Activision Blizzard Onlive.pptx

- Количество слайдов: 30

Hosk&Young Activision Blizzard & Onlive Proposed Merger November 2012 Hosk&Young

Disclaimer The material in this presentation has been prepared by Hosk&Young Financial Advisory and is the analysis of the proposed acquisition of On. Live by Activision Blizzard. The information is given in summary form and does not purport to be complete. Information in this presentation, including forecast and analytical financial information, should not be considered as advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling securities or other financial products or instruments and does not take into account your particular investment objectives, financial situation or needs. Before acting on any information you should consider the appropriateness of the information having regard to these matters, any relevant offer document and in particular, you should seek independent financial advice. All financial products or instrument transactions involve risks, which include (among others) the risk of adverse or unanticipated market, financial or political developments and, in international transactions, currency risk. This presentation may contain forward looking statements including statements regarding estimates of enterprise value, forecasts of potential synergies, recommendations and conclusions on deal commencement. Readers are cautioned not to place undue reliance on these forward looking statements. Hosk&Young does not undertake any obligation to publicly release the result of any revisions to these forward looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events. While due care has been used in the preparation of forecast information, actual results may vary in a materially positive or negative manner. Forecasts and hypothetical examples are subject to uncertainty and contingencies outside Hosk&Young’s control. Hosk&Young

Agenda Video Games Industry Activision Blizzard & Onlive Valuation Deal Risks Hosk&Young

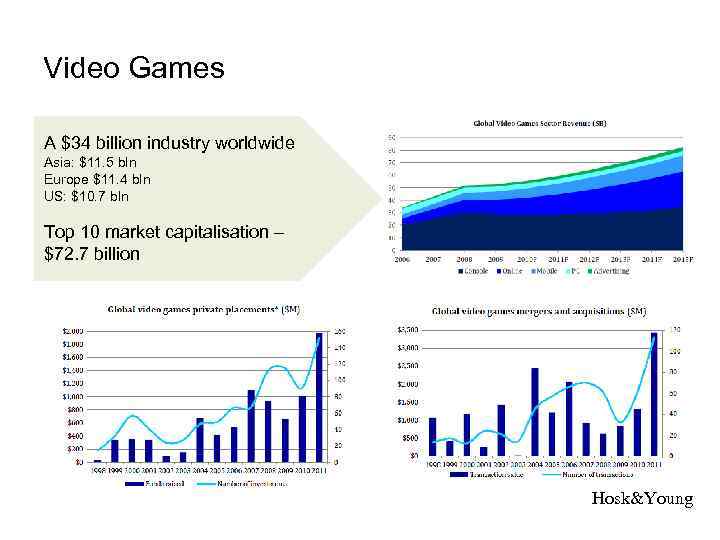

Video Games A $34 billion industry worldwide Asia: $11. 5 bln Europe $11. 4 bln US: $10. 7 bln Top 10 market capitalisation – $72. 7 billion Hosk&Young

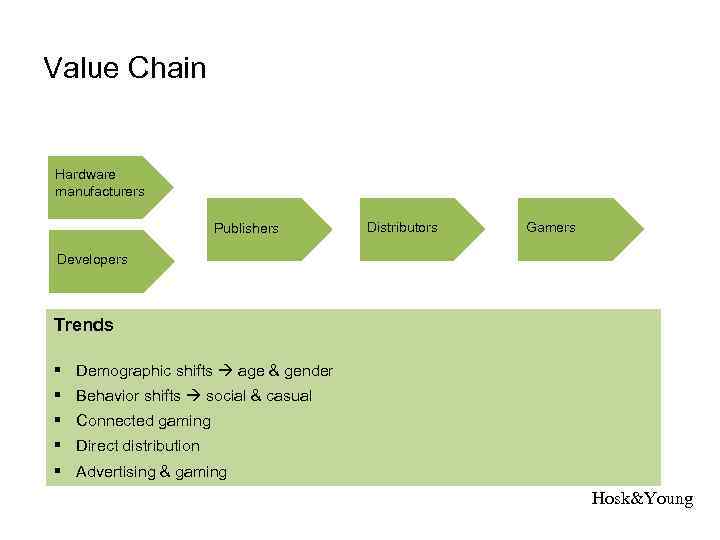

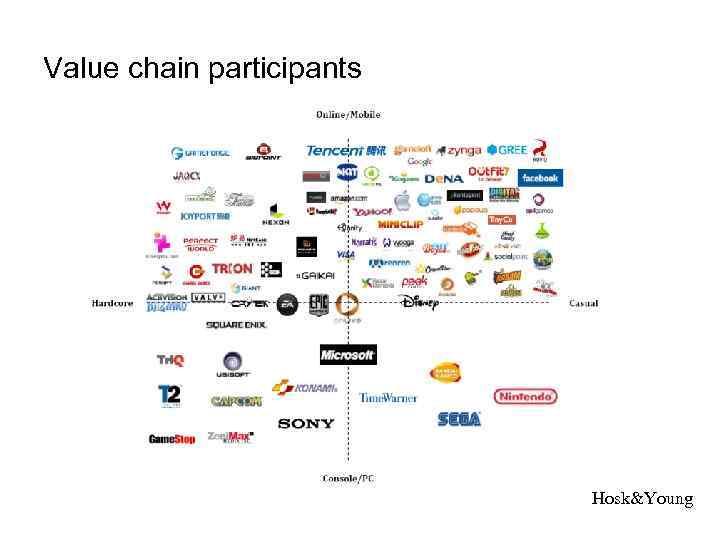

Value Chain Hardware manufacturers Publishers Distributors Gamers Developers Trends § Demographic shifts age & gender § Behavior shifts social & casual § Connected gaming § Direct distribution § Advertising & gaming Hosk&Young

Value chain participants Hosk&Young

Agenda Video Games Industry Activision Blizzard & Onlive Valuation Deal Risks Hosk&Young

