34d961f8c76e17db18f7d420ca5146a5.ppt

- Количество слайдов: 30

Helping Farmers/Ranchers and Their Families Locate Funding for Assistive Technology Devices and Services Susan Tachau, Pennsylvania Assistive Technology Foundation David Troutman, PA Agr. Ability Project October 6, 2009

Helping Farmers/Ranchers and Their Families Locate Funding for Assistive Technology Devices and Services Susan Tachau, Pennsylvania Assistive Technology Foundation David Troutman, PA Agr. Ability Project October 6, 2009

History of Assistive Technology (AT) Legislation • The Rehabilitation Act of 1973, as amended, has several provisions for AT devices and services among the available services. • Technology-Related Assistance for Individuals with Disabilities Act of 1988 (and, as amended in 1994). Later becomes the Assistive Technology Act (see below). • The Individuals with Disabilities Education Act has included AT devices and services since 1990. • Assistive Technology Act of 1998. Includes: Title I, State Grant Programs; and, Title III, Alternative Financing Programs (AFP)

History of Assistive Technology (AT) Legislation • The Rehabilitation Act of 1973, as amended, has several provisions for AT devices and services among the available services. • Technology-Related Assistance for Individuals with Disabilities Act of 1988 (and, as amended in 1994). Later becomes the Assistive Technology Act (see below). • The Individuals with Disabilities Education Act has included AT devices and services since 1990. • Assistive Technology Act of 1998. Includes: Title I, State Grant Programs; and, Title III, Alternative Financing Programs (AFP)

Assistive Technology Legislation (continued) • Assistive Technology Act of 2004 Specifies that State Grant Programs: 60% of monies shall be spent on assistive technology reutilization programs, demonstration programs, state financing (includes alternative financing) programs, and device loan programs; or, 70% on at least two, and up to all four of the programs listed above.

Assistive Technology Legislation (continued) • Assistive Technology Act of 2004 Specifies that State Grant Programs: 60% of monies shall be spent on assistive technology reutilization programs, demonstration programs, state financing (includes alternative financing) programs, and device loan programs; or, 70% on at least two, and up to all four of the programs listed above.

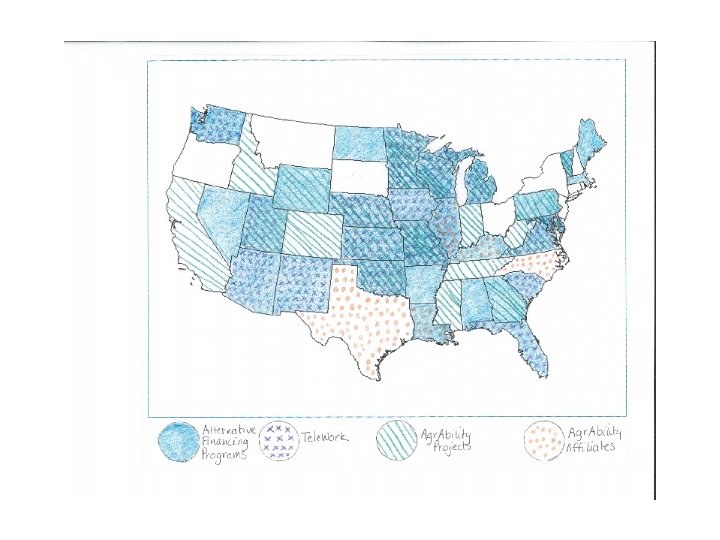

AT Act of 2004 For AFPs, there was a significant change in the AT Act of 2004 – they no longer had a separate funding stream, outside of an appropriation under a “Special Ruling”. Why does this matter? Like Agr. Ability funding, AFP funding is limited and there isn’t a project in every state.

AT Act of 2004 For AFPs, there was a significant change in the AT Act of 2004 – they no longer had a separate funding stream, outside of an appropriation under a “Special Ruling”. Why does this matter? Like Agr. Ability funding, AFP funding is limited and there isn’t a project in every state.

