679030c40d97f672f3b3931e93983d63.ppt

- Количество слайдов: 41

Harnessing Nature Creating Value 2 nd Annual NASDAQ TASE Israeli Investor Conference November, 2007

Harnessing Nature Creating Value 2 nd Annual NASDAQ TASE Israeli Investor Conference November, 2007

Disclaimer The information delivered or to be delivered to you does not constitute an offer or a recommendation to do any transaction in Israel Chemicals Ltd. (ICL) securities. Although our shares may be bought and sold on the Tel Aviv Stock Exchange (TASE) at any time, they do not constitute trade out of Israel - neither in the United States nor elsewhere and this presentation does not constitute an offer or investment advice to any US or other person at this time. If we ever do so, our offer will only be made by a prospectus or a registration statement conforming with the requirements of U. S. or any other applicable law. Certain statements in this presentation and other oral and written statements made by ICL from time to time, are forward-looking statements, including, but not limited to, those that discuss strategies, goals, outlook or other nonhistorical matters; or project revenues, income, returns or other financial measures. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements, including, among others, the following: (a) the changes in worldwide economic and political conditions that impact interest and foreign exchange rates, (b) the extent to which ICL is able to successfully integrate acquisitions, achieve synergies and develop new markets, (c) the extent to which ICL is able to achieve savings from its various plans, (d) government funding and program approvals affecting products being developed or sold under government programs, and (e) cost and delivery performance under various program and development contracts. We caution you that the above list of important factors is not comprehensive. We refer you to filings that we have made with the TASE. They may discuss new or different factors that may cause actual results to differ materially from this information. All information included in this document speaks only as of the date on which they are made, and we do not undertake any obligation to update such information afterwards. Some of the market and industry information is based on independent industry publications or other publicly available information, while other information is based on internal studies. Although we believe that these independent sources and our internal data are reliable as of their respective dates, the information contained in them has not been independently verified and we can not assure you as to the accuracy or completeness of this information. Readers and viewers are cautioned to consider these risks and uncertainties and to not place undue reliance on such information. Focused Synergistic Responsible

Disclaimer The information delivered or to be delivered to you does not constitute an offer or a recommendation to do any transaction in Israel Chemicals Ltd. (ICL) securities. Although our shares may be bought and sold on the Tel Aviv Stock Exchange (TASE) at any time, they do not constitute trade out of Israel - neither in the United States nor elsewhere and this presentation does not constitute an offer or investment advice to any US or other person at this time. If we ever do so, our offer will only be made by a prospectus or a registration statement conforming with the requirements of U. S. or any other applicable law. Certain statements in this presentation and other oral and written statements made by ICL from time to time, are forward-looking statements, including, but not limited to, those that discuss strategies, goals, outlook or other nonhistorical matters; or project revenues, income, returns or other financial measures. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those contained in the statements, including, among others, the following: (a) the changes in worldwide economic and political conditions that impact interest and foreign exchange rates, (b) the extent to which ICL is able to successfully integrate acquisitions, achieve synergies and develop new markets, (c) the extent to which ICL is able to achieve savings from its various plans, (d) government funding and program approvals affecting products being developed or sold under government programs, and (e) cost and delivery performance under various program and development contracts. We caution you that the above list of important factors is not comprehensive. We refer you to filings that we have made with the TASE. They may discuss new or different factors that may cause actual results to differ materially from this information. All information included in this document speaks only as of the date on which they are made, and we do not undertake any obligation to update such information afterwards. Some of the market and industry information is based on independent industry publications or other publicly available information, while other information is based on internal studies. Although we believe that these independent sources and our internal data are reliable as of their respective dates, the information contained in them has not been independently verified and we can not assure you as to the accuracy or completeness of this information. Readers and viewers are cautioned to consider these risks and uncertainties and to not place undue reliance on such information. Focused Synergistic Responsible

Company Basics

Company Basics

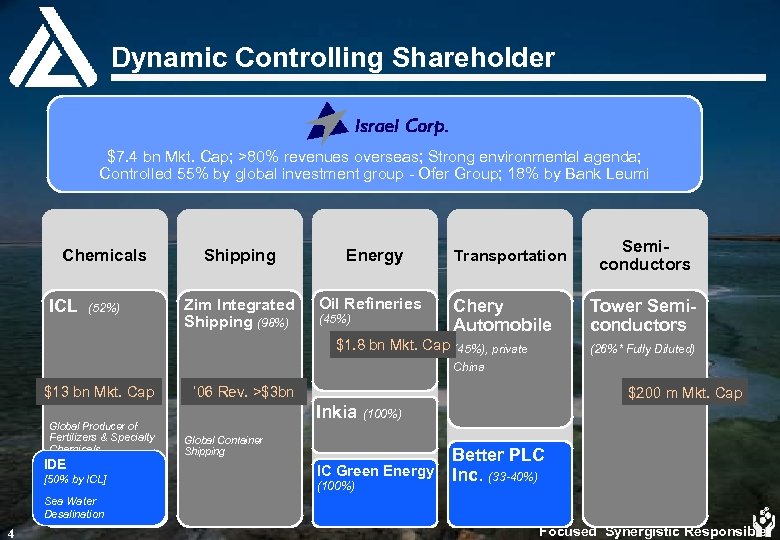

Dynamic Controlling Shareholder $7. 4 bn Mkt. Cap; >80% revenues overseas; Strong environmental agenda; Controlled 55% by global investment group - Ofer Group; 18% by Bank Leumi Chemicals ICL (52%) Shipping Zim Integrated Shipping (98%) Energy Oil Refineries (45%) Transportation Chery Automobile $1. 8 bn Mkt. Cap (45%), private Semiconductors Tower Semiconductors (26%* Fully Diluted) China $13 bn Mkt. Cap Global Producer of Fertilizers & Specialty Chemicals IDE [50% by ICL] Sea Water Desalination 4 ’ 06 Rev. >$3 bn $200 m Mkt. Cap Inkia Global Container Shipping (100%) $1. 8 bn Mkt. Cap IC Green Energy (100%) Lat. AM Power Plants Better PLC Inc. (33 -40%) Focused Synergistic Responsible

