110279bea77f3311af394f4a09473cbb.ppt

- Количество слайдов: 65

HIMS Risk Management in Microfinance Banks Presentation at the 6 th CBN Annual Microfinance Conference & Entrepreneurship Awards Rogers A. I. Nwoke MD/CEO, HASAL MFB

Ground Rules/Expectations Obey Concentrate in Class ©HASAL INSTITUTE FOR MICROFINANCE STUDIES HIMS/NAMB Training 2

Presentation Objectives/Expectations To understand the reality, concept and source of risks in microfinance To improve on our knowledge of Risk Management and its impact on microfinance performance To improve our expertise in applying risk management strategies in our microfinance institutions To gain competence and skill in Risk Management for the growth of our MFIs ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Presentation Outline A. RISK MANAGEMENT OVERVIEW Introduction Dimensions of Risk & Risk Management B. RISK FACTORS & IMPACT ON MFIs C. RISK MANAGEMENT STRATEGIES FOR MFBs Credit Administration & Control Fraud Prevention and Control Auditing, Compliance and Internal Control Training & Skills Development ‣ ‣ D. CASE STUDIES IN RISK MANAGEMENT ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Section A: Risk Management Perspective What is Risk? The potential loss an asset or a portfolio is likely to suffer due to a variety of reasons. defined in ISO 31000 as the effect of uncertainty on objectives, whether positive or negative Risks can come from uncertainty in financial markets, project failures, legal liabilities, credit risk, accidents, natural causes and disasters as well as deliberate attacks from an adversary. What is Risk Management? The identification, assessment, and prioritization of risks followed by a co-ordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

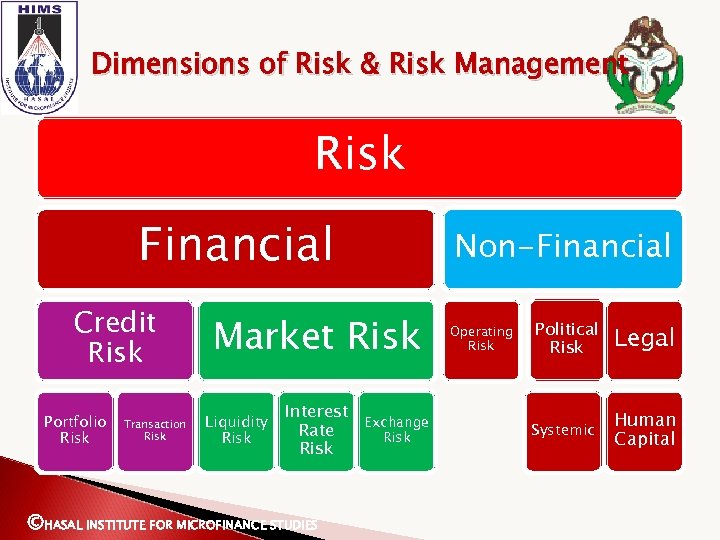

Dimensions of Risk & Risk Management Risk Financial Credit Risk Portfolio Risk Transaction Risk Market Risk Liquidity Risk Interest Exchange Rate Risk ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Non-Financial Operating Risk Political Risk Legal Systemic Human Capital

FINANCIAL RISKS Credit risk Loss arising from a borrower who does not make payments as promised. Such an event is called a default Another term for credit risk is default risk. Risk that the counterparty will fail to perform or meet the obligation on the agreed terms ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

TYPES OF CREDIT RISKS Transaction Risk relating to specific trade transactions, sectors or groups. Portfolio Risk arising from lending to sectors non related to the core competencies of the Bank / concentrated credits to a particular sector / lending to a few big borrowers. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

MARKET RISK Market risk is the risk to a bank’s financial condition that could result from adverse movements in market price. TYPES OF MARKET RISK Interest Rate Risk felt, when changes in the interest rate structure put pressure on the net interest margin of the Bank. Liquidity Risk arising due to the potential for liabilities to drain from the Bank at a faster rate than assets. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

TYPES OF MARKET RISK (continued) FOREX RISK This risk can be classified into three types. Transaction Risk is observed when movements in price of a currency upwards or downwards, result in a loss on a particular transaction. Translation Risk arises due to adverse exchange rate movements and change in the level of investments and borrowings in foreign currency. Country Risk. The buyers are unable to meet the commitment due to restrictions imposed on transfer of funds by the foreign govt. or regulators. When the transactions are with the foreign govt. the risk is called as Sovereign Risk. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

