28abeb5c7f745995885293a5cd2c7856.ppt

- Количество слайдов: 27

Have you thought about Managed Futures yet?

Disclaimer The material provided herein shall only be presented in those jurisdictions where permitted by law and must be preceded or accompanied by a current disclosure document. There can be no assurance that the investment objective of a managed futures fund will be achieved. Most managed futures funds are highly leveraged which may potentially provide higher return, but also increases the overall risk and volatility of the investment. Managed futures funds are less liquid than stocks and bonds, with redemptions typically limited to monthly intervals. Costs and expenses in managed futures PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. funds are significantly higher than mutual funds and other investment vehicles. Investors in managed futures funds realize taxable gains and losses in the year in which they occur and proper consideration should be given to the tax implications of an investment. Futures and forward contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Investing in managed futures is speculative and investors must be prepared to lose all or a substantial amount of their investment.

Content § § § INTRODUCTION BENEFITS SUPERFUND PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Introduction

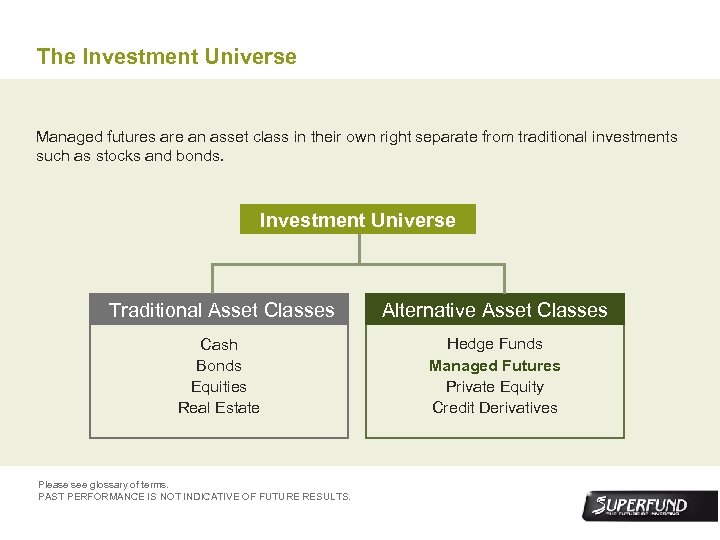

The Investment Universe Managed futures are an asset class in their own right separate from traditional investments such as stocks and bonds. Investment Universe Traditional Asset Classes Alternative Asset Classes Cash Bonds Equities Real Estate Hedge Funds Managed Futures Private Equity Credit Derivatives Please see glossary of terms. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

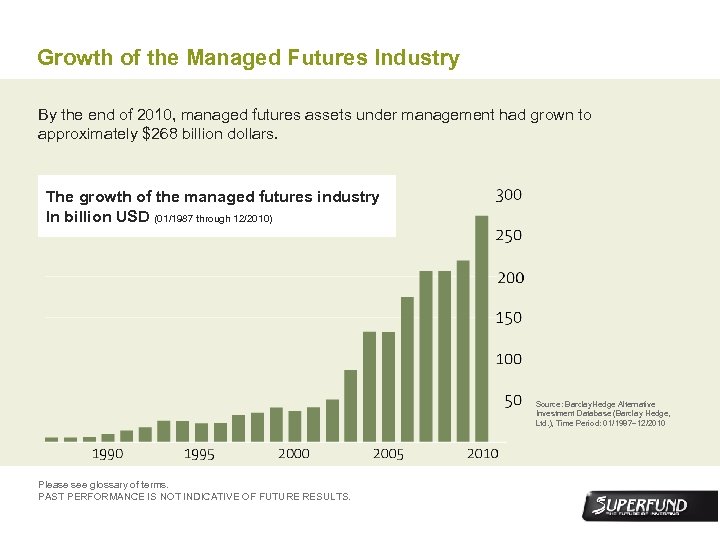

Growth of the Managed Futures Industry By the end of 2010, managed futures assets under management had grown to approximately $268 billion dollars. The growth of the managed futures industry In billion USD (01/1987 through 12/2010) Source: Barclay. Hedge Alternative Investment Database (Barclay Hedge, Ltd. ), Time Period: 01/1987– 12/2010 Please see glossary of terms. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

