d29305c42af7cac63f826c11b8cb7526.ppt

- Количество слайдов: 63

HCV Program Financial Management & Reporting HUD Webcast Washington D. C. November 3, 2009 2 p. m. - 5 p. m.

HCV Program Financial Management & Reporting Opening Remarks David Vargas, CPA Associate Deputy Assistant Secretary

HCV Program Financial Management & Reporting Presenter Ray Adair, MBA, CGFM Vice President & Senior Associate Nan Mc. Kay and Associates, Inc.

HCV Program Financial Management & Reporting • Today's topics: – How the Program is Funded – Basic Elements of Financial Management – Year-end Financial Reporting Basics

HCV Program Financial Management & Reporting • Topic One: – How the Program is Funded

How The Program Is Funded Renewal HAP Funding • The Congress: – Appropriates a set $ amount – Requires funding for PHAs be based on VMS leasing & cost data – Specifies FFY be used for VMS leasing & costs data – Requires the cost data be inflated by the AAF

How The Program Is Funded Renewal HAP Funding • In addition, the Congress allows for certain adjustments to the cost base): – First time renewals – FSS escrow deposits

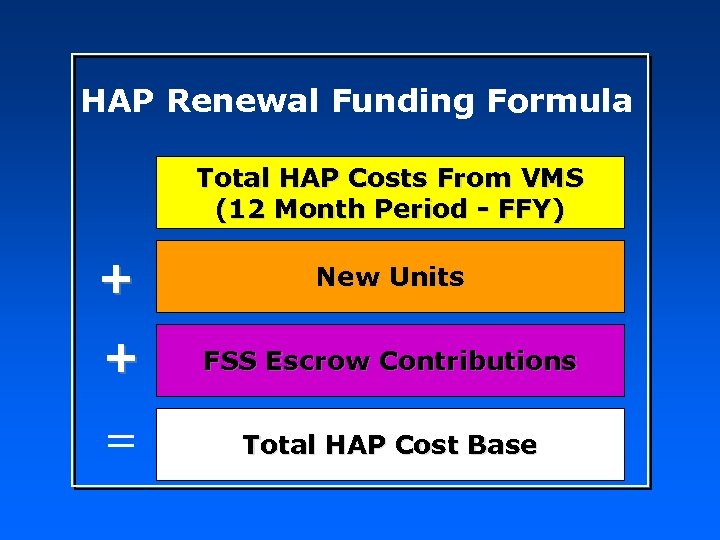

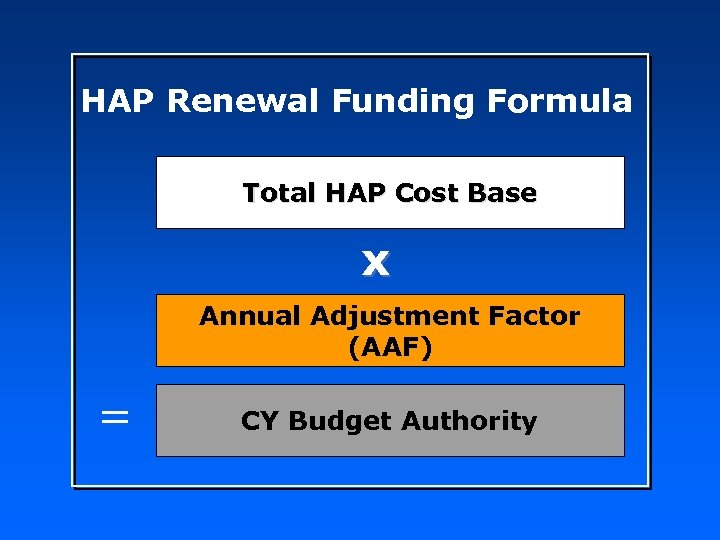

HAP Renewal Funding Formula Total HAP Costs From VMS (12 Month Period - FFY) + New Units + FSS Escrow Contributions = Total HAP Cost Base

HAP Renewal Funding Formula Total HAP Cost Base x Annual Adjustment Factor (AAF) = CY Budget Authority

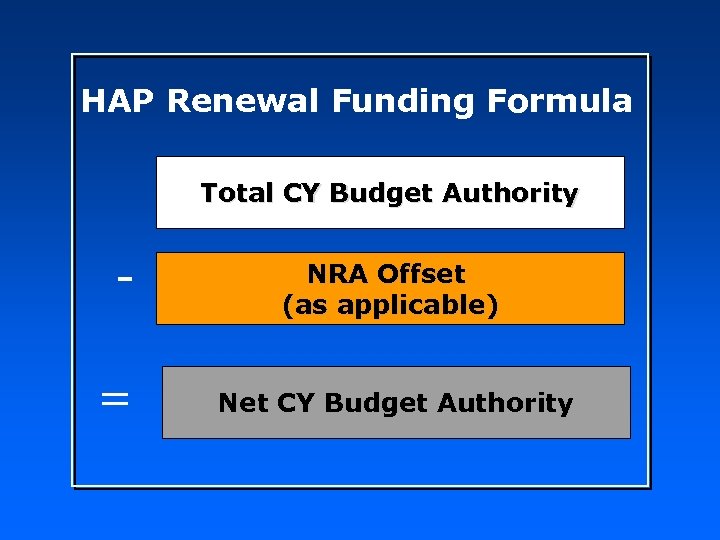

HAP Renewal Funding Formula Total CY Budget Authority = NRA Offset (as applicable) Net CY Budget Authority