NON-FINANCIAL RISKS Operational Risk arises as a result of failure of operating system in the bank due to certain reasons like fraudulent activities, natural disaster, human error, omission or sabotage etc. Systemic Risk is seen when the failure of one financial institution spreads as chain reaction to threaten the financial stability of the financial system as a whole. Political Risk arises due to introduction of Service tax or increase in income tax, freezing the assets of the bank by the legal authority etc. Human Capital Risk Labour unrest, lack of motivation, inadequate skills, brain drain, etc. Technology Risk Obsolescence, mismatches, breakdowns, adoption of latest technology by competitors, etc, come under technology risk ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

HIMS Basic CREDIT RISK MANAGEMENT

Basic Concepts in CRM Credit risk Loss arising from a borrower who does not make payments as promised. Such an event is called a default. Another term for credit risk is default risk. Risk that the counterparty will fail to perform or meet the obligation on the agreed terms Transaction Risk ⇛ Risk relating to specific trade transactions, sectors or groups. Portfolio Risk ⇛ Risk arising from lending to sectors non related to the core competencies of the Bank/concentrated credits to a particular sector /lending to a few big borrowers. Sovereign risk is the risk of a government becoming unwilling or unable to meet its loan obligations, or reneging on loans it guarantees. The existence of sovereign risk means that creditors should take a two-stage decision process when deciding to lend to a firm based in a foreign country. Firstly one should consider the sovereign risk quality of the country and then consider the firm's credit quality ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Why Loan Default Rates are High Lax credit standards for borrowers and counterparties Poor loan monitoring standards Poor portfolio risk management Lack of attention to changes in economic or other circumstances that can lead to a deterioration in the credit standing of a bank's customers ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

The Goal of Credit Risk Management To maximise a bank's risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. To establish an appropriate credit risk environment To operate under a sound credit-granting process To maintain an appropriate credit administration, measurement and monitoring process To ensure adequate controls over credit risk. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Tools for Management Of Credit Risk ⇛ Measurement through Credit Rating / scoring ⇛ Pricing on a scientific basis ⇛ Imposing Exposure Ceilings ⇛ Multi-tier credit approving authority ⇛ Higher delegated powers for better rated borrowers ⇛ Discriminatory time for credit review / renewal ⇛ Hurdle rates / benchmarks for fresh exposures & periodicity for renewal based on risk rating. ⇛ Loan Review Mechanism which should be done independent of credit operations & administration and cover all the loans above certain cut-off limit ensuring that at least 30 – 40% of the portfolio is subjected to LRM in a year. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

TOOLS OF CREDIT RISK MANAGEMENT LOAN REVIEW MECHANISM : This should be done independent of credit operations & administration and cover all the loans above certain cut-off limit ensuring that at least 30 – 40% of the portfolio is subjected to LRM in a year. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

HIMS General Lending Principles

Types of Credit Facilities Commercial Loans ◦ Short Term – with tenor of less than 1 year usually repaid through one cash flow cycle ◦ Long Term – with tenor of more than 1 year paid through several cash flow cycles Overdrafts – usually short term in nature to support cash flow gaps but may be structured as line of credit. They are revolving through out the tenor Leases – usually medium to long term to support asset acquisition ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Loan Purposes Seasonal Loans ◦ Caused by temporary build up in accounts receivable/inventory required for normal operations ◦ Repayment comes from conversion of that inventory/receivable to cash after the peak selling season Bridge Loans ◦ Used to fill funding gaps pending next financing ◦ Repayment is made from permanent financing Project Financing ◦ Used for specific financing of capital investments ◦ Repayment is from the future cash flows of the project Lease Finance ◦ Used to support asset acquisition ◦ Repayment may come from the cash flows of the asset financed ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

