ac3d6d03d514724217f57162db48ba2c.ppt

- Количество слайдов: 59

Hospital Market

Hospital Market

Outline Why are nonprofits in hospital market? How do hospitals compete? What is hospitals’ objective function?

Outline Why are nonprofits in hospital market? How do hospitals compete? What is hospitals’ objective function?

Background High share of total health spending led to hospitals as target for cost containment Hospitals very labor-intensive (54%) Multiple payment sources

Background High share of total health spending led to hospitals as target for cost containment Hospitals very labor-intensive (54%) Multiple payment sources

Characteristics of Hospitals Vast majority are private not-for-profit (NFP) Who are the residual claimants? Tripartite structure of hospital management

Characteristics of Hospitals Vast majority are private not-for-profit (NFP) Who are the residual claimants? Tripartite structure of hospital management

For-profit Organization supervised by the board elected by shareholders the ability to raise capital through equity and bond markets the ability to separate ownership from control limited liability to shareholders

For-profit Organization supervised by the board elected by shareholders the ability to raise capital through equity and bond markets the ability to separate ownership from control limited liability to shareholders

Nonprofit Organization Nonprofits not owned by shareholders Nonprofits do not have a governing broad elected by shareholders Nonprofits cannot participate in equity funding arrangements Nonprofits can accept charitable gifts Nonprofits may enjoy the tax exemptions

Nonprofit Organization Nonprofits not owned by shareholders Nonprofits do not have a governing broad elected by shareholders Nonprofits cannot participate in equity funding arrangements Nonprofits can accept charitable gifts Nonprofits may enjoy the tax exemptions

Stylized Facts on Nonprofit Organization operate in service sector, but no in manufacturing one operate locally, not nationally have a higher quality of product than for-profit firms, when they compete Have a self-perpetuating board of trustees are supported by, but not rely on tax exemptions rely on gifts or bonds for financing have a church related history rely on gifts of money or time or both for their operations

Stylized Facts on Nonprofit Organization operate in service sector, but no in manufacturing one operate locally, not nationally have a higher quality of product than for-profit firms, when they compete Have a self-perpetuating board of trustees are supported by, but not rely on tax exemptions rely on gifts or bonds for financing have a church related history rely on gifts of money or time or both for their operations

Impact of Ownership Status on Health Care Non-for-profit (NFP) organizations concentrate in the area of education, health care, and the arts. Hospital facilities: U. S. (60% ), France (16%), Germany (33%) NFPs do not distribute profits to individual equity holders (Non. Distribution Constraint). NFPs enjoy some advantages including tax exemption (corporate income and property taxes), better access to tax-exempt bond financing, and eligibility for private donations. )

Impact of Ownership Status on Health Care Non-for-profit (NFP) organizations concentrate in the area of education, health care, and the arts. Hospital facilities: U. S. (60% ), France (16%), Germany (33%) NFPs do not distribute profits to individual equity holders (Non. Distribution Constraint). NFPs enjoy some advantages including tax exemption (corporate income and property taxes), better access to tax-exempt bond financing, and eligibility for private donations. )

Ownership Types in Taiwan Public: managed by the government or public enterprises or universities Private NFP: private universities or donations for purposes of charity or medical research Private FP: physicians

Ownership Types in Taiwan Public: managed by the government or public enterprises or universities Private NFP: private universities or donations for purposes of charity or medical research Private FP: physicians

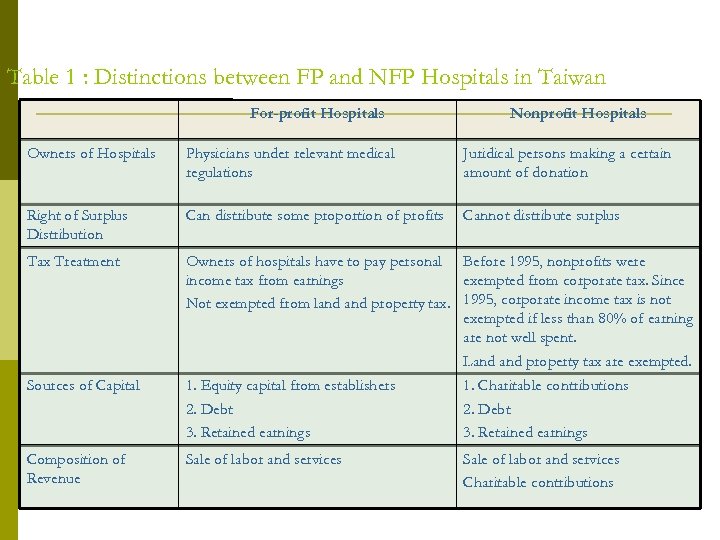

Table 1 : Distinctions between FP and NFP Hospitals in Taiwan For-profit Hospitals Nonprofit Hospitals Owners of Hospitals Physicians under relevant medical regulations Juridical persons making a certain amount of donation Right of Surplus Distribution Can distribute some proportion of profits Cannot distribute surplus Tax Treatment Owners of hospitals have to pay personal Before 1995, nonprofits were income tax from earnings exempted from corporate tax. Since Not exempted from land property tax. 1995, corporate income tax is not exempted if less than 80% of earning are not well spent. Land property tax are exempted. Sources of Capital 1. Equity capital from establishers 2. Debt 3. Retained earnings 1. Charitable contributions 2. Debt 3. Retained earnings Composition of Revenue Sale of labor and services Charitable contributions

Table 1 : Distinctions between FP and NFP Hospitals in Taiwan For-profit Hospitals Nonprofit Hospitals Owners of Hospitals Physicians under relevant medical regulations Juridical persons making a certain amount of donation Right of Surplus Distribution Can distribute some proportion of profits Cannot distribute surplus Tax Treatment Owners of hospitals have to pay personal Before 1995, nonprofits were income tax from earnings exempted from corporate tax. Since Not exempted from land property tax. 1995, corporate income tax is not exempted if less than 80% of earning are not well spent. Land property tax are exempted. Sources of Capital 1. Equity capital from establishers 2. Debt 3. Retained earnings 1. Charitable contributions 2. Debt 3. Retained earnings Composition of Revenue Sale of labor and services Charitable contributions

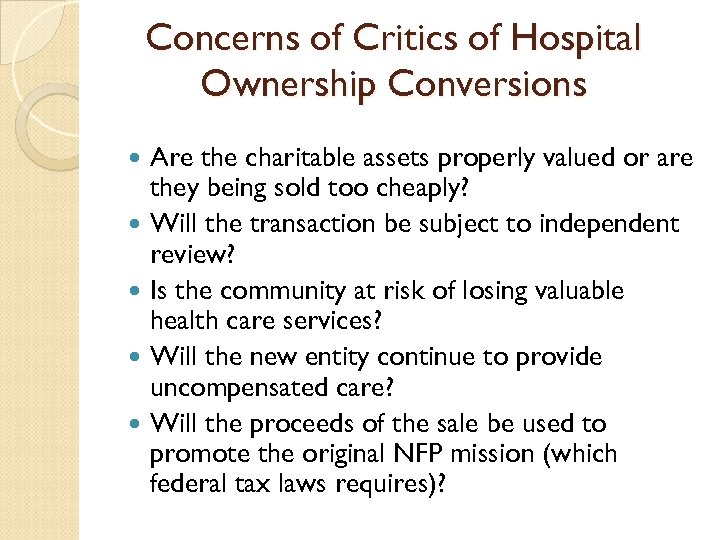

Concerns of Critics of Hospital Ownership Conversions Are the charitable assets properly valued or are they being sold too cheaply? Will the transaction be subject to independent review? Is the community at risk of losing valuable health care services? Will the new entity continue to provide uncompensated care? Will the proceeds of the sale be used to promote the original NFP mission (which federal tax laws requires)?