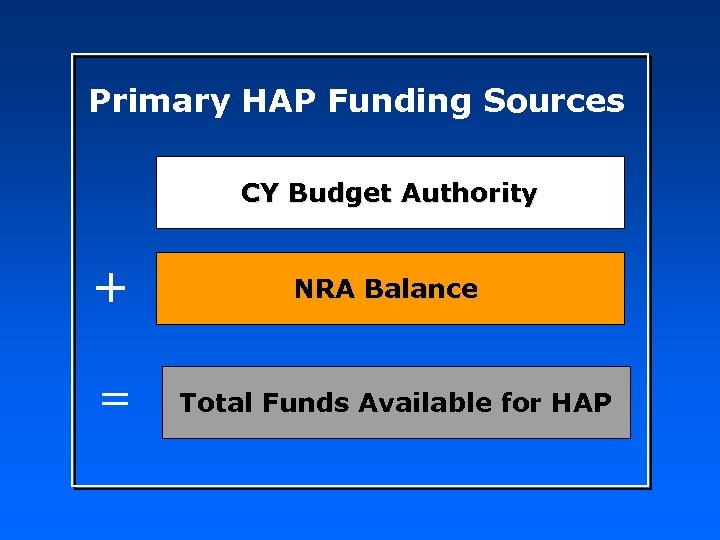

Primary HAP Funding Sources CY Budget Authority + = NRA Balance Total Funds Available for HAP

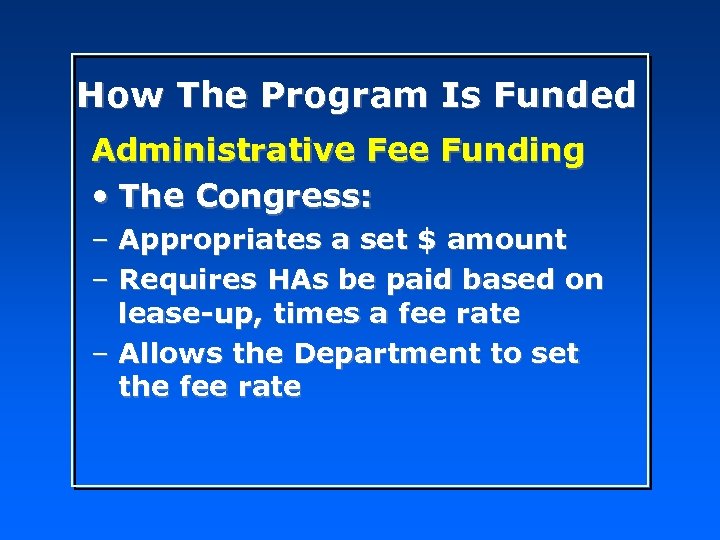

How The Program Is Funded Administrative Fee Funding • The Congress: – Appropriates a set $ amount – Requires HAs be paid based on lease-up, times a fee rate – Allows the Department to set the fee rate

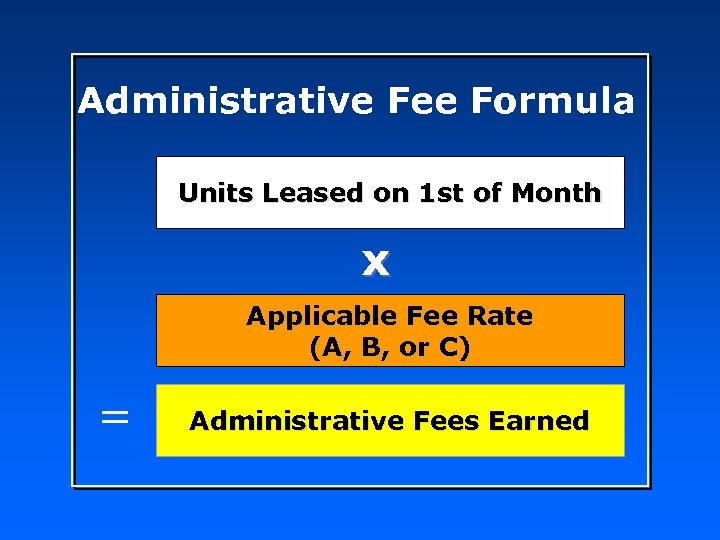

Administrative Fee Formula Units Leased on 1 st of Month x Applicable Fee Rate (A, B, or C) = Administrative Fees Earned

