03e8e62474023acbe16f4c2f560ea1f5.ppt

- Количество слайдов: 36

Health & Benefits Training on Work And Disability Assisting youth and adults who want to work, save and safeguard health care and needed benefits February 25, 2012 Riverside, California by Disability Benefits 101 Information Services © Copyright 2012 by the World Institute on Disability, permission to copy pro bono will be granted to non-profit 1 entities with appropriate acknowledgement of credit.

Sponsored by: 31 st Annual CARS+ Convention Riverside, CA – "Uniting and Empowering“ T H A N K Y O U! 2

Work and Benefits 101 “When you change the way you see things, The things you see will change. ” Doctor Tom Pomeranz, Ph. D. February 5, 2007 A New Day California 2007 Conference San Diego, California 3

Work and Disability Benefits 101 What type of benefit is it? o Means-Tested Programs Supplemental Security Income, SSI and Medicaid o Social Insurance Social Security Disability Insurance, SSDI and Medicare Childhood Disability Beneficiary, CDB (formerly DAC) o Private Sector Disability and Health Care Benefits From work or family coverage, rules differ plan Coordination of Benefits … Workers can use all three types at the same time; The key is knowing how to work with program integration and program interactions. 4

Social Security and Work Social Security Definition for Disability: “the inability to engage in any substantial gainful activity (SGA) because of a medically determinable physical or mental impairment(s): that can be expected to result in death, or that has lasted or that Social Security expects to last for a continuous period of not less than 12 months. ” 5

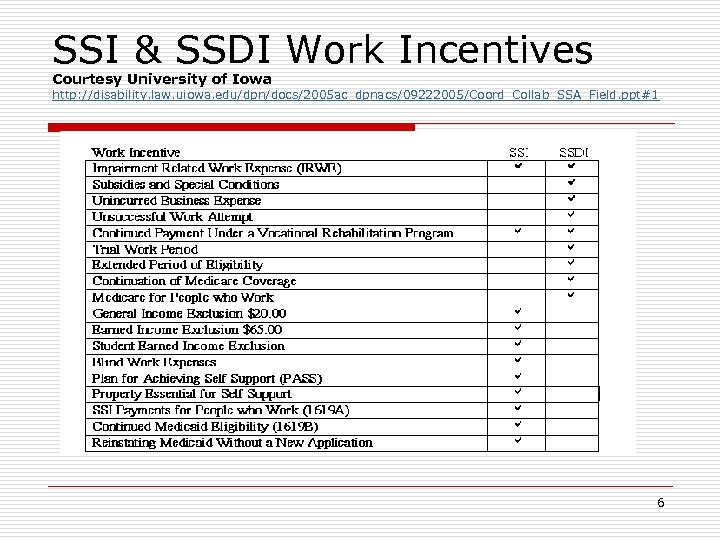

SSI & SSDI Work Incentives Courtesy University of Iowa http: //disability. law. uiowa. edu/dpn/docs/2005 ac_dpnacs/09222005/Coord_Collab_SSA_Field. ppt#1 6

Benefits Planning Tools & Skills for Results 1) Social Security’s Benefits Planning Query, the BPQY: Know what benefits you receive now; see DB 101 News article “What benefits am I on? ” 2) The Benefits Binder: your notebook and log of phone calls, Binder office visits, and names of service staff you contact. File original paycheck stubs and government letters here. 3) Reporting Requirements: Who is responsible, when? If you Requirements have a payee, the payee is responsible to report monthly changes to Social Security by the 10 th of the next month. If not, it’s the beneficiary. Reporting income and other life changes timely is required. 4) Know your appeal rights: A Notice of Action explains them. These tools, rules and skills can result in timely and improved customer service with benefit programs. Resource: Key Facts Vol. I No. 1, February, 2003 Benefits Assistance Resource Center - Virginia Commonwealth University Rehabilitation Research & Training Center on Workplace Supports 7

SSI and Work Key Program Legal Terms o Substantial Gainful Activity, SGA n $1010 and $1, 690 if blind (2012) o Continuing Disability Review, CDR o Countable Income n Countable Earned Income n Countable Unearned Income o Eligibility Status vs. -0 - Cash Benefit o Social Security Work Credits: workers earn 4 credits per year maximum n SSDI Eligibility n Quarter of Coverage (QC): $1, 130 gross earnings over three months in 2012 8

