cff02ccce9e2834394e035fb7733afaa.ppt

- Количество слайдов: 115

Health Care Frauds and Scams

How Big is the Problem? Ø Government Accountability Office estimates 10% of all health care spending came from fraud and abuse ØCenters for Medicare and Medicaid Services loses $65 billion to criminals each year

Agenda ØScams related to the new health care law § How to spot § How to report ØFraud related to the health care system § How to spot § How to report ØNew anti-fraud enforcement measures 3

Scams to Spot “Help” getting the $250 doughnut hole rebate check Ø New Law: § Check for people in the doughnut hole § Comes automatically § Don’t have to apply Ø Scam: § “I’ll help you get your check” 4

Scams to Spot Selling “new” insurance ØNew Law: §Temporary insurance for those without insurance and pre-existing conditions §Coverage for young adults §Exchanges §Medicare ØScam: ØSelling door-to-door, over the phone, or by email ØClaiming to be government representative Ø Some new programs not available until 2014 5

Scam Warning Signs Ø“Need” new Medicare card Ø“Limited time offer” sales pitch Ø“Free information” post card 6

Scam Safety Tips Ø No government representative sells insurance over the phone or door to door or by email ØRely on official sources of information ØVerify with whom you are dealing ØCheck the facts ØGet it in writing ØDon’t give out personal information ØCheck the licenses 7

Report Scams ØState insurance department ØState Attorney General ØLocal law enforcement ØMedicare Get Questions Answered ØState Health Insurance Counseling and Assistance Programs ØMedicare. gov Øwww. healthcare. gov Øwww. aarp. org/getthefacts, www. aarp. org/medicare 8

How Health Care Fraud Happens Ø“Up-coding” ØUndelivered services ØPaying kickbacks ØStealing identities ØMistreating patients 9

ATTORNEY GENERAL CUOMO ANNOUNCES ARRESTS IN MULTIMILLION DOLLAR MEDICAID FRAUD SCHEME RUN OUT OF THREE NEW YORK CITY DENTAL CLINICS Defendants Allegedly Stole $5. 7 Million From Medicaid Fund NEW YORK, N. Y. (June 2, 2010) The xxxx and xxxx paid recruiters, known as “flyer boys”, to bring Medicaid recipients to the clinics, and paid the recipients to get treatment, whether medically necessary or not. The Medicaid recipients were sometimes brought to the clinics from homeless shelters, and were paid cash as well as gifts such as CD players and Mc. Donald’s gift certificates. In terms of the “flyer boys, ” the more Medicaid recipients they brought in, the higher the pay. The operation employed dozens of dentists who were often required to pay two thirds of their Medicaid billings to the defendants. It is alleged that xxxx, a high-billing dentist in the clinics, actively exhorted the flyer-boys “to go out and get more patients. ” 10

Office of the Nevada Attorney General FOR IMMEDIATE RELEASE DATE: June 2, 2010 WORKER SENTENCED FOR MEDICAID FRAUD …The investigation began in 2008 after information was obtained that personal care aid services were not being provided to a Medicaid recipient. Medicaid has a personal care aid program to keep people living independently in their own homes by providing basic services, including bathing, dressing, house cleaning and meal preparation. Medicaid contracts with home care companies that in turn employ individuals to provide the actual day-to-day care. The investigation developed information that xxx was not at a patient’s home for the time periods she claimed to be providing services. District Court Judge Y sentenced xxx to 60 days in jail, suspended, 120 hours of community service, payment of $15, 300. 00 in restitution, penalties, and costs, plus 5 years probation. 11

TRENTON, June 1, 2010: New Jersey Attorney General Paula T. Dow and Division of Criminal Justice Director Stephen J. Taylor announced that a Hoboken pharmacist pleaded guilty today for his role in a scheme to defraud the Medicaid program. In pleading guilty, xxx, a pharmacist in charge at xxx Drugs, admitted that between Jan. 1 and Oct. 9, 2009, he submitted claims to the Medicaid program for prescription drugs allegedly dispensed to Medicaid beneficiaries, even though the prescription drugs were never dispensed. The claims were subsequently paid out by the Medicaid program. The investigation by the Medicaid Fraud Control Unit of the Office of the Insurance Fraud Prosecutor revealed that xxxx accepted fictitious prescriptions for Prevacid, Advair and Singulair from undercover Detectives as payment for narcotic prescription drugs. xxxx then billed and was paid by Medicaid for the Prevacid, Advair and Singulair even though the prescriptions were not filled or dispensed. 12

Former State Employee Charged In “Double-Dip” Scheme To Defraud Medicaid May 27, 2010 -- … According to the arrest warrant affidavit, Mr. xxxx was a fulltime employee of the Connecticut Department of Developmental Services while also engaged in private practice as a licensed clinical social worker. A 2007 DSS audit disclosed that Mr. xxxx had billed the Medicaid program for professional services he claimed to have rendered during the same time that he was being paid for his work as a state employee, the warrant alleges. Between January 2006 and December 2007, Mr. xxxx collected his state salary and also submitted claims to Medicaid for private professional services totaling $166, 798. 99. 13

AG's Office Gets 4 Indictments for Medicaid Fraud Sunday, May 02, 2010 (ALBUQUERQUE)---New Mexico Attorney General Gary King's Medicaid Fraud and Elder Abuse (MFEA) Division succeeded in obtaining grand jury indictments on 26 felony charges against three individuals and one business in an alleged longterm Medicaid fraud scheme. … Defendant xxx is accused of fraudulently billing the New Mexico Medicaid program for counseling services she never provided. She allegedly billed the state for 54 hours of counseling in a single day. 14

AG’s Medicaid fraud investigators recover for NC Release date: 4/28/2010 …. xxx previously worked as an officer manager for xxx, a company that provides ambulance services. Investigators discovered that from 2006 to 2008, xxx unlawfully billed Medicare and Medicaid for more than $650, 000 by submitting false claims for ambulance trips to take clients to and from dialysis treatments. Patients were usually transported to routine dialysis treatments by van, but xxx repeatedly falsified trip records and related documents to make it appear that patients needed to be taken by ambulance for medical reasons. … On March 23, a United States District Court judge sentenced xxx to 46 months in prison followed by three years of supervised release. Under a plea agreement, xxx will also pay $677, 272 in restitution to Medicare and Medicaid. 15

Missouri Attorney General’s Press Release March 23, 2010 Koster says Joplin dentist sentenced for 13 felony counts of Medicaid fraud --must repay state $550, 000 -Xxx submitted fraudulent billings for procedures such as x-rays, root canals, and resin-based composite restorations he did not perform. Xxx tried to conceal his false claims by creating false dental records, physically cutting off portions of dental records and taking x-rays from one patient's file and putting it in another. xxx came under investigation because a citizen reported her suspicions that he was committing fraud. 16

What You Can do to Prevent Fraud ØStay smart about your health care ØRead your billing statement 17

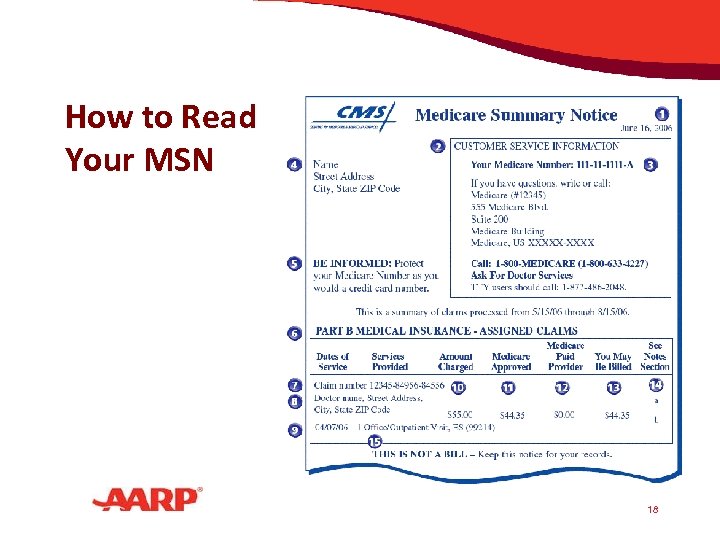

How to Read Your MSN 18

What You Can do to Prevent Fraud ØAsk: §Are there charges for something you didn’t get? §Are there charges for services that are not medically necessary? §Were you billed for the same thing more than once? 19

What You Can do to Prevent Fraud ØContact the provider—it might be an innocent mistake ØReport to authorities—it might not! 20

Tips to Avoid Fraud ØKeep your personal medical information from the wrong hands § Only carry your Medicare card when you are going to a doctor’s appointment, a hospital or clinic, or pharmacy § Never sign blank insurance claim forms § Be alert to “free” medical services 21

What Will You Do? You get an offer for a free three-day trip to Las Vegas if you go to a clinic to get a free diagnostic test. You will: a) Make an appointment b) Hang up c) Report the fraud 22