Activision Blizzard Profile: in-house Publisher § World’s 2 nd gaming company § The only market publisher with leading positions across all categories § Best selling video game portfolio § Holding company for § Activision (since 1991) § Leading International interactive software developer & publisher § Blizzard Enterntainment (since 1979) § Leading MMORPG developer & publisher § Market share – 18. 6% § Market capitalisation – $12. 6 bln § Revenue 2011 – $4. 75 bln § Headquarters: Santa Monica, California Hosk&Young

On. Live Profile: Middleware § Pioneer of cloud gaming § Play online from social to hardcore games § No hardware § Playpack § Arena § Brags § Social Networking § Over 300 games available § Assassin’s Creed § Deus Ex § Dirt § Over 50 publisher partners § Take Two § Sega § Ubisoft § Epic Games § Atari § THQ § Markets: USA, UK, Belgium § Owners: Lauder Partners VC § Founded 2003 § Headquarters: Palo Alto, California Hosk&Young

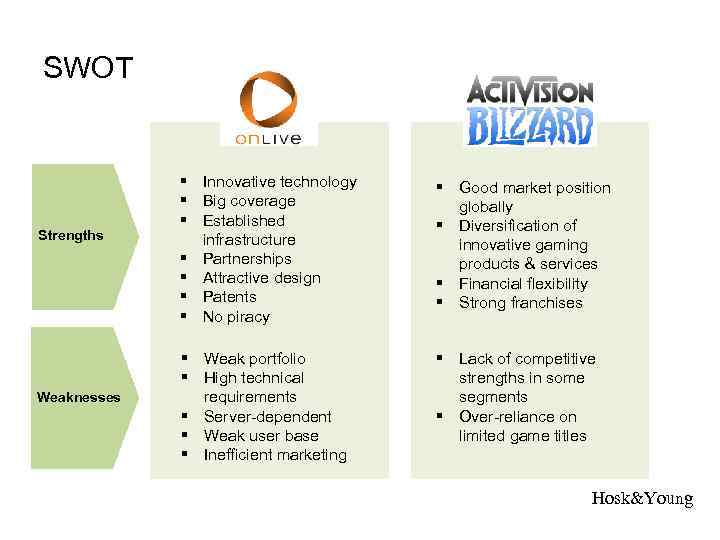

SWOT Strengths Weaknesses § Innovative technology § Big coverage § Established infrastructure § Partnerships § Attractive design § Patents § No piracy § Good market position globally § Diversification of innovative gaming products & services § Financial flexibility § Strong franchises § Weak portfolio § High technical requirements § Server-dependent § Weak user base § Inefficient marketing § Lack of competitive strengths in some segments § Over-reliance on limited game titles Hosk&Young

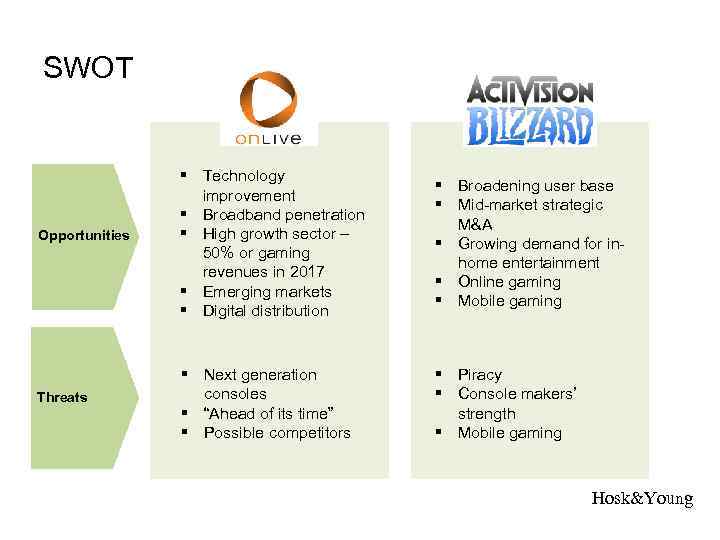

SWOT Opportunities Threats § Technology improvement § Broadband penetration § High growth sector – 50% or gaming revenues in 2017 § Emerging markets § Digital distribution § Broadening user base § Mid-market strategic M&A § Growing demand for inhome entertainment § Online gaming § Mobile gaming § Next generation consoles § “Ahead of its time” § Possible competitors § Piracy § Console makers’ strength § Mobile gaming Hosk&Young

Agenda Video Games Industry Activision Blizzard & Onlive Valuation Deal Risks Hosk&Young

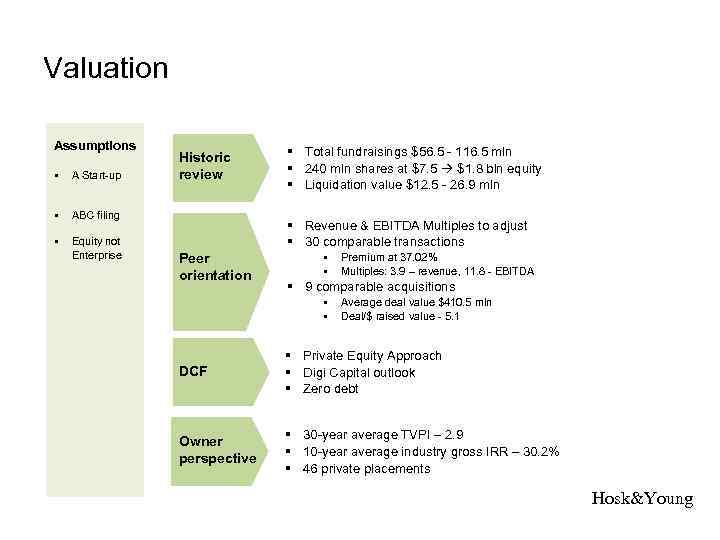

Valuation Assumptions § A Start-up § ABC filing § Equity not Enterprise Historic review § Total fundraisings $56. 5 - 116. 5 mln § 240 mln shares at $7. 5 $1. 8 bln equity § Liquidation value $12. 5 - 26. 9 mln § Revenue & EBITDA Multiples to adjust § 30 comparable transactions Peer orientation § § Premium at 37. 02% Multiples: 3. 9 – revenue, 11. 8 - EBITDA § 9 comparable acquisitions § § Average deal value $410. 5 mln Deal/$ raised value - 5. 1 DCF § Private Equity Approach § Digi Capital outlook § Zero debt Owner perspective § 30 -year average TVPI – 2. 9 § 10 -year average industry gross IRR – 30. 2% § 46 private placements Hosk&Young

