631f4698756670a957733bfe94ef9c53.ppt

- Количество слайдов: 72

Hedging Strategies Using Futures Chapter 4

Hedging Strategies Using Futures Chapter 4

Chapter Outline 4. 1 Basic principles 4. 2 Arguments for and against hedging 4. 3 Basis risk 4. 4 Minimum variance hedge ratio 4. 5 Stock index futures 4. 6 Rolling the hedge forward 4. 7 Summary

Chapter Outline 4. 1 Basic principles 4. 2 Arguments for and against hedging 4. 3 Basis risk 4. 4 Minimum variance hedge ratio 4. 5 Stock index futures 4. 6 Rolling the hedge forward 4. 7 Summary

4. 1 Basic principles • The object of the exercise to to take a position that neutralizes risk as far as possible.

4. 1 Basic principles • The object of the exercise to to take a position that neutralizes risk as far as possible.

Long & Short Hedges • A long futures hedge is appropriate when you know you will purchase an asset in the future and want to lock in the price • A short futures hedge is appropriate when you know you will sell an asset in the future & want to lock in the price

Long & Short Hedges • A long futures hedge is appropriate when you know you will purchase an asset in the future and want to lock in the price • A short futures hedge is appropriate when you know you will sell an asset in the future & want to lock in the price

Hedging • Two counterparties with offsetting risks can eliminate risk. – For example, if a wheat farmer and a flour mill enter into a forward contract, they can eliminate the risk each other faces regarding the future price of wheat. • Hedgers can also transfer price risk to speculators and speculators absorb price risk from hedgers.

Hedging • Two counterparties with offsetting risks can eliminate risk. – For example, if a wheat farmer and a flour mill enter into a forward contract, they can eliminate the risk each other faces regarding the future price of wheat. • Hedgers can also transfer price risk to speculators and speculators absorb price risk from hedgers.

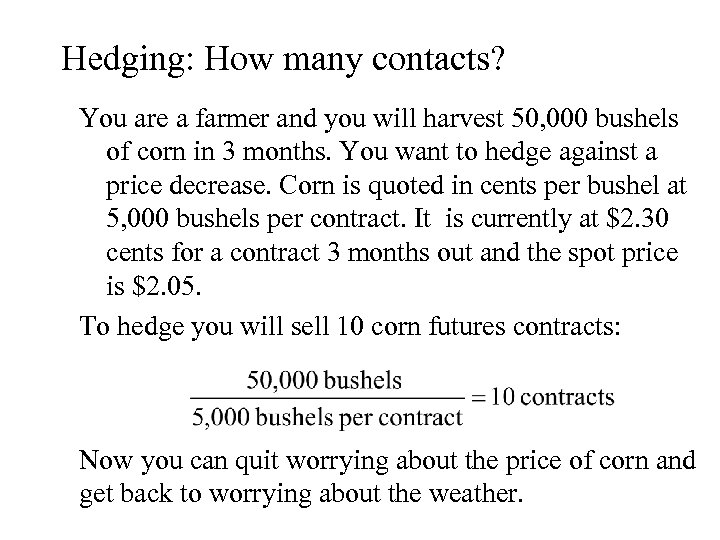

Hedging: How many contacts? You are a farmer and you will harvest 50, 000 bushels of corn in 3 months. You want to hedge against a price decrease. Corn is quoted in cents per bushel at 5, 000 bushels per contract. It is currently at $2. 30 cents for a contract 3 months out and the spot price is $2. 05. To hedge you will sell 10 corn futures contracts: Now you can quit worrying about the price of corn and get back to worrying about the weather.

Hedging: How many contacts? You are a farmer and you will harvest 50, 000 bushels of corn in 3 months. You want to hedge against a price decrease. Corn is quoted in cents per bushel at 5, 000 bushels per contract. It is currently at $2. 30 cents for a contract 3 months out and the spot price is $2. 05. To hedge you will sell 10 corn futures contracts: Now you can quit worrying about the price of corn and get back to worrying about the weather.

Forward Market Hedge • If you are going to owe foreign currency in the future, agree to buy the foreign currency now by entering into long position in a forward contract. • If you are going to receive foreign currency in the future, agree to sell the foreign currency now by entering into short position in a forward contract.

Forward Market Hedge • If you are going to owe foreign currency in the future, agree to buy the foreign currency now by entering into long position in a forward contract. • If you are going to receive foreign currency in the future, agree to sell the foreign currency now by entering into short position in a forward contract.

Forward Market Hedge: an Example You are a U. S. importer of British woolens and have just ordered next year’s inventory. Payment of £ 100 M is due in one year. Question: How can you fix the cash outflow in dollars? Answer: One way is to put yourself in a position that delivers £ 100 M in one year—a long forward contract on the pound.

Forward Market Hedge: an Example You are a U. S. importer of British woolens and have just ordered next year’s inventory. Payment of £ 100 M is due in one year. Question: How can you fix the cash outflow in dollars? Answer: One way is to put yourself in a position that delivers £ 100 M in one year—a long forward contract on the pound.

4. 2 Arguments for and against hedging • The arguments in favor of hedging are readily apparent. • The arguments against hedging are somewhat more subtle.

4. 2 Arguments for and against hedging • The arguments in favor of hedging are readily apparent. • The arguments against hedging are somewhat more subtle.

Arguments in Favor of Hedging • Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables

Arguments in Favor of Hedging • Companies should focus on the main business they are in and take steps to minimize risks arising from interest rates, exchange rates, and other market variables

Arguments against Hedging • Shareholders are usually well diversified and can make their own hedging decisions • It may increase risk to hedge when competitors do not. • Explaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult

Arguments against Hedging • Shareholders are usually well diversified and can make their own hedging decisions • It may increase risk to hedge when competitors do not. • Explaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult

How hedging could increase risk. • Consider single competitor in a commodity industry dominated by competitors who do not hedge. • If the competitor hedges the raw materials and then prices of raw materials fall, the price of the finished product will fall as well —this could decrease profit margins.

How hedging could increase risk. • Consider single competitor in a commodity industry dominated by competitors who do not hedge. • If the competitor hedges the raw materials and then prices of raw materials fall, the price of the finished product will fall as well —this could decrease profit margins.

Should the Firm Hedge? • Not everyone agrees that a firm should hedge: – Hedging by the firm may not add to shareholder wealth if the shareholders can manage exposure themselves. – Hedging may not reduce the non-diversifiable risk of the firm. Therefore shareholders who hold a diversified portfolio are not helped when management hedges.

Should the Firm Hedge? • Not everyone agrees that a firm should hedge: – Hedging by the firm may not add to shareholder wealth if the shareholders can manage exposure themselves. – Hedging may not reduce the non-diversifiable risk of the firm. Therefore shareholders who hold a diversified portfolio are not helped when management hedges.

Should the Firm Hedge? • In the presence of market imperfections, the firm should hedge. – Information Asymmetry • The managers may have better information than the shareholders. – Differential Transactions Costs • The firm may be able to hedge at better prices than the shareholders. – Default Costs • Hedging may reduce the firms cost of capital if it reduces the probability of default.

Should the Firm Hedge? • In the presence of market imperfections, the firm should hedge. – Information Asymmetry • The managers may have better information than the shareholders. – Differential Transactions Costs • The firm may be able to hedge at better prices than the shareholders. – Default Costs • Hedging may reduce the firms cost of capital if it reduces the probability of default.

Should the Firm Hedge? • Taxes can be a large market imperfection. – Corporations that face progressive tax rates may find that they pay less in taxes if they can manage earnings by hedging than if they have “boom and bust” cycles in their earnings stream.

Should the Firm Hedge? • Taxes can be a large market imperfection. – Corporations that face progressive tax rates may find that they pay less in taxes if they can manage earnings by hedging than if they have “boom and bust” cycles in their earnings stream.

What Risk Management Products do Firms Use? • Most U. S. firms meet their exchange risk management needs with forward, swap, and options contracts. • The greater the degree of international involvement, the greater the firm’s use of foreign exchange risk management.

What Risk Management Products do Firms Use? • Most U. S. firms meet their exchange risk management needs with forward, swap, and options contracts. • The greater the degree of international involvement, the greater the firm’s use of foreign exchange risk management.

4. 3 Basis risk • It may be difficult to find a forward contract on the asset that you are trying to hedge. • There may be uncertainty regarding the maturity date. • These problems give rise to basis risk.

4. 3 Basis risk • It may be difficult to find a forward contract on the asset that you are trying to hedge. • There may be uncertainty regarding the maturity date. • These problems give rise to basis risk.

