36b7dc992559be3c09fa063f546cbc6e.ppt

- Количество слайдов: 29

HOSPITALITY AND TOURISM ADVISORY SERVICES A New Market Strategy for Israeli Tourism The Ministry of Tourism Government of Israel November 2006 e Quality in Everything We Do

HOSPITALITY AND TOURISM ADVISORY SERVICES A New Market Strategy for Israeli Tourism The Ministry of Tourism Government of Israel November 2006 e Quality in Everything We Do

Agenda 1 Introduction 2 The Potential 3 The Road to 4 Million Annual Visitors 4 Summary Quality in Everything We Do 1 e

Agenda 1 Introduction 2 The Potential 3 The Road to 4 Million Annual Visitors 4 Summary Quality in Everything We Do 1 e

Introduction Quality in Everything We Do 2 e

Introduction Quality in Everything We Do 2 e

The Research Team Ernst & Young, LLP – Project Leader § World’s largest professional services firm: § 106, 000 employees in 140 countries § Global Real Estate, Hospitality and Construction practice with 3, 500 employees in more than 25 countries serving more than 4, 000 clients § The Hospitality and Tourism Advisory Services group: § Advisor to the leading organizations in the hospitality industry § Knowledge leader in hospitality, tourism and leisure § Extensive international experience § Expertise in hospitality & tourism infrastructure 3 Quality in Everything We Do development e

The Research Team Ernst & Young, LLP – Project Leader § World’s largest professional services firm: § 106, 000 employees in 140 countries § Global Real Estate, Hospitality and Construction practice with 3, 500 employees in more than 25 countries serving more than 4, 000 clients § The Hospitality and Tourism Advisory Services group: § Advisor to the leading organizations in the hospitality industry § Knowledge leader in hospitality, tourism and leisure § Extensive international experience § Expertise in hospitality & tourism infrastructure 3 Quality in Everything We Do development e

The Research Team Ernst & Young, LLP – Hospitality & Tourism Advisory Services § Extensive international experience in: § § § § Hotels Resorts Mixed-Use Developments Convention Centers Amusement Parks Sport Facilities Museums Other Leisure Real Estate Quality in Everything We Do 4 e

The Research Team Ernst & Young, LLP – Hospitality & Tourism Advisory Services § Extensive international experience in: § § § § Hotels Resorts Mixed-Use Developments Convention Centers Amusement Parks Sport Facilities Museums Other Leisure Real Estate Quality in Everything We Do 4 e

The Research Team A Fully Integrated Team § The advisory team represents the best in class in their respective fields § Project management and infrastructure assessment § Policy, economic analysis and tracking & forecasting systems § Source markets and future marketing strategy Quality in Everything We Do 5 e

The Research Team A Fully Integrated Team § The advisory team represents the best in class in their respective fields § Project management and infrastructure assessment § Policy, economic analysis and tracking & forecasting systems § Source markets and future marketing strategy Quality in Everything We Do 5 e

