e32a43d704503b611bc18d8e43c98a09.ppt

- Количество слайдов: 41

Home Buyer Workshop Jayne Mc. Burney, M. S. Family & Consumer Sciences Agent Housing Counselor 919 -989 -5380 jayne_mcburney@ncsu. edu http: //www. ces. ncsu. edu/johnston/ Jayne Makes Cents @Jayne. Makes. Cents

Rent vs. Buy Advantages to Rent • Pay less • Little financial risk • Cost of selling Disadvantages to Rent • Finding suitable rentals • No tax advantage • No freedom for individualizing space

Rent vs. Buy Advantages to Buy • Investment of mortgage dollars • Interest is tax deductible • Home can increase in value Disadvantage to Buy • Commitment of time, etc. • Ties up money • Maintenance

Can you afford a home? Consider that most lenders suggest that 25 -29% of your gross income will go to housing. Lenders want to see less than 41% tied up in long term debt (car loans, alimony, child support, installment loans, credit cards)

What do lenders look at? • • Income Debt Assets Credit Score

Understanding Income Gross income vs Before taxes and deductions Net Income ‘bring home pay’ $40, 872 (2000 Census for Johnston County) $3406/month $29, 428 $786/wk $566/wk $2452/month

Monthly debts • Should be less than 15 -20% of net income • $368 -490/month

Housing 25% - 33% of gross pay $852 -$1124/month

Vehicle • less than 15% of gross including insurance, gas and maintenance • $511/ month

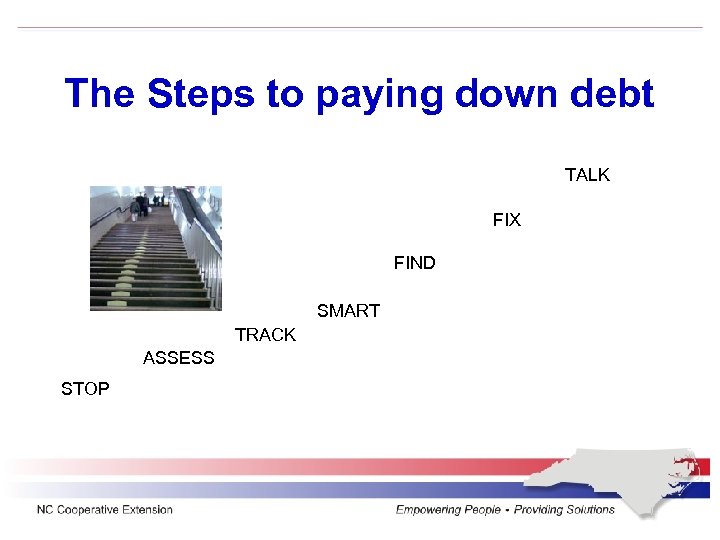

The Steps to paying down debt TALK FIX FIND SMART TRACK ASSESS STOP

STOP new purchases • Average Credit Card Debt: 2008 $8, 000 2010 $19, 000 (January) $15, 000 (October) 2014 $15, 480

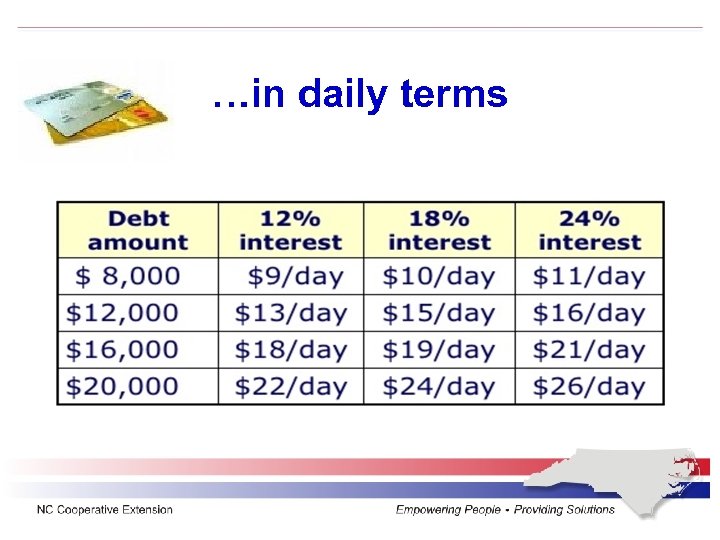

…in daily terms

Assess the problem • How did you get there? • Is it permanent or temporary? – – – Job loss or lay off Health/Accident Divorce or death Living too big: needs vs. wants Spending problem

TRACK your spending • Write down EVERYTHING you spend • Use a calendar with due dates – A wake-up call • Make a budget: ABC

Fixed vs Flexible • Fixed is NEEDS: Rent, car, utilities, insurance, savings • Flexible is WANTS: Food, clothing, recreation, car maintenance, phone

SMART Goals • • • Specific: I need new brakes for my car in 6 months. Measurable: They will cost $300. Attainable: I will save $50/month for six months Realistic: how will I get the $, look at spending Time Bound: I will have the $ by x date