Dynamic Controlling Shareholder $7. 4 bn Mkt. Cap; >80% revenues overseas; Strong environmental agenda; Controlled 55% by global investment group - Ofer Group; 18% by Bank Leumi Chemicals ICL (52%) Shipping Zim Integrated Shipping (98%) Energy Oil Refineries (45%) Transportation Chery Automobile $1. 8 bn Mkt. Cap (45%), private Semiconductors Tower Semiconductors (26%* Fully Diluted) China $13 bn Mkt. Cap Global Producer of Fertilizers & Specialty Chemicals IDE [50% by ICL] Sea Water Desalination 4 ’ 06 Rev. >$3 bn $200 m Mkt. Cap Inkia Global Container Shipping (100%) $1. 8 bn Mkt. Cap IC Green Energy (100%) Lat. AM Power Plants Better PLC Inc. (33 -40%) Focused Synergistic Responsible

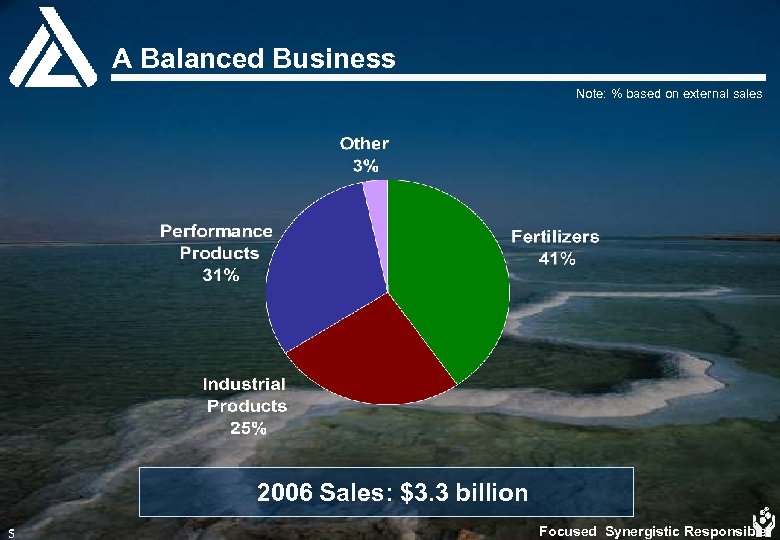

A Balanced Business Note: % based on external sales 2006 Sales: $3. 3 billion 5 Focused Synergistic Responsible

A Balanced Business Note: % based on external sales 2006 Sales: $3. 3 billion 5 Focused Synergistic Responsible

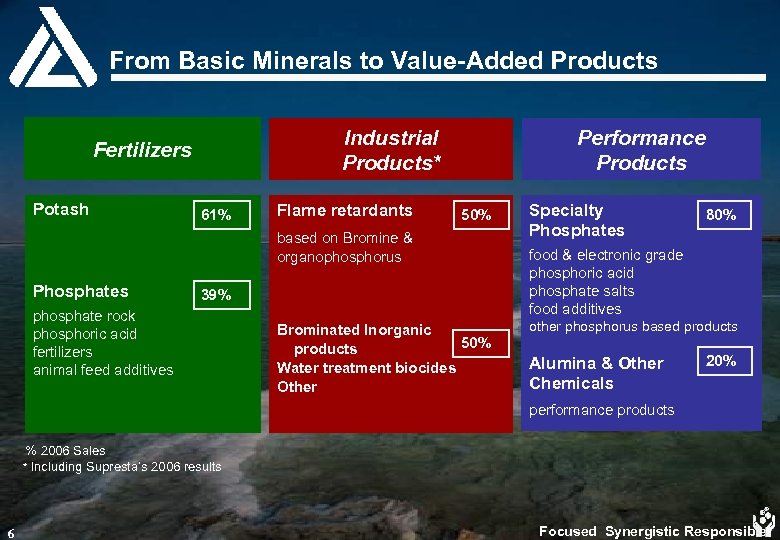

From Basic Minerals to Value-Added Products Industrial Products* Fertilizers Potash 61% Flame retardants Performance Products 50% based on Bromine & organophosphorus Phosphates 39% phosphate rock phosphoric acid fertilizers animal feed additives Brominated Inorganic 50% products Water treatment biocides Other Specialty Phosphates 80% food & electronic grade phosphoric acid phosphate salts food additives other phosphorus based products Alumina & Other Chemicals 20% performance products % 2006 Sales * Including Supresta’s 2006 results 6 Focused Synergistic Responsible

From Basic Minerals to Value-Added Products Industrial Products* Fertilizers Potash 61% Flame retardants Performance Products 50% based on Bromine & organophosphorus Phosphates 39% phosphate rock phosphoric acid fertilizers animal feed additives Brominated Inorganic 50% products Water treatment biocides Other Specialty Phosphates 80% food & electronic grade phosphoric acid phosphate salts food additives other phosphorus based products Alumina & Other Chemicals 20% performance products % 2006 Sales * Including Supresta’s 2006 results 6 Focused Synergistic Responsible

Recognized and Well Established Shareholders 1952 1975 1992 1995 Mining operations begin at Dead Sea & Negev desert ICL established as a state-owned holding company IPO (TASE) Israel Corporation acquires control 1999 Ofer Group acquires control of Israel Corporation ~ $13 billion market cap* * November 20, 2007 7 Focused Synergistic Responsible

Recognized and Well Established Shareholders 1952 1975 1992 1995 Mining operations begin at Dead Sea & Negev desert ICL established as a state-owned holding company IPO (TASE) Israel Corporation acquires control 1999 Ofer Group acquires control of Israel Corporation ~ $13 billion market cap* * November 20, 2007 7 Focused Synergistic Responsible

