4e41e61d67d45f2beef236e2a117d357.ppt

- Количество слайдов: 39

Hera Group 2008

Hera Group 2008

Index page Introduction > > > > > 1 Establishment Italian utility sector Sector consolidation process Portfolio mix and ranking Governance and operating model 5 years growth Mission Citizenship Organization Sustainability milestones 1 2 3 4 5 6 7 8 9 10 Hera sustainable future 12 > > > 12 13 17 18 20 Strategy Financial sustainability Business plan targets on KPIs Focus on environment Closing remarks Index Annex > > > > Focus on personnel Focus on customers Focus on suppliers CSR past and future activities Main CSR results and awards Focus on Hera strategy Business plan assumptions Focus on upstream strategy Focus on sales expansion Focus on Waste and Water business plan Focus on energy business plan Focus on Other activities and portfolio mix Focus on last financial achievements: Q 1 ‘ 08 21 23 23 25 26 27 28 30 31 32 33 34 35

Index page Introduction > > > > > 1 Establishment Italian utility sector Sector consolidation process Portfolio mix and ranking Governance and operating model 5 years growth Mission Citizenship Organization Sustainability milestones 1 2 3 4 5 6 7 8 9 10 Hera sustainable future 12 > > > 12 13 17 18 20 Strategy Financial sustainability Business plan targets on KPIs Focus on environment Closing remarks Index Annex > > > > Focus on personnel Focus on customers Focus on suppliers CSR past and future activities Main CSR results and awards Focus on Hera strategy Business plan assumptions Focus on upstream strategy Focus on sales expansion Focus on Waste and Water business plan Focus on energy business plan Focus on Other activities and portfolio mix Focus on last financial achievements: Q 1 ‘ 08 21 23 23 25 26 27 28 30 31 32 33 34 35

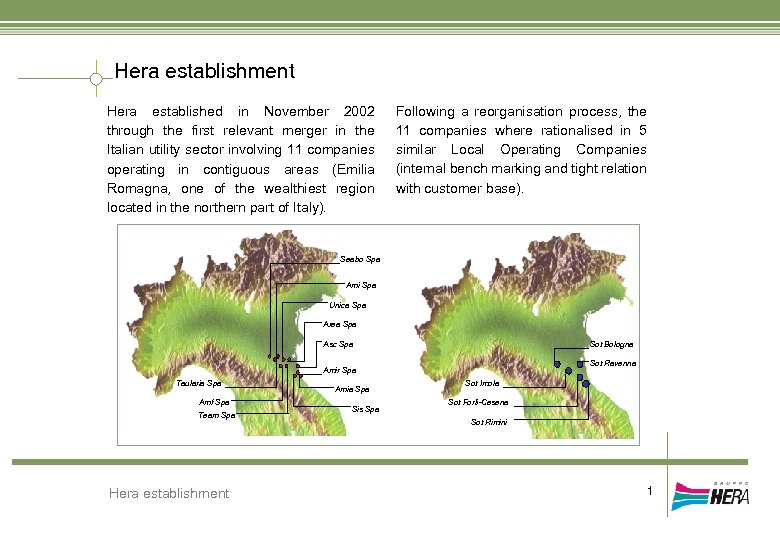

Hera establishment Hera established in November 2002 through the first relevant merger in the Italian utility sector involving 11 companies operating in contiguous areas (Emilia Romagna, one of the wealthiest region located in the northern part of Italy). Following a reorganisation process, the 11 companies where rationalised in 5 similar Local Operating Companies (internal bench marking and tight relation with customer base). Seabo Spa Ami Spa Unica Spa Area Spa Sot Bologna Asc Spa Sot Ravenna Amir Spa Taularia Spa Amf Spa Team Spa Hera establishment Amia Spa Sis Spa Sot Imola Sot Forlì-Cesena Sot Rimini 1

Hera establishment Hera established in November 2002 through the first relevant merger in the Italian utility sector involving 11 companies operating in contiguous areas (Emilia Romagna, one of the wealthiest region located in the northern part of Italy). Following a reorganisation process, the 11 companies where rationalised in 5 similar Local Operating Companies (internal bench marking and tight relation with customer base). Seabo Spa Ami Spa Unica Spa Area Spa Sot Bologna Asc Spa Sot Ravenna Amir Spa Taularia Spa Amf Spa Team Spa Hera establishment Amia Spa Sis Spa Sot Imola Sot Forlì-Cesena Sot Rimini 1

Italian Utility sector Italian Utility Sector Hera expansion track record Agea Turnover 144 Geat Gas Turnover SAT Turnover 62 13 Aspes Turnover 90 Meta Turnover 380 Below 50% stake 100% stake Sector includes national players (focused on energy businesses) and local-multi utility players (energy, water and waste). Sector overview Hera Group has so far primarily expanded in Emilia Romagna (merging further 5 companies) and has become a leading player with a market cap. of about 2. 8 b€. 2

Italian Utility sector Italian Utility Sector Hera expansion track record Agea Turnover 144 Geat Gas Turnover SAT Turnover 62 13 Aspes Turnover 90 Meta Turnover 380 Below 50% stake 100% stake Sector includes national players (focused on energy businesses) and local-multi utility players (energy, water and waste). Sector overview Hera Group has so far primarily expanded in Emilia Romagna (merging further 5 companies) and has become a leading player with a market cap. of about 2. 8 b€. 2

Sector consolidation process Hera signed in May 2008 a Memorandum of Understanding with Enìa and Iride to pursue a “full” merger. The combined entity will reach a market cap of 5 billion € and will become the Sector consolidation leading player in Waste management (5. 3 m ton waste/year) and District Heating, second best in Water and Gas (450 m m 3 fresh water and 6 b m 3 of gas respectively), top ranking in Electricity (20 TWh sales). 3

Sector consolidation process Hera signed in May 2008 a Memorandum of Understanding with Enìa and Iride to pursue a “full” merger. The combined entity will reach a market cap of 5 billion € and will become the Sector consolidation leading player in Waste management (5. 3 m ton waste/year) and District Heating, second best in Water and Gas (450 m m 3 fresh water and 6 b m 3 of gas respectively), top ranking in Electricity (20 TWh sales). 3

Portfolio mix and ranking 2° in Italy Water Volume sold (mm 3) Other business 241 Clients (K unit) 24. 806 319 Heat (GWh) 1. 015 Networks (km) Lighting towers (k unit) 392 Municip. Served (unit) 60 Electricity EBITDA 2007: Volume sold (Gwh) 453 m€ Clients (k unit) Waste Urban waste (m ton) 1, 7 Special Waste (m ton) 2, 7 People served (m) Portfolio mix 273 3° in Italy Gas 1° in Italy Treatment plants 4. 335 Volume sold (mm 3) 2. 337 Volume distrib. (mm 3) 2. 150 2, 4 Clients (K unit) 1. 019 73 Networks (km) 12. 360 Regulated Liberalised ~ 48% ~ 52% 4