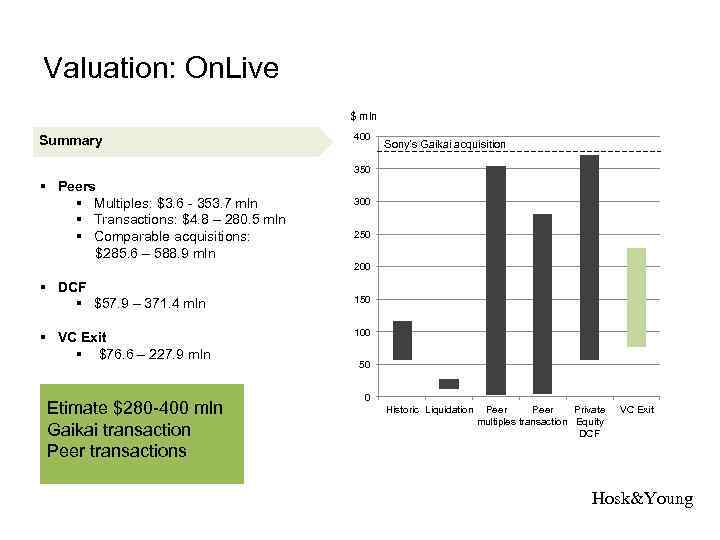

Valuation: On. Live $ mln Summary 400 Sony’s Gaikai acquisition 350 § Peers § Multiples: $3. 6 - 353. 7 mln § Transactions: $4. 8 – 280. 5 mln § Comparable acquisitions: $285. 6 – 588. 9 mln 300 250 200 § DCF § $57. 9 – 371. 4 mln § VC Exit § $76. 6 – 227. 9 mln Etimate $280 -400 mln Gaikai transaction Peer transactions 150 100 50 0 Historic Liquidation Peer Private multiples transaction Equity DCF VC Exit Hosk&Young

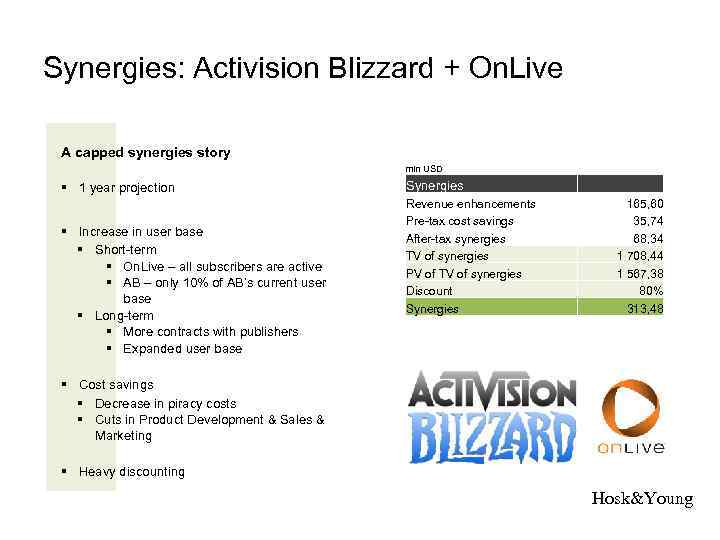

Synergies: Activision Blizzard + On. Live A capped synergies story mln USD § 1 year projection § Increase in user base § Short-term § On. Live – all subscribers are active § AB – only 10% of AB’s current user base § Long-term § More contracts with publishers § Expanded user base Synergies Revenue enhancements Pre-tax cost savings After-tax synergies TV of synergies PV of TV of synergies Discount Synergies 165, 60 35, 74 68, 34 1 708, 44 1 567, 38 80% 313, 48 § Cost savings § Decrease in piracy costs § Cuts in Product Development & Sales & Marketing § Heavy discounting Hosk&Young

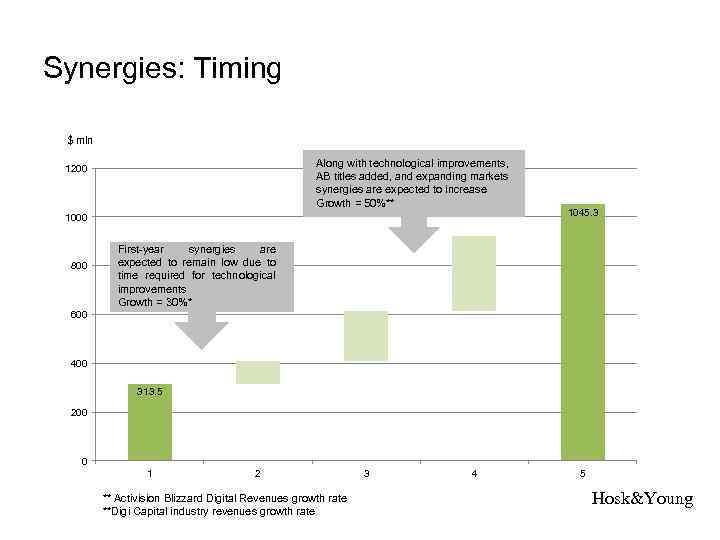

Synergies: Timing $ mln Along with technological improvements, AB titles added, and expanding markets synergies are expected to increase Growth = 50%** 1200 1000 800 1045. 3 First-year synergies are expected to remain low due to time required for technological improvements Growth = 30%* 600 400 313. 5 200 0 1 2 ** Activision Blizzard Digital Revenues growth rate **Digi Capital industry revenues growth rate 3 4 5 Hosk&Young

Agenda Video Games Industry Activision Blizzard & Onlive Valuation Deal Risks Hosk&Young