What Will You Do? You get a call from a medical supply company saying that Medicare made a mistake in payment. The company wants your Social Security number and bank account information so they can transfer funds to your account. You will: a) Give your bank account number b) Hang up c) Report the fraud 23

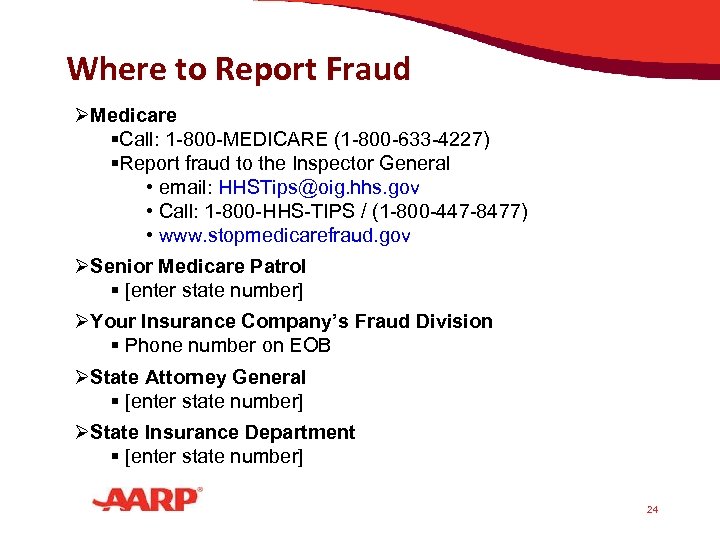

Where to Report Fraud ØMedicare §Call: 1 -800 -MEDICARE (1 -800 -633 -4227) §Report fraud to the Inspector General • email: HHSTips@oig. hhs. gov • Call: 1 -800 -HHS-TIPS / (1 -800 -447 -8477) • www. stopmedicarefraud. gov ØSenior Medicare Patrol § [enter state number] ØYour Insurance Company’s Fraud Division § Phone number on EOB ØState Attorney General § [enter state number] ØState Insurance Department § [enter state number] 24

Fraud Enforcement ØHEAT - Health Care Fraud Prevention and Enforcement Action Team ØDouble size of Senior Medicare Patrol ØMore inter-agency cooperation 25

For More Information ØOn the new health care law www. aarp. org/getthefacts www. aarp. org/consigarespuestas ØVisit www. healthcare. gov ØVisit www. stopmedicarefraud. gov ØCall 1 -800 -MEDICARE 26

AARP endorses Medicare fraud prevention bills: The Medicare Fraud Enforcement and Prevention Act (H. R. 5044) Sponsors: Reps. Ron Klein (D-FL) and Ileana Ros-Lehtinen (R-FL), and Sen. Kirsten Gillibrand (D-NY) What the bill does: Strengthens the penalties for Medicare fraud Makes it illegal to distribute Medicare identification numbers with the intent to defraud the program Gives law enforcement officials real-time access to Medicare claims data, allowing them to act quickly when suspicious activity is spotted. H. R. 5546, sponsored by Rep. Peter Roskam (R-IL), creates a stronger process for Medicare to review claims before paying providers. 27

Thank You! 28

PROGRAM INTEGRITY Across CMS’ Four Lines of Business SMP Regional Conference Charleston, SC August 24, 2010 Bob Foster, CMS Atlanta INFORMATION NOT RELEASABLE TO THE PUBLIC UNLESS AUTHORIZED BY LAW: This information has not been publicly disclosed and may be privileged and confidential. It is for internal government use only and must not be disseminated, distributed, or copied to persons not authorized to receive the information. Unauthorized disclosure may result in prosecution to the full extent of the law .

30

AGENDA Background Definitions Scope of the Problem Program Integrity Activities Medicare Parts A & B Fee-for-Service (FFS) Medicare Parts C & D Medicaid 31

BACKGROUND Program Integrity refers to all CMS programs aimed at: Reducing improper payments – from errors, mistakes or misunderstandings; and Eliminating outright fraud 32

BACKGROUND The entire agency contributes to Medicare and Medicaid program integrity, but there is a specific funding mechanism that specifically defines the components of program integrity. 33

MEDICARE PARTS A & B FEE-FOR-SERVICE (FFS) INFORMATION NOT RELEASABLE TO THE PUBLIC UNLESS AUTHORIZED BY LAW: This information has not been publicly disclosed and may be privileged and confidential. It is for internal government use only and must not be disseminated, distributed, or copied to persons not authorized to receive the information. Unauthorized disclosure may result in prosecution to the full extent of the law . 34

SCOPE OF MEDICARE FFS PROGRAM Medicare pays over 4. 4 million claims every working day to more than 1. 5 million distinct providers and suppliers valued at $1. 1 billion per working day totaling $431. 2 billion in annual Medicare payments. By law, CMS must pay submitted claims within 30 days of receipt. Due to time and resource limitations, Medicare only conducts medical review on fewer than 3% of all submitted claims before they are paid. Each month CMS receives 18, 000 Part A & B provider enrollment applications and 900 DME supplier applications. 35

KEY COMPONENTS OF FFS PROGRAM INTEGRITY Provider/Supplier Enrollment Medical Review Data Analysis/Benefit Integrity Provider Education 36

PREVENTING FRAUDULENT ENROLLMENT Distinguishing between legitimate and sham businesses Presumption that “any willing” provider who wants to enroll can do so CMS’ inability to conduct onsite reviews for every provider/supplier application makes it difficult to distinguish between legitimate and fraudulent providers. Preventing fraud through effective program safeguards to prevent unscrupulous providers from enrolling Surety bond requirement Accreditation standards 37

PROVIDER/SUPPLIER ENROLLMENT Goals: Ensure that only eligible providers (e. g. , hospitals, physicians) and suppliers (chain pharmacies, stand alone wheelchair stores) furnish services to Medicare beneficiaries. Remove sham providers and suppliers from the program. 38

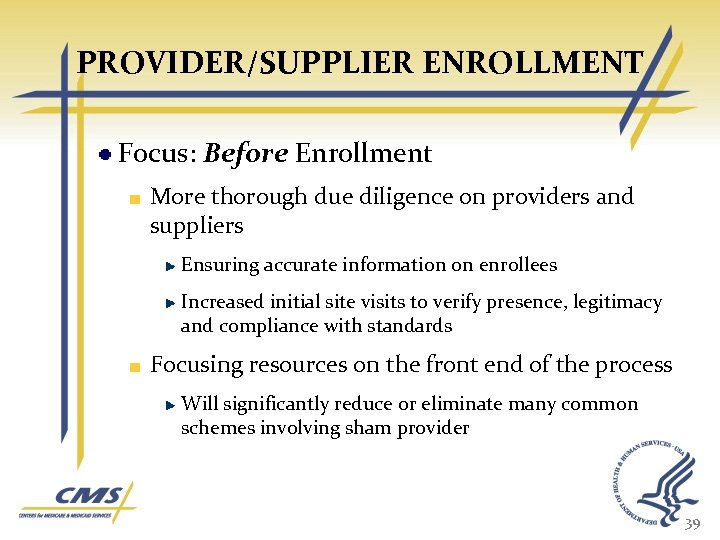

PROVIDER/SUPPLIER ENROLLMENT Focus: Before Enrollment More thorough due diligence on providers and suppliers Ensuring accurate information on enrollees Increased initial site visits to verify presence, legitimacy and compliance with standards Focusing resources on the front end of the process Will significantly reduce or eliminate many common schemes involving sham provider 39

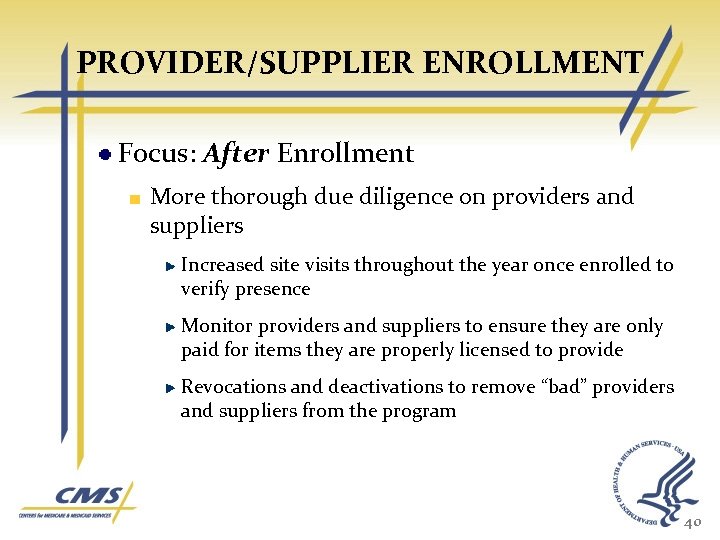

PROVIDER/SUPPLIER ENROLLMENT Focus: After Enrollment More thorough due diligence on providers and suppliers Increased site visits throughout the year once enrolled to verify presence Monitor providers and suppliers to ensure they are only paid for items they are properly licensed to provide Revocations and deactivations to remove “bad” providers and suppliers from the program 40