Concerns of Critics of Hospital Ownership Conversions Are the charitable assets properly valued or are they being sold too cheaply? Will the transaction be subject to independent review? Is the community at risk of losing valuable health care services? Will the new entity continue to provide uncompensated care? Will the proceeds of the sale be used to promote the original NFP mission (which federal tax laws requires)?

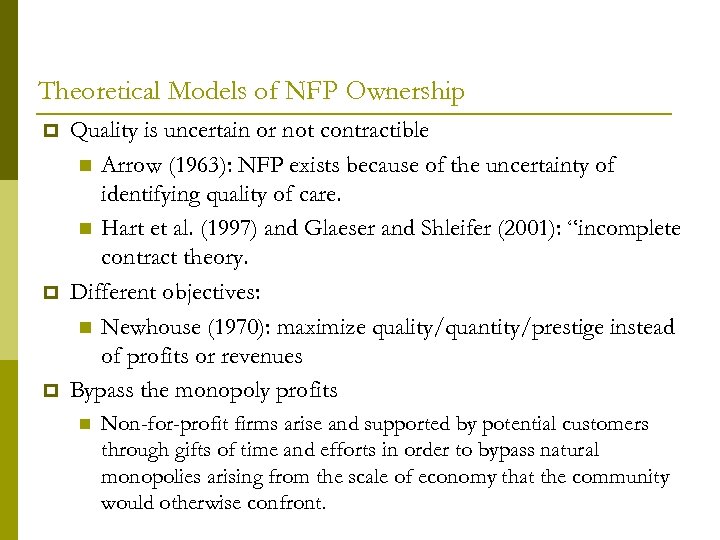

Theoretical Models of NFP Ownership Quality is uncertain or not contractible Arrow (1963): NFP exists because of the uncertainty of identifying quality of care. Hart et al. (1997) and Glaeser and Shleifer (2001): “incomplete contract theory. Different objectives: Newhouse (1970): maximize quality/quantity/prestige instead of profits or revenues Bypass the monopoly profits Non-for-profit firms arise and supported by potential customers through gifts of time and efforts in order to bypass natural monopolies arising from the scale of economy that the community would otherwise confront.

Theoretical Models of NFP Ownership Quality is uncertain or not contractible Arrow (1963): NFP exists because of the uncertainty of identifying quality of care. Hart et al. (1997) and Glaeser and Shleifer (2001): “incomplete contract theory. Different objectives: Newhouse (1970): maximize quality/quantity/prestige instead of profits or revenues Bypass the monopoly profits Non-for-profit firms arise and supported by potential customers through gifts of time and efforts in order to bypass natural monopolies arising from the scale of economy that the community would otherwise confront.

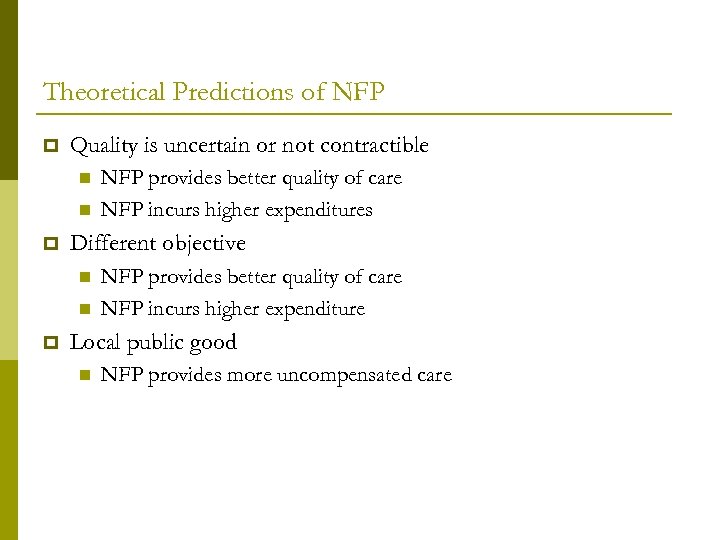

Theoretical Predictions of NFP Quality is uncertain or not contractible Different objective NFP provides better quality of care NFP incurs higher expenditures NFP provides better quality of care NFP incurs higher expenditure Local public good NFP provides more uncompensated care

Theoretical Predictions of NFP Quality is uncertain or not contractible Different objective NFP provides better quality of care NFP incurs higher expenditures NFP provides better quality of care NFP incurs higher expenditure Local public good NFP provides more uncompensated care

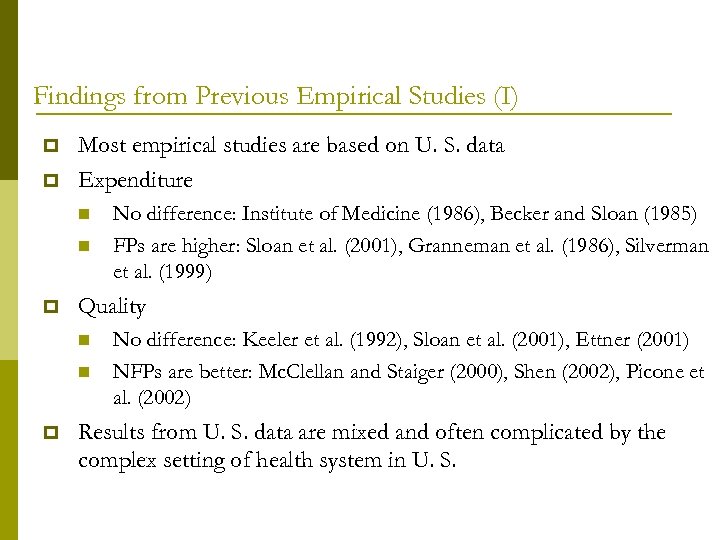

Findings from Previous Empirical Studies (I) Most empirical studies are based on U. S. data Expenditure Quality No difference: Institute of Medicine (1986), Becker and Sloan (1985) FPs are higher: Sloan et al. (2001), Granneman et al. (1986), Silverman et al. (1999) No difference: Keeler et al. (1992), Sloan et al. (2001), Ettner (2001) NFPs are better: Mc. Clellan and Staiger (2000), Shen (2002), Picone et al. (2002) Results from U. S. data are mixed and often complicated by the complex setting of health system in U. S.

Findings from Previous Empirical Studies (I) Most empirical studies are based on U. S. data Expenditure Quality No difference: Institute of Medicine (1986), Becker and Sloan (1985) FPs are higher: Sloan et al. (2001), Granneman et al. (1986), Silverman et al. (1999) No difference: Keeler et al. (1992), Sloan et al. (2001), Ettner (2001) NFPs are better: Mc. Clellan and Staiger (2000), Shen (2002), Picone et al. (2002) Results from U. S. data are mixed and often complicated by the complex setting of health system in U. S.