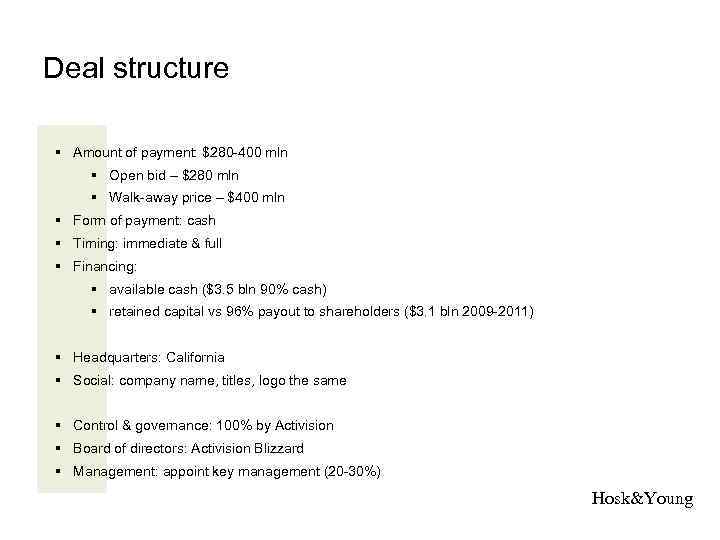

Deal structure § Amount of payment: $280 -400 mln § Open bid – $280 mln § Walk-away price – $400 mln § Form of payment: cash § Timing: immediate & full § Financing: § available cash ($3. 5 bln 90% cash) § retained capital vs 96% payout to shareholders ($3. 1 bln 2009 -2011) § Headquarters: California § Social: company name, titles, logo the same § Control & governance: 100% by Activision § Board of directors: Activision Blizzard § Management: appoint key management (20 -30%) Hosk&Young

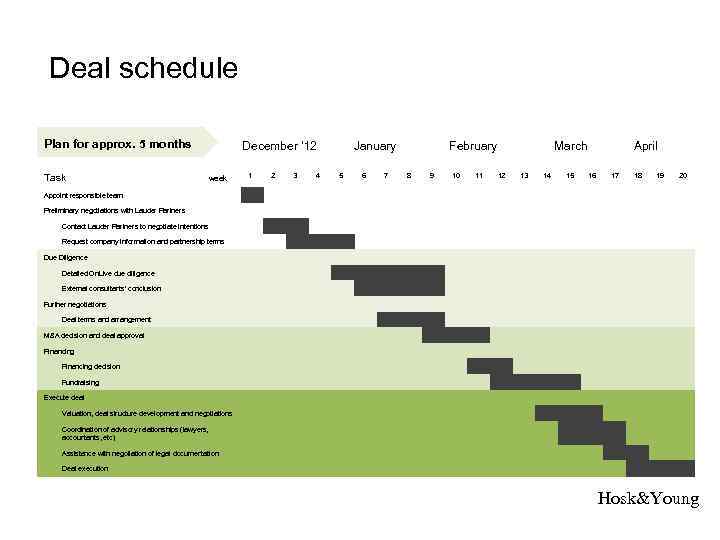

Deal schedule Plan for approx. 5 months Task week December ’ 12 January February March April 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Appoint responsible team Preliminary negotiations with Lauder Partners Contact Lauder Partners to negotiate intentions Request company information and partnership terms Due Diligence Detailed On. Live due diligence External consultants' conclusion Further negotiations Deal terms and arrangement M&A decision and deal approval Financing decision Fundraising Execute deal Valuation, deal structure development and negotiations Coordination of advisory relationships (lawyers, accountants, etc) Assistance with negotiation of legal documentation Deal execution Hosk&Young

Agenda Video Games Industry Activision Blizzard & Onlive Valuation Deal Risks Hosk&Young

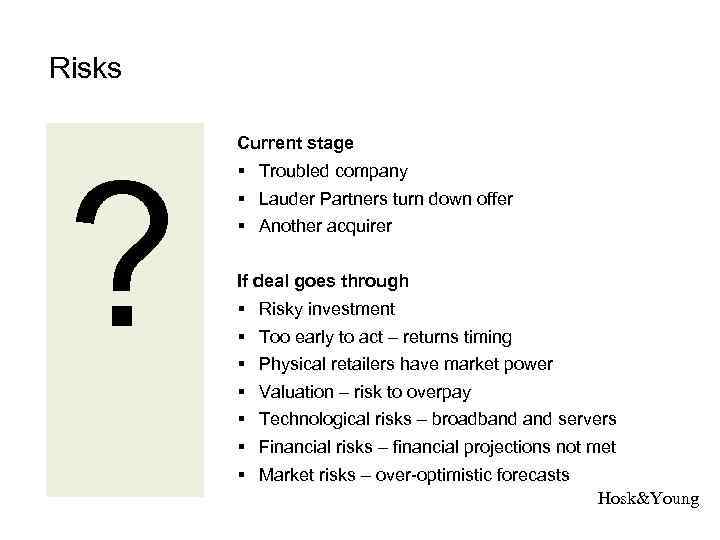

Risks ? Current stage § Troubled company § Lauder Partners turn down offer § Another acquirer If deal goes through § § § § Risky investment Too early to act – returns timing Physical retailers have market power Valuation – risk to overpay Technological risks – broadband servers Financial risks – financial projections not met Market risks – over-optimistic forecasts Hosk&Young