Alternative Financing Programs (AFPs) In the Act (1998) the elements for an AFP were established: A community-based organization that has individuals with disabilities involved in organizational levels administers the AFP; financing (one or more of the following: lowinterest loan; interest buy-down; revolving loan fund; guarantee; partnership for purchase, lease, or other acquisition of AT devices or services); access to the AFP to consumers regardless of type of disability, age, income level, location of residence, type of AT device or service requested; assure consumer-controlled oversight.

Alternative Financing Programs (AFPs) In the Act (1998) the elements for an AFP were established: A community-based organization that has individuals with disabilities involved in organizational levels administers the AFP; financing (one or more of the following: lowinterest loan; interest buy-down; revolving loan fund; guarantee; partnership for purchase, lease, or other acquisition of AT devices or services); access to the AFP to consumers regardless of type of disability, age, income level, location of residence, type of AT device or service requested; assure consumer-controlled oversight.

AFP Projects There are 33 Alternative Financing Programs (AFPs) among the states and territories. Every state develops their own program based upon core principles of consumercontrol, consumer direction, improving economic well-being, and supporting independence.

AFP Projects There are 33 Alternative Financing Programs (AFPs) among the states and territories. Every state develops their own program based upon core principles of consumercontrol, consumer direction, improving economic well-being, and supporting independence.

What do AFP Programs Do? • Provide Information and Referral Services Ø State AT Grant Program: general AT information, equipment demonstrations, equipment lending libraries, equipment reuse/recycling programs. Also, Telecommunication Device Distribution Programs. To locate contact information about your state, go to: www. resna. org and click on “Projects”, and then click on “Individuals with Disabilities and their family members and caregivers. ”

What do AFP Programs Do? • Provide Information and Referral Services Ø State AT Grant Program: general AT information, equipment demonstrations, equipment lending libraries, equipment reuse/recycling programs. Also, Telecommunication Device Distribution Programs. To locate contact information about your state, go to: www. resna. org and click on “Projects”, and then click on “Individuals with Disabilities and their family members and caregivers. ”

Information and Referral (continued) Ø Equipment Reuse: Pass It On Center http: //passitoncenter. org Ø Provide general information about AT devices/services and concepts of universal design, Visitability, local vendors, consumer rights and responsibilities, and access to assessments so that consumers have the information they need to make informed decisions.

Information and Referral (continued) Ø Equipment Reuse: Pass It On Center http: //passitoncenter. org Ø Provide general information about AT devices/services and concepts of universal design, Visitability, local vendors, consumer rights and responsibilities, and access to assessments so that consumers have the information they need to make informed decisions.

Information and Referral (continued) Ø Provide information about other possible funding resources. Vocational Rehabilitation Health Insurance (durable medical equipment) including private, Medicaid, Medicare Home and Community-Based Waivers (DME, home modifications, adaptations for vehicles)

Information and Referral (continued) Ø Provide information about other possible funding resources. Vocational Rehabilitation Health Insurance (durable medical equipment) including private, Medicaid, Medicare Home and Community-Based Waivers (DME, home modifications, adaptations for vehicles)

Information and Referral, Possible Sources of Funding (continued) Grants from disability-specific or civic organizations (Granges, Lions Clubs, Rotary Club, National Multiple Sclerosis Society, United Cerebral Palsy affiliates) Veterans Administration (www. va. gov) Veterans Health Administration Veterans Benefits Administration

Information and Referral, Possible Sources of Funding (continued) Grants from disability-specific or civic organizations (Granges, Lions Clubs, Rotary Club, National Multiple Sclerosis Society, United Cerebral Palsy affiliates) Veterans Administration (www. va. gov) Veterans Health Administration Veterans Benefits Administration

AFPs Also Improve Credit-Worthiness • Many AFPs provide consumer credit counseling and/or education. • Establish Individual Development Accounts (IDA). • Many AFPs report to the Credit Builders Alliance.