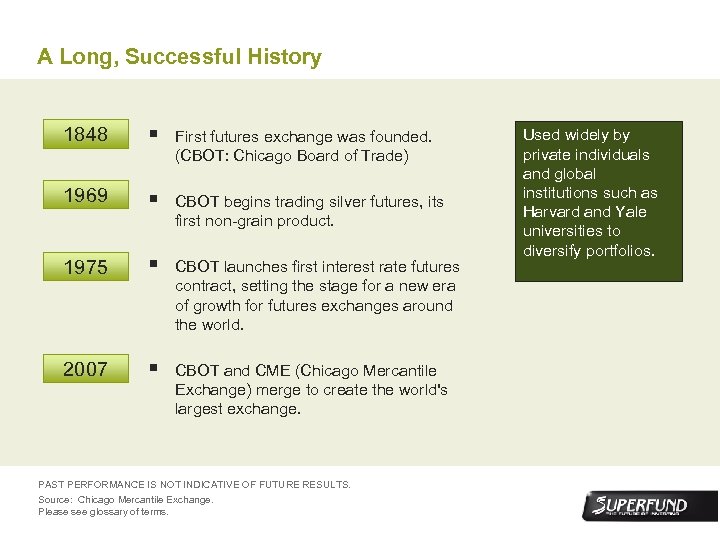

A Long, Successful History 1848 § First futures exchange was founded. (CBOT: Chicago Board of Trade) 1969 § CBOT begins trading silver futures, its first non-grain product. 1975 § CBOT launches first interest rate futures contract, setting the stage for a new era of growth for futures exchanges around the world. 2007 § CBOT and CME (Chicago Mercantile Exchange) merge to create the world's largest exchange. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Source: Chicago Mercantile Exchange. Please see glossary of terms. Used widely by private individuals and global institutions such as Harvard and Yale universities to diversify portfolios.

More than 120 Future Exchanges Around the World PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The above listing is a representative sample of exchanges only. It is not intended to be a complete list of exchanges worldwide.

Benefits

The Benefits of Managed Futures 1 2 HIGH PERFORMANCE POTENTIAL With the ability to trade long or short, in rising or falling markets, managed futures have the potential for high performance over a long-term investment period. ENHANCED PORTFOLIO EFFICIENCY When added to a traditional portfolio of stocks and bonds, managed futures have the potential to reduce the volatility and enhance the returns of the entire portfolio. 3 4 DIVERSIFICATION Managed futures trade in commodity and financial futures in more that 120 markets around the world. CORRELATION Historically, managed futures have a low correlation to other asset classes including stocks and bonds. Futures and forward contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Investing in managed futures is speculative and investors must be prepared to lose all or a substantial amount of their investment. Please see glossary of terms. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