Appendix Hosk&Young

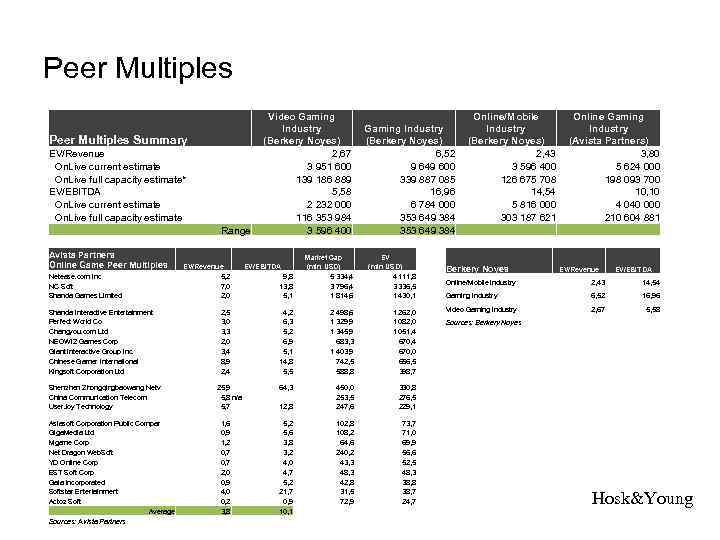

Peer Multiples Summary EV/Revenue On. Live current estimate On. Live full capacity estimate* EV/EBITDA On. Live current estimate On. Live full capacity estimate Range Avista Partners Online Game Peer Multiples Netease. com Inc NC Soft Shanda Games Limited Shanda Interactive Entertainment Perfect World Co Changyou. com Ltd NEOWIZ Games Corp Giant Interactive Group Inc. Chinese Gamer International Kingsoft Corporation Ltd Shenzhen Zhongqingbaowang Netv China Communication Telecom User. Joy Technology Asiasoft Corporation Public Compar Giga. Media Ltd Mgame Corp Net Dragon Web. Soft YD Online Corp EST Soft Corp Gala Incorporated Softstar Entertainment Actoz Soft Average Sources: Avista Partners EV/Revenue 5, 2 7, 0 2, 0 Video Gaming Industry (Berkery Noyes) 2, 67 3 951 600 139 186 889 5, 58 2 232 000 116 353 984 3 596 400 EV/EBITDA 9, 8 13, 8 5, 1 2, 5 3, 0 3, 3 2, 0 3, 4 8, 9 2, 4 Online/Mobile Online Gaming Industry (Berkery Noyes) (Avista Partners) 6, 52 2, 43 3, 80 9 649 600 3 596 400 5 624 000 339 887 085 126 675 708 198 093 700 16, 96 14, 54 10, 10 6 784 000 5 816 000 4 040 000 353 649 384 303 187 621 210 604 881 353 649 384 Market Cap (mln USD) 5 334, 4 3 796, 4 1 814, 6 EV (mln USD) 4 111, 8 3 336, 5 1 430, 1 4, 2 6, 3 5, 2 6, 9 5, 1 14, 8 5, 5 25, 9 5, 8 n/a 5, 7 1, 6 0, 9 1, 2 0, 7 2, 0 0, 9 4, 0 0, 2 3, 8 2 498, 6 1 329, 9 1 345, 9 683, 3 1 403, 9 742, 5 588, 8 1 262, 0 1 082, 0 1 051, 4 670, 0 656, 5 398, 7 64, 3 450, 0 253, 5 247, 6 73, 7 71, 0 69, 9 56, 6 52, 5 48, 3 38, 8 38, 7 24, 7 EV/Revenue EV/EBITDA Online/Mobile Industry 2, 43 14, 54 Gaming Industry 6, 52 16, 96 Video Gaming Industry 2, 67 5, 58 330, 8 276, 5 229, 1 102, 8 108, 2 64, 6 240, 2 43, 3 48, 3 42, 8 31, 5 72, 9 Berkery Noyes 12, 8 5, 2 5, 6 3, 8 3, 2 4, 0 4, 7 5, 2 21, 7 0, 9 10, 1 Sources: Berkery Noyes Hosk&Young

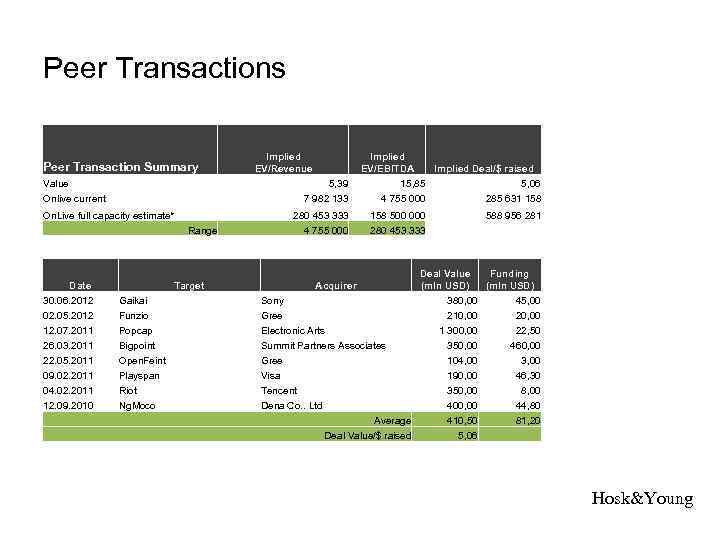

Peer Transactions Peer Transaction Summary Value Onlive current 5, 39 7 982 133 On. Live full capacity estimate* Range Date 30. 06. 2012 02. 05. 2012 12. 07. 2011 26. 03. 2011 22. 05. 2011 09. 02. 2011 04. 02. 2011 12. 09. 2010 Implied EV/Revenue Target Gaikai Funzio Popcap Bigpoint Open. Feint Playspan Riot Ng. Moco 280 453 333 4 755 000 Implied EV/EBITDA Implied Deal/$ raised 15, 85 5, 06 4 755 000 285 631 158 500 000 280 453 333 588 956 281 Deal Value Funding (mln USD) Sony 380, 00 45, 00 Gree 210, 00 20, 00 Electronic Arts 1 300, 00 22, 50 Summit Partners Associates 350, 00 460, 00 Gree 104, 00 3, 00 Visa 190, 00 46, 30 Tencent 350, 00 8, 00 Dena Co. . Ltd 400, 00 44, 80 Average 410, 50 81, 20 Deal Value/$ raised 5, 06 Acquirer Hosk&Young