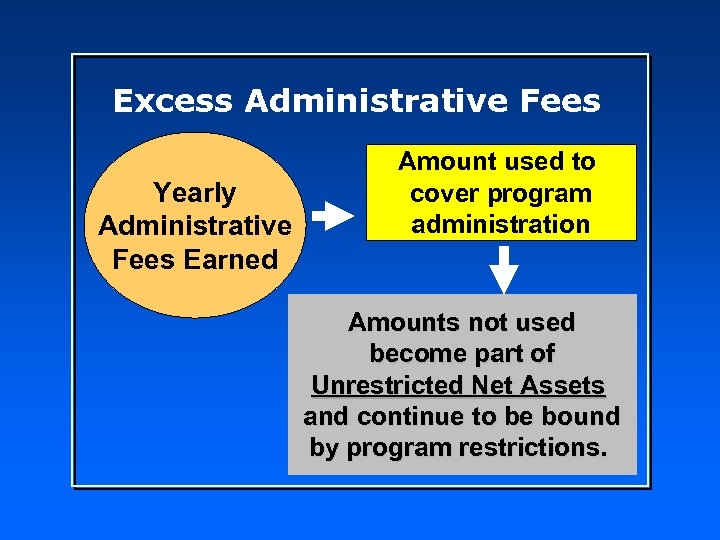

Excess Administrative Fees Yearly Administrative Fees Earned Amount used to cover program administration Amounts not used become part of Unrestricted Net Assets and continue to be bound by program restrictions.

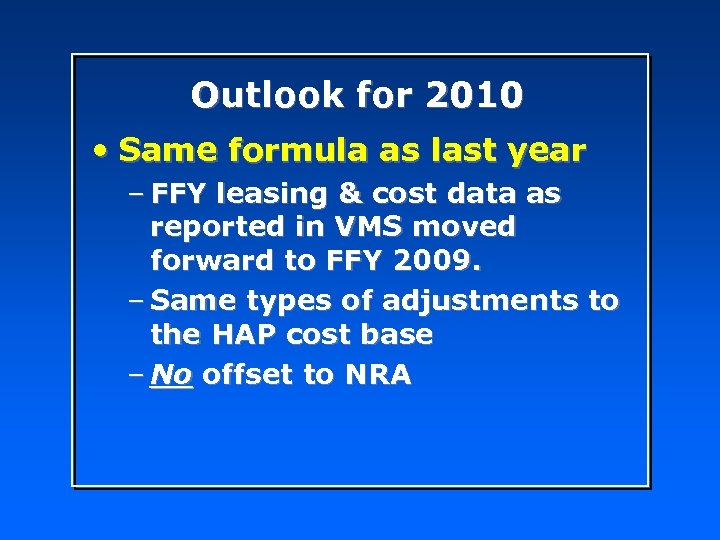

Outlook for 2010 • Same formula as last year – FFY leasing & cost data as reported in VMS moved forward to FFY 2009. – Same types of adjustments to the HAP cost base – No offset to NRA

HCV Program Financial Management & Reporting • Topic Two: – Basic elements of good HCV program financial management

Financial Management • Good financial management involves: – Preparing a program budget – Monitoring actual to budget performance – Maintaining adequate cash – Investing excess cash

Financial Management • Importance of having a HCV program budget: – The program is budget based – Funds have prescribed uses – Funds are capped – How equity can be used is controlled by statute

Financial Management • Importance of PUC in monitoring HAP expense: – Determine trend in HAP costs (is it going up or down) – Set a target for the number of vouchers to lease – Set a target for monthly spending