Basis Risk • Basis is the difference between spot & futures: Basis = Spot price of asset to be hedged – Futures price of contract used • Basis risk arises because of the uncertainty about the basis when the hedge is closed out

Basis Risk • Basis is the difference between spot & futures: Basis = Spot price of asset to be hedged – Futures price of contract used • Basis risk arises because of the uncertainty about the basis when the hedge is closed out

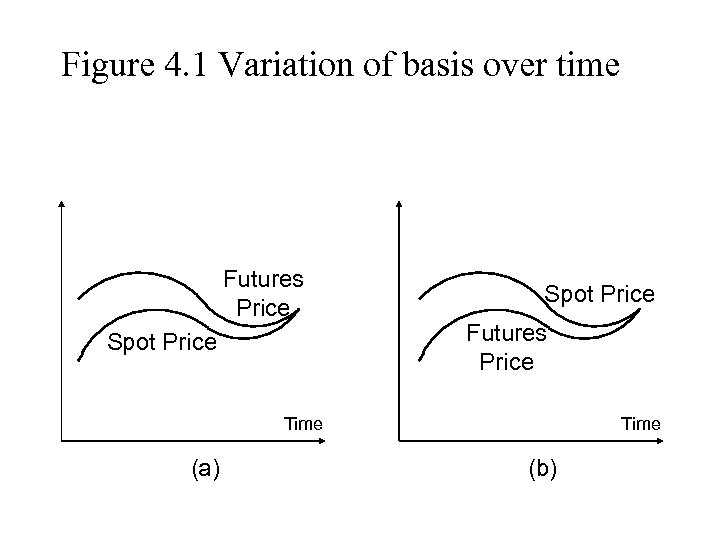

Figure 4. 1 Variation of basis over time Futures Price Spot Price Futures Price Time (a) Time (b)

Figure 4. 1 Variation of basis over time Futures Price Spot Price Futures Price Time (a) Time (b)

Long Hedge • Suppose that F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price • You hedge the future purchase of an asset by entering into a long futures contract • Cost of Asset=S 2 –(F 2 – F 1) = F 1 + Basis

Long Hedge • Suppose that F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price • You hedge the future purchase of an asset by entering into a long futures contract • Cost of Asset=S 2 –(F 2 – F 1) = F 1 + Basis

Short Hedge • Suppose that F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price • You hedge the future sale of an asset by entering into a short futures contract • Price Realized=S 2+ (F 1 –F 2) = F 1 + Basis

Short Hedge • Suppose that F 1 : Initial Futures Price F 2 : Final Futures Price S 2 : Final Asset Price • You hedge the future sale of an asset by entering into a short futures contract • Price Realized=S 2+ (F 1 –F 2) = F 1 + Basis

Choice of Contract • Choose a delivery month that is as close as possible to, but later than, the end of the life of the hedge • When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the asset price. There are then 2 components to basis

Choice of Contract • Choose a delivery month that is as close as possible to, but later than, the end of the life of the hedge • When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the asset price. There are then 2 components to basis

Cross-Hedging Minor Currency Exposure • The major currencies are the: U. S. dollar, Canadian dollar, British pound, Swiss franc, Mexican peso, Japanese yen, and now the euro. • Everything else is a minor currency, like the Polish zloty. • It is difficult, expensive, or impossible to use financial contracts to hedge exposure to minor currencies.

Cross-Hedging Minor Currency Exposure • The major currencies are the: U. S. dollar, Canadian dollar, British pound, Swiss franc, Mexican peso, Japanese yen, and now the euro. • Everything else is a minor currency, like the Polish zloty. • It is difficult, expensive, or impossible to use financial contracts to hedge exposure to minor currencies.

Cross-Hedging Minor Currency Exposure • Cross-Hedging involves hedging a position in one asset by taking a position in another asset. • The effectiveness of cross-hedging depends upon how well the assets are correlated. – An example would be a U. S. importer with liabilities in Czech koruna hedging with long or short forward contracts on the euro. If the koruna is expensive when the euro is expensive, or even if the koruna is cheap when the euro is expensive it can be a good hedge. But they need to co-vary in a predictable way.

Cross-Hedging Minor Currency Exposure • Cross-Hedging involves hedging a position in one asset by taking a position in another asset. • The effectiveness of cross-hedging depends upon how well the assets are correlated. – An example would be a U. S. importer with liabilities in Czech koruna hedging with long or short forward contracts on the euro. If the koruna is expensive when the euro is expensive, or even if the koruna is cheap when the euro is expensive it can be a good hedge. But they need to co-vary in a predictable way.

Hedging Contingent Exposure • If only certain contingencies give rise to exposure, then options can be effective insurance. • For example, if your firm is bidding on a hydroelectric dam project in Canada, you will need to hedge the Canadian-U. S. dollar exchange rate only if your bid wins the contract. Your firm can hedge this contingent risk with options.

Hedging Contingent Exposure • If only certain contingencies give rise to exposure, then options can be effective insurance. • For example, if your firm is bidding on a hydroelectric dam project in Canada, you will need to hedge the Canadian-U. S. dollar exchange rate only if your bid wins the contract. Your firm can hedge this contingent risk with options.

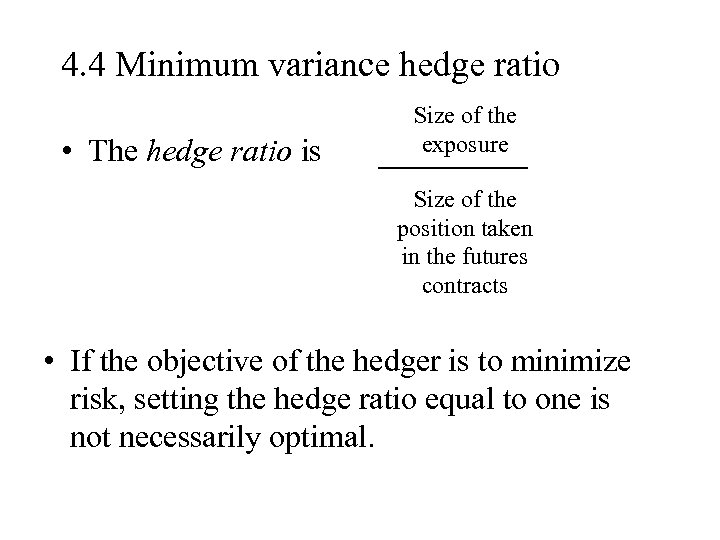

4. 4 Minimum variance hedge ratio • The hedge ratio is Size of the exposure Size of the position taken in the futures contracts • If the objective of the hedger is to minimize risk, setting the hedge ratio equal to one is not necessarily optimal.

4. 4 Minimum variance hedge ratio • The hedge ratio is Size of the exposure Size of the position taken in the futures contracts • If the objective of the hedger is to minimize risk, setting the hedge ratio equal to one is not necessarily optimal.

Notation d. S Change in the spot price, S, during the life of the hedge d. F Change in the futures price, F, during the life of the hedge s. S is the standard deviation of d. S s. F is the standard deviation of d. F r is the coefficient of correlation between d. S and d. F.

Notation d. S Change in the spot price, S, during the life of the hedge d. F Change in the futures price, F, during the life of the hedge s. S is the standard deviation of d. S s. F is the standard deviation of d. F r is the coefficient of correlation between d. S and d. F.

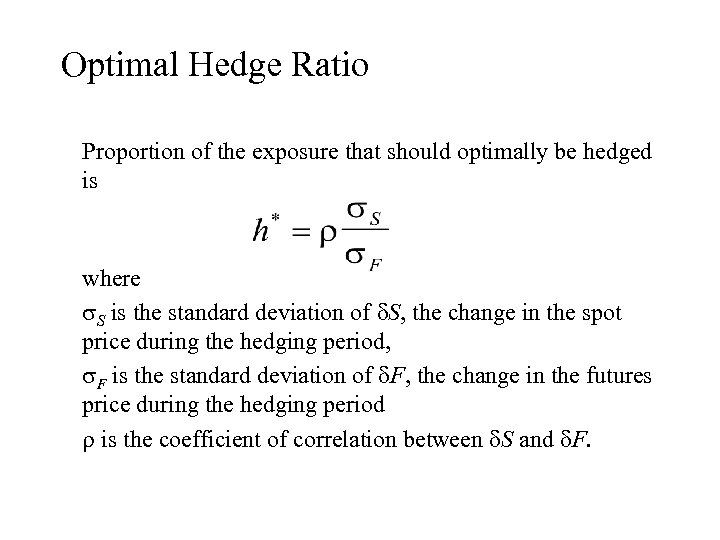

Optimal Hedge Ratio Proportion of the exposure that should optimally be hedged is where s. S is the standard deviation of d. S, the change in the spot price during the hedging period, s. F is the standard deviation of d. F, the change in the futures price during the hedging period r is the coefficient of correlation between d. S and d. F.

Optimal Hedge Ratio Proportion of the exposure that should optimally be hedged is where s. S is the standard deviation of d. S, the change in the spot price during the hedging period, s. F is the standard deviation of d. F, the change in the futures price during the hedging period r is the coefficient of correlation between d. S and d. F.