Portfolio mix and ranking 2° in Italy Water Volume sold (mm 3) Other business 241 Clients (K unit) 24. 806 319 Heat (GWh) 1. 015 Networks (km) Lighting towers (k unit) 392 Municip. Served (unit) 60 Electricity EBITDA 2007: Volume sold (Gwh) 453 m€ Clients (k unit) Waste Urban waste (m ton) 1, 7 Special Waste (m ton) 2, 7 People served (m) Portfolio mix 273 3° in Italy Gas 1° in Italy Treatment plants 4. 335 Volume sold (mm 3) 2. 337 Volume distrib. (mm 3) 2. 150 2, 4 Clients (K unit) 1. 019 73 Networks (km) 12. 360 Regulated Liberalised ~ 48% ~ 52% 4

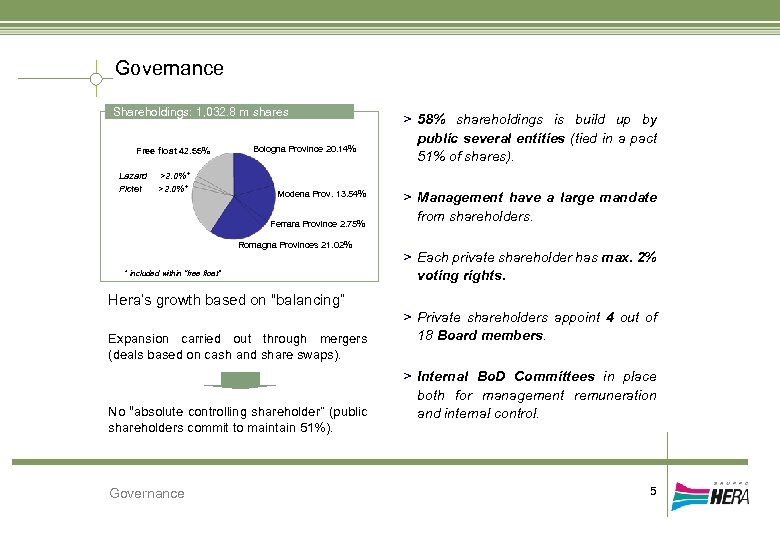

Governance Shareholdings: 1, 032. 8 m shares Free float 42. 55% Lazard Pictet >2. 0%* Bologna Province 20. 14% Modena Prov. 13. 54% Ferrara Province 2. 75% Romagna Provinces 21. 02% * included within “free float” Hera’s growth based on “balancing” Expansion carried out through mergers (deals based on cash and share swaps). No “absolute controlling shareholder” (public shareholders commit to maintain 51%). Governance > 58% shareholdings is build up by public several entities (tied in a pact 51% of shares). > Management have a large mandate from shareholders. > Each private shareholder has max. 2% voting rights. > Private shareholders appoint 4 out of 18 Board members. > Internal Bo. D Committees in place both for management remuneration and internal control. 5

Governance Shareholdings: 1, 032. 8 m shares Free float 42. 55% Lazard Pictet >2. 0%* Bologna Province 20. 14% Modena Prov. 13. 54% Ferrara Province 2. 75% Romagna Provinces 21. 02% * included within “free float” Hera’s growth based on “balancing” Expansion carried out through mergers (deals based on cash and share swaps). No “absolute controlling shareholder” (public shareholders commit to maintain 51%). Governance > 58% shareholdings is build up by public several entities (tied in a pact 51% of shares). > Management have a large mandate from shareholders. > Each private shareholder has max. 2% voting rights. > Private shareholders appoint 4 out of 18 Board members. > Internal Bo. D Committees in place both for management remuneration and internal control. 5

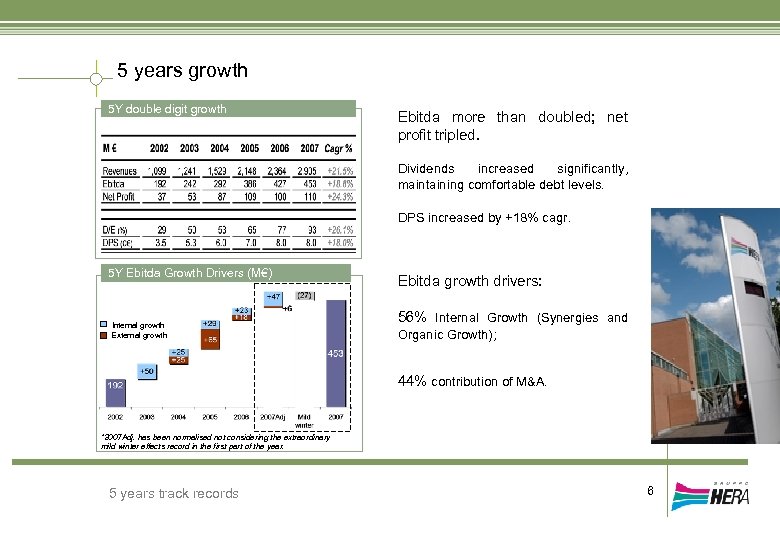

5 years growth 5 Y double digit growth Ebitda more than doubled; net profit tripled. Dividends increased significantly, maintaining comfortable debt levels. DPS increased by +18% cagr. 5 Y Ebitda Growth Drivers (M€) Internal growth External growth Ebitda growth drivers: 56% Internal Growth (Synergies and Organic Growth); 44% contribution of M&A. *2007 Adj. has been normalised not considering the extraordinary mild winter effects record in the first part of the year. 5 years track records 6

5 years growth 5 Y double digit growth Ebitda more than doubled; net profit tripled. Dividends increased significantly, maintaining comfortable debt levels. DPS increased by +18% cagr. 5 Y Ebitda Growth Drivers (M€) Internal growth External growth Ebitda growth drivers: 56% Internal Growth (Synergies and Organic Growth); 44% contribution of M&A. *2007 Adj. has been normalised not considering the extraordinary mild winter effects record in the first part of the year. 5 years track records 6

Mission with a multi-stakeholder approach “Hera goal is to be the best multiutility in Italy for its customers, workforce and shareholders. It aims to achieve this through further development of an original corporate model capable of innovation and of forging strong links with the areas in which it operates by respecting the local environment”. Mission 7

Mission with a multi-stakeholder approach “Hera goal is to be the best multiutility in Italy for its customers, workforce and shareholders. It aims to achieve this through further development of an original corporate model capable of innovation and of forging strong links with the areas in which it operates by respecting the local environment”. Mission 7