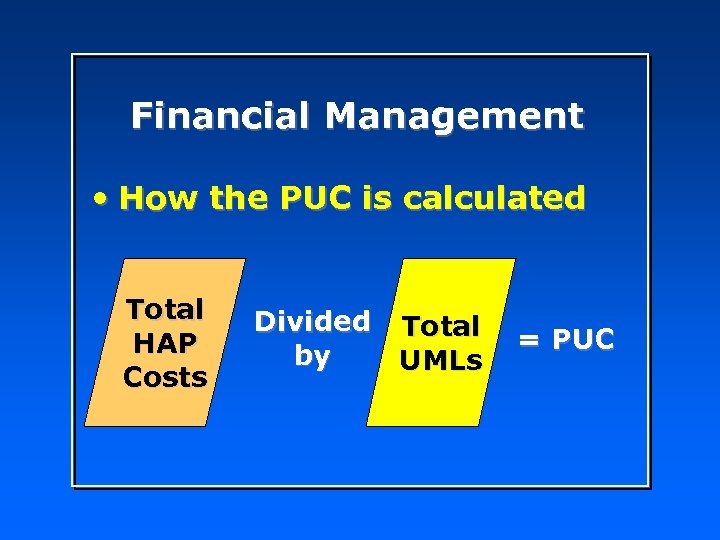

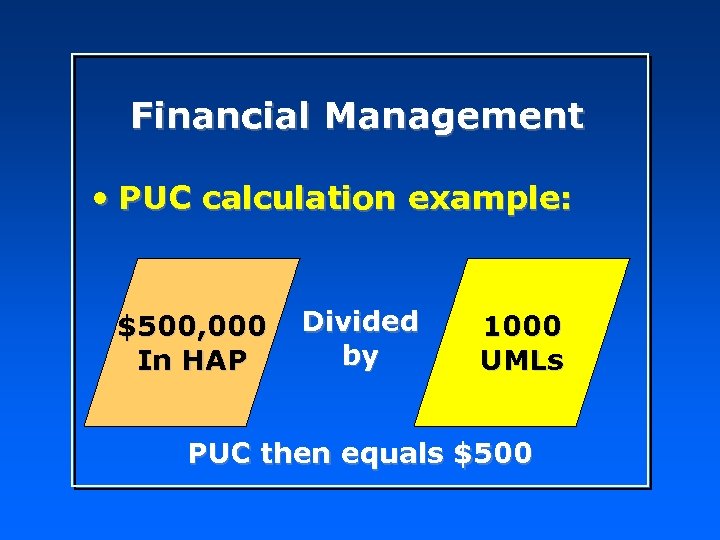

Financial Management • How the PUC is calculated Total HAP Costs Divided Total by UMLs = PUC

Financial Management • PUC calculation example: $500, 000 In HAP Divided by 1000 UMLs PUC then equals $500

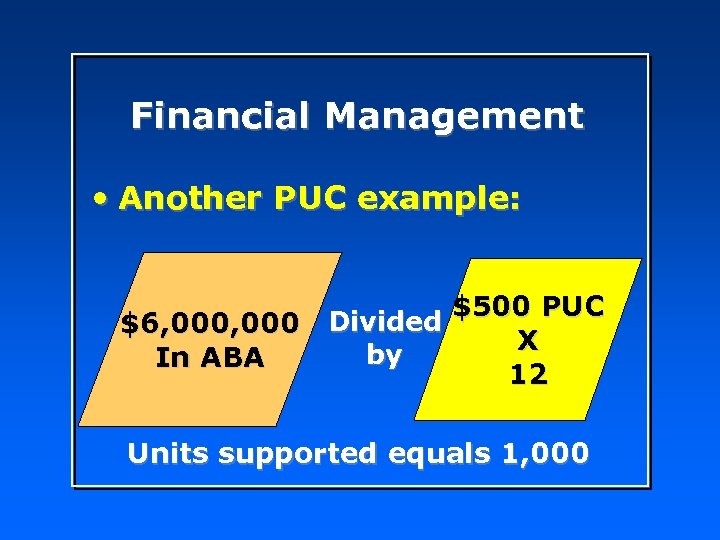

Financial Management • Another PUC example: $6, 000 Divided by In ABA $500 PUC X 12 Units supported equals 1, 000

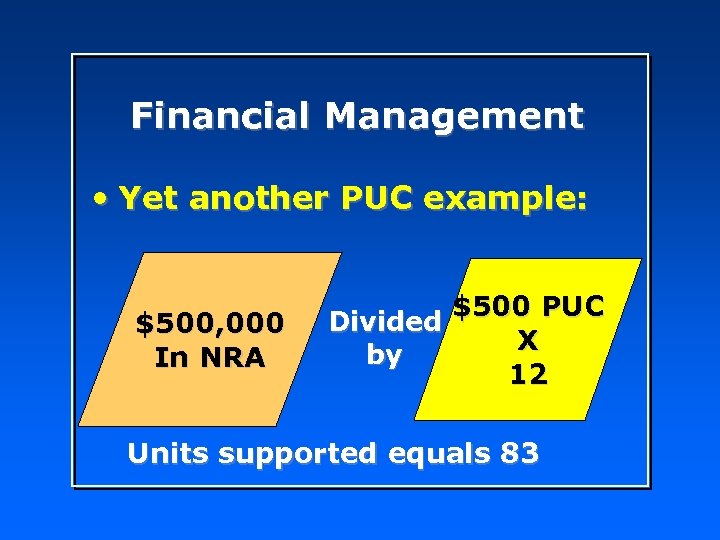

Financial Management • Yet another PUC example: $500, 000 In NRA Divided by $500 PUC X 12 Units supported equals 83

Financial Management • Importance of maintaining cash flow: – Budgets help to project – Monitoring revenue and expense helps to control – Deficit spending will deplete – NRA can't be used to cover admin expenses