Find $ • Cable…. movie packages • Internet/Cell phone Nails/ Haircut…can you wait a week? • Daily lunch, at a modest $5 = $100 a month • Vending machine: 1/day @ $1. 50, $45/month

Easy Fix: • Bring snacks from home in a cooler, save $30/mo • Pack Lunch 3 days a week, save $60/mo • If you have a smart phone, you may not need Internet at home, save $45/mo • Rent movies, save $25 -$50/mo • Have hair and nails done every ten days, save $50/mo

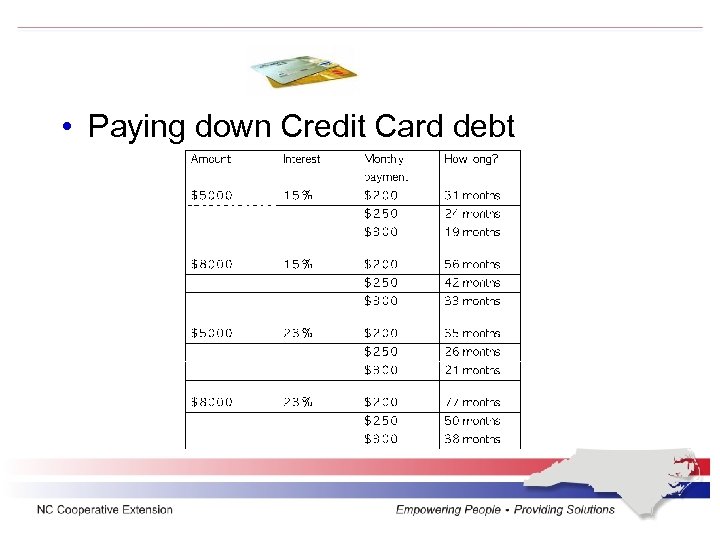

• Paying down Credit Card debt

Talk • Communicate with anyone who depends on your paycheck about spending issues and financial goals

Review the Steps TALK FIX FIND SMART TRACK ASSESS STOP

Monitor and Modify • Stuff happens…. change in income, emergencies…. • Goals change • But also…. new income…SAVE IT! • Is it worth it? - opportunity costs

BREAK • Need one?

Assets/Collateral Things you own that have value… • • Car, vehicles bank accounts, CDs , stocks retirement plans, 401 K, IRAs Life Insurance cash values, Trust funds

What is my Credit Score? Score range: 300 -850 • www. my. FICO. com Use the Credit Education tab • www. annualcreditreport. com

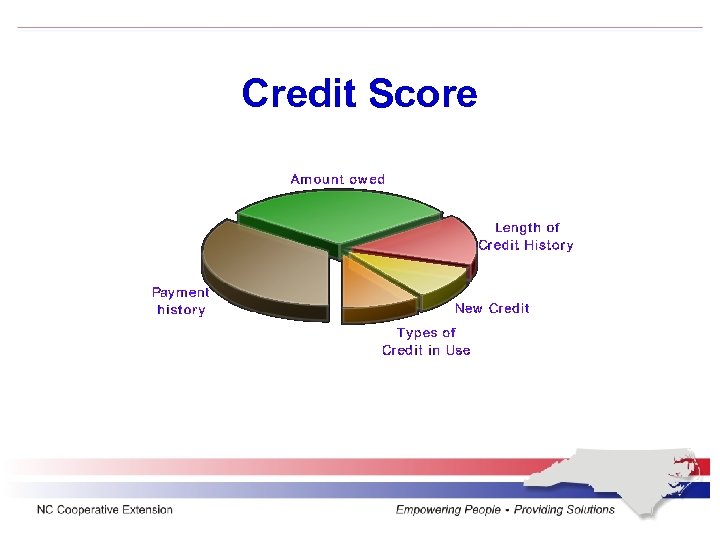

Credit Score

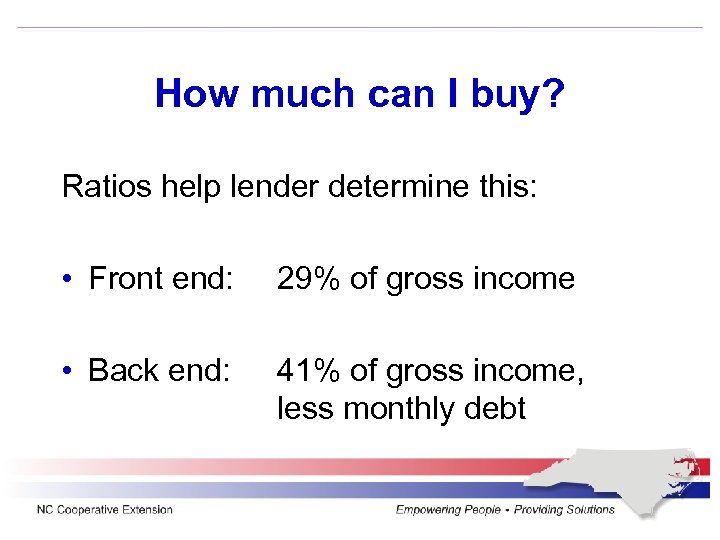

How much can I buy? Ratios help lender determine this: • Front end: 29% of gross income • Back end: 41% of gross income, less monthly debt

