ebcce3a47c4cb6832ed258c39b3f8d20.ppt

- Количество слайдов: 64

Heinz-Beech Nut Merger THINGS TO FOCUS ON: • Significance of Structure and Operation of the Market • Key Evidence** (for Exam Q 2) – Identify significance of facts – Identify missing facts that would aid analysis • Headers are Color of Strained Carrots

Heinz-Beech Nut Merger: Background

Heinz-Beech Nut Merger: Background 2000 Baby Food Market Shares: • Gerber (premium) ……………. 65% • Heinz (~15% discount)………. . 17% • Beech-Nut (premium)………. . . 15%

Heinz-Beech Nut Merger: Background Proposed Merger: • Heinz agrees to buy Beech-Nut • Would sell both products under Beech. Nut label • Claimed would use cost savings to charge Heinz prices for Beech-Nut products

Heinz-Beech Nut Merger: Background Legal Proceedings: • FTC challenges; controversial w/in FTC – Investigative staff recommended ag. challenge – Commission vote 3 -2 • After trial, District Court upheld merger • Reversed by D. C. Circuit

Heinz-Beech Nut Merger: Significance of Market Structure

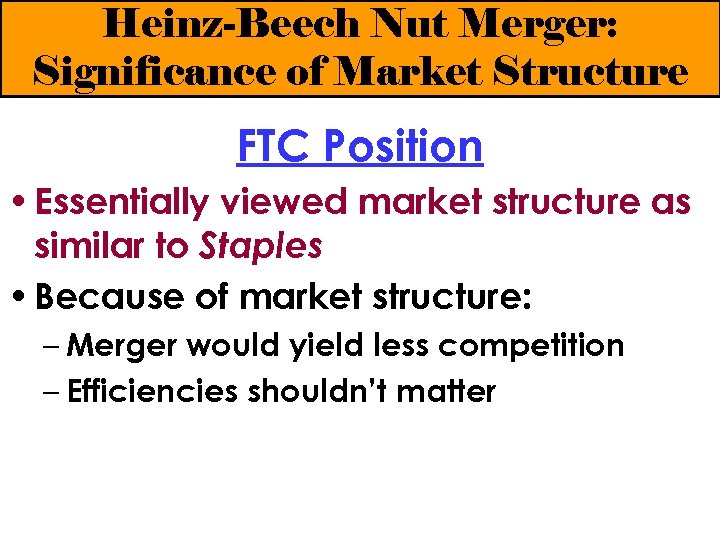

Heinz-Beech Nut Merger: Significance of Market Structure FTC Position • Essentially viewed market structure as similar to Staples – 3 2 in market w very high concentration/ HHI numbers – Significant barriers to entry (BE) – Merger to duopoly in industry w high BE = anti-competitive

Heinz-Beech Nut Merger: Significance of Market Structure FTC Position • Essentially viewed market structure as similar to Staples • Because of market structure: – Merger would yield less competition – Efficiencies shouldn’t matter

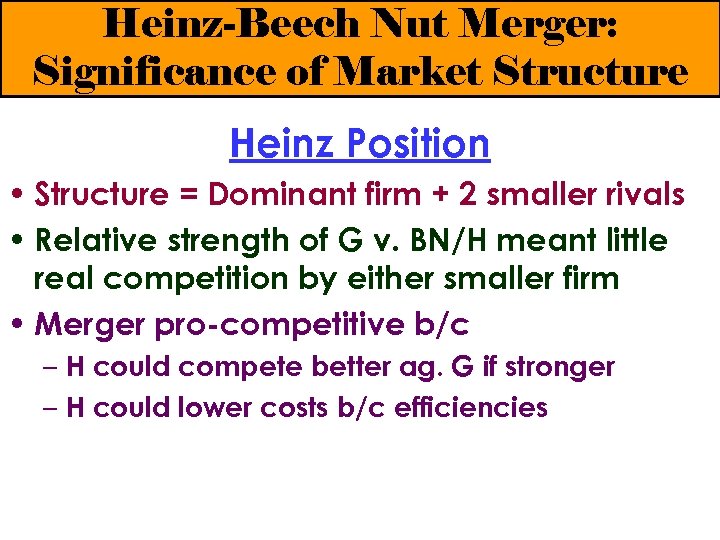

Heinz-Beech Nut Merger: Significance of Market Structure Heinz Position • Structure = Dominant firm + 2 smaller rivals • Relative strength of G v. BN/H meant little real competition by either smaller firm • Merger pro-competitive b/c – H could compete better ag. G if stronger – H could lower costs b/c efficiencies