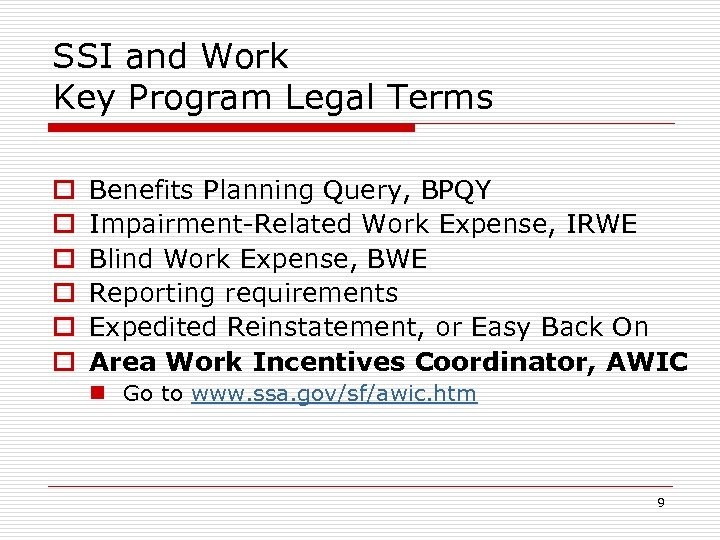

SSI and Work Key Program Legal Terms o o o Benefits Planning Query, BPQY Impairment-Related Work Expense, IRWE Blind Work Expense, BWE Reporting requirements Expedited Reinstatement, or Easy Back On Area Work Incentives Coordinator, AWIC n Go to www. ssa. gov/sf/awic. htm 9

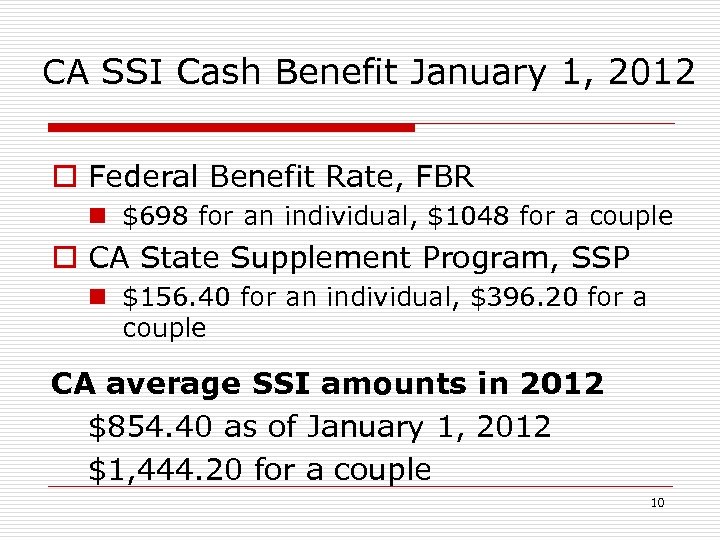

CA SSI Cash Benefit January 1, 2012 o Federal Benefit Rate, FBR n $698 for an individual, $1048 for a couple o CA State Supplement Program, SSP n $156. 40 for an individual, $396. 20 for a couple CA average SSI amounts in 2012 $854. 40 as of January 1, 2012 $1, 444. 20 for a couple 10

