currently only has a very weak market position: § approx. 1% market share in the French and US market (as best markets) § clearly below 1% in all other markets § altogether, approx. 2 million international arrivals in 2005 In contrast, the competitors … Quality in Everything We Do 16 e

How are Israel’s Market Prospects in the International Markets? Quality in Everything We Do 17 e

How are Israel’s Market Prospects in the International Markets? Quality in Everything We Do 17 e

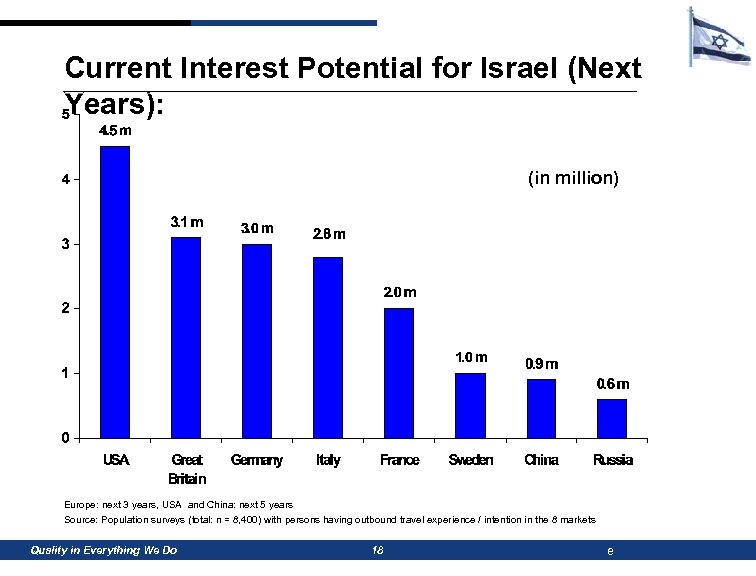

Current Interest Potential for Israel (Next Years): (in million) Europe: next 3 years, USA and China: next 5 years Source: Population surveys (total: n = 8, 400) with persons having outbound travel experience / intention in the 8 markets Quality in Everything We Do 18 e

Current Interest Potential for Israel (Next Years): (in million) Europe: next 3 years, USA and China: next 5 years Source: Population surveys (total: n = 8, 400) with persons having outbound travel experience / intention in the 8 markets Quality in Everything We Do 18 e

That means, alone in these 8 markets, Israel has currently an Interest Potential of 18 million In comparison, the visitors from these 8 markets are now 1. 2 million I. e. , the number of those interested in a holiday trip to Israel § significantly exceeds the present number of visitors In the case of outright peace, the potential would even be § doubled or tripled Quality in Everything We Do 19 e

That means, alone in these 8 markets, Israel has currently an Interest Potential of 18 million In comparison, the visitors from these 8 markets are now 1. 2 million I. e. , the number of those interested in a holiday trip to Israel § significantly exceeds the present number of visitors In the case of outright peace, the potential would even be § doubled or tripled Quality in Everything We Do 19 e

Israel has considerable “growth prospects” in the international markets Quality in Everything We Do 20 e

Israel has considerable “growth prospects” in the international markets Quality in Everything We Do 20 e

Needless to say: § The future exploitation of this large interest potential in the individual markets heavily depends on the political situation But not only: Irrespective of crises § interest potentials today are not automatically realized by themselves, especially because of the very strong international competition in tourism Quality in Everything We Do 21 e

Needless to say: § The future exploitation of this large interest potential in the individual markets heavily depends on the political situation But not only: Irrespective of crises § interest potentials today are not automatically realized by themselves, especially because of the very strong international competition in tourism Quality in Everything We Do 21 e

That means: § The right strategy and intensive marketing has – also for Israel – a decisive influence on the exploitation of the interest potential In order to implement the right strategies / measures it is necessary to know § the preferences, the needs, the expectations but also the barriers in relation to a holiday in Israel § the strengths of Israel Quality in Everything We Do 22 e

