f25d0c56f6eae53ba2bd077746a2b4e9.ppt

- Количество слайдов: 16

HIGHER EDUCATION FINANCIAL WELLNESS SUMMIT 2017 Webinar Series DESIGNING A SUCCESSFUL STUDENT MONEY MANAGEMENT CENTER THROUGH ASSESSMENT AND EVALUATION Kayleen Chen Peer Mentor UU Personal Money Management Center kchen@sa. utah. edu Paul F Goebel Director UNT Student Money Management Center goebel@unt. edu

AGENDA Research Program Development Recommendations Resources

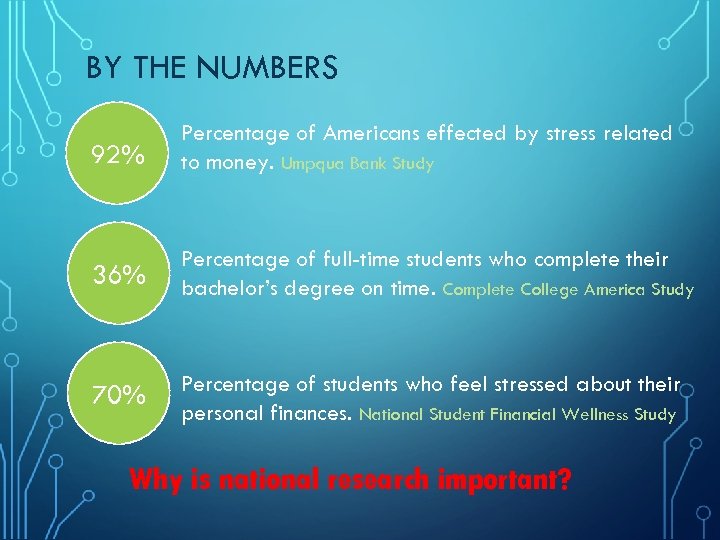

BY THE NUMBERS 92% Percentage of Americans effected by stress related to money. Umpqua Bank Study 36% Percentage of full-time students who complete their bachelor’s degree on time. Complete College America Study 70% Percentage of students who feel stressed about their personal finances. National Student Financial Wellness Study Why is national research important?

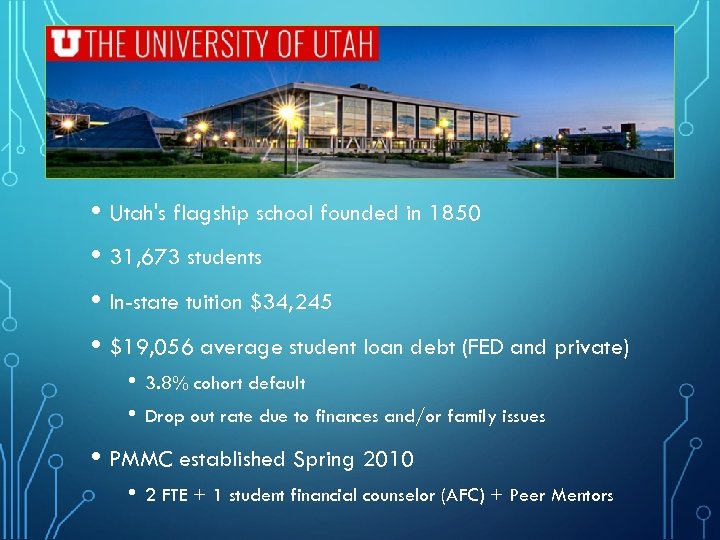

• Utah's flagship school founded in 1850 • 31, 673 students • In-state tuition $34, 245 • $19, 056 average student loan debt (FED and private) • • 3. 8% cohort default Drop out rate due to finances and/or family issues • PMMC established Spring 2010 • 2 FTE + 1 student financial counselor (AFC) + Peer Mentors