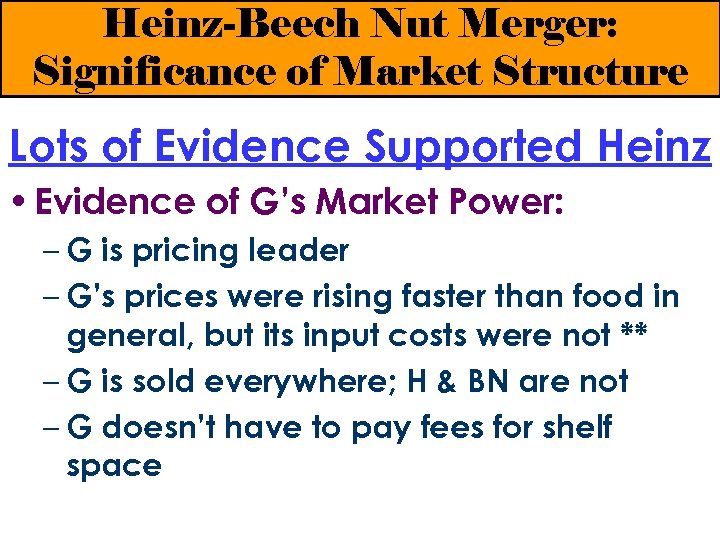

Heinz-Beech Nut Merger: Significance of Market Structure Lots of Evidence Supported Heinz • Evidence of G’s Market Power: – G is pricing leader – G’s prices were rising faster than food in general, but its input costs were not ** – G is sold everywhere; H & BN are not – G doesn’t have to pay fees for shelf space

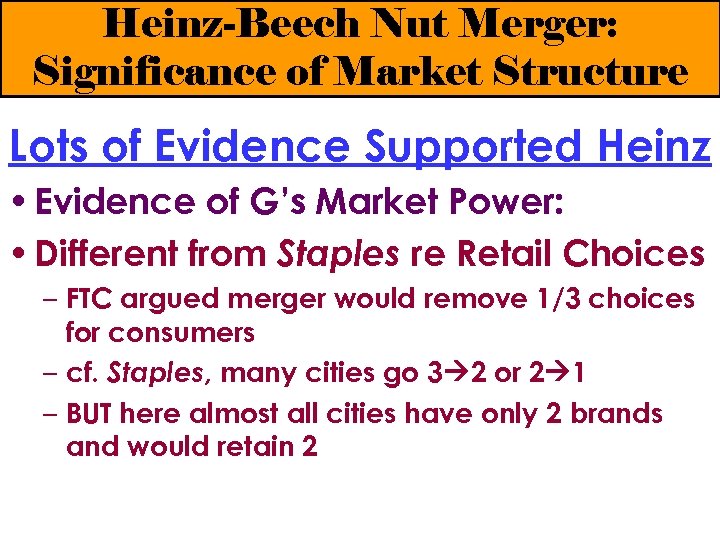

Heinz-Beech Nut Merger: Significance of Market Structure Lots of Evidence Supported Heinz • Evidence of G’s Market Power: • Different from Staples re Retail Choices – FTC argued merger would remove 1/3 choices for consumers – cf. Staples, many cities go 3 2 or 2 1 – BUT here almost all cities have only 2 brands and would retain 2