That means: § The right strategy and intensive marketing has – also for Israel – a decisive influence on the exploitation of the interest potential In order to implement the right strategies / measures it is necessary to know § the preferences, the needs, the expectations but also the barriers in relation to a holiday in Israel § the strengths of Israel Quality in Everything We Do 22 e

What are the Main Attraction Factors of Israel? The surveys (in all markets) revealed a clear result: The absolutely most attractive feature Israel has for the international markets is § its “religious culture and history” Quality in Everything We Do 23 e

What are the Main Attraction Factors of Israel? The surveys (in all markets) revealed a clear result: The absolutely most attractive feature Israel has for the international markets is § its “religious culture and history” Quality in Everything We Do 23 e

Israel’s Uniqueness: The religious culture / history makes Israel unique worldwide Unique, not only from a religious standpoint but above all from a general touristic point of view Quality in Everything We Do 24 e

Israel’s Uniqueness: The religious culture / history makes Israel unique worldwide Unique, not only from a religious standpoint but above all from a general touristic point of view Quality in Everything We Do 24 e

Meaning: Irrespective of the target group (if it is religiously motivated or not) to visit / experience the religious culture / history § is the absolute main motive / the purchase-crucial motive for Israel this also means, § both, the culturally as well as the religiouslymotivated can be addressed with the same topic / attraction factor ! Quality in Everything We Do 25 e

Meaning: Irrespective of the target group (if it is religiously motivated or not) to visit / experience the religious culture / history § is the absolute main motive / the purchase-crucial motive for Israel this also means, § both, the culturally as well as the religiouslymotivated can be addressed with the same topic / attraction factor ! Quality in Everything We Do 25 e

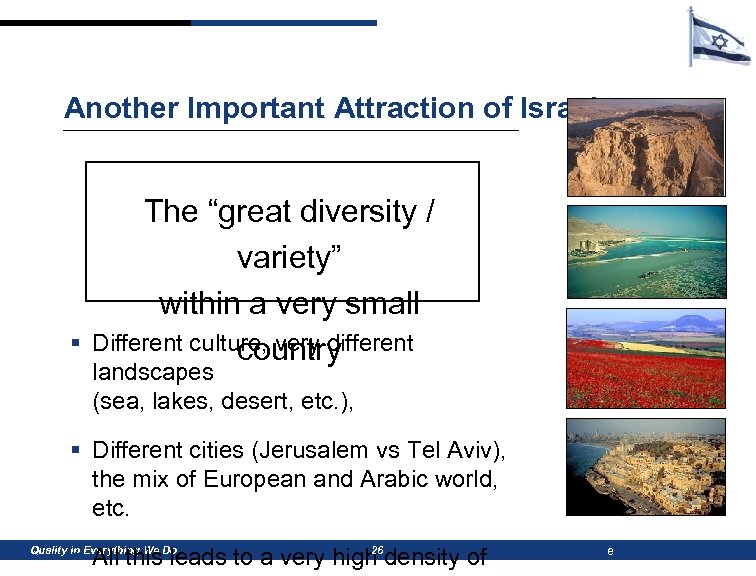

Another Important Attraction of Israel: § The “great diversity / variety” within a very small Different culture, very different country landscapes (sea, lakes, desert, etc. ), § Different cities (Jerusalem vs Tel Aviv), the mix of European and Arabic world, etc. 26 § All this leads to a very high density of Quality in Everything We Do e

Another Important Attraction of Israel: § The “great diversity / variety” within a very small Different culture, very different country landscapes (sea, lakes, desert, etc. ), § Different cities (Jerusalem vs Tel Aviv), the mix of European and Arabic world, etc. 26 § All this leads to a very high density of Quality in Everything We Do e

What are the preferred Holiday Types for Israel? The major interest in all international markets is focused on the Tour About 70% of the Israel interest potential can be reached by Tours Quality in Everything We Do 27 e

What are the preferred Holiday Types for Israel? The major interest in all international markets is focused on the Tour About 70% of the Israel interest potential can be reached by Tours Quality in Everything We Do 27 e

