989a6690c35465cf45a5277ec6e59cae.ppt

- Количество слайдов: 45

Home. Works - Money Management Financial Planning Taxes Home Equity and Mortgage Refinancing Home Insurance

Home. Works - Money Management Financial Planning Taxes Home Equity and Mortgage Refinancing Home Insurance

Home. Works - Money Management Financial Planning

Home. Works - Money Management Financial Planning

Financial Responsibility § Keys to success l l communication compromise commitment § Plan ahead § Use credit wisely Home l Works Financial Planning

Financial Responsibility § Keys to success l l communication compromise commitment § Plan ahead § Use credit wisely Home l Works Financial Planning

Monthly spending plan § Track spending § Balance Expenses Home Income Works Financial Planning

Monthly spending plan § Track spending § Balance Expenses Home Income Works Financial Planning

Behind in paying the bills? § Adjust spending plan _____ Income _____ Expenses § Use emergency fund Home l Works Financial Planning

Behind in paying the bills? § Adjust spending plan _____ Income _____ Expenses § Use emergency fund Home l Works Financial Planning

Behind in paying the bills? § Contact creditors before you miss a payment l make an offer l put it in writing l keep your promise l stop using credit Home l Works Financial Planning

Behind in paying the bills? § Contact creditors before you miss a payment l make an offer l put it in writing l keep your promise l stop using credit Home l Works Financial Planning

Emergency funds Surprise expenses § Advantages l l Direct deposit Use unexpected $ Get extra job Use payments Home § But how? Works Financial Planning

Emergency funds Surprise expenses § Advantages l l Direct deposit Use unexpected $ Get extra job Use payments Home § But how? Works Financial Planning

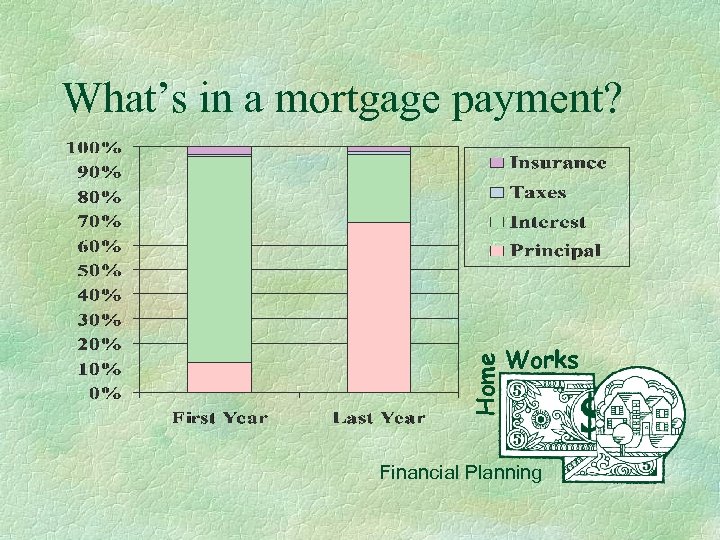

Home What’s in a mortgage payment? Works Financial Planning

Home What’s in a mortgage payment? Works Financial Planning

Private mortgage insurance § Required by lenders when the buyer makes a down payment of <20% § Paid l l at closing and added to mortgage as part of monthly payment Works annually Home l Financial Planning

Private mortgage insurance § Required by lenders when the buyer makes a down payment of <20% § Paid l l at closing and added to mortgage as part of monthly payment Works annually Home l Financial Planning

Private mortgage insurance l l method of payment mortgage term APR amount of down payment § Stop when equity 20% reaches ____ Home § Cost depends on Works Financial Planning

Private mortgage insurance l l method of payment mortgage term APR amount of down payment § Stop when equity 20% reaches ____ Home § Cost depends on Works Financial Planning

Escrow accounts l l payments too _____ sudden increases late payments Home § Money for taxes and insurance § Total divided by 12 = monthly payment § Problems Works Financial Planning

Escrow accounts l l payments too _____ sudden increases late payments Home § Money for taxes and insurance § Total divided by 12 = monthly payment § Problems Works Financial Planning

Selling your home § Most keep 1 st house 6 years § Decisions affecting the sale Loans l Home improvements l Regulations § Keep records Home l Works Financial Planning

Selling your home § Most keep 1 st house 6 years § Decisions affecting the sale Loans l Home improvements l Regulations § Keep records Home l Works Financial Planning