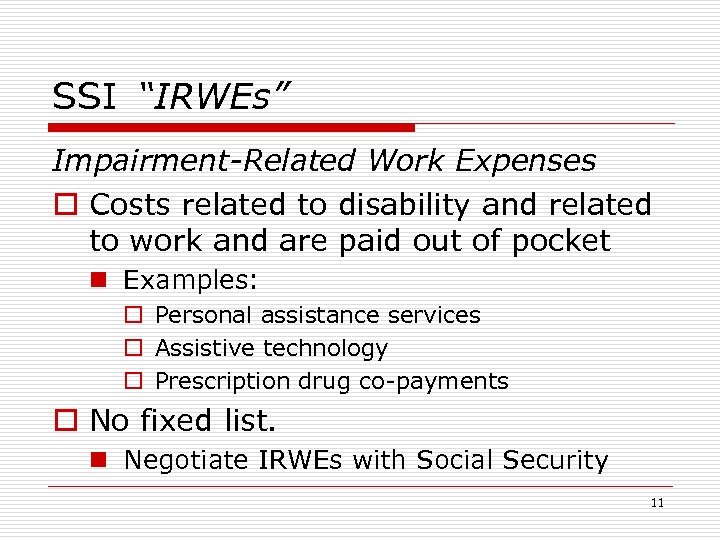

SSI “IRWEs” Impairment-Related Work Expenses o Costs related to disability and related to work and are paid out of pocket n Examples: o Personal assistance services o Assistive technology o Prescription drug co-payments o No fixed list. n Negotiate IRWEs with Social Security 11

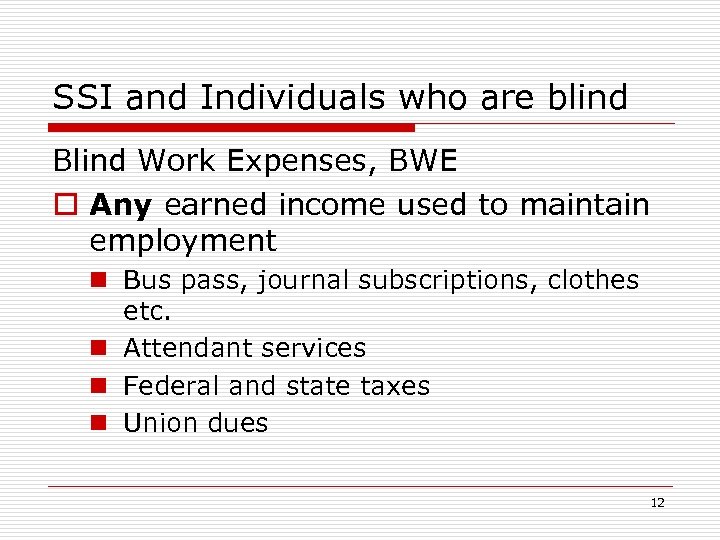

SSI and Individuals who are blind Blind Work Expenses, BWE o Any earned income used to maintain employment n Bus pass, journal subscriptions, clothes etc. n Attendant services n Federal and state taxes n Union dues 12

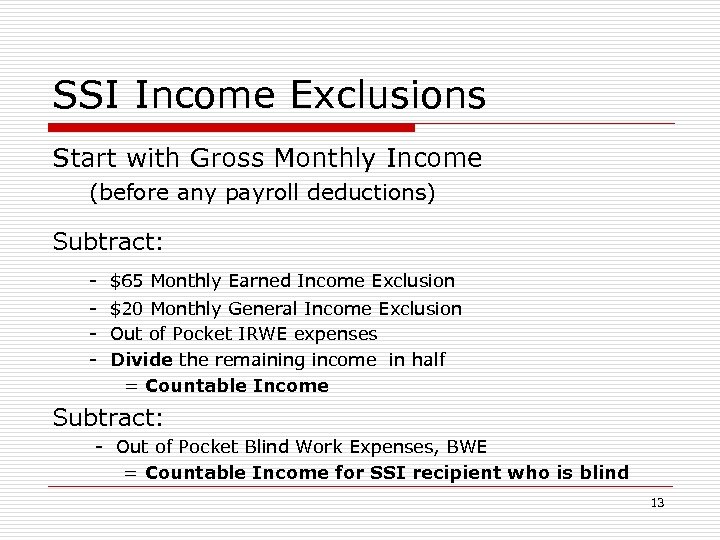

SSI Income Exclusions Start with Gross Monthly Income (before any payroll deductions) Subtract: - $65 Monthly Earned Income Exclusion - $20 Monthly General Income Exclusion - Out of Pocket IRWE expenses - Divide the remaining income in half = Countable Income Subtract: - Out of Pocket Blind Work Expenses, BWE = Countable Income for SSI recipient who is blind 13