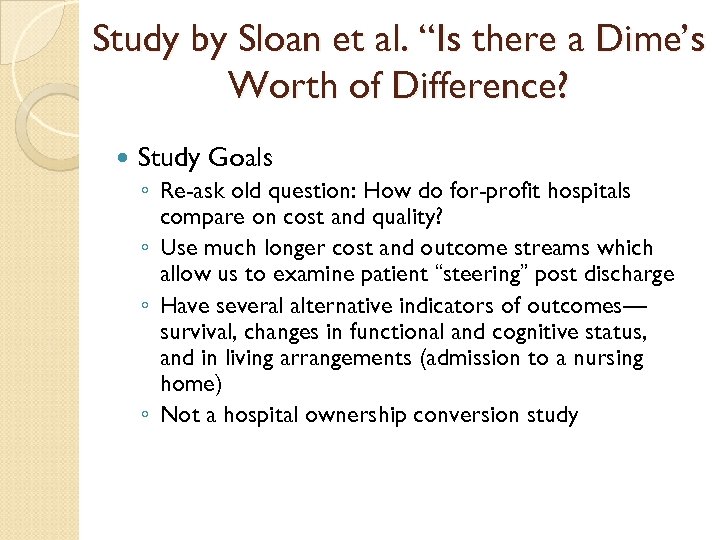

Study by Sloan et al. “Is there a Dime’s Worth of Difference? Study Goals ◦ Re-ask old question: How do for-profit hospitals compare on cost and quality? ◦ Use much longer cost and outcome streams which allow us to examine patient “steering” post discharge ◦ Have several alternative indicators of outcomes— survival, changes in functional and cognitive status, and in living arrangements (admission to a nursing home) ◦ Not a hospital ownership conversion study

Study by Sloan et al. “Is there a Dime’s Worth of Difference? Study Goals ◦ Re-ask old question: How do for-profit hospitals compare on cost and quality? ◦ Use much longer cost and outcome streams which allow us to examine patient “steering” post discharge ◦ Have several alternative indicators of outcomes— survival, changes in functional and cognitive status, and in living arrangements (admission to a nursing home) ◦ Not a hospital ownership conversion study

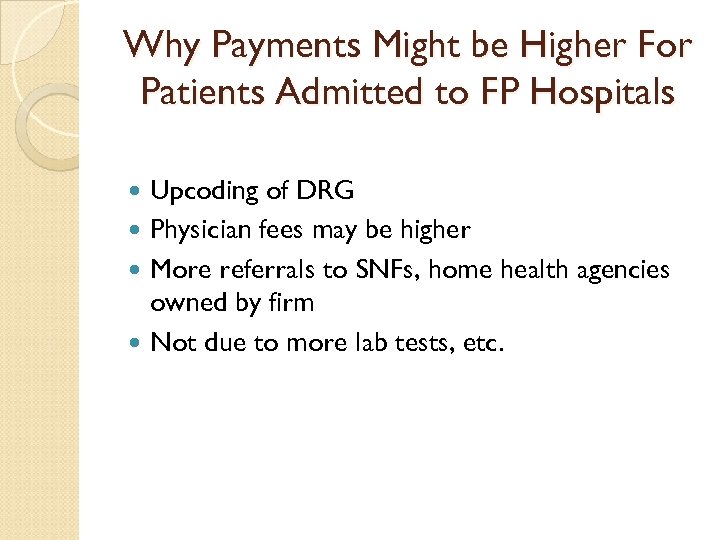

Why Payments Might be Higher For Patients Admitted to FP Hospitals Upcoding of DRG Physician fees may be higher More referrals to SNFs, home health agencies owned by firm Not due to more lab tests, etc.

Why Payments Might be Higher For Patients Admitted to FP Hospitals Upcoding of DRG Physician fees may be higher More referrals to SNFs, home health agencies owned by firm Not due to more lab tests, etc.

Study by Sloan et al. “Is there a Dime’s Worth of Difference? Conclusion Adjusting for endogeneity, FPs more expensive to U. S. Medicare, especially for downstream payments Did not find differences in outcomes suggesting that quality comparable between FPs and the other ownership types Should we be bothered by the added expense to Medicare from the FPs?

Study by Sloan et al. “Is there a Dime’s Worth of Difference? Conclusion Adjusting for endogeneity, FPs more expensive to U. S. Medicare, especially for downstream payments Did not find differences in outcomes suggesting that quality comparable between FPs and the other ownership types Should we be bothered by the added expense to Medicare from the FPs?

Results • Medicare Payments ◦ Both total payments for 6 months and payments less payments for index admission (“downstream payments”) were lower if patient admitted to NFP or G hospital than if admitted to a FP hospital. ◦ Differentials ranged from 8 -11% for G and 5 -6% for NFP (see Table 5) ◦ Differentials larger for downstream payments than for total payments

Results • Medicare Payments ◦ Both total payments for 6 months and payments less payments for index admission (“downstream payments”) were lower if patient admitted to NFP or G hospital than if admitted to a FP hospital. ◦ Differentials ranged from 8 -11% for G and 5 -6% for NFP (see Table 5) ◦ Differentials larger for downstream payments than for total payments

Mortality ◦ None of the ownership variables were statistically significant at even the 10% level ◦ Effect sizes very small

Mortality ◦ None of the ownership variables were statistically significant at even the 10% level ◦ Effect sizes very small

Regulation and Competition Among Hospitals

Regulation and Competition Among Hospitals

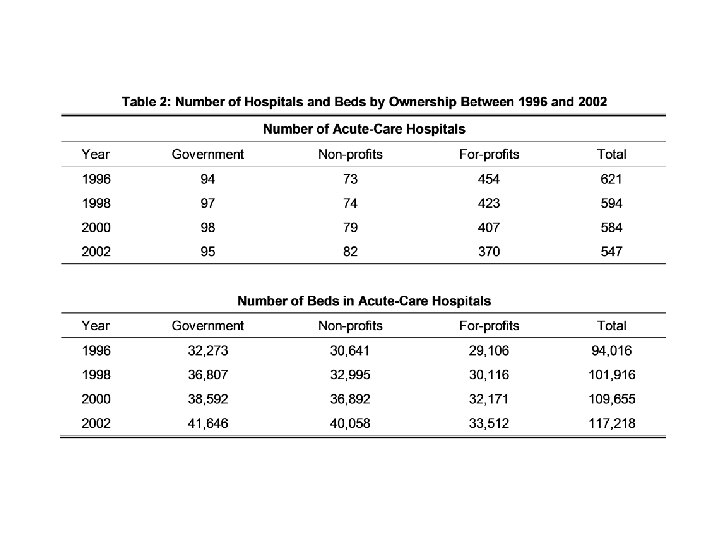

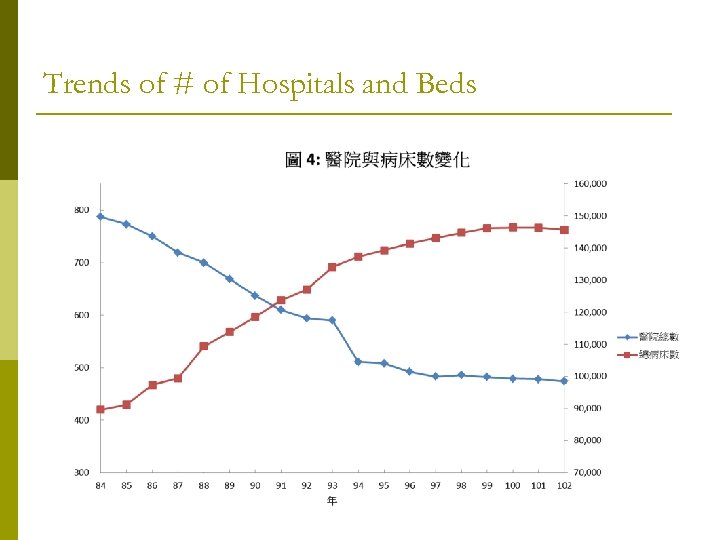

Trends of # of Hospitals and Beds

Trends of # of Hospitals and Beds

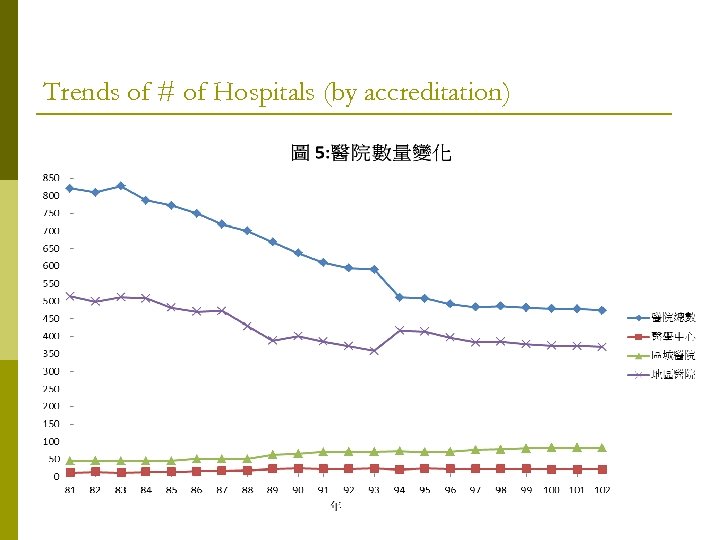

Trends of # of Hospitals (by accreditation)