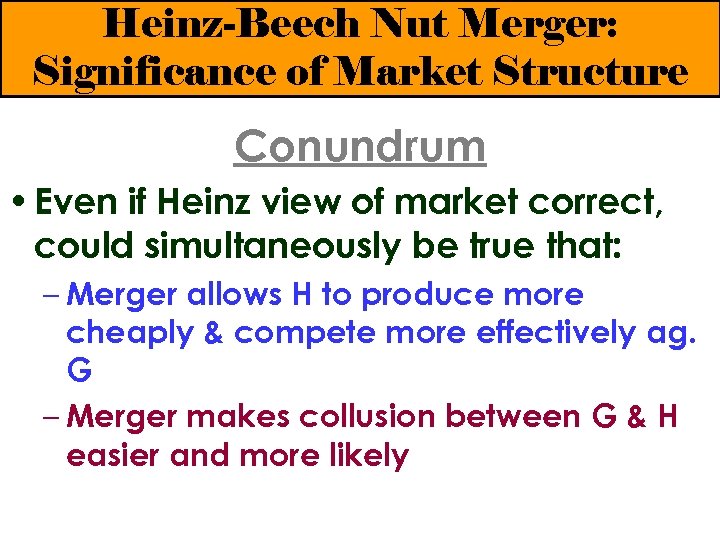

Heinz-Beech Nut Merger: Significance of Market Structure Conundrum • Even if Heinz view of market correct, could simultaneously be true that: – Merger allows H to produce more cheaply & compete more effectively ag. G – Merger makes collusion between G & H easier and more likely

Heinz-Beech Nut Merger: Effects on Competition

Heinz-Beech Nut Merger: Likely Effects on Competition Three Potential Effects Debated 1. Effects on Competition with Gerber 2. Effects on Innovation 3. Incentives to Raise Prices Unilaterally

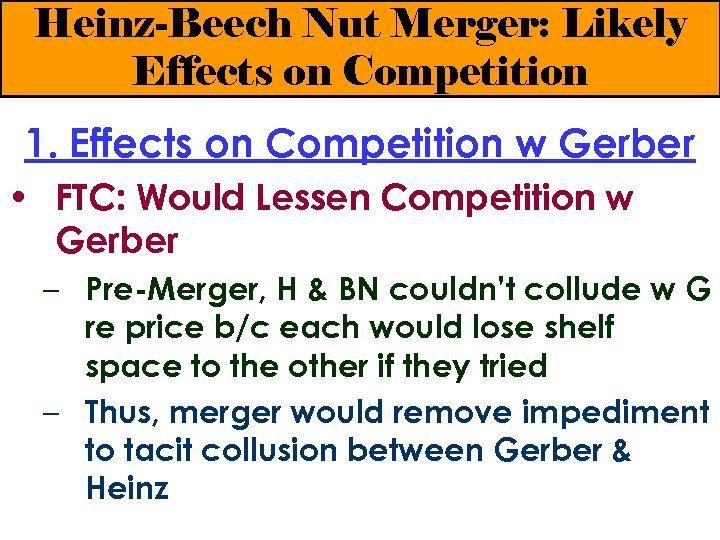

Heinz-Beech Nut Merger: Likely Effects on Competition 1. Effects on Competition w Gerber • FTC: Would Lessen Competition w Gerber – Pre-Merger, H & BN couldn’t collude w G re price b/c each would lose shelf space to the other if they tried – Thus, merger would remove impediment to tacit collusion between Gerber & Heinz

Heinz-Beech Nut Merger: Likely Effects on Competition 1. Effects on Competition w Gerber Heinz: Would Increase Competition w G a. H & BN can’t challenge G dominance b/c hard to expand b. Merged Entity Could Compete Better c. Collusion with G Unlikely

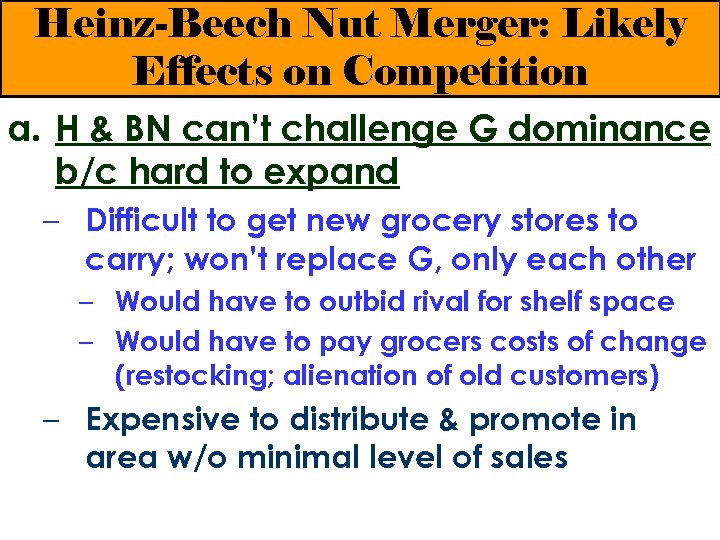

Heinz-Beech Nut Merger: Likely Effects on Competition a. H & BN can’t challenge G dominance b/c hard to expand – Difficult to get new grocery stores to carry; won’t replace G, only each other – Would have to outbid rival for shelf space – Would have to pay grocers costs of change (restocking; alienation of old customers) – Expensive to distribute & promote in area w/o minimal level of sales

