484793572114097ac8e4c88613165c4a.ppt

- Количество слайдов: 47

Home Buying Seminar Open the Door to Ownership First -time Home Buyers Seminar

Home Buying Seminar Class Overview • Benefits and drawbacks of home ownership • Renting versus buying • Home appreciation or depreciation STEP 1: Select a loan and lender STEP 2: Choose a Realtor® /FSBOs STEP 3: Search for a home STEP 4: Make an offer STEP 5: Open and close escrow Buyer Realtor Lender Seller Escrow Pre Paids Fees Attorney Contract

Home Buying Seminar Benefits and Drawbacks • Do what you want, when you want to do it! • Equity accumulation • Tax benefits – Subtract interest and taxes from gross income, calculate the difference in tax liability • Pride in ownership • Maintenance and repairs • Liabilities – Buying and Selling Costs – Lack of liquidity – Time factors in selling

Home Buying Seminar Benefits and Drawbacks • • • Base housing vs owning New homes Custom homes Used homes Maintenance and repairs Being house poor Unexpected costs Financial obligation Buying and selling costs Realtor Buyer Lender Seller Escrow Pre Paid Fees Attorney Contract

Home Buying Seminar Renting or Buying Which is better?

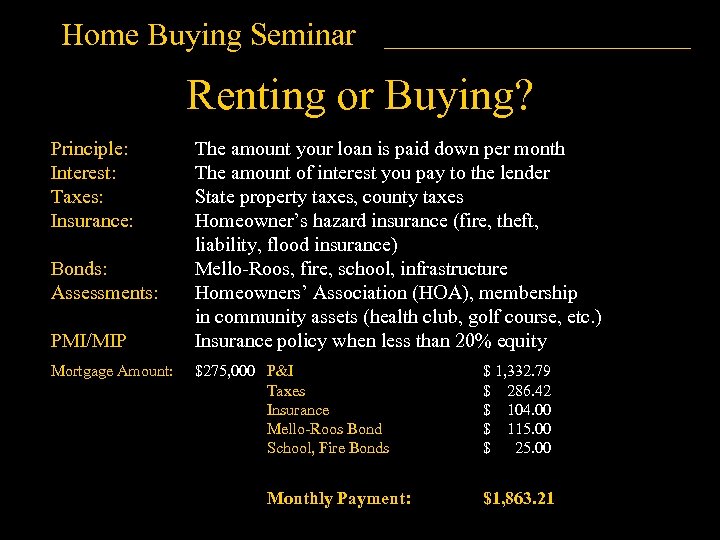

Home Buying Seminar Renting or Buying? Principle: Interest: Taxes: Insurance: Bonds: Assessments: PMI/MIP Mortgage Amount: The amount your loan is paid down per month The amount of interest you pay to the lender State property taxes, county taxes Homeowner’s hazard insurance (fire, theft, liability, flood insurance) Mello-Roos, fire, school, infrastructure Homeowners’ Association (HOA), membership in community assets (health club, golf course, etc. ) Insurance policy when less than 20% equity $275, 000 P&I Taxes Insurance Mello-Roos Bond School, Fire Bonds Monthly Payment: $ 1, 332. 79 $ 286. 42 $ 104. 00 $ 115. 00 $ 25. 00 $1, 863. 21

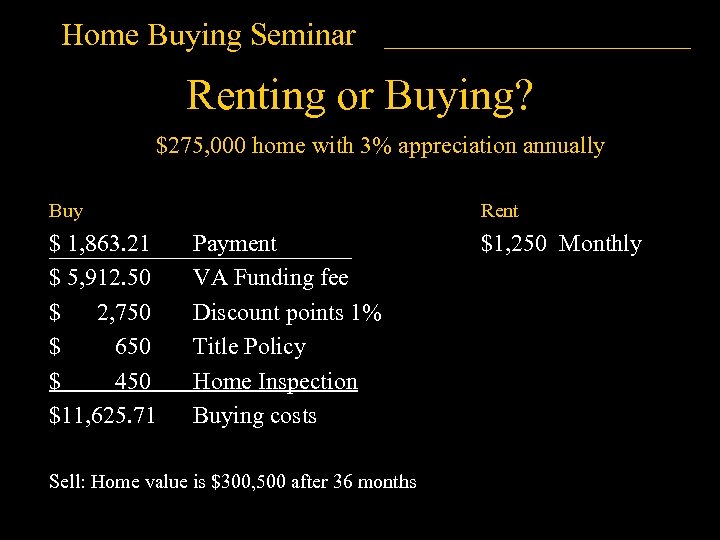

Home Buying Seminar Renting or Buying? $275, 000 home with 3% appreciation annually Buy $ 1, 863. 21 $ 5, 912. 50 $ 2, 750 $ 650 $ 450 $11, 625. 71 Rent Payment VA Funding fee Discount points 1% Title Policy Home Inspection Buying costs Sell: Home value is $300, 500 after 36 months $1, 250 Monthly