Trends of # of Hospitals (by accreditation)

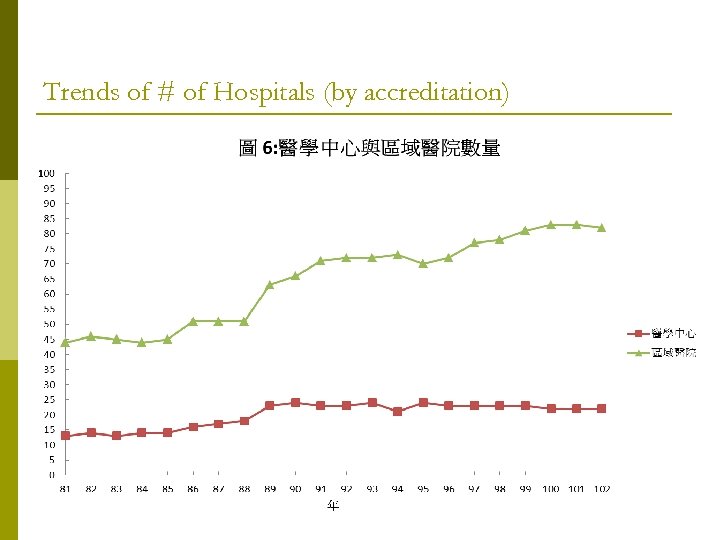

Trends of # of Hospitals (by accreditation)

Trends of # of Hospitals (by accreditation)

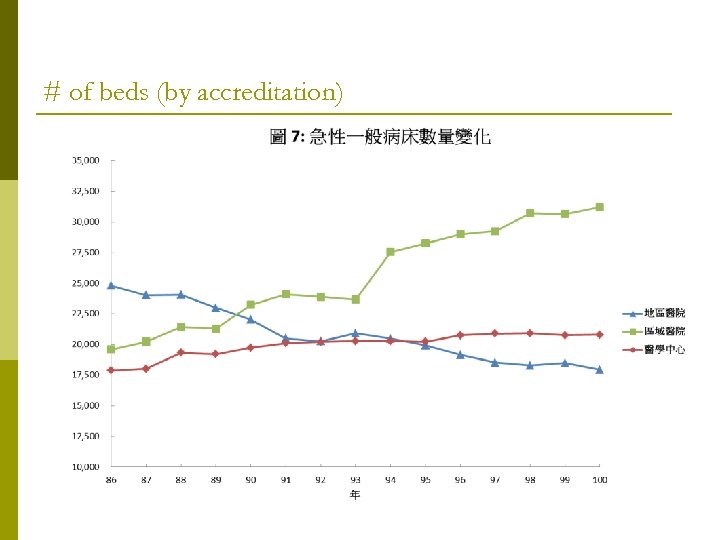

From 1995 to 2013,the number of beds increases from 90000 to 145000,but the number of hospital decreases from 787 to 474. Obviously, there is a trend of bigger hospitals. Among hospitals, the number of community hospitals drops from 568 to 370, approximately 35% closed within 20 years. On the contrary, major hospitals rises from 13 to 22, and minor teaching hospitals rises from 48 to 82.

From 1995 to 2013,the number of beds increases from 90000 to 145000,but the number of hospital decreases from 787 to 474. Obviously, there is a trend of bigger hospitals. Among hospitals, the number of community hospitals drops from 568 to 370, approximately 35% closed within 20 years. On the contrary, major hospitals rises from 13 to 22, and minor teaching hospitals rises from 48 to 82.

# of beds (by accreditation)

# of beds (by accreditation)

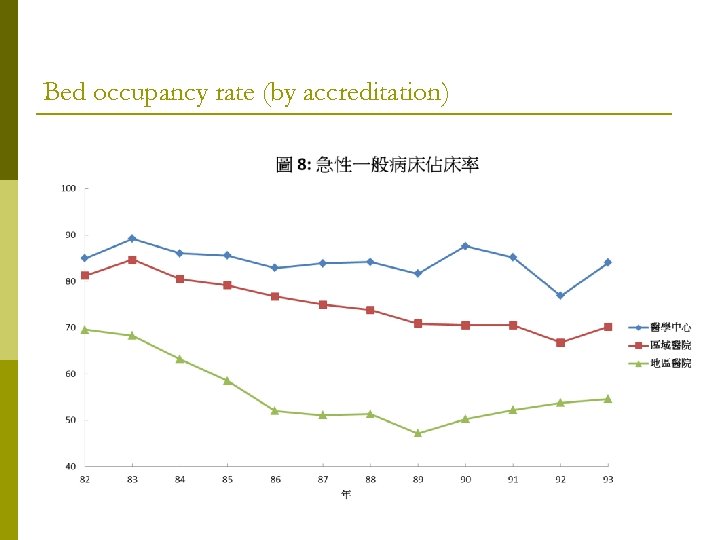

Bed occupancy rate (by accreditation)

Bed occupancy rate (by accreditation)

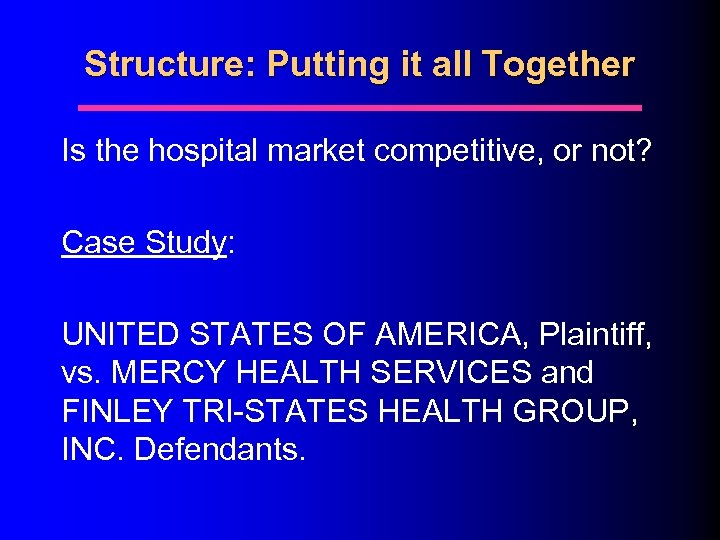

Structure: Putting it all Together Is the hospital market competitive, or not? Case Study: UNITED STATES OF AMERICA, Plaintiff, vs. MERCY HEALTH SERVICES and FINLEY TRI-STATES HEALTH GROUP, INC. Defendants.

Structure: Putting it all Together Is the hospital market competitive, or not? Case Study: UNITED STATES OF AMERICA, Plaintiff, vs. MERCY HEALTH SERVICES and FINLEY TRI-STATES HEALTH GROUP, INC. Defendants.

