04492cbf92fd6e2ff202b31520b4ecf4.ppt

- Количество слайдов: 33

Help Your Clients Buy a Texas Home

About TSAHC The Texas State Affordable Housing Corporation (TSAHC) is a housing nonprofit created at the direction of the Texas Legislature to serve the housing needs of low and moderate income Texans. Home Buyer Programs: • • Homes for Texas Heroes Home Loan Program Home Sweet Texas Home Loan Program www. Ready. To. Buy. ATexas. Home. com

Home Buyer Programs These Home Buyer Programs offer two types of assistance to home buyers STATEWIDE. Loans with Down Payment Assistance Mortgage Interest Tax Credits www. Ready. To. Buy. ATexas. Home. com

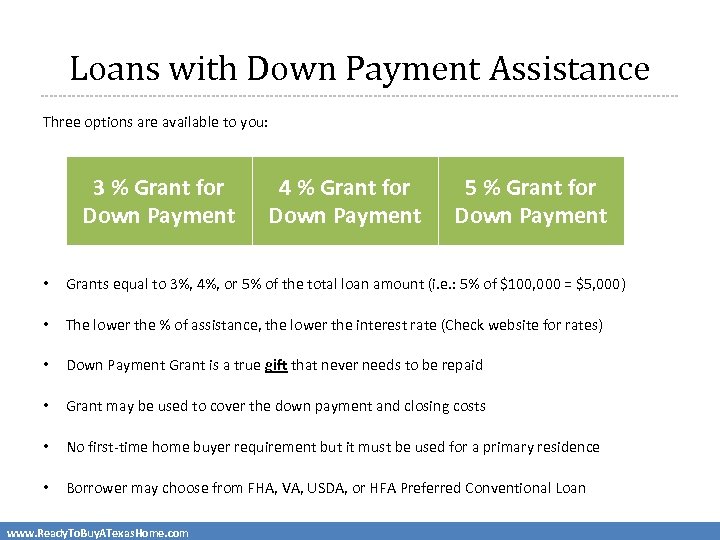

Loans with Down Payment Assistance Three options are available to you: 3 % Grant for Down Payment 4 % Grant for Down Payment 5 % Grant for Down Payment • Grants equal to 3%, 4%, or 5% of the total loan amount (i. e. : 5% of $100, 000 = $5, 000) • The lower the % of assistance, the lower the interest rate (Check website for rates) • Down Payment Grant is a true gift that never needs to be repaid • Grant may be used to cover the down payment and closing costs • No first-time home buyer requirement but it must be used for a primary residence • Borrower may choose from FHA, VA, USDA, or HFA Preferred Conventional Loan www. Ready. To. Buy. ATexas. Home. com