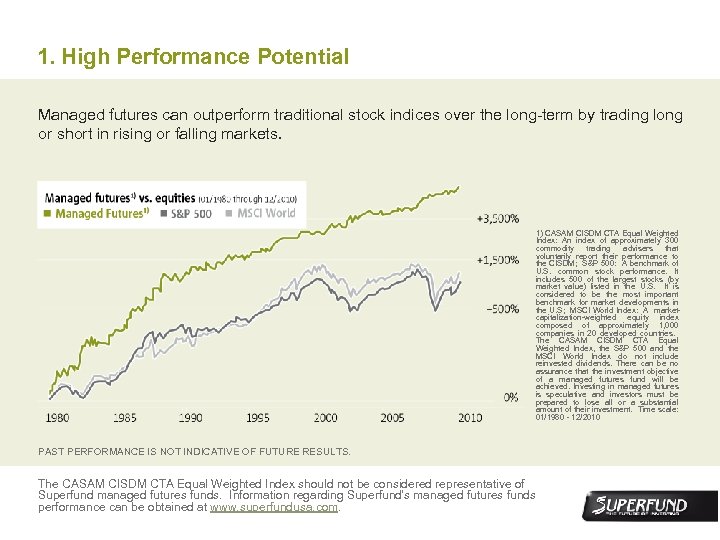

1. High Performance Potential Managed futures can outperform traditional stock indices over the long-term by trading long or short in rising or falling markets. 1) CASAM CISDM CTA Equal Weighted Index: An index of approximately 300 commodity trading advisers that voluntarily report their performance to the CISDM; S&P 500: A benchmark of U. S. common stock performance. It includes 500 of the largest stocks (by market value) listed in the U. S. It is considered to be the most important benchmark for market developments in the U. S; MSCI World Index: A marketcapitalization-weighted equity index composed of approximately 1, 000 companies in 20 developed countries. The CASAM CISDM CTA Equal Weighted Index, the S&P 500 and the MSCI World Index do not include reinvested dividends. There can be no assurance that the investment objective of a managed futures fund will be achieved. Investing in managed futures is speculative and investors must be prepared to lose all or a substantial amount of their investment. Time scale: 01/1980 - 12/2010 PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The CASAM CISDM CTA Equal Weighted Index should not be considered representative of Superfund managed futures funds. Information regarding Superfund’s managed futures funds performance can be obtained at www. superfundusa. com.

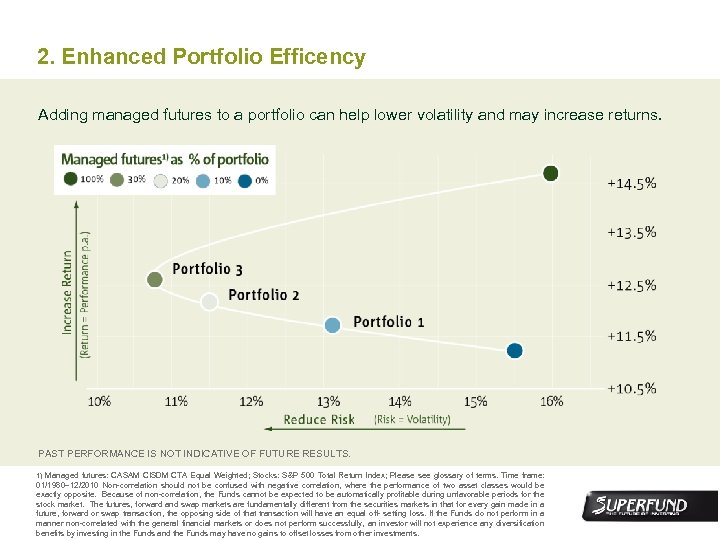

2. Enhanced Portfolio Efficency Adding managed futures to a portfolio can help lower volatility and may increase returns. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. 1) Managed futures: CASAM CISDM CTA Equal Weighted; Stocks: S&P 500 Total Return Index; Please see glossary of terms. Time frame: 01/1980– 12/2010 Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be exactly opposite. Because of non-correlation, the Funds cannot be expected to be automatically profitable during unfavorable periods for the stock market. The futures, forward and swap markets are fundamentally different from the securities markets in that for every gain made in a future, forward or swap transaction, the opposing side of that transaction will have an equal off- setting loss. If the Funds do not perform in a manner non-correlated with the general financial markets or does not perform successfully, an investor will not experience any diversification benefits by investing in the Funds and the Funds may have no gains to offset losses from other investments.

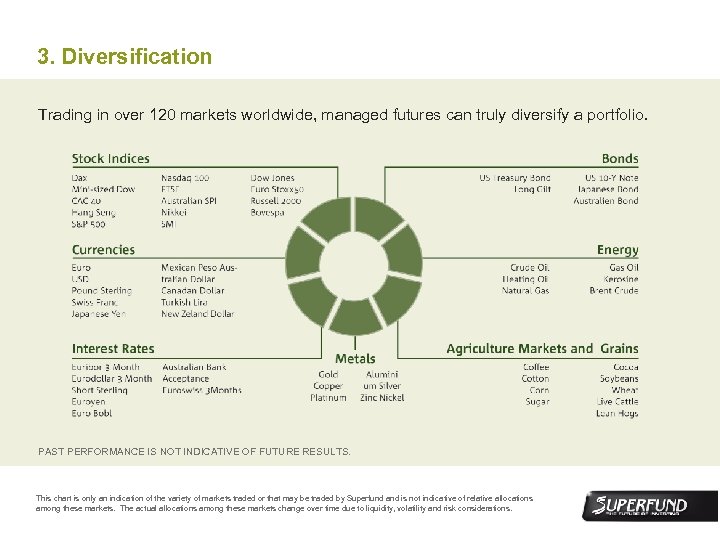

3. Diversification Trading in over 120 markets worldwide, managed futures can truly diversify a portfolio. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. This chart is only an indication of the variety of markets traded or that may be traded by Superfund and is not indicative of relative allocations among these markets. The actual allocations among these markets change over time due to liquidity, volatility and risk considerations.