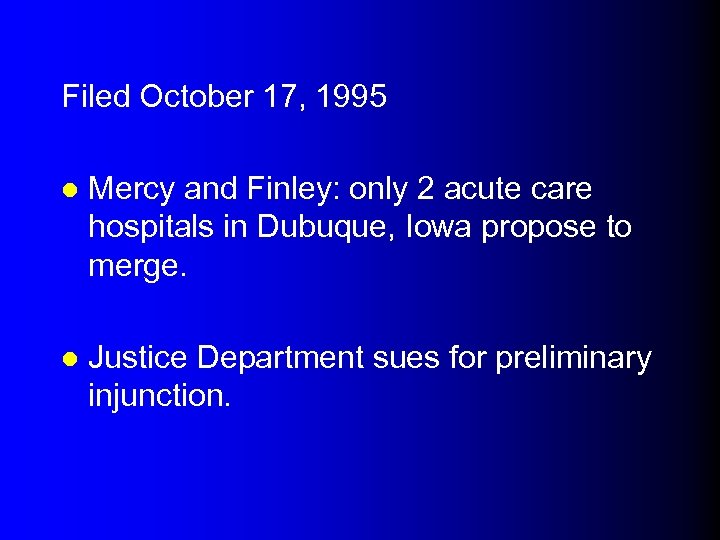

Filed October 17, 1995 l Mercy and Finley: only 2 acute care hospitals in Dubuque, Iowa propose to merge. l Justice Department sues for preliminary injunction.

Filed October 17, 1995 l Mercy and Finley: only 2 acute care hospitals in Dubuque, Iowa propose to merge. l Justice Department sues for preliminary injunction.

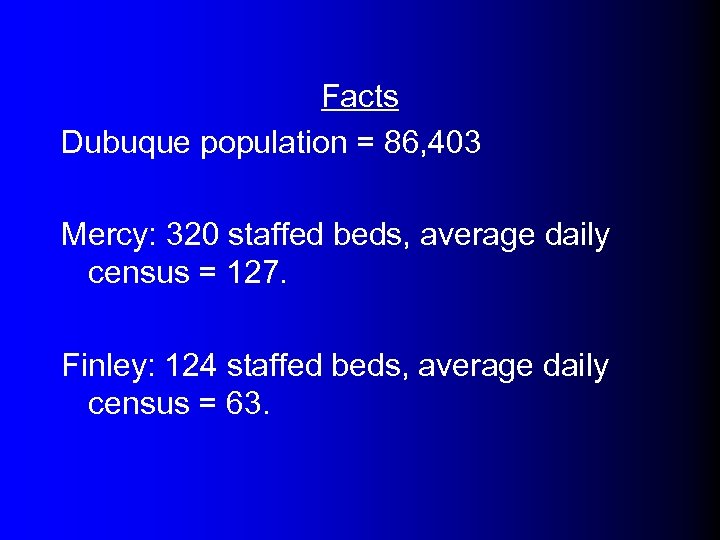

Facts Dubuque population = 86, 403 Mercy: 320 staffed beds, average daily census = 127. Finley: 124 staffed beds, average daily census = 63.

Facts Dubuque population = 86, 403 Mercy: 320 staffed beds, average daily census = 127. Finley: 124 staffed beds, average daily census = 63.

competition - outside 70 m radius, but within 100 m. Madison, Wisconsin Waterloo Cedar Rapids Iowa City, Iowa Dubuque Freeport, Illinois

competition - outside 70 m radius, but within 100 m. Madison, Wisconsin Waterloo Cedar Rapids Iowa City, Iowa Dubuque Freeport, Illinois

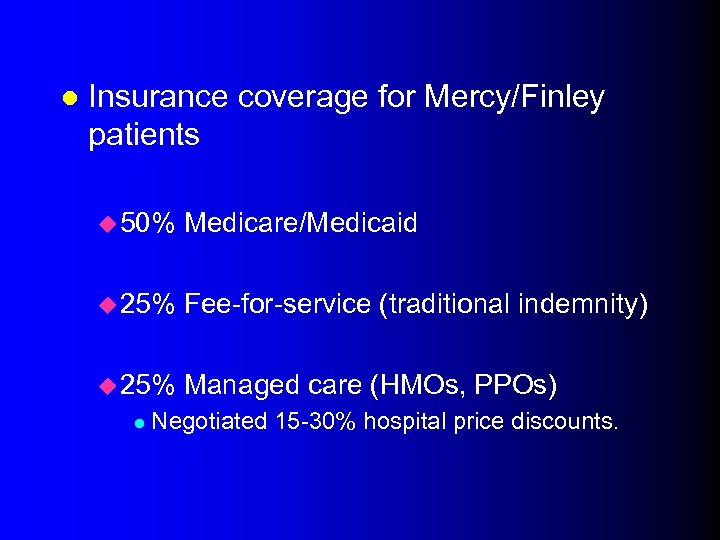

l Insurance coverage for Mercy/Finley patients u 50% Medicare/Medicaid u 25% Fee-for-service (traditional indemnity) u 25% Managed care (HMOs, PPOs) l Negotiated 15 -30% hospital price discounts.

l Insurance coverage for Mercy/Finley patients u 50% Medicare/Medicaid u 25% Fee-for-service (traditional indemnity) u 25% Managed care (HMOs, PPOs) l Negotiated 15 -30% hospital price discounts.

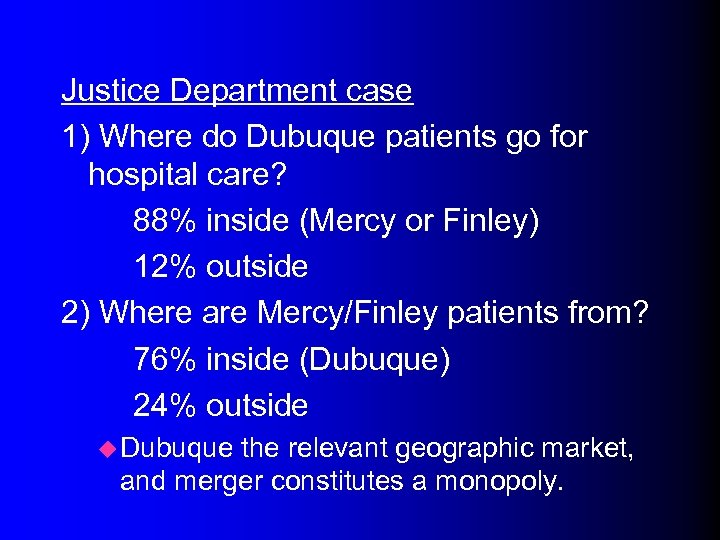

Justice Department case 1) Where do Dubuque patients go for hospital care? 88% inside (Mercy or Finley) 12% outside 2) Where are Mercy/Finley patients from? 76% inside (Dubuque) 24% outside u Dubuque the relevant geographic market, and merger constitutes a monopoly.

Justice Department case 1) Where do Dubuque patients go for hospital care? 88% inside (Mercy or Finley) 12% outside 2) Where are Mercy/Finley patients from? 76% inside (Dubuque) 24% outside u Dubuque the relevant geographic market, and merger constitutes a monopoly.

