783a641dd95c704e38853431e2da8735.ppt

- Количество слайдов: 18

HILA-AIDA SUMMIT, Athens - Greece, 07 – 09 May 2014 W orking P a rty: D istribution of I nsura nce P r o d u c t s Cross selling practices in financial products and transparency implications Alkistis Christofilou, Partner - Rokas (Athens) 08. 05. 2014

HILA-AIDA SUMMIT, Athens - Greece, 07 – 09 May 2014 W orking P a rty: D istribution of I nsura nce P r o d u c t s Cross selling practices in financial products and transparency implications Alkistis Christofilou, Partner - Rokas (Athens) 08. 05. 2014

IMD 2 Article 21 a para. 1 - Tying and bundling practices When insurance is offered together with another service or ancillary product n as part of a package or the same agreement or package, n the insurance intermediary or the insurance undertaking n shall inform and offer the customer the possibility of buying the different components jointly or separately n [and] provide for a separate evidence of the premium or prices of each component. HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 2 © Alkistis Christofilou - Partner

IMD 2 Article 21 a para. 1 - Tying and bundling practices When insurance is offered together with another service or ancillary product n as part of a package or the same agreement or package, n the insurance intermediary or the insurance undertaking n shall inform and offer the customer the possibility of buying the different components jointly or separately n [and] provide for a separate evidence of the premium or prices of each component. HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 2 © Alkistis Christofilou - Partner

IMD 2 – alignment to Mi. FID 2 n IMD 2 Recital 9: distribution of insurance contracts including investment products should: Ø be aligned between IMD 2 and Mi. FID 2 Ø Minimum standards must be raised to create level playing field for all packaged insurance investment products Ø Mi. FID 2 sets high and detailed standards of transparency and care for suitability of customer’s investment needs n Mi. FID 2 Article 24 para. 11: only duty to inform customers whether they can buy the component services separately and to provide for a separate evidence of the costs and charges of each component. HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 3 © Alkistis Christofilou - Partner

IMD 2 – alignment to Mi. FID 2 n IMD 2 Recital 9: distribution of insurance contracts including investment products should: Ø be aligned between IMD 2 and Mi. FID 2 Ø Minimum standards must be raised to create level playing field for all packaged insurance investment products Ø Mi. FID 2 sets high and detailed standards of transparency and care for suitability of customer’s investment needs n Mi. FID 2 Article 24 para. 11: only duty to inform customers whether they can buy the component services separately and to provide for a separate evidence of the costs and charges of each component. HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 3 © Alkistis Christofilou - Partner

Tying and bundling – IMD 2 Definitions n Article 2. 1. (19): “tying practice” means Ø the offering or the selling of an insurance product in a package with other distinct ancillary products or services Ø where the insurance product is not made available to the consumer separately n => “Tying practices”: where the various components are not available to buy on a standalone basis –> not allowed n Article 2. 1. (20): “bundling practice” … Ø where the insurance product is also made available to the consumer separately but not necessarily on the same terms and conditions as when offered bundled with the ancillary services n => “Bundling practices”: where the various components of a contract can be bought separately -> allowed HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 4 © Alkistis Christofilou - Partner

Tying and bundling – IMD 2 Definitions n Article 2. 1. (19): “tying practice” means Ø the offering or the selling of an insurance product in a package with other distinct ancillary products or services Ø where the insurance product is not made available to the consumer separately n => “Tying practices”: where the various components are not available to buy on a standalone basis –> not allowed n Article 2. 1. (20): “bundling practice” … Ø where the insurance product is also made available to the consumer separately but not necessarily on the same terms and conditions as when offered bundled with the ancillary services n => “Bundling practices”: where the various components of a contract can be bought separately -> allowed HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 4 © Alkistis Christofilou - Partner

Examples of cross-selling practices – Is there a risk to the consumer? n What is a “Gateway” product: current account, mortgage loan, investment scheme, various insurances Examples: n Current bank account bundled with travel insurance, mobile phone insurance, roadside recovery n Mortgage loan with fire insurance and life / incapacitation insurance n Health insurance bundled with life insurance linked to investment n Municipalities and regional authorities buying complex structured investment products in combination with deposits HILA-AIDA SUMMIT, Athens - Greece n Bundling : is coupled with loyalty or volume preferential contract Working Party Distribution of Insurance Products © Alkistis Christofilou - Partner conditions 5 08. 05. 2014

