bb61b98eb6b110810589fafa53fac500.ppt

- Количество слайдов: 12

HIGH NET WORTH READERSHIP ANALYSIS Conducted by Prince & Associates 2005 Research January 2005 June 2005 October 2005

RUSS ALAN PRINCE President, Prince & Associates, Inc. • Consultants to financial institutions and high-end financial advisors and lawyers targeting the ultra-affluent • Institutional clients include: AIG, American Express, Bank of New York, Chase, Citigroup, Bear Stearns, Goldman Sachs, Merrill Lynch and Contributing Editor to Institution Investor High Net Morgan Stanley • Author of 31 books focused on wealth management for the ultra-affluent • Worth Newsletter • Regularly used by Wall Street Journal as expert on high-net worth individuals

• Representative Sample of high net worth individuals obtained through lawyers and financial advisors • Telephone and in-person surveys • Three separate surveys January 2005 - 316 Total Respondents May 2005 – 304 Total Respondents October 2005 – 471 Total Respondents • Sample - Minimum Net Worth $10 million + to qualify

HIGHLIGHTS-PRINCE SURVEYS IN 2005 • Between 66% and 70% High-Net Worth individuals (Net Worth $10 million +) surveyed report they are regular readers of the magazine (three surveys) • Median Household Income of these readers is $1. 724 million, and projected against the universe of individuals with a Net Worth of $10 million + the magazine has a readership of 436, 000 individuals in this category. This does not include readers the magazine may have with a net worth under $10 million as this group was not surveyed • The main location readers receive Elite Traveler is private jets (68%) and many receive Elite Traveler outside the US (37%) as well as within the US (89%) indicating they are frequently out-of-the country making them hard-to-reach by other means • Readers like the size (86%), design (88%) and content (84%) • 90% of readers consider Elite Traveler higher quality than other magazines providing excellent branding opportunities • 89% of readers find information in Elite Traveler they don’t see in other magazines which provides the magazine a unique position with readers • More than half of reader (57%) consider it one of their two or three favorite magazines which reflects positively on products featured • There are very high incidences of purchases of items seen in the magazine, with very strong purchasing of Accessories (69%), Jewelry (68%), Hotels and Resorts (68%), Fashion (65%) and Watches (56%). Other strong categories included purchasing of private jet products (46%), Real Estate and Vacation Clubs (40%) and Yacht Charters and Yachts (20%). As these are high-priced items, this shows a very high trust readers place in the magazine. • Average spend on purchasing categories in the Summer Survey (June) showed high amounts of money spent in a short period (two months) – cruises ($71, 000), Hotels/Resorts/Spas ($147, 000), Vacation Home/Villa Rentals ($143, 000), Jewelry/Watches ($63, 000) and Apparel ($16, 000) among others • Post hurricane research no significant changes in purchasing of luxury goods and services, demonstrating the magazine’s readership provides luxury marketers a segment of big purchasers that can be depended on to keep spending • More than 4 in 10 readers take the magazine with them from their private jet/yacht (43%) showing a very high degree of interest and typically look at the magazine at least three times (2. 9 median) • Preference and trust for the magazine is again demonstrated in that readers typically show something in the magazine to approximately five other people (4. 7 median)

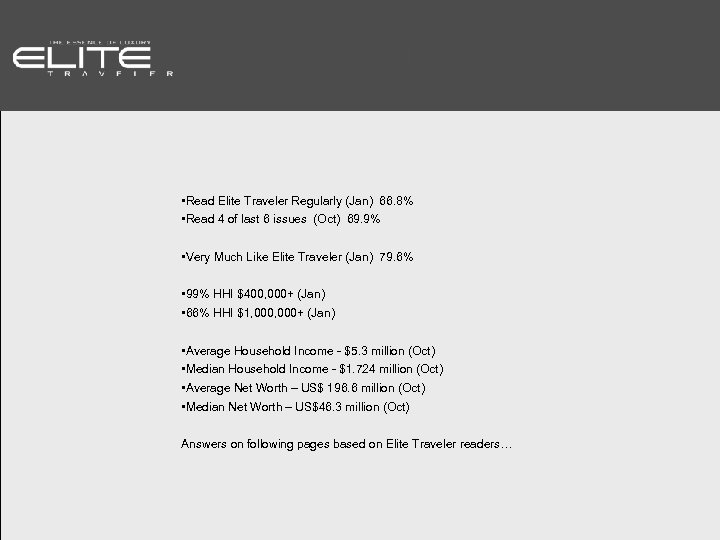

Private Jet Displays • Read Elite Traveler Regularly (Jan) 66. 8% • Read 4 of last 6 issues (Oct) 69. 9% • Very Much Like Elite Traveler (Jan) 79. 6% • 99% HHI $400, 000+ (Jan) • 66% HHI $1, 000+ (Jan) • Average Household Income - $5. 3 million (Oct) • Median Household Income - $1. 724 million (Oct) • Average Net Worth – US$ 196. 6 million (Oct) • Median Net Worth – US$46. 3 million (Oct) Answers on following pages based on Elite Traveler readers…