Heinz-Beech Nut Merger: Likely Effects on Competition b. Merged Entity Could Compete Better with G – Combine H cheap production w BN premium reputation – Efficiencies would lower costs; aid competition – Would increase wholesale competition w G, which might then have to bid for shelf space

Heinz-Beech Nut Merger: Likely Effects on Competition c. Collusion with G Unlikely – Hard to coordinate prices; time lag for awareness of wholesale price changes – H better off lowering price & increasing market share than colluding – G internal documents predict more competition from merged entity, not tacit collusion**

Heinz-Beech Nut Merger: Likely Effects on Competition 2. Effects on Innovation FTC: BN had been innovator, thus merger would reduce innovation in industry

Heinz-Beech Nut Merger: Likely Effects on Competition 2. Effects on Innovation Heinz: Little Pre-merger Innovation in Market • G little incentive to innovate; would cannibalize own sales • Innovation not good investment for BN & H – Low market shares = less sales to spread costs over – H didn’t want to do national campaign to introduce new products where only in 45% of stores – H concluded pre-merger that not profitable to bring to US market 2 major innovations ** • Access to 85% of grocery shelves will provide merged firm with more incentive to innovate

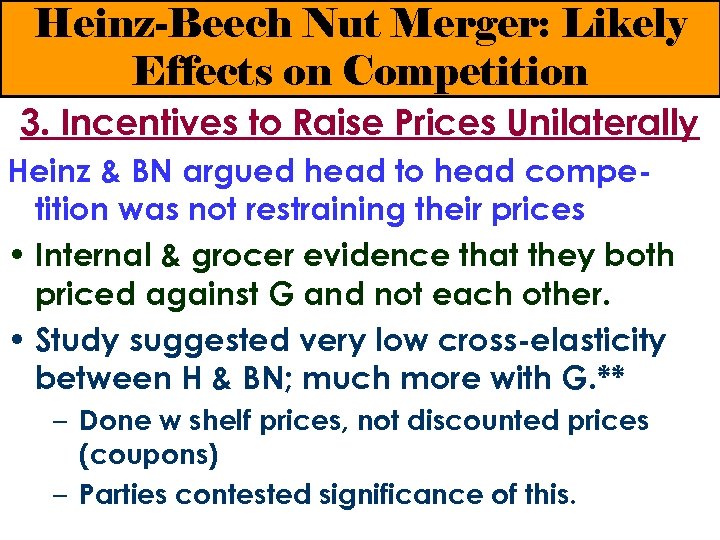

Heinz-Beech Nut Merger: Likely Effects on Competition 3. Incentives to Raise Prices Unilaterally • FTC argues loss of a major competitor will allow H to raise its prices. • Heinz & BN argued head to head competition was not restraining their prices • Greatly conflicting evidence

Heinz-Beech Nut Merger: Likely Effects on Competition 3. Incentives to Raise Prices Unilaterally FTC argues loss of a major competitor will allow H to raise its prices. Supported by grocer testimony: ** • Some retail competition between BN & H would be eliminated • When both in market, tended to depress prices of BN/H & of G • Threat to switch between BN & H sometimes associated w retail price competition (also supported by BN & H internal documents**)

Heinz-Beech Nut Merger: Likely Effects on Competition 3. Incentives to Raise Prices Unilaterally Heinz & BN argued head to head competition was not restraining their prices • Internal & grocer evidence that they both priced against G and not each other. • Study suggested very low cross-elasticity between H & BN; much more with G. ** – Done w shelf prices, not discounted prices (coupons) – Parties contested significance of this.