Home. Works - Money Management Home Equity and Mortgage Refinancing

Home. Works - Money Management Home Equity and Mortgage Refinancing

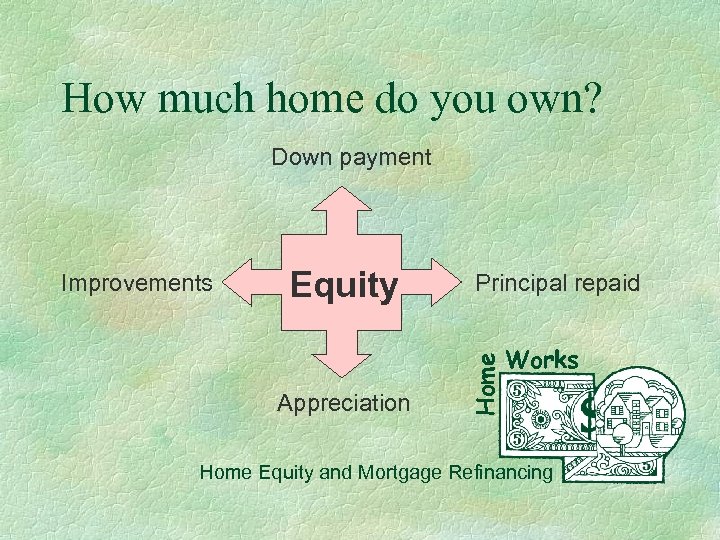

How much home do you own? Down payment Equity Appreciation Principal repaid Home Improvements Works Home Equity and Mortgage Refinancing

How much home do you own? Down payment Equity Appreciation Principal repaid Home Improvements Works Home Equity and Mortgage Refinancing

Equity is Home Works Home Equity and Mortgage Refinancing

Equity is Home Works Home Equity and Mortgage Refinancing

Equity = Home Cash value Works Home Equity and Mortgage Refinancing

Equity = Home Cash value Works Home Equity and Mortgage Refinancing

Home After-Purchase Mortgage Options Works Home Equity and Mortgage Refinancing

Home After-Purchase Mortgage Options Works Home Equity and Mortgage Refinancing

mequt. htm § § § A line of credit Low interest rate? Tax-deductible interest Home is collateral Fees Home equity loans Works Home Equity and Mortgage Refinancing

mequt. htm § § § A line of credit Low interest rate? Tax-deductible interest Home is collateral Fees Home equity loans Works Home Equity and Mortgage Refinancing

The reverse mortgage de Commission at: § § § A type of home equity ______ loan Trade equity for cash 62+ years old Income is not a factor Home ownership retained Home . htm Works Home Equity and Mortgage Refinancing

The reverse mortgage de Commission at: § § § A type of home equity ______ loan Trade equity for cash 62+ years old Income is not a factor Home ownership retained Home . htm Works Home Equity and Mortgage Refinancing

The reverse mortgage Closing costs and fees Public benefits? Maintenance, taxes and insurance Home at risk Home § § Works Home Equity and Mortgage Refinancing

The reverse mortgage Closing costs and fees Public benefits? Maintenance, taxes and insurance Home at risk Home § § Works Home Equity and Mortgage Refinancing

Refinancing your mortgage § Should you? Commission at: ubs/homes/refinanc. htm § It depends l Tax bracket Home ation at l Costs nfo/refinance. html long you plan to stay l How Works Home Equity and Mortgage Refinancing

Refinancing your mortgage § Should you? Commission at: ubs/homes/refinanc. htm § It depends l Tax bracket Home ation at l Costs nfo/refinance. html long you plan to stay l How Works Home Equity and Mortgage Refinancing

Refinancing your mortgage § Consider another type § Shop and compare l Interest and fees Compare APR Home l Works Home Equity and Mortgage Refinancing

Refinancing your mortgage § Consider another type § Shop and compare l Interest and fees Compare APR Home l Works Home Equity and Mortgage Refinancing

Home. Works - Money Management Taxes

Home. Works - Money Management Taxes

Property taxes § Local officials determine l l l revenue required market value of taxable property assessment level tax rate Home l Works Taxes

Property taxes § Local officials determine l l l revenue required market value of taxable property assessment level tax rate Home l Works Taxes

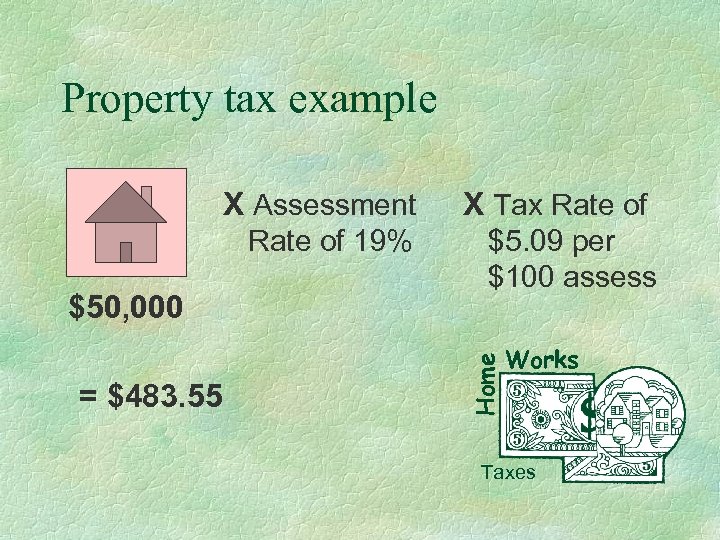

Property tax example Rate of 19% $50, 000 = $483. 55 X Tax Rate of $5. 09 per $100 assess Home X Assessment Works Taxes

