d65dbddb19e737f9b85552e3371a6bc9.ppt

- Количество слайдов: 16

Hellenic Forum 27 March 2008 Athens Peter M. Swift

Hellenic Forum 27 March 2008 Athens Peter M. Swift

Update on the revision of MARPOL ANNEX VI & GHG reduction Hellenic Forum 27 March 2008 Athens

Update on the revision of MARPOL ANNEX VI & GHG reduction Hellenic Forum 27 March 2008 Athens

IMO Annex VI Revision Process • End 2007 Group of Experts Report published • February - BLG finalised its contributions • April - MEPC 57 to narrow the options and (start) to develop (and approve) the revision • October - MEPC 58 to adopt the revision • Enforcement (tacit agreement) – earliest February 2010

IMO Annex VI Revision Process • End 2007 Group of Experts Report published • February - BLG finalised its contributions • April - MEPC 57 to narrow the options and (start) to develop (and approve) the revision • October - MEPC 58 to adopt the revision • Enforcement (tacit agreement) – earliest February 2010

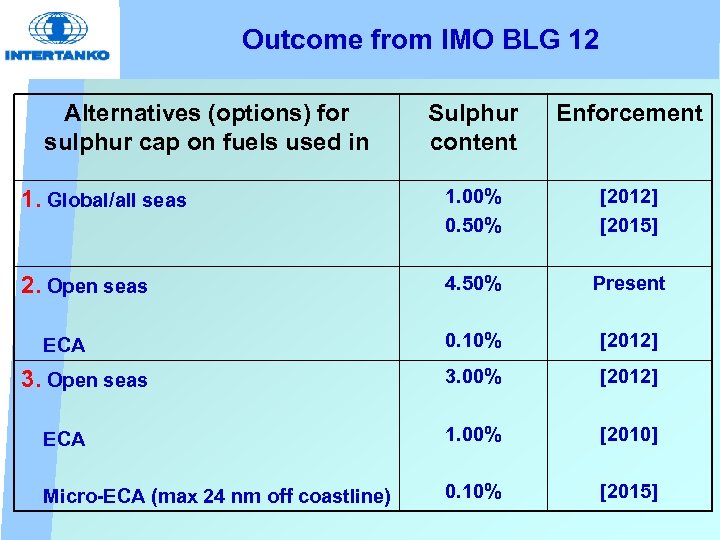

Outcome from IMO BLG 12 Alternatives (options) for sulphur cap on fuels used in Sulphur content Enforcement 1. Global/all seas 1. 00% 0. 50% [2012] [2015] 2. Open seas 4. 50% Present 0. 10% [2012] 3. 00% [2012] ECA 1. 00% [2010] Micro-ECA (max 24 nm off coastline) 0. 10% [2015] ECA 3. Open seas

Outcome from IMO BLG 12 Alternatives (options) for sulphur cap on fuels used in Sulphur content Enforcement 1. Global/all seas 1. 00% 0. 50% [2012] [2015] 2. Open seas 4. 50% Present 0. 10% [2012] 3. 00% [2012] ECA 1. 00% [2010] Micro-ECA (max 24 nm off coastline) 0. 10% [2015] ECA 3. Open seas

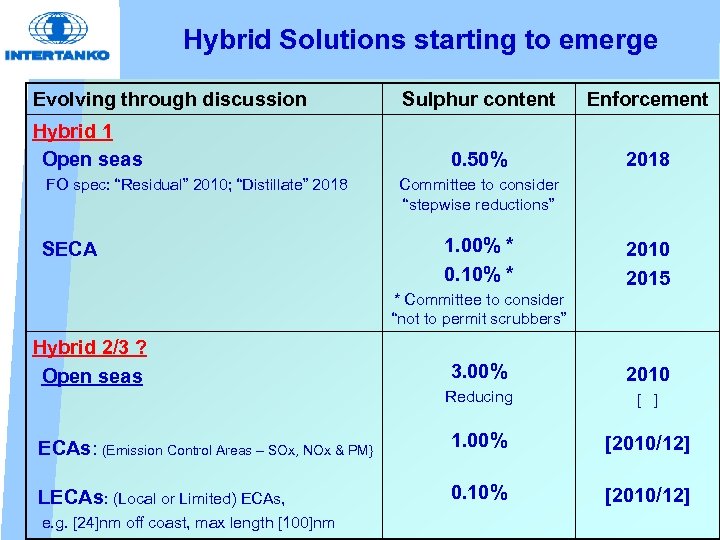

Hybrid Solutions starting to emerge Evolving through discussion Hybrid 1 Open seas FO spec: “Residual” 2010; “Distillate” 2018 SECA Sulphur content Enforcement 0. 50% 2018 Committee to consider “stepwise reductions” 1. 00% * 0. 10% * 2010 2015 * Committee to consider “not to permit scrubbers” Hybrid 2/3 ? Open seas 3. 00% 2010 Reducing [ ] ECAs: (Emission Control Areas – SOx, NOx & PM} 1. 00% [2010/12] LECAs: (Local or Limited) ECAs, 0. 10% [2010/12] e. g. [24]nm off coast, max length [100]nm

