d4113119bae07d7809788e17cb4640f6.ppt

- Количество слайдов: 36

HBC 220 – Topic 9 Accounting for Manufacturing

Learning Objectives 1. Distinguish between costs and expenses, and understand how different costs are used for different purposes 2. Define and identify the 3 manufacturing cost elements — direct materials, direct labour and factory overhead

Learning Objectives (cont’d) 3. Explain the basic nature of absorption costing and a cost allocation based on cost behaviour • Identify the essential differences in the financial statements for retail and manufacturing entities

Learning Objectives (cont’d) 5. Describe the additional accounts and accounting procedures required for a manufacturing entity. • Understand how a manager can use the financial reports for a manufacturing entity for control and decision making

Learning Objectives 7. Explain the nature of cost accounting 8. Describe the flow of costs in a job order cost accounting system 9. Explain the accounting procedures used in job order cost systems

Learning Objectives (cont’d) 10. Understand how costing and cost accounting are applied in service businesses 11. Understand the basic principles of a just-intime processing system

Lecture References • Hoggett, Edwards & Medlin, 6 th edition, Chapter 8, 9

Cost Classifications LO. 1 • Cost – Economic sacrifice of resources made in exchange for a product or service • Expense – Consumption or loss of resources

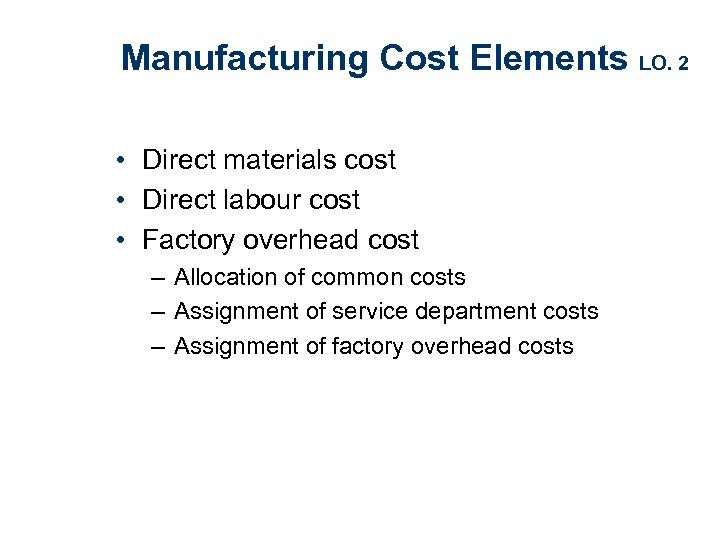

Manufacturing Cost Elements LO. 2 • Direct materials cost • Direct labour cost • Factory overhead cost – Allocation of common costs – Assignment of service department costs – Assignment of factory overhead costs

Absorption Costing and Cost Behaviour LO. 3 • Absorption costing – All direct manufacturing costs treated as product costs • Direct costing – Recognises as product costs only manufacturing costs that vary in relation to production levels

Absorption Costing and Cost Behaviour (cont’d) • Variable costs – Costs which vary directly, or nearly directly, with the volume of production • Fixed costs – Costs which remain relatively constant regardless of the production level