Citizenship > Hera is a relevant economic entity managing significant environmental and social resources of its reference territory. > Hera is committed to properly use natural resources (earth, water, air) delivering services to people aiming at reducing negative environmental effects (CO 2 emissions, water and soul pollution). > Hera is as well committed to promote social enhancement through promotion of values, respect of people, listening and speaking to all stakeholders. > This citizenship has a significant impact on how Hera people effectively think, organize, act and manage relations with stakeholders. Hera Sustainability 8

Citizenship > Hera is a relevant economic entity managing significant environmental and social resources of its reference territory. > Hera is committed to properly use natural resources (earth, water, air) delivering services to people aiming at reducing negative environmental effects (CO 2 emissions, water and soul pollution). > Hera is as well committed to promote social enhancement through promotion of values, respect of people, listening and speaking to all stakeholders. > This citizenship has a significant impact on how Hera people effectively think, organize, act and manage relations with stakeholders. Hera Sustainability 8

Organization Organisation Board of Directors Remuneration Committee Chairman Internal Audit Committee C. E. O. Investor Relat. CSR Communication QSA Vice President Internal Audit > All main functions focused on stakeholders are directly in staff to Top Management. > Further more other main Organizational Units are in place: > Supervisory Board on corporate crime prevention (legislative decree 231/2001). > Risk management Unit. Organization 9

Organization Organisation Board of Directors Remuneration Committee Chairman Internal Audit Committee C. E. O. Investor Relat. CSR Communication QSA Vice President Internal Audit > All main functions focused on stakeholders are directly in staff to Top Management. > Further more other main Organizational Units are in place: > Supervisory Board on corporate crime prevention (legislative decree 231/2001). > Risk management Unit. Organization 9

“Sustainability” Milestones (1) The RAB at Ferrara started On May 2005 the kick-off meeting of the Residential Advisory Board regarding the Ferrara waste-to-energy plant was held. The RAB provides a method for consultation between the company and citizens. New Mission approved On June 2006, the Board of Directors of Hera Sp. A approved the new Mission and new company Charter of Values. The Mission and Charter of Values have been submitted to the approval of the workforce through focus groups and a survey. The first Hera's kindergarten On January 2007 the first Hera's kindergarten "Tirithera" was opened. Waste-to-energy plant emissions available on-line From February 2007 the daily updated atmospheric emissions are available on the Hera Group website. Sustainability milestones 10

“Sustainability” Milestones (1) The RAB at Ferrara started On May 2005 the kick-off meeting of the Residential Advisory Board regarding the Ferrara waste-to-energy plant was held. The RAB provides a method for consultation between the company and citizens. New Mission approved On June 2006, the Board of Directors of Hera Sp. A approved the new Mission and new company Charter of Values. The Mission and Charter of Values have been submitted to the approval of the workforce through focus groups and a survey. The first Hera's kindergarten On January 2007 the first Hera's kindergarten "Tirithera" was opened. Waste-to-energy plant emissions available on-line From February 2007 the daily updated atmospheric emissions are available on the Hera Group website. Sustainability milestones 10

“Sustainability” Milestones (2) Corporate Social Responsibility Convention organized by Hera On June 2007 was held an international convention organized by Hera entitled "Corporate Social Responsibility: the other side of competition. How to reconcile social responsibility and competitive advantage? " Second internal climate survey On October 2007 the second internal climate survey was conducted (first edition in 2005) with the participation of more than 60% of employees. Approval of the new Hera Group Code of Ethics On September 2007 the Board of Directors approved the new Group Code of Ethics. Sustainability milestones 11

“Sustainability” Milestones (2) Corporate Social Responsibility Convention organized by Hera On June 2007 was held an international convention organized by Hera entitled "Corporate Social Responsibility: the other side of competition. How to reconcile social responsibility and competitive advantage? " Second internal climate survey On October 2007 the second internal climate survey was conducted (first edition in 2005) with the participation of more than 60% of employees. Approval of the new Hera Group Code of Ethics On September 2007 the Board of Directors approved the new Group Code of Ethics. Sustainability milestones 11

Hera Sustainable Future

Hera Sustainable Future

Strategy Hera sustainable strategy Create value for Stakeholders Development Efficiency Innovation Sustainable approach Strategy 12

Strategy Hera sustainable strategy Create value for Stakeholders Development Efficiency Innovation Sustainable approach Strategy 12

Financial sustainability: expected +57% in Ebitda by 2010 Profit & Loss (M€) Revenues +0. 6% Cagr Revenues increase by +50 m€ through: >Cross selling and market expansion in electricity business >Expansion of Special Waste market share and increase in Urban waste tariffs (+2. 9% cagr) >Increase in water tariffs (+4. 7% cagr). Business plan 2007 -2010 restated with 2007 actual figures Returns and Capex plan Ebitda +13. 8% Cagr Increase of +217 m€ (+48% in the period) with the contribution of all core businesses. Group margin up to 23%. Profitability and Dividends Increases expected in all return ratios maintaining a sound capital structure. Double digit dividend increase confirmed (+13% avg. per year throughout 2010). Capex plan Business plan 2007 -2010 restated with 2007 actual figures 2008 -2010 Business Plan targets at a glance Fully funded by 2008 -2010 operating cash flows. 13

Financial sustainability: expected +57% in Ebitda by 2010 Profit & Loss (M€) Revenues +0. 6% Cagr Revenues increase by +50 m€ through: >Cross selling and market expansion in electricity business >Expansion of Special Waste market share and increase in Urban waste tariffs (+2. 9% cagr) >Increase in water tariffs (+4. 7% cagr). Business plan 2007 -2010 restated with 2007 actual figures Returns and Capex plan Ebitda +13. 8% Cagr Increase of +217 m€ (+48% in the period) with the contribution of all core businesses. Group margin up to 23%. Profitability and Dividends Increases expected in all return ratios maintaining a sound capital structure. Double digit dividend increase confirmed (+13% avg. per year throughout 2010). Capex plan Business plan 2007 -2010 restated with 2007 actual figures 2008 -2010 Business Plan targets at a glance Fully funded by 2008 -2010 operating cash flows. 13

Financial sustainability: Balanced contribution from visible levers 2007 -2010 Ebitda Build-up (m€) Growth is based on proven drivers M&A: SAT (merger agreed in July 2007) has been included in 2010 targets. Synergy exploitation is driven by cost cutting, efficiency improvement and HC rationalisation in line with track records. Business plan 2007 -2010 restated with 2007 actual figures Organic Growth mainly involves market expansion, to tariff increases and to the contribution of power generation. Past and expected value drivers New Plants add up mainly relates to new WTE +90 m€ (1 completed, 3 under construction and 1 refurbishment) and other power gen. plants +14 m€. Ebitda Growth drivers 14