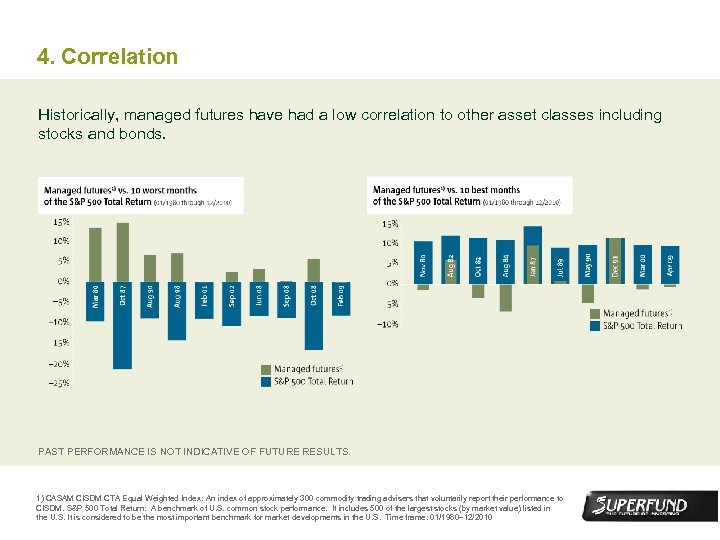

4. Correlation Historically, managed futures have had a low correlation to other asset classes including stocks and bonds. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. 1) CASAM CISDM CTA Equal Weighted Index: An index of approximately 300 commodity trading advisers that voluntarily report their performance to CISDM. S&P 500 Total Return: A benchmark of U. S. common stock performance. It includes 500 of the largest stocks (by market value) listed in the U. S. It is considered to be the most important benchmark for market developments in the U. S. Time frame: 01/1980– 12/2010

The Managed Futures Portfolio Effect Nobel Laureate, Professor Harry M. Markowitz proved that adding a non-correlated asset class to a traditional portfolio of stocks and bonds could improve performance while reducing risk. “A good portfolio is more than a long list of stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies. ” Professor Harry M. Markowitz Portfolio Selection, 1959 Nobel Prize in Economics, 1990 Prof. Harry M. Markowitz Christian Baha, Founder Superfund PART PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

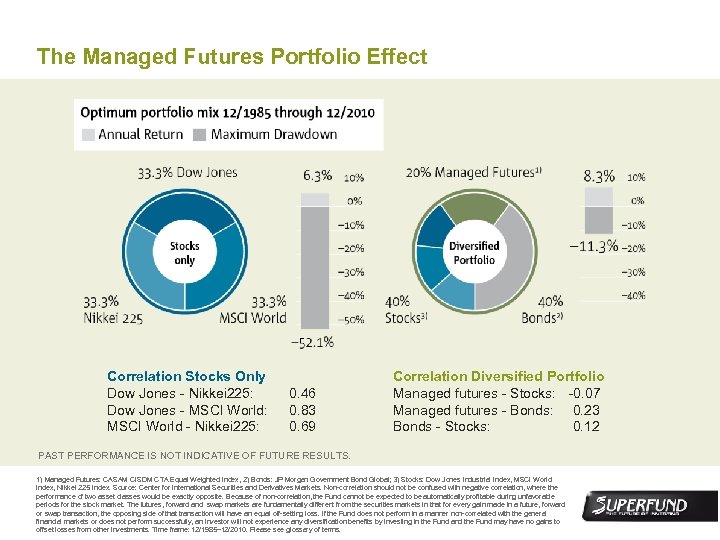

The Managed Futures Portfolio Effect Correlation Stocks Only Dow Jones - Nikkei 225: Dow Jones - MSCI World: MSCI World - Nikkei 225: 0. 46 0. 83 0. 69 PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Correlation Diversified Portfolio Managed futures - Stocks: -0. 07 Managed futures - Bonds: 0. 23 Bonds - Stocks: 0. 12 1) Managed Futures: CASAM CISDM CTA Equal Weighted Index, 2) Bonds: JP Morgan Government Bond Global; 3) Stocks: Dow Jones Industrial Index, MSCI World Index, Nikkei 225 Index. Source: Center for International Securities and Derivatives Markets. Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be exactly opposite. Because of non-correlation, the Fund cannot be expected to be automatically profitable during unfavorable periods for the stock market. The futures, forward and swap markets are fundamentally different from the securities markets in that for every gain made in a future, forward or swap transaction, the opposing side of that transaction will have an equal off-setting loss. If the Fund does not perform in a manner non-correlated with the general financial markets or does not perform successfully, an investor will not experience any diversification benefits by investing in the Fund and the Fund may have no gains to offset losses from other investments. Time frame: 12/1985– 12/2010. Please see glossary of terms.