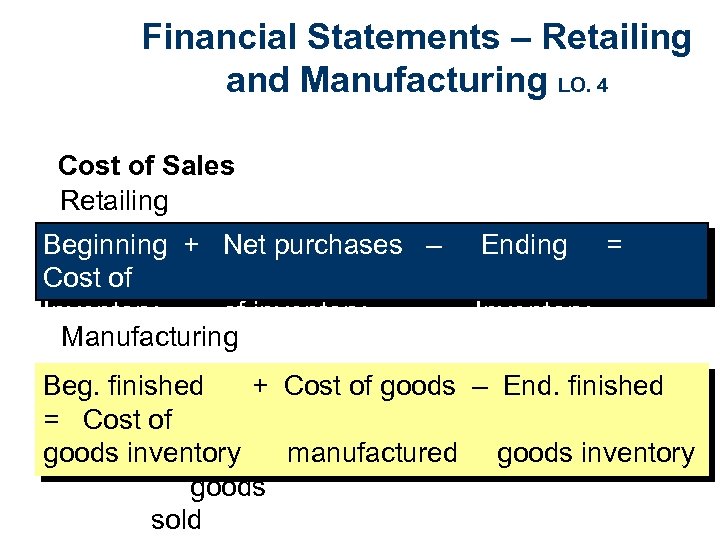

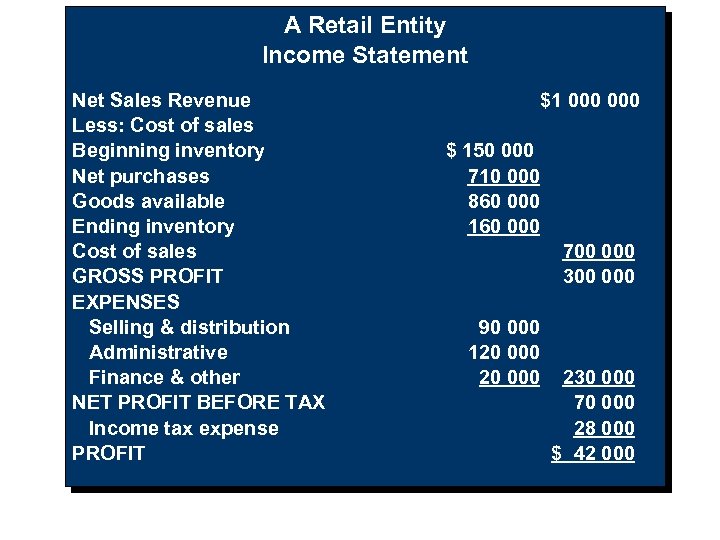

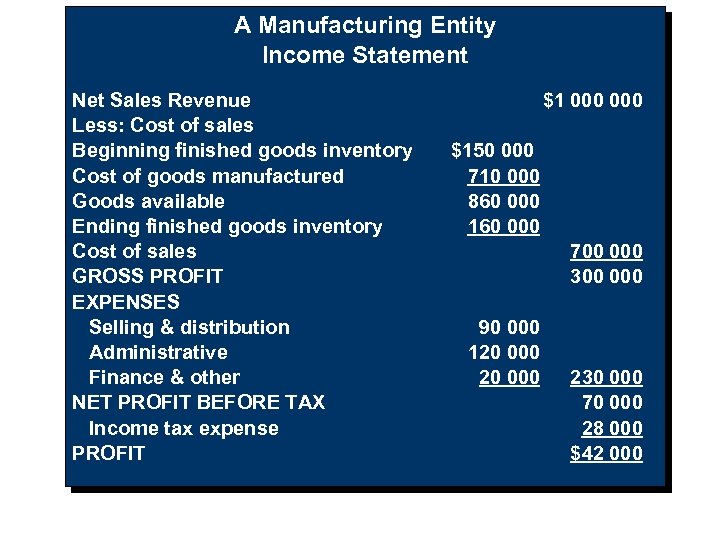

Financial Statements – Retailing and Manufacturing LO. 4 Cost of Sales Retailing Beginning + Net purchases – Ending = Cost of Inventory of inventory Inventory Manufacturing goods sold Beg. finished + Cost of goods – End. finished = Cost of goods inventory manufactured goods inventory goods sold

A Retail Entity Income Statement Net Sales Revenue Less: Cost of sales Beginning inventory Net purchases Goods available Ending inventory Cost of sales GROSS PROFIT EXPENSES Selling & distribution Administrative Finance & other NET PROFIT BEFORE TAX Income tax expense PROFIT $1 000 $ 150 000 710 000 860 000 160 000 700 000 300 000 90 000 120 000 230 000 70 000 28 000 $ 42 000