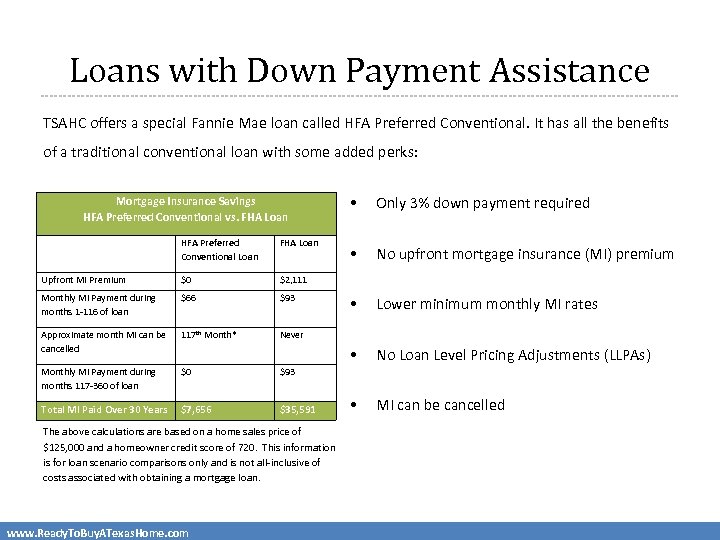

Loans with Down Payment Assistance TSAHC offers a special Fannie Mae loan called HFA Preferred Conventional. It has all the benefits of a traditional conventional loan with some added perks: HFA Preferred Conventional Loan FHA Loan Upfront MI Premium $0 $66 $93 Approximate month MI can be cancelled 117 th Month* $0 $7, 656 $35, 591 No upfront mortgage insurance (MI) premium • Lower minimum monthly MI rates No Loan Level Pricing Adjustments (LLPAs) • MI can be cancelled $93 Total MI Paid Over 30 Years • Never Monthly MI Payment during months 117 -360 of loan Only 3% down payment required $2, 111 Monthly MI Payment during months 1 -116 of loan • • Mortgage Insurance Savings HFA Preferred Conventional vs. FHA Loan The above calculations are based on a home sales price of $125, 000 and a homeowner credit score of 720. This information is for loan scenario comparisons only and is not all-inclusive of costs associated with obtaining a mortgage loan. www. Ready. To. Buy. ATexas. Home. com

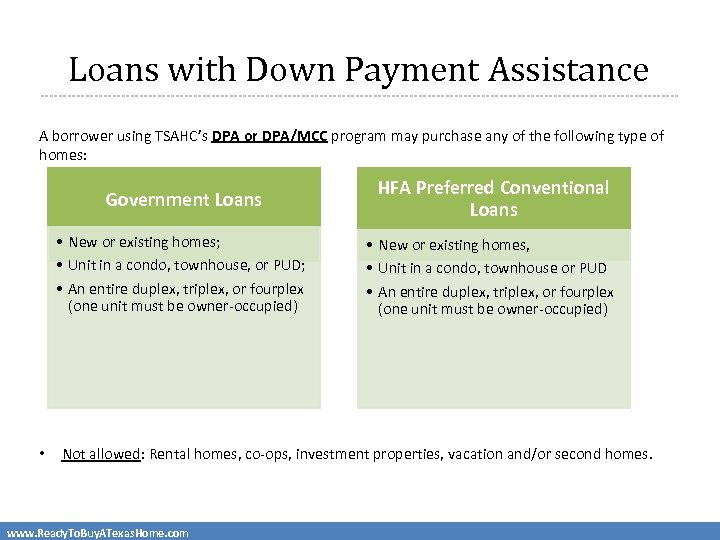

Loans with Down Payment Assistance A borrower using TSAHC’s DPA or DPA/MCC program may purchase any of the following type of homes: Government Loans • New or existing homes; • Unit in a condo, townhouse, or PUD; • An entire duplex, triplex, or fourplex (one unit must be owner-occupied) • HFA Preferred Conventional Loans • New or existing homes, • Unit in a condo, townhouse or PUD • An entire duplex, triplex, or fourplex (one unit must be owner-occupied) Not allowed: Rental homes, co-ops, investment properties, vacation and/or second homes. www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits Mortgage Credit Certificate (MCC) • First-time buyers only (Waived for Qualified Veterans and Targeted Areas) • Annual tax credit worth up to $2, 000 • Must occupy the home as principal residence • Debt-to-income ratio reduced so buying power increased • FREE for Texas Heroes using our DPA program www. Ready. To. Buy. ATexas. Home. com

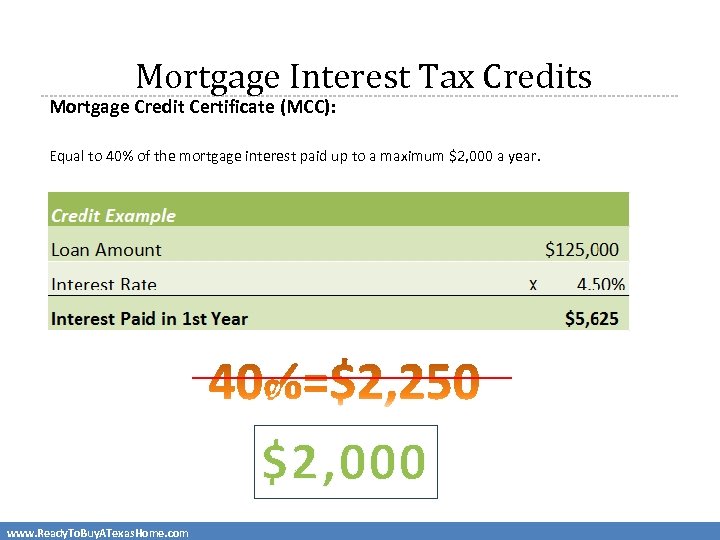

Mortgage Interest Tax Credits Mortgage Credit Certificate (MCC): Equal to 40% of the mortgage interest paid up to a maximum $2, 000 a year. $2, 000 www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits What’s the difference between a tax credit and a tax deduction? • Tax Credits = Reduction of tax liability or taxes owed • Tax Deductions = Reduction of taxable income www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits An MCC allows you to take advantage of both forms of savings: • Using the previous example, they can take the remaining mortgage interest in the amount of $3, 625 ($5, 625 - $2, 000 credit) plus any property taxes, etc. as a deduction www. Ready. To. Buy. ATexas. Home. com