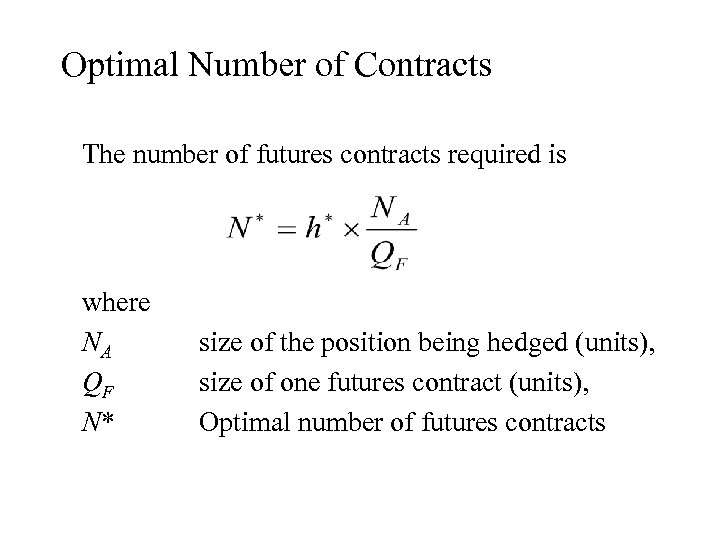

Optimal Number of Contracts The number of futures contracts required is where NA QF N* size of the position being hedged (units), size of one futures contract (units), Optimal number of futures contracts

Optimal Number of Contracts The number of futures contracts required is where NA QF N* size of the position being hedged (units), size of one futures contract (units), Optimal number of futures contracts

4. 5 Stock index futures • Stock index futures can be used to hedge an equity portfolio.

4. 5 Stock index futures • Stock index futures can be used to hedge an equity portfolio.

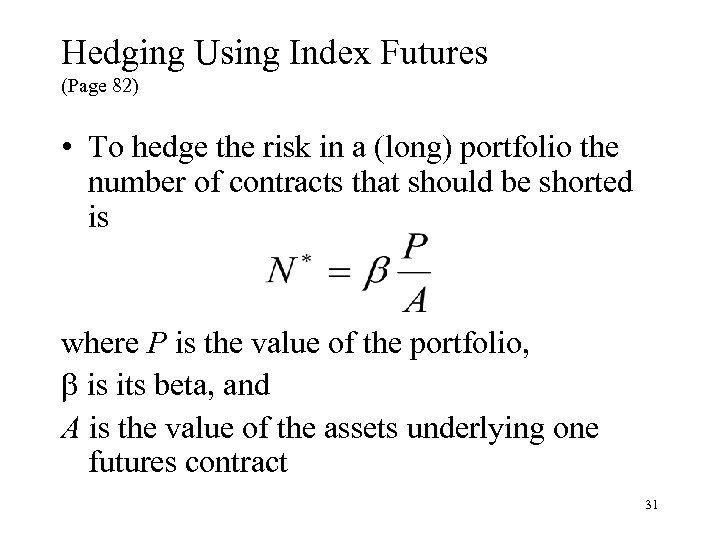

Hedging Using Index Futures (Page 82) • To hedge the risk in a (long) portfolio the number of contracts that should be shorted is where P is the value of the portfolio, b is its beta, and A is the value of the assets underlying one futures contract 31

Hedging Using Index Futures (Page 82) • To hedge the risk in a (long) portfolio the number of contracts that should be shorted is where P is the value of the portfolio, b is its beta, and A is the value of the assets underlying one futures contract 31

Reasons for Hedging an Equity Portfolio • Desire to be out of the market for a short period of time. (Hedging may be cheaper than selling the portfolio and buying it back. ) • Desire to hedge systematic risk (Appropriate when you feel that you have picked stocks that will outperform the market. )

Reasons for Hedging an Equity Portfolio • Desire to be out of the market for a short period of time. (Hedging may be cheaper than selling the portfolio and buying it back. ) • Desire to hedge systematic risk (Appropriate when you feel that you have picked stocks that will outperform the market. )

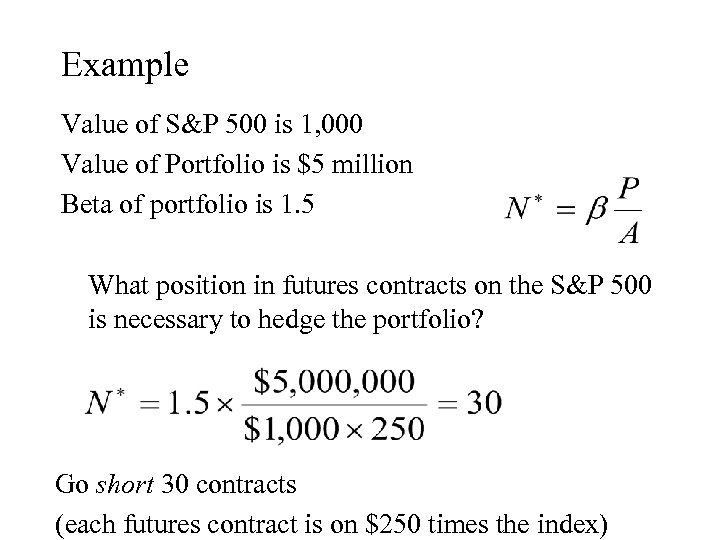

Example Value of S&P 500 is 1, 000 Value of Portfolio is $5 million Beta of portfolio is 1. 5 What position in futures contracts on the S&P 500 is necessary to hedge the portfolio? Go short 30 contracts (each futures contract is on $250 times the index)

Example Value of S&P 500 is 1, 000 Value of Portfolio is $5 million Beta of portfolio is 1. 5 What position in futures contracts on the S&P 500 is necessary to hedge the portfolio? Go short 30 contracts (each futures contract is on $250 times the index)

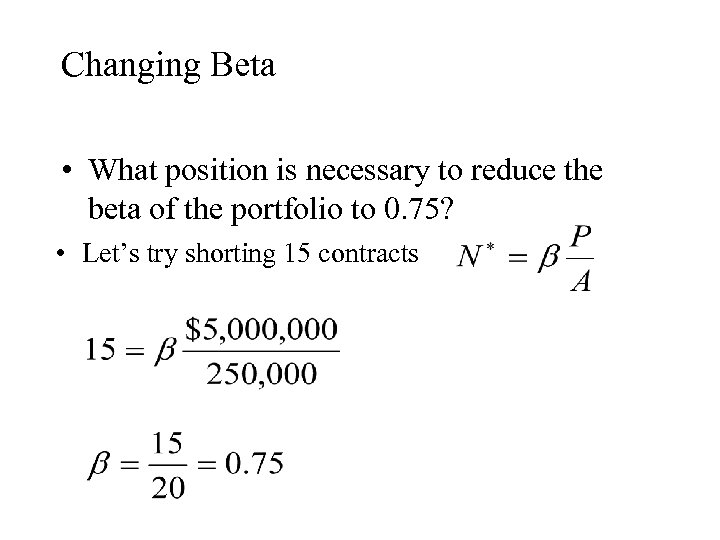

Changing Beta • What position is necessary to reduce the beta of the portfolio to 0. 75? • Let’s try shorting 15 contracts

Changing Beta • What position is necessary to reduce the beta of the portfolio to 0. 75? • Let’s try shorting 15 contracts

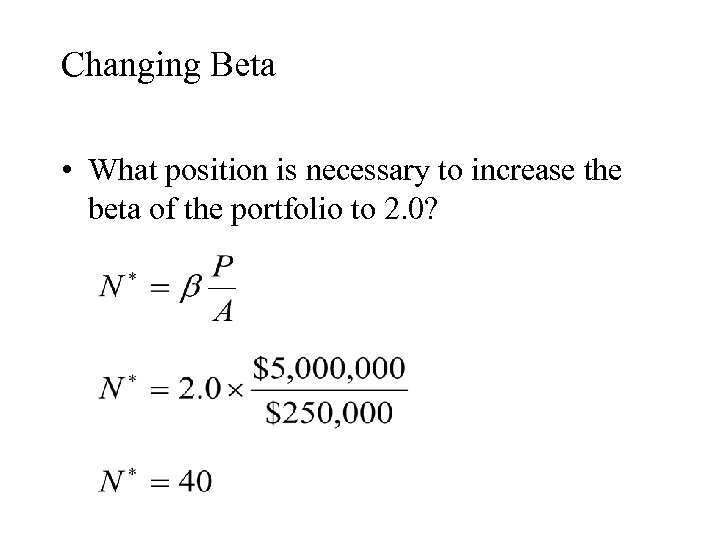

Changing Beta • What position is necessary to increase the beta of the portfolio to 2. 0?

Changing Beta • What position is necessary to increase the beta of the portfolio to 2. 0?