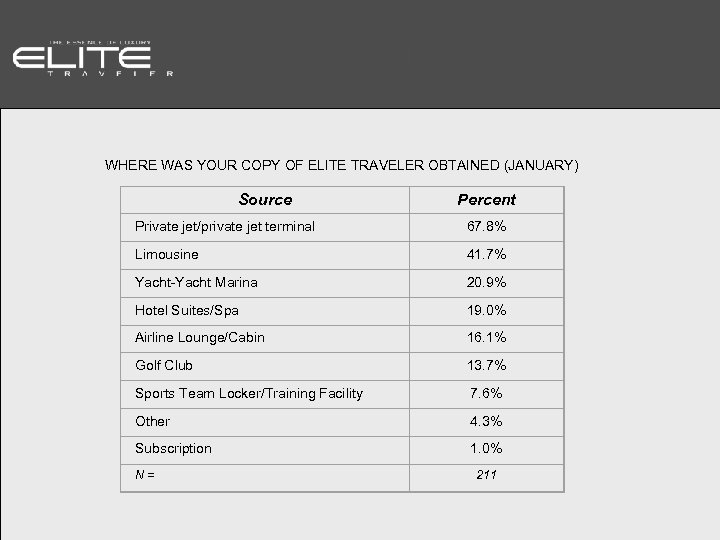

WHERE WAS YOUR COPY OF ELITE TRAVELER OBTAINED (JANUARY) Source Percent Private jet/private jet terminal 67. 8% Limousine 41. 7% Yacht-Yacht Marina 20. 9% Hotel Suites/Spa 19. 0% Airline Lounge/Cabin 16. 1% Golf Club 13. 7% Sports Team Locker/Training Facility 7. 6% Other 4. 3% Subscription 1. 0% N= 211

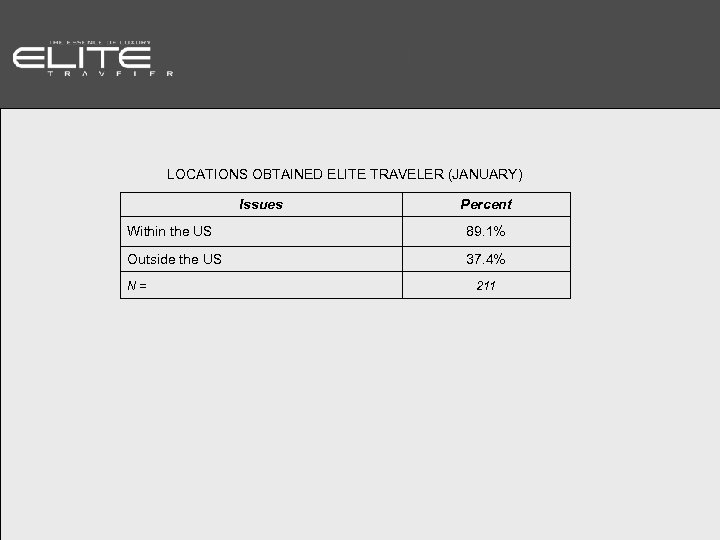

LOCATIONS OBTAINED ELITE TRAVELER (JANUARY) Issues Percent Within the US 89. 1% Outside the US 37. 4% N= 211