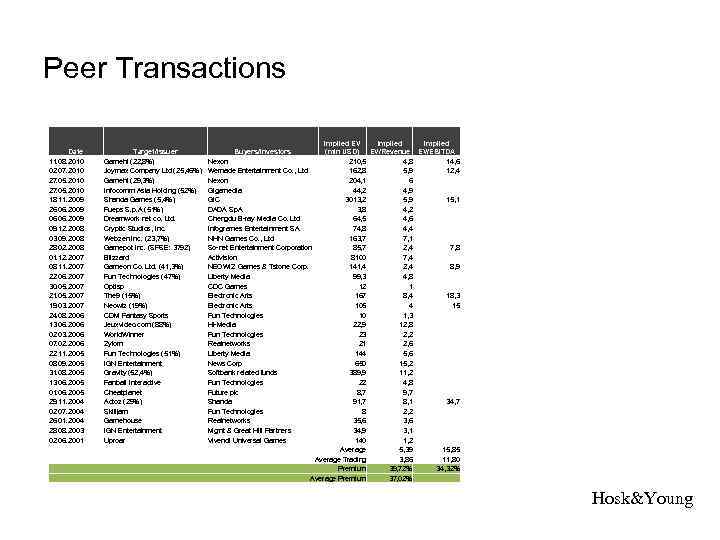

Peer Transactions Date 11. 08. 2010 02. 07. 2010 27. 05. 2010 18. 11. 2009 26. 06. 2009 09. 12. 2008 03. 09. 2008 28. 02. 2008 01. 12. 2007 08. 11. 2007 22. 06. 2007 30. 05. 2007 21. 05. 2007 19. 03. 2007 24. 08. 2006 13. 06. 2006 02. 03. 2006 07. 02. 2006 22. 11. 2005 08. 09. 2005 31. 08. 2005 13. 06. 2005 01. 06. 2005 29. 11. 2004 02. 07. 2004 26. 01. 2004 28. 08. 2003 02. 06. 2001 Target/Issuer Gamehi (22, 8%) Joymax Company Ltd (25, 46%) Gamehi (29, 3%) Infocomm Asia Holding (52%) Shanda Games (5, 4%) Fueps S. p. A (51%) Dreamwork net co. Ltd. Cryptic Studios, Inc. Webzen Inc. (23, 7%) Gamepot Inc. (SPSE: 3792) Blizzard Gameon Co. Ltd. (41, 3%) Fun Technologies (47%) Optisp The 9 (15%) Neowiz (19%) CDM Fantasy Sports Jeuxvideo. com (88%) World. Winner Zylom Fun Technologies (51%) IGN Entertainment Gravity (52, 4%) Fanball Interactive Cheatplanet Actoz (29%) Skilljam Gamehouse IGN Entertainment Uproar Implied EV Implied (mln USD) EV/Revenue EV/EBITDA Nexon 210, 5 4, 8 14, 6 Wemade Entertainment Co. , Ltd 162, 8 5, 9 12, 4 Nexon 204, 1 6 Gigamedia 44, 2 4, 9 GIC 3013, 2 5, 9 15, 1 DADA Sp. A 3, 8 4, 2 Chengdu B-ray Media Co. Ltd 64, 5 4, 6 Infogrames Entertainment SA 74, 8 4, 4 NHN Games Co. , Ltd 163, 7 7, 1 So-net Entertainment Corporation 85, 7 2, 4 7, 8 Activision 8100 7, 4 NEOWIZ Games & Tstone Corp. 141, 4 2, 4 8, 9 Liberty Media 99, 3 4, 8 CDC Games 12 1 Electronic Arts 167 8, 4 18, 3 Electronic Arts 105 4 15 Fun Technologies 10 1, 3 Hi-Media 22, 9 12, 8 Fun Technologies 23 2, 2 Realnetworks 21 2, 6 Liberty Media 144 5, 6 News Corp 650 15, 2 Softbank related funds 389, 9 11, 2 Fun Technologies 22 4, 8 Future plc 8, 7 9, 7 Shanda 91, 7 8, 1 34, 7 Fun Technologies 8 2, 2 Realnetworks 35, 6 3, 6 Mgmt & Great Hill Partners 34, 9 3, 1 Vivendi Universal Games 140 1, 2 Average 5, 39 15, 85 Average Trading 3, 86 11, 80 Premium 39, 72% 34, 32% Average Premium 37, 02% Buyers/Investors Hosk&Young