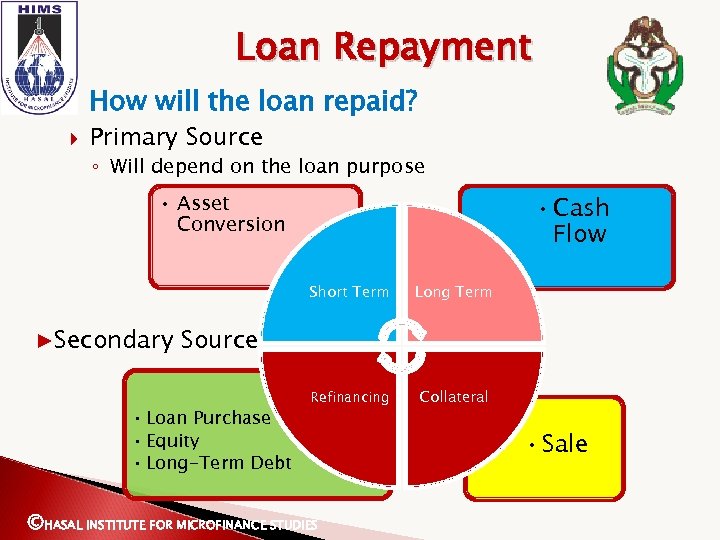

Loan Repayment How will the loan repaid? Primary Source ◦ Will depend on the loan purpose • Asset Conversion • Cash Flow Short Term Long Term Refinancing Collateral ▶Secondary Source • Loan Purchase • Equity • Long-Term Debt ©HASAL INSTITUTE FOR MICROFINANCE STUDIES • Sale

HIMS CREDIT ANALYSIS ‘The Process of determining a borrower’s ability to make timely repayments of a loan’

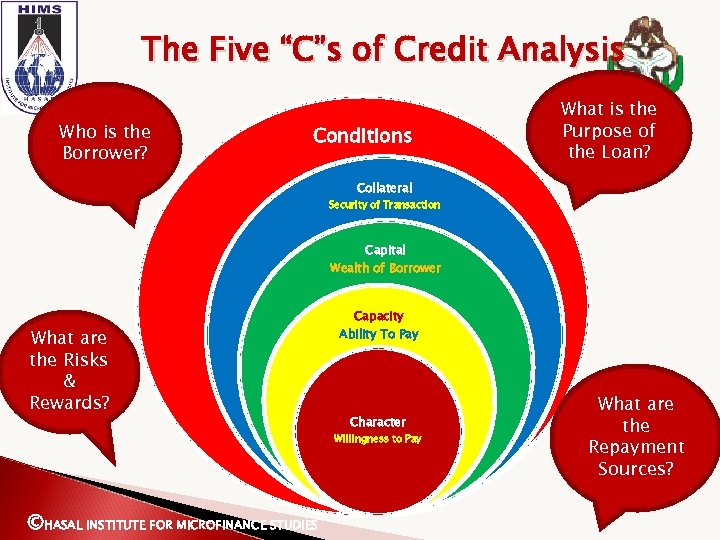

The Five “C”s of Credit Analysis Who is the Borrower? Conditions What is the Purpose of the Loan? Collateral Security of Transaction Capital Wealth of Borrower What are the Risks & Rewards? Capacity Ability To Pay Character Willingness to Pay ©HASAL INSTITUTE FOR MICROFINANCE STUDIES What are the Repayment Sources?

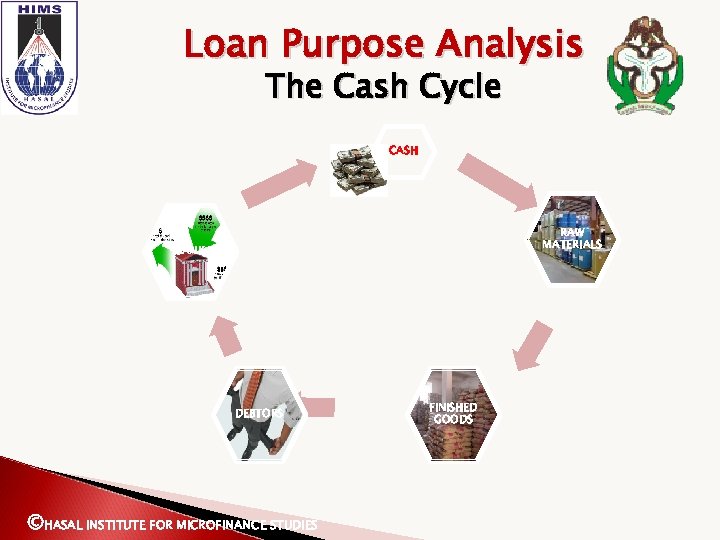

Loan Purpose Analysis The Cash Cycle CASH RAW MATERIALS BANK DEBTORS ©HASAL INSTITUTE FOR MICROFINANCE STUDIES FINISHED GOODS