A Manufacturing Entity Income Statement Net Sales Revenue Less: Cost of sales Beginning finished goods inventory Cost of goods manufactured Goods available Ending finished goods inventory Cost of sales GROSS PROFIT EXPENSES Selling & distribution Administrative Finance & other NET PROFIT BEFORE TAX Income tax expense PROFIT $1 000 $150 000 710 000 860 000 160 000 700 000 300 000 90 000 120 000 230 000 70 000 28 000 $42 000

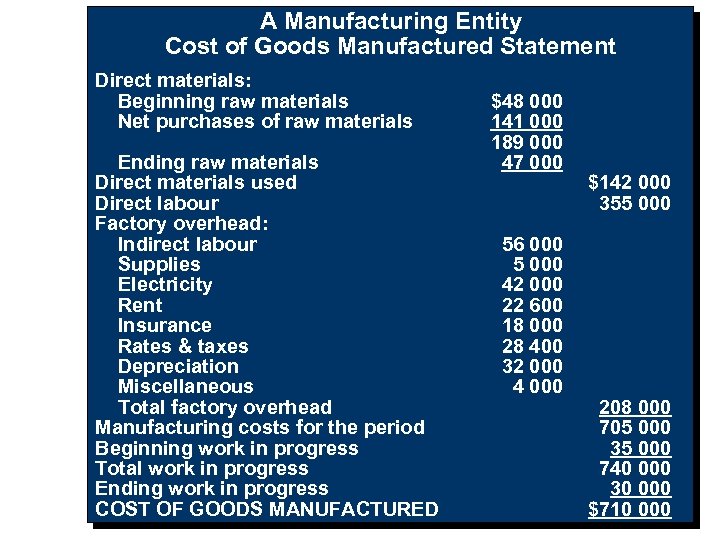

A Manufacturing Entity Cost of Goods Manufactured Statement Direct materials: Beginning raw materials Net purchases of raw materials Ending raw materials Direct materials used Direct labour Factory overhead: Indirect labour Supplies Electricity Rent Insurance Rates & taxes Depreciation Miscellaneous Total factory overhead Manufacturing costs for the period Beginning work in progress Total work in progress Ending work in progress COST OF GOODS MANUFACTURED $48 000 141 000 189 000 47 000 56 000 5 000 42 000 22 600 18 000 28 400 32 000 4 000 $142 000 355 000 208 000 705 000 35 000 740 000 30 000 $710 000

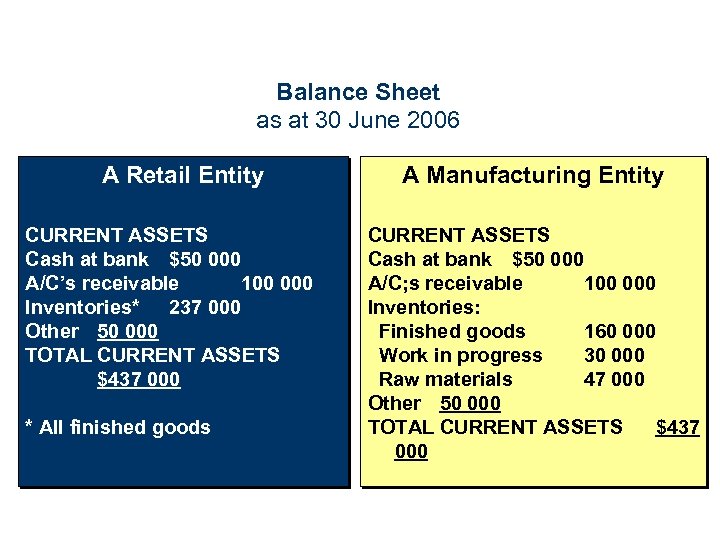

Balance Sheet as at 30 June 2006 A Retail Entity CURRENT ASSETS Cash at bank $50 000 A/C’s receivable 100 000 Inventories* 237 000 Other 50 000 TOTAL CURRENT ASSETS $437 000 * All finished goods A Manufacturing Entity CURRENT ASSETS Cash at bank $50 000 A/C; s receivable 100 000 Inventories: Finished goods 160 000 Work in progress 30 000 Raw materials 47 000 Other 50 000 TOTAL CURRENT ASSETS $437 000