Methodology Quality in Everything We Do 6 e

Methodology Quality in Everything We Do 6 e

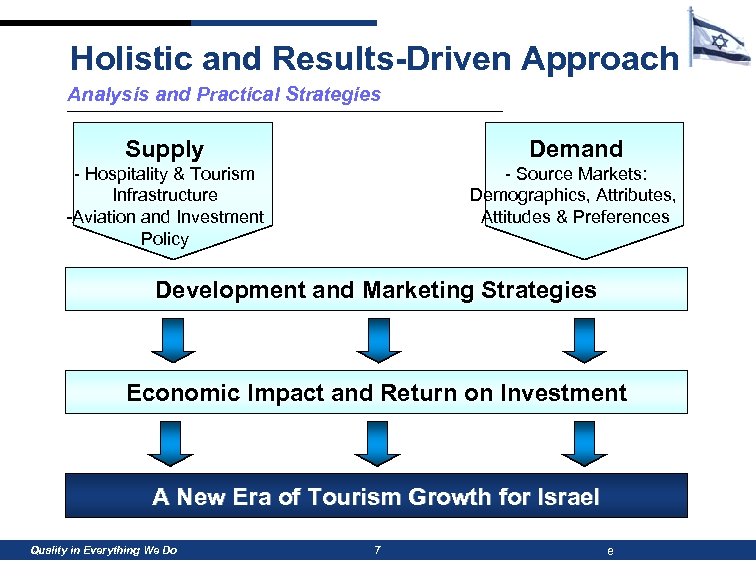

Holistic and Results-Driven Approach Analysis and Practical Strategies Supply Demand - Hospitality & Tourism Infrastructure -Aviation and Investment Policy - Source Markets: Demographics, Attributes, Attitudes & Preferences Development and Marketing Strategies Economic Impact and Return on Investment A New Era of Tourism Growth for Israel Quality in Everything We Do 7 e

Holistic and Results-Driven Approach Analysis and Practical Strategies Supply Demand - Hospitality & Tourism Infrastructure -Aviation and Investment Policy - Source Markets: Demographics, Attributes, Attitudes & Preferences Development and Marketing Strategies Economic Impact and Return on Investment A New Era of Tourism Growth for Israel Quality in Everything We Do 7 e

The Primary Research in Fifteen Countries § Interviews with 104 tourism industry stakeholders in Israel § 135 site inspections of tourism infrastructure § 500, 000 annual interviews for World Travel Monitor survey § Survey interviews with a total of 8, 400 respondents in 8 countries § 18 focus groups in 8 countries § 51 interviews with international tour operators e 8 in 8 Quality in Everything We Do

The Primary Research in Fifteen Countries § Interviews with 104 tourism industry stakeholders in Israel § 135 site inspections of tourism infrastructure § 500, 000 annual interviews for World Travel Monitor survey § Survey interviews with a total of 8, 400 respondents in 8 countries § 18 focus groups in 8 countries § 51 interviews with international tour operators e 8 in 8 Quality in Everything We Do

The main goal is… To substantially grow inbound tourism and to establish tourism as a leading engine of growth for the Israeli economy Quality in Everything We Do 9 e

The main goal is… To substantially grow inbound tourism and to establish tourism as a leading engine of growth for the Israeli economy Quality in Everything We Do 9 e