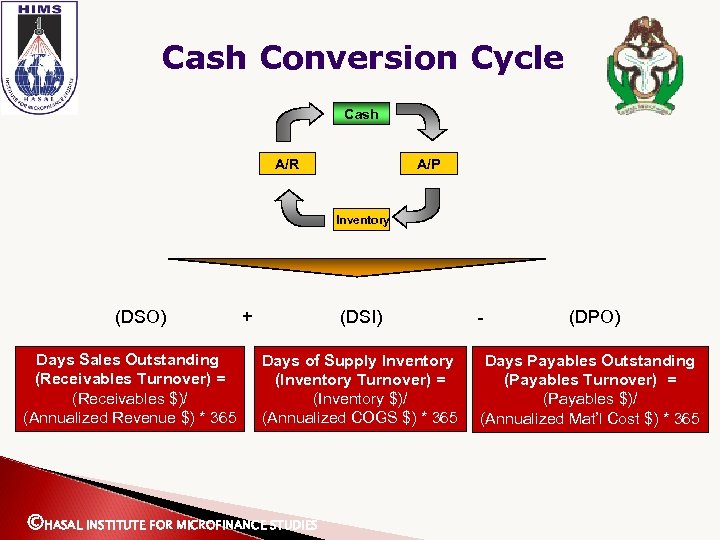

Cash Conversion Cycle Cash A/R A/P Inventory (DSO) Days Sales Outstanding (Receivables Turnover) = (Receivables $)/ (Annualized Revenue $) * 365 + (DSI) Days of Supply Inventory (Inventory Turnover) = (Inventory $)/ (Annualized COGS $) * 365 ©HASAL INSTITUTE FOR MICROFINANCE STUDIES - (DPO) Days Payables Outstanding (Payables Turnover) = (Payables $)/ (Annualized Mat’l Cost $) * 365

HIMS Stages in Credit Processing

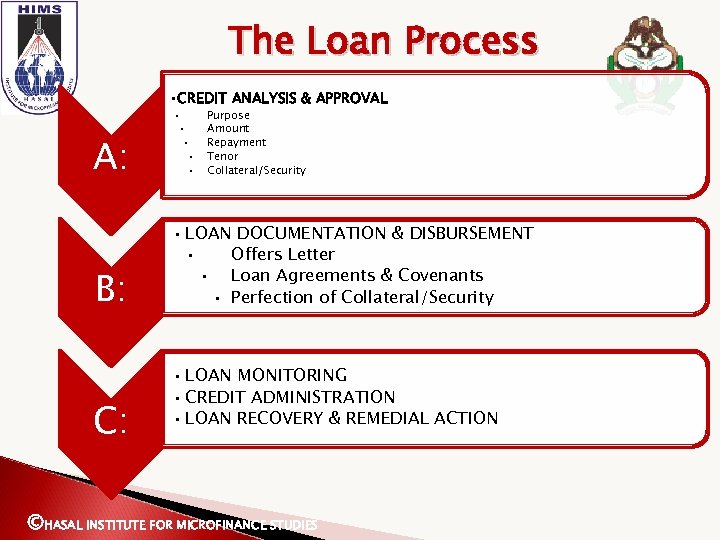

The Loan Process • CREDIT ANALYSIS & APPROVAL A: B: C: • • • Purpose Amount Repayment Tenor Collateral/Security • LOAN DOCUMENTATION & DISBURSEMENT • Offers Letter • Loan Agreements & Covenants • Perfection of Collateral/Security • LOAN MONITORING • CREDIT ADMINISTRATION • LOAN RECOVERY & REMEDIAL ACTION ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

HIMS Fraud Prevention and control FELIX EMENIKE EJINWA JULY 2011

DEFINITION OF FRAUD - 1 DECEIT, TRICKERY; specifically: intentional perversion of truth in order to induce another to part with something of value or to surrender a legal right. An act of deceiving or misrepresenting. Webster Dictionary “To defraud ordinarily means, to deprive a person dishonestly of something which is his or of something to which he is or would or might, but for the perpetration of the fraud, be entitled. ” Felix ©HASAL INSTITUTE FOR MICROFINANCE STUDIESEmenike Ejinwa 7/23/2011 Pa ge 29