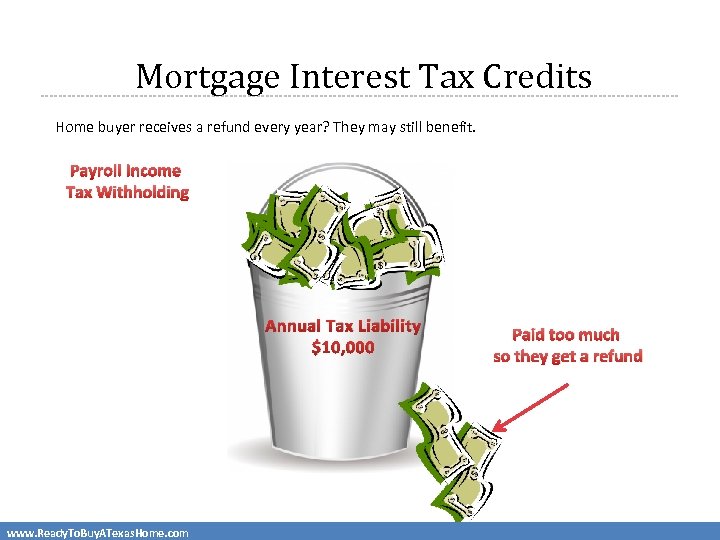

Mortgage Interest Tax Credits Home buyer receives a refund every year? They may still benefit. Payroll Income Tax Withholding Annual Tax Liability $10, 000 www. Ready. To. Buy. ATexas. Home. com Paid too much so they get a refund

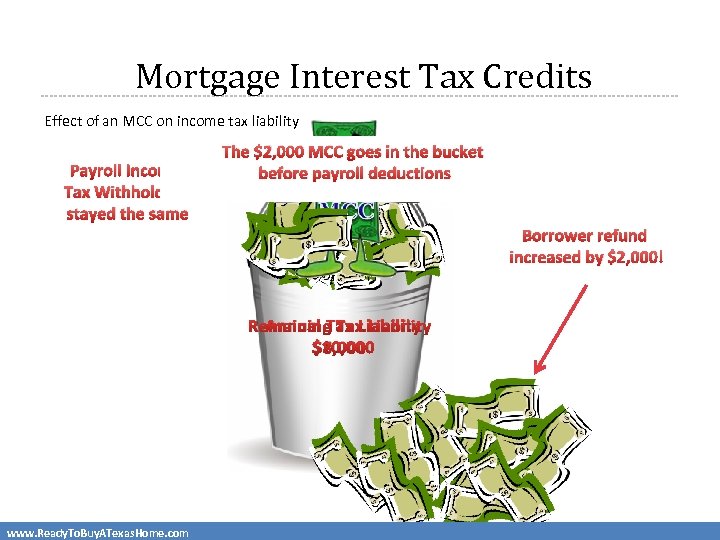

Mortgage Interest Tax Credits Effect of an MCC on income tax liability Payroll Income Tax Withholding stayed the same The $2, 000 MCC goes in the bucket before payroll deductions Borrower refund increased by $2, 000! Annual Tax Liability Remaining Tax Liability $10, 000 $8, 000 www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits Mortgage Credit Certificate (MCC) • It’s the homebuyer’s responsibility to claim the mortgage interest credit on their federal income tax return every year • The credit cannot be larger than the annual federal income tax liability, after all other credits and deductions have been considered www. Ready. To. Buy. ATexas. Home. com