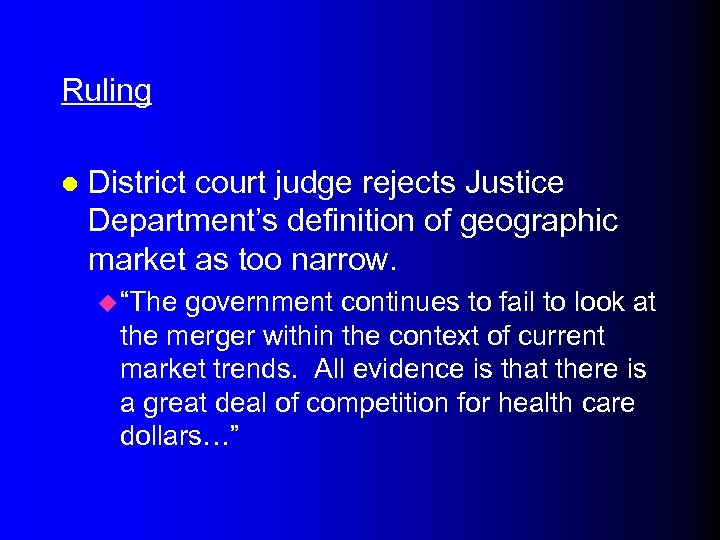

Ruling l District court judge rejects Justice Department’s definition of geographic market as too narrow. u “The government continues to fail to look at the merger within the context of current market trends. All evidence is that there is a great deal of competition for health care dollars…”

Ruling l District court judge rejects Justice Department’s definition of geographic market as too narrow. u “The government continues to fail to look at the merger within the context of current market trends. All evidence is that there is a great deal of competition for health care dollars…”

![u “…if DRHS [merged entity] reacted in a noncompetitive manner, an HMO that could u “…if DRHS [merged entity] reacted in a noncompetitive manner, an HMO that could](https://present5.com/presentation/ac3d6d03d514724217f57162db48ba2c/image-35.jpg) u “…if DRHS [merged entity] reacted in a noncompetitive manner, an HMO that could successfully induce Dubuque area residents to use alternative hospitals would be at a significant cost advantage. ” u “There is also evidence that managed care entities can successfully induce Dubuque residents to use other regional hospitals for their inpatient needs. ” Merger of Mercy and Finley would not/could not result in higher prices.

u “…if DRHS [merged entity] reacted in a noncompetitive manner, an HMO that could successfully induce Dubuque area residents to use alternative hospitals would be at a significant cost advantage. ” u “There is also evidence that managed care entities can successfully induce Dubuque residents to use other regional hospitals for their inpatient needs. ” Merger of Mercy and Finley would not/could not result in higher prices.

Case Study Conclusion l Even if only one hospital exists in a given geographic region, it may not be able to act as a monopolist l Ability of large, managed care buyers to shift patients can keep the market competitive.

Case Study Conclusion l Even if only one hospital exists in a given geographic region, it may not be able to act as a monopolist l Ability of large, managed care buyers to shift patients can keep the market competitive.

Hospital Conduct l Large #s of sellers and low barriers to entry promote competition. l We expect increased competition to lead to: u Higher output and quality. u Lower price.

Hospital Conduct l Large #s of sellers and low barriers to entry promote competition. l We expect increased competition to lead to: u Higher output and quality. u Lower price.

l However, the hospital market has important differences. u Hospitals don’t necessarily maximize profits. u Government is a major payer l Prices not set competitively. u Consumer less likely to shop around. l • Insurance and asymmetric info. Is hospital market competition good or bad for consumers?

l However, the hospital market has important differences. u Hospitals don’t necessarily maximize profits. u Government is a major payer l Prices not set competitively. u Consumer less likely to shop around. l • Insurance and asymmetric info. Is hospital market competition good or bad for consumers?

l Markets with fewer hospitals may face higher prices. u But hospitals in more concentrated markets may be larger, and econ of scale may reduce costs. l Look at price and quality effects of hospital mergers.

l Markets with fewer hospitals may face higher prices. u But hospitals in more concentrated markets may be larger, and econ of scale may reduce costs. l Look at price and quality effects of hospital mergers.

MAR Worse When There are More Hospitals More hospitals in market more competition among hospitals for doctors (and their patients) more Medical Arm Race Cost and quality much higher than is socially optimal

MAR Worse When There are More Hospitals More hospitals in market more competition among hospitals for doctors (and their patients) more Medical Arm Race Cost and quality much higher than is socially optimal

Regulatory (Government) Responses Entry regulation: certificate of need (CON) Revenue or price regulation: Nixon price controls, state rate setting programs Utilization review: Professional Standards Review Organizations Peer Review Organizations for Medicare

Regulatory (Government) Responses Entry regulation: certificate of need (CON) Revenue or price regulation: Nixon price controls, state rate setting programs Utilization review: Professional Standards Review Organizations Peer Review Organizations for Medicare

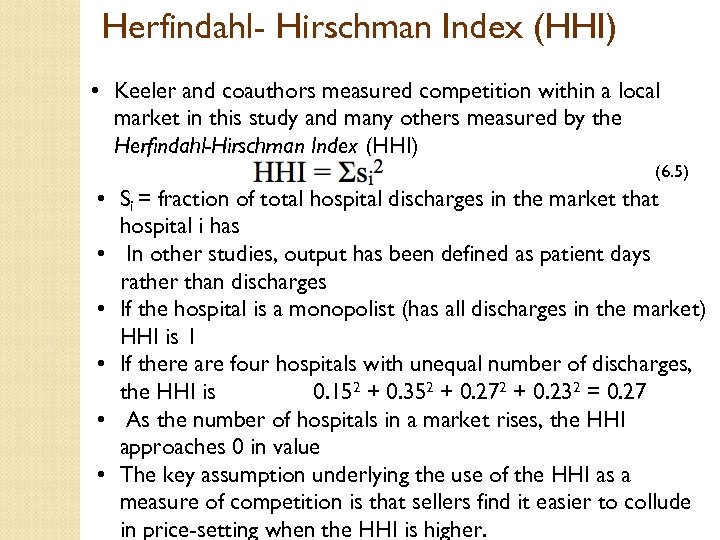

Herfindahl- Hirschman Index (HHI) • Keeler and coauthors measured competition within a local market in this study and many others measured by the Herfindahl-Hirschman Index (HHI) (6. 5) • Si = fraction of total hospital discharges in the market that hospital i has • In other studies, output has been defined as patient days rather than discharges • If the hospital is a monopolist (has all discharges in the market) HHI is 1 • If there are four hospitals with unequal number of discharges, the HHI is 0. 152 + 0. 352 + 0. 272 + 0. 232 = 0. 27 • As the number of hospitals in a market rises, the HHI approaches 0 in value • The key assumption underlying the use of the HHI as a measure of competition is that sellers find it easier to collude in price-setting when the HHI is higher.

Herfindahl- Hirschman Index (HHI) • Keeler and coauthors measured competition within a local market in this study and many others measured by the Herfindahl-Hirschman Index (HHI) (6. 5) • Si = fraction of total hospital discharges in the market that hospital i has • In other studies, output has been defined as patient days rather than discharges • If the hospital is a monopolist (has all discharges in the market) HHI is 1 • If there are four hospitals with unequal number of discharges, the HHI is 0. 152 + 0. 352 + 0. 272 + 0. 232 = 0. 27 • As the number of hospitals in a market rises, the HHI approaches 0 in value • The key assumption underlying the use of the HHI as a measure of competition is that sellers find it easier to collude in price-setting when the HHI is higher.