Which Tour Design is desired: In the focus: § The “religious / historic sites” with the highlight “Jerusalem” § But there is also a great interest to visit the - Dead Sea - Red Sea - Sea of Galilee - Tel Aviv - Desert / Negev - Kibbutz - and experience the mix of European and Arab world - to get to know the Israel of today 28 Quality in Everything We Do e

Which Tour Design is desired: In the focus: § The “religious / historic sites” with the highlight “Jerusalem” § But there is also a great interest to visit the - Dead Sea - Red Sea - Sea of Galilee - Tel Aviv - Desert / Negev - Kibbutz - and experience the mix of European and Arab world - to get to know the Israel of today 28 Quality in Everything We Do e

The great diversity and the contrasts of the country significantly increase the attractiveness of a Tour Quality in Everything We Do 29 e

The great diversity and the contrasts of the country significantly increase the attractiveness of a Tour Quality in Everything We Do 29 e

Preferred: Guided Tours § more / better information § more convenience § greater safety Quality in Everything We Do 30 e

Preferred: Guided Tours § more / better information § more convenience § greater safety Quality in Everything We Do 30 e

Important also: Supplementing the Tour with “relaxing days” § at the seaside (Red Sea, Mediterranean Coast) § at the Dead Sea (Spa / Wellness) § at the Sea of Galilee Quality in Everything We Do 31 e

Important also: Supplementing the Tour with “relaxing days” § at the seaside (Red Sea, Mediterranean Coast) § at the Dead Sea (Spa / Wellness) § at the Sea of Galilee Quality in Everything We Do 31 e

Pilgrimage / Religiously-Motivated Trip: The interest in Pilgrimages / religiously-motivated trips is different in the individual markets: § very important in the USA (50% share of the interest potential) § also in Italy § and Poland / Canada § (to a lesser extent also France) Quality in Everything We Do 32 e

Pilgrimage / Religiously-Motivated Trip: The interest in Pilgrimages / religiously-motivated trips is different in the individual markets: § very important in the USA (50% share of the interest potential) § also in Italy § and Poland / Canada § (to a lesser extent also France) Quality in Everything We Do 32 e

In all other markets: § only a minority has religious motives (20% on average) Therefore, important for the marketing: § high interest in religious culture / history does not automatically mean interest in a Pilgrimage / religious trip Quality in Everything We Do 33 e

In all other markets: § only a minority has religious motives (20% on average) Therefore, important for the marketing: § high interest in religious culture / history does not automatically mean interest in a Pilgrimage / religious trip Quality in Everything We Do 33 e

Also important, the religious segment splits into different target groups: § traditional religious Pilgrimages (frequently older and also lower classes) – the smallest segment § a new kind of spiritual / meditative / self-finding trips (also for younger target groups) – somewhat larger and growing § and religiously-motivated trips in the form of a normal Tour (not We Do 34 Quality in Everything Pilgrimage) – the largest segment e

Also important, the religious segment splits into different target groups: § traditional religious Pilgrimages (frequently older and also lower classes) – the smallest segment § a new kind of spiritual / meditative / self-finding trips (also for younger target groups) – somewhat larger and growing § and religiously-motivated trips in the form of a normal Tour (not We Do 34 Quality in Everything Pilgrimage) – the largest segment e

Ethnic / Visiting Friends and Relatives (VFR) Trips: In relation to the total interest potential § an altogether smaller target group (15 % on average) Exception: France (And USA, Canada and the Netherlands in relation to the present trips) Quality in Everything We Do 35 e

Ethnic / Visiting Friends and Relatives (VFR) Trips: In relation to the total interest potential § an altogether smaller target group (15 % on average) Exception: France (And USA, Canada and the Netherlands in relation to the present trips) Quality in Everything We Do 35 e