Financial sustainability: Balanced contribution from visible levers 2007 -2010 Ebitda Build-up (m€) Growth is based on proven drivers M&A: SAT (merger agreed in July 2007) has been included in 2010 targets. Synergy exploitation is driven by cost cutting, efficiency improvement and HC rationalisation in line with track records. Business plan 2007 -2010 restated with 2007 actual figures Organic Growth mainly involves market expansion, to tariff increases and to the contribution of power generation. Past and expected value drivers New Plants add up mainly relates to new WTE +90 m€ (1 completed, 3 under construction and 1 refurbishment) and other power gen. plants +14 m€. Ebitda Growth drivers 14

Financial sustainability: New WTE Plants New WTE construction program Hera is the leading player in Waste Management with 73 treatment plants of which 7 WTE. Ferrara and Forlì WTE new plant already started operations. The construction of Modena and Rimini new WTE are progressing. The economics of WTE plants highlight good margins due to incentive schemes (Cip 6 and Green Certificate certificates). CO 2 – New allocation plan will not cause significant impacts up to 2011. Achievements in Waste business 15

Financial sustainability: New WTE Plants New WTE construction program Hera is the leading player in Waste Management with 73 treatment plants of which 7 WTE. Ferrara and Forlì WTE new plant already started operations. The construction of Modena and Rimini new WTE are progressing. The economics of WTE plants highlight good margins due to incentive schemes (Cip 6 and Green Certificate certificates). CO 2 – New allocation plan will not cause significant impacts up to 2011. Achievements in Waste business 15

Financial sustainability: Mix and cash generation Ebitda 2007 & E 2010 by Business (m€) Expected cash flows 2007 -2010 (m€) Free CF Capex Operating CF 2008 -E 2010 Group Capex plan (m€) > Portfolio mix confirms balance among businesses and between regulated and nonregulated activities. 967 45% 55% Portfolio Mix and cash generation > Capex plan includes significant developments in infrastructures (new plants constructions and network enlargements). > Free cash flows progressively increase “fully” funding the capex plan. 16

Financial sustainability: Mix and cash generation Ebitda 2007 & E 2010 by Business (m€) Expected cash flows 2007 -2010 (m€) Free CF Capex Operating CF 2008 -E 2010 Group Capex plan (m€) > Portfolio mix confirms balance among businesses and between regulated and nonregulated activities. 967 45% 55% Portfolio Mix and cash generation > Capex plan includes significant developments in infrastructures (new plants constructions and network enlargements). > Free cash flows progressively increase “fully” funding the capex plan. 16

Business plan targets on KPIs > Hera strategic planning sets targets for all main KPIs. > Strategic planning in Hera is a “bottom. Up” process renewed every year to define a 3 -years business plan. > Targets are analytically defined in a Balanced Score Card system extended to all senior and middle management. > Top management remuneration (disclosed in the financial statements) is 50% linked to target achievements. > Senior and middle management remuneration system is also linked (15% -20%) to the achievements of target set in the BSC. Business plan E 2007 -2010: KPIs 17

Business plan targets on KPIs > Hera strategic planning sets targets for all main KPIs. > Strategic planning in Hera is a “bottom. Up” process renewed every year to define a 3 -years business plan. > Targets are analytically defined in a Balanced Score Card system extended to all senior and middle management. > Top management remuneration (disclosed in the financial statements) is 50% linked to target achievements. > Senior and middle management remuneration system is also linked (15% -20%) to the achievements of target set in the BSC. Business plan E 2007 -2010: KPIs 17

Focus on Environment (1) > Hera waste management, water services and energy production intensively use environmental sources. 2005 -2007 Electricity Production > The commitments regarding low environmental impact of these activities highlights positive results in past 3 years. > In electricity production, Hera is active in all renewable sources mainly in WTE plants, district Heating and biogas (100% renewable sources) which benefit from incentive schemes (CIP 6 tariff and Green certificates). 2005 -2007 KPI > Hera is respecting all national law and Kyoto protocol standards on pollution. > 10% of 2007 Ebitda was related to benefits coming from Hera environmental low impact activities. Sustainability: Environment 18

Focus on Environment (1) > Hera waste management, water services and energy production intensively use environmental sources. 2005 -2007 Electricity Production > The commitments regarding low environmental impact of these activities highlights positive results in past 3 years. > In electricity production, Hera is active in all renewable sources mainly in WTE plants, district Heating and biogas (100% renewable sources) which benefit from incentive schemes (CIP 6 tariff and Green certificates). 2005 -2007 KPI > Hera is respecting all national law and Kyoto protocol standards on pollution. > 10% of 2007 Ebitda was related to benefits coming from Hera environmental low impact activities. Sustainability: Environment 18

Focus on Environment (2) > Hera is committed to enhance the outstanding position in WTE (building 4 new plants). Electricity Production targets > Waste management will focus on recycling (up to 50% of urban waste). > Investments in Water to reduce leakages. > CO 2 emissions will have a positive balance up to 2011. > Cogeneration expected to increase (district heating plants) in energy production by 5. 5 x. Environment: targets > R&D will focus on alternative energy sources (Biomass, vegetable oil, solar) and recycling CO 2 emission in electricity generation (Bio-digestion technology) > Hera expect to increase up to 20% the portion of E 2010 Ebitda coming from benefits yield on low environmental impact of activities. Sustainability: Environment 19

Focus on Environment (2) > Hera is committed to enhance the outstanding position in WTE (building 4 new plants). Electricity Production targets > Waste management will focus on recycling (up to 50% of urban waste). > Investments in Water to reduce leakages. > CO 2 emissions will have a positive balance up to 2011. > Cogeneration expected to increase (district heating plants) in energy production by 5. 5 x. Environment: targets > R&D will focus on alternative energy sources (Biomass, vegetable oil, solar) and recycling CO 2 emission in electricity generation (Bio-digestion technology) > Hera expect to increase up to 20% the portion of E 2010 Ebitda coming from benefits yield on low environmental impact of activities. Sustainability: Environment 19

Closing remarks > Hera has a long tradition in sustainability due the sensibleness of public shareholders (main shareholders of Hera and the companies merged in Hera Group). > From flotation, Hera has adopted several governance and organizational changes in order to involved effectively stakeholders in continuous dialog. > Track records give evidence of the sustainable progress performed and strategic planning has set enhancement targets on all main KPIs for the next 3 years. > Hera remuneration system assures personnel commitment on achieving the sustainable targets. > Sustainability represent and ethical “must” and a “profitable” business (20% of E 2010 Ebitda comes from incentives such as Green Certificates, Cip 6 and white certificates). > R&D department engaged in working out new technologies to reduce environmental impact of Hera activities (CO 2 project, water network leakage control systems etc. ). > The sustainable profile have been awarded by several entities and positively analysed by specialist analysts and ethical investors (Oddo Securities, Cheuvreux, Axia, and Ethifinance analysts; several U. K. , Suisse and France investors). > Hera website (www. gruppohera. it) include a “sustainable” and “investor Relations” section that make available further information. Closing remarks 20