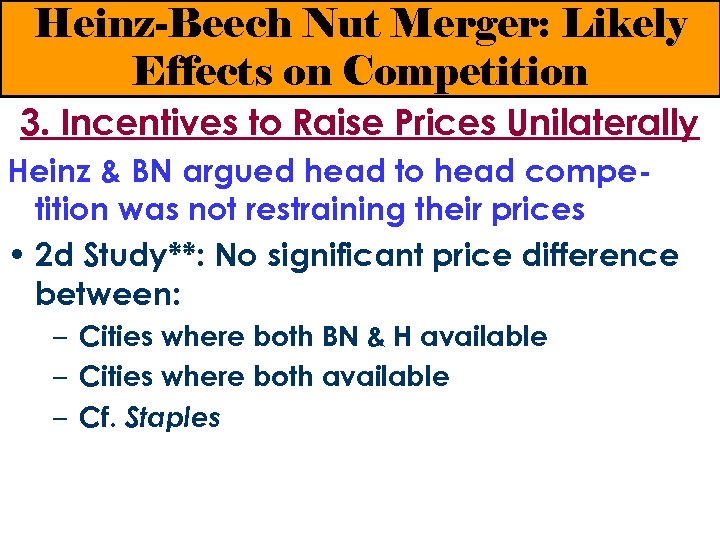

Heinz-Beech Nut Merger: Likely Effects on Competition 3. Incentives to Raise Prices Unilaterally Heinz & BN argued head to head competition was not restraining their prices • 2 d Study**: No significant price difference between: – Cities where both BN & H available – Cities where both available – Cf. Staples

Heinz-Beech Nut Merger: Debate re Efficiencies

Heinz-Beech Nut Merger: Debate re Efficiencies FTC: B/c market so concentrated, efficiencies would need to be extraordinary; not true here. • Could have been achieved w/o merger – More investment in brand reputation by H – Plant modernization by BN – Sale of BN to other buyer • Insufficient in magnitude to outweigh likely harm to competition.

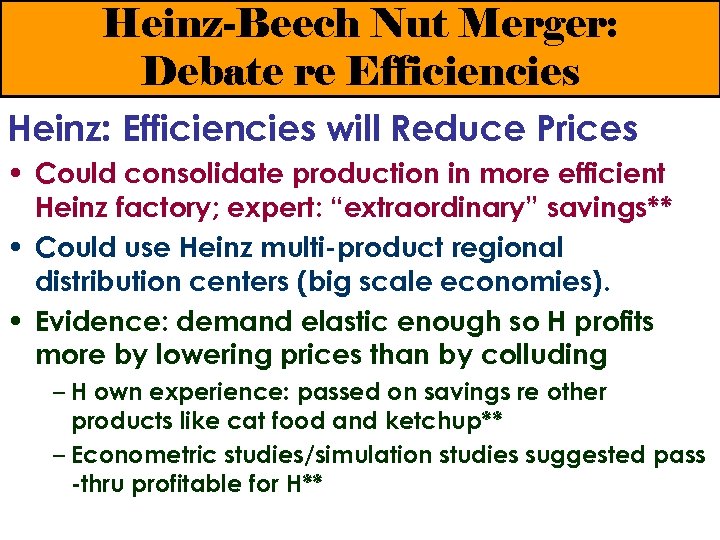

Heinz-Beech Nut Merger: Debate re Efficiencies Heinz: Efficiencies will Reduce Prices • Could consolidate production in more efficient Heinz factory; expert: “extraordinary” savings** • Could use Heinz multi-product regional distribution centers (big scale economies). • Evidence: demand elastic enough so H profits more by lowering prices than by colluding – H own experience: passed on savings re other products like cat food and ketchup** – Econometric studies/simulation studies suggested pass -thru profitable for H**