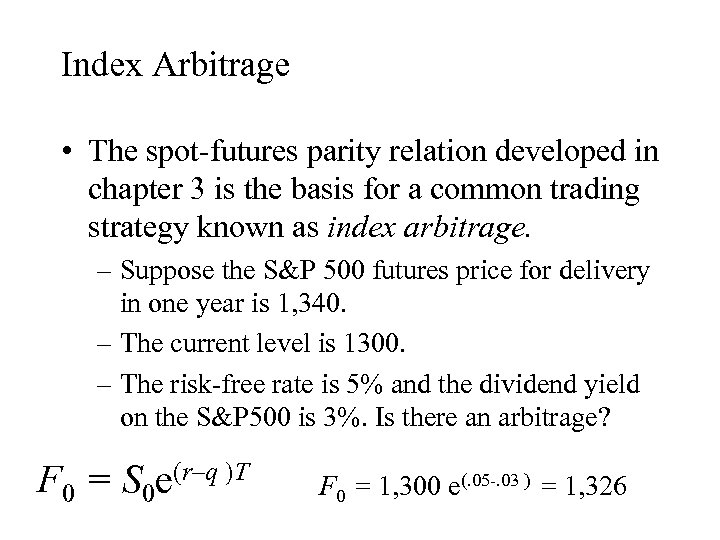

Index Arbitrage • The spot-futures parity relation developed in chapter 3 is the basis for a common trading strategy known as index arbitrage. – Suppose the S&P 500 futures price for delivery in one year is 1, 340. – The current level is 1300. – The risk-free rate is 5% and the dividend yield on the S&P 500 is 3%. Is there an arbitrage? F 0 = S 0 e(r–q )T F 0 = 1, 300 e(. 05 -. 03 ) = 1, 326

Index Arbitrage • The spot-futures parity relation developed in chapter 3 is the basis for a common trading strategy known as index arbitrage. – Suppose the S&P 500 futures price for delivery in one year is 1, 340. – The current level is 1300. – The risk-free rate is 5% and the dividend yield on the S&P 500 is 3%. Is there an arbitrage? F 0 = S 0 e(r–q )T F 0 = 1, 300 e(. 05 -. 03 ) = 1, 326

4. 6 Rolling The Hedge Forward • We can use a series of futures contracts to increase the life of a hedge • Each time we switch from 1 futures contract to another we incur a type of basis risk, rollover basis.

4. 6 Rolling The Hedge Forward • We can use a series of futures contracts to increase the life of a hedge • Each time we switch from 1 futures contract to another we incur a type of basis risk, rollover basis.

Exposure Netting • A multinational firm should not consider deals in isolation, but should focus on hedging the firm as a portfolio of currency positions. – As an example, consider a U. S. -based multinational with Korean won receivables and Japanese yen payables. Since the won and the yen tend to move in similar directions against the U. S. dollar, the firm can just wait until these accounts come due and just buy yen with won. – Even if it’s not a perfect hedge, it may be too expensive or impractical to hedge each currency separately.

Exposure Netting • A multinational firm should not consider deals in isolation, but should focus on hedging the firm as a portfolio of currency positions. – As an example, consider a U. S. -based multinational with Korean won receivables and Japanese yen payables. Since the won and the yen tend to move in similar directions against the U. S. dollar, the firm can just wait until these accounts come due and just buy yen with won. – Even if it’s not a perfect hedge, it may be too expensive or impractical to hedge each currency separately.

Exposure Netting • Many multinational firms use a reinvoice center. Which is a financial subsidiary that nets out the intrafirm transactions. • Once the residual exposure is determined, then the firm implements hedging.

Exposure Netting • Many multinational firms use a reinvoice center. Which is a financial subsidiary that nets out the intrafirm transactions. • Once the residual exposure is determined, then the firm implements hedging.

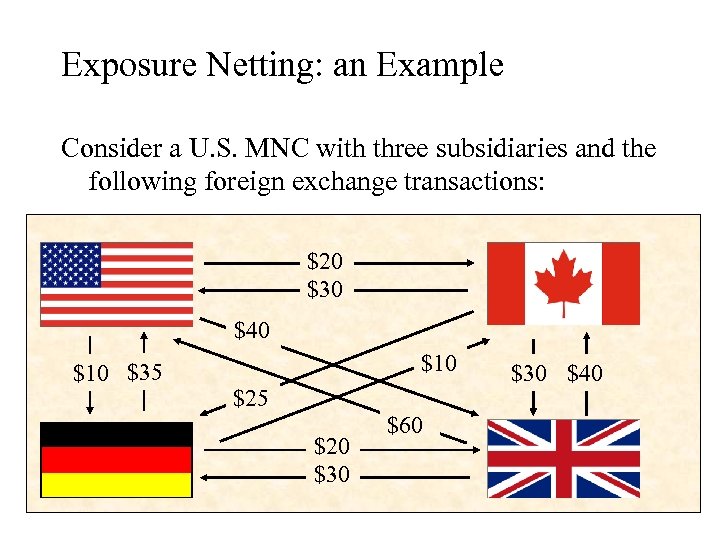

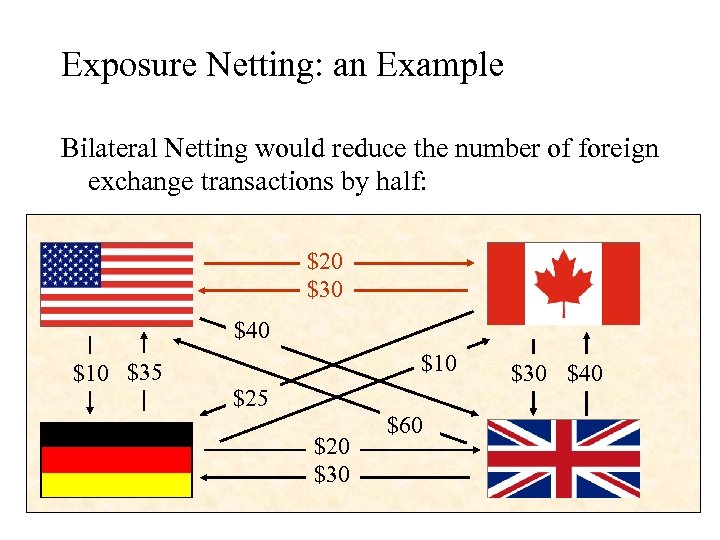

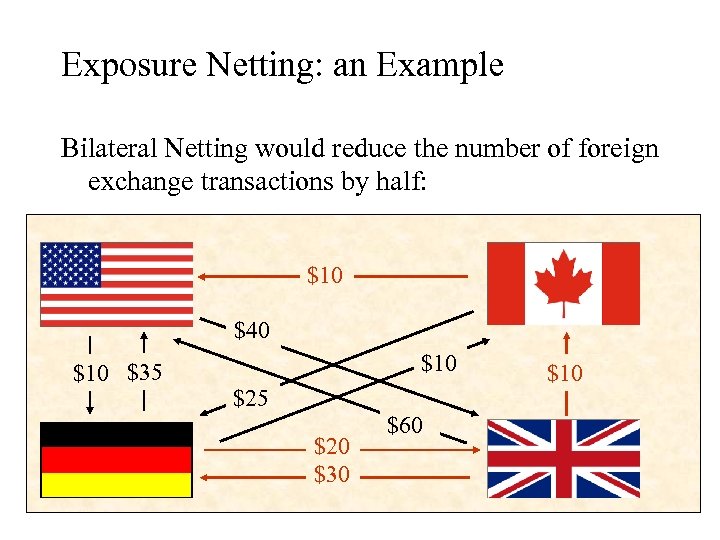

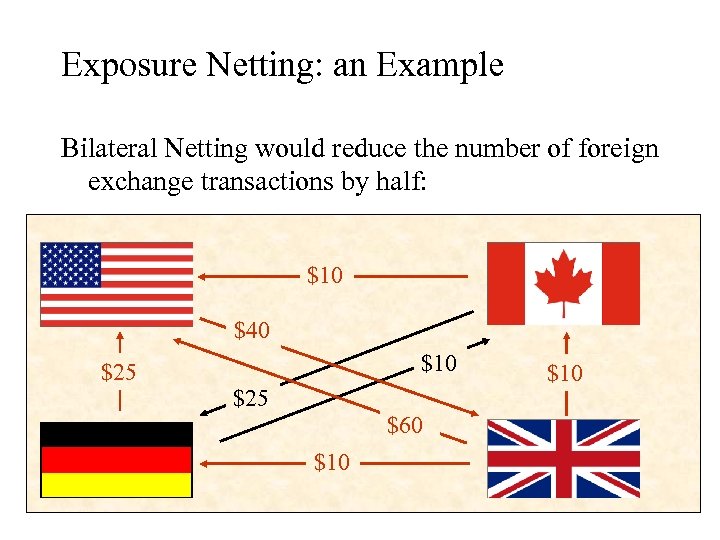

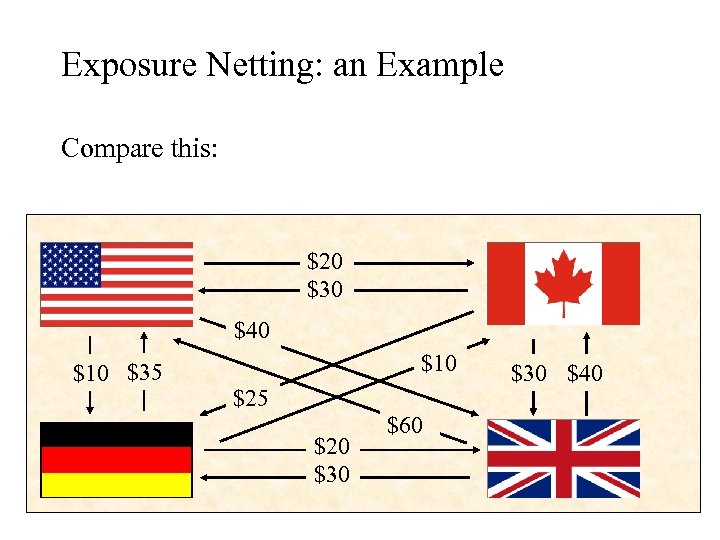

Exposure Netting: an Example Consider a U. S. MNC with three subsidiaries and the following foreign exchange transactions: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