The main obstacle… Perception versus Reality Quality in Everything We Do 10 e

The main obstacle… Perception versus Reality Quality in Everything We Do 10 e

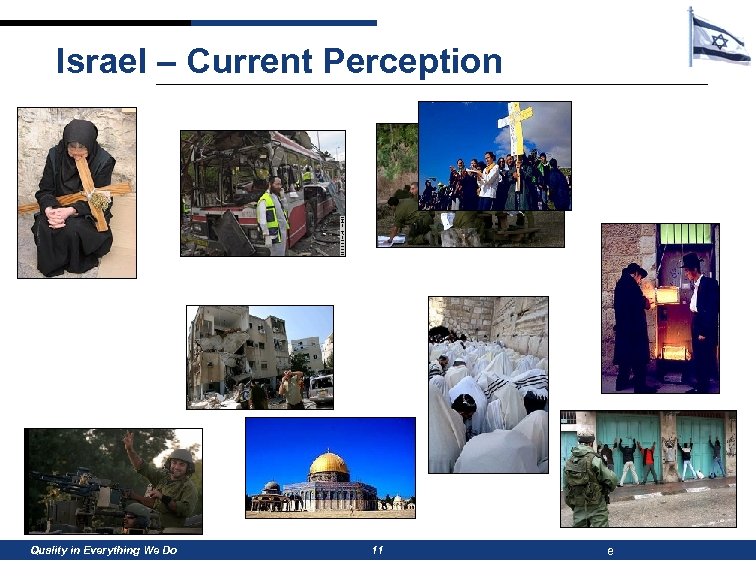

Israel – Current Perception Quality in Everything We Do 11 e

Israel – Current Perception Quality in Everything We Do 11 e

Israel – Current Reality Quality in Everything We Do 12 e

Israel – Current Reality Quality in Everything We Do 12 e

The Potential Quality in Everything We Do 13 e

The Potential Quality in Everything We Do 13 e

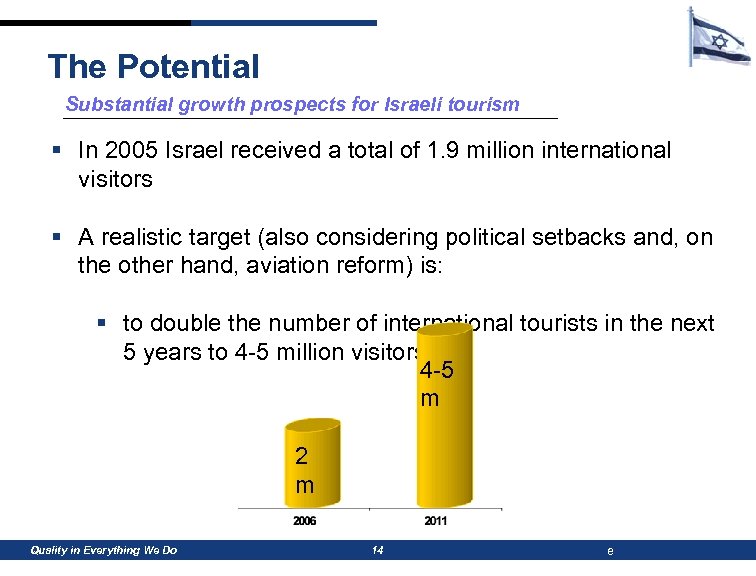

The Potential Substantial growth prospects for Israeli tourism § In 2005 Israel received a total of 1. 9 million international visitors § A realistic target (also considering political setbacks and, on the other hand, aviation reform) is: § to double the number of international tourists in the next 5 years to 4 -5 million visitors 4 -5 m 2 m Quality in Everything We Do 14 e

The Potential Substantial growth prospects for Israeli tourism § In 2005 Israel received a total of 1. 9 million international visitors § A realistic target (also considering political setbacks and, on the other hand, aviation reform) is: § to double the number of international tourists in the next 5 years to 4 -5 million visitors 4 -5 m 2 m Quality in Everything We Do 14 e

The Potential Substantial growth prospects for Israeli economy § Doubling the number of annual international visitors by 2011 to 4 million visitors could result in: § An annual addition of approximately NIS 18 billion in international travel and tourism receipts in Israel § An annual addition of approximately NIS 15 billion to Israel’s GDP § The creation of nearly 45, 000 new jobs in Israel Quality in Everything We Do 15 e

The Potential Substantial growth prospects for Israeli economy § Doubling the number of annual international visitors by 2011 to 4 million visitors could result in: § An annual addition of approximately NIS 18 billion in international travel and tourism receipts in Israel § An annual addition of approximately NIS 15 billion to Israel’s GDP § The creation of nearly 45, 000 new jobs in Israel Quality in Everything We Do 15 e

The Road to 4 Million Annual Visitors Quality in Everything We Do 16 e

The Road to 4 Million Annual Visitors Quality in Everything We Do 16 e

Marketing Strategy A research-driven long-term marketing strategy for Israeli tourism § Israel has a large unexploited interest potential in international markets and thus considerable growth prospects § Current interest potential in Eight Priority Markets: 17. 9 million visitors § Current annual visitation from Eight Priority Markets: 1. 2 million § The political situation acts as a barrier but it can be overcome via the establishment of an attractive “touristic image” and a “moderate price” policy § Israel’s most important strength is its worldwide unique “religious culture / history” (but primarily in a touristic culture / sightseeing rather than a pure religious sense) § Another important strength is the “great diversity / variety” within 17 e Quality in Everything We Do

Marketing Strategy A research-driven long-term marketing strategy for Israeli tourism § Israel has a large unexploited interest potential in international markets and thus considerable growth prospects § Current interest potential in Eight Priority Markets: 17. 9 million visitors § Current annual visitation from Eight Priority Markets: 1. 2 million § The political situation acts as a barrier but it can be overcome via the establishment of an attractive “touristic image” and a “moderate price” policy § Israel’s most important strength is its worldwide unique “religious culture / history” (but primarily in a touristic culture / sightseeing rather than a pure religious sense) § Another important strength is the “great diversity / variety” within 17 e Quality in Everything We Do