Market Prospects for a Pure Sun&Beach Holiday? In relation to the international markets § Israel’s market prospects cannot be assessed very positively Compared to Eilat, Egypt has (from the consumer / tour operators’ view) § a qualitatively better / newer § a much larger § less expensive § more known offer § and at least not considered more unsafe than Eilat Quality in Everything We Do 36 e Why should one choose Eilat instead of Sharm-el-Sheik

Market Prospects for a Pure Sun&Beach Holiday? In relation to the international markets § Israel’s market prospects cannot be assessed very positively Compared to Eilat, Egypt has (from the consumer / tour operators’ view) § a qualitatively better / newer § a much larger § less expensive § more known offer § and at least not considered more unsafe than Eilat Quality in Everything We Do 36 e Why should one choose Eilat instead of Sharm-el-Sheik

Realistically seen: § In relation to the Red Sea, Egypt represents a nearly unbeatable competition for a pure Sun&Beach holiday § Also in relation to the Mediterranean Coast, Israel faces an overwhelming already established competition And: (Greece, Turkey but also Italy, Tunisia and § Spain) The international Sun&Beach offer has developed strongly in the last 5/6 years (extreme competition, price dumping, new destinations entering the market, etc. ) Quality in Everything We Do 37 e

Realistically seen: § In relation to the Red Sea, Egypt represents a nearly unbeatable competition for a pure Sun&Beach holiday § Also in relation to the Mediterranean Coast, Israel faces an overwhelming already established competition And: (Greece, Turkey but also Italy, Tunisia and § Spain) The international Sun&Beach offer has developed strongly in the last 5/6 years (extreme competition, price dumping, new destinations entering the market, etc. ) Quality in Everything We Do 37 e

Therefore, in the international markets: § limited sales prospects for Israel’s Sun&Beach offer (still the best in Great Britain, Sweden) but § an important supplement / component for Israel’s Tour product Quality in Everything We Do 38 e

Therefore, in the international markets: § limited sales prospects for Israel’s Sun&Beach offer (still the best in Great Britain, Sweden) but § an important supplement / component for Israel’s Tour product Quality in Everything We Do 38 e

Market Prospects for City. Breaks? Despite an interest in some markets § not competitive in the end Why? § The effort involved (length of journey, security checks, costs, etc. ) § is ultimately too high for the typical City. Break stay of 2 -3 days And the consumers say: § if we travel to Israel, we would like to see more – not only Tel Aviv resulting in: Quality in Everything We Do 39 e

Market Prospects for City. Breaks? Despite an interest in some markets § not competitive in the end Why? § The effort involved (length of journey, security checks, costs, etc. ) § is ultimately too high for the typical City. Break stay of 2 -3 days And the consumers say: § if we travel to Israel, we would like to see more – not only Tel Aviv resulting in: Quality in Everything We Do 39 e

Wellness / Spa Holiday at the Dead Sea? Medical stay at the Dead Sea: Very good prospects, for a certain / smaller target group with specific ailments: § Known and competent offer Wellness holiday at the Dead Sea: Very limited market prospects: § Heavy international competition § Mostly a short holiday stay spent nearby Dead Sea as part of a Tour: Very large interest: § Also: one or two Wellness / relaxing days as a component of a Quality in Everything We Do 40 e

Wellness / Spa Holiday at the Dead Sea? Medical stay at the Dead Sea: Very good prospects, for a certain / smaller target group with specific ailments: § Known and competent offer Wellness holiday at the Dead Sea: Very limited market prospects: § Heavy international competition § Mostly a short holiday stay spent nearby Dead Sea as part of a Tour: Very large interest: § Also: one or two Wellness / relaxing days as a component of a Quality in Everything We Do 40 e

Holiday in the Countryside? Kibbutz stay: Many see the Kibbutz as an interesting institution § for a short visit within the scope of a Tour (possibly also one overnight stay) but not § as a place for a longer holiday Exception: for younger people / students Quality in Everything We Do 41 e

Holiday in the Countryside? Kibbutz stay: Many see the Kibbutz as an interesting institution § for a short visit within the scope of a Tour (possibly also one overnight stay) but not § as a place for a longer holiday Exception: for younger people / students Quality in Everything We Do 41 e