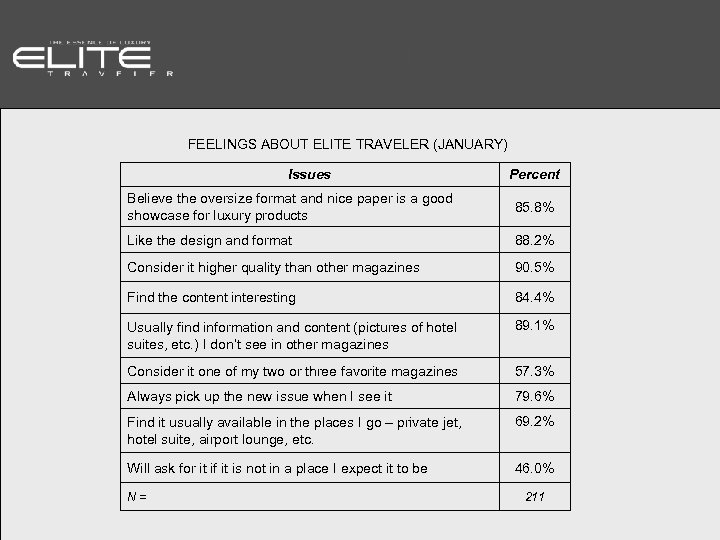

FEELINGS ABOUT ELITE TRAVELER (JANUARY) Issues Percent Believe the oversize format and nice paper is a good showcase for luxury products 85. 8% Like the design and format 88. 2% Consider it higher quality than other magazines 90. 5% Find the content interesting 84. 4% Usually find information and content (pictures of hotel suites, etc. ) I don’t see in other magazines 89. 1% Consider it one of my two or three favorite magazines 57. 3% Always pick up the new issue when I see it 79. 6% Find it usually available in the places I go – private jet, hotel suite, airport lounge, etc. 69. 2% Will ask for it if it is not in a place I expect it to be 46. 0% N= 211

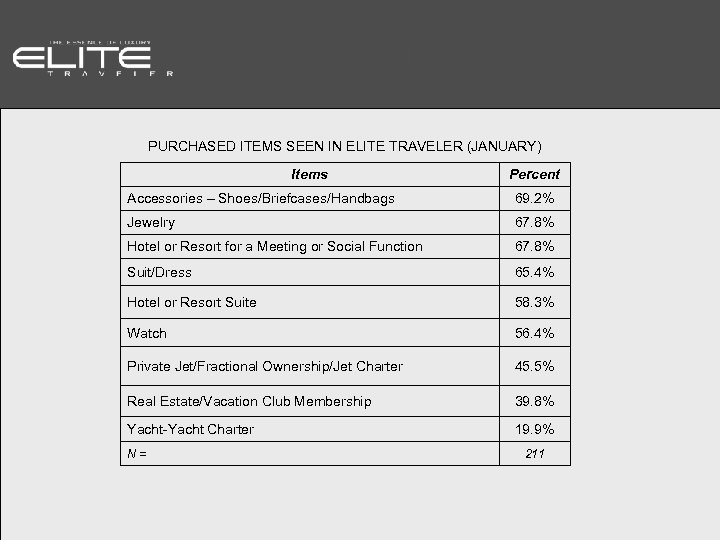

PURCHASED ITEMS SEEN IN ELITE TRAVELER (JANUARY) Items Percent Accessories – Shoes/Briefcases/Handbags 69. 2% Jewelry 67. 8% Hotel or Resort for a Meeting or Social Function 67. 8% Suit/Dress 65. 4% Hotel or Resort Suite 58. 3% Watch 56. 4% Private Jet/Fractional Ownership/Jet Charter 45. 5% Real Estate/Vacation Club Membership 39. 8% Yacht-Yacht Charter 19. 9% N= 211