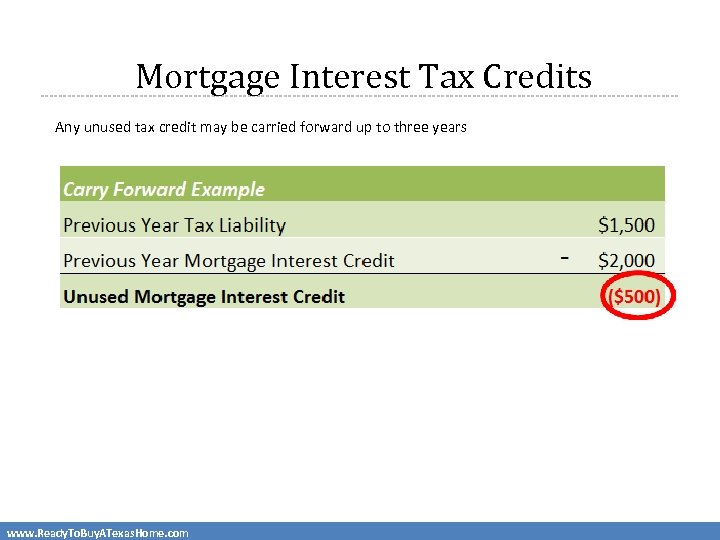

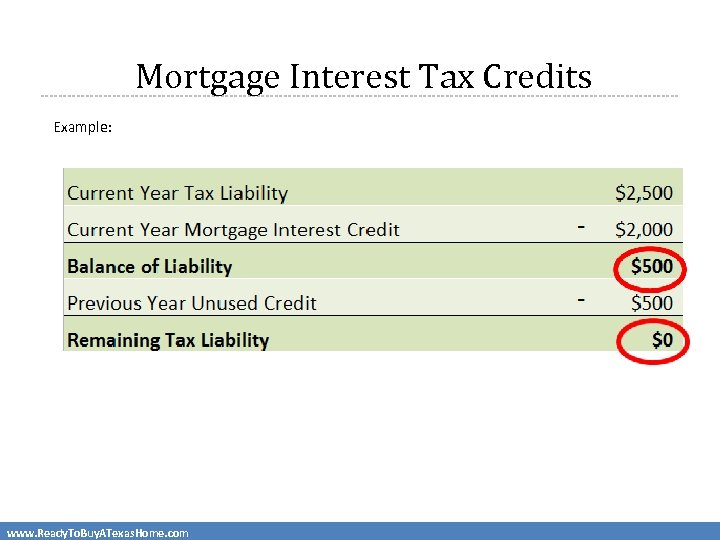

Mortgage Interest Tax Credits Any unused tax credit may be carried forward up to three years www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits Example: www. Ready. To. Buy. ATexas. Home. com

Mortgage Interest Tax Credits Mortgage Credit Certificate (MCC) • • The MCC can be used by itself or with the DPA program. If MCC is used with other mortgage loan product: o Must be fixed rate mortgage – no requirement on term or product o Lender can sell loan to any investor/servicer o No minimum credit score or maximum DTI requirements www. Ready. To. Buy. ATexas. Home. com

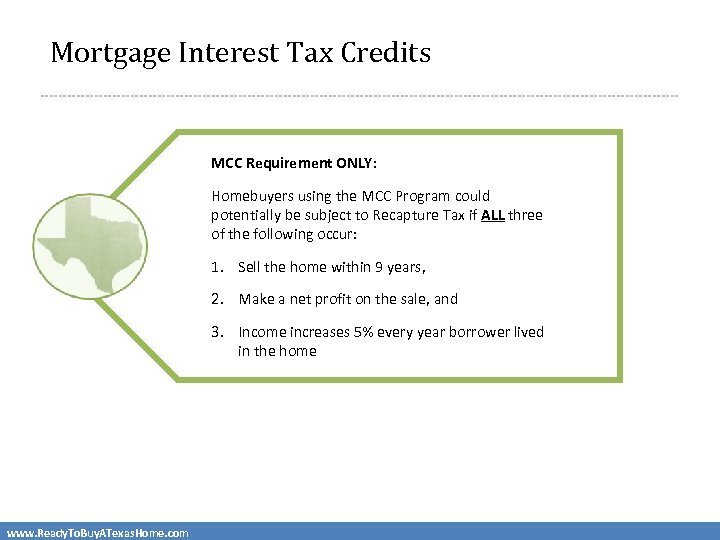

Mortgage Interest Tax Credits MCC Requirement ONLY: Homebuyers using the MCC Program could potentially be subject to Recapture Tax if ALL three of the following occur: 1. Sell the home within 9 years, 2. Make a net profit on the sale, and 3. Income increases 5% every year borrower lived in the home www. Ready. To. Buy. ATexas. Home. com