Recreational holiday in the Countryside (e. g. at the Sea of Galilee): Limited prospects for a longer stay within a smaller target group § possibly for meditative / self-finding stays / Pilgrimages (also in combination with agro-accommodation / Zimmerim) But: 42 a visit to the Sea of Galilee is an important part of a Tour e Quality in Everything We Do

Recreational holiday in the Countryside (e. g. at the Sea of Galilee): Limited prospects for a longer stay within a smaller target group § possibly for meditative / self-finding stays / Pilgrimages (also in combination with agro-accommodation / Zimmerim) But: 42 a visit to the Sea of Galilee is an important part of a Tour e Quality in Everything We Do

Outdoor Activity Holidays? Diving at the Red Sea: Limited prospects due to the very strong competition from Egypt (better offer, less expensive, much more known) Adventure / Desert Trip: Market prospects in principle, however: small target group and the offer would first of all have to be made known Quality in Everything We Do 43 e

Outdoor Activity Holidays? Diving at the Red Sea: Limited prospects due to the very strong competition from Egypt (better offer, less expensive, much more known) Adventure / Desert Trip: Market prospects in principle, however: small target group and the offer would first of all have to be made known Quality in Everything We Do 43 e

Visiting Israel During a Cruise? There is a certain interest in visiting Israel during a cruise, shore excursion: Jerusalem A cruise could also be an option for safety-sensitive target groups Israel should try to be among the standard cruise products / routes in the Southeast Mediterranean Quality in Everything We Do 44 e

Visiting Israel During a Cruise? There is a certain interest in visiting Israel during a cruise, shore excursion: Jerusalem A cruise could also be an option for safety-sensitive target groups Israel should try to be among the standard cruise products / routes in the Southeast Mediterranean Quality in Everything We Do 44 e

Impact of the Political Situation It is undoubted that Israel’s political situation acts as a § very strong barrier to international tourism For consumers (and tour operators) the main reason not to consider Israel as a travel destination is § “too unsafe” Quality in Everything We Do 45 e

Impact of the Political Situation It is undoubted that Israel’s political situation acts as a § very strong barrier to international tourism For consumers (and tour operators) the main reason not to consider Israel as a travel destination is § “too unsafe” Quality in Everything We Do 45 e

But, the consumers also express § not only Israel has safety problems (even if particularly strong and frequently) § the Middle East in general is unsafe § also Egypt § Turkey § and numerous other countries General tenor: “Today, something can happen anywhere and anytime” Quality in Everything We Do 46 e

But, the consumers also express § not only Israel has safety problems (even if particularly strong and frequently) § the Middle East in general is unsafe § also Egypt § Turkey § and numerous other countries General tenor: “Today, something can happen anywhere and anytime” Quality in Everything We Do 46 e

That means § also other destinations are confronted with this problem § in the acute crisis there always cancellations (no matter which destination) § a mix of realism und fatalism (“everywhere / anytime”) determines the behavior of many Quality in Everything We Do 47 e

That means § also other destinations are confronted with this problem § in the acute crisis there always cancellations (no matter which destination) § a mix of realism und fatalism (“everywhere / anytime”) determines the behavior of many Quality in Everything We Do 47 e

Therefore: § Israel’s political situation acts as a strong barrier but § this should not be an argument for being inactive in the international markets § other destinations are also affected § ways need to be found to overcome this barrier Quality in Everything We Do 48 e

Therefore: § Israel’s political situation acts as a strong barrier but § this should not be an argument for being inactive in the international markets § other destinations are also affected § ways need to be found to overcome this barrier Quality in Everything We Do 48 e

Distribution Situation From the consumer’s perspective, at present § too few tour operators / travel agencies are offering Israel (In contrast to Greece, Turkey, Italy or Egypt with a strong presence) Quality in Everything We Do 49 e