DEFINITION OF FRAUD Fraud can be defined as an intentional misrepresentation of facts for the purpose of obtaining personal gain. The above definition exposes three key elements that must exist before it is concluded that a fraud has occurred. Intent Misrepresentation of fact Personal Gain ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

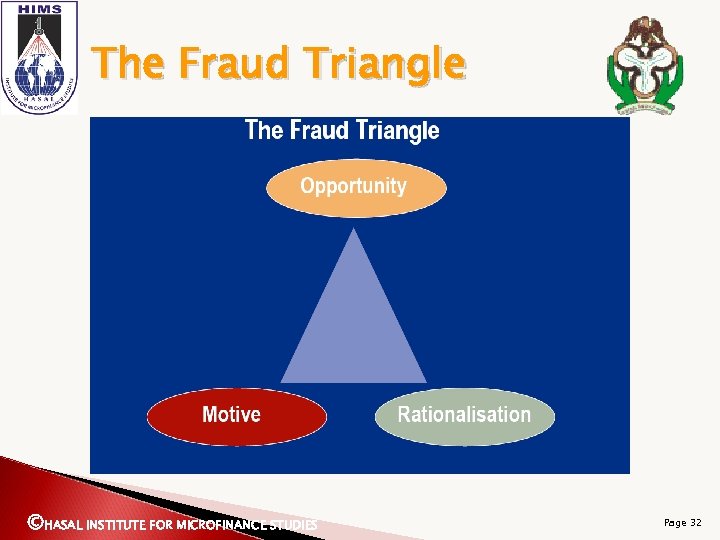

WHY DO FRAUD OCCUR? Some people commit fraud as a result of greed. However, there are three key reasons why fraud occur: ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

The Fraud Triangle ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Page 32

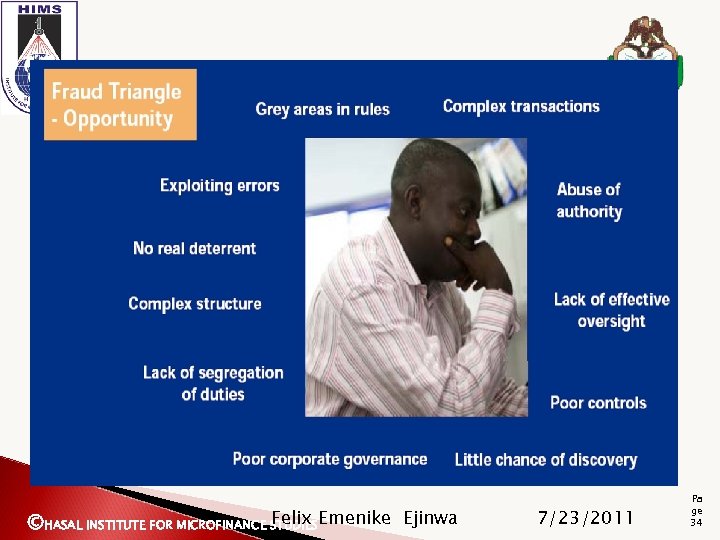

WHY DO FRAUD OCCUR? OPPORTUNITY This is the ability to commit fraud, created by weak internal controls, poor supervision, abuse of position and authority. Failure to establish adequate procedure to detect fraud also creates opportunity ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Felix ©HASAL INSTITUTE FOR MICROFINANCE STUDIESEmenike Ejinwa 7/23/2011 Pa ge 34

WHO IS INVOLVED WITH CONTROLS? YOU Felix ©HASAL INSTITUTE FOR MICROFINANCE STUDIESEmenike Ejinwa YOU 7/23/2011 Pa ge 35

WHY DO FRAUD OCCUR? PRESSURE/MOTIVE Pressure can include anything including unpaid bills, expensive tastes, peer pressure, addition problem e. t. c. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