AFPs Also Improve Credit-Worthiness • Many AFPs provide consumer credit counseling and/or education. • Establish Individual Development Accounts (IDA). • Many AFPs report to the Credit Builders Alliance.

AFPs Provide Low-Interest Loans • Low-Interest Loans (including interest buy-downs) Traditional and Guaranteed • Revolving Loans • May Have Small Grants (partial or whole) Program

AFPs Provide Low-Interest Loans • Low-Interest Loans (including interest buy-downs) Traditional and Guaranteed • Revolving Loans • May Have Small Grants (partial or whole) Program

PA Examples of Agr. Ability Consumers and Loans • Mini-Loan/Mini-Grant. • Partnership Loans with the PA Office of Vocational Rehabilitation. Ø Independence Capital Access Network (ICAN) ØFederal/State VR-funded program (guaranteed and traditional) • Low-Interest Loan

PA Examples of Agr. Ability Consumers and Loans • Mini-Loan/Mini-Grant. • Partnership Loans with the PA Office of Vocational Rehabilitation. Ø Independence Capital Access Network (ICAN) ØFederal/State VR-funded program (guaranteed and traditional) • Low-Interest Loan

Michael, who has arthritis and a herniated disc in his back, was referred to PATF by the PA Agr. Ability caseworker. Michael applied for a PATF loan to purchase a new (previously owned) adapted tractor that has wider steps, a larger doorway and more spacious cab (also has heating and air-conditioning. ) Result: Within ten days of receiving his application, PATF provided Michael with a loan for $5, 000 (cost of tractor) at a fixed rate of 4. 5%. Monthly loan payments: $79. 37 Repayment period 6 years

Michael, who has arthritis and a herniated disc in his back, was referred to PATF by the PA Agr. Ability caseworker. Michael applied for a PATF loan to purchase a new (previously owned) adapted tractor that has wider steps, a larger doorway and more spacious cab (also has heating and air-conditioning. ) Result: Within ten days of receiving his application, PATF provided Michael with a loan for $5, 000 (cost of tractor) at a fixed rate of 4. 5%. Monthly loan payments: $79. 37 Repayment period 6 years

Everett has cervical and lumbar pain and degenerative disease. In order to continue farming, Everett needs to modify many of the ways he currently works. He needs an Ag-bag machine, a feeder wagon, a utility vehicle, and an elevator lift system. Everett also needs to adapt his tractor (new suspension seating, adapted shifting mechanism to engage the transmission and other gears) as well as purchase a new vehicle that provides a smoother (and less painful) ride. FYI: Everett had three state tax liens from 1990 through 1995 – two have been satisfied and one is in dispute. In addition, Everett had two credit card accounts that showed late payments during 2003 through 2006 (lower farm income). All monthly payments have been paid on time since 2006.

Everett has cervical and lumbar pain and degenerative disease. In order to continue farming, Everett needs to modify many of the ways he currently works. He needs an Ag-bag machine, a feeder wagon, a utility vehicle, and an elevator lift system. Everett also needs to adapt his tractor (new suspension seating, adapted shifting mechanism to engage the transmission and other gears) as well as purchase a new vehicle that provides a smoother (and less painful) ride. FYI: Everett had three state tax liens from 1990 through 1995 – two have been satisfied and one is in dispute. In addition, Everett had two credit card accounts that showed late payments during 2003 through 2006 (lower farm income). All monthly payments have been paid on time since 2006.

Result: The Office of Vocational Rehabilitation paid for the new farm equipment as well as $1, 200 for the adaptations to the tractor. PATF guaranteed a loan for $19, 300 at a fixed rate of 4. 5% so that Everett could pay the difference between the old tractor and the new one ($4, 800) and the truck ($14, 500). Monthly loan payments: $306. 37 Repayment period: 6 years

Result: The Office of Vocational Rehabilitation paid for the new farm equipment as well as $1, 200 for the adaptations to the tractor. PATF guaranteed a loan for $19, 300 at a fixed rate of 4. 5% so that Everett could pay the difference between the old tractor and the new one ($4, 800) and the truck ($14, 500). Monthly loan payments: $306. 37 Repayment period: 6 years

Why Choose AFP Funding? • • • More flexible underwriting criteria. Lower interest rates. Extended repayment periods. Rescue payments may be available. Quick process. Consumer chooses equipment and vendor.

