7a61e332e5b1ddb6c1e65b94cc2cb359.ppt

- Количество слайдов: 26

Highways Agency Market Consultation Event End User Computing (EUC) services 27 th March 2014

Highways Agency Market Consultation Event End User Computing (EUC) services 27 th March 2014

Agenda • Introduction • • • Purpose of today Part 1 - Highways Agency roles and responsibilities Part 2 – Future ICT sourcing programme • • • Part 3 – Scope of EUC Part 4 - Procurement Strategy / Next steps Q and A session

Agenda • Introduction • • • Purpose of today Part 1 - Highways Agency roles and responsibilities Part 2 – Future ICT sourcing programme • • • Part 3 – Scope of EUC Part 4 - Procurement Strategy / Next steps Q and A session

Purpose of the event To provide potential suppliers with a brief introduction to: § The role and responsibilities of the Highways Agency. § The objectives of the HA Future ICT (FICT) programme. § The scope of the End User Computing (EUC) service. § Understand how our requirements can be delivered by the market place. § Continue engagement and collect feedback. We are committed to making this a success.

Purpose of the event To provide potential suppliers with a brief introduction to: § The role and responsibilities of the Highways Agency. § The objectives of the HA Future ICT (FICT) programme. § The scope of the End User Computing (EUC) service. § Understand how our requirements can be delivered by the market place. § Continue engagement and collect feedback. We are committed to making this a success.

PART 1 Highways Agency (HA) roles and responsibilities

PART 1 Highways Agency (HA) roles and responsibilities

Context § § OJEU for EUC Tower ended November 2013 with no bids HA were constrained by Cabinet Office to a 2 year term HA commissioned an independent review Aim is to listen to the market and work with you to ensure success Feedback from the original competition: § Term – a longer term would be preferable; § Engagement – greater engagement; § Timing - response period should be longer; § Requirements- okay, but some SLA s onerous and some revisions made; § TUPE- information required; Feedback from questionnaires so far corroborates this.

Context § § OJEU for EUC Tower ended November 2013 with no bids HA were constrained by Cabinet Office to a 2 year term HA commissioned an independent review Aim is to listen to the market and work with you to ensure success Feedback from the original competition: § Term – a longer term would be preferable; § Engagement – greater engagement; § Timing - response period should be longer; § Requirements- okay, but some SLA s onerous and some revisions made; § TUPE- information required; Feedback from questionnaires so far corroborates this.

Who we are and what we do § Executive Agency of the Department for Transport (Df. T), established 1994. § To become a Government-owned company from spring 2015. § Responsible for operating and maintaining the Strategic Road Network in England; 6, 500 miles of motorway and trunk road network, which accounts for 34% of all UK road travel and 67% of UK freight travel. § Build and manage roads through supplier partnerships. § Manage £ 109 bn of assets. § Traffic Officer Service to help keep the traffic flowing.

Who we are and what we do § Executive Agency of the Department for Transport (Df. T), established 1994. § To become a Government-owned company from spring 2015. § Responsible for operating and maintaining the Strategic Road Network in England; 6, 500 miles of motorway and trunk road network, which accounts for 34% of all UK road travel and 67% of UK freight travel. § Build and manage roads through supplier partnerships. § Manage £ 109 bn of assets. § Traffic Officer Service to help keep the traffic flowing.

Organisational structure

Organisational structure

Personnel and hours § A mix of office-based and on-road staff, approximately 3, 800 – all reliant on ICT services. § Office based staff hours: 0700 – 1900 Monday – Friday. § Traffic Officers, RCC and NTOC hours: 24/7, 365 days a year.

Personnel and hours § A mix of office-based and on-road staff, approximately 3, 800 – all reliant on ICT services. § Office based staff hours: 0700 – 1900 Monday – Friday. § Traffic Officers, RCC and NTOC hours: 24/7, 365 days a year.

Locations § 8 main offices; Bedford, Birmingham (largest office), Bristol, Dorking, Exeter, Leeds (majority of ICT staff), Manchester and York; New office in Guildford to replace Dorking, approx 2, 000 personnel in total. § 7 Regional Control Centres (RCCs); approx. 650 personnel. § 1 National Traffic Operating Centre (NTOC); approx. 90 personnel. § 33 outstations; approx. 1, 090 personnel § 60 home workers. § External stakeholders (suppliers, managing agents etc. ).

Locations § 8 main offices; Bedford, Birmingham (largest office), Bristol, Dorking, Exeter, Leeds (majority of ICT staff), Manchester and York; New office in Guildford to replace Dorking, approx 2, 000 personnel in total. § 7 Regional Control Centres (RCCs); approx. 650 personnel. § 1 National Traffic Operating Centre (NTOC); approx. 90 personnel. § 33 outstations; approx. 1, 090 personnel § 60 home workers. § External stakeholders (suppliers, managing agents etc. ).