Examples of cross-selling practices – Is there a risk to the consumer? n What is a “Gateway” product: current account, mortgage loan, investment scheme, various insurances Examples: n Current bank account bundled with travel insurance, mobile phone insurance, roadside recovery n Mortgage loan with fire insurance and life / incapacitation insurance n Health insurance bundled with life insurance linked to investment n Municipalities and regional authorities buying complex structured investment products in combination with deposits HILA-AIDA SUMMIT, Athens - Greece n Bundling : is coupled with loyalty or volume preferential contract Working Party Distribution of Insurance Products © Alkistis Christofilou - Partner conditions 5 08. 05. 2014

IMD 2 Article 21 a para. 2 – explaining the risk n Where the risks resulting from such an agreement or package offered to a customer are likely to be different from the risks associated with the components taken separately Ø the insurance intermediary or undertaking shall upon the customer’s request n * IMD 2 Recital 21: The directive is an important step towards increased level of consumer protection and internal market integration Ø provide an adequate description of the different components of the agreement or package Ø and the way in which its interaction alters the risks. n ** KIID PRIIPs Reg– Key information document for investment & insurance products HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 6 © Alkistis Christofilou - Partner

IMD 2 Article 21 a para. 2 – explaining the risk n Where the risks resulting from such an agreement or package offered to a customer are likely to be different from the risks associated with the components taken separately Ø the insurance intermediary or undertaking shall upon the customer’s request n * IMD 2 Recital 21: The directive is an important step towards increased level of consumer protection and internal market integration Ø provide an adequate description of the different components of the agreement or package Ø and the way in which its interaction alters the risks. n ** KIID PRIIPs Reg– Key information document for investment & insurance products HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 6 © Alkistis Christofilou - Partner

IMD 2 Article 21 a para. 4 – Advising on packaged products n Member States shall ensure that where an insurance intermediary or an insurance undertaking provides advice, it ensures that the overall package meets the demands and needs of the customer => Mi. FID 2; duty to investigate and understand customer needs n Article 1. 9: Advice is the personal recommendation to a customer, either upon request or at the initiative of the insurance intermediary or undertaking HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 7 © Alkistis Christofilou - Partner

IMD 2 Article 21 a para. 4 – Advising on packaged products n Member States shall ensure that where an insurance intermediary or an insurance undertaking provides advice, it ensures that the overall package meets the demands and needs of the customer => Mi. FID 2; duty to investigate and understand customer needs n Article 1. 9: Advice is the personal recommendation to a customer, either upon request or at the initiative of the insurance intermediary or undertaking HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 7 © Alkistis Christofilou - Partner

Is cross-selling a good or a bad thing? n IMD 2 Recital 41 Ø cross-selling practices are a common and appropriate strategy for retail financial service providers throughout the Union n IMD 2 Recital 41 a Ø When insurance is offered together with another service or product as part of a package or as a condition for the same agreement or package, it is subject to Directive 2005/29/EC on Unfair Commercial Practices HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 8 © Alkistis Christofilou - Partner

Is cross-selling a good or a bad thing? n IMD 2 Recital 41 Ø cross-selling practices are a common and appropriate strategy for retail financial service providers throughout the Union n IMD 2 Recital 41 a Ø When insurance is offered together with another service or product as part of a package or as a condition for the same agreement or package, it is subject to Directive 2005/29/EC on Unfair Commercial Practices HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 8 © Alkistis Christofilou - Partner