Why Choose AFP Funding? • • • More flexible underwriting criteria. Lower interest rates. Extended repayment periods. Rescue payments may be available. Quick process. Consumer chooses equipment and vendor.

For More Information Independence is priceless…we help make it affordable PATF 1004 West 9 th Avenue King of Prussia, PA 19406 888 -744 -1938 (voice/TTY) www. patf. us or www. resna. org

For More Information Independence is priceless…we help make it affordable PATF 1004 West 9 th Avenue King of Prussia, PA 19406 888 -744 -1938 (voice/TTY) www. patf. us or www. resna. org

More on the Veterans’ Administration…

More on the Veterans’ Administration…

VA Health Care Enrollment Veteran must complete VA Form 10 -10 EZ, application for health benefits. The veterans must also provide financial information. Eligibility for particular health care benefits will be based upon whether the veteran has service-connected or non-service connected health care needs. Enrollment for health care benefits via the VA 1010 EZ is not the same as going through the Compensation and Pension Service (benefits). The VA 10 -10 EZ is for health care only (includes services to people who are blind).

VA Health Care Enrollment Veteran must complete VA Form 10 -10 EZ, application for health benefits. The veterans must also provide financial information. Eligibility for particular health care benefits will be based upon whether the veteran has service-connected or non-service connected health care needs. Enrollment for health care benefits via the VA 1010 EZ is not the same as going through the Compensation and Pension Service (benefits). The VA 10 -10 EZ is for health care only (includes services to people who are blind).

Enrollment After the paperwork has been filed with the VA (at a VA medical center or via mail), a veteran will be notified if he/she will be enrolled. At this time, the veteran may be assigned a priority group*. While many veterans qualify for enrollment and cost-free health care services based on a compensable serviceconnected condition, most veterans will be asked to complete a financial assessment as part of their enrollment application process. This information will be used to determine the applicant’s enrollment priority group. *Priority grouping is extremely important!

Enrollment After the paperwork has been filed with the VA (at a VA medical center or via mail), a veteran will be notified if he/she will be enrolled. At this time, the veteran may be assigned a priority group*. While many veterans qualify for enrollment and cost-free health care services based on a compensable serviceconnected condition, most veterans will be asked to complete a financial assessment as part of their enrollment application process. This information will be used to determine the applicant’s enrollment priority group. *Priority grouping is extremely important!

Veterans Health Administration (VHA) Standard Benefits • Immunizations • Physical Examinations (including eye and hearing exams) • Health Care Assessments • Screening tests • Health Education Programs

Veterans Health Administration (VHA) Standard Benefits • Immunizations • Physical Examinations (including eye and hearing exams) • Health Care Assessments • Screening tests • Health Education Programs

Outpatient Diagnostic and Treatment Services • Medical • Surgical (including reconstructive/plastic surgery as a result of disease or trauma) • Mental Health • Substance Abuse

Outpatient Diagnostic and Treatment Services • Medical • Surgical (including reconstructive/plastic surgery as a result of disease or trauma) • Mental Health • Substance Abuse

Additional Medical Benefits • • Prescription Drugs (when prescribed by a VA physician) Dental Care Durable Medical Equipment (wheelchairs, scooters) Eyeglasses Hearing Aids Orthopedic, Prosthetic and Rehabilitative Devices Clothing Allowance ($670) Home Improvement and Structural Alterations Benefit ($4, 100 service-connected; $1, 200 non-service connected. )

Additional Medical Benefits • • Prescription Drugs (when prescribed by a VA physician) Dental Care Durable Medical Equipment (wheelchairs, scooters) Eyeglasses Hearing Aids Orthopedic, Prosthetic and Rehabilitative Devices Clothing Allowance ($670) Home Improvement and Structural Alterations Benefit ($4, 100 service-connected; $1, 200 non-service connected. )