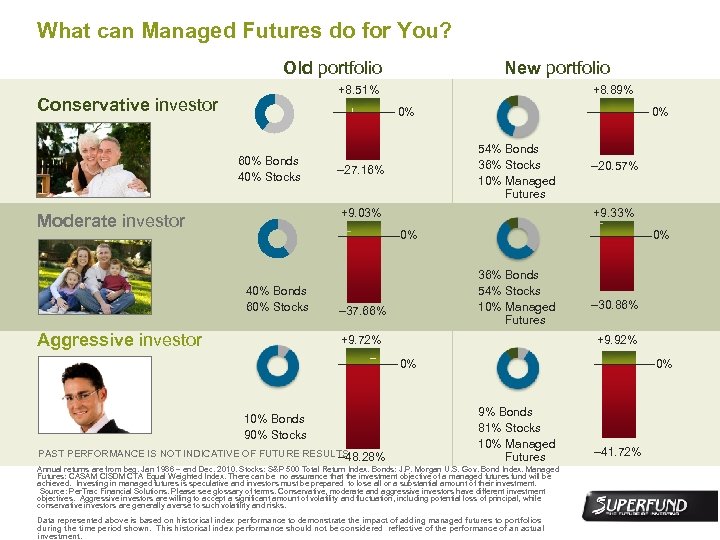

What can Managed Futures do for You? Old portfolio New portfolio +8. 51% Conservative investor +8. 89% 0% 60% Bonds 40% Stocks 0% 54% Bonds 36% Stocks 10% Managed Futures – 27. 16% +9. 03% Moderate investor – 20. 57% +9. 33% 0% 40% Bonds 60% Stocks Aggressive investor 0% 36% Bonds 54% Stocks 10% Managed Futures – 37. 66% +9. 72% – 30. 86% +9. 92% 0% 10% Bonds 90% Stocks 0% 9% Bonds 81% Stocks 10% Managed Futures PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. – 48. 28% Annual returns are from beg. Jan 1986 – end Dec. 2010. Stocks: S&P 500 Total Return Index. Bonds: J. P. Morgan U. S. Gov. Bond Index. Managed Futures: CASAM CISDM CTA Equal Weighted Index. There can be no assurance that the investment objective of a managed futures fund will be achieved. Investing in managed futures is speculative and investors must be prepared to lose all or a substantial amount of their investment. Source: Per. Trac Financial Solutions. Please see glossary of terms. Conservative, moderate and aggressive investors have different investment objectives. Aggressive investors are willing to accept a significant amount of volatility and fluctuation, including potential loss of principal, while conservative investors are generally averse to such volatility and risks. Data represented above is based on historical index performance to demonstrate the impact of adding managed futures to portfolios during the time period shown. This historical index performance should not be considered reflective of the performance of an actual investment. – 41. 72%

Superfund

Superfund Funds Superfund Product Line Superfund Green L. P. Series A 1% MAXIMUM INITIAL RISK PER TRADE MINIMUM INVESTMENT: USD 5, 000 Superfund Green L. P. Series B 1. 5% MAXIMUM INITIAL RISK PER TRADE MINIMUM INVESTMENT: USD 5, 000 PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Superfund Capital Management generally allocates between 0. 6% to 0. 8% of portfolio equity to any single market position with a maximum risk per trade of 1% to 1. 5%. This indicates the possibility of losing some or all of the original investment. However, no guarantee is provided that losses will be limited to these percentages.