Increasing Share Price Compared to Peers 8 Focused Synergistic Responsible

Increasing Share Price Compared to Peers 8 Focused Synergistic Responsible

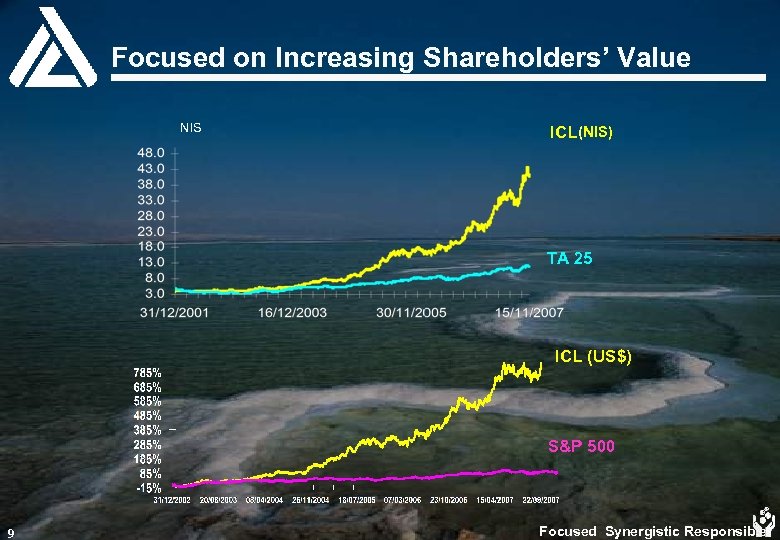

Focused on Increasing Shareholders’ Value NIS ICL(NIS) TA 25 ICL (US$) S&P 500 9 Focused Synergistic Responsible

Focused on Increasing Shareholders’ Value NIS ICL(NIS) TA 25 ICL (US$) S&P 500 9 Focused Synergistic Responsible

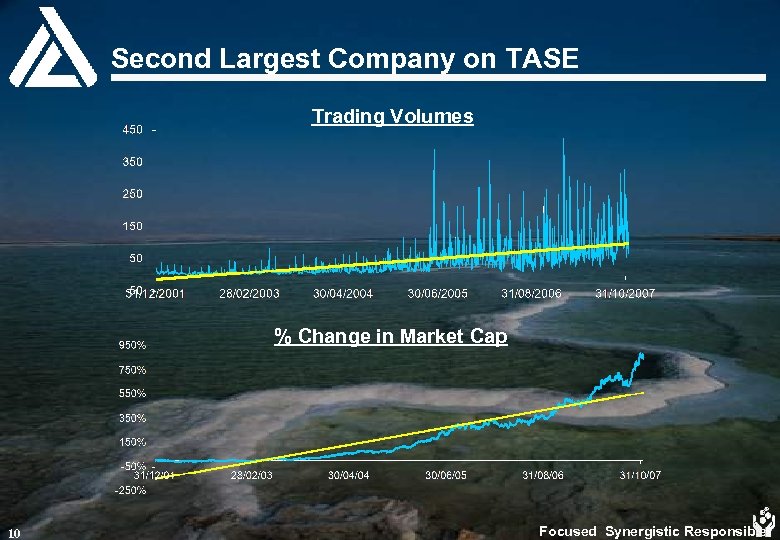

Second Largest Company on TASE Trading Volumes % Change in Market Cap 10 Focused Synergistic Responsible

Second Largest Company on TASE Trading Volumes % Change in Market Cap 10 Focused Synergistic Responsible

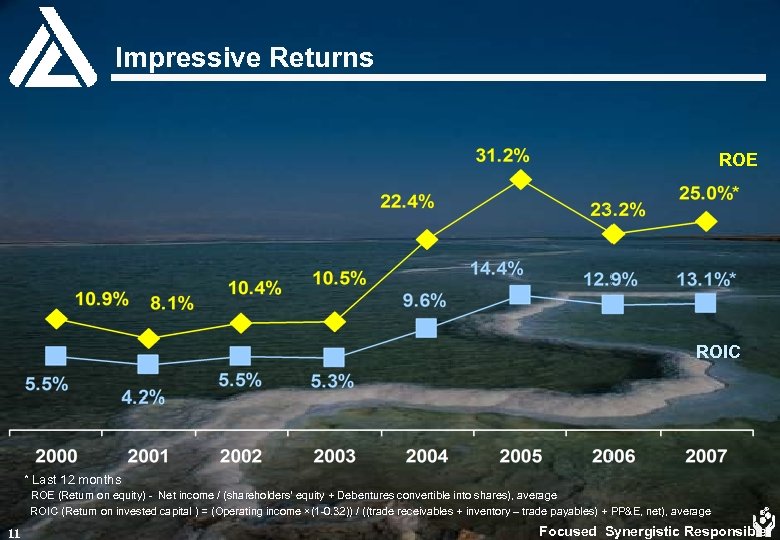

Impressive Returns ROE ROIC * Last 12 months ROE (Return on equity) - Net income / (shareholders' equity + Debentures convertible into shares), average ROIC (Return on invested capital ) = (Operating income ×(1 -0. 32)) / ((trade receivables + inventory – trade payables) + PP&E, net), average 11 Focused Synergistic Responsible

Impressive Returns ROE ROIC * Last 12 months ROE (Return on equity) - Net income / (shareholders' equity + Debentures convertible into shares), average ROIC (Return on invested capital ) = (Operating income ×(1 -0. 32)) / ((trade receivables + inventory – trade payables) + PP&E, net), average 11 Focused Synergistic Responsible