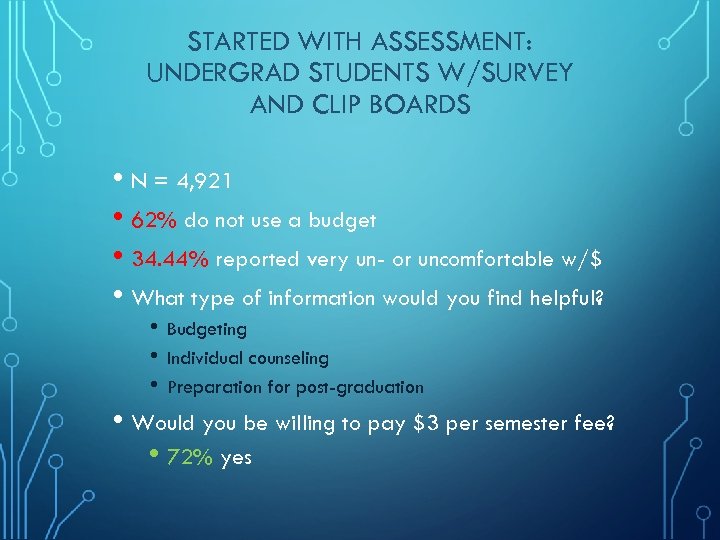

STARTED WITH ASSESSMENT: UNDERGRAD STUDENTS W/SURVEY AND CLIP BOARDS • N = 4, 921 • 62% do not use a budget • 34. 44% reported very un- or uncomfortable w/$ • What type of information would you find helpful? • • • Budgeting Individual counseling Preparation for post-graduation • Would you be willing to pay $3 per semester fee? • 72% yes

ASSESSMENT FINDINGS 1. 2. 3. Administrative buy-in Funding sustainability Developed our program model

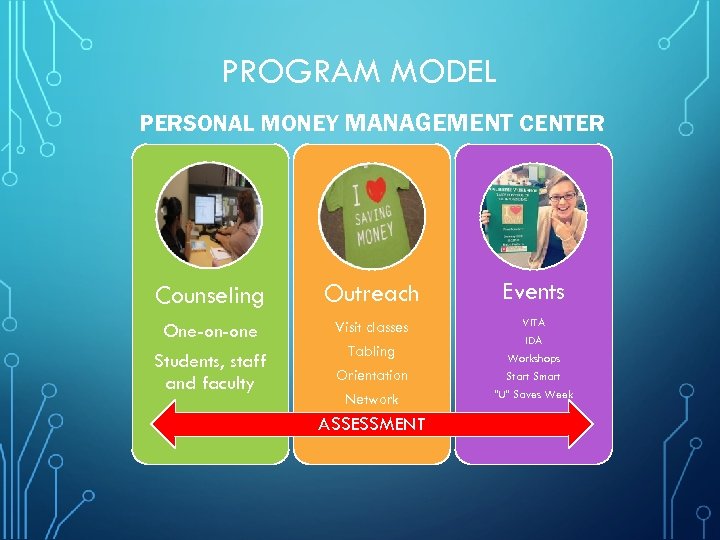

PROGRAM MODEL PERSONAL MONEY MANAGEMENT CENTER Events Counseling Outreach Events One-on-one Students, staff and faculty Visit classes VITA IDA Workshops Start Smart “U” Saves Week Tabling Orientation Network ASSESSMENT

• Public university founded 1890 • 37, 973 students • In-state COA $23, 780 • $23, 240 average student loan debt (FED) • 6. 7% cohort default • SMMC established Fall 2005 • 4 FTE | 1 GA | 6 Mentors | 2 Interns