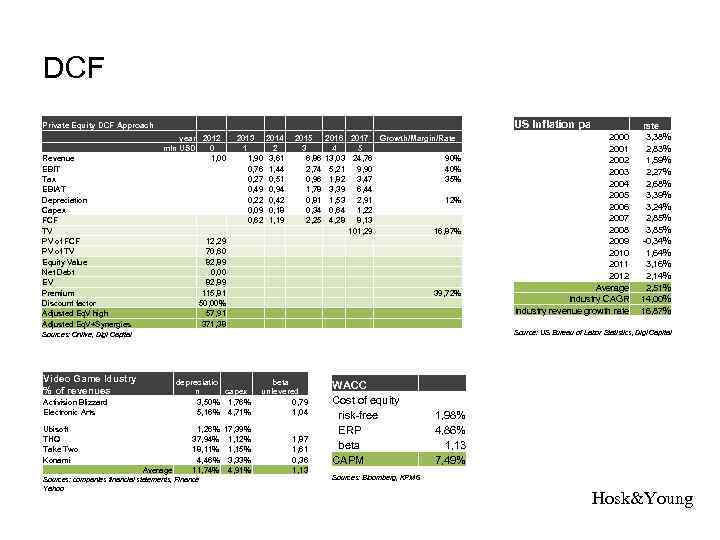

DCF Private Equity DCF Approach Revenue EBIT Tax EBIAT Depreciation Capex FCF TV PV of FCF PV of TV Equity Value Net Debt EV Premium Discount factor Adjusted Eq. V high Adjusted Eq. V+Synergies Sources: Onlive, Digi Capital US Inflation pa year 2012 2013 2014 2015 2016 2017 Growth/Margin/Rate mln USD 0 1 2 3 4 5 1, 00 1, 90 3, 61 6, 86 13, 03 24, 76 90% 0, 76 1, 44 2, 74 5, 21 9, 90 40% 0, 27 0, 51 0, 96 1, 82 3, 47 35% 0, 49 0, 94 1, 78 3, 39 6, 44 0, 22 0, 42 0, 81 1, 53 2, 91 12% 0, 09 0, 18 0, 34 0, 64 1, 22 0, 62 1, 19 2, 25 4, 28 8, 13 101, 29 16, 87% 12, 29 70, 60 82, 89 0, 00 82, 89 115, 81 39, 72% 50, 00% 57, 91 371, 38 Video Game Idustry % of revenues depreciatio n capex 3, 50% 1, 76% 5, 16% 4, 71% Activision Blizzard Electronic Arts Ubisoft THQ Take Two Konami Average beta unlevered 0, 79 1, 04 1, 26% 17, 39% 37, 94% 1, 12% 18, 11% 1, 15% 4, 46% 3, 33% 11, 74% 4, 91% Sources: companies financial statements, Finance Yahoo 1, 87 1, 61 0, 36 1, 13 WACC Cost of equity risk-free ERP beta CAPM 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Average Industry CAGR Industry revenue growth rate 3, 38% 2, 83% 1, 59% 2, 27% 2, 68% 3, 39% 3, 24% 2, 85% 3, 85% -0, 34% 1, 64% 3, 16% 2, 14% 2, 51% 14, 00% 16, 87% Source: US Bureau of Labor Statistics, Digi Capital 1, 98% 4, 86% 1, 13 7, 49% Sources: Bloomberg, KPMG Hosk&Young

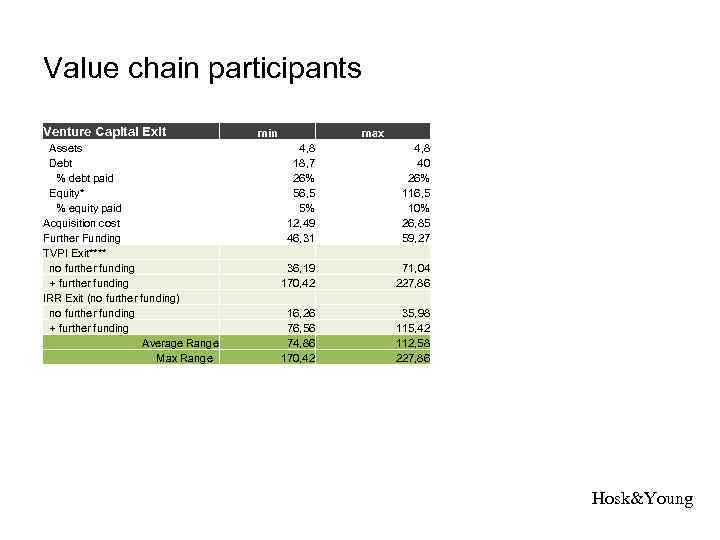

Value chain participants Venture Capital Exit Assets Debt % debt paid Equity* % equity paid Acquisition cost Further Funding TVPI Exit**** no further funding + further funding IRR Exit (no further funding) no further funding + further funding Average Range Max Range min max 4, 8 18, 7 26% 56, 5 5% 12, 49 46, 31 4, 8 40 26% 116, 5 10% 26, 85 59, 27 36, 19 170, 42 71, 04 227, 86 16, 26 76, 56 74, 86 170, 42 35, 98 115, 42 112, 58 227, 86 Hosk&Young