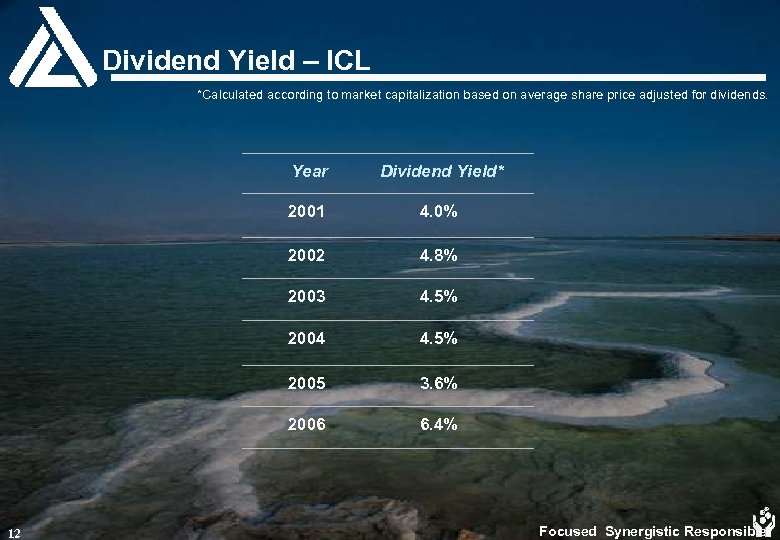

Dividend Yield – ICL *Calculated according to market capitalization based on average share price adjusted for dividends. Year 2001 4. 0% 2002 4. 8% 2003 4. 5% 2004 4. 5% 2005 3. 6% 2006 12 Dividend Yield* 6. 4% Focused Synergistic Responsible

Dividend Yield – ICL *Calculated according to market capitalization based on average share price adjusted for dividends. Year 2001 4. 0% 2002 4. 8% 2003 4. 5% 2004 4. 5% 2005 3. 6% 2006 12 Dividend Yield* 6. 4% Focused Synergistic Responsible

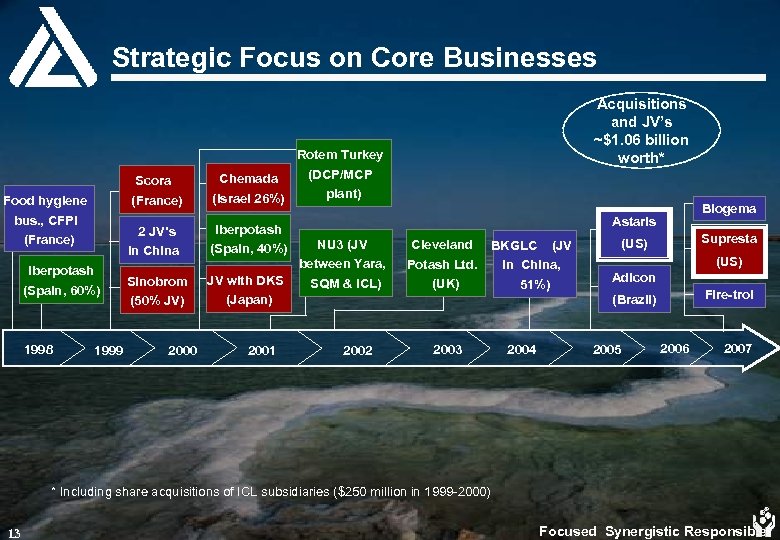

Strategic Focus on Core Businesses Scora (France) Food hygiene bus. , CFPI (France) 1998 Rotem Turkey (DCP/MCP Chemada plant) (Israel 26%) 2 JV’s in China Iberpotash (Spain, 60%) 1999 Iberpotash (Spain, 40%) Sinobrom (50% JV) JV with DKS (Japan) 2000 Acquisitions and JV’s ~$1. 06 billion worth* 2001 Biogema Astaris NU 3 (JV between Yara, SQM & ICL) Cleveland Potash Ltd. (UK) BKGLC (JV in China, 51%) Supresta (US) Adicon Fire-trol (Brazil) 2002 2003 2004 2005 2006 2007 * Including share acquisitions of ICL subsidiaries ($250 million in 1999 -2000) 13 Focused Synergistic Responsible

Strategic Focus on Core Businesses Scora (France) Food hygiene bus. , CFPI (France) 1998 Rotem Turkey (DCP/MCP Chemada plant) (Israel 26%) 2 JV’s in China Iberpotash (Spain, 60%) 1999 Iberpotash (Spain, 40%) Sinobrom (50% JV) JV with DKS (Japan) 2000 Acquisitions and JV’s ~$1. 06 billion worth* 2001 Biogema Astaris NU 3 (JV between Yara, SQM & ICL) Cleveland Potash Ltd. (UK) BKGLC (JV in China, 51%) Supresta (US) Adicon Fire-trol (Brazil) 2002 2003 2004 2005 2006 2007 * Including share acquisitions of ICL subsidiaries ($250 million in 1999 -2000) 13 Focused Synergistic Responsible

Invested Significantly Acquisitions Investments $674 M $960 M ICL Spent ~$1. 6 B from 2001 -2007 on investments (net of grants) and acquisitions 14 Focused Synergistic Responsible

Invested Significantly Acquisitions Investments $674 M $960 M ICL Spent ~$1. 6 B from 2001 -2007 on investments (net of grants) and acquisitions 14 Focused Synergistic Responsible

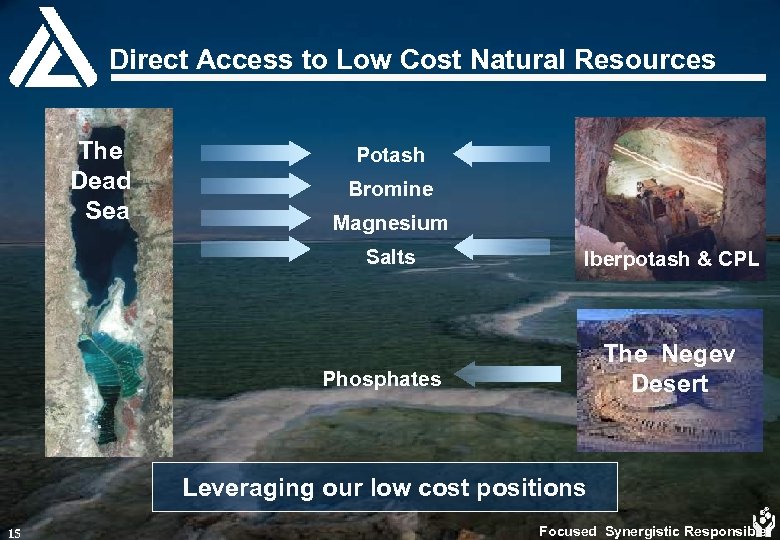

Direct Access to Low Cost Natural Resources The Dead Sea Potash Bromine Magnesium Salts Iberpotash & CPL The Negev Desert Phosphates Leveraging our low cost positions 15 Focused Synergistic Responsible