Exposure Netting: an Example Consider a U. S. MNC with three subsidiaries and the following foreign exchange transactions: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

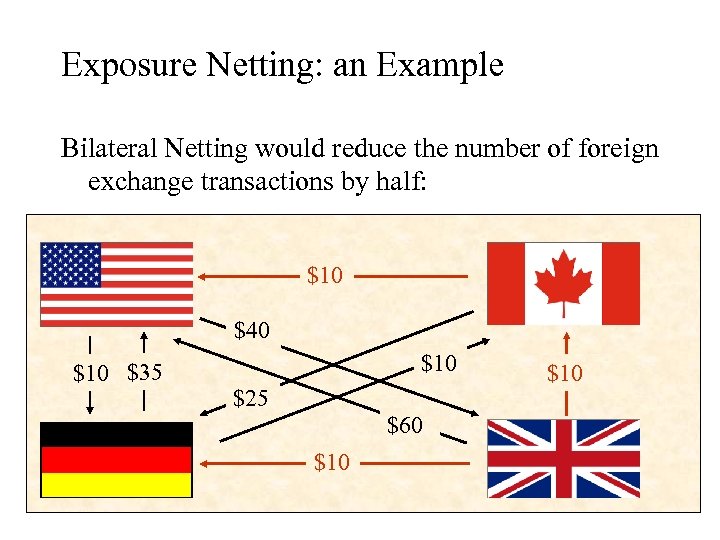

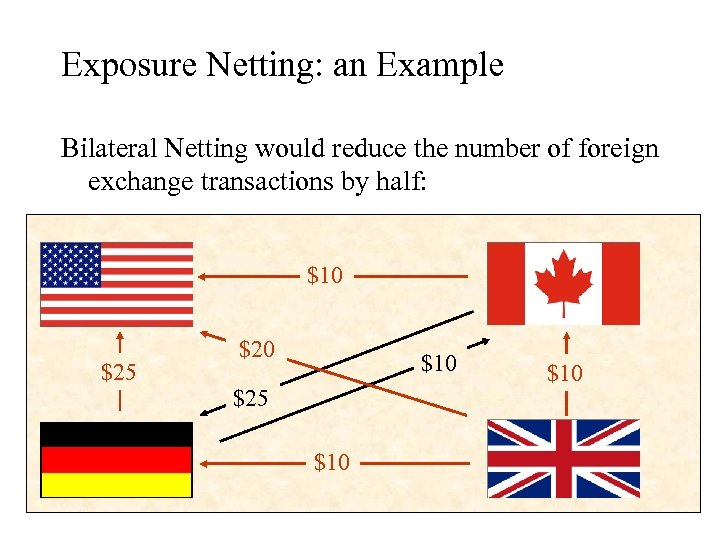

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

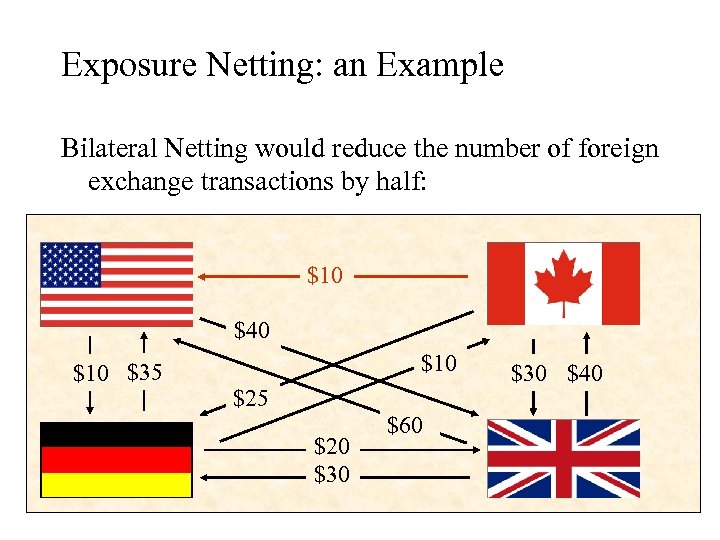

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

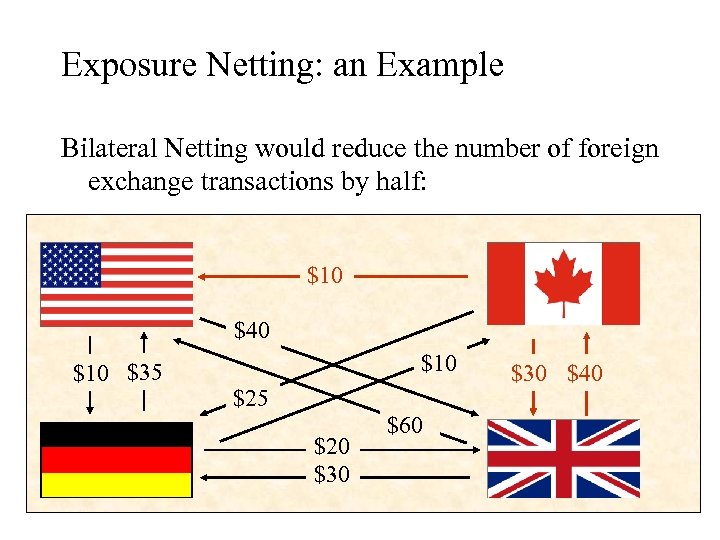

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

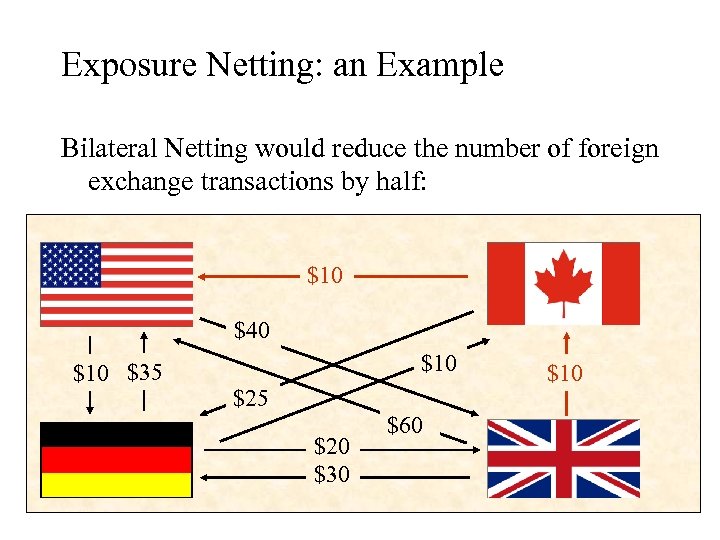

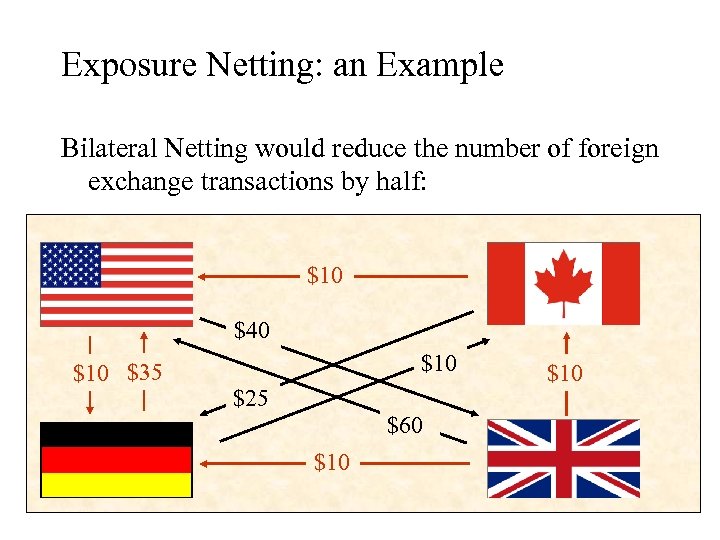

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $20 $30 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $10 $35 $10 $25 $60 $10