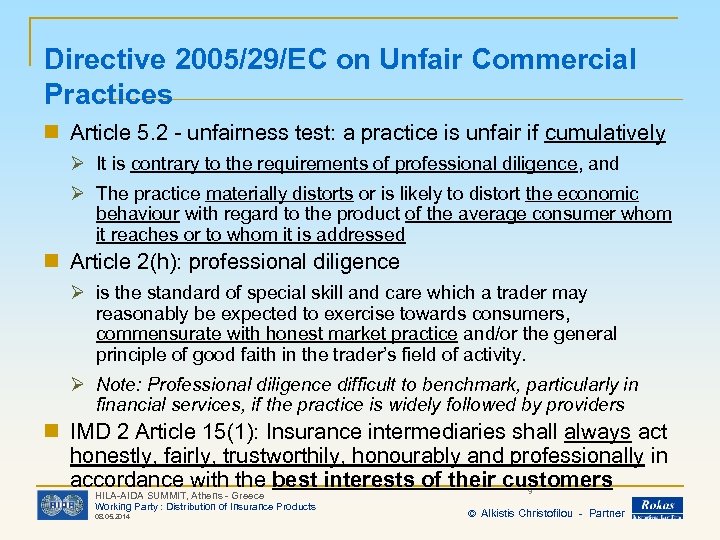

Directive 2005/29/EC on Unfair Commercial Practices n Article 5. 2 - unfairness test: a practice is unfair if cumulatively Ø It is contrary to the requirements of professional diligence, and Ø The practice materially distorts or is likely to distort the economic behaviour with regard to the product of the average consumer whom it reaches or to whom it is addressed n Article 2(h): professional diligence Ø is the standard of special skill and care which a trader may reasonably be expected to exercise towards consumers, commensurate with honest market practice and/or the general principle of good faith in the trader’s field of activity. Ø Note: Professional diligence difficult to benchmark, particularly in financial services, if the practice is widely followed by providers n IMD 2 Article 15(1): Insurance intermediaries shall always act honestly, fairly, trustworthily, honourably and professionally in accordance with the best interests of their customers HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 9 © Alkistis Christofilou - Partner

Directive 2005/29/EC on Unfair Commercial Practices n Article 5. 2 - unfairness test: a practice is unfair if cumulatively Ø It is contrary to the requirements of professional diligence, and Ø The practice materially distorts or is likely to distort the economic behaviour with regard to the product of the average consumer whom it reaches or to whom it is addressed n Article 2(h): professional diligence Ø is the standard of special skill and care which a trader may reasonably be expected to exercise towards consumers, commensurate with honest market practice and/or the general principle of good faith in the trader’s field of activity. Ø Note: Professional diligence difficult to benchmark, particularly in financial services, if the practice is widely followed by providers n IMD 2 Article 15(1): Insurance intermediaries shall always act honestly, fairly, trustworthily, honourably and professionally in accordance with the best interests of their customers HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 9 © Alkistis Christofilou - Partner

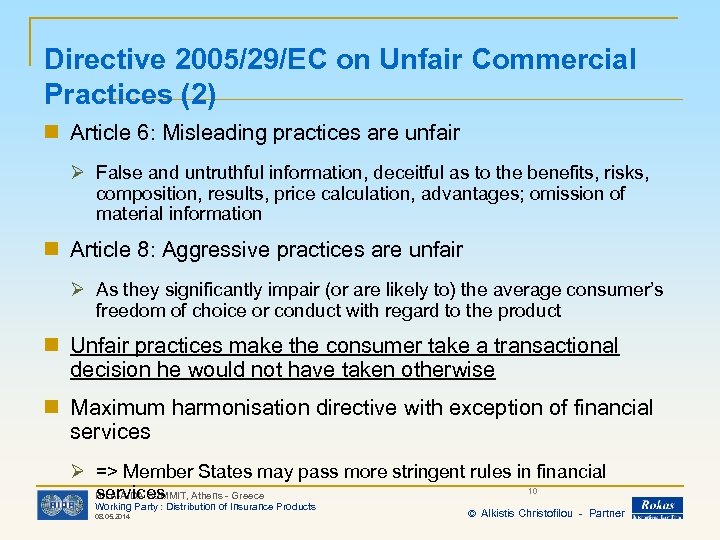

Directive 2005/29/EC on Unfair Commercial Practices (2) n Article 6: Misleading practices are unfair Ø False and untruthful information, deceitful as to the benefits, risks, composition, results, price calculation, advantages; omission of material information n Article 8: Aggressive practices are unfair Ø As they significantly impair (or are likely to) the average consumer’s freedom of choice or conduct with regard to the product n Unfair practices make the consumer take a transactional decision he would not have taken otherwise n Maximum harmonisation directive with exception of financial services Ø => Member States may pass more stringent rules in financial 10 HILA-AIDA SUMMIT, Athens - Greece services Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