Direct Access to Low Cost Natural Resources The Dead Sea Potash Bromine Magnesium Salts Iberpotash & CPL The Negev Desert Phosphates Leveraging our low cost positions 15 Focused Synergistic Responsible

Leading Player in Global Industry #1 elemental bromine ~one third of global production #1 in organophosphorus flame retardants #1 producer of pure phosphoric acid #1 in specialty phosphates #1 supplier in Europe of PK fertilizers (compound potash & phosphate) #2 Europe and #6 Worldwide in potash supply #2 Western World - magnesium production and… Major player in specialty chemical high margin niche markets & specialty fertilizers 16 Focused Synergistic Responsible

Leading Player in Global Industry #1 elemental bromine ~one third of global production #1 in organophosphorus flame retardants #1 producer of pure phosphoric acid #1 in specialty phosphates #1 supplier in Europe of PK fertilizers (compound potash & phosphate) #2 Europe and #6 Worldwide in potash supply #2 Western World - magnesium production and… Major player in specialty chemical high margin niche markets & specialty fertilizers 16 Focused Synergistic Responsible

Strong Global Presence Europe 37% North America 22% Israel 6% Africa 2% Asia Pacific 23% South America 10% Sales by Geography (2006) 17 Focused Synergistic Responsible

Strong Global Presence Europe 37% North America 22% Israel 6% Africa 2% Asia Pacific 23% South America 10% Sales by Geography (2006) 17 Focused Synergistic Responsible

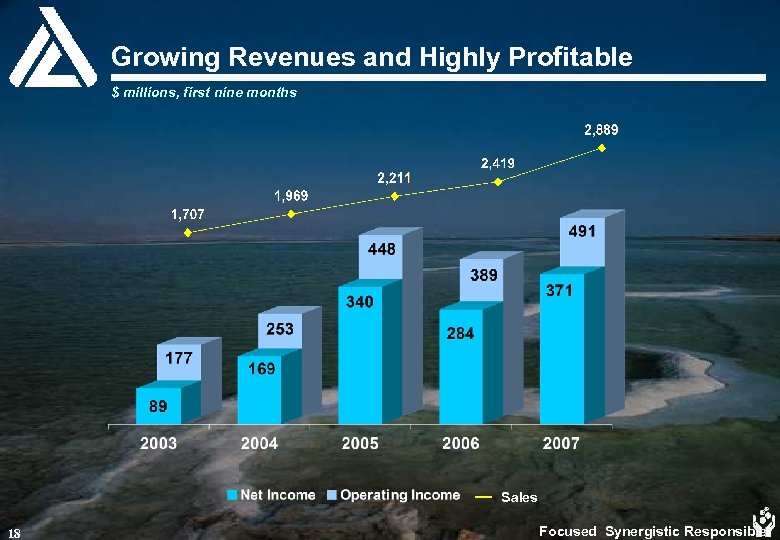

Growing Revenues and Highly Profitable $ millions, first nine months Sales 18 Focused Synergistic Responsible

Growing Revenues and Highly Profitable $ millions, first nine months Sales 18 Focused Synergistic Responsible

Environmental Strategy: An Active, Dedicated Focus § Integral part of ICL business strategy is preservation of the environment and full compliance with standards of environmental responsibility. § Environmental work plan includes investment of $130 million (2006 and 2007) to improve the environmental profile of operations. § Primary focus is on implementing processes for: § creating a safe work environment § improving safety of manufacturing processes § creating safe products for our customers (product lifecycle) § rehabilitation of areas for the benefit of the public, tourists (e. g. landscaping) § Environmental strategy includes full transparency to the government, environmental organizations and the public to increase trust in ICL’s stewardship of the environment. 19 Focused Synergistic Responsible

Environmental Strategy: An Active, Dedicated Focus § Integral part of ICL business strategy is preservation of the environment and full compliance with standards of environmental responsibility. § Environmental work plan includes investment of $130 million (2006 and 2007) to improve the environmental profile of operations. § Primary focus is on implementing processes for: § creating a safe work environment § improving safety of manufacturing processes § creating safe products for our customers (product lifecycle) § rehabilitation of areas for the benefit of the public, tourists (e. g. landscaping) § Environmental strategy includes full transparency to the government, environmental organizations and the public to increase trust in ICL’s stewardship of the environment. 19 Focused Synergistic Responsible