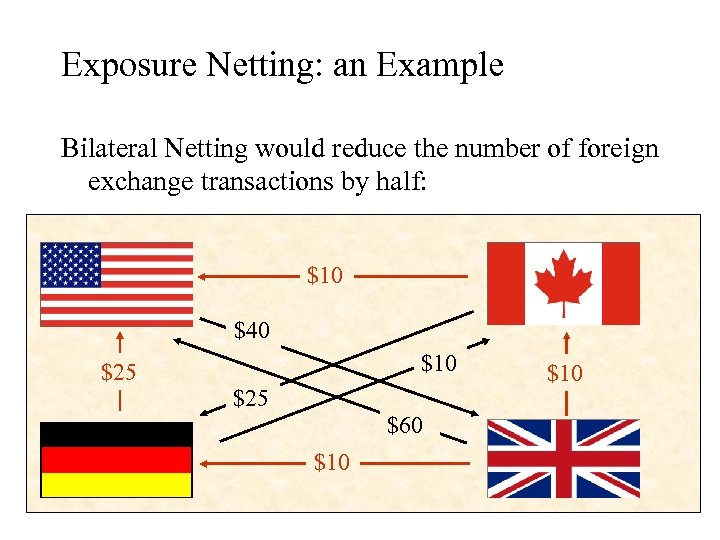

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $25 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $25 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $25 $10 $25 $60 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $40 $25 $10 $25 $60 $10

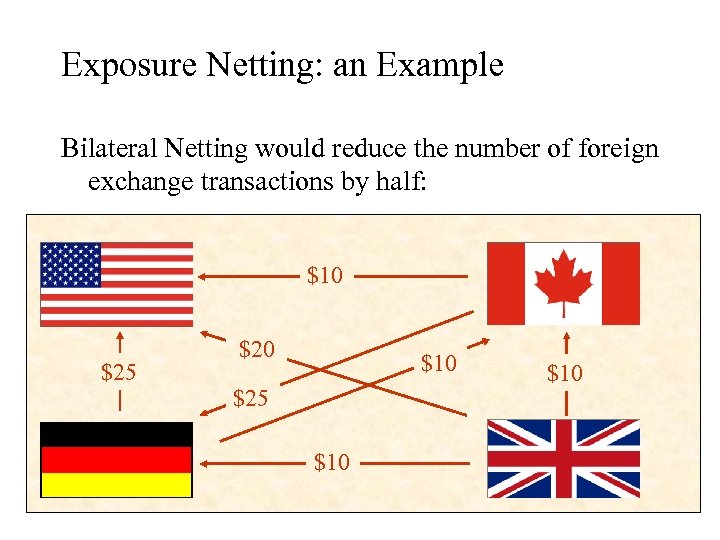

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $10 $25 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $10 $25 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $10 $25 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $10 $25 $10

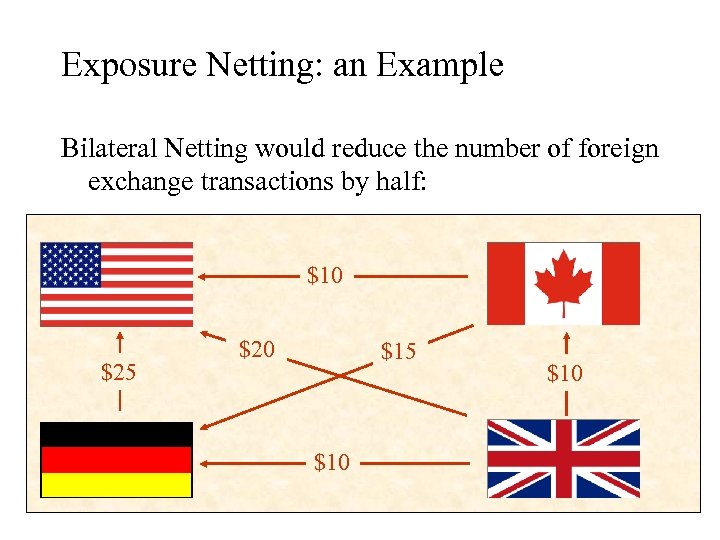

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $15 $10

Exposure Netting: an Example Bilateral Netting would reduce the number of foreign exchange transactions by half: $10 $25 $20 $15 $10