Closing remarks > Hera has a long tradition in sustainability due the sensibleness of public shareholders (main shareholders of Hera and the companies merged in Hera Group). > From flotation, Hera has adopted several governance and organizational changes in order to involved effectively stakeholders in continuous dialog. > Track records give evidence of the sustainable progress performed and strategic planning has set enhancement targets on all main KPIs for the next 3 years. > Hera remuneration system assures personnel commitment on achieving the sustainable targets. > Sustainability represent and ethical “must” and a “profitable” business (20% of E 2010 Ebitda comes from incentives such as Green Certificates, Cip 6 and white certificates). > R&D department engaged in working out new technologies to reduce environmental impact of Hera activities (CO 2 project, water network leakage control systems etc. ). > The sustainable profile have been awarded by several entities and positively analysed by specialist analysts and ethical investors (Oddo Securities, Cheuvreux, Axia, and Ethifinance analysts; several U. K. , Suisse and France investors). > Hera website (www. gruppohera. it) include a “sustainable” and “investor Relations” section that make available further information. Closing remarks 20

Annexes Business Plan: Breakdown by business and targets on main KPIs

Annexes Business Plan: Breakdown by business and targets on main KPIs

Focus on Personnel (1) Hera’s most relevant stakeholder > A continuous internal communications system is having success (meetings, House organ, intra-net site, television screens) 2005 -2007 KPI > At Hera all relevant matters are shared with employees starting from the discussion on the new mission, new business plan etc. > In 2007 the second survey on personnel satisfaction yielded positive results. > A Balance score Card system was introduced to guarantee a fair valuation of results and bonuses. > Hera commitment is to improve education and know how sharing. Training activities performed obtained positive feed back from personnel (above 1 ml€ spent in training in 2007). 21

Focus on Personnel (1) Hera’s most relevant stakeholder > A continuous internal communications system is having success (meetings, House organ, intra-net site, television screens) 2005 -2007 KPI > At Hera all relevant matters are shared with employees starting from the discussion on the new mission, new business plan etc. > In 2007 the second survey on personnel satisfaction yielded positive results. > A Balance score Card system was introduced to guarantee a fair valuation of results and bonuses. > Hera commitment is to improve education and know how sharing. Training activities performed obtained positive feed back from personnel (above 1 ml€ spent in training in 2007). 21

Focus on Personnel (2) Hera actions and commitments on social responsibility Targets 2007 -E 2010 > Hera commitments to improve its social responsibility are stated in the business plan 2007 -E 2010. > Hera will invest in training employed people to share best practices and promote internal carriers replacing natural retirement. > Above 3 Ml€ investments are planned to improve training courses to employees in next 3 years. > Safe and security on work place have been certified with Ohsas 18001 in 2007. > Balanced Scorecard system has been extended to 100% of managers in 2007. > Facilities will be built in order to meet family needs of workers (e. g. Kinder garden etc). 22

Focus on Personnel (2) Hera actions and commitments on social responsibility Targets 2007 -E 2010 > Hera commitments to improve its social responsibility are stated in the business plan 2007 -E 2010. > Hera will invest in training employed people to share best practices and promote internal carriers replacing natural retirement. > Above 3 Ml€ investments are planned to improve training courses to employees in next 3 years. > Safe and security on work place have been certified with Ohsas 18001 in 2007. > Balanced Scorecard system has been extended to 100% of managers in 2007. > Facilities will be built in order to meet family needs of workers (e. g. Kinder garden etc). 22

Focus on Customers represent Hera focus 2005 -2007 KPI > Customer satisfaction survey in 2007 highlighted a significant degree of satisfaction (67 points achieved on a max of 100). > Loyalty of customers is highlighted by low churn rates in liberalized activities (such as gas sale: 0. 8% churn rate). > In order to meet the commitment to improve the customer care Hera is implementing: Targets 2007 -2010 >An integrated SAP IT system (CRM and one invoice for different services). >Working out a quality standard card of services for all provinces >Several projects aiming at enhancing customer care activity (in 3 years dedicated personnel increased by above +100%). > Develop web-site potentials to serve customers > Work out a welcome kit for new customers 23

Focus on Customers represent Hera focus 2005 -2007 KPI > Customer satisfaction survey in 2007 highlighted a significant degree of satisfaction (67 points achieved on a max of 100). > Loyalty of customers is highlighted by low churn rates in liberalized activities (such as gas sale: 0. 8% churn rate). > In order to meet the commitment to improve the customer care Hera is implementing: Targets 2007 -2010 >An integrated SAP IT system (CRM and one invoice for different services). >Working out a quality standard card of services for all provinces >Several projects aiming at enhancing customer care activity (in 3 years dedicated personnel increased by above +100%). > Develop web-site potentials to serve customers > Work out a welcome kit for new customers 23

Focus on Suppliers considered strategic partners 2005 -2007 Suppliers data > Hera deals with 21 k suppliers > 75% in reference territory > A qualification system introduced on certification basis > Ethical Code in contract clauses Commitments for the future > Improve ethical code knowledge among suppliers > Increase share of supplier certified Ohsas 18001, SINAL, SIT and SA 8000 > Improve web-site information dedicated to suppliers 24

Focus on Suppliers considered strategic partners 2005 -2007 Suppliers data > Hera deals with 21 k suppliers > 75% in reference territory > A qualification system introduced on certification basis > Ethical Code in contract clauses Commitments for the future > Improve ethical code knowledge among suppliers > Increase share of supplier certified Ohsas 18001, SINAL, SIT and SA 8000 > Improve web-site information dedicated to suppliers 24

CSR past and future activities Past main focus of Hera CSR action: > Mission and Corporate value identification > Sustainability reporting > Strategy sharing and management process optimisation (Balanced Scorecard) > Dialog with inhabitants living close to industrial plants of Hera > Reduce environmental impacts and certification (ISO 9001, ISO 14001) > Targets for CSR activities: > Sharing and apply the ethical code of conduct > Obtain further certification (OHSAS 18001, EMAS) > Start the process to obtain SA 8000 certification > Further extend the dialog opportunities with stakeholders (es. RAB) 25

CSR past and future activities Past main focus of Hera CSR action: > Mission and Corporate value identification > Sustainability reporting > Strategy sharing and management process optimisation (Balanced Scorecard) > Dialog with inhabitants living close to industrial plants of Hera > Reduce environmental impacts and certification (ISO 9001, ISO 14001) > Targets for CSR activities: > Sharing and apply the ethical code of conduct > Obtain further certification (OHSAS 18001, EMAS) > Start the process to obtain SA 8000 certification > Further extend the dialog opportunities with stakeholders (es. RAB) 25