Superfund Group Of Companies Since first established in 1995, Superfund has been a pioneer in the world of managed futures. In March 1996, Superfund launched the flagship fund, Superfund Q-AG (closed fund). At that time, Superfund was one of the world’s first managed futures fund providers to offer this innovative alternative investment to the private sector. Today, Superfund companies collectively have 220 employees in over 10 countries with 50, 000 private and institutional investors worldwide. * PAST PERFORMANCE IS NOT INDICATIVE OF FUTRUE RESULTS. * As of 12/2010

Contact § FOR MORE INFORMATION PLEASE CONTACT US: New York 489 5 th Avenue New York, NY 10017 Tel. 212 -750 -6300 Fax 212 -750 -2206 usa@superfund. com

Have you thought about managed futures yet?

Glossary of Terms Annual Return: The gain or loss of a security in a year. The return consists of the income and the capital gains relative on an investment and is usually quoted as a percentage. Assets Under Management: The market value of assets that an investment company manages on behalf of investors. Assets Under Management (AUM) is looked at as a measure of success against the competition and consists of growth/decline due to both capital appreciation/losses and new money inflow/outflow. Barclay Hedge Alternative Investment Database (Barclay Hedge. Ltd): The Global Database is a comprehensive database specific to modern alternative investments. Data is refreshed twice-monthly with a complete universe of hedge fund, funds of hedge funds and managed futures. 104 unique qualitative fields per fund are combined with well over 1, 000 individual monthly data points which are maintained with an average update frequency of 92% within 30 days. Bonds: A long-term promissory note in which the issuer agrees to pay the owner the amount of the face value on a future date and to pay interest at a specified rate at regular intervals. Bonds are used by companies, municipalities, states and U. S. and foreign governments to finance a variety of projects and activities. Bonds are commonly referred to as fixed-income securities and are one of the three main asset classes, along with stocks and cash equivalents. Cash: Legal tender or coins that can be used in exchange goods, debt, or services. CISDM (Center for International Securities and Derivatives Markets): The CISDM is a non-profit academic research center that focuses on security and investment fund performance in both U. S. and international asset markets for approximately 1, 800 active hedge funds and 600 active commodity trading advisors, commodity pool operators and managed futures programs. CBOT (Chicago Board of Trade): The CBOT, established in 1848, is a leading futures and futures-options exchange. More than 3, 600 CBOT member/stockholders trade 50 different futures and options products at the CBOT by open auction and electronically. Volume at the Exchange in 2006 surpassed 805 million contracts, the highest yearly total recorded in its history. The CBOT and the Chicago Mercantile Exchange merged in 2008, becoming the CME Group, the largest exchange in the world.

Glossary of Terms CME (Chicago Mercantile Exchange): The CME is an American financial and commodity derivative exchange based in Chicago. CME trades several types of financial instruments: interest rates, equities, currencies, and commodities. It also offers trading in alternative investments such as weather and real estate derivatives. CME has the largest options and futures contracts open interest (number of contracts outstanding) of any futures exchange in the world. The CBOT and the Chicago Mercantile Exchange merged in 2008, becoming the CME Group, the largest exchange in the world. CASAM (Crédit Agricole Structured Asset Management) CISDM CTA Equal Weighted Index: An index of approximately 300 commodity trading advisers that voluntarily report their performance to the CISDM; CTAs trade a wide variety of OTC and exchange traded forward, futures and options markets (e. g. , physicals, currency, financial) based on a wide variety of trading models. In order to be included in the equally weighted index universe, a CTA must have at least $500, 000 under management and at least a 12 -month track record. The index goes back historically to January 1980. Credit Derivatives: Privately held negotiable bilateral contracts that allow users to manage their exposure to credit risk. Credit derivatives are financial assets like forward contracts, swaps, and options for which the price is driven by the credit risk of economic agents (private investors or governments). For example, a bank concerned that one of its customers may not be able to repay a loan can protect itself against loss by transferring the credit risk to another party while keeping the loan on its books. Correlation: In the world of finance, a statistical measure of how two securities move in relation to each other. Correlation is computed into what is known as the correlation coefficient, which ranges between -1 and +1. Perfect positive correlation (a correlation co-efficient of +1) implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. Alternatively, perfect negative correlation means that if one security moves in either direction the security that is perfectly negatively correlated will move by an equal amount in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. Diversification: Diversification is an investment strategy for spreading principal among different markets, sectors, industries, and securities. The goal is to protect the value of your overall portfolio in case a single security or market sector takes a serious downturn and drops in price. In short, diversification spreads your risk, while still seeking a strong return on overall investment. Equities: A stock or any other security representing an ownership interest.