Business and Market Opportunities

Business and Market Opportunities

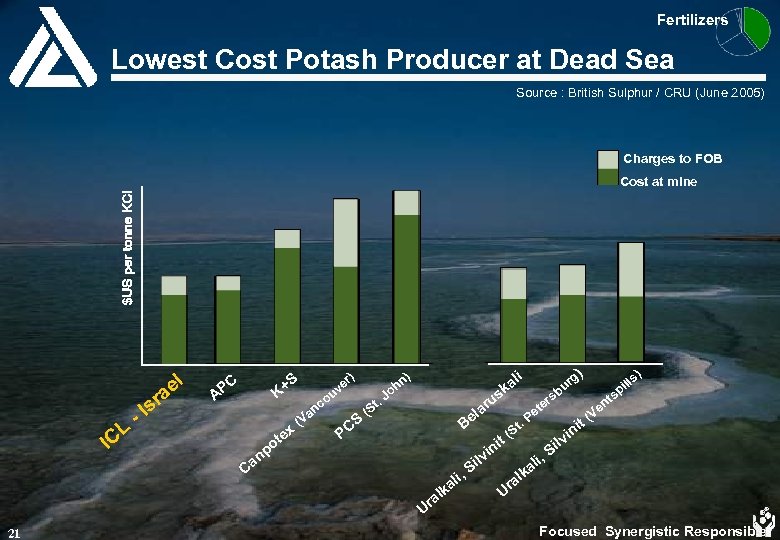

Fertilizers Lowest Cost Potash Producer at Dead Sea Source : British Sulphur / CRU (June 2005) Charges to FOB Cost at mine el L IC a sr -I A t po ex (V c an S PC n oh l ka s . J St ( ru la e B n Ca li ka al Ur 21 g) ur b i ) ) er uv o S K+ PC . P i ilv , S t ni ts s er et t (S a Ur l l ka i, lv Si t ni s) ill p ( n Ve i Focused Synergistic Responsible

Fertilizers Lowest Cost Potash Producer at Dead Sea Source : British Sulphur / CRU (June 2005) Charges to FOB Cost at mine el L IC a sr -I A t po ex (V c an S PC n oh l ka s . J St ( ru la e B n Ca li ka al Ur 21 g) ur b i ) ) er uv o S K+ PC . P i ilv , S t ni ts s er et t (S a Ur l l ka i, lv Si t ni s) ill p ( n Ve i Focused Synergistic Responsible

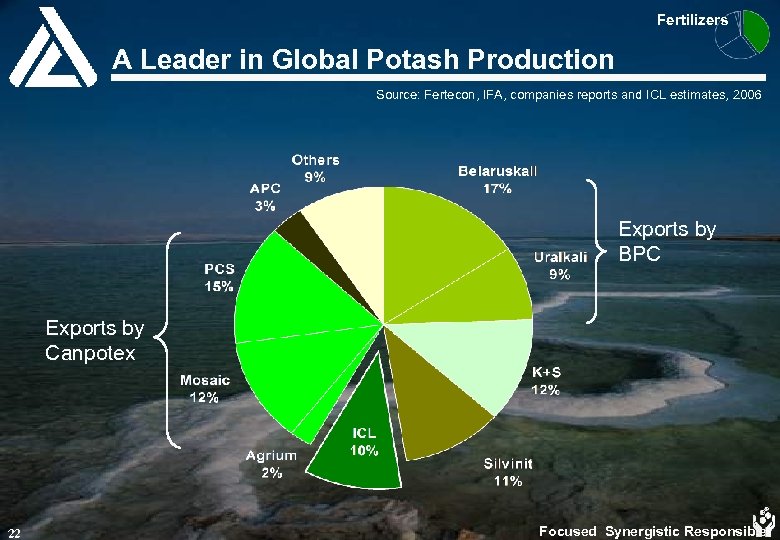

Fertilizers A Leader in Global Potash Production Source: Fertecon, IFA, companies reports and ICL estimates, 2006 Exports by BPC Exports by Canpotex 22 Focused Synergistic Responsible

Fertilizers A Leader in Global Potash Production Source: Fertecon, IFA, companies reports and ICL estimates, 2006 Exports by BPC Exports by Canpotex 22 Focused Synergistic Responsible

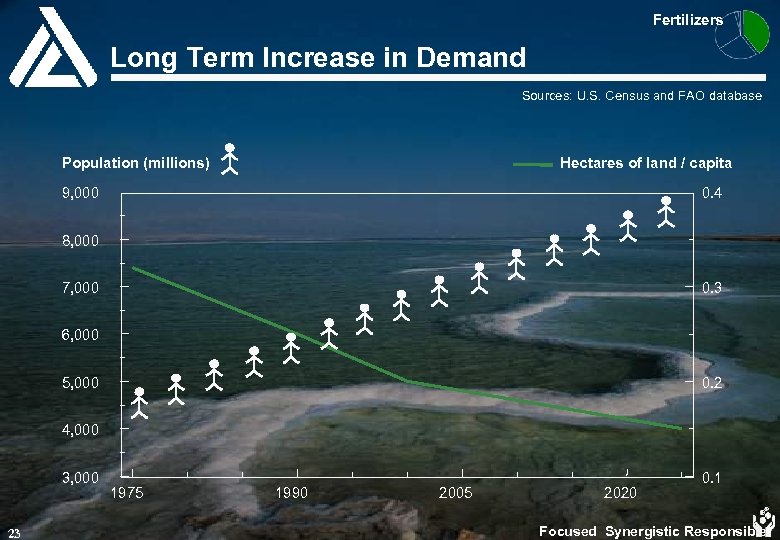

Fertilizers Long Term Increase in Demand Sources: U. S. Census and FAO database Population (millions) Hectares of land / capita 9, 000 0. 4 8, 000 7, 000 0. 3 6, 000 5, 000 0. 2 4, 000 3, 000 23 1975 1990 2005 2020 0. 1 Focused Synergistic Responsible

Fertilizers Long Term Increase in Demand Sources: U. S. Census and FAO database Population (millions) Hectares of land / capita 9, 000 0. 4 8, 000 7, 000 0. 3 6, 000 5, 000 0. 2 4, 000 3, 000 23 1975 1990 2005 2020 0. 1 Focused Synergistic Responsible