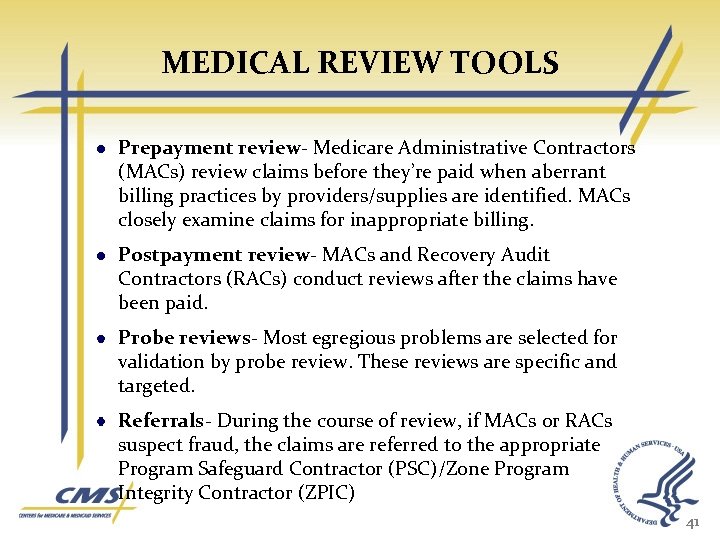

MEDICAL REVIEW TOOLS Prepayment review- Medicare Administrative Contractors (MACs) review claims before they’re paid when aberrant billing practices by providers/supplies are identified. MACs closely examine claims for inappropriate billing. Postpayment review- MACs and Recovery Audit Contractors (RACs) conduct reviews after the claims have been paid. Probe reviews- Most egregious problems are selected for validation by probe review. These reviews are specific and targeted. Referrals- During the course of review, if MACs or RACs suspect fraud, the claims are referred to the appropriate Program Safeguard Contractor (PSC)/Zone Program Integrity Contractor (ZPIC) 41

CONTRACTOR TOOLS MR BY AC/MAC MR FOR BI PURPOSES BY PSC/ZPIC Prepayment review MAC ZPIC Postpayment Review MAC ZPIC RAC 42

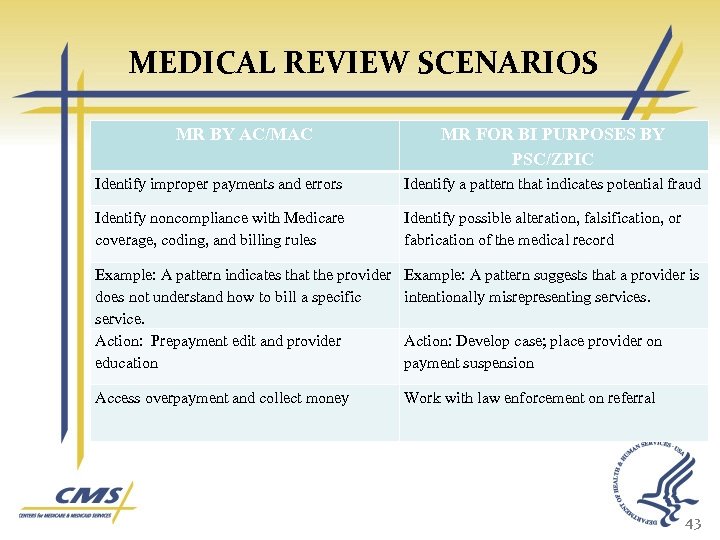

MEDICAL REVIEW SCENARIOS MR BY AC/MAC MR FOR BI PURPOSES BY PSC/ZPIC Identify improper payments and errors Identify a pattern that indicates potential fraud Identify noncompliance with Medicare coverage, coding, and billing rules Identify possible alteration, falsification, or fabrication of the medical record Example: A pattern indicates that the provider does not understand how to bill a specific service. Action: Prepayment edit and provider education Example: A pattern suggests that a provider is intentionally misrepresenting services. Access overpayment and collect money Work with law enforcement on referral Action: Develop case; place provider on payment suspension 43

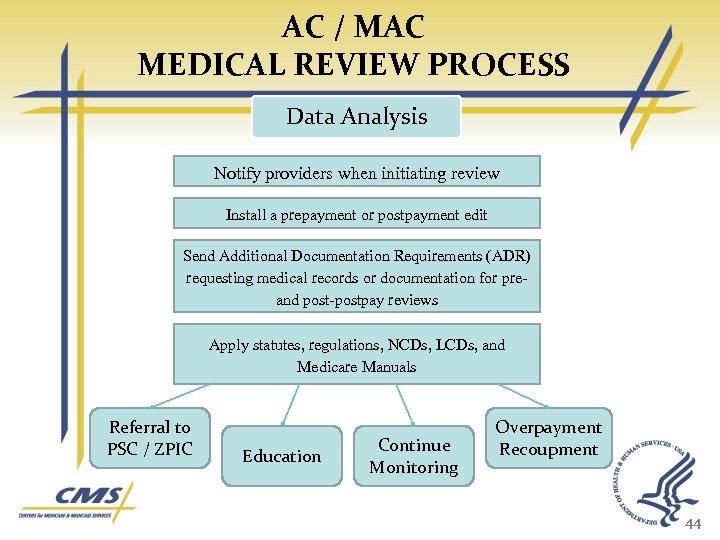

AC / MAC MEDICAL REVIEW PROCESS Data Analysis Notify providers when initiating review Install a prepayment or postpayment edit Send Additional Documentation Requirements (ADR) requesting medical records or documentation for pre and postpay reviews Apply statutes, regulations, NCDs, LCDs, and Medicare Manuals Referral to PSC / ZPIC Education Continue Monitoring Overpayment Recoupment 44

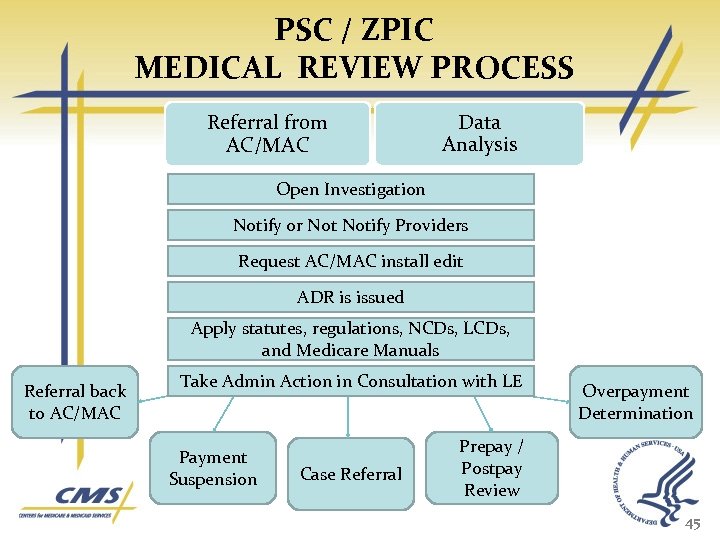

PSC / ZPIC MEDICAL REVIEW PROCESS Referral from AC/MAC Data Analysis Open Investigation Notify or Notify Providers Request AC/MAC install edit ADR is issued Apply statutes, regulations, NCDs, LCDs, and Medicare Manuals Referral back to AC/MAC Take Admin Action in Consultation with LE Payment Suspension Case Referral Overpayment Determination Prepay / Postpay Review 45

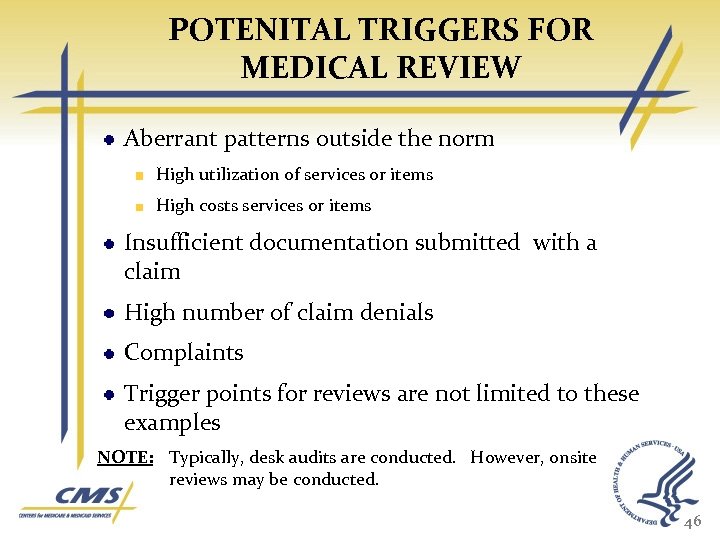

POTENITAL TRIGGERS FOR MEDICAL REVIEW Aberrant patterns outside the norm High utilization of services or items High costs services or items Insufficient documentation submitted with a claim High number of claim denials Complaints Trigger points for reviews are not limited to these examples NOTE: Typically, desk audits are conducted. However, onsite reviews may be conducted. 46