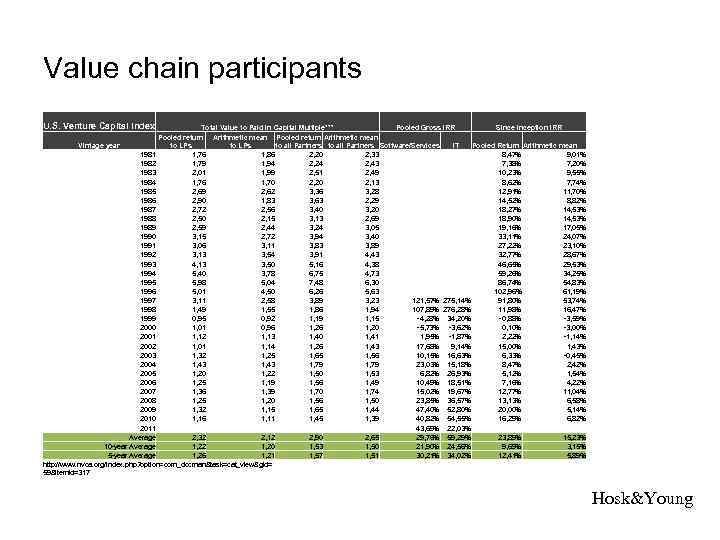

Value chain participants U. S. Venture Capital Index Total Value to Paid In Capital Multiple*** Pooled Gross IRR Since Inception IRR Pooled return Arithmetic mean Vintage year to LPs to all Partners Software/Services IT Pooled Return Arithmetic mean 1981 1, 76 1, 86 2, 20 2, 33 8, 47% 9, 01% 1982 1, 79 1, 94 2, 24 2, 43 7, 38% 7, 20% 1983 2, 01 1, 99 2, 51 2, 49 10, 23% 9, 55% 1984 1, 76 1, 70 2, 20 2, 13 8, 62% 7, 74% 1985 2, 69 2, 62 3, 36 3, 28 12, 91% 11, 70% 1986 2, 90 1, 83 3, 63 2, 29 14, 52% 8, 82% 1987 2, 72 2, 56 3, 40 3, 20 18, 27% 14, 53% 1988 2, 50 2, 15 3, 13 2, 69 18, 90% 14, 53% 1989 2, 59 2, 44 3, 24 3, 05 19, 16% 17, 05% 1990 3, 15 2, 72 3, 94 3, 40 33, 11% 24, 07% 1991 3, 06 3, 11 3, 83 3, 89 27, 22% 23, 10% 1992 3, 13 3, 54 3, 91 4, 43 32, 77% 28, 67% 1993 4, 13 3, 50 5, 16 4, 38 46, 65% 29, 53% 1994 5, 40 3, 78 6, 75 4, 73 59, 26% 34, 25% 1995 5, 98 5, 04 7, 48 6, 30 86, 74% 54, 83% 1996 5, 01 4, 50 6, 26 5, 63 102, 96% 61, 19% 1997 3, 11 2, 58 3, 89 3, 23 121, 57% 275, 14% 91, 80% 53, 74% 1998 1, 49 1, 55 1, 86 1, 94 107, 89% 276, 28% 11, 98% 16, 47% 1999 0, 95 0, 92 1, 19 1, 15 -4, 28% 34, 20% -0, 88% -3, 59% 2000 1, 01 0, 96 1, 20 -5, 73% -3, 62% 0, 10% -3, 00% 2001 1, 12 1, 13 1, 40 1, 41 1, 95% -1, 87% 2, 22% -1, 14% 2002 1, 01 1, 14 1, 26 1, 43 17, 68% 9, 14% 15, 00% 1, 43% 2003 1, 32 1, 25 1, 65 1, 56 10, 15% 16, 63% 6, 33% -0, 45% 2004 1, 43 1, 79 23, 03% 15, 18% 8, 47% 2, 42% 2005 1, 20 1, 22 1, 50 1, 53 6, 82% 26, 93% 5, 12% 1, 54% 2006 1, 25 1, 19 1, 56 1, 49 10, 49% 18, 51% 7, 16% 4, 22% 2007 1, 36 1, 39 1, 70 1, 74 15, 02% 19, 67% 12, 77% 11, 04% 2008 1, 25 1, 20 1, 56 1, 50 23, 85% 36, 57% 13, 13% 6, 58% 2009 1, 32 1, 15 1, 65 1, 44 47, 40% 52, 80% 20, 00% 5, 14% 2010 1, 16 1, 11 1, 45 1, 39 40, 82% 54, 55% 16, 29% 6, 82% 2011 43, 69% 22, 03% Average 2, 32 2, 12 2, 90 2, 65 29, 76% 59, 29% 23, 89% 15, 23% 10 -year Average 1, 22 1, 20 1, 53 1, 50 21, 90% 24, 56% 9, 69% 3, 15% 5 -year Average 1, 26 1, 21 1, 57 1, 51 30, 21% 34, 02% 12, 41% 5, 89% http: //www. nvca. org/index. php? option=com_docman&task=cat_view&gid= 59&Itemid=317 Hosk&Young

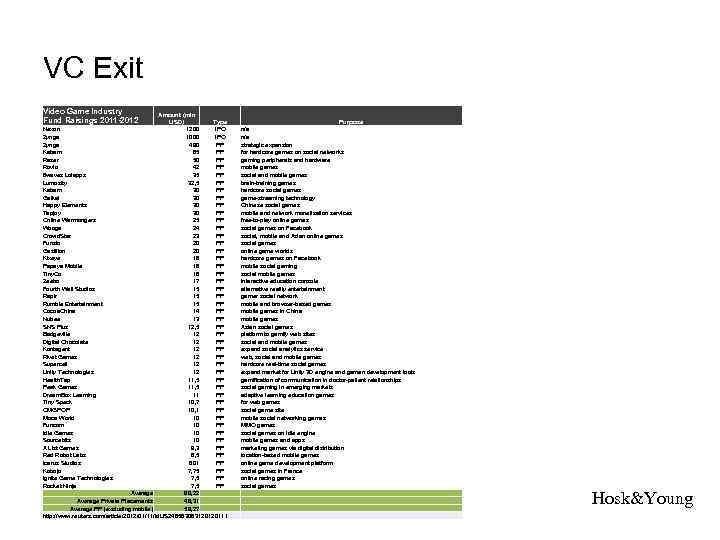

VC Exit Video Game Industry Fund Raisings 2011 -2012 Amount (mln USD) Type 1200 IPO 1000 IPO 490 PP 85 PP 50 PP 42 PP 35 PP 32, 5 PP 30 PP 25 PP 24 PP 23 PP 20 PP 18 PP 17 PP 15 PP 14 PP 13 PP 12, 5 PP 12 PP 12 PP 11, 5 PP 11 PP 10, 7 PP 10, 1 PP 10 PP 9, 3 PP 8, 5 PP 801 PP 7, 75 PP 7, 5 PP Average 90, 22 Average Private Placements 46, 31 Average PP (excluding mobile) 59, 27 http: //www. reuters. com/article/2012/01/11/id. US 246583083120120111 Nexon Zynga Kabam Razer Rovio 6 waves Lolapps Lumosity Kabam Gaikai Happy Elements Tapjoy Online Warmongers Wooga Crowd. Star Funzio Gazillion Kixeye Papaya Mobile Tiny. Co Zeebo Fourth Wall Studios Raptr Rumble Entertainment Cocoa. China Nubee SNS Plus Badgeville Digital Chocolate Kontagent Rivet Games Supercell Unity Technologies Health. Tap Peak Games Dream. Box Learning Tiny Speck OMGPOP Moca World Funcom Idle Games Sourcebits A List Games Red Robot Labs Icarus Studios Kobojo Ignite Game Technologies Rocket Ninja Purpose n/a strategic expansion for hardcore games on social networks gaming peripherals and hardware mobile games social and mobile games brain-training games hardcore social games game-streaming technology Chinese social games mobile and network monetization services free-to-play online games social games on Facebook social, mobile and Asian online games social games online game worlds hardcore games on Facebook mobile social gaming social mobile games interactive education console alternative reality entertainment gamer social network mobile and browser-based games mobile games in China mobile games Asian social games platform to gamify web sites social and mobile games expand social analytics service web, social and mobile games hardcore real-time social games expand market for Unity 3 D engine and gamen development tools gamification of communication in doctor-patient relationships social gaming in emerging markets adaptive learning education games for web games social game site mobile social networking games MMO games social games on Idle engine mobile games and apps marketing games via digital distribution location-based mobile games online game development platform social games in France online racing games social games Hosk&Young

Hosk&Young Financial Advisors 134 Dostyk Ave. , Almaty

Activision Blizzard Onlive.pptx