Accounting Systems Considerations LO. 5 • Periodic inventory system – Additional accounts required • Raw materials inventory • Raw materials purchases • WIP inventory • Finished goods inventory • Manufacturing plant and equipment

Accounting Systems Considerations (cont’d) • Periodic inventory system – Additional accounts required • Factory payroll • Factory overhead • Manufacturing summary – Worksheets • Additional two columns required to record manufacturing data

Accounting Systems Considerations (cont’d) • Closing entries – Account balance used to determine cost of goods manufactured closed to ‘Manufacturing Summary’ account – Manufacturing summary closed to Profit and Loss Summary account

Accounting Systems Considerations (cont’d) • Valuation of inventories – All three types of inventory valued at the end of the accounting period – Raw materials and finished goods • Inventory counted and costed – Work in process • Judgement required, usually an educated guess.

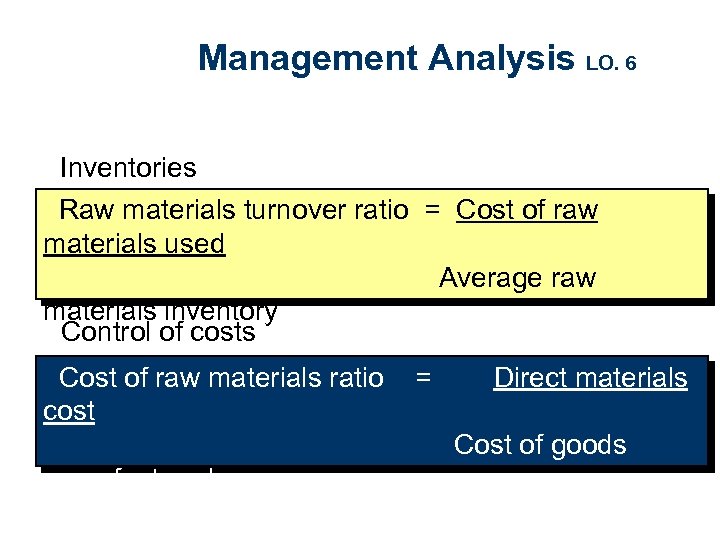

Management Analysis LO. 6 Inventories Raw materials turnover ratio = Cost of raw materials used Average raw materials inventory Control of costs Cost of raw materials ratio cost = Direct materials Cost of goods manufactured

Cost Accounting LO. 7 • Cost information recorded in separate ledger accounts – Product costs used to value WIP and finished goods – Facilitates management decisions • Non-manufacturing entities – Used to determine cost of services

Cost Accounting (cont’d) • Two types of cost accounting systems • Job order costing – Used when items produced can be separately identified • Process costing – Products manufactured on a continuous basis • Cost accounting in non-manufacturing entities

Job Order Costing LO. 8 • Costs assigned to each job • Requires well defined beginning and completion time • Can be used for a single product • Needs a perpetual inventory system

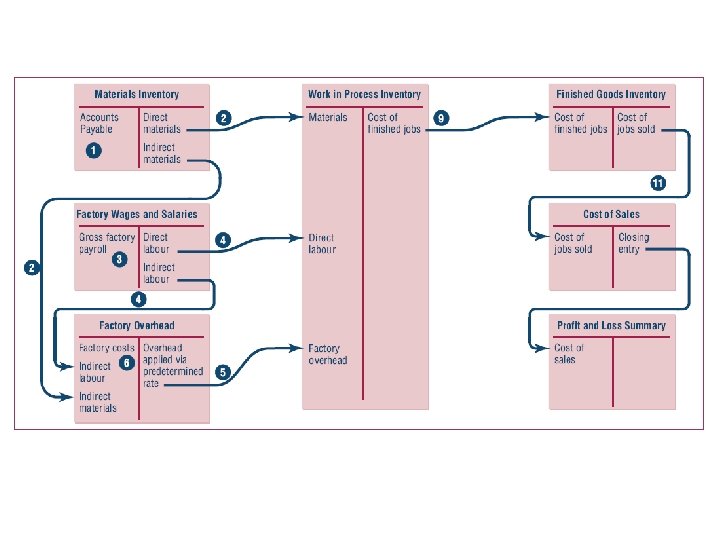

Job Order Costing (cont’d) • Cost flows in a job order system – Inventory controlled via general ledger control accounts and subsidiary ledgers – Productions costs: • Recorded • Assigned to production (WIP) • Assigned to finished goods when job completed