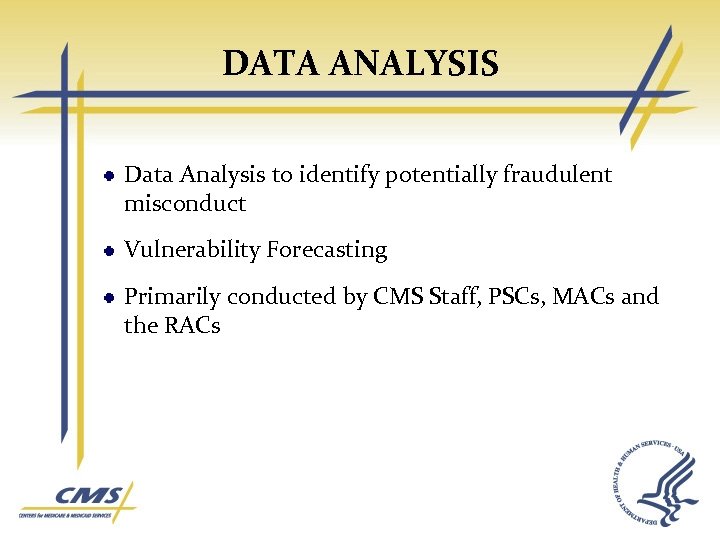

DATA ANALYSIS Data Analysis to identify potentially fraudulent misconduct Vulnerability Forecasting Primarily conducted by CMS Staff, PSCs, MACs and the RACs

PROVIDER EDUCATION Individual provider/supplier education to address root cause of billing errors and prevent errors resulting from lack of understanding -- “one on one” education Broad based education on medical review related policy and coding issues to all providers and suppliers Ensure that only properly licensed individuals furnish services to Medicare beneficiaries and that those individuals understand the Medicare laws & regulations

RECOVERY AUDIT CONTRACTOR PROGRAM Conduct post-payment review of all paid Medicare claims based on data analysis. Identify and correct improper payments. The National Recovery Audit Contractor (RAC) program was fully implemented as of October , 2009. Prior to beginning widespread review of an issue the RAC must receive CMS approval. As of December 9, 2009 CMS has approved 98 new issues. Through the end of November 2009 $2. 8 million in improper payments has been demanded. 49

MEDICARE FFS ERROR RATE Comprehensive Error Rate Testing (CERT) Program Conducts post-payment review on claims to determine if they were paid appropriately Randomly selects a sample of approximately 120, 000 submitted claims Requests medical records from providers who submitted the claims 50

MEDICARE FFS ERROR RATE Comprehensive Error Rate Testing (CERT) Program Reviews the claims and medical records for compliance with Medicare coverage, coding, and billing rules CERT error rate reports inform contractors of the vulnerabilities in the program that can be better addressed. Corrective actions include: Refining error rate measurement processes, improving system edits, updating coverage policies, and conducting provider education efforts 51

MEDICARE PARTS C & D INFORMATION NOT RELEASABLE TO THE PUBLIC UNLESS AUTHORIZED BY LAW: This information has not been publicly disclosed and may be privileged and confidential. It is for internal government use only and must not be disseminated, distributed, or copied to persons not authorized to receive the information. Unauthorized disclosure may result in prosecution to the full extent of the law . 52

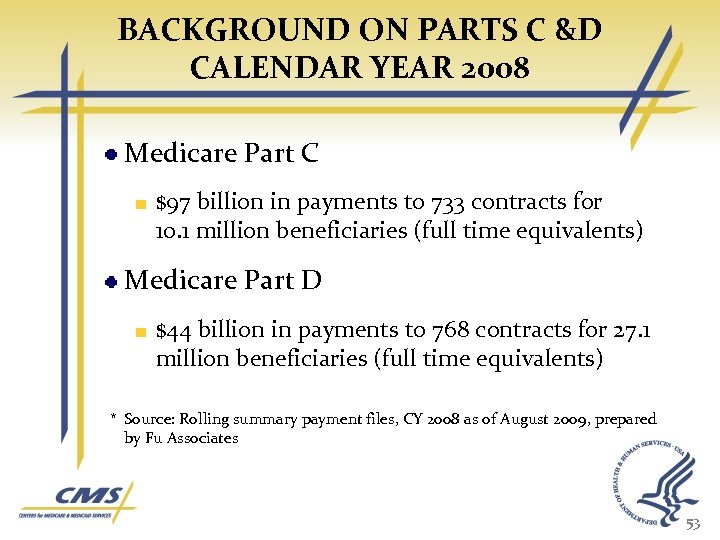

BACKGROUND ON PARTS C &D CALENDAR YEAR 2008 Medicare Part C $97 billion in payments to 733 contracts for 10. 1 million beneficiaries (full time equivalents) Medicare Part D $44 billion in payments to 768 contracts for 27. 1 million beneficiaries (full time equivalents) * Source: Rolling summary payment files, CY 2008 as of August 2009, prepared by Fu Associates 53

CALCULATING PARTS C & D PAYMENTS Both Part C and D payments are based on plan bids Part C are per beneficiary, risk adjusted monthly payments There are four components to monthly Part D payments Direct subsidy Risk sharing Low-income subsidies Reinsurance 54

CALCULATING PARTS C & D ERROR RATES Part C 15. 4 percent or $12 billion based on 2007 payments CY 1. 5 percent MARx Payment System 13. 9 percent risk adjustment Part D is developmental * Source: As reported in the FY 2009 AFR 55

ENSURING PROPER PARTS C & D PAYMENTS Bid reviews Beneficiary Payment Validation (BPV) Risk Adjustment Data Validation (RADV) Payment Reconciliation Statutory Financial Audits MEDIC Oversight 56

BID REVIEWS Bids are required to be certified by a qualified actuary Objective of bid review is to ensure that bids are prepared in accordance with actuarial standards of practice and the law, regulations, and instructions OACT leads an extensive review process that Focuses on outliers Evaluates reasonableness of assumptions Compares the bid to actual or reported experience After approval, OACT selects a number of bids for a detailed audit where all bid assumptions and methods are evaluated 57

BENEFICIARY PAYMENT VALIDATION (BPV) A monthly control that verifies the accuracy of payments generated by the payment system (MARx) BPV focuses on the accuracy of: Data transferred from other data systems to MARx for payment calculations Payment calculations performed by MARx Payment errors are identified and defined as the difference between the beneficiarylevel payment amount calculated by MARx and CMS’ independently simulated payment Payments are simulated for 100% of Part C and Part D enrollees prior to payment each month and payment error differences were less than 1 percent for CY 2008 and CY 2009 payments 58

RISK ADJUSTMENT DATA VALIDATION (RADV) RADV verifies, through medical record review, the accuracy of enrollee diagnoses, used to support risk adjustment, submitted by plans CMS conducts RADV annually on a national and contract specific basis. Payment error estimates: CY 2007 risk adjustment error for National Sample was 13. 9 percent CY 2007 contract specific audits are now underway CMS will conduct contract level payment adjustments based on these finding 59

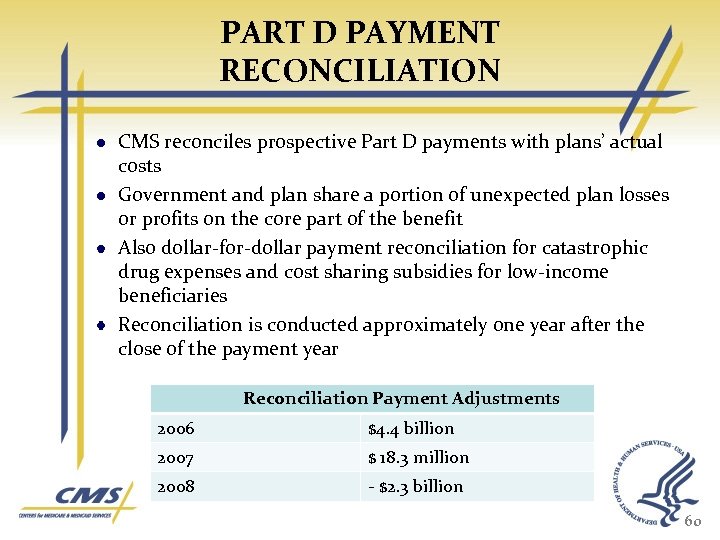

PART D PAYMENT RECONCILIATION CMS reconciles prospective Part D payments with plans’ actual costs Government and plan share a portion of unexpected plan losses or profits on the core part of the benefit Also dollar-for-dollar payment reconciliation for catastrophic drug expenses and cost sharing subsidies for low-income beneficiaries Reconciliation is conducted approximately one year after the close of the payment year Reconciliation Payment Adjustments 2006 $4. 4 billion 2007 $ 18. 3 million 2008 - $2. 3 billion 60