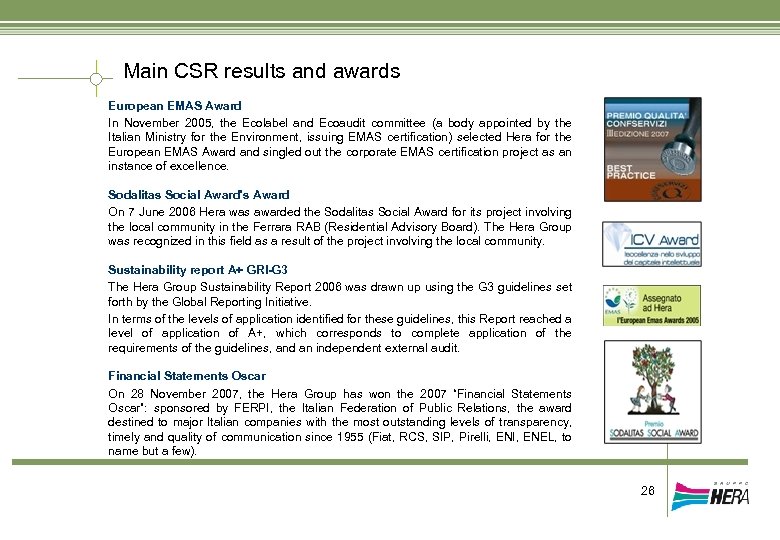

Main CSR results and awards European EMAS Award In November 2005, the Ecolabel and Ecoaudit committee (a body appointed by the Italian Ministry for the Environment, issuing EMAS certification) selected Hera for the European EMAS Award and singled out the corporate EMAS certification project as an instance of excellence. Sodalitas Social Award's Award On 7 June 2006 Hera was awarded the Sodalitas Social Award for its project involving the local community in the Ferrara RAB (Residential Advisory Board). The Hera Group was recognized in this field as a result of the project involving the local community. Sustainability report A+ GRI-G 3 The Hera Group Sustainability Report 2006 was drawn up using the G 3 guidelines set forth by the Global Reporting Initiative. In terms of the levels of application identified for these guidelines, this Report reached a level of application of A+, which corresponds to complete application of the requirements of the guidelines, and an independent external audit. Financial Statements Oscar On 28 November 2007, the Hera Group has won the 2007 “Financial Statements Oscar”: sponsored by FERPI, the Italian Federation of Public Relations, the award destined to major Italian companies with the most outstanding levels of transparency, timely and quality of communication since 1955 (Fiat, RCS, SIP, Pirelli, ENI, ENEL, to name but a few). 26

Main CSR results and awards European EMAS Award In November 2005, the Ecolabel and Ecoaudit committee (a body appointed by the Italian Ministry for the Environment, issuing EMAS certification) selected Hera for the European EMAS Award and singled out the corporate EMAS certification project as an instance of excellence. Sodalitas Social Award's Award On 7 June 2006 Hera was awarded the Sodalitas Social Award for its project involving the local community in the Ferrara RAB (Residential Advisory Board). The Hera Group was recognized in this field as a result of the project involving the local community. Sustainability report A+ GRI-G 3 The Hera Group Sustainability Report 2006 was drawn up using the G 3 guidelines set forth by the Global Reporting Initiative. In terms of the levels of application identified for these guidelines, this Report reached a level of application of A+, which corresponds to complete application of the requirements of the guidelines, and an independent external audit. Financial Statements Oscar On 28 November 2007, the Hera Group has won the 2007 “Financial Statements Oscar”: sponsored by FERPI, the Italian Federation of Public Relations, the award destined to major Italian companies with the most outstanding levels of transparency, timely and quality of communication since 1955 (Fiat, RCS, SIP, Pirelli, ENI, ENEL, to name but a few). 26

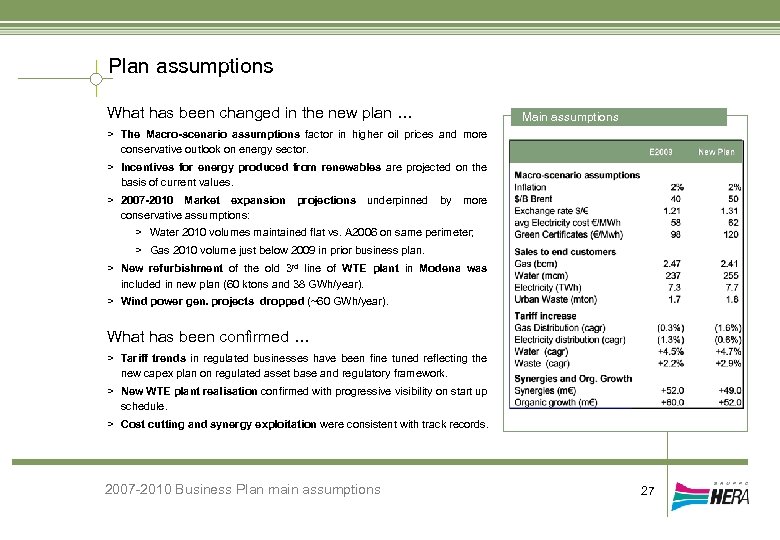

Plan assumptions What has been changed in the new plan … Main assumptions > The Macro-scenario assumptions factor in higher oil prices and more conservative outlook on energy sector. > Incentives for energy produced from renewables are projected on the basis of current values. > 2007 -2010 Market expansion projections underpinned by more conservative assumptions: > Water 2010 volumes maintained flat vs. A 2006 on same perimeter; > Gas 2010 volume just below 2009 in prior business plan. > New refurbishment of the old 3 rd line of WTE plant in Modena was included in new plan (60 ktons and 38 GWh/year). > Wind power gen. projects dropped (~60 GWh/year). What has been confirmed … > Tariff trends in regulated businesses have been fine tuned reflecting the new capex plan on regulated asset base and regulatory framework. > New WTE plant realisation confirmed with progressive visibility on start up schedule. > Cost cutting and synergy exploitation were consistent with track records. 2007 -2010 Business Plan main assumptions 27

Plan assumptions What has been changed in the new plan … Main assumptions > The Macro-scenario assumptions factor in higher oil prices and more conservative outlook on energy sector. > Incentives for energy produced from renewables are projected on the basis of current values. > 2007 -2010 Market expansion projections underpinned by more conservative assumptions: > Water 2010 volumes maintained flat vs. A 2006 on same perimeter; > Gas 2010 volume just below 2009 in prior business plan. > New refurbishment of the old 3 rd line of WTE plant in Modena was included in new plan (60 ktons and 38 GWh/year). > Wind power gen. projects dropped (~60 GWh/year). What has been confirmed … > Tariff trends in regulated businesses have been fine tuned reflecting the new capex plan on regulated asset base and regulatory framework. > New WTE plant realisation confirmed with progressive visibility on start up schedule. > Cost cutting and synergy exploitation were consistent with track records. 2007 -2010 Business Plan main assumptions 27