Financial Management • Investing excess cash: – Maintain liquidity & preserve principle – Limit investments to approved types – Secure form HUD-51999, General Depository Agreement before depositing – Maintain required collateral

Financial Management • Interest earned on investments: – Interest earned on excess HAP funds is restricted and becomes part of NRA – Interest earned on excess admin fees is unrestricted and becomes part of unrestricted net assets

Financial Management • VMS Overview Basics: – Web based reporting template – Used to monitor HA leasing & spending utilization – Replaces old paper HUD-52681 – Used to determine HAP renewal funding – Used to determine admin fees

Financial Management • VMS data gathered: – Leasing & HAP expense for regular & special use vouchers – Certain types of administrative expenses – Certain types of revenue items that ultimately impact the NRA

Financial Management • VMS Common Reporting Errors: 1) Lease-up & HAP expense reported in month paid instead of month it applies 2) Special use vouchers not reported or in wrong category

Financial Management • VMS Common Reporting Errors (continued): 3) "Number of vouchers leased on the last day of the month" reported with 1 st of month lease-up 4) "HA owned units" not reported but HA has owned units

Financial Management • VMS Common Reporting Errors (continued): 5)"All voucher HAP expense after the first of the month" reported with more than the pro-rate first time HAP 6)Interest earned on HAP funds not reported or in wrong month

Financial Management • VMS Common Reporting Errors (continued): 7)Fraud recovery recorded at: a)100% instead of 50% b)full amount of repayment agreement when it is booked to the balance sheet when it should be amount actually collected

Financial Management • VMS Common Reporting Errors (continued): 8) Total administrative fees earned is reported instead of expense 9) FSS Coordinator grant is recorded instead of actual expense incurred

Financial Management • Charging indirect costs to the HCV program: − Two methods available, indirect cost plan or fee-forservice − Authority for found in OMB Cir A-87 − Guidance for fee-for-service found in Supplement to HB 7475. 1

Financial Management • Traditional indirect cost plans: − A plan document is normally prepared − Indirect costs are collected in a cost pool − Costs in the indirect cost pool are allocated to programs via a cost driver

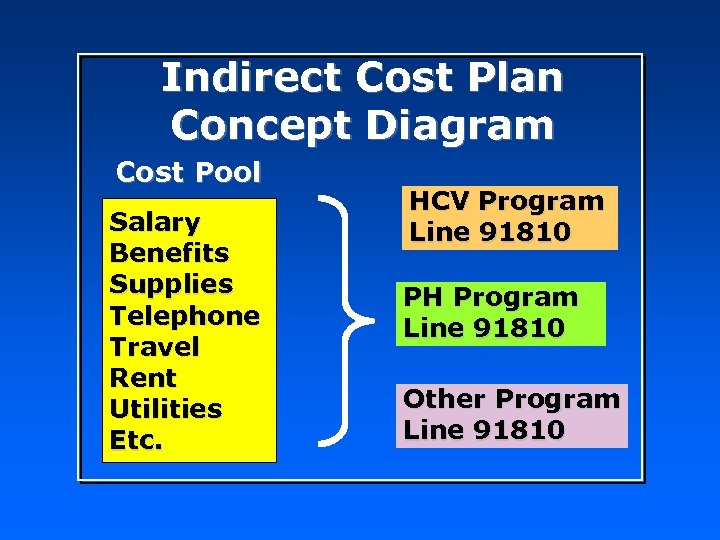

Indirect Cost Plan Concept Diagram Cost Pool Salary Benefits Supplies Telephone Travel Rent Utilities Etc. HCV Program Line 91810 PH Program Line 91810 Other Program Line 91810

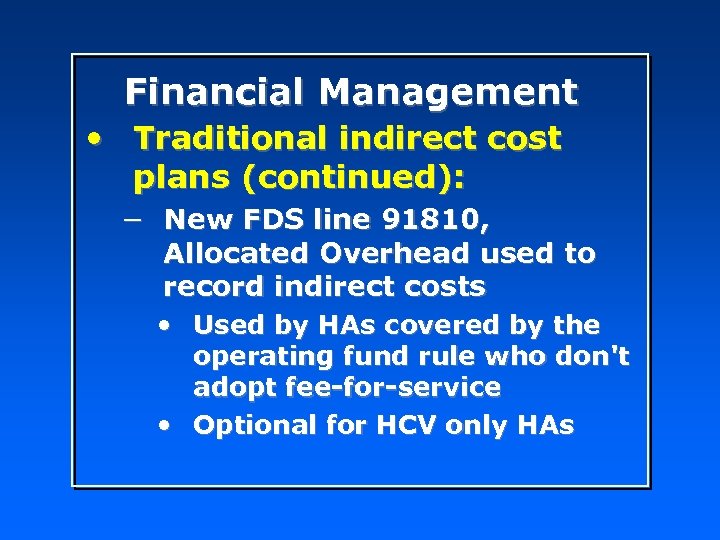

Financial Management • Traditional indirect cost plans (continued): − New FDS line 91810, Allocated Overhead used to record indirect costs • Used by HAs covered by the operating fund rule who don't adopt fee-for-service • Optional for HCV only HAs