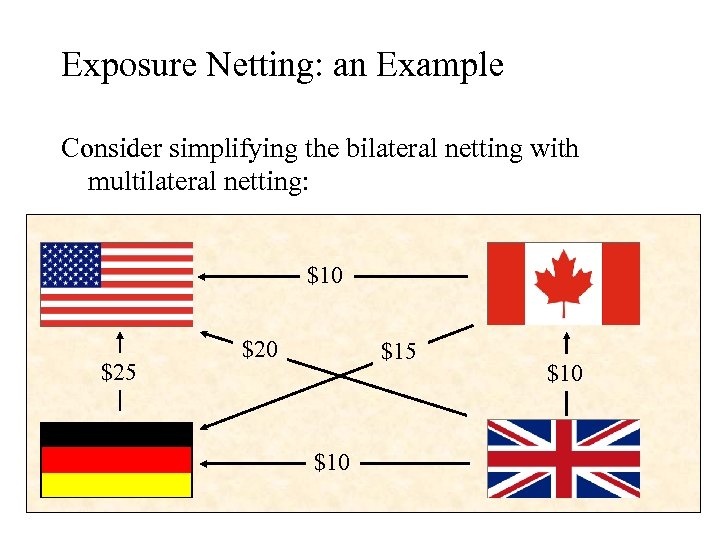

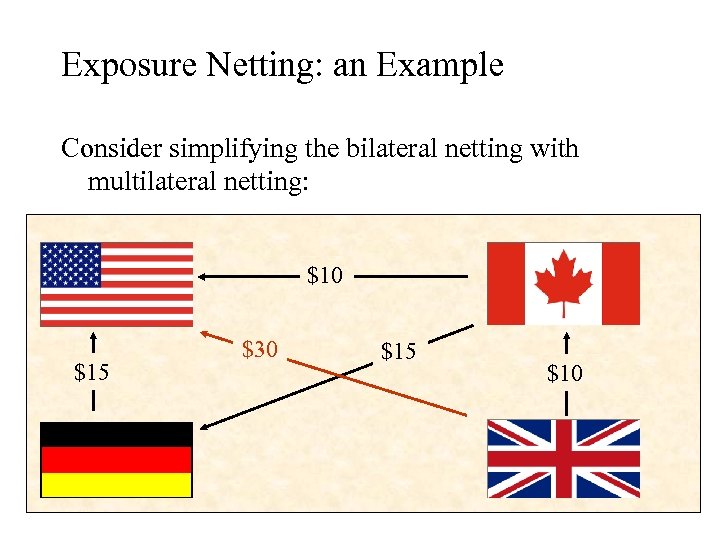

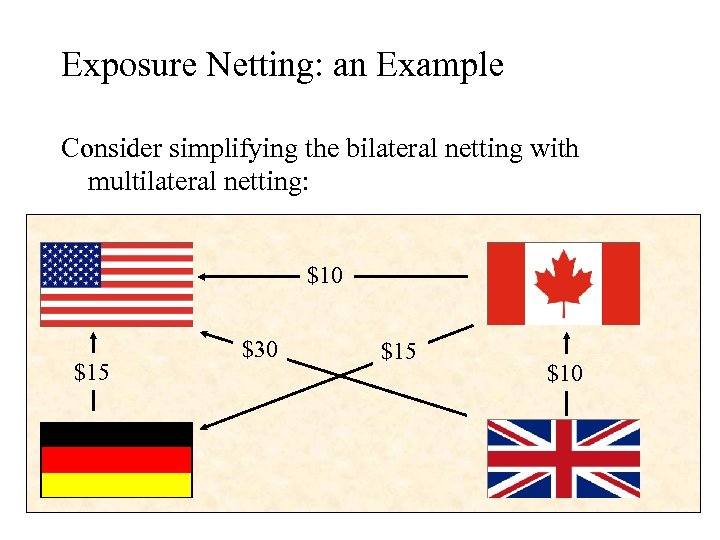

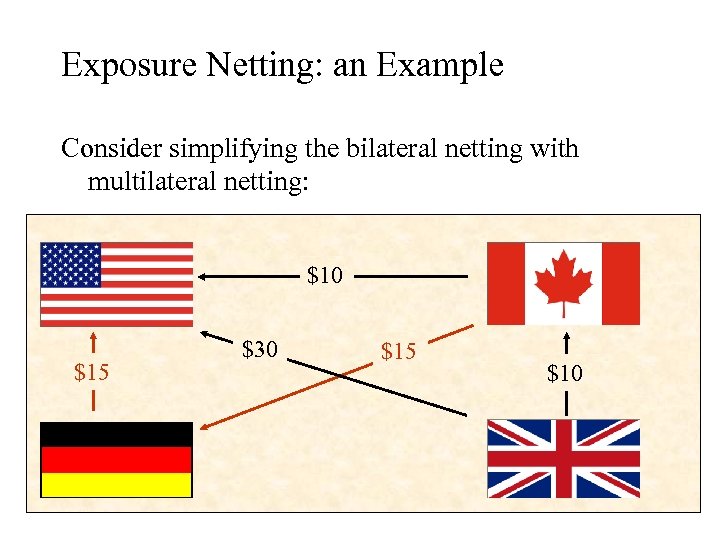

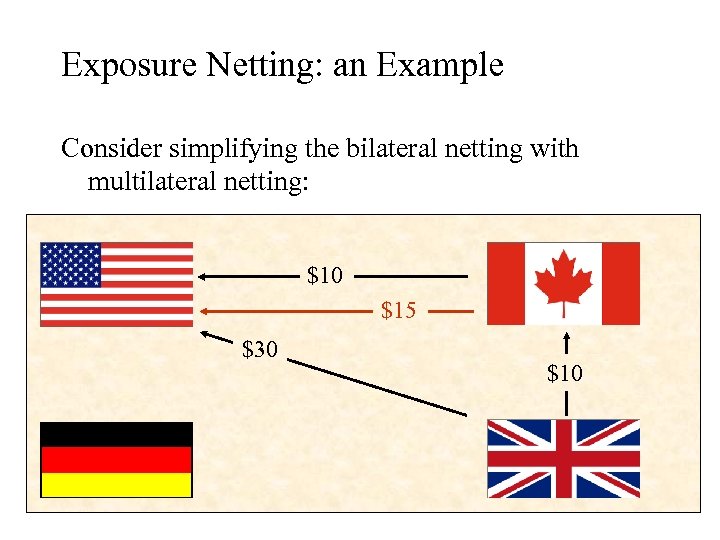

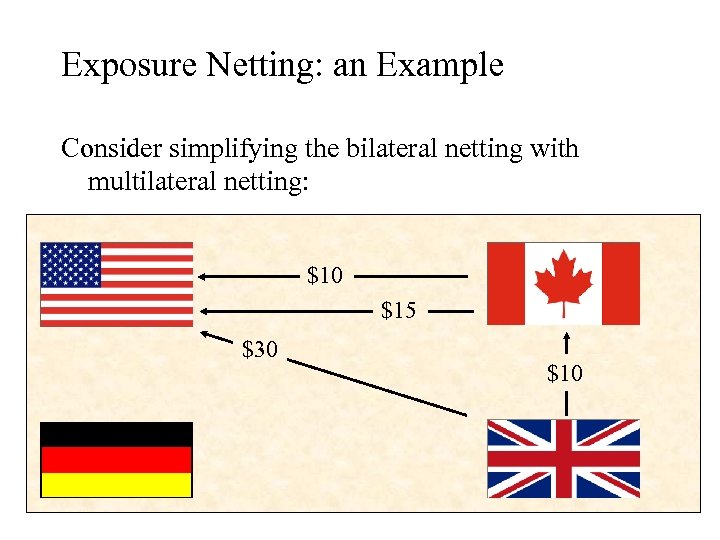

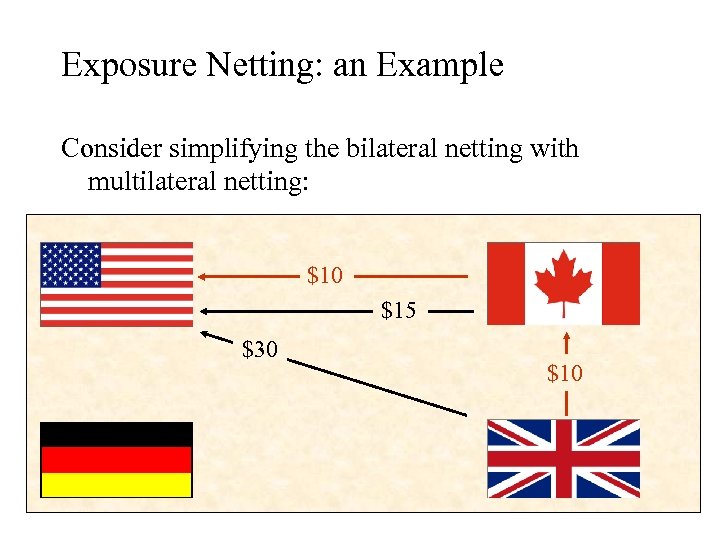

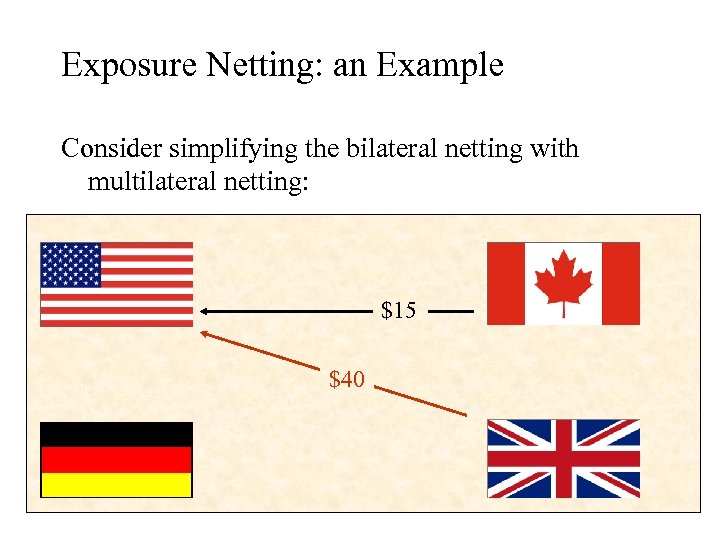

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $25 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $25 $20 $15 $10

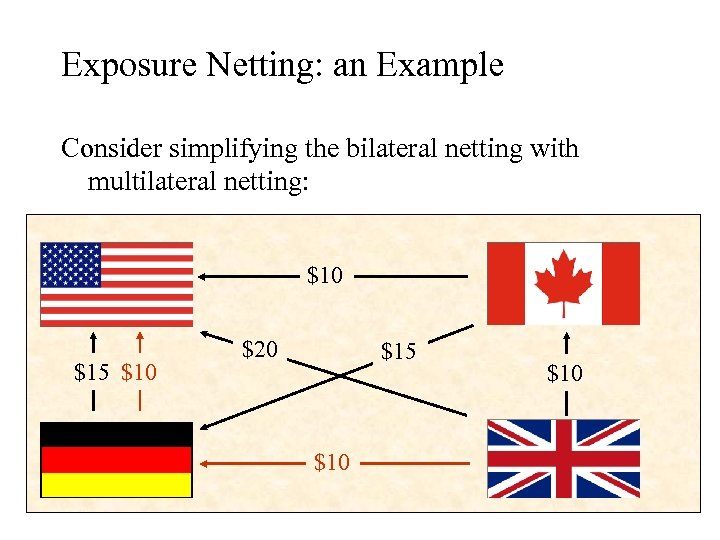

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $10 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $10 $20 $15 $10

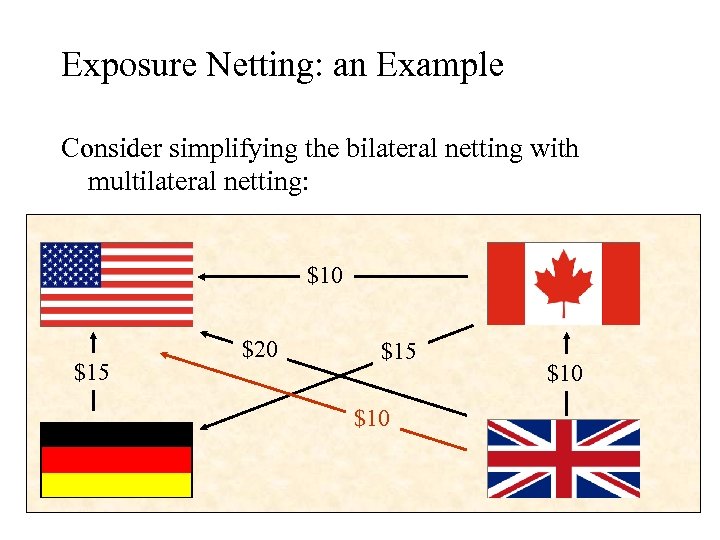

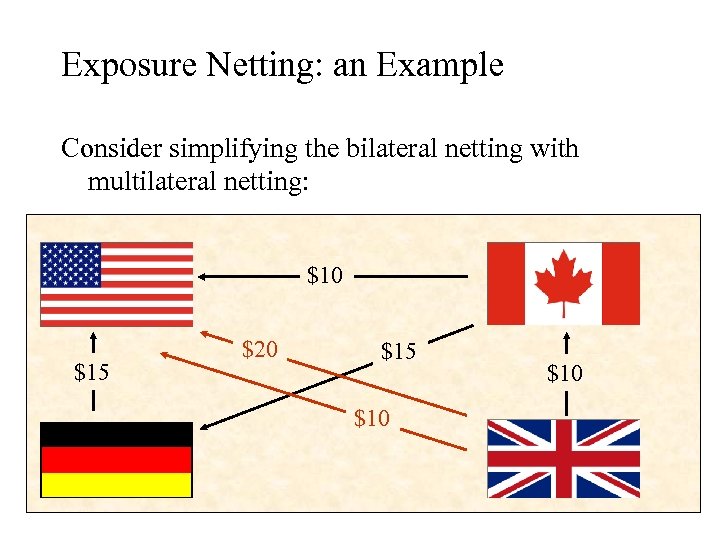

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $20 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $15 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $10 $15 $30 $10