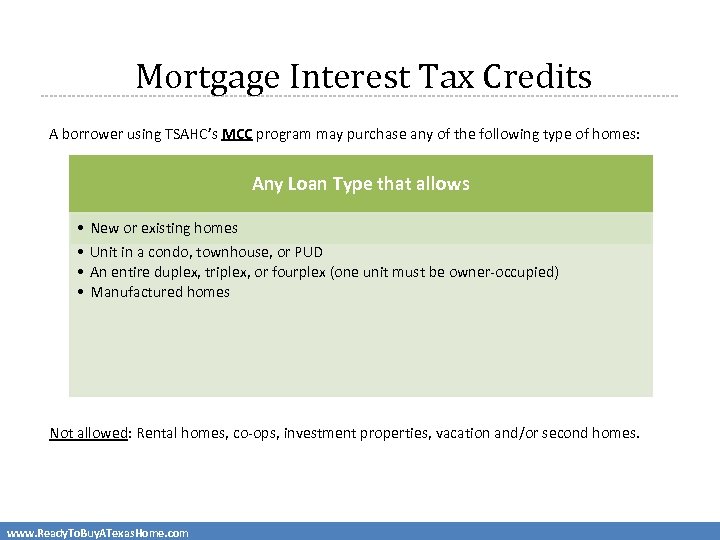

Mortgage Interest Tax Credits A borrower using TSAHC’s MCC program may purchase any of the following type of homes: Any Loan Type that allows • • New or existing homes Unit in a condo, townhouse, or PUD An entire duplex, triplex, or fourplex (one unit must be owner-occupied) Manufactured homes Not allowed: Rental homes, co-ops, investment properties, vacation and/or second homes. www. Ready. To. Buy. ATexas. Home. com

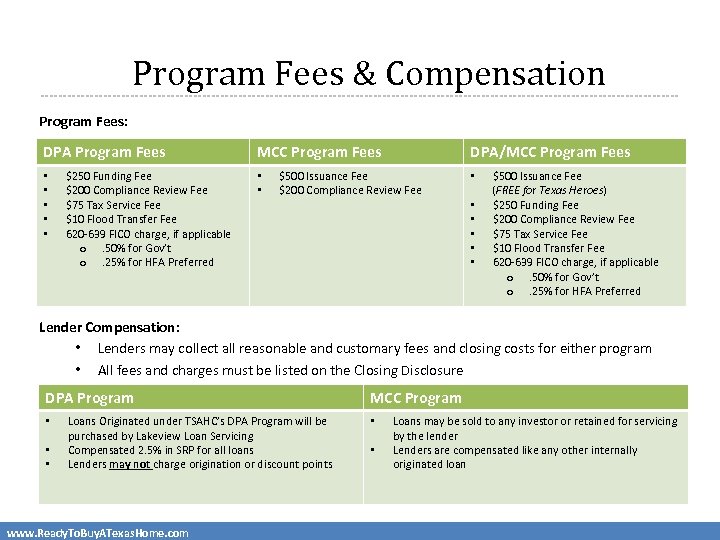

Program Fees & Compensation Program Fees: DPA Program Fees • • • $250 Funding Fee $200 Compliance Review Fee $75 Tax Service Fee $10 Flood Transfer Fee 620 -639 FICO charge, if applicable o. 50% for Gov’t o. 25% for HFA Preferred MCC Program Fees • • DPA/MCC Program Fees $500 Issuance Fee $200 Compliance Review Fee • $500 Issuance Fee (FREE for Texas Heroes) • $250 Funding Fee • $200 Compliance Review Fee • $75 Tax Service Fee • $10 Flood Transfer Fee • 620 -639 FICO charge, if applicable o. 50% for Gov’t o. 25% for HFA Preferred Lender Compensation: • Lenders may collect all reasonable and customary fees and closing costs for either program • All fees and charges must be listed on the Closing Disclosure DPA Program • • • Loans Originated under TSAHC’s DPA Program will be purchased by Lakeview Loan Servicing Compensated 2. 5% in SRP for all loans Lenders may not charge origination or discount points www. Ready. To. Buy. ATexas. Home. com MCC Program • • Loans may be sold to any investor or retained for servicing by the lender Lenders are compensated like any other internally originated loan