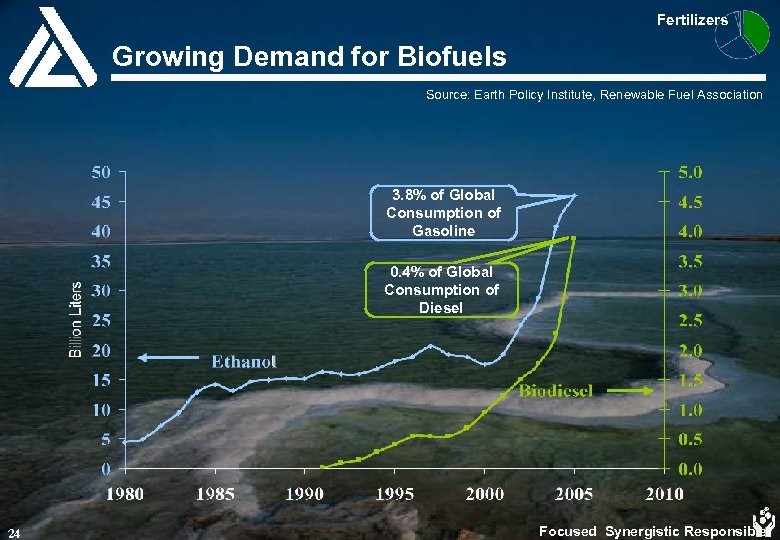

Fertilizers Growing Demand for Biofuels Source: Earth Policy Institute, Renewable Fuel Association 3. 8% of Global Consumption of Gasoline 0. 4% of Global Consumption of Diesel 24 Focused Synergistic Responsible

Fertilizers Growing Demand for Biofuels Source: Earth Policy Institute, Renewable Fuel Association 3. 8% of Global Consumption of Gasoline 0. 4% of Global Consumption of Diesel 24 Focused Synergistic Responsible

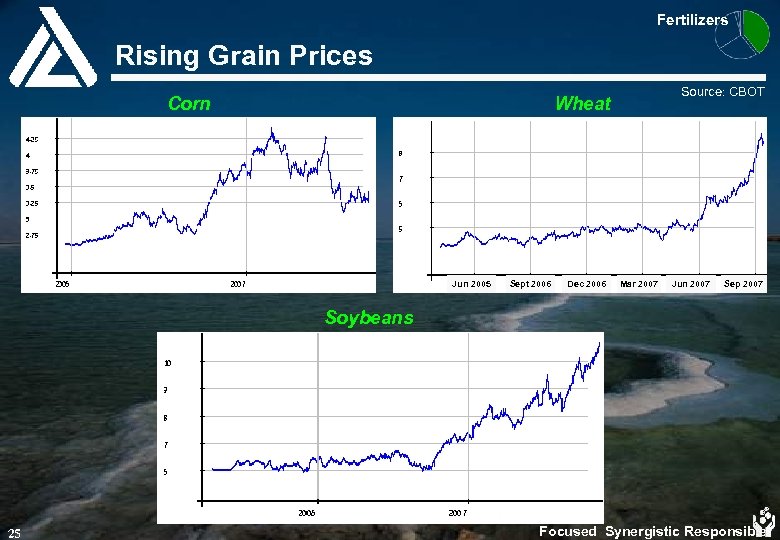

Fertilizers Rising Grain Prices Corn Source: CBOT Wheat Jun 2005 Sept 2006 Dec 2006 Mar 2007 Jun 2007 Sep 2007 Soybeans 25 Focused Synergistic Responsible

Fertilizers Rising Grain Prices Corn Source: CBOT Wheat Jun 2005 Sept 2006 Dec 2006 Mar 2007 Jun 2007 Sep 2007 Soybeans 25 Focused Synergistic Responsible

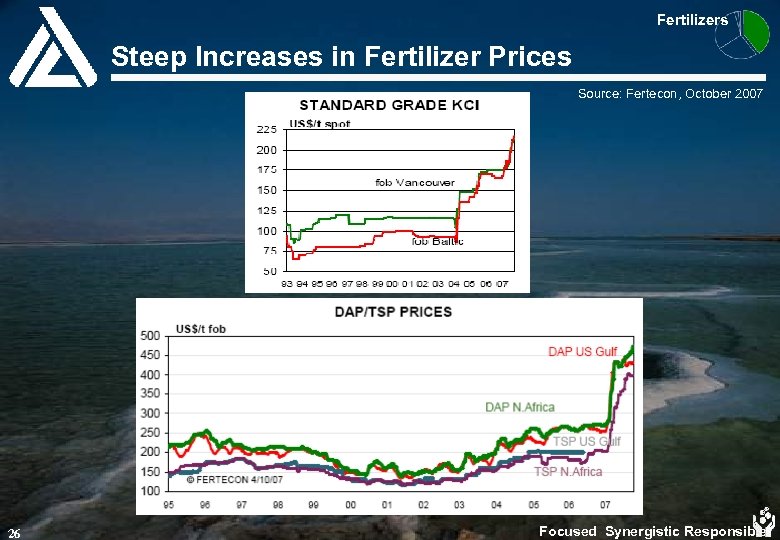

Fertilizers Steep Increases in Fertilizer Prices Source: Fertecon, October 2007 26 Focused Synergistic Responsible

Fertilizers Steep Increases in Fertilizer Prices Source: Fertecon, October 2007 26 Focused Synergistic Responsible

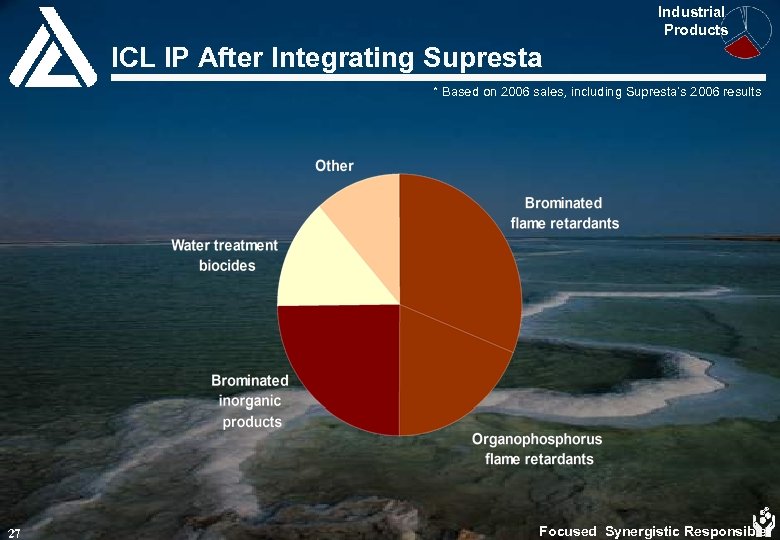

Industrial Products ICL IP After Integrating Supresta * Based on 2006 sales, including Supresta’s 2006 results 27 Focused Synergistic Responsible