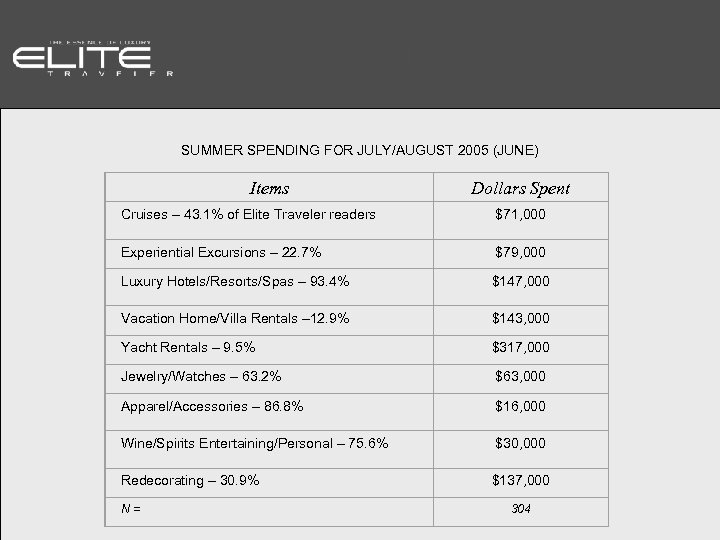

SUMMER SPENDING FOR JULY/AUGUST 2005 (JUNE) Items Dollars Spent Cruises – 43. 1% of Elite Traveler readers $71, 000 Experiential Excursions – 22. 7% $79, 000 Luxury Hotels/Resorts/Spas – 93. 4% $147, 000 Vacation Home/Villa Rentals – 12. 9% $143, 000 Yacht Rentals – 9. 5% $317, 000 Jewelry/Watches – 63. 2% $63, 000 Apparel/Accessories – 86. 8% $16, 000 Wine/Spirits Entertaining/Personal – 75. 6% $30, 000 Redecorating – 30. 9% $137, 000 N= 304

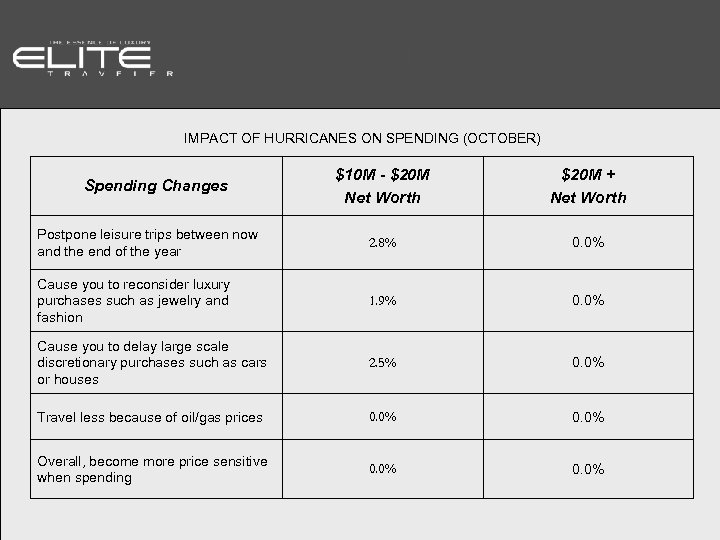

IMPACT OF HURRICANES ON SPENDING (OCTOBER) $10 M - $20 M Net Worth $20 M + Net Worth Postpone leisure trips between now and the end of the year 2. 8% 0. 0% Cause you to reconsider luxury purchases such as jewelry and fashion 1. 9% 0. 0% Cause you to delay large scale discretionary purchases such as cars or houses 2. 5% 0. 0% Travel less because of oil/gas prices 0. 0% Overall, become more price sensitive when spending 0. 0% Spending Changes

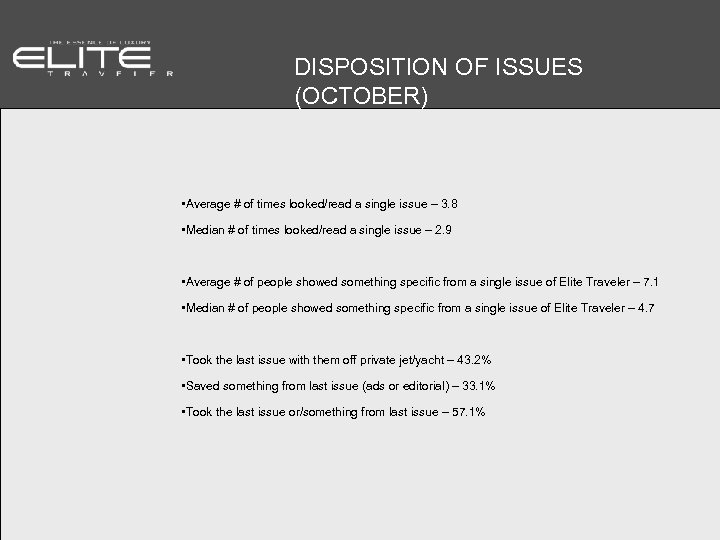

DISPOSITION OF ISSUES (OCTOBER) • Average # of times looked/read a single issue – 3. 8 • Median # of times looked/read a single issue – 2. 9 • Average # of people showed something specific from a single issue of Elite Traveler – 7. 1 • Median # of people showed something specific from a single issue of Elite Traveler – 4. 7 • Took the last issue with them off private jet/yacht – 43. 2% • Saved something from last issue (ads or editorial) – 33. 1% • Took the last issue or/something from last issue – 57. 1%

bb61b98eb6b110810589fafa53fac500.ppt