Financial Management • Traditional indirect cost plans (continued): − A good reference source for guidance in developing indirect cost plans is: • "Cost Principles & Procedures for Developing Cost Allocation Plans" - publication of HHS

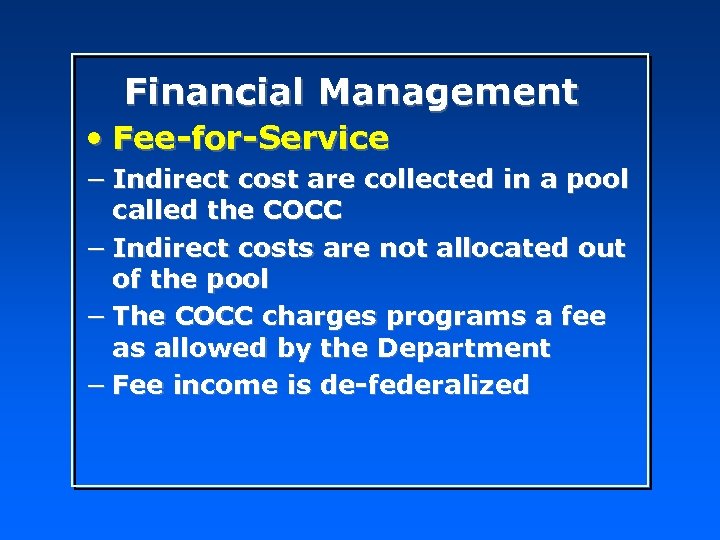

Financial Management • Fee-for-Service − Indirect cost are collected in a pool called the COCC − Indirect costs are not allocated out of the pool − The COCC charges programs a fee as allowed by the Department − Fee income is de-federalized

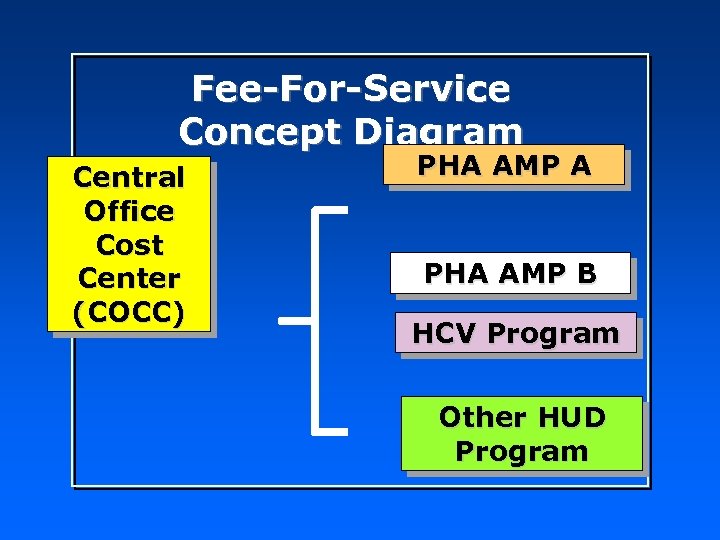

Fee-For-Service Concept Diagram Central Office Cost Center (COCC) PHA AMP A PHA AMP B HCV Program Other HUD Program

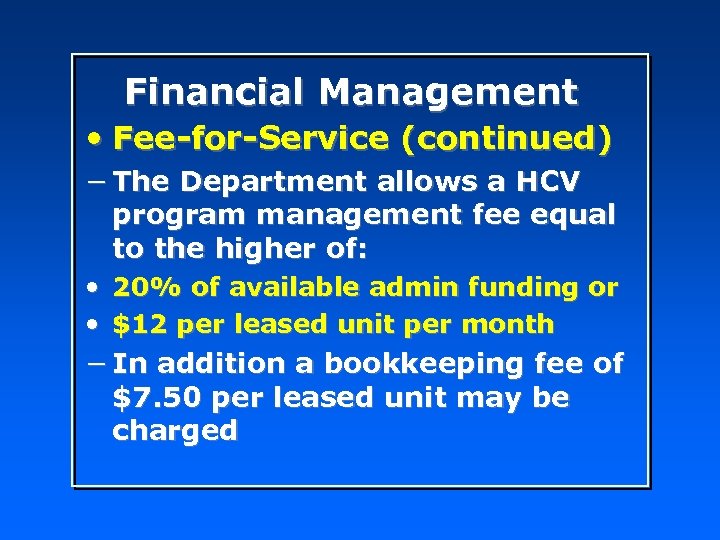

Financial Management • Fee-for-Service (continued) − The Department allows a HCV program management fee equal to the higher of: • 20% of available admin funding or • $12 per leased unit per month − In addition a bookkeeping fee of $7. 50 per leased unit may be charged

