Home Equity Release Demystifying and reigniting the category

Home Equity Release Demystifying and reigniting the category

HER – A complex Product Attitudes to HER have changed over time Family home hard to plan as inheritance NNEG critical element of HER loan HER annuities an attractive product Reversions provide maximum cash but create winners and losers – higher LVR alternative?

HER – A complex Product Attitudes to HER have changed over time Family home hard to plan as inheritance NNEG critical element of HER loan HER annuities an attractive product Reversions provide maximum cash but create winners and losers – higher LVR alternative?

HER Interest Bases – a range of alternatives Variable interest best – perhaps with CAP Fixed for term or life – penalties on VMO an issue Interest linked to CPI

HER Interest Bases – a range of alternatives Variable interest best – perhaps with CAP Fixed for term or life – penalties on VMO an issue Interest linked to CPI

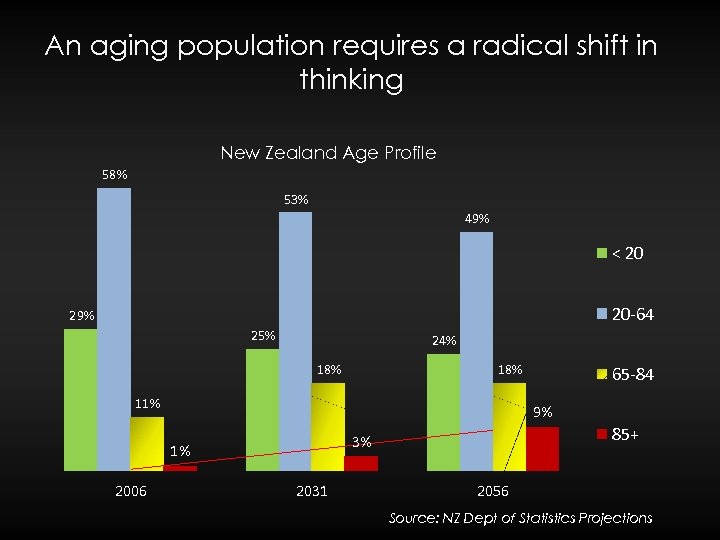

An aging population requires a radical shift in thinking New Zealand Age Profile 58% 53% 49% < 20 20 -64 29% 25% 24% 18% 11% 9% 85+ 3% 1% 2006 65 -84 2031 2056 Source: NZ Dept of Statistics Projections

An aging population requires a radical shift in thinking New Zealand Age Profile 58% 53% 49% < 20 20 -64 29% 25% 24% 18% 11% 9% 85+ 3% 1% 2006 65 -84 2031 2056 Source: NZ Dept of Statistics Projections

HER model operates under a range of assumptions Adjusted Population Mortality Move-to-Care developed from AIHW statistics Voluntary-Move-Out often health related Joint lives – adjusted single life Interest differential over HPI – about 4. 5% a year Issue expenses relatively high

HER model operates under a range of assumptions Adjusted Population Mortality Move-to-Care developed from AIHW statistics Voluntary-Move-Out often health related Joint lives – adjusted single life Interest differential over HPI – about 4. 5% a year Issue expenses relatively high

Solvency Reserving for HER Conservative figures for mortality and other moveouts Similarly, conservative assumptions on interest and HPI – adjust house values to cyclical trend low Major issue as whether need to zeroize negative reserves Simulation probably a better measure of risk

Solvency Reserving for HER Conservative figures for mortality and other moveouts Similarly, conservative assumptions on interest and HPI – adjust house values to cyclical trend low Major issue as whether need to zeroize negative reserves Simulation probably a better measure of risk

Simulation – modelled to reflect market reality Base pattern of cyclical rates of interest and HPI - Adjust each run for Normal stdev of 5% each year Regional and individual variations on each loan of Normal stdev 7. 5% each year Random by probability rate for exits, top-ups Discounted profit-flows sorted in ascending order to assess Va. R and t. Va. R at various %

Simulation – modelled to reflect market reality Base pattern of cyclical rates of interest and HPI - Adjust each run for Normal stdev of 5% each year Regional and individual variations on each loan of Normal stdev 7. 5% each year Random by probability rate for exits, top-ups Discounted profit-flows sorted in ascending order to assess Va. R and t. Va. R at various %

Funding has always been the main consideration HER a strong match with Annuities – achieved by Pension Fund investing in HER - or HER investing in annuities Securitization another long term funding mechanism Rating agencies extended RMBS thinking to HER without re-assessing long term interest HPI assumptions – ultra conservative assumptions will hinder HER product development

Funding has always been the main consideration HER a strong match with Annuities – achieved by Pension Fund investing in HER - or HER investing in annuities Securitization another long term funding mechanism Rating agencies extended RMBS thinking to HER without re-assessing long term interest HPI assumptions – ultra conservative assumptions will hinder HER product development

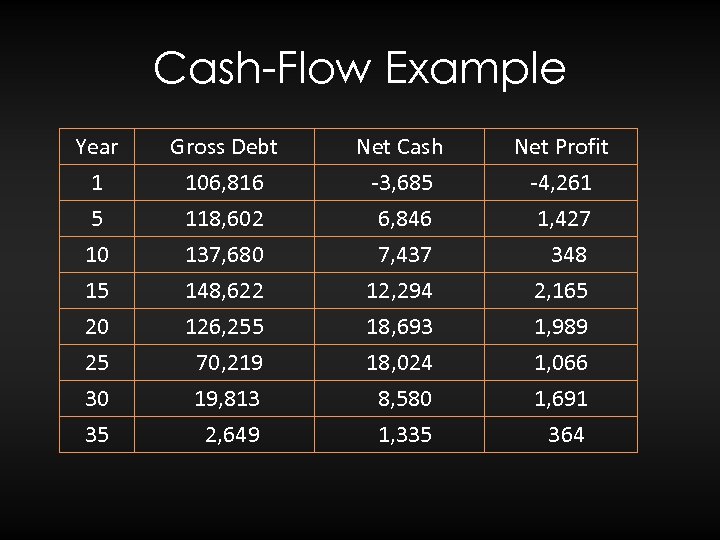

Cash-Flow Example Year 1 5 10 Gross Debt 106, 816 118, 602 137, 680 Net Cash -3, 685 6, 846 7, 437 Net Profit -4, 261 1, 427 348 15 20 25 30 35 148, 622 126, 255 70, 219 19, 813 2, 649 12, 294 18, 693 18, 024 8, 580 1, 335 2, 165 1, 989 1, 066 1, 691 364

Cash-Flow Example Year 1 5 10 Gross Debt 106, 816 118, 602 137, 680 Net Cash -3, 685 6, 846 7, 437 Net Profit -4, 261 1, 427 348 15 20 25 30 35 148, 622 126, 255 70, 219 19, 813 2, 649 12, 294 18, 693 18, 024 8, 580 1, 335 2, 165 1, 989 1, 066 1, 691 364