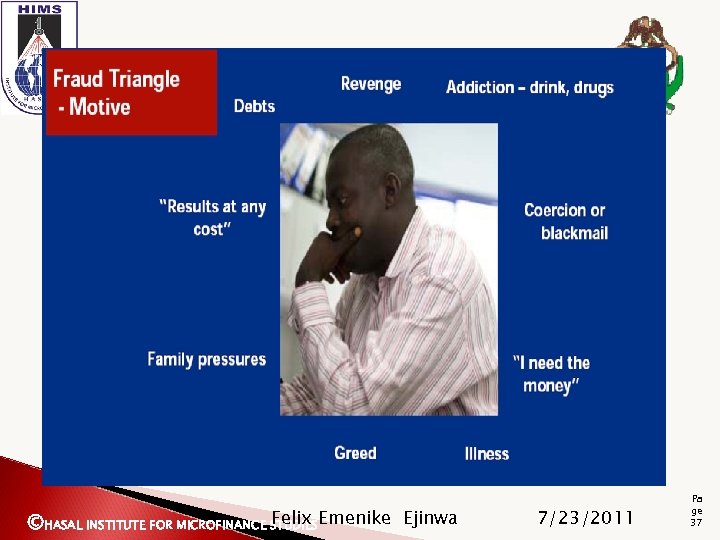

Felix ©HASAL INSTITUTE FOR MICROFINANCE STUDIESEmenike Ejinwa 7/23/2011 Pa ge 37

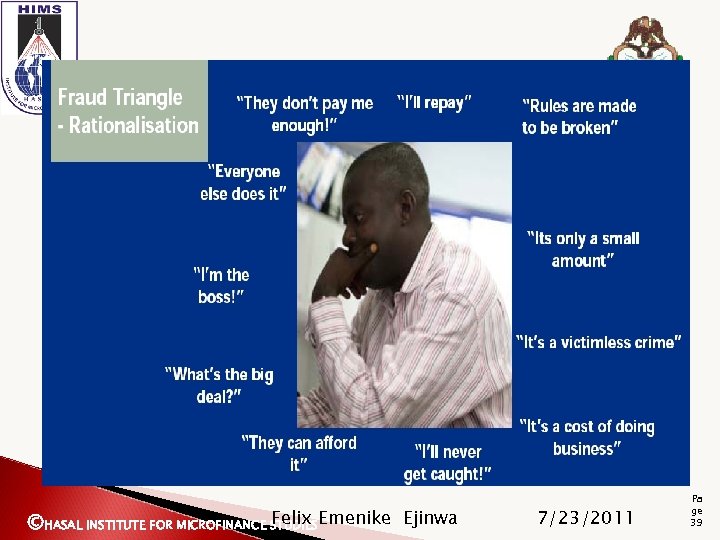

WHY DO FRAUD OCCUR? Ø RATIONALISATION This involves a person rationalizing his/her action to commit fraud i. e. fraud is justified to save a family member from dying, intends to pay back, no help is available from outside. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

Felix ©HASAL INSTITUTE FOR MICROFINANCE STUDIESEmenike Ejinwa 7/23/2011 Pa ge 39

TYPES OF FRAUD IN BANKS Fraud can be classified into: Internal Fraud : committed by employees of the bank External Fraud: by customers and other external parties It is also possible for employees to collude with customers and other external parties to defraud the bank. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FORMS OF INTERNAL FRAUD Cash Theft Stealing of cash from the till or vault, thereby creating a shortage in the books/record Suppression of customer’s deposit Cash is collected from customer but not given any deposit slip, or a deposit slip is issued to the customer but the one to be retained by the bank is destroyed Fraudulent loans The supposed borrower is the bank’s employee or an accomplice Forged Documents Forgery of documents to conceal another theft or fraud ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FORMS OF INTERNAL FRAUD - Contd Fraudulent debits into accounts Unauthorized postings into customers’ or internal accounts Ø Expense ‘Padding’ Inflating prices of items to be purchased or underdelivery of stock Ø Cheque suppression Inward cheques are not debited to customer’s account within the specified clearing days Ø Electronic Card Frauds Fraudulent request to issue electronic card on customer’s accounts or deliberate linking a customer’s account to another customer’s account. Ø ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FORMS OF EXTERNAL FRAUD Stolen cheques Cheque leaves are stolen and customer’s signature forged Forged/Altered cheques Deposit of fake Currencies Issuance of Dud cheques Cheque drawn on unfunded accounts Fraudulent loans Card Frauds ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