Benefits for Veterans Who Are Blind and visually impaired veterans may be eligible for services at a VA medical center or for admission to a VA blind rehabilitation center. In addition, blind veterans enrolled in the VA health care system may receive: • 1. A total health and benefits review. • 2. Adjustment to blindness training and counseling. • 3. Home improvements and structural alterations. • 4. Specially adapted housing and adaptations. • 5. Automobile grant. • 6. Low-vision devices and training in their use. • 7. Electronic and mechanical aids for the blind, including adaptive computers and computer-assisted devices such as reading machines and electronic travel aids. • 8. Guide dogs, including cost of training for the veteran to learn to work with the dog. • 9. Talking books, tapes and Braille literature.

Benefits for Veterans Who Are Blind and visually impaired veterans may be eligible for services at a VA medical center or for admission to a VA blind rehabilitation center. In addition, blind veterans enrolled in the VA health care system may receive: • 1. A total health and benefits review. • 2. Adjustment to blindness training and counseling. • 3. Home improvements and structural alterations. • 4. Specially adapted housing and adaptations. • 5. Automobile grant. • 6. Low-vision devices and training in their use. • 7. Electronic and mechanical aids for the blind, including adaptive computers and computer-assisted devices such as reading machines and electronic travel aids. • 8. Guide dogs, including cost of training for the veteran to learn to work with the dog. • 9. Talking books, tapes and Braille literature.

Benefits for Veterans Who Have Low-Vision Eligible visually impaired veterans (who are not blind) enrolled in the VA health care system may receive: • 1. A total health and benefits review. • 2. Adjustment to vision loss counseling and training. • 3. Low-vision devices and training in their use. • 4. Electronic and mechanical aids for the visually impaired, including adaptive computers and computer-assisted devices such as reading machines and electronic travel aids, and training in their use.

Benefits for Veterans Who Have Low-Vision Eligible visually impaired veterans (who are not blind) enrolled in the VA health care system may receive: • 1. A total health and benefits review. • 2. Adjustment to vision loss counseling and training. • 3. Low-vision devices and training in their use. • 4. Electronic and mechanical aids for the visually impaired, including adaptive computers and computer-assisted devices such as reading machines and electronic travel aids, and training in their use.

Veterans Benefits Administration Compensation & Pension Service administers a variety of benefits and services for veterans who have a service-connected disability (as well as to their dependents and survivors. ) Burden is on the veteran to provide documentation on injuries, illnesses, from medical records, information from family, friends, neighbors, physicians, psychologists, psychiatrists. Note: Most veterans who have a service-connected disability will enter the VA system through “Comp and Pension”.

Veterans Benefits Administration Compensation & Pension Service administers a variety of benefits and services for veterans who have a service-connected disability (as well as to their dependents and survivors. ) Burden is on the veteran to provide documentation on injuries, illnesses, from medical records, information from family, friends, neighbors, physicians, psychologists, psychiatrists. Note: Most veterans who have a service-connected disability will enter the VA system through “Comp and Pension”.

VBA (compensation) • Education • Life Insurance • Vocational Rehabilitation (vehicles, adaptations, and other AT devices) • Burials and Memorials • Specially Adapted Housing (up to $50, 000; some funding if living with a family member) • Veterans Mortgage Life Insurance (covers unpaid principle up to $90, 000 on the mortgage loan) • Disability Compensation (tax free) ranging from $115 to $2, 527/month

VBA (compensation) • Education • Life Insurance • Vocational Rehabilitation (vehicles, adaptations, and other AT devices) • Burials and Memorials • Specially Adapted Housing (up to $50, 000; some funding if living with a family member) • Veterans Mortgage Life Insurance (covers unpaid principle up to $90, 000 on the mortgage loan) • Disability Compensation (tax free) ranging from $115 to $2, 527/month