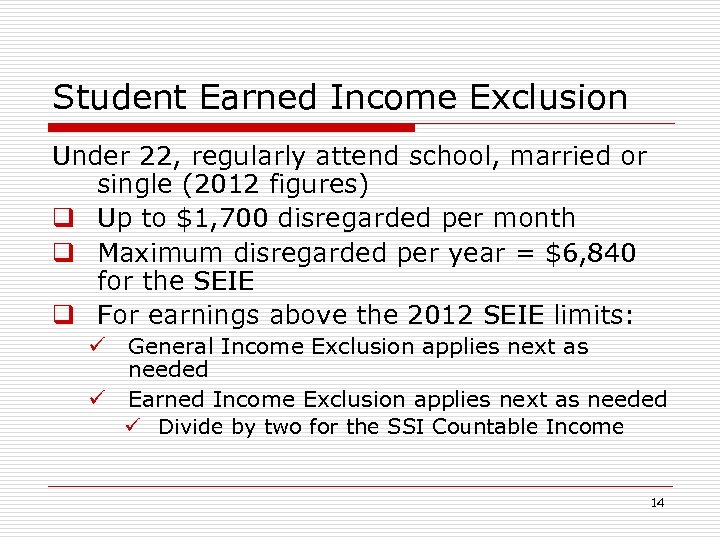

Student Earned Income Exclusion Under 22, regularly attend school, married or single (2012 figures) q Up to $1, 700 disregarded per month q Maximum disregarded per year = $6, 840 for the SEIE q For earnings above the 2012 SEIE limits: ü General Income Exclusion applies next as needed ü Earned Income Exclusion applies next as needed ü Divide by two for the SSI Countable Income 14

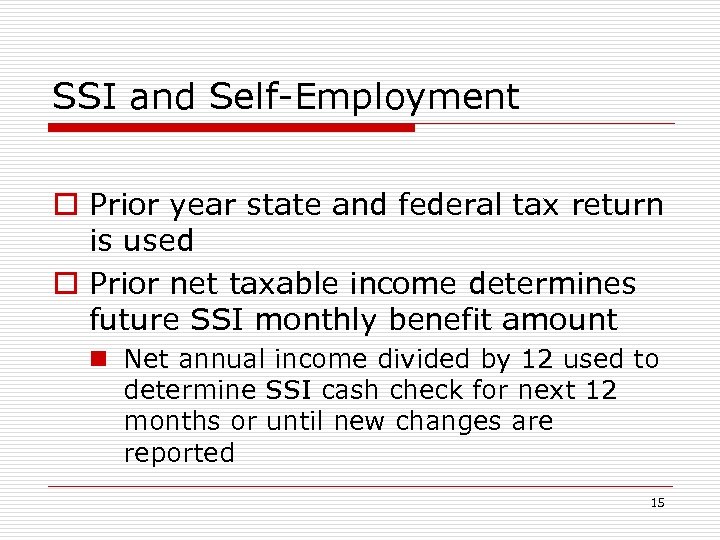

SSI and Self-Employment o Prior year state and federal tax return is used o Prior net taxable income determines future SSI monthly benefit amount n Net annual income divided by 12 used to determine SSI cash check for next 12 months or until new changes are reported 15

Plan to Achieve Self-Support o An approved plan that allows SSI eligible disability beneficiaries to set aside income and/or resources for a specified period of time to be used to achieve a chosen occupational objective o Funds set aside: n Reduce SSI countable income n Do not count toward SSI resource limits 16

Plan to Achieve Self-Support o A strong PASS candidate: Has income other than SSI Wants to be self-supporting Is a DOR consumer Is using other work incentives Would otherwise have benefits reduced due to receipt of income n Has ability or support(s) to manage PASS procedures and tracking n n n 17

Plan to Achieve Self-Support o Support Counselor Roles: Ambassador for the PASS Assist in writing a PASS (if needed) Communicate with PASS Specialist Provide IPE with PASS application (DOR) Document PASS communications in Case Notes (DOR and others) n Identify PASS applicants in IPE screen (DOR) n n n 18