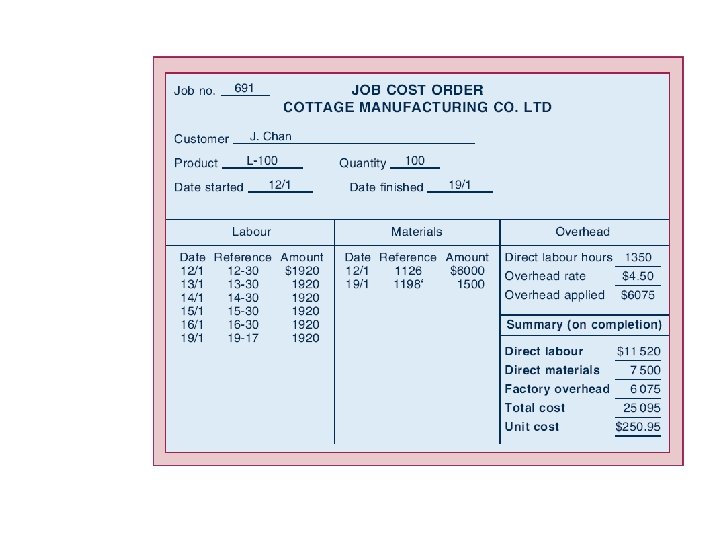

Job Order Costing (cont’d) • Job cost order • Control account – Itemised listing of production costs: • materials • labour • overhead – Serves as a subsidiary ledger – Control number assigned to each job started

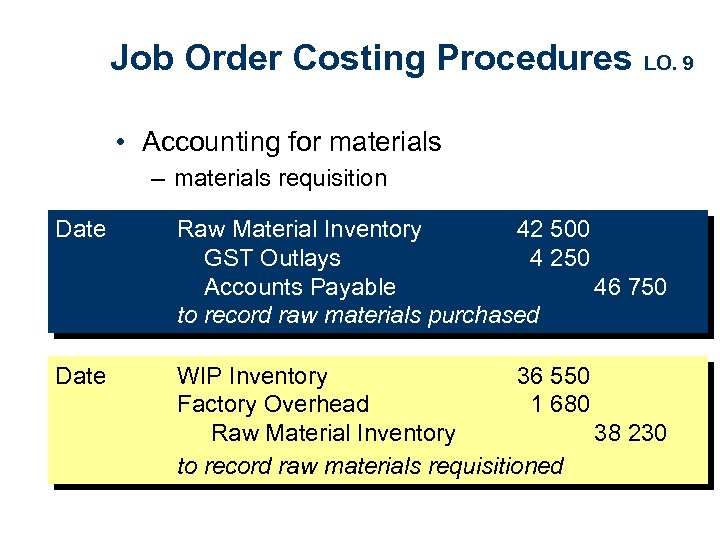

Job Order Costing Procedures LO. 9 • Accounting for materials – materials requisition Date Raw Material Inventory 42 500 GST Outlays 4 250 Accounts Payable 46 750 to record raw materials purchased Date WIP Inventory 36 550 Factory Overhead 1 680 Raw Material Inventory 38 230 to record raw materials requisitioned