EFFECTS OF FRAUD Reduced Profit Damage to Reputation Reduced customer’s confidence Low Morale among employees Cost of Investigation ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD DETECTION The key to detecting fraud is understanding the symptoms. These symptoms are referred to as ‘Red Flags’. Red Flags for fraud by insiders can be grouped into: Personality Traits Domineering/Controlling Don’t like people reviewing their work Strong desire for personal gain “Beat the system” Attitude ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD DETECTION contd Ø Living beyond income level Close relationship with customer/vendors Don’t take vacation Outwardly, appear to be trustworthy Situational Pressure Medical Problems – especially for a loved one Loss of job by spouse Divorce/Marital Problems ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD DETECTION contd Need to maintain a certain lifestyle Addiction Indebtedness Behavioral Changes Suddenly appears to be buying more material items Carry unusual large amount of cash Creditors showing up at work place Borrowing money from coworkers Becomes unreasonably upset when questioned ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD DETECTION contd Ø Others Unexplained difference in account reconciliation Improper recording of transactions Missing documents Duplication Unsupported or unauthorised documents ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD PREVENTION Fraud is a crime and the best means of prevention is to understand why it occurs. Fraudsters generally identify an opportunity for exploiting a weakness in the control procedures and then assess whether their potential rewards will outweigh the penalties should they be caught. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

FRAUD PREVENTION contd Prevention of fraud is a two stage process: ensure that opportunities for fraud are minimised, (fraud prevention), and ensure that potential fraudsters believe they will be caught, (fraud deterrence). ©HASAL INSTITUTE FOR MICROFINANCE STUDIES

TRAITS SHARED BY MOST FRAUDSTERS Male Intelligent (challenged by “secure” systems, bored with the job routine) Egotistical (scornful of "obvious" control flaws, "dumb" managers, etc. ) Inquisitive (tempted by the discovery of a computer vulnerability, for example) A risk taker (willing to bend the rules, take chances) A rule breaker (takes short cuts, self-justifies infractions of law, rules, etc. ) A hard worker (first to arrive in the morning, last to leave at night, takes few vacations) Under stress (suffering from a personal crisis, such as a financial problem, bad marriage, etc. ) Greedy or has a genuine financial need (illness, drugs, gambling, etc. ) Disgruntled at work or a complainer (may try to "get even", or take what he/she "really deserves") A big spender (expensive hobbies, living beyond means) ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 51

WHAT YOU SHOULD KNOW ABOUT FRAUD The Don’ts: Don’t take anything for granted. Don’t volunteer confidential information over the telephone/telex/fax unless you know and trust those who are inquiring. Don’t allow customers to pressure you into making impulsive decisions. Don’t give value against uncleared payment items. Don’t accept third-party cheques from new customers without a senior manager’s authorization. Don’t cash cheques for strangers. Don’t transfer funds without first obtaining proper authorizations. Don’t discuss internal operations or systems with outsiders. Don’t write to suspicious individuals on company stationery. Don’t be afraid to contact the police if you have suspicions about certain customers and their respective business dealings. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 52

WHAT YOU SHOULD KNOW ABOUT FRAUD (Cont’d) Be Cautious Always resist promises of inordinately high returns and guarantees of endless supplies of funding. Nothing ever comes for free. Think twice when you are presented with confusing business proposals or when potential business partners supply vague answers. And should you ever be requested to provide letters printed on your company letterhead, outlining potential new business relationships, always decline. Remember, you are the only one who can save yourself from fraud. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 53

REPORT SUSPICIONS The average person is totally unaware of the magnitude of fraudulent activity that occurs on an ongoing basis. Having gone through this workshop to this point, you should understand its far-reaching effects and be able to better identify examples of this crime. It cannot be emphasized strongly enough that unfamiliar companies need to be investigated thoroughly if you are contemplating a business association with them. Walk away from questionable activities: never be afraid or too embarrassed to immediately report them to your local police departments. These authorities are there to help you to deter new and repeat offenders. They receive regular updates on successful and unsuccessful frauds, and will often recognize a particular fraudster’s method of operation. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 54

REPORT SUSPICIONS (Cont’d) Anticipate criminal activity If you become suspicious of a recently established business relationship, terminate it. Companies can appear straight-forward at the outset. Once they have earned your trust, they may subsequently initiate criminal activity. Similarly, terminate long-term business dealings with associate companies if management, for some reason, begins to act abnormally. Take nothing for granted. Also, be cautious of those approaching you professing to represent legitimate banks. If they offer to deal with your company and you are unfamiliar with their financial institutions, refer to such publications as the Bankers’ Almanac, etc which can be found at local library. They list all the major international banks, their histories, ownership status, and assets and liabilities. Above all, remember, if a deal looks too good to be true, it very likely is – and usually involves fraud. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 55