Hybrid Solutions starting to emerge Evolving through discussion Hybrid 1 Open seas FO spec: “Residual” 2010; “Distillate” 2018 SECA Sulphur content Enforcement 0. 50% 2018 Committee to consider “stepwise reductions” 1. 00% * 0. 10% * 2010 2015 * Committee to consider “not to permit scrubbers” Hybrid 2/3 ? Open seas 3. 00% 2010 Reducing [ ] ECAs: (Emission Control Areas – SOx, NOx & PM} 1. 00% [2010/12] LECAs: (Local or Limited) ECAs, 0. 10% [2010/12] e. g. [24]nm off coast, max length [100]nm

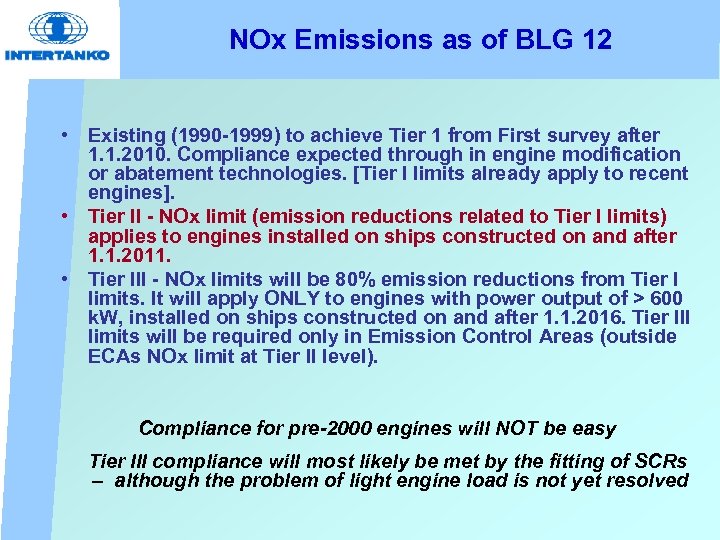

NOx Emissions as of BLG 12 • Existing (1990 -1999) to achieve Tier 1 from First survey after 1. 1. 2010. Compliance expected through in engine modification or abatement technologies. [Tier I limits already apply to recent engines]. • Tier II - NOx limit (emission reductions related to Tier I limits) applies to engines installed on ships constructed on and after 1. 1. 2011. • Tier III - NOx limits will be 80% emission reductions from Tier I limits. It will apply ONLY to engines with power output of > 600 k. W, installed on ships constructed on and after 1. 1. 2016. Tier III limits will be required only in Emission Control Areas (outside ECAs NOx limit at Tier II level). Compliance for pre-2000 engines will NOT be easy Tier III compliance will most likely be met by the fitting of SCRs – although the problem of light engine load is not yet resolved

NOx Emissions as of BLG 12 • Existing (1990 -1999) to achieve Tier 1 from First survey after 1. 1. 2010. Compliance expected through in engine modification or abatement technologies. [Tier I limits already apply to recent engines]. • Tier II - NOx limit (emission reductions related to Tier I limits) applies to engines installed on ships constructed on and after 1. 1. 2011. • Tier III - NOx limits will be 80% emission reductions from Tier I limits. It will apply ONLY to engines with power output of > 600 k. W, installed on ships constructed on and after 1. 1. 2016. Tier III limits will be required only in Emission Control Areas (outside ECAs NOx limit at Tier II level). Compliance for pre-2000 engines will NOT be easy Tier III compliance will most likely be met by the fitting of SCRs – although the problem of light engine load is not yet resolved