Property tax example Rate of 19% $50, 000 = $483. 55 X Tax Rate of $5. 09 per $100 assess Home X Assessment Works Taxes

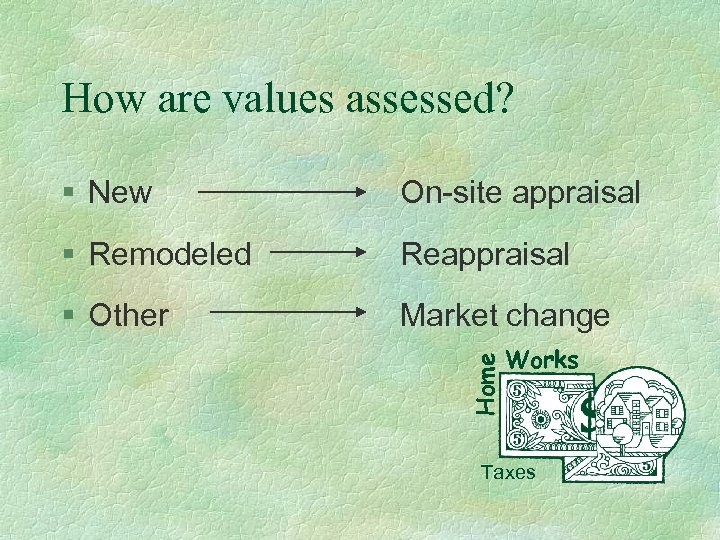

How are values assessed? On-site appraisal § Remodeled Reappraisal § Other Market change Home § New Works Taxes

How are values assessed? On-site appraisal § Remodeled Reappraisal § Other Market change Home § New Works Taxes

Other info on property taxes § Appeal § Pay through escrow or directly § If you don’t pay l interest and fees can be high house will be seized Works Home l Taxes

Other info on property taxes § Appeal § Pay through escrow or directly § If you don’t pay l interest and fees can be high house will be seized Works Home l Taxes

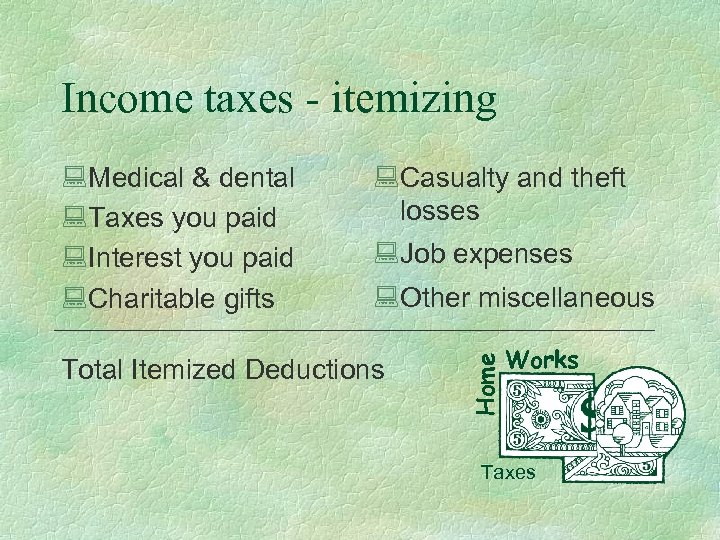

Income taxes - itemizing : Casualty and theft losses : Job expenses : Other miscellaneous Total Itemized Deductions Home : Medical & dental : Taxes you paid : Interest you paid : Charitable gifts Works Taxes

Income taxes - itemizing : Casualty and theft losses : Job expenses : Other miscellaneous Total Itemized Deductions Home : Medical & dental : Taxes you paid : Interest you paid : Charitable gifts Works Taxes