Home Buying Seminar Renting or Buying? Sales price Selling commission Selling fees (inspect/reports/title) Loan balance at 36 months Buying costs (VA fee, title, inspect) BAH Received (E 5, with dependents) Total House Payments Gross Profit from BAH Equity Net to Buyer from sale $ 300, 500. 00 $ 18, 030. 00 $ 1, 912. 00 $ 260, 180. 00 $ 11, 625. 71 $ 61, 992. 00 $ 62, 035. 44 $ - 43. 44 $ 10, 891. 00 Rent (E 6/dependents) $1, 495 mo Profit Sewer, Water, Garbage Housing maintenance and repairs* Tax benefit from interest/taxes NET PROFIT AFTER ALL EXPENSES $ $ $ Profit $ 8, 172. 00 Sewer, Water, Garb. 0 Maint/Repair 0 7, 188. 45 3, 708. 00 1, 800. 00 1, 350. 00 330. 45 * estimating housing maintenance/repairs at $50 per month BAH Received Total Rent Paid $61, 992. 00 $53, 820. 00 Net to Renter $ 8, 172. 00 NET $ 8, 172. 00

Home Buying Seminar Risk Reward

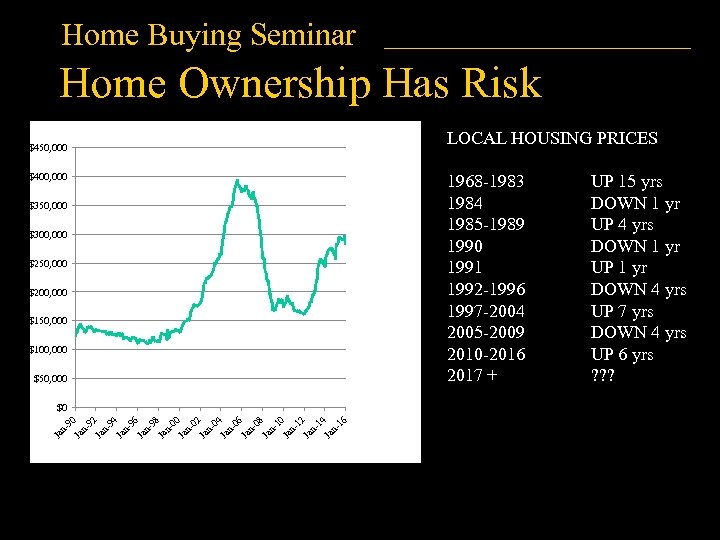

Home Buying Seminar Home Ownership Has Risk LOCAL HOUSING PRICES $450, 000 1968 -1983 1984 1985 -1989 1990 1991 1992 -1996 1997 -2004 2005 -2009 2010 -2016 2017 + $400, 000 $350, 000 $300, 000 $250, 000 $200, 000 $150, 000 $100, 000 $50, 000 n 92 Ja n 94 Ja n 96 Ja n 98 Ja n 00 Ja n 02 Ja n 04 Ja n 06 Ja n 08 Ja n 10 Ja n 12 Ja n 14 Ja n 16 Ja Ja n- 90 $0 UP 15 yrs DOWN 1 yr UP 4 yrs DOWN 1 yr UP 1 yr DOWN 4 yrs UP 7 yrs DOWN 4 yrs UP 6 yrs ? ? ?

Home Buying Seminar Real Estate is like other investments • There is risk • You must purchase “low” or wait to buy • You must sell “high” or wait to sell • You must know the market to make money • You must be ready to move when the time is right Real Estate is unlike other investments • It is the largest purchase most people make • Memories are built around our “homes” • Homes give us a level of comfort, security, stability and pride • We dream of owning our own homes

Home Buying Seminar Nobody knows the future

Home Buying Seminar STEP 1 Selecting a Loan and Lender

Home Buying Seminar Check your credit reports Equifax (www. equifax. com) P. O. Box 740241 Atlanta, GA 30374 -0241 1 -800 -685 -1111 Experian (www. experian. com) P. O. Box 2104 Allen, TX 75013 -0949 1 -888 -EXPERIAN (397 -3742) Trans Union (www. transunion. com) P. O. Box 1000 Chester, PA 19022 1 -800 -916 -8800