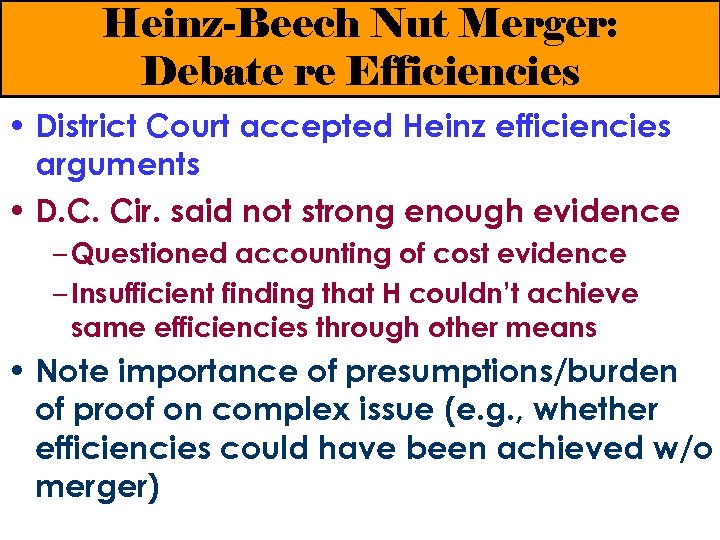

Heinz-Beech Nut Merger: Debate re Efficiencies • District Court accepted Heinz efficiencies arguments • D. C. Cir. said not strong enough evidence – Questioned accounting of cost evidence – Insufficient finding that H couldn’t achieve same efficiencies through other means • Note importance of presumptions/burden of proof on complex issue (e. g. , whether efficiencies could have been achieved w/o merger)

Heinz-Beech Nut Merger: Concluding Notes re Evidence

Heinz-Beech Nut Merger: Concluding Notes re Evidence • Use of Internal Files of H, BN & Gerber • Difficulties with Major Types of Evidence: – Economic Studies: Need to Understand Assumptions & Methodology – Grocer Testimony: Impressions Could be Wrong or Atypical (cf. Aspen) – Helpful to Have Both Where Possible

Heinz-Beech Nut Merger: Questions?

Closing Up the Class (!) • General Info on Exam & What I’m Looking For on Each Question Type (Today Tuesday) • Review of Spring 2008 Exam (Tues. ) • Closing Argument (Tues. )

General Information Related to the Exam

My Availability • Office Hours: Listed on Course Page • I Will respond to – Typed answers to old exam questions if you • Transmit by Sat 12/13 @ midnight • Follow directions on Course Page – E-mail & Phone Qs until 6 pm on day before exam • Review session on 12/14: – 7 pm; Room TBA – I’ll do a little bit of substance, then take Qs – Will be taped

Exam Coverage • Substantive Law from Units I, III – Except Vertical Restraints & Predatory Pricing – Includes Review Problems except vertical parts of Toys R Us • You won’t be asked to analyze vertical restraints, mergers or predatory pricing – Can refer to cases covering those topics if helpful – Market & competition analyses in AR case studies particularly useful • Note: I can’t cover every major issue in

Exam = Open Book • You can bring anything that doesn’t talk and isn’t programmable • You should bring course materials & AR book; I sometimes reference on test • Useful to prepare and bring checklists: – Qs to consider for particular legal issues – Cases from different units that address same issue • e. g. , market power • e. g. , claims re non-economic interests

Dangers of Open Book Tests • Under-Studying/Over-Reliance on Outline – Insufficient time to look up material – Use outline as security blanket or for checklists • Reliance on commercial sources; old outlines; old model answers – Responsible for Knowing What Material Is Covered by This Course This Year – Oversimplification in Commercial Outlines – Copying Material v. Responding to This

Structure of Exam • Three hours; two equally weighted Qs – One hour to read Qs, take notes, outline – Two hours to write answers • One hour per Q • Stick to times • Instructions page of exam will be available on Course Page so you can read it in advance

Using Your Reading Period • Read each Q carefully at least twice • List major points you’d like to discuss • Choose order to make rough outline • My Recommendation: – Use about half of reading period on each Q – Write first the Q you outline last

Aftermath • By tradition, I’ll be on the bricks at the end of the scheduled exam time • I’ll post grading progress on Course Page • Once grades are submitted, I’ll create packets for each of you with: – Your scores on each part of course – Comments & Model Answers for Exam

Qs on Exam Logistics?