Directive 2005/29/EC on Unfair Commercial Practices (2) n Article 6: Misleading practices are unfair Ø False and untruthful information, deceitful as to the benefits, risks, composition, results, price calculation, advantages; omission of material information n Article 8: Aggressive practices are unfair Ø As they significantly impair (or are likely to) the average consumer’s freedom of choice or conduct with regard to the product n Unfair practices make the consumer take a transactional decision he would not have taken otherwise n Maximum harmonisation directive with exception of financial services Ø => Member States may pass more stringent rules in financial 10 HILA-AIDA SUMMIT, Athens - Greece services Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

From cross-selling to mis-selling n Aggressive sales practices Ø Pressure and inertia selling Ø Churning Ø Steering HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 11 © Alkistis Christofilou - Partner

From cross-selling to mis-selling n Aggressive sales practices Ø Pressure and inertia selling Ø Churning Ø Steering HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 11 © Alkistis Christofilou - Partner

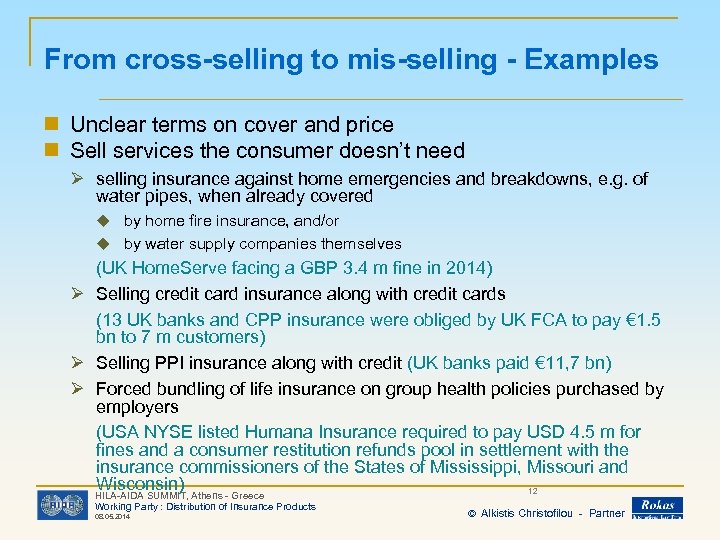

From cross-selling to mis-selling - Examples n Unclear terms on cover and price n Sell services the consumer doesn’t need Ø selling insurance against home emergencies and breakdowns, e. g. of water pipes, when already covered u by home fire insurance, and/or u by water supply companies themselves (UK Home. Serve facing a GBP 3. 4 m fine in 2014) Ø Selling credit card insurance along with credit cards (13 UK banks and CPP insurance were obliged by UK FCA to pay € 1. 5 bn to 7 m customers) Ø Selling PPI insurance along with credit (UK banks paid € 11, 7 bn) Ø Forced bundling of life insurance on group health policies purchased by employers (USA NYSE listed Humana Insurance required to pay USD 4. 5 m for fines and a consumer restitution refunds pool in settlement with the insurance commissioners of the States of Mississippi, Missouri and Wisconsin) 12 HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

From cross-selling to mis-selling - Examples n Unclear terms on cover and price n Sell services the consumer doesn’t need Ø selling insurance against home emergencies and breakdowns, e. g. of water pipes, when already covered u by home fire insurance, and/or u by water supply companies themselves (UK Home. Serve facing a GBP 3. 4 m fine in 2014) Ø Selling credit card insurance along with credit cards (13 UK banks and CPP insurance were obliged by UK FCA to pay € 1. 5 bn to 7 m customers) Ø Selling PPI insurance along with credit (UK banks paid € 11, 7 bn) Ø Forced bundling of life insurance on group health policies purchased by employers (USA NYSE listed Humana Insurance required to pay USD 4. 5 m for fines and a consumer restitution refunds pool in settlement with the insurance commissioners of the States of Mississippi, Missouri and Wisconsin) 12 HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