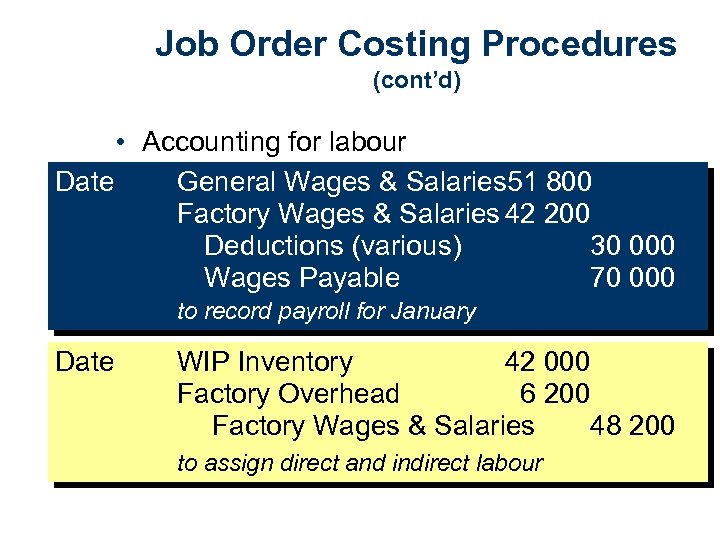

Job Order Costing Procedures (cont’d) • Accounting for labour Date General Wages & Salaries 51 800 Factory Wages & Salaries 42 200 Deductions (various) 30 000 Wages Payable 70 000 to record payroll for January Date WIP Inventory 42 000 Factory Overhead 6 200 Factory Wages & Salaries 48 200 to assign direct and indirect labour

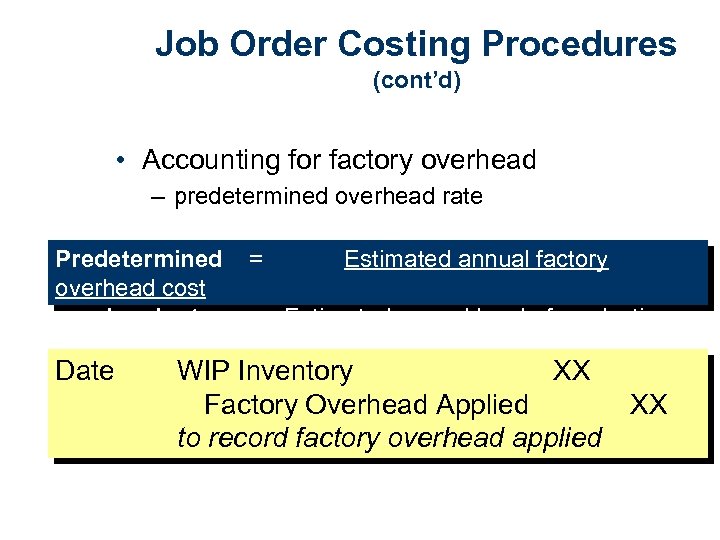

Job Order Costing Procedures (cont’d) • Accounting for factory overhead – predetermined overhead rate Predetermined overhead cost overhead rate activity Date = Estimated annual factory Estimated annual level of production WIP Inventory XX Factory Overhead Applied to record factory overhead applied XX

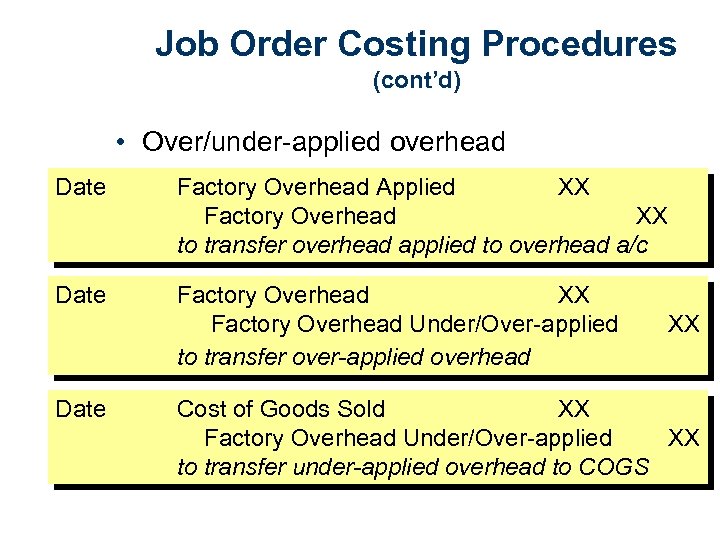

Job Order Costing Procedures (cont’d) • Over/under-applied overhead Date Factory Overhead Applied XX Factory Overhead XX to transfer overhead applied to overhead a/c Date Factory Overhead XX Factory Overhead Under/Over-applied to transfer over-applied overhead Date XX Cost of Goods Sold XX Factory Overhead Under/Over-applied XX to transfer under-applied overhead to COGS