MEDICS Role of Medicare Drug Integrity Contractors (MEDICs) Ensure that fraudulent or abusive behavior against the Medicare program is identified and corrective action is taken. Serve as a law enforcement liaison to ensure coordination on cross-cutting issues. Identify, monitor and track fraud, waste, and abuse in Medicare through data analysis. 61

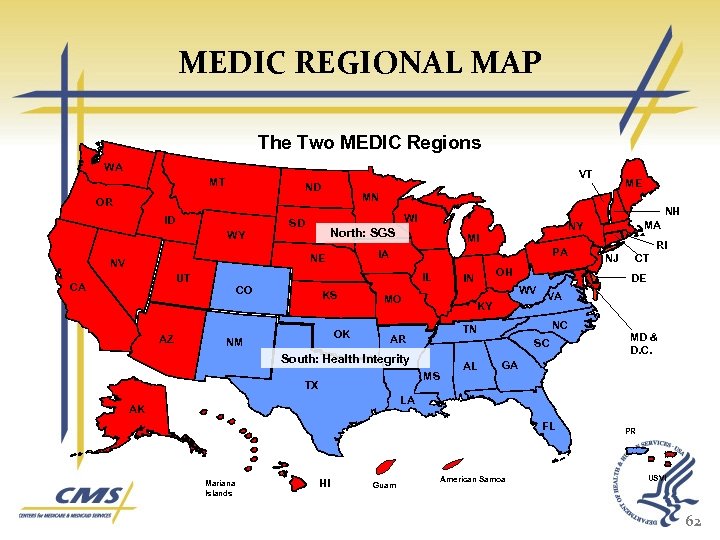

MEDIC REGIONAL MAP The Two MEDIC Regions WA VT MT ND MN OR ID PA IL UT AZ MI IA NE CO KS OK NM MA NY North: SGS WY CA NH WI SD NV ME MO WV KY VA NC SC South: Health Integrity MS AL CT DE TN AR TX OH IN RI NJ MD & D. C. GA LA AK FL Mariana Islands HI Guam American Samoa PR USVI 62

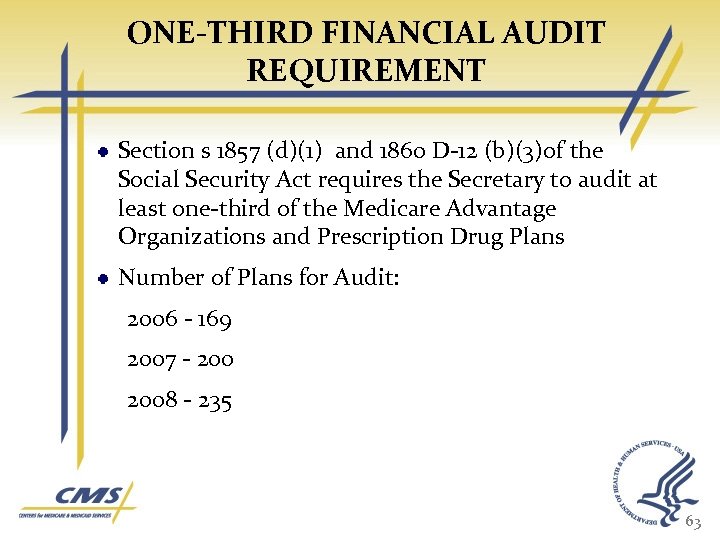

ONE-THIRD FINANCIAL AUDIT REQUIREMENT Section s 1857 (d)(1) and 1860 D-12 (b)(3)of the Social Security Act requires the Secretary to audit at least one-third of the Medicare Advantage Organizations and Prescription Drug Plans Number of Plans for Audit: 2006 - 169 2007 - 2008 - 235 63

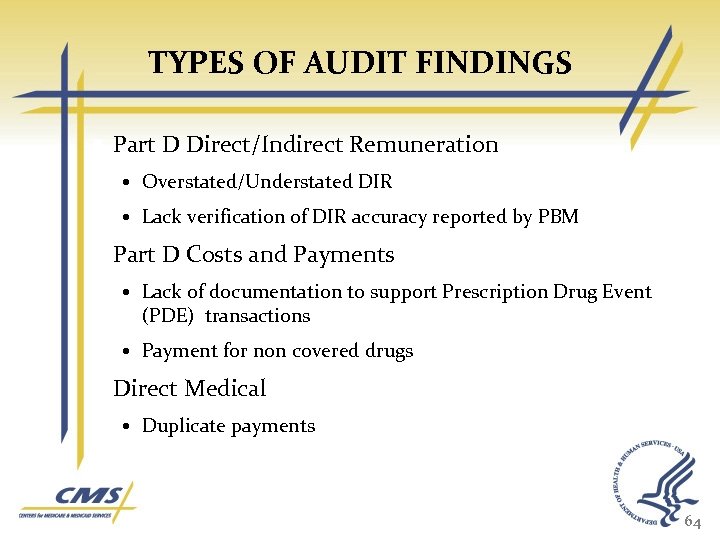

TYPES OF AUDIT FINDINGS Part D Direct/Indirect Remuneration Overstated/Understated DIR Lack verification of DIR accuracy reported by PBM Part D Costs and Payments Lack of documentation to support Prescription Drug Event (PDE) transactions Payment for non covered drugs Direct Medical Duplicate payments 64

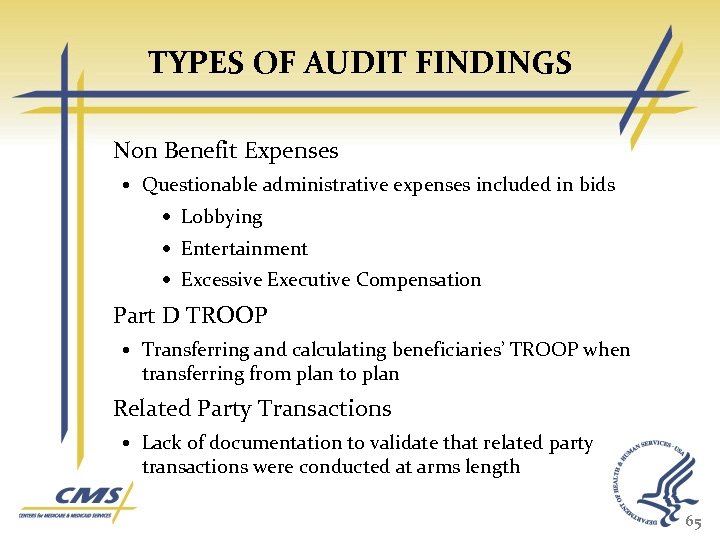

TYPES OF AUDIT FINDINGS Non Benefit Expenses Questionable administrative expenses included in bids Lobbying Entertainment Excessive Executive Compensation Part D TROOP Transferring and calculating beneficiaries’ TROOP when transferring from plan to plan Related Party Transactions Lack of documentation to validate that related party transactions were conducted at arms length 65

MEDICAID INFORMATION NOT RELEASABLE TO THE PUBLIC UNLESS AUTHORIZED BY LAW: This information has not been publicly disclosed and may be privileged and confidential. It is for internal government use only and must not be disseminated, distributed, or copied to persons not authorized to receive the information. Unauthorized disclosure may result in prosecution to the full extent of the law . 66

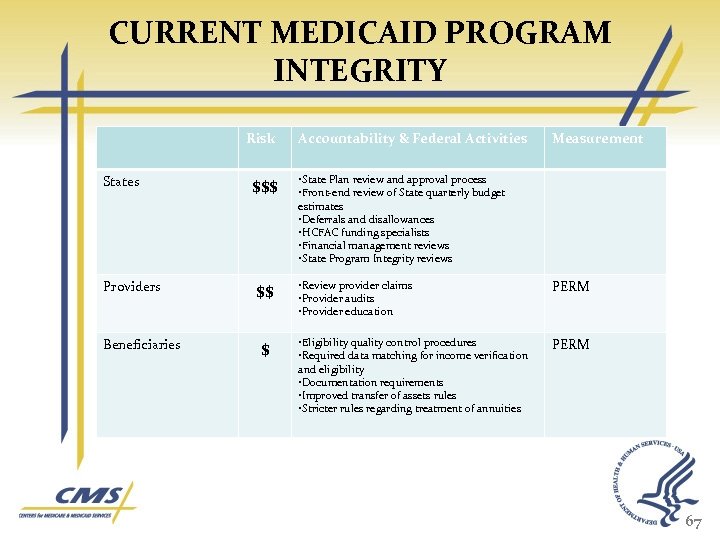

CURRENT MEDICAID PROGRAM INTEGRITY Risk States Providers Beneficiaries $$$ $$ $ Accountability & Federal Activities Measurement • State Plan review and approval process • Front-end review of State quarterly budget estimates • Deferrals and disallowances • HCFAC funding specialists • Financial management reviews • State Program Integrity reviews • Review provider claims • Provider audits • Provider education PERM • Eligibility quality control procedures • Required data matching for income verification and eligibility • Documentation requirements • Improved transfer of assets rules • Stricter rules regarding treatment of annuities PERM 67