PART 2 HA Future ICT (FICT) programme

PART 2 HA Future ICT (FICT) programme

Future ICT (FICT) programme § The HA Future ICT programme (abbreviated as FICT) will deliver the next generation of ICT services for the Highways Agency. § FICT will implement a ‘Service Tower’ model in line with current Government ICT strategy, with one or more contracts supporting each Tower. § Each Service Tower is being delivered as a project within the overall FICT programme. § There are 6 projects in total.

Future ICT (FICT) programme § The HA Future ICT programme (abbreviated as FICT) will deliver the next generation of ICT services for the Highways Agency. § FICT will implement a ‘Service Tower’ model in line with current Government ICT strategy, with one or more contracts supporting each Tower. § Each Service Tower is being delivered as a project within the overall FICT programme. § There are 6 projects in total.

Future ICT (FICT) programme § Contracts will range from 2 to 5 years depending on the Service Tower and procurement strategy. § Competitions are conducted through existing GPS /CCS Frameworks, OJEU or Cloud. Store – depending on Tower specific requirements.

Future ICT (FICT) programme § Contracts will range from 2 to 5 years depending on the Service Tower and procurement strategy. § Competitions are conducted through existing GPS /CCS Frameworks, OJEU or Cloud. Store – depending on Tower specific requirements.

Drivers for FICT programme § Align with new and evolving Government ICT strategy, ensuring a disaggregation of services in line with the Service Tower model. § HA is under pressure to reduce the annual cost of ICT. § Support business agility, by ensuring new ICT contracts are flexible enough to accommodate changes to business priorities, new requirements, ICT innovations, fluctuation in headcount etc. § Improve the end user experience of ICT services. § Allow specialist suppliers and SMEs to provide services to the HA, who may offer more innovative approaches to delivery and be more responsive to our needs. § Align our ICT provision with the aims, objectives and aspirations of our changed status to a Government-owned Company.

Drivers for FICT programme § Align with new and evolving Government ICT strategy, ensuring a disaggregation of services in line with the Service Tower model. § HA is under pressure to reduce the annual cost of ICT. § Support business agility, by ensuring new ICT contracts are flexible enough to accommodate changes to business priorities, new requirements, ICT innovations, fluctuation in headcount etc. § Improve the end user experience of ICT services. § Allow specialist suppliers and SMEs to provide services to the HA, who may offer more innovative approaches to delivery and be more responsive to our needs. § Align our ICT provision with the aims, objectives and aspirations of our changed status to a Government-owned Company.

HA ICT Service Tower model

HA ICT Service Tower model

PART 3 Scope of the EUC service

PART 3 Scope of the EUC service

EUC background – As is § As per the Government ICT strategy of the day, HA outsourced the vast majority of its ICT services in December 2007. § There a small number of ICT services provided by other ICT suppliers, some of which are internal. § The HA has a large estate of legacy IT applications, several of which are regarded as business critical. § We have an IL 3 environment, although some of our IT applications only require IL 2 or IL 1. § An overarching review of our BIL is underway to reassess against the new government security marking scheme

EUC background – As is § As per the Government ICT strategy of the day, HA outsourced the vast majority of its ICT services in December 2007. § There a small number of ICT services provided by other ICT suppliers, some of which are internal. § The HA has a large estate of legacy IT applications, several of which are regarded as business critical. § We have an IL 3 environment, although some of our IT applications only require IL 2 or IL 1. § An overarching review of our BIL is underway to reassess against the new government security marking scheme