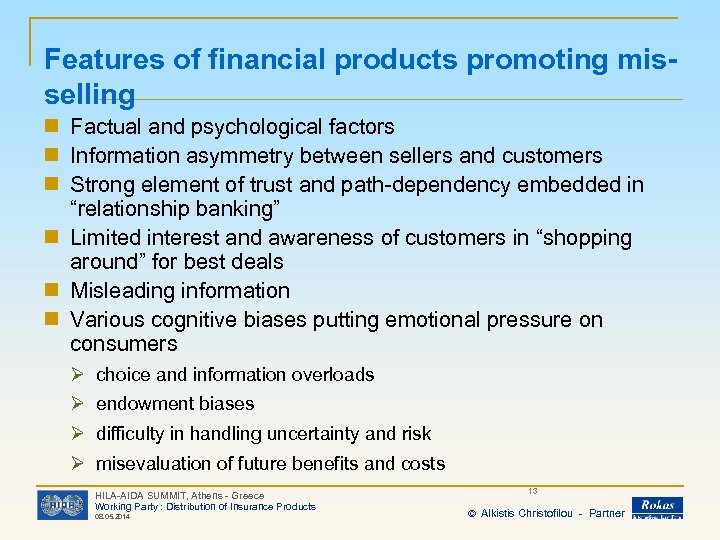

Features of financial products promoting misselling n Factual and psychological factors n Information asymmetry between sellers and customers n Strong element of trust and path-dependency embedded in “relationship banking” n Limited interest and awareness of customers in “shopping around” for best deals n Misleading information n Various cognitive biases putting emotional pressure on consumers Ø choice and information overloads Ø endowment biases Ø difficulty in handling uncertainty and risk Ø misevaluation of future benefits and costs HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 13 © Alkistis Christofilou - Partner

Features of financial products promoting misselling n Factual and psychological factors n Information asymmetry between sellers and customers n Strong element of trust and path-dependency embedded in “relationship banking” n Limited interest and awareness of customers in “shopping around” for best deals n Misleading information n Various cognitive biases putting emotional pressure on consumers Ø choice and information overloads Ø endowment biases Ø difficulty in handling uncertainty and risk Ø misevaluation of future benefits and costs HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 13 © Alkistis Christofilou - Partner

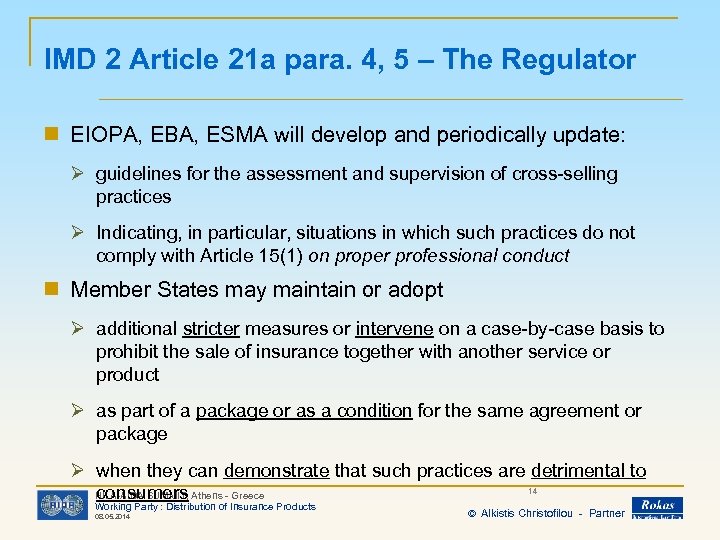

IMD 2 Article 21 a para. 4, 5 – The Regulator n EIOPA, EBA, ESMA will develop and periodically update: Ø guidelines for the assessment and supervision of cross-selling practices Ø Indicating, in particular, situations in which such practices do not comply with Article 15(1) on proper professional conduct n Member States may maintain or adopt Ø additional stricter measures or intervene on a case-by-case basis to prohibit the sale of insurance together with another service or product Ø as part of a package or as a condition for the same agreement or package Ø when they can demonstrate that such practices are detrimental to 14 HILA-AIDA SUMMIT, Athens - Greece consumers Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

IMD 2 Article 21 a para. 4, 5 – The Regulator n EIOPA, EBA, ESMA will develop and periodically update: Ø guidelines for the assessment and supervision of cross-selling practices Ø Indicating, in particular, situations in which such practices do not comply with Article 15(1) on proper professional conduct n Member States may maintain or adopt Ø additional stricter measures or intervene on a case-by-case basis to prohibit the sale of insurance together with another service or product Ø as part of a package or as a condition for the same agreement or package Ø when they can demonstrate that such practices are detrimental to 14 HILA-AIDA SUMMIT, Athens - Greece consumers Working Party : Distribution of Insurance Products 08. 05. 2014 © Alkistis Christofilou - Partner