Marketing Strategy Core strategies for the international markets: § Implementation of a 5 -year image campaign: budget of 250 million USD / 50 million USD per year (this would be in line with the competitors) § Concentration on the first priority / high potential markets: § USA § France § UK § Italy § Germany § Sweden § Russia and China are examples of second priority markets § Concentration on the core product “Tour” § Following a “mid-priced” strategy § Close partnership with tour operators / travel agencies as the central distribution channel § Improvement of the offer quality / orientation on the core product “Tour” 18 § Improvement of the flight offer / cheaper flight prices Quality in Everything We Do e

Marketing Strategy Core strategies for the international markets: § Implementation of a 5 -year image campaign: budget of 250 million USD / 50 million USD per year (this would be in line with the competitors) § Concentration on the first priority / high potential markets: § USA § France § UK § Italy § Germany § Sweden § Russia and China are examples of second priority markets § Concentration on the core product “Tour” § Following a “mid-priced” strategy § Close partnership with tour operators / travel agencies as the central distribution channel § Improvement of the offer quality / orientation on the core product “Tour” 18 § Improvement of the flight offer / cheaper flight prices Quality in Everything We Do e

Return on Investment in Marketing High return on investment ROI of 9: 1 § Our analysis suggests that for every additional dollar invested in marketing, the return on investment will be $9 in additional spending § An annual increase in marketing spending to $50 million could initially yield an annual average of $447 million in spending and over 510, 000 additional visitors. Quality in Everything We Do 19 e

Return on Investment in Marketing High return on investment ROI of 9: 1 § Our analysis suggests that for every additional dollar invested in marketing, the return on investment will be $9 in additional spending § An annual increase in marketing spending to $50 million could initially yield an annual average of $447 million in spending and over 510, 000 additional visitors. Quality in Everything We Do 19 e

Physical Infrastructure Aging Lodging Supply § Upgrade the lodging product § Existing Hotels: generally dated, relatively unsophisticated, poorly designed, offer few international brands and present limited variety in product § First Priority: renovate existing hotels § Second Priority: develop new hotels § Attract well known international hotel brands § An upgraded lodging product could improve Israel’s market position Quality in Everything We Do 20 e

Physical Infrastructure Aging Lodging Supply § Upgrade the lodging product § Existing Hotels: generally dated, relatively unsophisticated, poorly designed, offer few international brands and present limited variety in product § First Priority: renovate existing hotels § Second Priority: develop new hotels § Attract well known international hotel brands § An upgraded lodging product could improve Israel’s market position Quality in Everything We Do 20 e