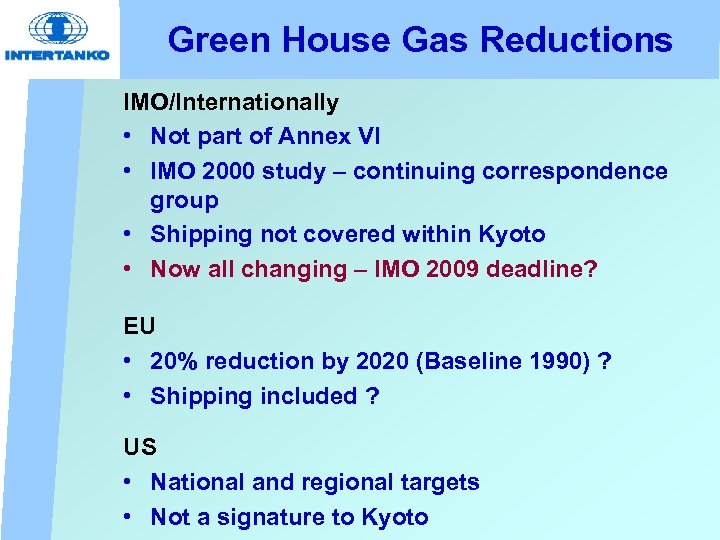

Green House Gas Reductions IMO/Internationally • Not part of Annex VI • IMO 2000 study – continuing correspondence group • Shipping not covered within Kyoto • Now all changing – IMO 2009 deadline? EU • 20% reduction by 2020 (Baseline 1990) ? • Shipping included ? US • National and regional targets • Not a signature to Kyoto

Green House Gas Reductions IMO/Internationally • Not part of Annex VI • IMO 2000 study – continuing correspondence group • Shipping not covered within Kyoto • Now all changing – IMO 2009 deadline? EU • 20% reduction by 2020 (Baseline 1990) ? • Shipping included ? US • National and regional targets • Not a signature to Kyoto

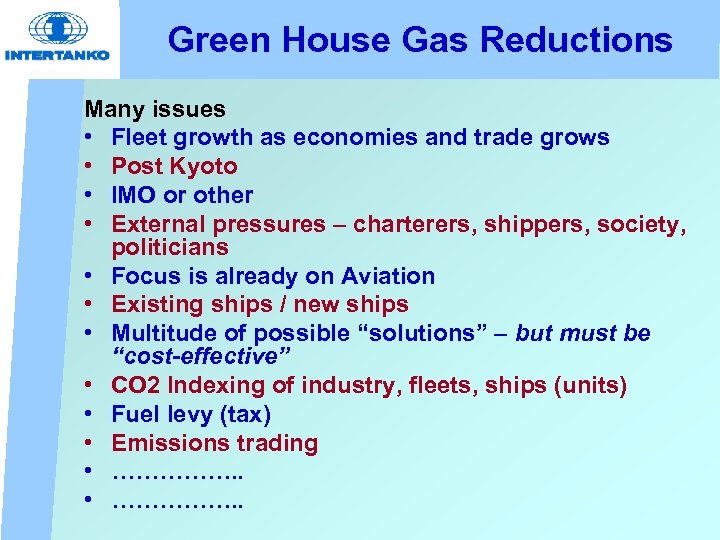

Green House Gas Reductions Many issues • Fleet growth as economies and trade grows • Post Kyoto • IMO or other • External pressures – charterers, shippers, society, politicians • Focus is already on Aviation • Existing ships / new ships • Multitude of possible “solutions” – but must be “cost-effective” • CO 2 Indexing of industry, fleets, ships (units) • Fuel levy (tax) • Emissions trading • ……………. .

Green House Gas Reductions Many issues • Fleet growth as economies and trade grows • Post Kyoto • IMO or other • External pressures – charterers, shippers, society, politicians • Focus is already on Aviation • Existing ships / new ships • Multitude of possible “solutions” – but must be “cost-effective” • CO 2 Indexing of industry, fleets, ships (units) • Fuel levy (tax) • Emissions trading • ……………. .

Emissions Trading An Introduction: A system based on “market mechanisms”, i. e. “economic incentives”, to control emissions (pollution) Based on the principle that: Overall emission reductions take place where the cost of reduction is lowest Most common system is known as “Cap and Trade” - others include “Baseline and Credit” Seen by many as the preferred alternative to emission taxes and/or direct regulation

Emissions Trading An Introduction: A system based on “market mechanisms”, i. e. “economic incentives”, to control emissions (pollution) Based on the principle that: Overall emission reductions take place where the cost of reduction is lowest Most common system is known as “Cap and Trade” - others include “Baseline and Credit” Seen by many as the preferred alternative to emission taxes and/or direct regulation

Emissions Trading – Cap and Trade • The “Cap” on a specific emission is set by the government (or other authority) over a compliance period (e. g. one year) • Companies (or industries) are issued permits to “emit” and are required to hold an equivalent number of allowances (or credits) which represent the right to emit a specific amount over the period • Total amount of allowances and credits can not exceed the cap • Companies which need to increase their emissions buy “credits” from those which emit less – hence the reference to “trading” • At end of period a company (or industry) not holding sufficient allowances is penalised The overall goal to reduce total emissions is achieved either by lowering the cap over time or by “retiring” credits