Distribution Situation From the consumer’s perspective, at present § too few tour operators / travel agencies are offering Israel (In contrast to Greece, Turkey, Italy or Egypt with a strong presence) Quality in Everything We Do 49 e

Yet, the population surveys showed § a clear preference to book Israel in a travel agency, which is logical: § the main interest is on guided tours § these are primarily first-time visitors § and the political situation leads to an increased need for safety It is utterly decisive to have someone – at a travel agency – to discuss everything with during the trip-planning phase – also risks and threats Quality in Everything We Do 50 e

Yet, the population surveys showed § a clear preference to book Israel in a travel agency, which is logical: § the main interest is on guided tours § these are primarily first-time visitors § and the political situation leads to an increased need for safety It is utterly decisive to have someone – at a travel agency – to discuss everything with during the trip-planning phase – also risks and threats Quality in Everything We Do 50 e

Therefore, tour operators / travel agencies should be § the main distribution channel for Israel in the international markets also in future Although the Internet is sometimes mentioned as a possible booking site, it mostly has relevance for § repeat visitors or § VFR-travelers Thus for persons already familiar with Israel or only booking a flight Quality in Everything We Do 51 e

Therefore, tour operators / travel agencies should be § the main distribution channel for Israel in the international markets also in future Although the Internet is sometimes mentioned as a possible booking site, it mostly has relevance for § repeat visitors or § VFR-travelers Thus for persons already familiar with Israel or only booking a flight Quality in Everything We Do 51 e

The Price Image by the Consumers Those already having dealt with Israel more closely or already having been there § assess Israel as being rather expensive Those who do not have concrete experience with Israel § do not have a precise price image of Israel Quality in Everything We Do 52 e

The Price Image by the Consumers Those already having dealt with Israel more closely or already having been there § assess Israel as being rather expensive Those who do not have concrete experience with Israel § do not have a precise price image of Israel Quality in Everything We Do 52 e

Price Image by the Tour Operator The European tour operators: § assessed airfares as mediocre to rather poor, § and the hotel prices as too expensive (above all in comparison to Egypt) The U. S. tour operators: § also assessed airfares as mediocre to rather poor § but the hotel prices were not cited as a 53 Quality in Everything We Do problem e

Price Image by the Tour Operator The European tour operators: § assessed airfares as mediocre to rather poor, § and the hotel prices as too expensive (above all in comparison to Egypt) The U. S. tour operators: § also assessed airfares as mediocre to rather poor § but the hotel prices were not cited as a 53 Quality in Everything We Do problem e

In general, price-sensitivity for touristic products § is increasing in all markets (especially also in the Sun&Beach segment) and if one wants to better exploit an interest potential today § prices must not be a barrier Quality in Everything We Do 54 e

In general, price-sensitivity for touristic products § is increasing in all markets (especially also in the Sun&Beach segment) and if one wants to better exploit an interest potential today § prices must not be a barrier Quality in Everything We Do 54 e

Thus, in terms of Israel’s future price policy: § As the political situation represents a substantial barrier to winning over foreign visitors § prices must not constitute a second barrier for Israel Quality in Everything We Do 55 e

Thus, in terms of Israel’s future price policy: § As the political situation represents a substantial barrier to winning over foreign visitors § prices must not constitute a second barrier for Israel Quality in Everything We Do 55 e

Communication Aspects Advertising Despite some ads / TV commercials, there was (in the Focus Groups) § no awareness of advertising for Israel as a travel destination in any of the markets In contrast thereto: (including no awareness of the “Think Israel” / “Who § knew? ” videos)Greece, Turkey and Egypt was noticed in advertising for all markets (even to a very frequent degree at times) Quality in Everything We Do 56 e

Communication Aspects Advertising Despite some ads / TV commercials, there was (in the Focus Groups) § no awareness of advertising for Israel as a travel destination in any of the markets In contrast thereto: (including no awareness of the “Think Israel” / “Who § knew? ” videos)Greece, Turkey and Egypt was noticed in advertising for all markets (even to a very frequent degree at times) Quality in Everything We Do 56 e