STATE CLAIMING INTEGRITY Accomplished through federal employees State plan amendment review process includes review of state’s source of non federal share, integrated approach to reviewing State eligibility, coverage and financing proposals Upfront review of state budget estimates includes look for previously disallowed funds Back end review of quarterly expenditure reports for anomalies, risk areas Deferrals and disallowances taken when concerns or errors detected 68

STATE CLAIMING INTEGRITY Focused Financial Management Reviews Structured financial management workplan for Medicaid which incorporates risk assessment factor Medicaid/ CHIP Financial management Project. Funding specialists work to improve CMS’ financial oversight of Medicaid and CHIP (100 dedicated FTEs funded through HCFAC): FY 09 – Identified and resolved $3. 5 billion of approximately $7 billion in questionable costs Averted approximately $1. 5 billion due to preventive work with states 69

MEDICAID INTEGRITY PROGRAM Deficit Reduction Act of 2005 (DRA) established the Medicaid Integrity Program in § 1936 of the Social Security Act. Provided funding of $75 M annually (no year money). Allowed for funding of federal employees -- 100 Provided authority to contract with entities to: Review provider claims Audit providers and others Identify overpayments, and Educate providers, managed care entities, beneficiaries and others with respect to payment integrity and quality of care. 70

MEDICAID INTEGRITY PROGRAM ACTIVITY Oversight and Technical Assistance to States Boots on the Ground State reviews Medicaid Integrity Institute 25 courses, for 1250 State Medicaid PI employees trained to date National Medicaid Audit Program Approximately 600 audits in progress Contracts awarded: 5 Review MICs, 5 Audit MICs and 2 Education MICs covering all 10 CMS regions $49 M for MIC contracts in FY 2009 Data Analysis CMS data analysis team developing algorithms to detect and identify improper payments – provider level & State system level 100+ algorithms developed to date 71

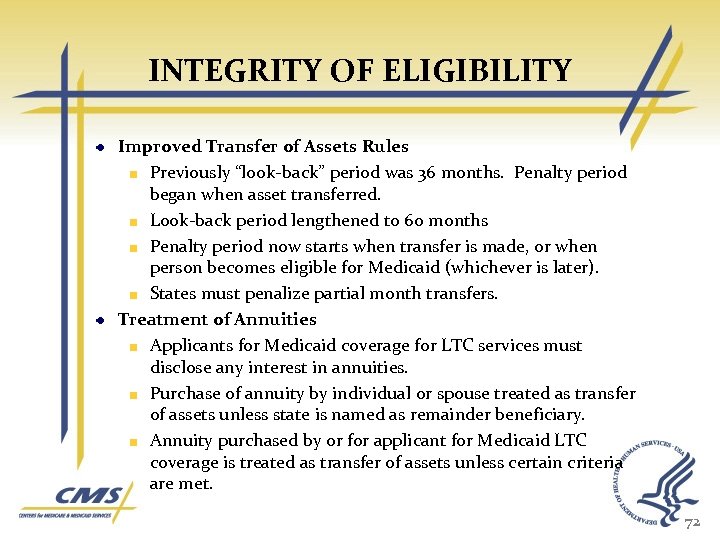

INTEGRITY OF ELIGIBILITY Improved Transfer of Assets Rules Previously “look-back” period was 36 months. Penalty period began when asset transferred. Look-back period lengthened to 60 months Penalty period now starts when transfer is made, or when person becomes eligible for Medicaid (whichever is later). States must penalize partial month transfers. Treatment of Annuities Applicants for Medicaid coverage for LTC services must disclose any interest in annuities. Purchase of annuity by individual or spouse treated as transfer of assets unless state is named as remainder beneficiary. Annuity purchased by or for applicant for Medicaid LTC coverage is treated as transfer of assets unless certain criteria are met. 72

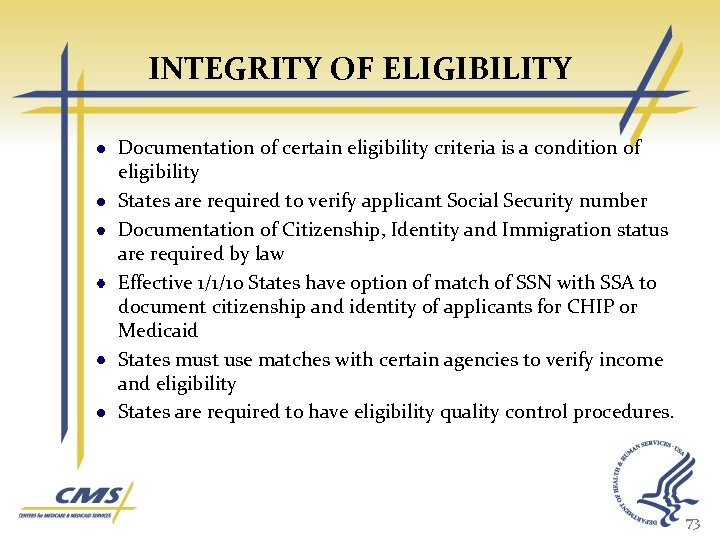

INTEGRITY OF ELIGIBILITY Documentation of certain eligibility criteria is a condition of eligibility States are required to verify applicant Social Security number Documentation of Citizenship, Identity and Immigration status are required by law Effective 1/1/10 States have option of match of SSN with SSA to document citizenship and identity of applicants for CHIP or Medicaid States must use matches with certain agencies to verify income and eligibility States are required to have eligibility quality control procedures. 73

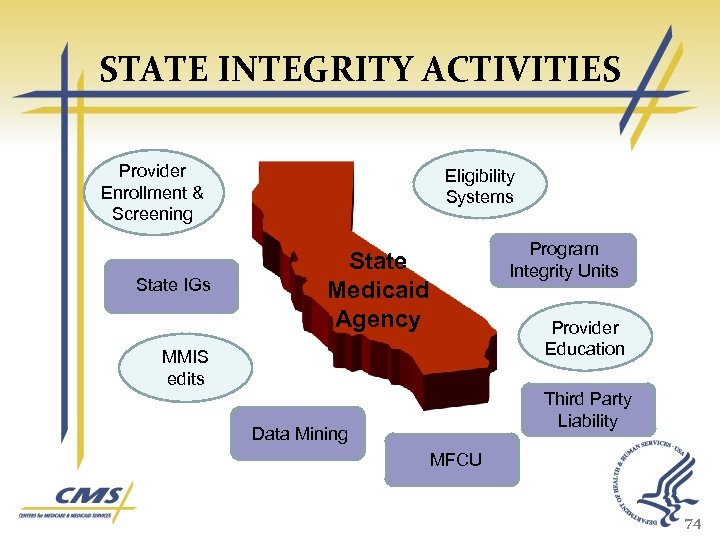

STATE INTEGRITY ACTIVITIES Provider Enrollment & Screening State IGs Eligibility Systems State Medicaid Agency MMIS edits Program Integrity Units Provider Education Third Party Liability Data Mining MFCU 74

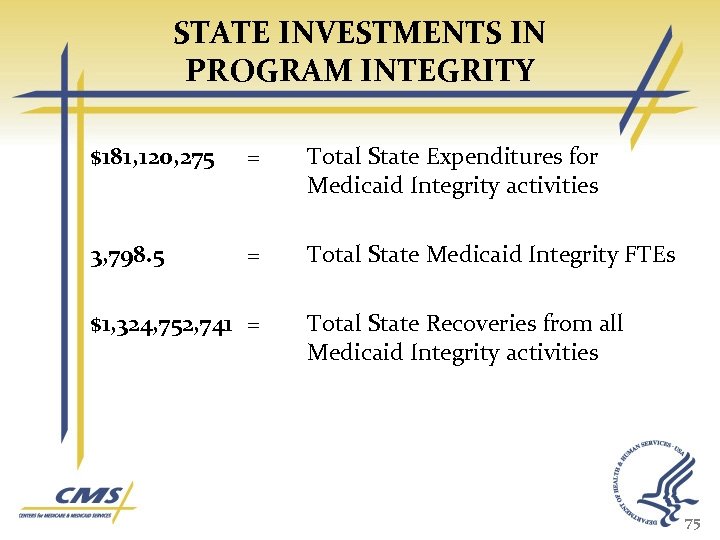

STATE INVESTMENTS IN PROGRAM INTEGRITY $181, 120, 275 = Total State Expenditures for Medicaid Integrity activities 3, 798. 5 = Total State Medicaid Integrity FTEs $1, 324, 752, 741 = Total State Recoveries from all Medicaid Integrity activities 75