Emissions Trading – Cap and Trade • The “Cap” on a specific emission is set by the government (or other authority) over a compliance period (e. g. one year) • Companies (or industries) are issued permits to “emit” and are required to hold an equivalent number of allowances (or credits) which represent the right to emit a specific amount over the period • Total amount of allowances and credits can not exceed the cap • Companies which need to increase their emissions buy “credits” from those which emit less – hence the reference to “trading” • At end of period a company (or industry) not holding sufficient allowances is penalised The overall goal to reduce total emissions is achieved either by lowering the cap over time or by “retiring” credits

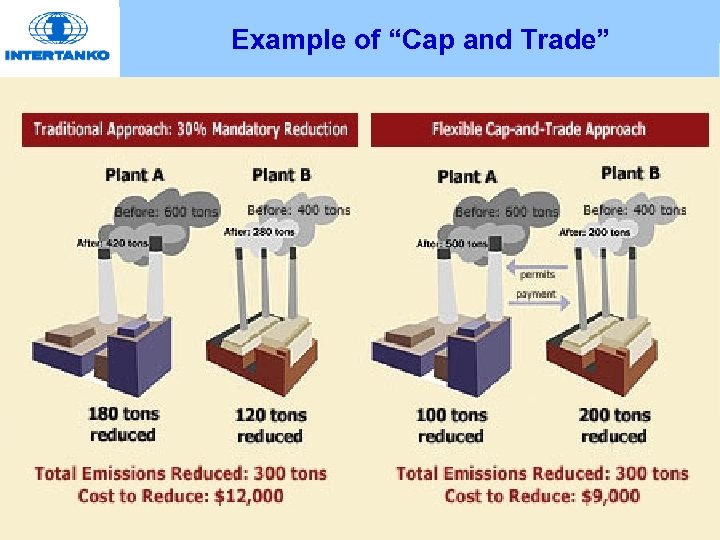

Example of “Cap and Trade”

Example of “Cap and Trade”

Emissions Trading – Cap and Trade Pros and Cons • “System” is emissions focused on sustainable development, as opposed to tax revenue generation • Does not impose a particular technology or set rigid limits • Allowances are frequently allocated with a “grandfathering” provision (i. e. based on historical emissions) • Doubts arise over complexity, baseline data, setting of caps and allowances, and monitoring • Concerns over “free” allowances given to companies (industries) as opposed to requirement to purchase or auction • Concerns also over ability in some systems to purchase “offsets”, i. e. tradable carbon credits in other countries, e. g. through the Clean Development Mechanism (CDM) established by the Kyoto Protocol

Emissions Trading – Cap and Trade Pros and Cons • “System” is emissions focused on sustainable development, as opposed to tax revenue generation • Does not impose a particular technology or set rigid limits • Allowances are frequently allocated with a “grandfathering” provision (i. e. based on historical emissions) • Doubts arise over complexity, baseline data, setting of caps and allowances, and monitoring • Concerns over “free” allowances given to companies (industries) as opposed to requirement to purchase or auction • Concerns also over ability in some systems to purchase “offsets”, i. e. tradable carbon credits in other countries, e. g. through the Clean Development Mechanism (CDM) established by the Kyoto Protocol

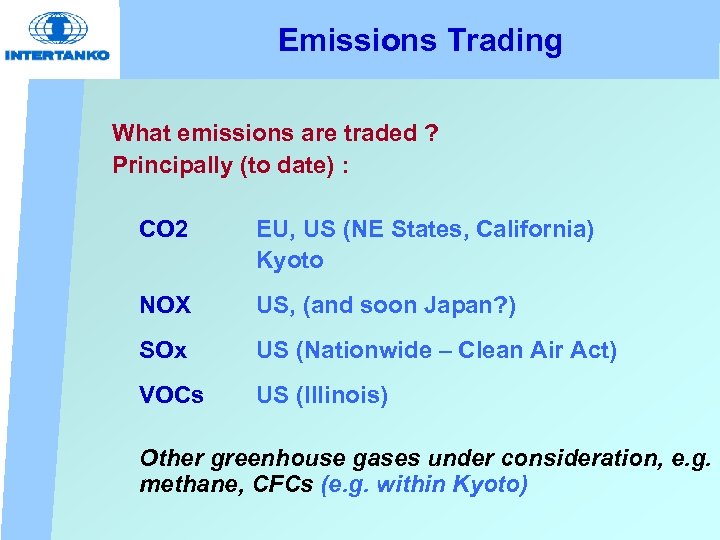

Emissions Trading What emissions are traded ? Principally (to date) : CO 2 EU, US (NE States, California) Kyoto NOX US, (and soon Japan? ) SOx US (Nationwide – Clean Air Act) VOCs US (Illinois) Other greenhouse gases under consideration, e. g. methane, CFCs (e. g. within Kyoto)