Home Buying Seminar FREE credit reports - www. annualcreditreport. com - 1 -877 -322 -8228 - Complete the request form at: https: //www. annualcreditreport. com/cra/requestformfinal. pdf and mail to: Annual Credit Report Request Service P. O. Box 105281 Atlanta, GA 30348 -5281

Home Buying Seminar What to look for - Accounts you never opened - Errors in credit limits and high balances - Items older than 7 years old - Incorrect addresses - Collection account information - Delinquent account information What to do and not to do - Dispute errors in writing - Pay down or pay off loan balances before applying for a home loan - Don’t open any new accounts - Don’t transfer account balances between credit cards - Don’t close old accounts

Home Buying Seminar Qualification • Income (Can you afford it? ) – Run your budget first – Reduce installment/revolving debt – Clean up your credit • Debt – You will have to show estimates – Be honest • Credit History • Dress Professionally • Ratios (not set in stone) – 28% of gross pay (front end), 36% of pay after debt (back end) – Most people are comfortable with 25% of take-home pay going to their mortgage

Home Buying Seminar Pre-qualification • Lender completes cursory review of credit, debt and income • Provides letter of pre-qualification to buyer • Does not always require a loan application Pre-approval • Lender completes through review of credit, debt and income • Requires copies of income tax returns/proof of income going back 3 years • Based upon information, issues a letter of pre-approval up to a specified amount of a loan with a specified interest rate • Usually requires completion of a loan application Pre-approval is more attractive to a seller!

Home Buying Seminar Selecting a Loan and Lender • Conventional • Government • Specialized • • • Builder’s preferred lender Your bank/credit union Mortgage lenders Mortgage brokers Internet sources

Home Buying Seminar Selecting a Loan and Lender • Conventional/conforming – Fannie Mae, Freddie Mac – Down payment required – Private mortgage insurance (PMI) required • Government (FHA, VA, Cal. Vet) – Easier qualification – Smaller or no down payment options – Price limits and income restrictions • Special Loans (Portfolio B, C, D) – Higher interest – Shorter terms – Down payment varies

Home Buying Seminar Selecting a Loan and Lender • Fixed Rate Mortgage (30, 20, 15, 10) • Adjustable Rate Mortgages (normal or negative amortizing) – Index, margin, initial rate, long-term rate, max rate, annual adjustment cap, lifetime cap • • Interest Only Mortgages Hybrid or Piggyback Loans (can you say mortgage crisis? ) Mortgage Bond Money: Cal. FHA, Local Bonds Gifting down payments

Home Buying Seminar Selecting a Loan and Lender • • • Points versus Loan Origination Fees Avoid Prepayment Penalties Avoid Balloon Payments Don’t Accept Negative Amortization Junk fees – – – – Processing Fee Administration Fee Courier Fees (above a reasonable amount) Underwriting Fee Overpriced credit report fee Funding and review fee Closing Fee

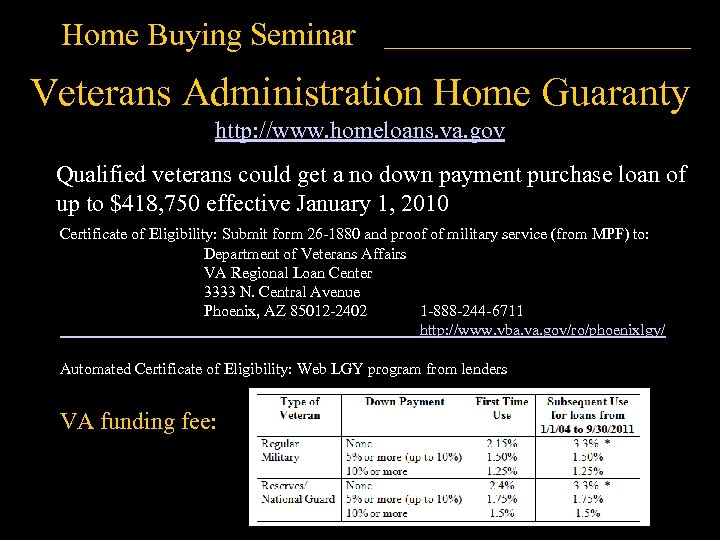

Home Buying Seminar Veterans Administration Home Guaranty http: //www. homeloans. va. gov Qualified veterans could get a no down payment purchase loan of up to $418, 750 effective January 1, 2010 Certificate of Eligibility: Submit form 26 -1880 and proof of military service (from MPF) to: Department of Veterans Affairs VA Regional Loan Center 3333 N. Central Avenue Phoenix, AZ 85012 -2402 1 -888 -244 -6711 http: //www. vba. va. gov/ro/phoenixlgy/ Automated Certificate of Eligibility: Web LGY program from lenders VA funding fee:

Home Buying Seminar Shop, Shop! It may be tough to find a lender -58% of home buyers rated the difficulty on a scale of 1 to 10 - as a 9 or 10 All lenders have different fees and structures - A Good Faith Estimate is required to show estimated costs and payments - All VA home loans are not the same If you don’t understand the terminology, ASK! - Don’t be ashamed to ask - The only dumb question is the one that goes unanswered Good Faith Estimate - Required under RESPA estimates total costs of the loan, payments, fees - Will vary from Final Settlement Statement at closing

Home Buying Seminar REALTOR OR FSBO

Home Buying Seminar Choosing a • Real estate salesperson/agent • Broker • Realtor® ® Realtor

Home Buying Seminar The Fi. SBO • • • FSBO (For Sale By Owner) Nobody to protect you Nobody to guide you through the process No guarantee contracts are complete and legal Must know title issues, mortgage issues well Most FSBOs are overpriced Can negotiate directly with owner More room for negotiation No pressure to buy

Home Buying Seminar Finding a Home

Home Buying Seminar Selecting a Home – Overview • Know your needs • Choose your neighborhood • New vs. Existing http: //www. bestplaces. net/default. aspx

Home Buying Seminar Selecting Your New Home • • • Consider your lifestyle Look at your needs House poor Single story vs. multi floor Bedrooms, baths & office space • Hobbies, garage & storage • Lawn size & configuration

Home Buying Seminar Selecting a Home – Neighborhood • • • Location, location Schools, shopping, transit time to work Economic health Crime Stability Property values Yuba Crime Map Sacramento/Placer Crime Map Registered Sex Offenders Best Places. net Homefair. com

Home Buying Seminar Selecting a Home – New or Existing • • Resale Energy Efficiency Plumbing Sewer Electric (grounded) Construction quality Repairs/Maintenance

Home Buying Seminar Selecting a Home – Listing Type • Equity property - Seller accepts offer within 24 hours of presentation; close escrow: 20 -45 days • Short sales (Approved and Contingencies) - Seller accepts offer within 24 hours of presentation - Bank must review and accept/decline offer (3 -6 months); set time limits! - Close escrow in 3 months - never • Foreclosure/Real Estate Owned - Offers collected by a specified deadline (auction or Realtor) - Bank reviews and accepts offers typically within 10 days - Close escrow in 20 -45 days

Home Buying Seminar PRICING RESEARCH AND MAKING THE OFFER

Home Buying Seminar Deal breakers when trying to buy a home • Offer too low or more desirable offer - Cash offers - No contingencies • Financing - Buyer not pre-qualified or pre-approved - Buyer’s financing falls through - No proof of income/proof of funds • Contingencies cannot be cleared - Pest report, survey, home inspection, financing - Appraisal lower than price offered - Bank does not accept short-sale offer - Clouded title • Buyer backs out due to non-responsive banks or sellers • Buyer or seller’s remorse

Home Buying Seminar Factors that can affect home values - Location – Location! - Crime rates - Quality and proximity of schools and colleges - Proximity to support services - Commute time and access to freeways/highways/transit - Environmental -Natural hazards (fire, flood, weather, earthquake) - Condition of neighboring homes and yards - Ambient noise from freeways, trains, airports, sports complexes, industrial plants - Proximity to potential bio-hazards, farms and waste treatment facilities

Home Buying Seminar Factors that can affect home values - Features of the home - Floor plan and architectural style - Age and condition of home - Size of parcel - Paint scheme and color choices - Economic - Unemployment rate - Median income - Employment outlook (plant closures, base closures, State and Fed cutbacks)

Home Buying Seminar Tracking Individual Home Values Don’t get ripped off by paying too much! A home is an investment – they increase and decrease in value What did the prior owner pay? How much have neighboring homes sold for? What is the average price per square foot? Are values increasing or decreasing? How many days has it been on the market? Definition: Comps are the value of homes that have sold and closed escrow that are of comparable age, condition, size and in the same neighborhood