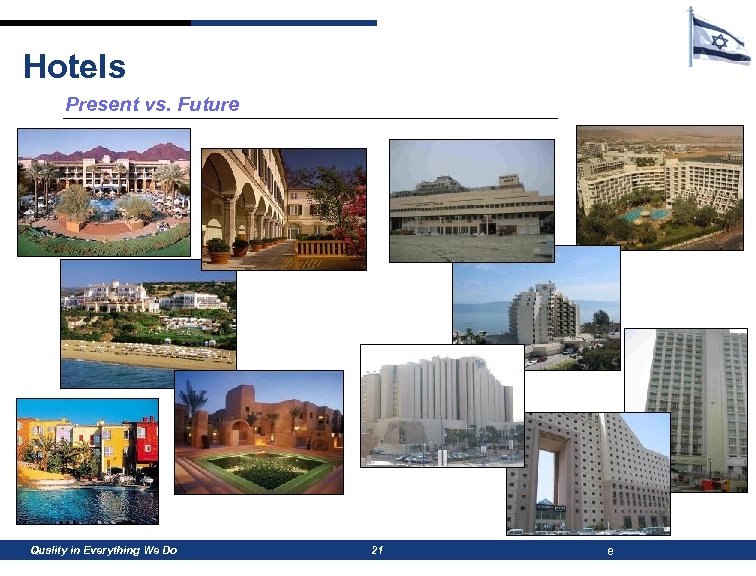

Hotels Present vs. Future Quality in Everything We Do 21 e

Hotels Present vs. Future Quality in Everything We Do 21 e

Physical Infrastructure Aging and Underdeveloped Sites and Attractions § Further develop existing sites and attractions § Israel has an unmatched concentration of unique attractions in a small area § However, many attractions are poorly maintained, underdeveloped, in need of renovation and do not include high-quality facilities and amenities § Public infrastructure in some tourist areas is in poor condition § Focus should be on further developing, expanding and upgrading existing sites and attractions in order to make them truly exceptional § Upgrade and better maintain public infrastructure in tourist areas: Old City of Jerusalem; Tel Aviv beachfront; Eilat promenade; Tiberias city center; etc. Quality in Everything We Do 22 e

Physical Infrastructure Aging and Underdeveloped Sites and Attractions § Further develop existing sites and attractions § Israel has an unmatched concentration of unique attractions in a small area § However, many attractions are poorly maintained, underdeveloped, in need of renovation and do not include high-quality facilities and amenities § Public infrastructure in some tourist areas is in poor condition § Focus should be on further developing, expanding and upgrading existing sites and attractions in order to make them truly exceptional § Upgrade and better maintain public infrastructure in tourist areas: Old City of Jerusalem; Tel Aviv beachfront; Eilat promenade; Tiberias city center; etc. Quality in Everything We Do 22 e

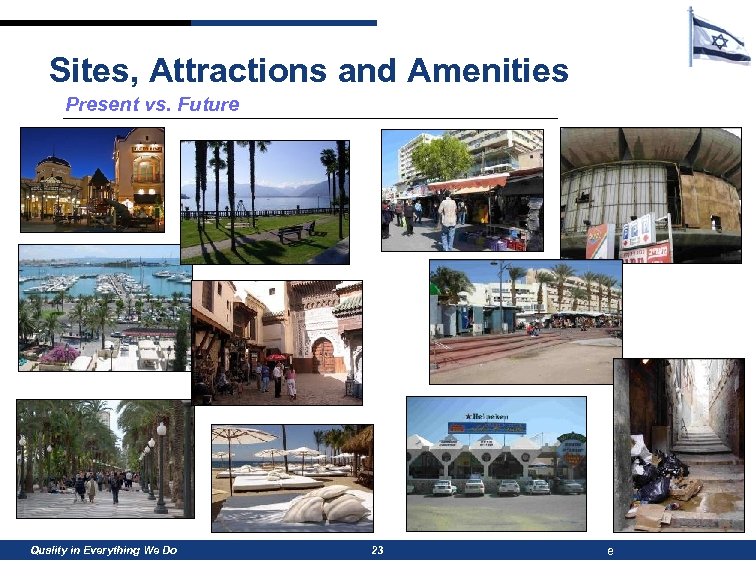

Sites, Attractions and Amenities Present vs. Future Quality in Everything We Do 23 e

Sites, Attractions and Amenities Present vs. Future Quality in Everything We Do 23 e

Investment Environment How can the government facilitate private investment in tourism? § Establish a single Tourism Investment Board (TIB): § Prospective investors in tourism in Israel face a confusing array of organizations and procedures to gain government approvals and grants § This creates confusion and inefficiencies, and does not allow for an overarching development strategy to be implemented § The TIB will assume all tourism-related responsibilities from the Investment Center and be responsible for tourism investment, grants, incentives and partnerships with the private sector, based on a clear long term strategy § The TIB will be a separate entity, under the umbrella of the Ministry of Tourism § Final decisions on projects will be taken by the TIB board, which will include IMOT, HAMAT, Finance Ministry, and the Land 24 Quality in Everything We Do e Administration