Focus on Hera strategy Linee strategiche Hera strategic pillars: Development: > Market expansion leveraging upon a loyal > > > Strategic guidelines include the Sustainable approach stated in Group mission customer base (cross selling). Upstream integration in electricity and gas sector through asset development and procurement portfolio enlargement. Development of waste asset base respond to fast growth in demand. Regulated tariff increase and asset enhancement. M&A activities also outside of E-R region. > Efficiency gains: > Cost cutting and HC reduction > Operating efficiency gains deploying knowledge sharing. > Enhancement of CRM to improve marketing initiatives. Innovation: > Integration of 2 nd level IT systems and deployment of new technologies. 28

Focus on Hera strategy Linee strategiche Hera strategic pillars: Development: > Market expansion leveraging upon a loyal > > > Strategic guidelines include the Sustainable approach stated in Group mission customer base (cross selling). Upstream integration in electricity and gas sector through asset development and procurement portfolio enlargement. Development of waste asset base respond to fast growth in demand. Regulated tariff increase and asset enhancement. M&A activities also outside of E-R region. > Efficiency gains: > Cost cutting and HC reduction > Operating efficiency gains deploying knowledge sharing. > Enhancement of CRM to improve marketing initiatives. Innovation: > Integration of 2 nd level IT systems and deployment of new technologies. 28

Focus on upstream strategy: Gas sourcing diversification Effective Consolidation of VNG relationship (400 ml mc 3). Gas procurement (bm 3) 1. 1 TAG imports from October 2008 (~200 ml m 3 for 5 years). 0. 8 Increase on Galsi stake to 10. 4%. 0. 5 2006 E&P stake in North Sea under evaluation. 2007 E 2010 Storage Project (Bagnolo Mella) feedback by June 2008 from MSE. Customer base expected to increase by +3%, reaching 2. 3 bm 3 of gas sold by 2008 (on normalised thermal season). 29

Focus on upstream strategy: Gas sourcing diversification Effective Consolidation of VNG relationship (400 ml mc 3). Gas procurement (bm 3) 1. 1 TAG imports from October 2008 (~200 ml m 3 for 5 years). 0. 8 Increase on Galsi stake to 10. 4%. 0. 5 2006 E&P stake in North Sea under evaluation. 2007 E 2010 Storage Project (Bagnolo Mella) feedback by June 2008 from MSE. Customer base expected to increase by +3%, reaching 2. 3 bm 3 of gas sold by 2008 (on normalised thermal season). 29

Focus on upstream strategy: Electricity – New project upcoming Teverola and Sparanise on commercial operation (2008 first full year). Electricity (TWh) 12. 2 8. 0 Sales & Wholesale 5. 1 3. 1 2. 8 2006 2007 to Napoli (Tirreno Levante Power) and Imola cogen. on stream by year end. New project on thermal generation (20% stake) under finalization. E 2010 4 MW on solar production under development and new projects on vegetable oil & biomass (~60 MW – 30% stake) under finalization. amount sales contracted 2008 about 5 TWh and customer base expected to increase by 3%-5%. 30

Focus on upstream strategy: Electricity – New project upcoming Teverola and Sparanise on commercial operation (2008 first full year). Electricity (TWh) 12. 2 8. 0 Sales & Wholesale 5. 1 3. 1 2. 8 2006 2007 to Napoli (Tirreno Levante Power) and Imola cogen. on stream by year end. New project on thermal generation (20% stake) under finalization. E 2010 4 MW on solar production under development and new projects on vegetable oil & biomass (~60 MW – 30% stake) under finalization. amount sales contracted 2008 about 5 TWh and customer base expected to increase by 3%-5%. 30

Focus on Sales expansion Development in liberalized businesses leveraging a loyal customer base Electricity: customer base up to 370 k Market expansion Supply market liberalization is an opportunity to develop: > cross selling and market expansion through energy dual fuel proposal mainly to “Soho” and residential clients; > commercial and trading capabilities. Overall margins enhanced due to “own” power gen. Gas: about 1 million customers Expanding leadership: >Market expansion in surrounding areas (including Megas clients) conservatively expected to offset increased competition; >Development of trading activities; >Expected normalized consumption in 2008 -2010 winter seasons. Margins preserved due to better procurement mix Waste: +6. 2% cagr volume increase Taking advantage from a fast growing market through: >cross selling: “trial fuel” offering (energy & special waste services); >“full” service contracts (including remediation of sites); >Up to 1. 3 m customers will be billed with Urban waste activities (thanks to the shift from tax to a tariff system). Cross selling activities will increase up to 2, 6 the number of services per client Leveraging a stronger and wide ranging asset base Focus on “Development” strategy (3): Market expansion 31

Focus on Sales expansion Development in liberalized businesses leveraging a loyal customer base Electricity: customer base up to 370 k Market expansion Supply market liberalization is an opportunity to develop: > cross selling and market expansion through energy dual fuel proposal mainly to “Soho” and residential clients; > commercial and trading capabilities. Overall margins enhanced due to “own” power gen. Gas: about 1 million customers Expanding leadership: >Market expansion in surrounding areas (including Megas clients) conservatively expected to offset increased competition; >Development of trading activities; >Expected normalized consumption in 2008 -2010 winter seasons. Margins preserved due to better procurement mix Waste: +6. 2% cagr volume increase Taking advantage from a fast growing market through: >cross selling: “trial fuel” offering (energy & special waste services); >“full” service contracts (including remediation of sites); >Up to 1. 3 m customers will be billed with Urban waste activities (thanks to the shift from tax to a tariff system). Cross selling activities will increase up to 2, 6 the number of services per client Leveraging a stronger and wide ranging asset base Focus on “Development” strategy (3): Market expansion 31

Focus: Waste & Water business plan 2007 -2010 2007 -E 2010 Growth Revenues 2007 -E 2010 Growth +9. 5% Revenues +3. 4% Urban w. tariff +2. 9% cagr Urban w. volumes: +3. 1% cagr Special w. volumes: +13. 9% cagr Hera exploits the positive Special waste market trends. Next Urban waste regulatory period 2008 -2010. Tariff growth: +4. 7% cagr Regulated water tariff increase will be agreed with AATOs by year end for the next regulatory period ranging 20082010. Volumes remain steady excluding contribution from M&A. Ebitda +19. 3% +11. 0% Mainly underpinned by the increase in energy production of new WTE plants (4 new and 1 refurbishment in Modena old plant), Special waste fast growing results and urban waste tariff increase. Ebitda margin up by 870 bp. Mainly underpinned by tariff increases. Efficiency gains pursued in network management and maintenance (reduction of network leakage). Ebitda margin up by 910 bp. Capex 276 m€ Mainly relates to new WTE plants, refurbishment of old Modena WTE, and expansion of Special waste treatment plants. Capex fully funded by waste business cash generation. 334 m€ Mainly relates to maintenance and development of pipelines. Capex is remunerated by 7% return on RAB. 32