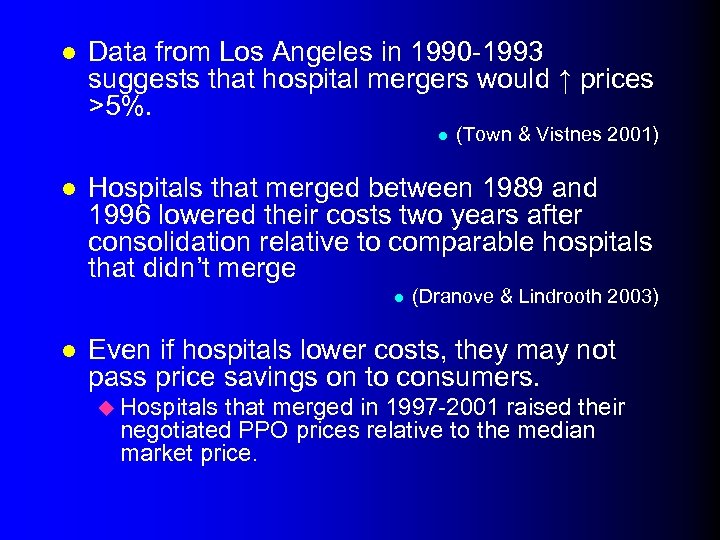

l Data from Los Angeles in 1990 -1993 suggests that hospital mergers would ↑ prices >5%. l l Hospitals that merged between 1989 and 1996 lowered their costs two years after consolidation relative to comparable hospitals that didn’t merge l l (Town & Vistnes 2001) (Dranove & Lindrooth 2003) Even if hospitals lower costs, they may not pass price savings on to consumers. u Hospitals that merged in 1997 -2001 raised their negotiated PPO prices relative to the median market price.

l Data from Los Angeles in 1990 -1993 suggests that hospital mergers would ↑ prices >5%. l l Hospitals that merged between 1989 and 1996 lowered their costs two years after consolidation relative to comparable hospitals that didn’t merge l l (Town & Vistnes 2001) (Dranove & Lindrooth 2003) Even if hospitals lower costs, they may not pass price savings on to consumers. u Hospitals that merged in 1997 -2001 raised their negotiated PPO prices relative to the median market price.

l Other studies suggest that hospital consolidation does not improve the quality of care. l These results suggest that more competitive hospital markets favor consumers.

l Other studies suggest that hospital consolidation does not improve the quality of care. l These results suggest that more competitive hospital markets favor consumers.

How do hospitals compete?

How do hospitals compete?

The Profit-Maximizing Hospital The Base Case

The Profit-Maximizing Hospital The Base Case

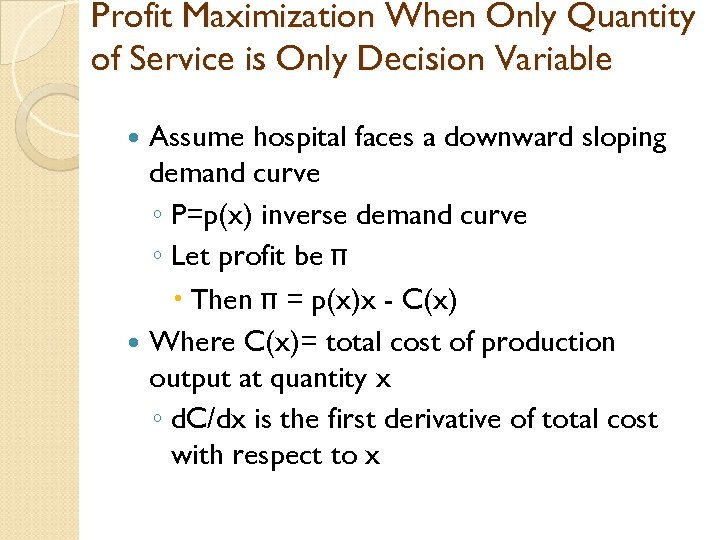

Profit Maximization When Only Quantity of Service is Only Decision Variable Assume hospital faces a downward sloping demand curve ◦ P=p(x) inverse demand curve ◦ Let profit be π Then π = p(x)x - C(x) Where C(x)= total cost of production output at quantity x ◦ d. C/dx is the first derivative of total cost with respect to x

Profit Maximization When Only Quantity of Service is Only Decision Variable Assume hospital faces a downward sloping demand curve ◦ P=p(x) inverse demand curve ◦ Let profit be π Then π = p(x)x - C(x) Where C(x)= total cost of production output at quantity x ◦ d. C/dx is the first derivative of total cost with respect to x

Profit Maximization When Only Quantity of Service is Only Decision Variable Continued d. C/dx is the firm’s marginal cost P(x)x = Total revenue R(x) d. R/dx = dp/dx x+p(x) = Marginal revenue Profit is maximized at dπ/dx = dp/dx x+p(x)-d. C/dx = 0

Profit Maximization When Only Quantity of Service is Only Decision Variable Continued d. C/dx is the firm’s marginal cost P(x)x = Total revenue R(x) d. R/dx = dp/dx x+p(x) = Marginal revenue Profit is maximized at dπ/dx = dp/dx x+p(x)-d. C/dx = 0

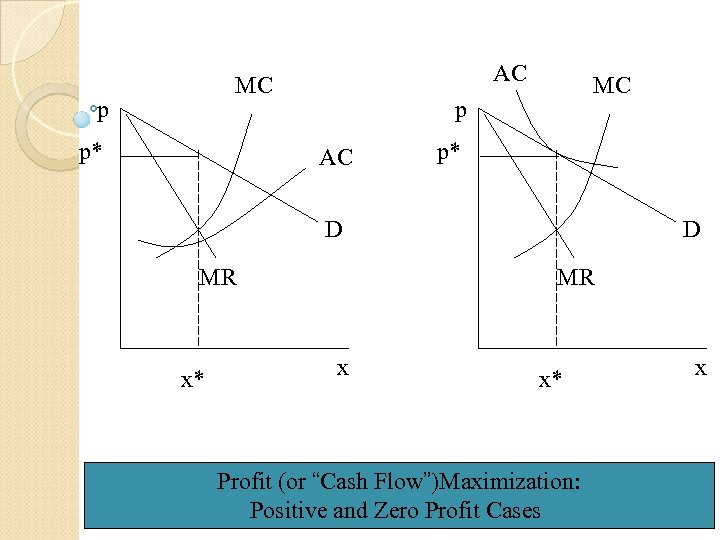

AC MC p p* MC p AC p* D MR x x* Profit (or “Cash Flow”)Maximization: Positive and Zero Profit Cases x

AC MC p p* MC p AC p* D MR x x* Profit (or “Cash Flow”)Maximization: Positive and Zero Profit Cases x

Profit Maximization When Only Quantity of Service is Only Decision Variable Continued Quantity is set at the quantity at which marginal revenue equals marginal cost. Once optimal quantity x* has been determined, optimal price p* is read from the demand curve. The optimal values are shown graphically in Chapter 5, Fig. 5. 5, Panel A.

Profit Maximization When Only Quantity of Service is Only Decision Variable Continued Quantity is set at the quantity at which marginal revenue equals marginal cost. Once optimal quantity x* has been determined, optimal price p* is read from the demand curve. The optimal values are shown graphically in Chapter 5, Fig. 5. 5, Panel A.

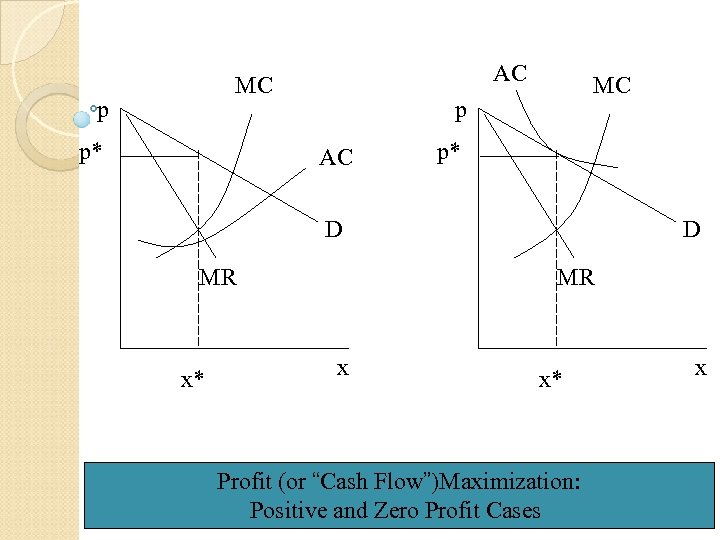

AC MC p p* MC p AC p* D MR x x* Profit (or “Cash Flow”)Maximization: Positive and Zero Profit Cases x

AC MC p p* MC p AC p* D MR x x* Profit (or “Cash Flow”)Maximization: Positive and Zero Profit Cases x