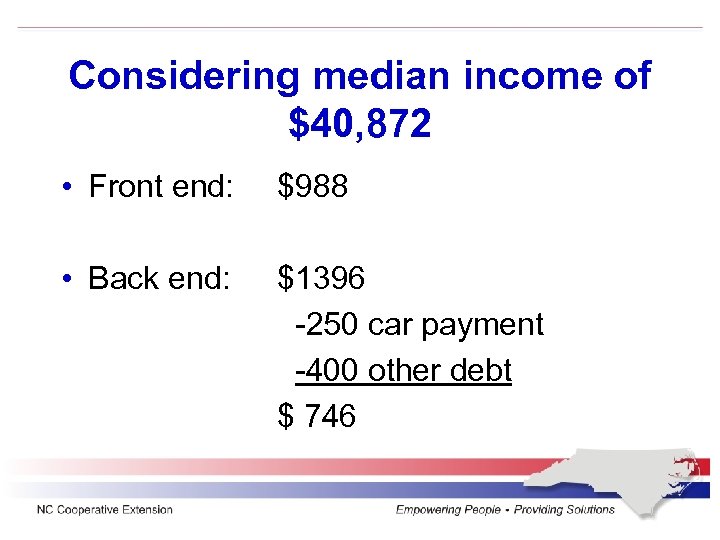

Considering median income of $40, 872 • Front end: $988 • Back end: $1396 -250 car payment -400 other debt $ 746

P+I+T+I Monthly payment = • Principal • Interest • Taxes • Insurance

Using the lower of the two ratios: • Total Payment less • Real Estate Tax • Home Owner Insurance • Principal & Interest $746 85 40 $621 use this amount to determine how much you can afford to finance

Amortization factors • Determine how big of a loan you can afford, depending on interest rate and monthly payment and term of loan • So…considering a 30 year loan and ability to pay principal and interest of $621

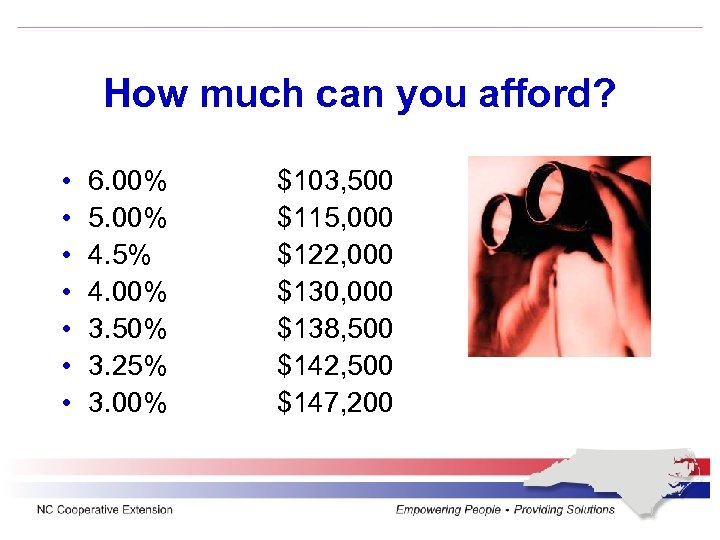

How much can you afford? • • 6. 00% 5. 00% 4. 5% 4. 00% 3. 50% 3. 25% 3. 00% $103, 500 $115, 000 $122, 000 $130, 000 $138, 500 $142, 500 $147, 200

Your Needs in housing: • Space, how many rooms are needed? • Exterior space - garage, yard, entertaining • Appliances • Location

Location • Schools • Work • Groceries, shopping areas • Environmental

Financial Aspects • One - Time Costs - closing costs moving expenses, set-up fees • Regular costs - payments, insurance, utilities • Future Costs - maintenance, repairs, furnishing

Don’t become “House Poor” • Space out things you will need • Be smart about furnishings, repairs, upgrades

Your Home Buying Professionals • • • Real Estate Agent Mortgage banker Home Inspector Appraiser Attorney

What to expect from a Home Inspector • Licensed by the North Carolina Home Inspection Board. • A home inspection is a written evaluation or report of the condition of the home on the day it is inspected. • Home inspectors generally evaluate: foundation, masonry, roof, windows and doors, plumbing, electrical, heating, ventilation and air conditioning system, floor, walls, interior and exterior components

Closing Statement • • • Taxes Stamps Recording Fees Commissions Inspections

What Next? • • Set up utilities Clean the new place Paint/repair Plan Moving Day – Keep kids busy!!!!

Questions? ? ? Ask the Extension Agent… • • Landscape, plants Bugs!!!! Nutrition and Cooking questions Youth programs • Johnston County 919 -989 -5380 • http: //ces. ncsu. edu

e32a43d704503b611bc18d8e43c98a09.ppt