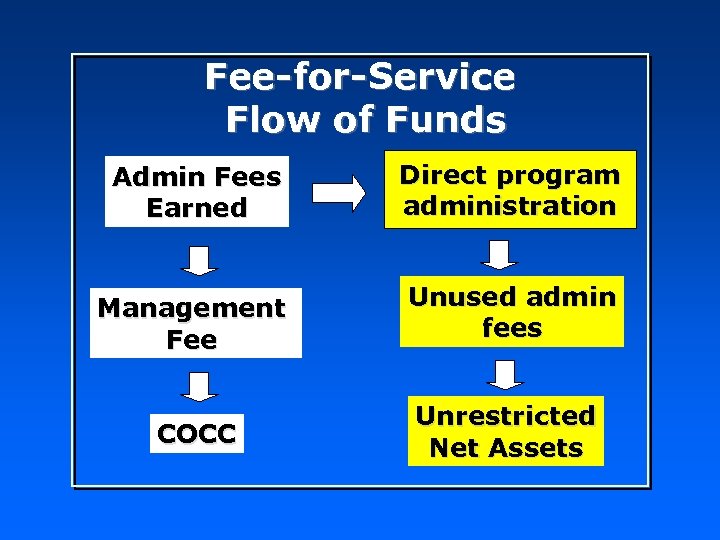

Fee-for-Service Flow of Funds Admin Fees Earned Direct program administration Management Fee Unused admin fees COCC Unrestricted Net Assets

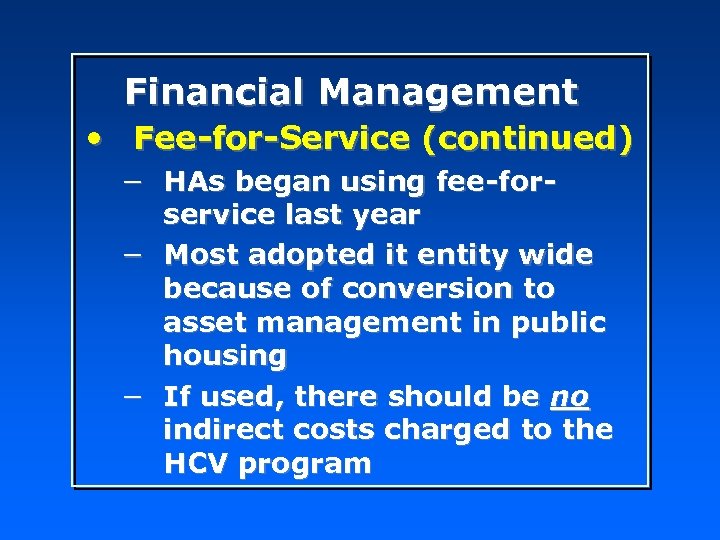

Financial Management • Fee-for-Service (continued) − HAs began using fee-forservice last year − Most adopted it entity wide because of conversion to asset management in public housing − If used, there should be no indirect costs charged to the HCV program

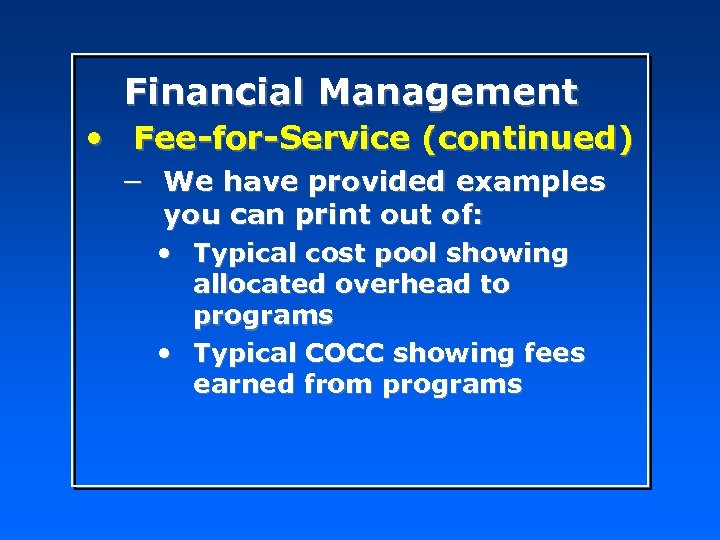

Financial Management • Fee-for-Service (continued) − We have provided examples you can print out of: • Typical cost pool showing allocated overhead to programs • Typical COCC showing fees earned from programs