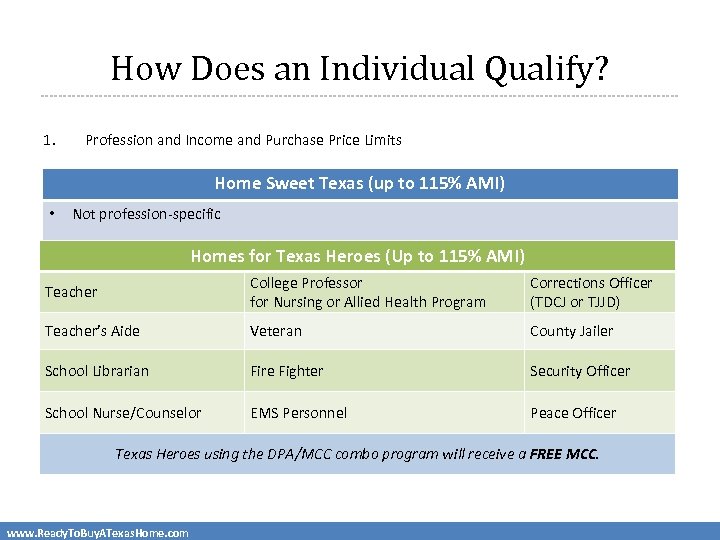

How Does an Individual Qualify? 1. Profession and Income and Purchase Price Limits Home Sweet Texas (up to 115% AMI) • Not profession-specific Homes for Texas Heroes (Up to 115% AMI) Teacher College Professor for Nursing or Allied Health Program Corrections Officer (TDCJ or TJJD) Teacher’s Aide Veteran County Jailer School Librarian Fire Fighter Security Officer School Nurse/Counselor EMS Personnel Peace Officer Texas Heroes using the DPA/MCC combo program will receive a FREE MCC. www. Ready. To. Buy. ATexas. Home. com

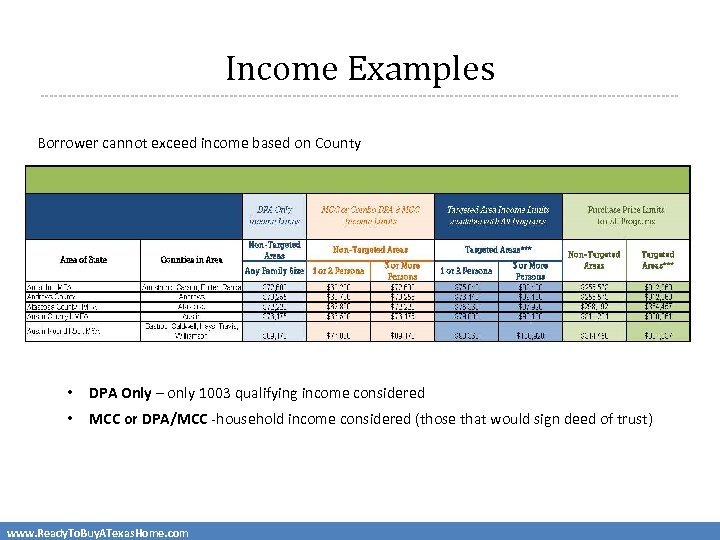

Income Examples Borrower cannot exceed income based on County • DPA Only – only 1003 qualifying income considered • MCC or DPA/MCC -household income considered (those that would sign deed of trust) www. Ready. To. Buy. ATexas. Home. com