Investment Environment How can the government facilitate private investment in tourism? § Establish a single Tourism Investment Board (TIB): § Prospective investors in tourism in Israel face a confusing array of organizations and procedures to gain government approvals and grants § This creates confusion and inefficiencies, and does not allow for an overarching development strategy to be implemented § The TIB will assume all tourism-related responsibilities from the Investment Center and be responsible for tourism investment, grants, incentives and partnerships with the private sector, based on a clear long term strategy § The TIB will be a separate entity, under the umbrella of the Ministry of Tourism § Final decisions on projects will be taken by the TIB board, which will include IMOT, HAMAT, Finance Ministry, and the Land 24 Quality in Everything We Do e Administration

Investment Environment What government incentives should be in place? § Revise the incentives available for investments in tourism: § Current grant and incentive system is too limited to make an impact § Israel’s investment incentives must address the real issue of a deteriorating product in the midst of new regional development of a much higher quality § Further, incentives need to address the particular risks to tourism investment in Israel and must be at least as compelling as those of destinations competing for the same capital and developers § Offer a safety net policy to investors to counterbalance security risks § Offer low interest financing for projects of special significance and/or when private financing is difficult to obtain § Award grants and incentives for renovations, not just for new 25 e developments Quality in Everything We Do

Investment Environment What government incentives should be in place? § Revise the incentives available for investments in tourism: § Current grant and incentive system is too limited to make an impact § Israel’s investment incentives must address the real issue of a deteriorating product in the midst of new regional development of a much higher quality § Further, incentives need to address the particular risks to tourism investment in Israel and must be at least as compelling as those of destinations competing for the same capital and developers § Offer a safety net policy to investors to counterbalance security risks § Offer low interest financing for projects of special significance and/or when private financing is difficult to obtain § Award grants and incentives for renovations, not just for new 25 e developments Quality in Everything We Do

Aviation Policy A more liberal aviation policy could result in substantial growth in tourism § Liberalize Israel’s aviation policy § Aviation policy in Israel has stunted market development § Liberalization of aviation policy alone could result in 580, 000 more international visitors and 10, 300 new jobs in travel and tourism sectors by 2011 § A liberalized policy will allow for increases in international airline activity to Israel, easing restrictions on airlines, capacity and frequencies § Provide extended rights for a second Israeli airline to fly international routes § Relax restrictions on connection flights § Pursue charter and low-cost airlines to operate international flights 26 Quality in Everything We Do to BGA e

Aviation Policy A more liberal aviation policy could result in substantial growth in tourism § Liberalize Israel’s aviation policy § Aviation policy in Israel has stunted market development § Liberalization of aviation policy alone could result in 580, 000 more international visitors and 10, 300 new jobs in travel and tourism sectors by 2011 § A liberalized policy will allow for increases in international airline activity to Israel, easing restrictions on airlines, capacity and frequencies § Provide extended rights for a second Israeli airline to fly international routes § Relax restrictions on connection flights § Pursue charter and low-cost airlines to operate international flights 26 Quality in Everything We Do to BGA e

Summary Quality in Everything We Do 27 e

Summary Quality in Everything We Do 27 e

Summary Considerable growth prospects for inbound tourism to Israel § Israel has substantial growth prospects in the international markets § Doubling the number of international visitors within five years could add NIS 15 Billion to Israel’s GDP and create 45, 000 new jobs § Improvements should be made to Israel’s organizational and physical tourism infrastructure in order for Israel to be competitive § Israel needs a better set of incentives and a more efficient organizational structure in order to more successfully attract investments in tourism § A more liberal aviation policy would have far reaching outcomes in terms of tourist arrivals, job creation and economic activity e § A long-term marketing strategy with a secured long-term budget Quality in Everything We Do 28

Summary Considerable growth prospects for inbound tourism to Israel § Israel has substantial growth prospects in the international markets § Doubling the number of international visitors within five years could add NIS 15 Billion to Israel’s GDP and create 45, 000 new jobs § Improvements should be made to Israel’s organizational and physical tourism infrastructure in order for Israel to be competitive § Israel needs a better set of incentives and a more efficient organizational structure in order to more successfully attract investments in tourism § A more liberal aviation policy would have far reaching outcomes in terms of tourist arrivals, job creation and economic activity e § A long-term marketing strategy with a secured long-term budget Quality in Everything We Do 28