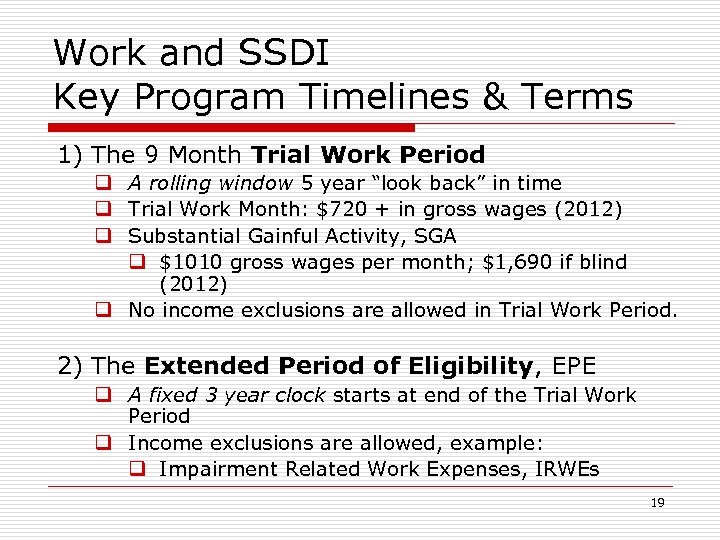

Work and SSDI Key Program Timelines & Terms 1) The 9 Month Trial Work Period q A rolling window 5 year “look back” in time q Trial Work Month: $720 + in gross wages (2012) q Substantial Gainful Activity, SGA q $1010 gross wages per month; $1, 690 if blind (2012) q No income exclusions are allowed in Trial Work Period. 2) The Extended Period of Eligibility, EPE q A fixed 3 year clock starts at end of the Trial Work Period q Income exclusions are allowed, example: q Impairment Related Work Expenses, IRWEs 19

Work and SSDI Key Program Terms q Benefits Planning Query, BPQY q Impairment-Related Work Expense, IRWE q Subsidy: for SSDI only; after award of benefits but not during Trial Work Period months q Unsuccessful Work Attempt: for SSDI only; after award of benefits but not during Trial Work Period months q q o Continuing Disability Review, CDR Eligibility status vs. -0 - cash benefit Expedited Reinstatement, “Easy Back On” Reporting Requirements Area Work Incentives Coordinator, AWIC ü Go to www. ssa. gov/sf/awic. htm 20

SSDI and Self-Employment Trial Work Period o $720 a month income (2012) or o 80 hours per month is used to measure a self employment trial work month, not both measures 21

SSDI WORK RULES CLOSEUP On www. db 101. org: Go to the “SSDI and Work” page for the link to the Closeup, or use http: //ca. db 101. org/ca/programs/ income_support/ss_disability/ssdi/ closeup_work_rules. htm 22

The Ticket To Work Program o All SSI/SSDI beneficiaries “in cash pay” have a “Ticket” or are Ticket eligible o DOR =“In-Use SVR”= Cost Reimbursement o EN =“Ticket Assigned”= Monthly Payments o Timely Progress o www. yourtickettowork. com 23

Ticket To Work o Medical Continuing Disability Review (CDR) protections o MAXIMUS: 1 -866 -968 -7842 o The SSA Work Site: www. ssa. gov/work 24