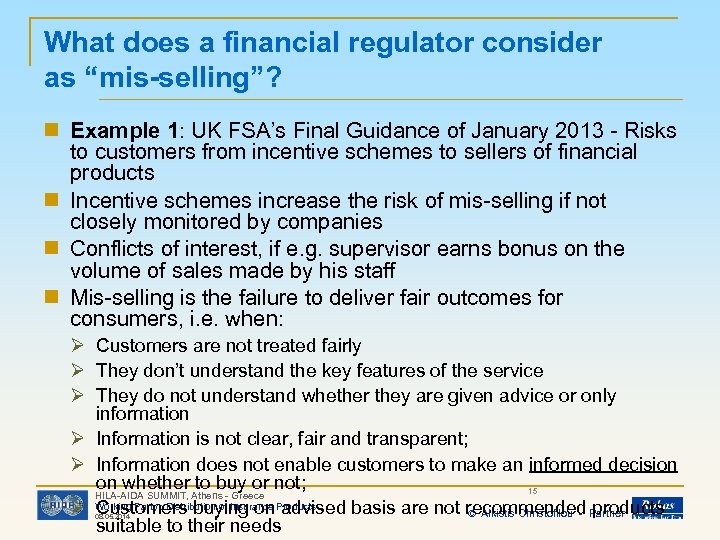

What does a financial regulator consider as “mis-selling”? n Example 1: UK FSA’s Final Guidance of January 2013 - Risks to customers from incentive schemes to sellers of financial products n Incentive schemes increase the risk of mis-selling if not closely monitored by companies n Conflicts of interest, if e. g. supervisor earns bonus on the volume of sales made by his staff n Mis-selling is the failure to deliver fair outcomes for consumers, i. e. when: Ø Customers are not treated fairly Ø They don’t understand the key features of the service Ø They do not understand whether they are given advice or only information Ø Information is not clear, fair and transparent; Ø Information does not enable customers to make an informed decision on whether to buy or not; 15 HILA-AIDA SUMMIT, Athens - Greece Ø Working Party : Distribution of Insurance Products Customers buying on advised basis are not recommended Partner © Alkistis Christofilou - products suitable to their needs 08. 05. 2014

What does a financial regulator consider as “mis-selling”? n Example 1: UK FSA’s Final Guidance of January 2013 - Risks to customers from incentive schemes to sellers of financial products n Incentive schemes increase the risk of mis-selling if not closely monitored by companies n Conflicts of interest, if e. g. supervisor earns bonus on the volume of sales made by his staff n Mis-selling is the failure to deliver fair outcomes for consumers, i. e. when: Ø Customers are not treated fairly Ø They don’t understand the key features of the service Ø They do not understand whether they are given advice or only information Ø Information is not clear, fair and transparent; Ø Information does not enable customers to make an informed decision on whether to buy or not; 15 HILA-AIDA SUMMIT, Athens - Greece Ø Working Party : Distribution of Insurance Products Customers buying on advised basis are not recommended Partner © Alkistis Christofilou - products suitable to their needs 08. 05. 2014