Focus: Waste & Water business plan 2007 -2010 2007 -E 2010 Growth Revenues 2007 -E 2010 Growth +9. 5% Revenues +3. 4% Urban w. tariff +2. 9% cagr Urban w. volumes: +3. 1% cagr Special w. volumes: +13. 9% cagr Hera exploits the positive Special waste market trends. Next Urban waste regulatory period 2008 -2010. Tariff growth: +4. 7% cagr Regulated water tariff increase will be agreed with AATOs by year end for the next regulatory period ranging 20082010. Volumes remain steady excluding contribution from M&A. Ebitda +19. 3% +11. 0% Mainly underpinned by the increase in energy production of new WTE plants (4 new and 1 refurbishment in Modena old plant), Special waste fast growing results and urban waste tariff increase. Ebitda margin up by 870 bp. Mainly underpinned by tariff increases. Efficiency gains pursued in network management and maintenance (reduction of network leakage). Ebitda margin up by 910 bp. Capex 276 m€ Mainly relates to new WTE plants, refurbishment of old Modena WTE, and expansion of Special waste treatment plants. Capex fully funded by waste business cash generation. 334 m€ Mainly relates to maintenance and development of pipelines. Capex is remunerated by 7% return on RAB. 32

Focus: Energy business plan 2007 -2010 2007 -E 2010 Growth Revenues 2007 -E 2010 Growth +2. 0% Gas distr. tariff (1. 6%) cagr Gas distr. volumes: +4. 7% cagr* Gas sales volumes: +3. 0% cagr Sales volumes increase due to market expansion in surrounding areas. The expected increase is based upon “normal” winter seasons. Gas sales prices projected in line with assumption of downward trend in commodity price. Gas distribution volumes benefit mainly from SAT contribution (116 m m 3/year) Ebitda +4. 8% Revenues Elect. distr. tariff Elect. sales volumes: (10. 4%) (0. 6)% cagr +21. 0% cagr Market expansion is mainly driven by cross selling on gas customer base (mainly Soho and residential customers). Ebitda +19. 5% Ebitda underpinned by market expansion capable of offsetting competition pressure on margins. Mainly underpinned by new power generation and market expansion. Ebitda margin up by 380 bp. Capex 102 m€ Mainly relates to maintenance of networks. Capex plan fully funded by business cash generation. 140 m€ Mainly relates to new plants and maintenance of networks *including contribution from M&A 33

Focus: Energy business plan 2007 -2010 2007 -E 2010 Growth Revenues 2007 -E 2010 Growth +2. 0% Gas distr. tariff (1. 6%) cagr Gas distr. volumes: +4. 7% cagr* Gas sales volumes: +3. 0% cagr Sales volumes increase due to market expansion in surrounding areas. The expected increase is based upon “normal” winter seasons. Gas sales prices projected in line with assumption of downward trend in commodity price. Gas distribution volumes benefit mainly from SAT contribution (116 m m 3/year) Ebitda +4. 8% Revenues Elect. distr. tariff Elect. sales volumes: (10. 4%) (0. 6)% cagr +21. 0% cagr Market expansion is mainly driven by cross selling on gas customer base (mainly Soho and residential customers). Ebitda +19. 5% Ebitda underpinned by market expansion capable of offsetting competition pressure on margins. Mainly underpinned by new power generation and market expansion. Ebitda margin up by 380 bp. Capex 102 m€ Mainly relates to maintenance of networks. Capex plan fully funded by business cash generation. 140 m€ Mainly relates to new plants and maintenance of networks *including contribution from M&A 33

Focus: business plan 2007 -2010 on Other business & Portfolio Mix 2007 -E 2010 Growth 2010 regulated businesses Regulated* ~ 52% Liberalised ~ 48% *includes Other businesses Revenues (1. 4)% District Heating Thermal e. : from 392 to 650 Gwht Power gen. from 76 to 130 Gwh Public Lighting towers. from 319 k to 349 k Sales expected reduction relates to non-core activities dismissions partially compensated by increase of District Heating and Public Lighting revenues. Ebitda +14. 2% mix confirmed balanced regulated and non-regulated business. between Waste business confirmed as main contributor to Group Ebitda. Efficiency gains in all core businesses mainly benefit Waste, Water and Other businesses. Organic growth development mainly driven by market expansion in all core activities. Mainly underpinned by efficiency gains and development of District Heating and Public Lighting activities. Ebitda margin expected to increase significantly. Capex Portfolio Risk profile diversified among core businesses and projected results based on conservative assumptions. 115 m€ 50% relates to expansion of District Heating network. 34

Focus: business plan 2007 -2010 on Other business & Portfolio Mix 2007 -E 2010 Growth 2010 regulated businesses Regulated* ~ 52% Liberalised ~ 48% *includes Other businesses Revenues (1. 4)% District Heating Thermal e. : from 392 to 650 Gwht Power gen. from 76 to 130 Gwh Public Lighting towers. from 319 k to 349 k Sales expected reduction relates to non-core activities dismissions partially compensated by increase of District Heating and Public Lighting revenues. Ebitda +14. 2% mix confirmed balanced regulated and non-regulated business. between Waste business confirmed as main contributor to Group Ebitda. Efficiency gains in all core businesses mainly benefit Waste, Water and Other businesses. Organic growth development mainly driven by market expansion in all core activities. Mainly underpinned by efficiency gains and development of District Heating and Public Lighting activities. Ebitda margin expected to increase significantly. Capex Portfolio Risk profile diversified among core businesses and projected results based on conservative assumptions. 115 m€ 50% relates to expansion of District Heating network. 34

Focus on last financial achievements: Q 1 2008 results Revenues +33. 8% Ebitda Q 1 2008 Group Results +14. 7% Mainly relates to normalised winter season, Electricity cross selling, enhanced commodity trading activities, energy prices increase and improved tariffs in “WW”. Normalised climate conditions of Q 1 2008, M&A activities and internal growth drivers underpinned growth offsetting personnel cost increase (renewal of national labour contracts). Ebitda margin, netting the higher Electricity trading activities, is about 18. 5%. Ebit +12. 2% +16. 8% Affected by D&A related to significant operating capex. Pre-tax Profit Discounting financial charges in line with financial debt increase. 35

Focus on last financial achievements: Q 1 2008 results Revenues +33. 8% Ebitda Q 1 2008 Group Results +14. 7% Mainly relates to normalised winter season, Electricity cross selling, enhanced commodity trading activities, energy prices increase and improved tariffs in “WW”. Normalised climate conditions of Q 1 2008, M&A activities and internal growth drivers underpinned growth offsetting personnel cost increase (renewal of national labour contracts). Ebitda margin, netting the higher Electricity trading activities, is about 18. 5%. Ebit +12. 2% +16. 8% Affected by D&A related to significant operating capex. Pre-tax Profit Discounting financial charges in line with financial debt increase. 35