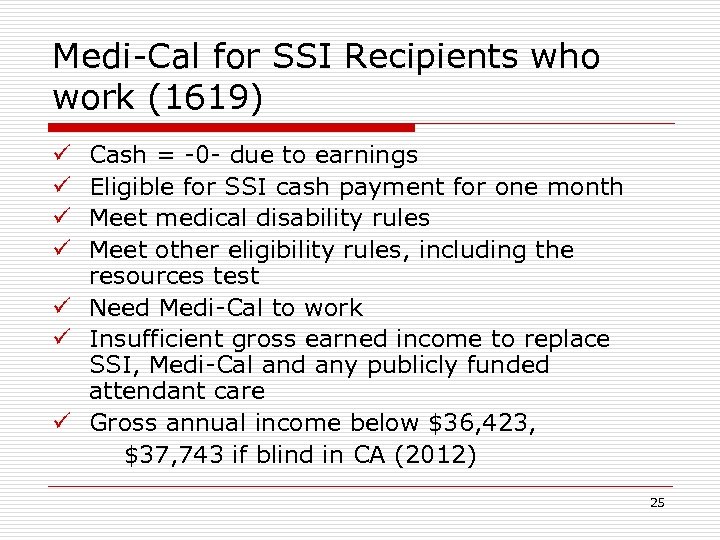

Medi-Cal for SSI Recipients who work (1619) Cash = -0 - due to earnings Eligible for SSI cash payment for one month Meet medical disability rules Meet other eligibility rules, including the resources test ü Need Medi-Cal to work ü Insufficient gross earned income to replace SSI, Medi-Cal and any publicly funded attendant care ü Gross annual income below $36, 423, $37, 743 if blind in CA (2012) ü ü 25

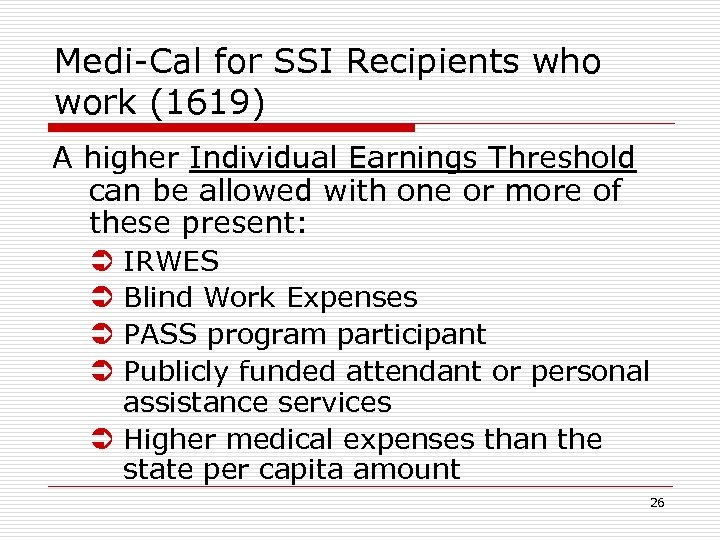

Medi-Cal for SSI Recipients who work (1619) A higher Individual Earnings Threshold can be allowed with one or more of these present: IRWES Blind Work Expenses PASS program participant Publicly funded attendant or personal assistance services Ü Higher medical expenses than the state per capita amount Ü Ü 26

Work and Medi-Cal’s California Working Disabled Program A “Fee for Service” and a Medi-Cal Managed Care Category Where available 27