Emissions Trading What emissions are traded ? Principally (to date) : CO 2 EU, US (NE States, California) Kyoto NOX US, (and soon Japan? ) SOx US (Nationwide – Clean Air Act) VOCs US (Illinois) Other greenhouse gases under consideration, e. g. methane, CFCs (e. g. within Kyoto)

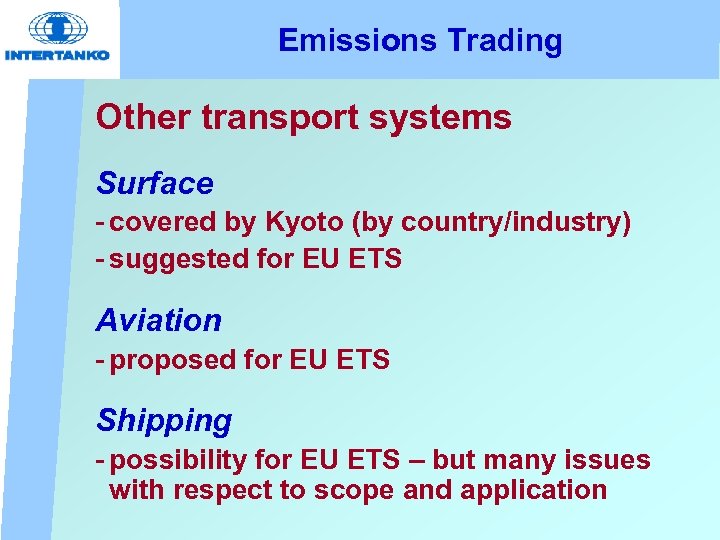

Emissions Trading Other transport systems Surface - covered by Kyoto (by country/industry) - suggested for EU ETS Aviation - proposed for EU ETS Shipping - possibility for EU ETS – but many issues with respect to scope and application

Emissions Trading Other transport systems Surface - covered by Kyoto (by country/industry) - suggested for EU ETS Aviation - proposed for EU ETS Shipping - possibility for EU ETS – but many issues with respect to scope and application

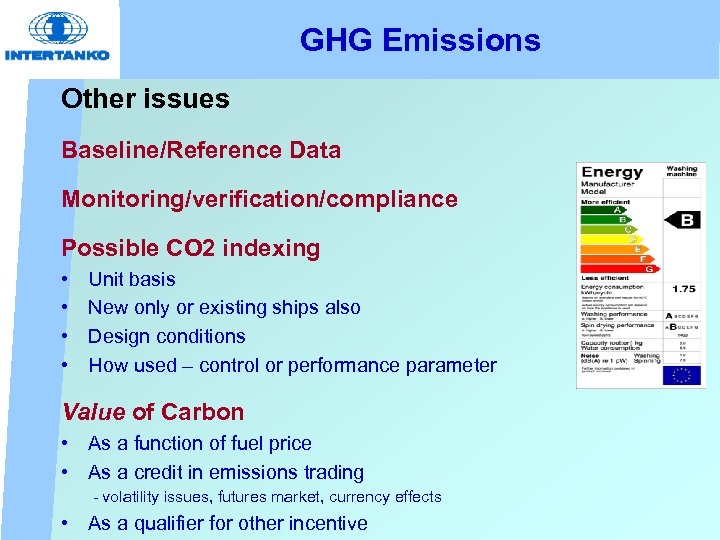

GHG Emissions Other issues Baseline/Reference Data Monitoring/verification/compliance Possible CO 2 indexing • • Unit basis New only or existing ships also Design conditions How used – control or performance parameter Value of Carbon • As a function of fuel price • As a credit in emissions trading - volatility issues, futures market, currency effects • As a qualifier for other incentive

GHG Emissions Other issues Baseline/Reference Data Monitoring/verification/compliance Possible CO 2 indexing • • Unit basis New only or existing ships also Design conditions How used – control or performance parameter Value of Carbon • As a function of fuel price • As a credit in emissions trading - volatility issues, futures market, currency effects • As a qualifier for other incentive

THANK YOU For more information, please visit: www. intertanko. com www. poseidonchallenge. com www. shippingfacts. com www. maritimefoundation. com

THANK YOU For more information, please visit: www. intertanko. com www. poseidonchallenge. com www. shippingfacts. com www. maritimefoundation. com