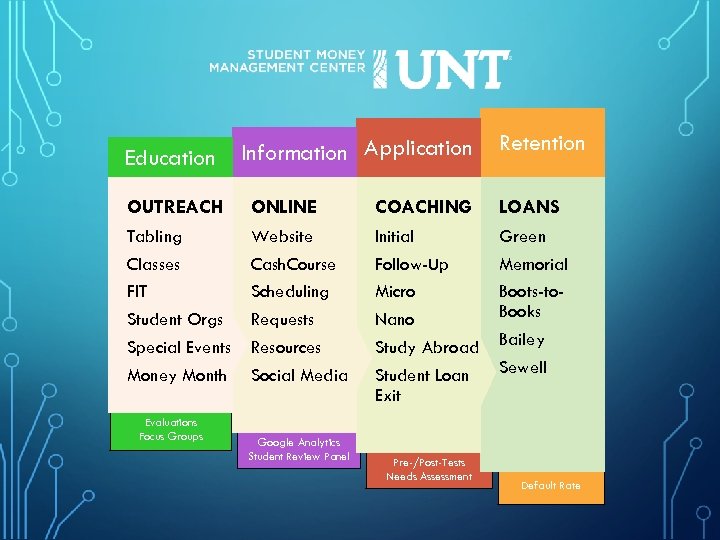

Education Information Application Retention OUTREACH ONLINE COACHING LOANS Tabling Classes FIT Student Orgs Special Events Money Month Website Cash. Course Scheduling Requests Resources Social Media Initial Follow-Up Micro Nano Study Abroad Green Memorial Boots-to. Books Bailey Sewell Evaluations Focus Groups Google Analytics Student Review Panel Student Loan Exit Pre-/Post-Tests Needs Assessment Default Rate

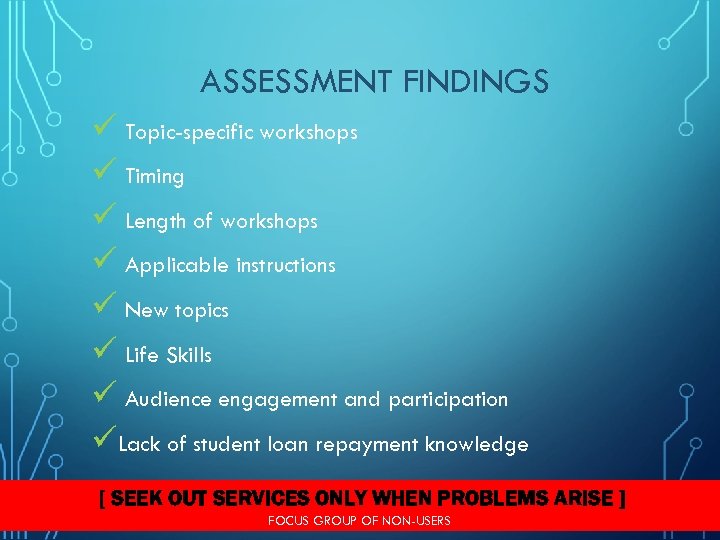

ASSESSMENT FINDINGS ü Topic-specific workshops ü Timing ü Length of workshops ü Applicable instructions ü New topics ü Life Skills ü Audience engagement and participation üLack of student loan repayment knowledge [ SEEK OUT SERVICES ONLY WHEN PROBLEMS ARISE ] FOCUS GROUP OF NON-USERS

LESSONS LEARNED FROM ASSESSMENT 1. Best marketing is word of mouth 2. Don’t need to spend a lot of $ on marketing 3. Simple works - don’t complicate the message 4. Students have great ideas 5. Nothing is constant 6. Assessment is always ongoing

NEXT STEPS Identify what you want to assess first Create an assessment plan Implement! CASE: Collect. Analyze. Strategize. Execute.

QUESTIONS?

HIGHER EDUCATION FINANCIAL WELLNESS SUMMIT 2017 Webinar Series DESIGNING A SUCCESSFUL STUDENT MONEY MANAGEMENT CENTER THROUGH ASSESSMENT AND EVALUATION Kayleen Chen Peer Mentor UU Personal Money Management Center kchen@sa. utah. edu Paul F Goebel Director UNT Student Money Management Center goebel@unt. edu

RESOURCES § www. aacu. org/sites/default/files/publications/Levels. Of. Assessm ent. pdf § www. baruch. cuny. edu/assessment/ § www. umass. edu/oapa/publications/online_handbooks/progra m_based. pdf § www. mindtools. com/pages/article/kirkpatrick. htm § www. huffingtonpost. com/mary-johnson/financialliteracy_b_4695896. html § intraweb. stockton. edu/eyos/scefl/content/docs/Financial%20 Literac y%20 Assessment%20 page%204 -3 -13. pdf

personal-money-management. utah. edu Financial success starts here. MONEYMANAGEMENT. UNT. EDU

f25d0c56f6eae53ba2bd077746a2b4e9.ppt