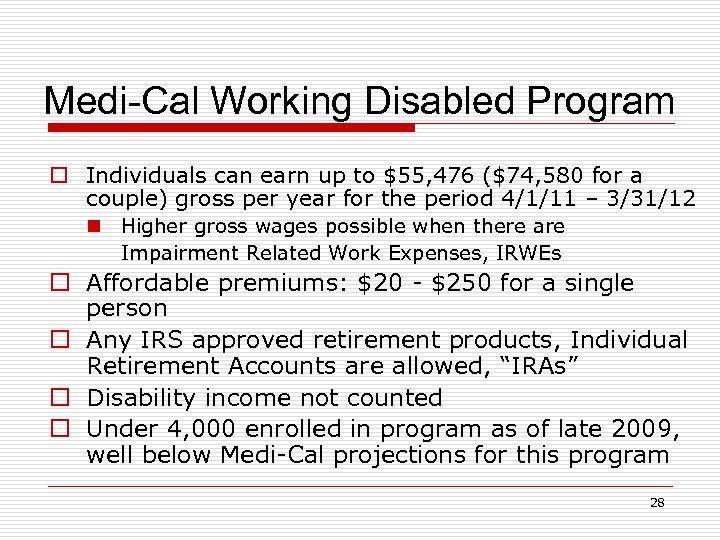

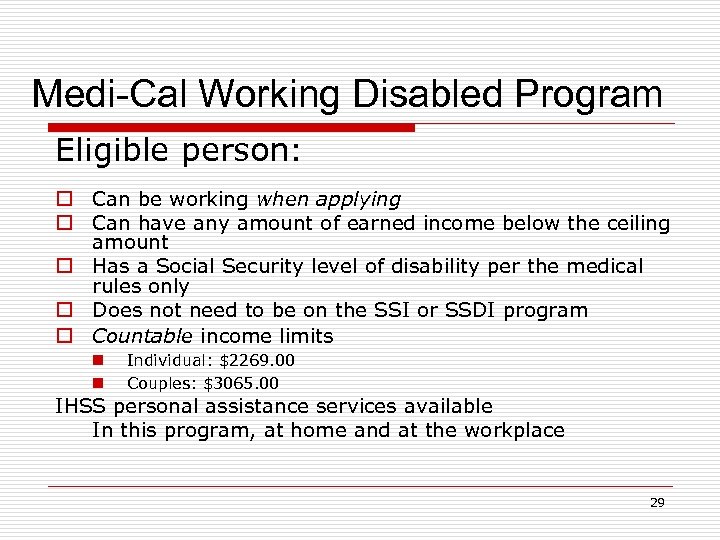

Medi-Cal Working Disabled Program o Individuals can earn up to $55, 476 ($74, 580 for a couple) gross per year for the period 4/1/11 – 3/31/12 n Higher gross wages possible when there are Impairment Related Work Expenses, IRWEs o Affordable premiums: $20 - $250 for a single person o Any IRS approved retirement products, Individual Retirement Accounts are allowed, “IRAs” o Disability income not counted o Under 4, 000 enrolled in program as of late 2009, well below Medi-Cal projections for this program 28

Medi-Cal Working Disabled Program Eligible person: o Can be working when applying o Can have any amount of earned income below the ceiling amount o Has a Social Security level of disability per the medical rules only o Does not need to be on the SSI or SSDI program o Countable income limits n n Individual: $2269. 00 Couples: $3065. 00 IHSS personal assistance services available In this program, at home and at the workplace 29

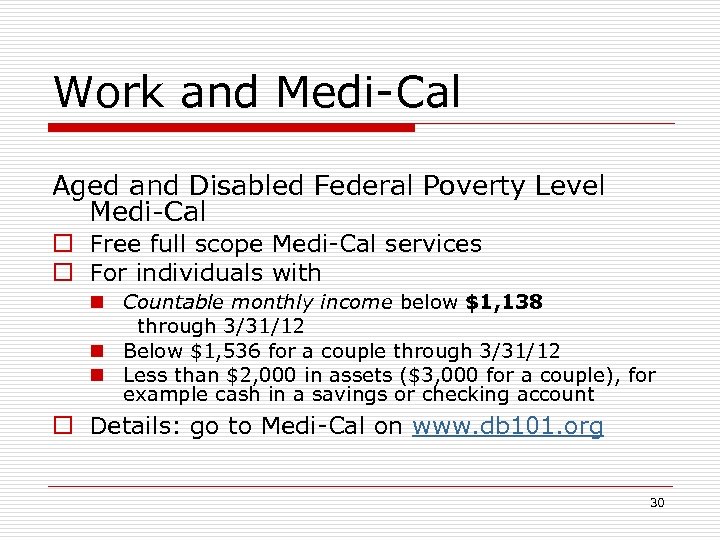

Work and Medi-Cal Aged and Disabled Federal Poverty Level Medi-Cal o Free full scope Medi-Cal services o For individuals with n Countable monthly income below $1, 138 through 3/31/12 n Below $1, 536 for a couple through 3/31/12 n Less than $2, 000 in assets ($3, 000 for a couple), for example cash in a savings or checking account o Details: go to Medi-Cal on www. db 101. org 30