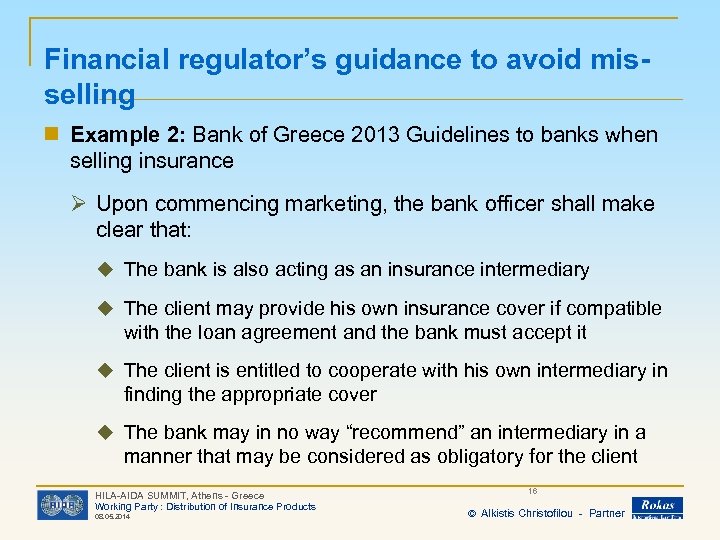

Financial regulator’s guidance to avoid misselling n Example 2: Bank of Greece 2013 Guidelines to banks when selling insurance Ø Upon commencing marketing, the bank officer shall make clear that: u The bank is also acting as an insurance intermediary u The client may provide his own insurance cover if compatible with the loan agreement and the bank must accept it u The client is entitled to cooperate with his own intermediary in finding the appropriate cover u The bank may in no way “recommend” an intermediary in a manner that may be considered as obligatory for the client HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 16 © Alkistis Christofilou - Partner

Financial regulator’s guidance to avoid misselling n Example 2: Bank of Greece 2013 Guidelines to banks when selling insurance Ø Upon commencing marketing, the bank officer shall make clear that: u The bank is also acting as an insurance intermediary u The client may provide his own insurance cover if compatible with the loan agreement and the bank must accept it u The client is entitled to cooperate with his own intermediary in finding the appropriate cover u The bank may in no way “recommend” an intermediary in a manner that may be considered as obligatory for the client HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 16 © Alkistis Christofilou - Partner

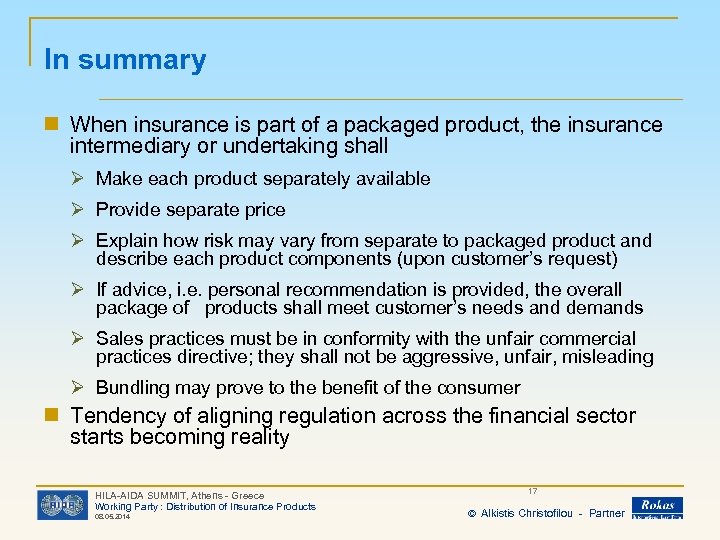

In summary n When insurance is part of a packaged product, the insurance intermediary or undertaking shall Ø Make each product separately available Ø Provide separate price Ø Explain how risk may vary from separate to packaged product and describe each product components (upon customer’s request) Ø If advice, i. e. personal recommendation is provided, the overall package of products shall meet customer’s needs and demands Ø Sales practices must be in conformity with the unfair commercial practices directive; they shall not be aggressive, unfair, misleading Ø Bundling may prove to the benefit of the consumer n Tendency of aligning regulation across the financial sector starts becoming reality HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 17 © Alkistis Christofilou - Partner

In summary n When insurance is part of a packaged product, the insurance intermediary or undertaking shall Ø Make each product separately available Ø Provide separate price Ø Explain how risk may vary from separate to packaged product and describe each product components (upon customer’s request) Ø If advice, i. e. personal recommendation is provided, the overall package of products shall meet customer’s needs and demands Ø Sales practices must be in conformity with the unfair commercial practices directive; they shall not be aggressive, unfair, misleading Ø Bundling may prove to the benefit of the consumer n Tendency of aligning regulation across the financial sector starts becoming reality HILA-AIDA SUMMIT, Athens - Greece Working Party : Distribution of Insurance Products 08. 05. 2014 17 © Alkistis Christofilou - Partner

HILA-AIDA SUMMIT, Athens - Greece, 07 – 09 May 2014 W orking P a rty: D istribution of I nsura nce P r o d u c t s © Alkistis Christofilou - Partner

HILA-AIDA SUMMIT, Athens - Greece, 07 – 09 May 2014 W orking P a rty: D istribution of I nsura nce P r o d u c t s © Alkistis Christofilou - Partner