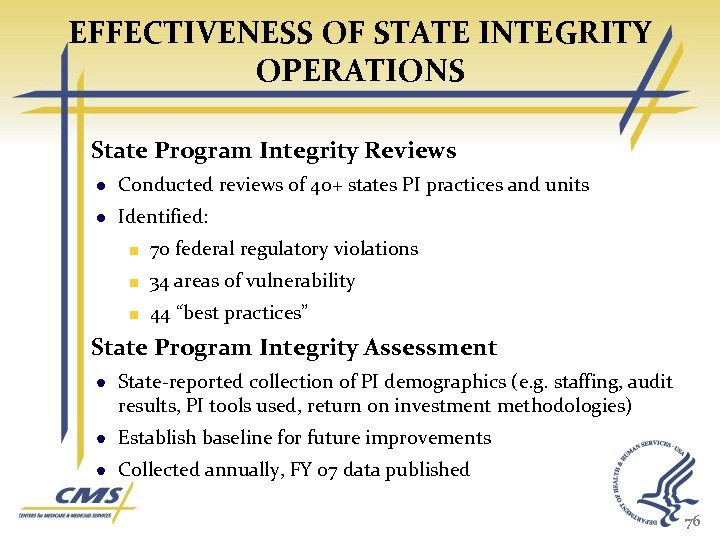

EFFECTIVENESS OF STATE INTEGRITY OPERATIONS State Program Integrity Reviews Conducted reviews of 40+ states PI practices and units Identified: 70 federal regulatory violations 34 areas of vulnerability 44 “best practices” State Program Integrity Assessment State-reported collection of PI demographics (e. g. staffing, audit results, PI tools used, return on investment methodologies) Establish baseline for future improvements Collected annually, FY 07 data published 76

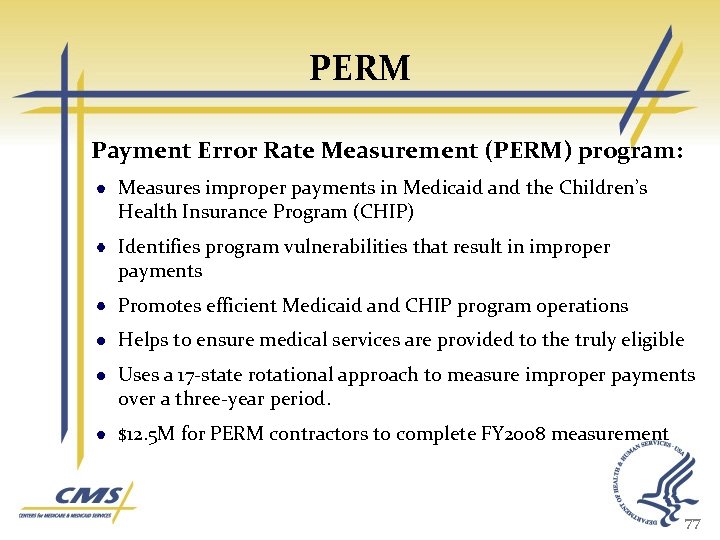

PERM Payment Error Rate Measurement (PERM) program: Measures improper payments in Medicaid and the Children’s Health Insurance Program (CHIP) Identifies program vulnerabilities that result in improper payments Promotes efficient Medicaid and CHIP program operations Helps to ensure medical services are provided to the truly eligible Uses a 17 -state rotational approach to measure improper payments over a three-year period. $12. 5 M for PERM contractors to complete FY 2008 measurement 77

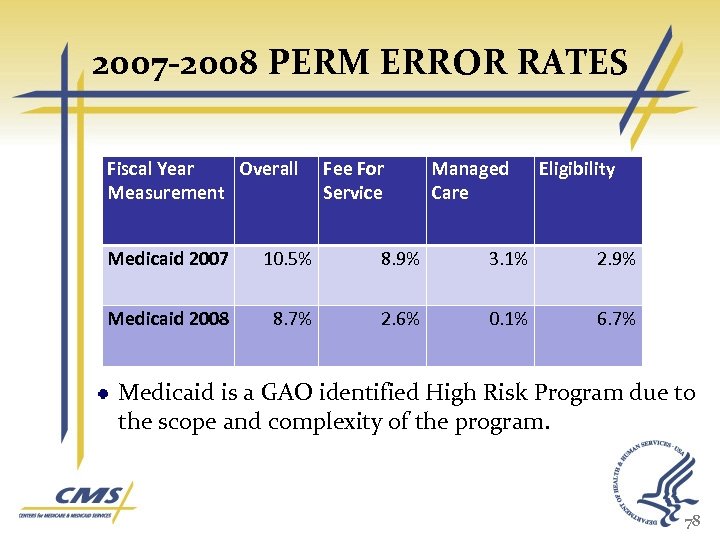

2007 -2008 PERM ERROR RATES Fiscal Year Overall Measurement Fee For Service Managed Care Eligibility Medicaid 2007 10. 5% 8. 9% 3. 1% 2. 9% Medicaid 2008 8. 7% 2. 6% 0. 1% 6. 7% Medicaid is a GAO identified High Risk Program due to the scope and complexity of the program. 78

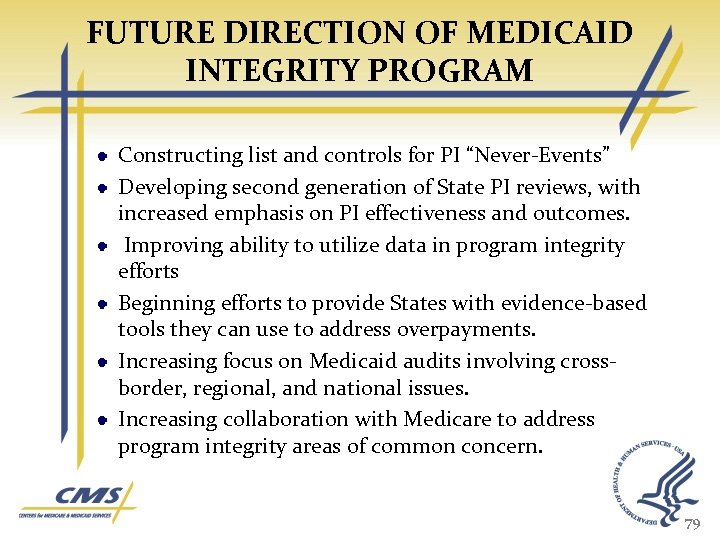

FUTURE DIRECTION OF MEDICAID INTEGRITY PROGRAM Constructing list and controls for PI “Never-Events” Developing second generation of State PI reviews, with increased emphasis on PI effectiveness and outcomes. Improving ability to utilize data in program integrity efforts Beginning efforts to provide States with evidence-based tools they can use to address overpayments. Increasing focus on Medicaid audits involving crossborder, regional, and national issues. Increasing collaboration with Medicare to address program integrity areas of common concern. 79

QUESTIONS Robert. Foster@cms. hhs. gov Spec 404 -562 -1743

HHS OIG and the Investigation of Health Care Fraud Brian Dimler Special Agent U. S. Department of Health and Human Services Office of Inspector General Office of Investigations Columbia, SC

Overview of HHS • One of the largest civilian departments in the federal government • Principle agency for protecting health of all Americans • Kathleen Sebelius sworn in as HHS Secretary in April 2009 • 11 Agencies & Office of the Secretary

Office of Inspector General (OIG) • Independent oversight agency with the department • Responsible for preventing waste, fraud, and abuse of agency’s programs and funds • Investigate both wasteful or fraudulent spending and employee misconduct

HHS OIG Core Values Integrity Acts with independence and objectivity Credibility Builds on a tradition of excellence and accountability Impact Yields results that are tangible and relevant

Healthcare Fraud

HHS OIG Office of Investigations

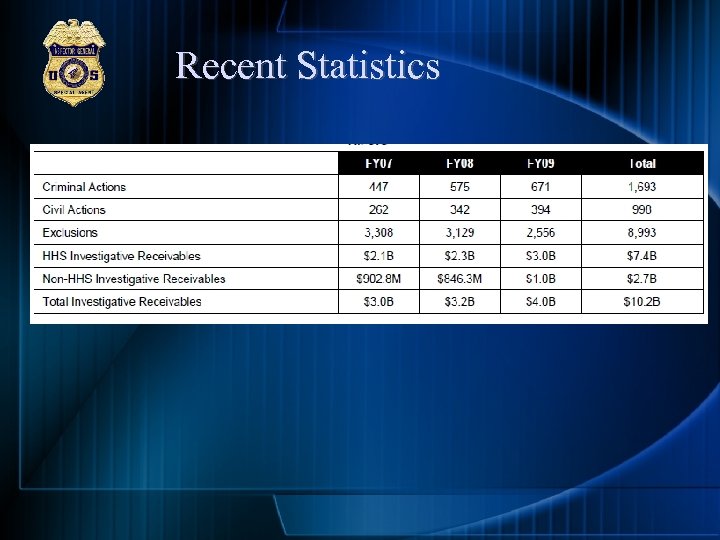

Recent Statistics

General Trends • • • DME Home Health Psych Fraud Office Visit Schemes Physical Therapy Wave Therapy

Emerging Trends • • • Cardiology Psych Vacations Pain Management Part D Diversion Diagnostic Imaging Qui Tams

Most Concerning Trends? • Medical Identity Theft • Organized Crime and Structured Criminal Activity

Fraud Trends – Med ID Theft • Benes received calls from companies representing themselves as Medicare • Buying/selling patient lists • Dumpsters? ? • Medical Identity Theft Brochure • Press Event with Secretary Sebelius on October 15 th • Following week – 67% Increase in hotline calls related to medical identity theft

Organized Criminal Activity in Health Care Fraud • • African Asian Eurasian Hispanic/Latin American • Italian • Middle Eastern http: //www. allposters. com/-sp/The-Godfather_i 2671311_. htm? aid=2025062015

What Are We Doing About It? Strike Force!