Exam Technique: Generally

Exam Technique: Generally • My Exam Techniques Lectures Available on Academic Achievement Website • Some Repetition Here, But Focused on Problems Commonly Arising on Old Antitrust Exams

Exam Technique: Generally (1) Testing Ability to Use Tools, Not Knowledge of Them • Don’t Simply Recite Legal Tests and History; Apply Them • Include Reference to Relevant Authority • Show All Work • Wizard of Oz (Because, Because)

Exam Technique: Generally (2) Draft, Not Final Product • No need formal introductions & conclusions • Use abbreviations (AT; Ro. R; Mkt Def/Pwr) • Can use telegraph English • Use headings, not topic sentences • Can use bulleted lists (e. g. , of evidence supporting one particular mkt def)

Exam Technique: Generally (3) Best Prep is Old Exam Qs • • Do some under exam conditions Review in groups if possible Read my comments where available Use model answers – to see organization/style I like – to see some possible ways to analyze – neither complete nor perfect

Exam Technique: Generally (4) Ask if you don’t know what a word or phrase means • “Saturday Night Special” • “Sheet Music”

Qs on General Exam Techniques

Exam Technique: Question I Opinion/Dissent

Exam Technique: Question I Opinion/Dissent Instructions: Compose drafts of the analysis sections of an opinion and of a shorter dissent for the [US Supreme] Court deciding this question/these questions in the context of the facts of this case.

Exam Technique: Question I Compose drafts … • As with issue-spotter, can include headings, bullet points, abbr. , etc. • Present concise versions of arguments, not rhetoric (don’t get carried away with role) • Don’t need fancy language, transitions, etc.

Exam Technique: Question I … of the analysis sections … • No need for – Introduction – Statement of facts – Procedural history – Conclusion • Do make clear which side would win

Exam Technique: Question I … of an opinion and of a shorter dissent … • Point: make best arguments on both sides of issue – caselaw; policy; economic theory – judicial efficiency, stare decisis • Must be 2 opinions; format/method flexible – can write both simultaneously – can do most of work in long opinion • Try to deal w other side’s best arguments

![Exam Technique: Question I … for the [US Supreme] Court … • Can use Exam Technique: Question I … for the [US Supreme] Court … • Can use](https://present5.com/presentation/ebcce3a47c4cb6832ed258c39b3f8d20/image-55.jpg)

Exam Technique: Question I … for the [US Supreme] Court … • Can use lower court cases; not bound by • Don't be afraid to take a stand – Can revisit own cases – Overrule Brown Shoe v. distinguish Brown Shoe • Awareness that deciding law, not just case in front of you – Must defend positions taken even if status quo – Considerations like market incentives in future

Exam Technique: Question I … deciding this question/these questions … • Narrow Q or Qs – Read Carefully – Look at Old Exam Qs for Examples

Exam Technique: Question I The U. S. Supreme Court granted certiorari to decide when, if ever, a boycott should be judged under the per se rule or using quick look analysis. • Stay within Boundaries set by Q or Qs – Pick a rule & defend it – Consider alternatives – Remember to decide case

Exam Technique: Question I The U. S. Supreme Court granted certiorari to decide when, if ever, a boycott should be judged under the per se rule or using quick look analysis. • Stay within Boundaries set by Q or Qs – Lawsuit in Q challenged one agreement; others should not be part of discussion – Don’t Finesse Q away: • “Result same so no need to decide …” • “Here dfdts would lose even under Ro. R so no need to decide …”

Exam Technique: Question I • Stay within Boundaries set by Q or Qs; if two questions: – Treat as roughly equal – Find a way to have arguments on 2 sides of each; can have 2 dissents or a dissent plus a concurrence if it enables you to do this

Exam Technique: Question I … deciding this question/these questions … • Narrow Q or Qs; Read Carefully • Stay within Boundaries set by Q • Address arguments made by lower courts – Guiding you to some available arguments – At least have side that rejects say why

Exam Technique: Question I …in the context of the facts of this case. (2007 Examples) • Again read carefully: Many students referred to defendants, who were a group of manufacturers, as “retailers. ”

Exam Technique: Question I …in the context of the facts of this case. (2007 Examples) • Again read carefully • Treat my facts as given; don’t argue w Q. Although question says defendants had market power, several students referred to them as small struggling businesses.

Exam Technique: Question I …in the context of the facts of this case. (2007 Examples) • Again read carefully • Treat my facts as given • Think about why facts are there. I chose facts to make as strong a case as possible for per se illegality under NWWS.

Exam Technique: Question I …in the context of the facts of this case. • Can use particular case you’re given as example or as counterexample – “The case before us demonstrates why …” – “We think this case is not typical because …”

ebcce3a47c4cb6832ed258c39b3f8d20.ppt