Test of the “Think Israel” / “Who knew? ” Videos: § All markets gave the “Think Israel” video a poor / unsatisfactory rating: too one-sided / does not show the main interesting aspects of Israel / too sexist § The “Who knew? ” performed better: but it is also not optimal: Israel / gives more information it shows the diversity of § too much content in too short sequences Thus, to continue both videos is not recommended Quality in Everything We Do 57 e

Test of the “Think Israel” / “Who knew? ” Videos: § All markets gave the “Think Israel” video a poor / unsatisfactory rating: too one-sided / does not show the main interesting aspects of Israel / too sexist § The “Who knew? ” performed better: but it is also not optimal: Israel / gives more information it shows the diversity of § too much content in too short sequences Thus, to continue both videos is not recommended Quality in Everything We Do 57 e

The term “Holy Land”: § Partly accepted (Italy, Russia, USA) § Partly not (too one-sided, only includes the Christians, somewhat outdated, Israel is more than just that) Hence, it is not ideal for all markets Quality in Everything We Do 58 e

The term “Holy Land”: § Partly accepted (Italy, Russia, USA) § Partly not (too one-sided, only includes the Christians, somewhat outdated, Israel is more than just that) Hence, it is not ideal for all markets Quality in Everything We Do 58 e

Information Behavior In general, (but also for Israel and it’s competing destinations) the most important sources of information are: § travel agencies § tour operator catalogues § and the Internet (to an ever-increasing extent) Information from friends / relatives also has a certain relevance to Israel as well Quality in Everything We Do 59 e

Information Behavior In general, (but also for Israel and it’s competing destinations) the most important sources of information are: § travel agencies § tour operator catalogues § and the Internet (to an ever-increasing extent) Information from friends / relatives also has a certain relevance to Israel as well Quality in Everything We Do 59 e

In contrast: § tourist boards (and their consumer services / brochures) § as well as tourism fairs virtually do not play any role These are primarily utilized only by those people who have § already decided on a specific travel destination Meaning that § winning new / additional customers with these instruments is close to impossible 60 Quality in Everything We Do e

In contrast: § tourist boards (and their consumer services / brochures) § as well as tourism fairs virtually do not play any role These are primarily utilized only by those people who have § already decided on a specific travel destination Meaning that § winning new / additional customers with these instruments is close to impossible 60 Quality in Everything We Do e

Image Israel is more or less permanently covered by the media (print, TV) § but only with regard to politics § and not as a “travel / holiday destination” Therefore, it is not surprising that the image of Israel (especially in Europe) is § foremost a negative image § shaped by the political situation Quality in Everything We Do 61 e

Image Israel is more or less permanently covered by the media (print, TV) § but only with regard to politics § and not as a “travel / holiday destination” Therefore, it is not surprising that the image of Israel (especially in Europe) is § foremost a negative image § shaped by the political situation Quality in Everything We Do 61 e

In contrast the competitors (such as Greece, Turkey, Egypt or Italy) have § a strong image as “travel and holiday destinations” in all markets Quality in Everything We Do 62 e

In contrast the competitors (such as Greece, Turkey, Egypt or Italy) have § a strong image as “travel and holiday destinations” in all markets Quality in Everything We Do 62 e

In principle, it is astonishing § that a country with such a negative image has such a large interest potential The only explanation is that what Israel has to offer § is of the highest attractiveness § something the others can never match § something which is unique the “religious culture / history” Quality in Everything We Do 63 e

In principle, it is astonishing § that a country with such a negative image has such a large interest potential The only explanation is that what Israel has to offer § is of the highest attractiveness § something the others can never match § something which is unique the “religious culture / history” Quality in Everything We Do 63 e

The future task is to convert Israel’s growth potentials into actual trips by appropriate policies, strategies and marketing measures Quality in Everything We Do 64 e

The future task is to convert Israel’s growth potentials into actual trips by appropriate policies, strategies and marketing measures Quality in Everything We Do 64 e