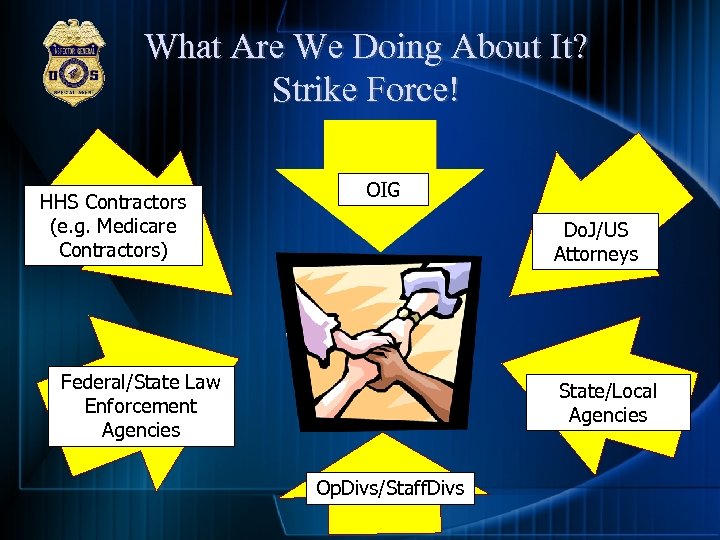

What Are We Doing About It? Strike Force! HHS Contractors (e. g. Medicare Contractors) OIG Do. J/US Attorneys Federal/State Law Enforcement Agencies State/Local Agencies Op. Divs/Staff. Divs

Strike Force • HEAT • SF supplements criminal HCF enforcement activities • Data driven analysis • Targets chronic fraud, emerging & migrating schemes

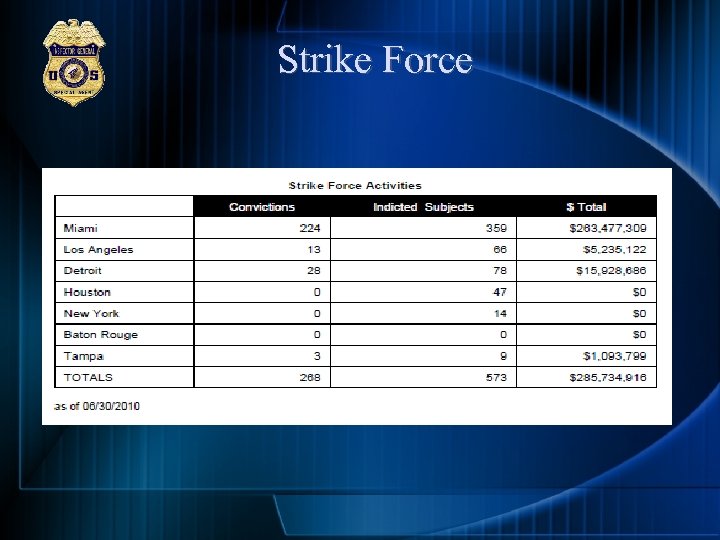

Strike Force

Communication Get the Word Out • Increase Press Releases • Internet • Health Care Related Organizations Compliance Training Best Practices

http: //www. oig. hhs. gov/fraud/IDTheft/

www. hhs. gov

www. oig. hhs. gov

www. oig. hhs. gov • You can call, email, send, or fax in a hotline tip: 1 800 HHS TIPS HHSTips@oig. hhs. gov • Enforcement Actions • Alerts, Bulletins & Other Guidance

Questions? Brian Dimler Special Agent DHHS OIG OI Columbia, SC 803 765 5604

South Carolina Attorney General’s Office SMP Bi Regional Conference August 24, 2010

South Carolina Attorney General’s Office ¨ Introduction ¨ Brief History ¨ Referrals ¨ Type of Cases Seen ¨ Correlations between MFCU & MRFU ¨ Other Scams ¨ Conclusion

Introduction ¨ SC Unique Medicaid Fraud Control Unit (MFCU) Medicaid Recipient Fraud Unit (MRFU) Work with Federal and State LE Units Work with Local LE Entities

History ¨ MFCU 1994 to Present Provider Related Vulnerable Adults Global ¨ MRFC 1989 First Unit Recipient Related Drug Diversion State Agencies

History

Referrals – SC HHS Hotline – Overpayment – Direct Referrals to AG’s Office

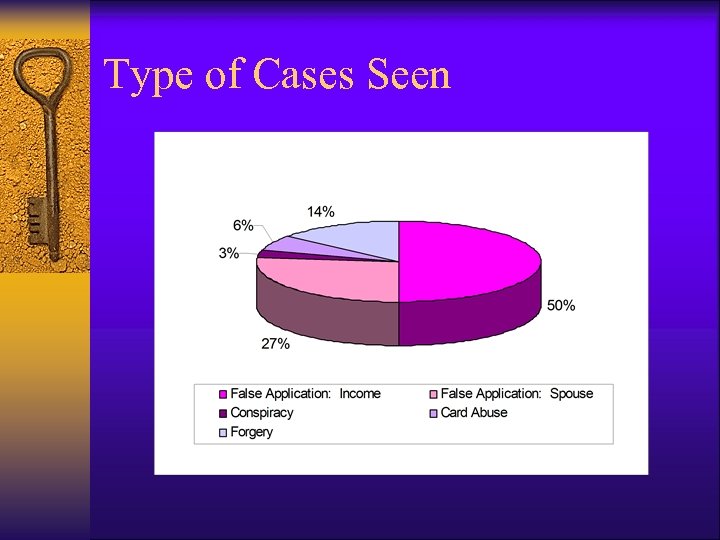

Type of Cases Seen

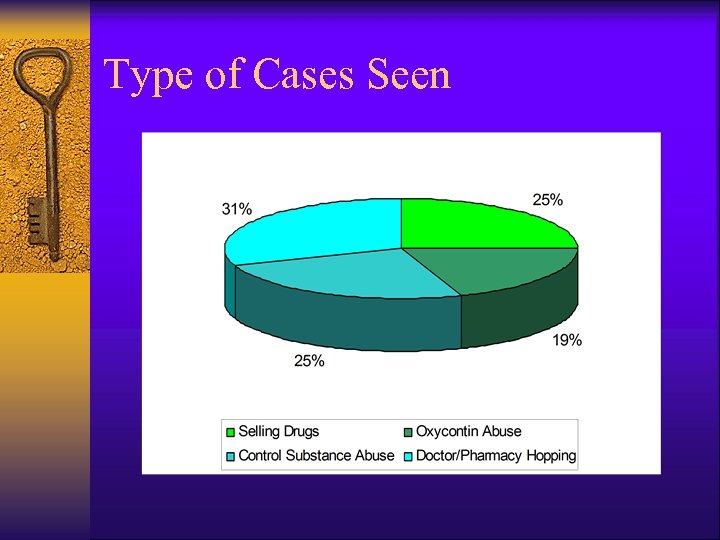

Type of Cases Seen

Correlations between MFCU and MRFU ¨ MFCU Financial Exploitation Neglect False Claims/ Billing for services not rendered. ¨ MRFU Concealing Income and Assets Doctor/Pharmacy Shopping Obtaining Controlled Substances by Fraud/ Conspiracy

Other Scams ¨ Insurance Fraud – Fake Accidents ¨ Disability Claims ¨ Out of State Insurance double dipping ¨ Conspiracy between Retiree and Medicaid Recipient. ¨ VA – Travel ¨ Companies indicating they work with Area Council on Aging.

The Future of Medicaid Recipient Fraud Investigations – Oxycontin/Drug Dealers – Medicaid Mills/Illegal Aliens – Homeland Security – Taking a Bite out of Crime

Conclusion ¨ Inroads to stop recipient fraud ¨ Contacts with State and Federal Law Enforcement ¨ Precedence ¨ Successful track record

cff02ccce9e2834394e035fb7733afaa.ppt