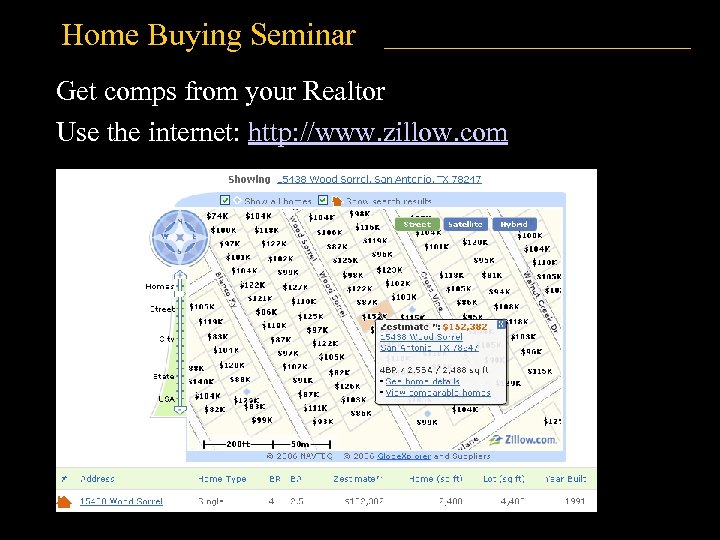

Home Buying Seminar Get comps from your Realtor Use the internet: http: //www. zillow. com

Home Buying Seminar Completing the Purchase - Overview • Negotiating Contract • Surviving Escrow

Home Buying Seminar Making an Offer – The Contract • • • Everything is negotiable Price Terms Contingencies Condition Occupancy Home warranties Specify dates and times for response times Specify what happens to earnest money Specify how costs are split between buyer/seller Offers, counter offers, counter-counter offers, etc.

Home Buying Seminar ACCEPTANCE OF OFFER AND ESCROW

Home Buying Seminar Completing the Purchase – Escrow • Contract, Earnest Money, Down Payment, Pre-paids - Requires check/certified check – NEVER PAY IN CASH • Letter of Credit Worthiness • Appraisal • Inspections and surveys completed • Repairs Completed • Loan Approved, Establish Impound Account • Title Search Completed • Walk-through – insist agent is present • Contingency Removals • Signing and Disbursement of Funds • Recordation

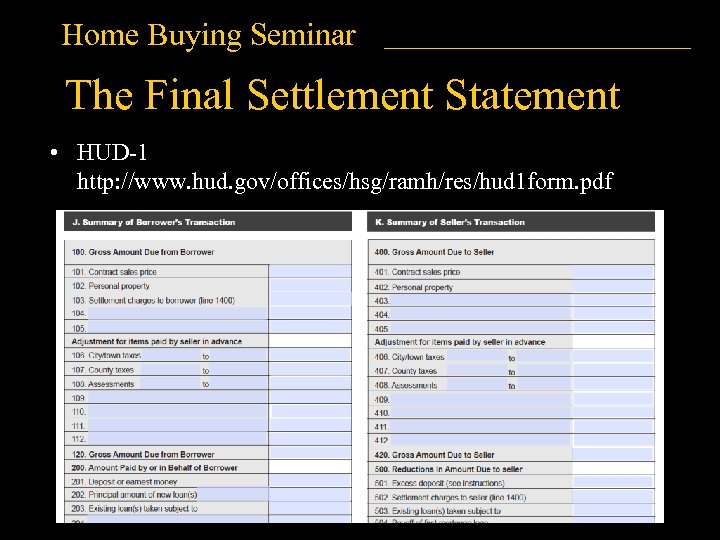

Home Buying Seminar The Final Settlement Statement • HUD-1 http: //www. hud. gov/offices/hsg/ramh/res/hud 1 form. pdf

Home Buying Seminar Completing the Purchase – Escrow • Recommendations - Determine ahead of time how you will hold title -- Most common is individual or joint tenancy - Establish a file and keep copies of all documents - Request advance copies of all closing documents so you can review them at home (24 hrs in advance) - Ensure Realtor will be present at closing - Review the final settlement statement -- Check terms, fees, pre-paids, impound terms, etc. -- Costs will be different than the Good Faith Estimate -- Don’t sign what you don’t understand - Plan on 30 -60 minutes at closing - Wear comfortable clothing and keep sense of humor

Home Buying Seminar Summary • • • Rent or Buy Risk Qualification Choosing a Lender Choosing Realtor Research Making the deal Escrow Move in! Buyer Realtor Lender Seller Escrow Pre Paid Fees Attorney Contract

Home Buying Seminar Questions

484793572114097ac8e4c88613165c4a.ppt