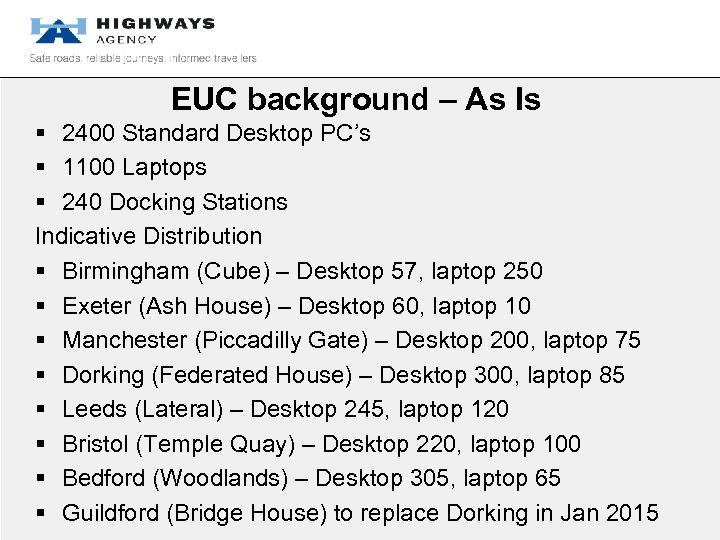

EUC background – As Is § 2400 Standard Desktop PC’s § 1100 Laptops § 240 Docking Stations Indicative Distribution § Birmingham (Cube) – Desktop 57, laptop 250 § Exeter (Ash House) – Desktop 60, laptop 10 § Manchester (Piccadilly Gate) – Desktop 200, laptop 75 § Dorking (Federated House) – Desktop 300, laptop 85 § Leeds (Lateral) – Desktop 245, laptop 120 § Bristol (Temple Quay) – Desktop 220, laptop 100 § Bedford (Woodlands) – Desktop 305, laptop 65 § Guildford (Bridge House) to replace Dorking in Jan 2015

EUC background – As Is § 2400 Standard Desktop PC’s § 1100 Laptops § 240 Docking Stations Indicative Distribution § Birmingham (Cube) – Desktop 57, laptop 250 § Exeter (Ash House) – Desktop 60, laptop 10 § Manchester (Piccadilly Gate) – Desktop 200, laptop 75 § Dorking (Federated House) – Desktop 300, laptop 85 § Leeds (Lateral) – Desktop 245, laptop 120 § Bristol (Temple Quay) – Desktop 220, laptop 100 § Bedford (Woodlands) – Desktop 305, laptop 65 § Guildford (Bridge House) to replace Dorking in Jan 2015

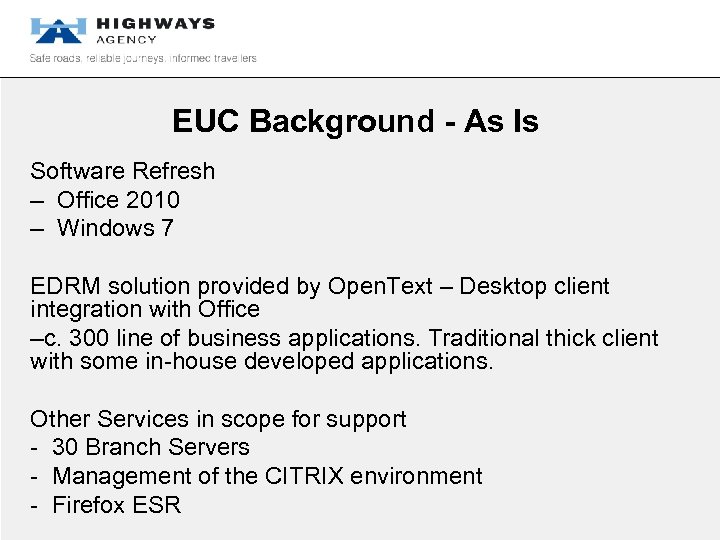

EUC Background - As Is Software Refresh – Office 2010 – Windows 7 EDRM solution provided by Open. Text – Desktop client integration with Office –c. 300 line of business applications. Traditional thick client with some in-house developed applications. Other Services in scope for support - 30 Branch Servers - Management of the CITRIX environment - Firefox ESR

EUC Background - As Is Software Refresh – Office 2010 – Windows 7 EDRM solution provided by Open. Text – Desktop client integration with Office –c. 300 line of business applications. Traditional thick client with some in-house developed applications. Other Services in scope for support - 30 Branch Servers - Management of the CITRIX environment - Firefox ESR

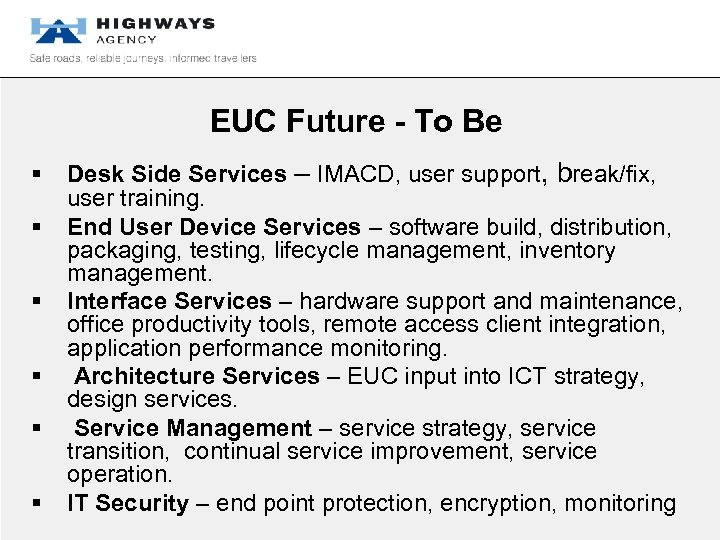

EUC Future - To Be § § § Desk Side Services – IMACD, user support, break/fix, user training. End User Device Services – software build, distribution, packaging, testing, lifecycle management, inventory management. Interface Services – hardware support and maintenance, office productivity tools, remote access client integration, application performance monitoring. Architecture Services – EUC input into ICT strategy, design services. Service Management – service strategy, service transition, continual service improvement, service operation. IT Security – end point protection, encryption, monitoring