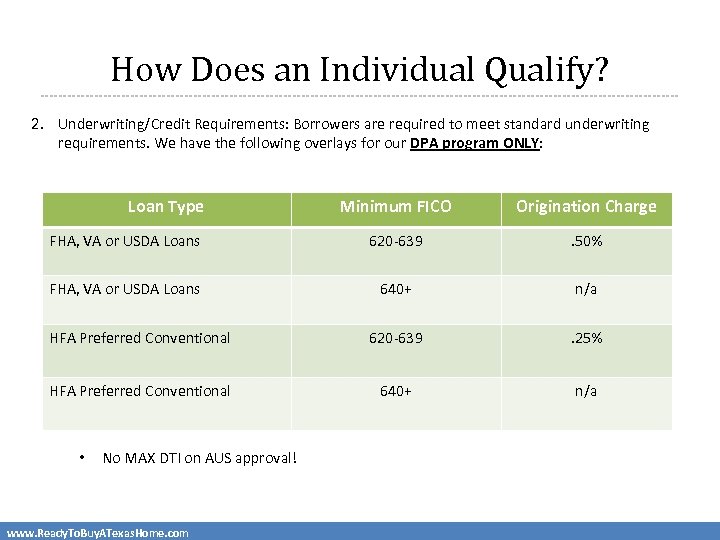

How Does an Individual Qualify? 2. Underwriting/Credit Requirements: Borrowers are required to meet standard underwriting requirements. We have the following overlays for our DPA program ONLY: Loan Type Minimum FICO Origination Charge FHA, VA or USDA Loans 620 -639 . 50% FHA, VA or USDA Loans 640+ n/a HFA Preferred Conventional 620 -639 . 25% HFA Preferred Conventional 640+ n/a • No MAX DTI on AUS approval! www. Ready. To. Buy. ATexas. Home. com

How Does an Individual Qualify? 3. Borrowers need to complete a homebuyer education course prior to closing on the home loan. • A homeowner is 33% less likely to fall behind on their mortgage if they’ve taken a home buyer education course • Met by attending a session through TSAHC’s network of housing counseling agencies • Visit www. texasfinancialtoolbox. com to find a course near your borrower • There may be a cost associated with this course. www. Ready. To. Buy. ATexas. Home. com

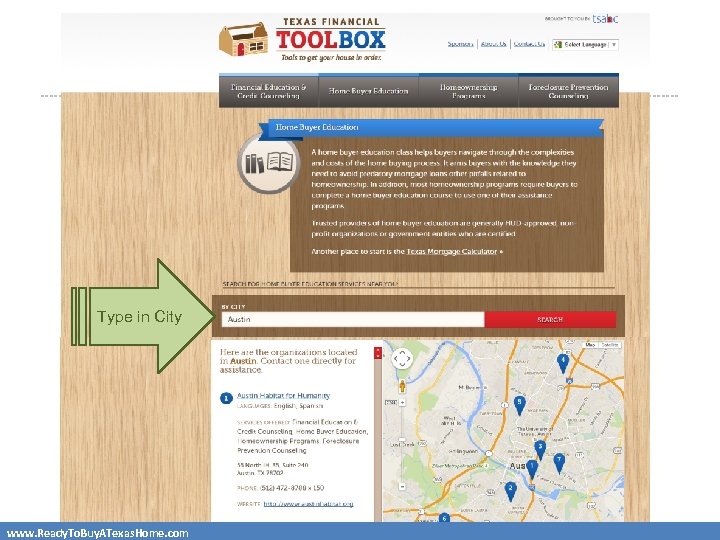

Type in City www. Ready. To. Buy. ATexas. Home. com

How Does an Individual Qualify? 4. Work with an approved participating lender 5. MCC Requirement ONLY: • First time home buyers – Defined as anyone who hasn’t had ownership interest in a principal residence in the last 3 years. www. Ready. To. Buy. ATexas. Home. com