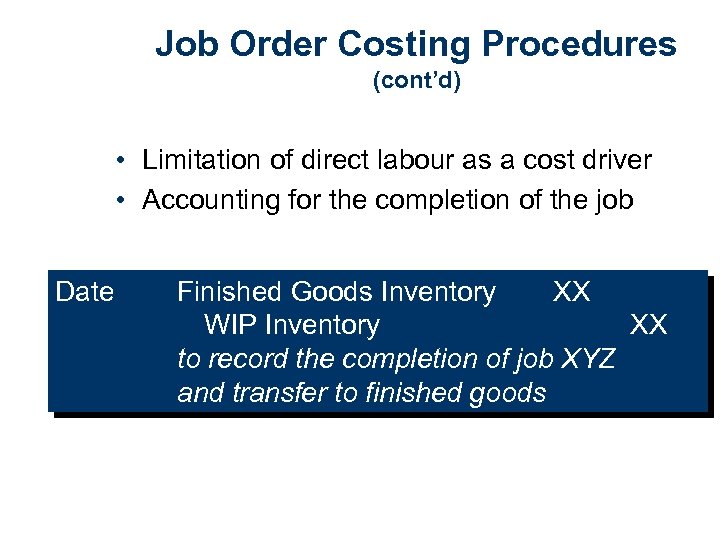

Job Order Costing Procedures (cont’d) • Limitation of direct labour as a cost driver • Accounting for the completion of the job Date Finished Goods Inventory XX WIP Inventory XX to record the completion of job XYZ and transfer to finished goods

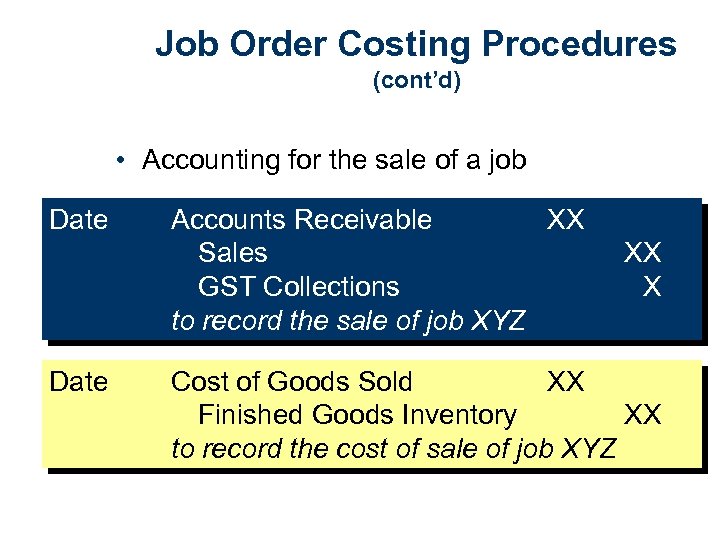

Job Order Costing Procedures (cont’d) • Accounting for the sale of a job Date Accounts Receivable XX Sales GST Collections to record the sale of job XYZ XX X Cost of Goods Sold XX Finished Goods Inventory XX to record the cost of sale of job XYZ

Cost Accounting in Service Entities LO. 10 • Cost information needed to prepare budgets, determine fees and analyse profitability • Developing cost application rules – Direct labour costs – General overheads • Assigning costs to jobs and setting a price

Just-in-time Processing LO. 11 • Eliminates holding excess inventory • Materials arrive just as needed and go straight into production • Finished goods shipped straight to customers on completion • Highly automated • Little margin for error

d4113119bae07d7809788e17cb4640f6.ppt