EUC Future - To Be § § § Desk Side Services – IMACD, user support, break/fix, user training. End User Device Services – software build, distribution, packaging, testing, lifecycle management, inventory management. Interface Services – hardware support and maintenance, office productivity tools, remote access client integration, application performance monitoring. Architecture Services – EUC input into ICT strategy, design services. Service Management – service strategy, service transition, continual service improvement, service operation. IT Security – end point protection, encryption, monitoring

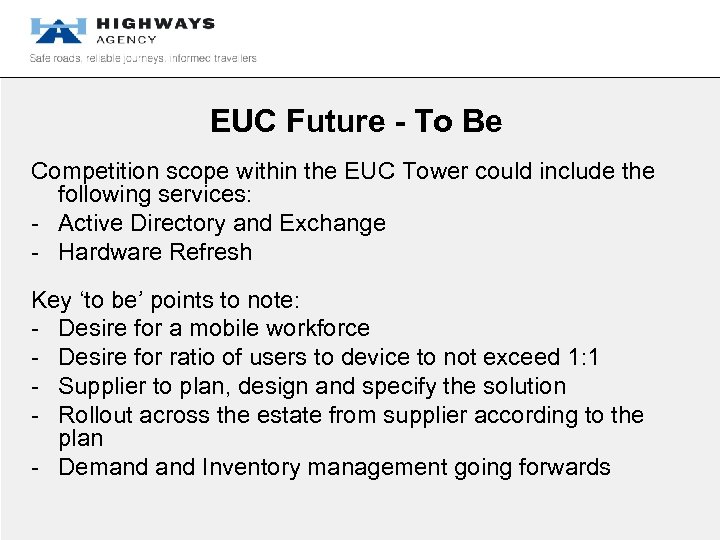

EUC Future - To Be Competition scope within the EUC Tower could include the following services: - Active Directory and Exchange - Hardware Refresh Key ‘to be’ points to note: - Desire for a mobile workforce - Desire for ratio of users to device to not exceed 1: 1 - Supplier to plan, design and specify the solution - Rollout across the estate from supplier according to the plan - Demand Inventory management going forwards

EUC Future - To Be Competition scope within the EUC Tower could include the following services: - Active Directory and Exchange - Hardware Refresh Key ‘to be’ points to note: - Desire for a mobile workforce - Desire for ratio of users to device to not exceed 1: 1 - Supplier to plan, design and specify the solution - Rollout across the estate from supplier according to the plan - Demand Inventory management going forwards

TUPE Information § There may be some staff in scope for TUPE who currently perform EUC services under contract with our current incumbent supplier. § TUPE information will be provided with the ITT document set. § We will include as much information as possible.

TUPE Information § There may be some staff in scope for TUPE who currently perform EUC services under contract with our current incumbent supplier. § TUPE information will be provided with the ITT document set. § We will include as much information as possible.

PART 4 Procurement strategy

PART 4 Procurement strategy

Procurement strategy - constraints § Internal governance. § Cabinet Office ICT and ‘Strategic Supplier’ spending controls. § Government ICT strategy. § § ICT services ‘towerised’ model. Short term, disaggregated contracts. ‘Cloud. First’ policy. Model Services Contract terms.

Procurement strategy - constraints § Internal governance. § Cabinet Office ICT and ‘Strategic Supplier’ spending controls. § Government ICT strategy. § § ICT services ‘towerised’ model. Short term, disaggregated contracts. ‘Cloud. First’ policy. Model Services Contract terms.

Procurement strategy - options § Multiple contracts via Cloud. Store. § CCS frameworks. § Open OJEU.

Procurement strategy - options § Multiple contracts via Cloud. Store. § CCS frameworks. § Open OJEU.

Next steps § § Please complete the questionnaire if not already done so. Potential for further engagement. Procurement exercise envisaged from June onwards. Slides will be sent to delegates.

Next steps § § Please complete the questionnaire if not already done so. Potential for further engagement. Procurement exercise envisaged from June onwards. Slides will be sent to delegates.

Q&A session

Q&A session