HCV Program Financial Management & Reporting • Topic Three: – Year-end Financial Reporting Basics

Year-end Financial Reporting Requirements: − HAs must submit year-end financial information in accordance with GAAP − Authority to require is at 24 CFR 5. 801 (UFRS) − Also applies to HCV only HAs − Data submitted electronically over the web using FDS

Year-end Financial Reporting Requirements: − REAC has responsibility to collect and review − Generally two submissions required: • Un-audited 60 days after year-end • Audited 9 months after year-end

Year-end Financial Reporting • Differences Between VMS & FDS: − Financial data is "locked" after a reporting period, VMS is not − Data collected not always the same − Timing of accrued expenses

Year-end Financial Reporting • Understanding the HCV Equity Accounts: − Equity means "ownership" − HCV equity is reported in three separate accounts: − Invested in Capital Assets, Net of Related Debt − Restricted Net Assets − Unrestricted Net Assets

Year-end Financial Reporting • Invested in Capital Assets Net of Related Debt: − Represents the "equity" in the HAs fixed assets − Represents assets at cost less accumulated depreciation and associated debt − Depends on HA's capitalization threshold

Year-end Financial Reporting • Restricted Net Assets: − Equity that has use restrictions place on it by an outside entity − Outside entity (Congress) has placed use restrictions on HAP funding

Year-end Financial Reporting • Restricted Net Assets: − In the HCV program this account represents: • Unused HAP • Interest earned on invested HAP proceeds • Fifty percent of fraud recoveries • Forfeited FSS escrow amounts

Year-end Financial Reporting • Unrestricted Net Assets: − Represents the accumulation of excess admin fees and: • Interest earned on invested excess admin fees • Fifty percent of fraud recoveries • Admin fees received under portability

Year-end Financial Reporting • Issues to be aware of with FDS reported data for HCV program - ground rules: − Assumed the learner is familiar with the FDS − Majority of learners are not experts in reviewing FDS financial data

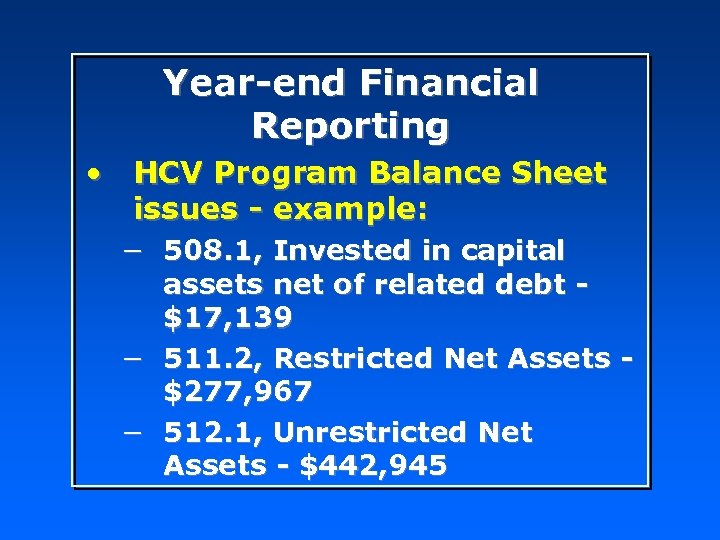

Year-end Financial Reporting • HCV Program Balance Sheet issues - example: − 508. 1, Invested in capital assets net of related debt $17, 139 − 511. 2, Restricted Net Assets $277, 967 − 512. 1, Unrestricted Net Assets - $442, 945

Year-end Financial Reporting • HCV Program Balance Sheet reporting issues: − Running deficits on the admin side without a balance in the Unrestricted Net Asset Account can mean HAP funds are being used for admin expenses.

Year-end Financial Reporting • HCV Program Balance Sheet reporting issues: − Using inter-funds to make inappropriate transfers of HCV funds to other programs

Year-end Financial Reporting • HCV Program Balance Sheet reporting issues: − Reporting an accounts receivable or payable from HUD for HAP funding • Could be accounts receivable from HUD for admin fees or deferred revenue, but not payable

Year-end Financial Reporting • HCV Program Income Statement reporting issues: − If using fee-for-service, there will be management fee and bookkeeping fee expense, but there should not be any allocated overhead.

Year-end Financial Reporting • HCV Program Income Statement reporting issues: − If using a cost allocation plan, there will be allocated overhead but no management fee and or bookkeeping fee expense.

Year-end Financial Reporting • HCV Program Income Statement reporting issues: − Failure to report restricted interest income when there is significant excess HAP funds available.

Year-end Financial Reporting • HCV Program Income Statement reporting issues: − Recording allocated overhead to line 96200, Other General Expense instead of line 91810, Allocated Overhead.

Questions − We now have some time to take your questions.

d29305c42af7cac63f826c11b8cb7526.ppt