deea79572f111a4fea0db5323230a614.ppt

- Количество слайдов: 10

Home Energy Retrofit Forum Reno, Nevada Simón Bryce | May 3, 2010

Original Architects of PACE Contracts cover 200+ governmental jurisdictions, 20+ million people Contracts in CA, WA, OR, NM, CO, OH, MD, LA Offices: CA, OR, NM, IL, DC

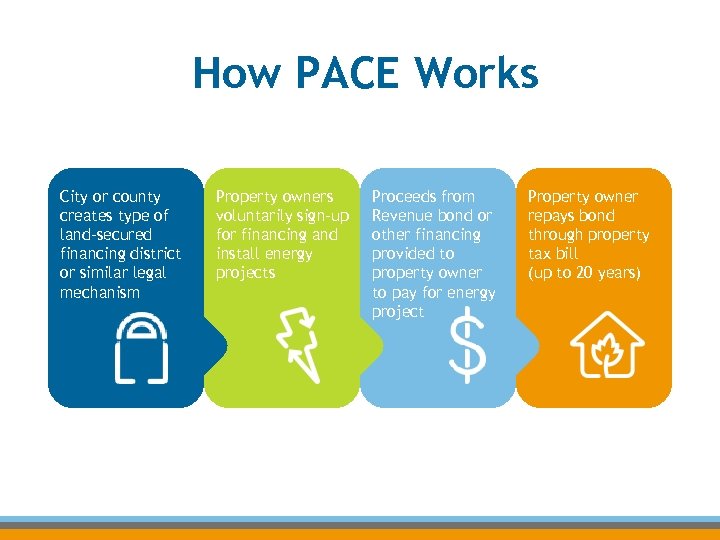

How PACE Works City or county creates type of land-secured financing district or similar legal mechanism Property owners voluntarily sign-up for financing and install energy projects Proceeds from Revenue bond or other financing provided to property owner to pay for energy project Property owner repays bond through property tax bill (up to 20 years)

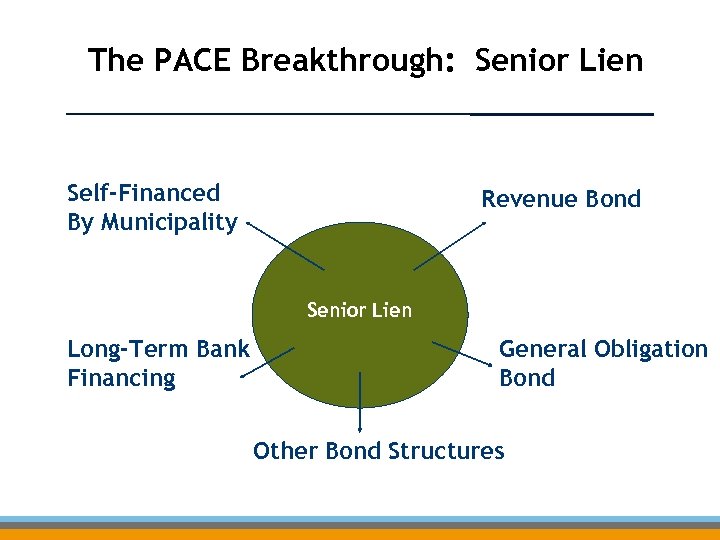

The PACE Breakthrough: Senior Lien Self-Financed By Municipality Revenue Bond Senior Lien Long-Term Bank Financing General Obligation Bond Other Bond Structures