Newhouse Model Explains how hospitals behave when they have an objective other than profit maximization See introduction of paper for characteristics of hospital author trying to explain, at least as of 1960 s Hospital maximizes utility subject to a constraint Derive constraint and then introduce hospital utility function

Newhouse Model Explains how hospitals behave when they have an objective other than profit maximization See introduction of paper for characteristics of hospital author trying to explain, at least as of 1960 s Hospital maximizes utility subject to a constraint Derive constraint and then introduce hospital utility function

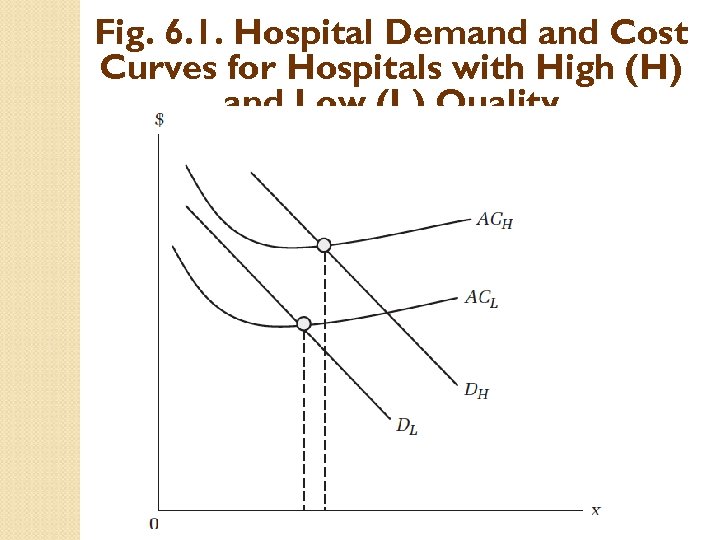

Fig. 6. 1. Hospital Demand Cost Curves for Hospitals with High (H) and Low (L) Quality

Fig. 6. 1. Hospital Demand Cost Curves for Hospitals with High (H) and Low (L) Quality

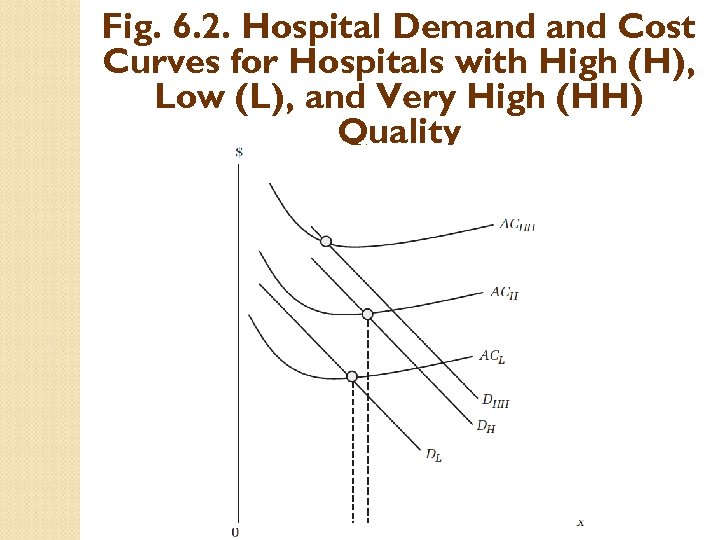

Fig. 6. 2. Hospital Demand Cost Curves for Hospitals with High (H), Low (L), and Very High (HH) Quality

Fig. 6. 2. Hospital Demand Cost Curves for Hospitals with High (H), Low (L), and Very High (HH) Quality

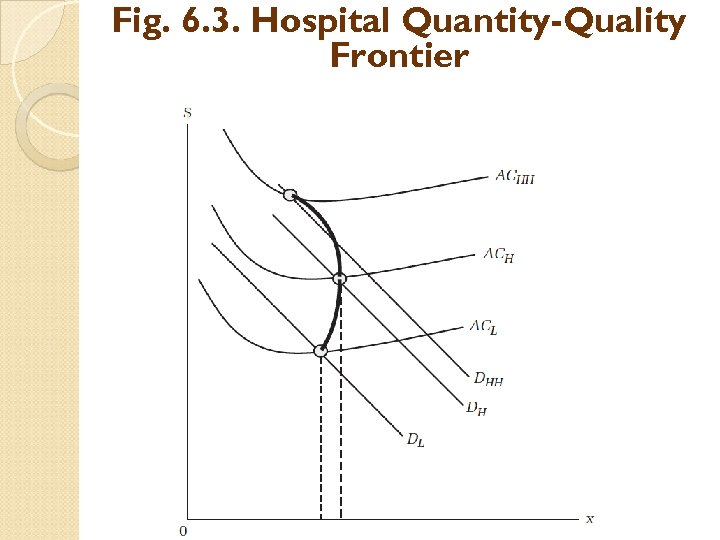

Fig. 6. 3. Hospital Quantity-Quality Frontier

Fig. 6. 3. Hospital Quantity-Quality Frontier

Introduce Hospital Utility Function

Introduce Hospital Utility Function

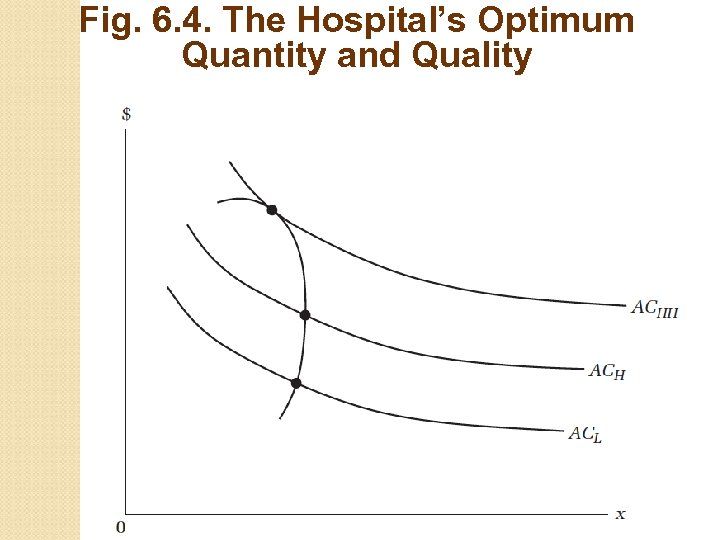

Fig. 6. 4. The Hospital’s Optimum Quantity and Quality

Fig. 6. 4. The Hospital’s Optimum Quantity and Quality

How quality is measured More $=More quality? ? ? Perhaps higher ratio of staff to patients (average daily census) Perhaps more and more technologically sophisticated equipment Sophisticated services, such as open heart surgery program, high level trauma unit, treatment unit for rare cancers, neonatal intensive care unit

How quality is measured More $=More quality? ? ? Perhaps higher ratio of staff to patients (average daily census) Perhaps more and more technologically sophisticated equipment Sophisticated services, such as open heart surgery program, high level trauma unit, treatment unit for rare cancers, neonatal intensive care unit

Other Metrics for Hospital Quality Nurse staffing (to average daily census) Facilities and services offered Hospitals’ credentials (certifications, affiliations) Patient outcomes: mortality rates (at discharge, at 30 days following admission, at 1 year following admission, etc. ) Patient outcomes: rehospitalization rates Patient outcomes: change in functional status, in cognitive status Process of care (chart reviews)

Other Metrics for Hospital Quality Nurse staffing (to average daily census) Facilities and services offered Hospitals’ credentials (certifications, affiliations) Patient outcomes: mortality rates (at discharge, at 30 days following admission, at 1 year following admission, etc. ) Patient outcomes: rehospitalization rates Patient outcomes: change in functional status, in cognitive status Process of care (chart reviews)