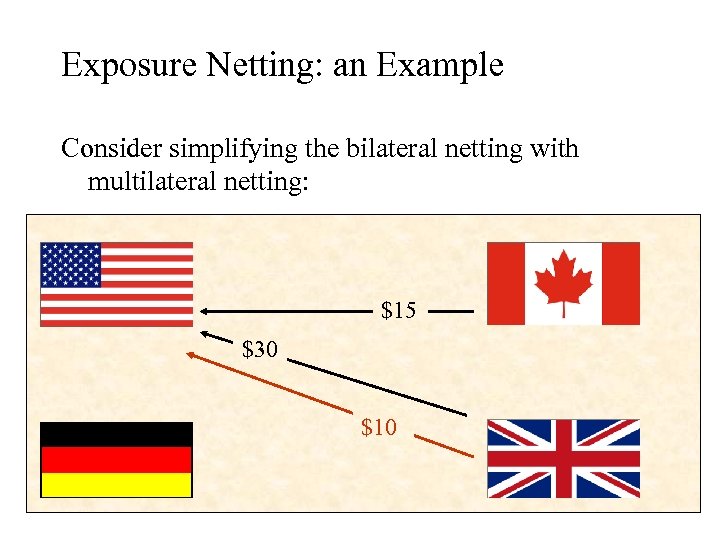

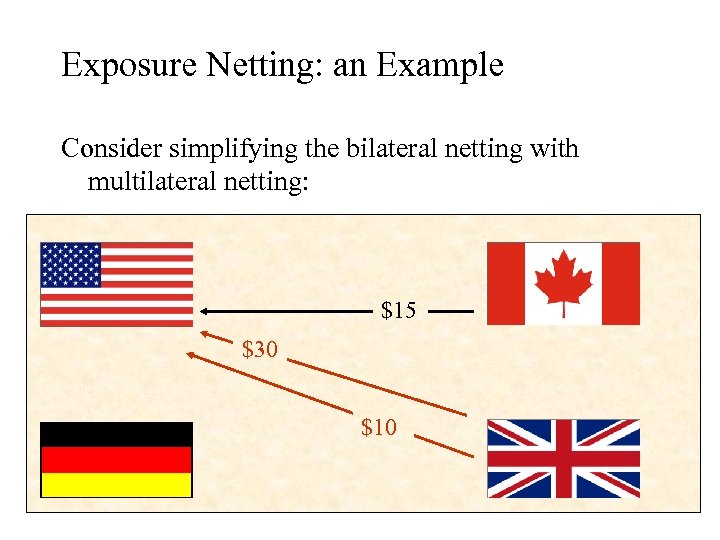

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $30 $10

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $40

Exposure Netting: an Example Consider simplifying the bilateral netting with multilateral netting: $15 $40

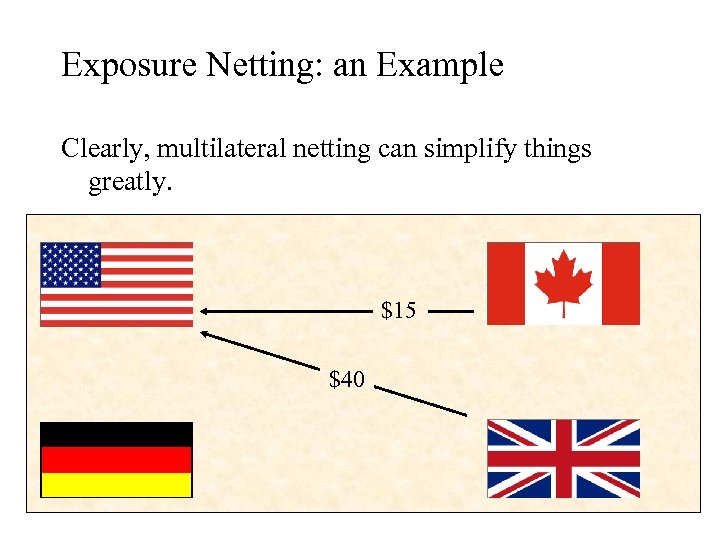

Exposure Netting: an Example Clearly, multilateral netting can simplify things greatly. $15 $40

Exposure Netting: an Example Clearly, multilateral netting can simplify things greatly. $15 $40

Exposure Netting: an Example Compare this: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

Exposure Netting: an Example Compare this: $20 $30 $40 $10 $35 $10 $25 $20 $30 $60 $30 $40

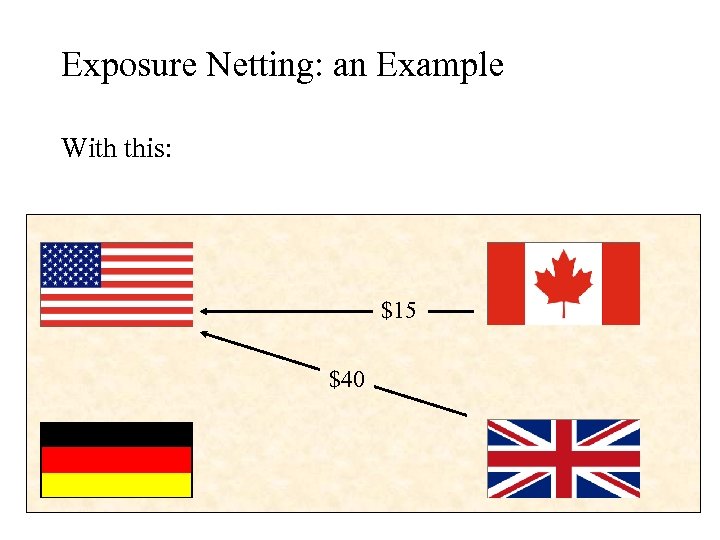

Exposure Netting: an Example With this: $15 $40

Exposure Netting: an Example With this: $15 $40

4. 7 Summary • There a variety of ways a firm can hedge exposure to the price of an asset using futures. • Hedging reduces risk, but for a variety of theoretical and practical reasons, many companies do not hedge.

4. 7 Summary • There a variety of ways a firm can hedge exposure to the price of an asset using futures. • Hedging reduces risk, but for a variety of theoretical and practical reasons, many companies do not hedge.

4. 7 Summary • An important concept in hedging is basis risk. – The basis is the difference between the spot price of an asset and the futures price. – Basis risk is created by a hedger’s uncertainty as to what the basis will be at maturity or the hedge. – Basis risk is greater for consumption assets than for investment assets.

4. 7 Summary • An important concept in hedging is basis risk. – The basis is the difference between the spot price of an asset and the futures price. – Basis risk is created by a hedger’s uncertainty as to what the basis will be at maturity or the hedge. – Basis risk is greater for consumption assets than for investment assets.

4. 7 Summary • The Hedge ratio is the ratio of the size of the position taken in futures contracts to the size of the exposure. – A hedge ratio of 1. 0 is not always optimal. – A hedge ratio different from 1 may offer a reduction in the variance. – The optimal hedge ratio is the slope of the best fit line when changes in the spot price are regressed against changes in the futures price.

4. 7 Summary • The Hedge ratio is the ratio of the size of the position taken in futures contracts to the size of the exposure. – A hedge ratio of 1. 0 is not always optimal. – A hedge ratio different from 1 may offer a reduction in the variance. – The optimal hedge ratio is the slope of the best fit line when changes in the spot price are regressed against changes in the futures price.

4. 7 Summary • Stock index futures can be used to hedge the systematic risk in an equity portfolio. – The number of futures required is the of the b portfolio × Dollar value of portfolio Dollar value of 1 forward – Stock index futures can also be used to change the beta of a portfolio without changing the stocks comprising the portfolio

4. 7 Summary • Stock index futures can be used to hedge the systematic risk in an equity portfolio. – The number of futures required is the of the b portfolio × Dollar value of portfolio Dollar value of 1 forward – Stock index futures can also be used to change the beta of a portfolio without changing the stocks comprising the portfolio