Glossary of Terms Futures Contracts: A futures contract is a contract to buy specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. They are traded on futures exchanges. Futures Exchanges: Traditionally, a term referring to a central marketplace where futures contracts and options on futures contracts are traded. More recently, with the growth in electronic trading, it is also used to describe the activity of futures trading itself. Hedge Funds: Hedge funds are private investment pools for wealthy, financially sophisticated investors. Hedge fund managers typically seek absolute positive investment performance. This means that hedge funds target a specific range of performance, and attempt to produce targeted returns irrespective of the underlying trends of the stock market. This stands in contrast to investments like mutual funds, where success or failure is often measured in terms of performance in relation to a stock index, like the Dow Jones Industrial Average. Fees are typically substantially greater than in mutual funds. Interest rate futures contract: A contractual agreement, generally made on the trading floor of a futures exchange, to buy or sell a particular commodity or financial instrument at a pre-determined price in the future. Some futures contracts may call for physical delivery of the asset, while others are settled in cash. An interest rate futures contract is a futures contract based on interest rates. JP Morgan Government Bond Global: Is a total returns index calculated based on gross price (clean price plus accrued interest). It assumes that a coupon received in one currency is immediately reinvested back into the bonds in that country's index. Local currency return is expressed as a basket of currencies which make up the index. Countries that compose the index: Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, Netherlands. Spain, Sweden, Switzerland, UK, and US. Lehman Brothers Aggregate Bond Index: An index used by bond funds as a benchmark to measure their relative performance. The index includes government securities, mortgage-backed securities, asset-backed securities and corporate securities to simulate the universe of bonds in the market. The maturities of the bonds in the index are more than one year. The index constructed by Lehman Brothers is considered to be the best total market bond index, as it is used by more than 90% of investors in the United States.

Glossary of Terms Liquidity: The degree to which an asset or security can be bought or sold in the market without affecting the asset's price. Liquidity is characterized by a high level of trading activity. Assets that can by easily bought or sold, are known as liquid assets. Managed Futures: A managed futures account (MFA) or managed futures fund is a type of alternative investment. Managed futures accounts include, but are not limited to, commodity pools and commodity funds. managed futures accounts can take both long and short positions in futures contracts and options on futures contracts in the global commodity, interest rate, equity, and currency markets. Managed futures accounts are operated by licensed commodity trading advisors (CTAs), who are regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. Max (Maximum) Drawdown: Losses experienced by a pool or account over a specified period. Maximum is the largest loss experienced in a given time frame. MSCI World Index: The MSCI World Index generally consists of more than 1, 500 stocks in 23 developed market countries and typically represents approximately 85 percent of the total market capitalization in those countries. Nikkei 225: Japan's Nikkei 225 Stock Average is the leading index of Japanese stocks. It is a price-weighted index comprised of Japan's top 225 blue-chip companies on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average Index in the U. S. Private Equity: Equity capital that is not quoted on a public exchange. Private equity consists of investors and funds that make investments directly into private companies or conduct buyouts of public companies that result in a delisting of public equity. Capital for private equity is raised from retail and institutional investors, and can be used to fund new technologies, expand working capital within an owned company, make acquisitions, or to strengthen a balance sheet. Real Estate: Land plus anything permanently fixed to it, including buildings, sheds and other items attached to the structure. Unlike other investments, real estate is dramatically affected by the condition of the immediate area where the property is located.

Glossary of Terms S&P 500: The S&P 500 is one of the most commonly used benchmarks for the overall U. S. stock market. It is an index consisting of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P 500 Index represents the price trend movements of the common stock of major U. S. public companies. S&P 500 Total Return Index: A type of equity index, including 500 of the largest stocks (by market value) listed in the U. S, that tracks both the capital gains of a group of stocks over time, and assumes that any cash distributions, such as dividends, are reinvested back into the index. Looking at an index's total return displays a more accurate representation of the index's performance. By assuming dividends are reinvested, you effectively have accounted for stocks in an index that do not issue dividends and instead, reinvest their earnings within the underlying company. Volatility: The degree of price fluctuation for a given asset, rate, or index. Usually expressed as a variance or standard deviation.

28abeb5c7f745995885293a5cd2c7856.ppt