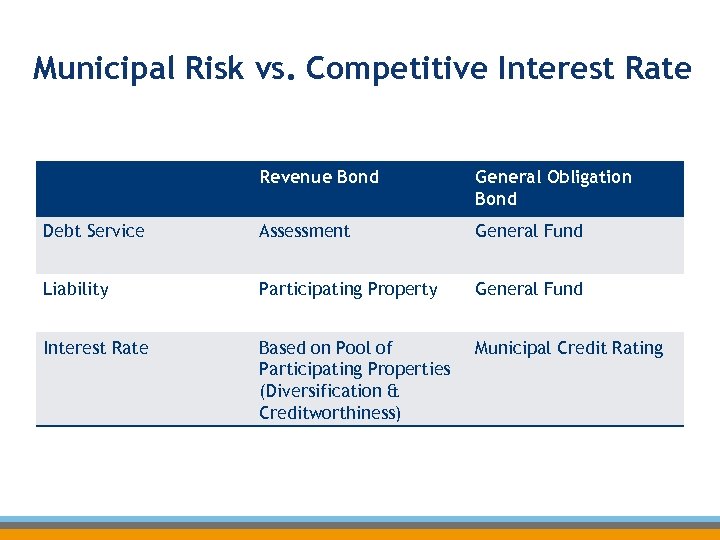

Municipal Risk vs. Competitive Interest Rate Revenue Bond General Obligation Bond Debt Service Assessment General Fund Liability Participating Property General Fund Interest Rate Based on Pool of Participating Properties (Diversification & Creditworthiness) Municipal Credit Rating

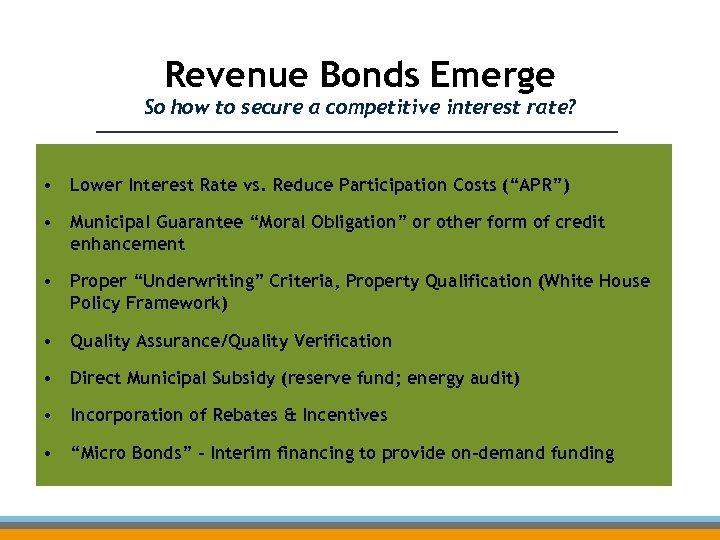

Revenue Bonds Emerge So how to secure a competitive interest rate? • Lower Interest Rate vs. Reduce Participation Costs (“APR”) • Municipal Guarantee “Moral Obligation” or other form of credit enhancement • Proper “Underwriting” Criteria, Property Qualification (White House Policy Framework) • Quality Assurance/Quality Verification • Direct Municipal Subsidy (reserve fund; energy audit) • Incorporation of Rebates & Incentives • “Micro Bonds” – Interim financing to provide on-demand funding

PACE Success Location Interest Rate Max Loan Repayment Term Project Types Total Amount Berkeley, CA (Micro Bond/Revenue Bond) 7. 75% $37, 500 20 years Solar Up to $80 M Boulder, CO (Revenue Bond/Moral Ob. ) 6. 68% and 5. 20% $50, 000 15 years Solar & EE Up to $40 M Palm Desert, CA (General Fund) 7. 0% $60 K or approval 5, 10, 15 or 20 years Solar & EE Currently $10 M+ Sonoma County, CA (Treasury/Utility) 7. 0% $60 K or approval 5, 10, 15 or 20 years RE, EE & Water Up to$100 M San Francisco (Micro Bond/Revenue 7. 0% $50 K 5, 10, 15 or 20 years RE & EE Up to $150 M

California. FIRST 14 Counties, 146 Cities - Launch: Summer 2010 Sponsor: CA Statewide Communities Development Authority Team: Renewable Funding; Royal Bank of Canada Capital Markets Eligible Projects: renewable energy, energy efficiency, water efficiency Requires energy efficiency projects before installing renewables Centralized administration and bond issuance, local customization Awarded $16. 5 Million ARRA grant

Renewable Funding Turnkey Services Program Design Education & Administration Financial Package

Simón Bryce| simon@renewfund. com | (510) 451 -7906

deea79572f111a4fea0db5323230a614.ppt