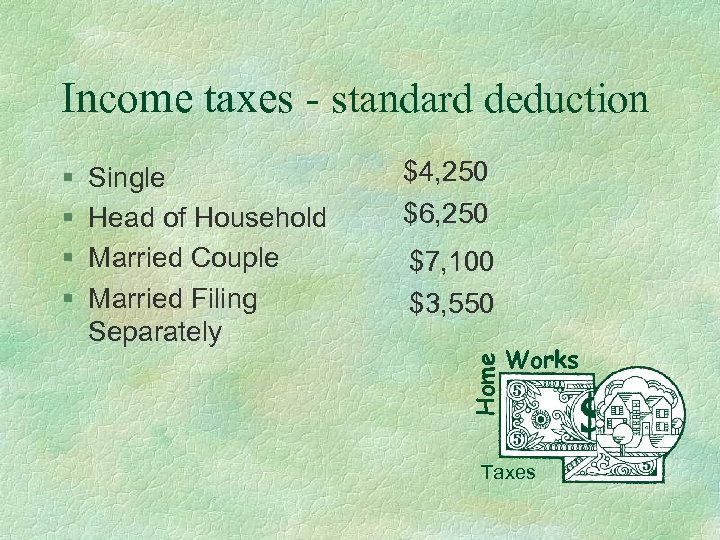

Income taxes - standard deduction Single Head of Household Married Couple Married Filing Separately $4, 250 $6, 250 $7, 100 $3, 550 Home § § Works Taxes

Income taxes - standard deduction Single Head of Household Married Couple Married Filing Separately $4, 250 $6, 250 $7, 100 $3, 550 Home § § Works Taxes

Home. Works - Money Management Home Insurance

Home. Works - Money Management Home Insurance

The Step Check-Up § Investigate your current coverage § Determine what you have to lose § Take steps to lower cost § Comparison shop Home § Compare coverage to potential loss Works Home Insurance

The Step Check-Up § Investigate your current coverage § Determine what you have to lose § Take steps to lower cost § Comparison shop Home § Compare coverage to potential loss Works Home Insurance

Investigate current coverage Review your present policy to determine: Kind of coverage l Limits Home l Works Home Insurance

Investigate current coverage Review your present policy to determine: Kind of coverage l Limits Home l Works Home Insurance

Property coverage § Two Kinds: Structure l Personal Property Home l Works Home Insurance

Property coverage § Two Kinds: Structure l Personal Property Home l Works Home Insurance

The structure § Perils § The 80% rule Home § Living expenses? Works Home Insurance

The structure § Perils § The 80% rule Home § Living expenses? Works Home Insurance

More about the structure § Deductible § Inflation protection § Replacement value Home § Changes to structure Works Home Insurance

More about the structure § Deductible § Inflation protection § Replacement value Home § Changes to structure Works Home Insurance

Personal property coverage § Normally, maximum is set as a percentage of value of house Home § Replacement value Works Home Insurance

Personal property coverage § Normally, maximum is set as a percentage of value of house Home § Replacement value Works Home Insurance

Liability coverage Home Liability insurance covers you when you or someone in your family causes a financial loss to someone else. Works Home Insurance

Liability coverage Home Liability insurance covers you when you or someone in your family causes a financial loss to someone else. Works Home Insurance

Two types of liability coverage § Personal liability Home § Medical payments liability Works Home Insurance

Two types of liability coverage § Personal liability Home § Medical payments liability Works Home Insurance

What do you have to lose? Home Do a household inventory Works Home Insurance

What do you have to lose? Home Do a household inventory Works Home Insurance

Doing a household inventory § Only what want/need to replace § Organize by room or category § Store outside home Home § Clump like items together Works Home Insurance

Doing a household inventory § Only what want/need to replace § Organize by room or category § Store outside home Home § Clump like items together Works Home Insurance

Home Compare coverage to loss Works Home Insurance

Home Compare coverage to loss Works Home Insurance

Lower your cost § Protect the structure Smoke alarms l Alarm system l Dead bolts l Fire extinguishers l Sprinkler system Home l Works Home Insurance

Lower your cost § Protect the structure Smoke alarms l Alarm system l Dead bolts l Fire extinguishers l Sprinkler system Home l Works Home Insurance

Lower your cost even more § Change your lifestyle l Lock doors l Store valuables elsewhere l l Grow older l Check appliances Home ys. txt Works Home Insurance

Lower your cost even more § Change your lifestyle l Lock doors l Store valuables elsewhere l l Grow older l Check appliances Home ys. txt Works Home Insurance

Comparison shop There can be significant differences in the cost of insurance from one company to another Home ys. txt Works Home Insurance

Comparison shop There can be significant differences in the cost of insurance from one company to another Home ys. txt Works Home Insurance

Money Management Contributors § Carole Bozworth l Consumer & Family Economics Specialist University Outreach and Extension l Professor/Extension Housing Specialist School of Human Ecology University of Wisconsin-Madison § Sandra K. Mc. Kinnon l Consumer & Family Economics/ Information Technology Specialist University Outreach and Extension Home § John Merrill Works

Money Management Contributors § Carole Bozworth l Consumer & Family Economics Specialist University Outreach and Extension l Professor/Extension Housing Specialist School of Human Ecology University of Wisconsin-Madison § Sandra K. Mc. Kinnon l Consumer & Family Economics/ Information Technology Specialist University Outreach and Extension Home § John Merrill Works