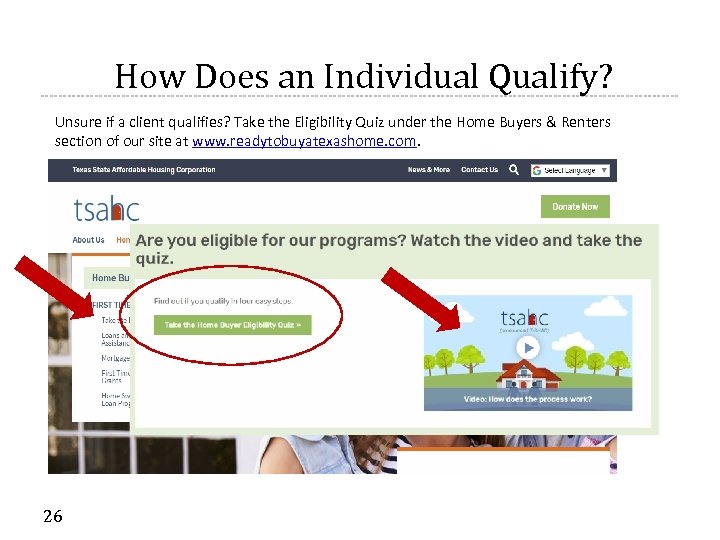

How Does an Individual Qualify? Unsure if a client qualifies? Take the Eligibility Quiz under the Home Buyers & Renters section of our site at www. readytobuyatexashome. com. 26

Use this slide and additional slides if needed, to promote yourself as one of TSAHC’s preferred lenders or Realtors.

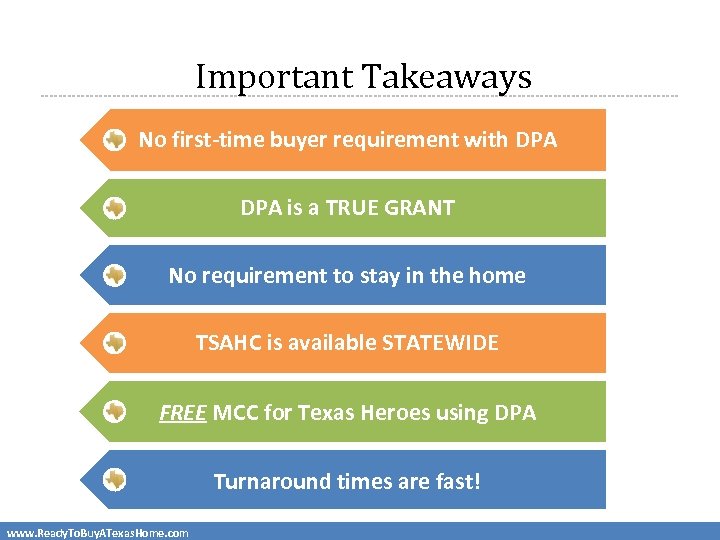

Important Takeaways No first-time buyer requirement with DPA is a TRUE GRANT No requirement to stay in the home TSAHC is available STATEWIDE FREE MCC for Texas Heroes using DPA Turnaround times are fast! www. Ready. To. Buy. ATexas. Home. com

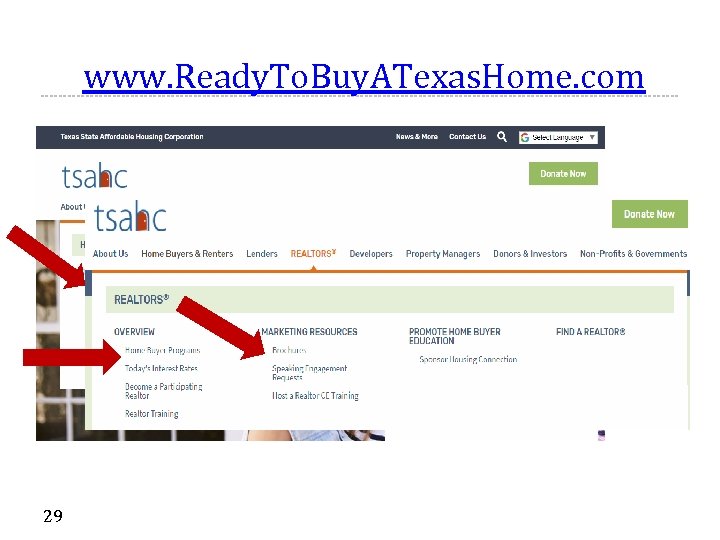

www. Ready. To. Buy. ATexas. Home. com 29

Brochures www. Ready. To. Buy. ATexas. Home. com

Fillable Flyers www. Ready. To. Buy. ATexas. Home. com

10 Step Checklists www. Ready. To. Buy. ATexas. Home. com

Questions ENTER YOUR CONTACT INFORMATION HERE www. readytobuyatexashome. com TSAHC’s Homeownership Hotline(877) 508 -4611 or email Homeownership@TSAHC. org www. Ready. To. Buy. ATexas. Home. com

04492cbf92fd6e2ff202b31520b4ecf4.ppt