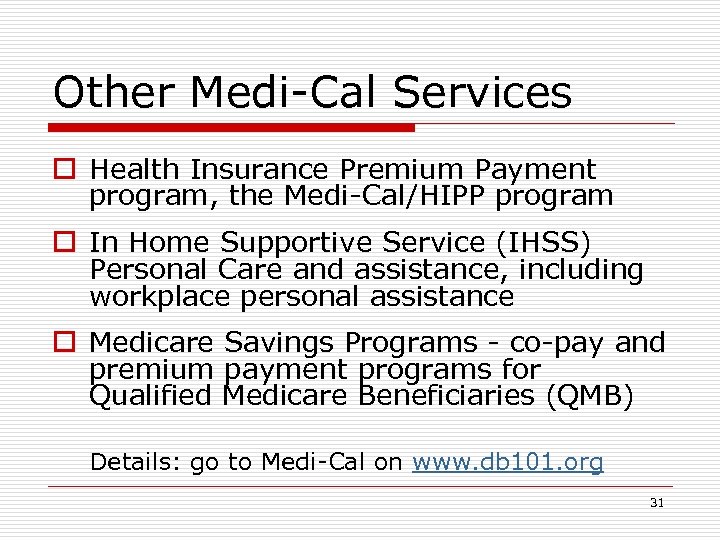

Other Medi-Cal Services o Health Insurance Premium Payment program, the Medi-Cal/HIPP program o In Home Supportive Service (IHSS) Personal Care and assistance, including workplace personal assistance o Medicare Savings Programs - co-pay and premium payment programs for Qualified Medicare Beneficiaries (QMB) Details: go to Medi-Cal on www. db 101. org 31

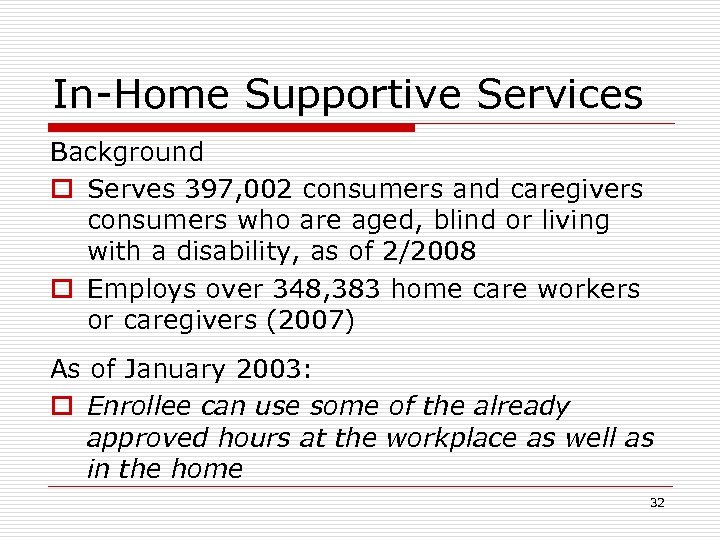

In-Home Supportive Services Background o Serves 397, 002 consumers and caregivers consumers who are aged, blind or living with a disability, as of 2/2008 o Employs over 348, 383 home care workers or caregivers (2007) As of January 2003: o Enrollee can use some of the already approved hours at the workplace as well as in the home 32

In-Home Supportive Services Eligibility for those under 65: o Apply for Medi-Cal first n Meet Social Security medical rules o Able to live at home with assistance o Meet “needs assessment” rules 33

IHSS Financial Eligibility Exemptions: o Liquid assets under $2, 000 n $3, 000 for a couple o The house you live in o One car 34

IHSS 101 IHSS Eligibility, Work & Program Interaction Aged and Disabled Federal Poverty Level Medi-Cal Medically Needy Medi-Cal SSI-linked Medi-Cal 1619(b) continued eligibility for SSI-linked Medi. Cal o Medi-Cal’s California Working Disabled Program o Cal. WORKS access to Medi-Cal IHSS available in each program, each of which can have different eligibility and resource rules. o o 35

Health & Benefits Training on Work And Disability Assisting youth and adults who want to work, save and safeguard health care and needed benefits Produced by Disability Benefits 101 Information Services Contact us at: Phone: 510 -225 -6304 TTY 510 -225 -0478 info@db 101. org www. db 101. org © Copyright 2012 by the World Institute on Disability, permission to copy pro bono will be granted to non profit entities with appropriate acknowledgement of credit. 36

03e8e62474023acbe16f4c2f560ea1f5.ppt