WHAT WE SHOULD DO ABOUT THIS? Training ◦ ◦ ◦ Management Associates Operations/Control staff Marketing/RMs Credit Officers Management Sharing experience with/of other Financial Institutions Learning from experiences Selectively fighting back (but …. CARE? ) ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 56

MINIMIZING THE RISK Learn from our mistakes (and from the mistakes of others) Run training courses – Fraud Awareness for Bankers in all jobs. Maintain specialist investigation teams Maintain a Network of Contacts (“I know a person. . ”) Ensure that bankers remain professionally skeptical and are never too embarrassed to say “I do not understand” Deal quickly, thoroughly and efficiently with all cases, hitting the Fraudsters where it hurts most (in their wallets) Design fraud out of a systems and processes. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 57

What Are The Tools Available To Perform The Control Functions? Accounting and Procedure Manual Local Policies and Procedures Credit Manuals System Manual Desk Manuals ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 58

WHAT HAPPENS IF WE HAVE POOR CONTROLS? Operating Losses Reporting Errors System/Dev. Fiascos Corporate Embarrassment Fraud ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 59

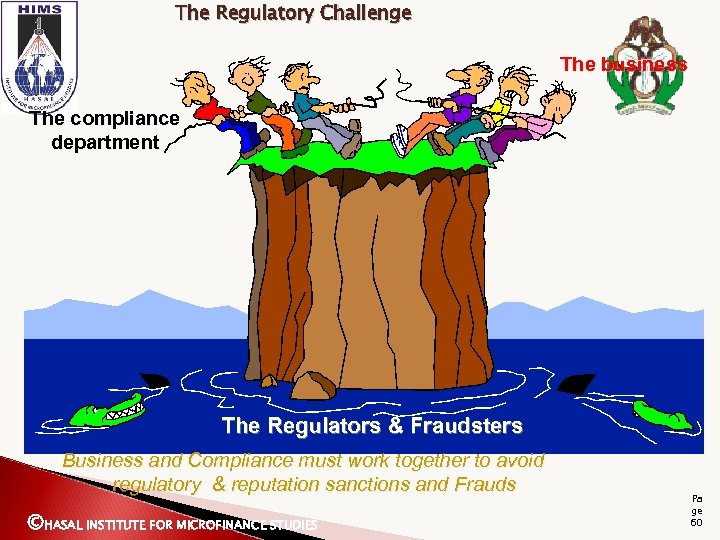

The Regulatory Challenge The business The compliance department The Regulators & Fraudsters Business and Compliance must work together to avoid regulatory & reputation sanctions and Frauds ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 60

Internal Audit & Control Function ØInternal audit being an integral part of banks internal control system functions as an independent, objective assurance and consulting activity designed to add value and improve the banks operations. ØIt is a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and corporate governance processes. ØInternal audit reviews and ensures integrity of information, compliance with policies and regulations, safeguarding of assets and efficient use of resources. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES 61

Independence of Internal Audit Function & Ethics ØTo function as the main machinery for the maintenance of internal controls, the auditor must be independent and given unrestricted access to information and records. ØHe should report directly to the Board Audit Committee and also administratively to the MD/CEO as well as coordinate audit activities with external auditors and examiners (CBN/NDIC). ØHigh premium is placed on effective staffing of the internal audit department with highly skilled, competent, and independent people of high integrity. ØThe internal auditor is not expected to perform operational duties and his performance should not be based on profit or revenue goals. ØHis independence therefore facilitates his functional role for safeguarding assets, ensure compliance with internal policies and procedures as well as laws and regulations. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES 62

Summary & Conclusions • The role of independent, competent and qualified auditors facilitates the internal control function which are vital to the corporate governance process in order to achieve the objective of safeguarding stakeholders’ interests. • In particular, internal auditors should facilitate the control function to provide an independent check and assurance on the information received from management on the operations and performance of the bank. • This goes a long way in determining the long-term soundness of the bank to sustain the going concern. ©HASAL INSTITUTE FOR MICROFINANCE STUDIES 63

Questions & Issues ©HASAL INSTITUTE FOR MICROFINANCE STUDIES Pa ge 64

Thank you. Pa ge 65

110279bea77f3311af394f4a09473cbb.ppt