Industrial Products ICL IP After Integrating Supresta * Based on 2006 sales, including Supresta’s 2006 results 27 Focused Synergistic Responsible

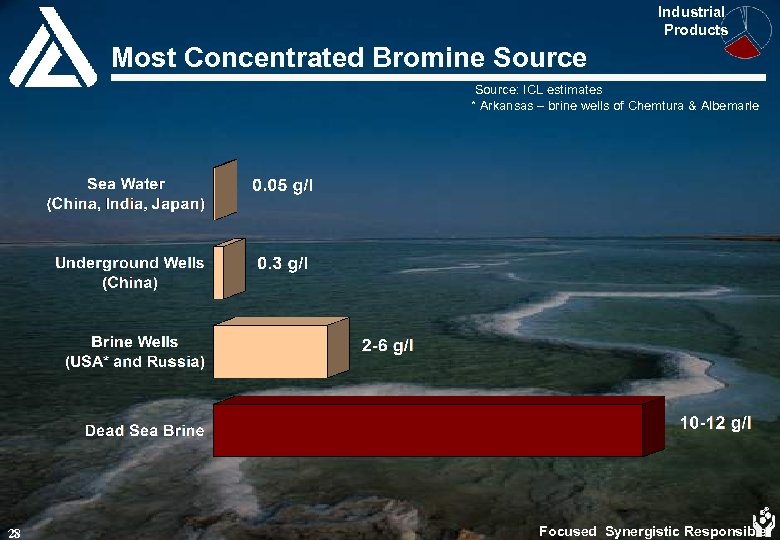

Industrial Products Most Concentrated Bromine Source: ICL estimates * Arkansas – brine wells of Chemtura & Albemarle 28 Focused Synergistic Responsible

Industrial Products Most Concentrated Bromine Source: ICL estimates * Arkansas – brine wells of Chemtura & Albemarle 28 Focused Synergistic Responsible

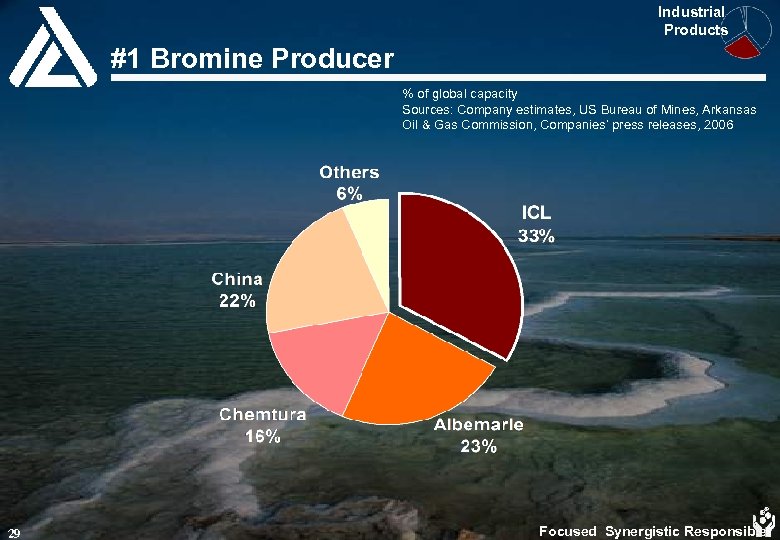

Industrial Products #1 Bromine Producer % of global capacity Sources: Company estimates, US Bureau of Mines, Arkansas Oil & Gas Commission, Companies’ press releases, 2006 29 Focused Synergistic Responsible

Industrial Products #1 Bromine Producer % of global capacity Sources: Company estimates, US Bureau of Mines, Arkansas Oil & Gas Commission, Companies’ press releases, 2006 29 Focused Synergistic Responsible

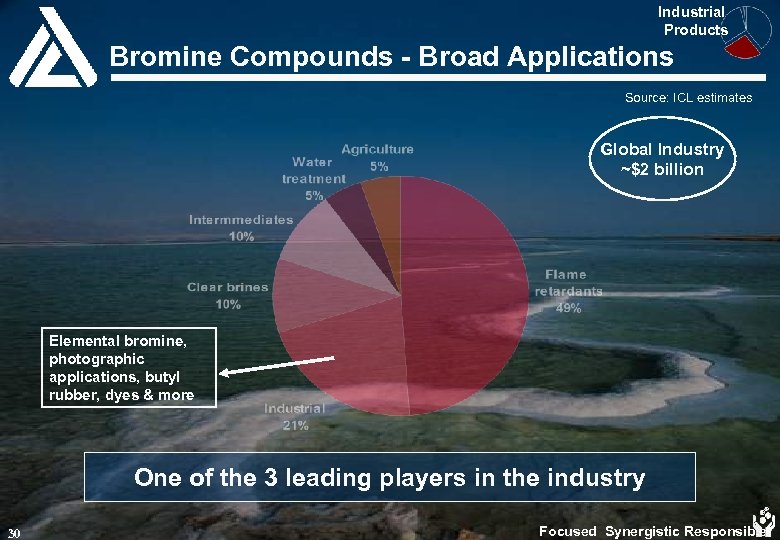

Industrial Products Bromine Compounds - Broad Applications Source: ICL estimates Global Industry ~$2 billion Elemental bromine, photographic applications, butyl rubber, dyes & more One of the 3 leading players in the industry 30 Focused Synergistic Responsible

Industrial Products Bromine Compounds - Broad Applications Source: ICL estimates Global Industry ~$2 billion Elemental bromine, photographic applications, butyl rubber, dyes & more One of the 3 leading players in the industry 30 Focused Synergistic Responsible

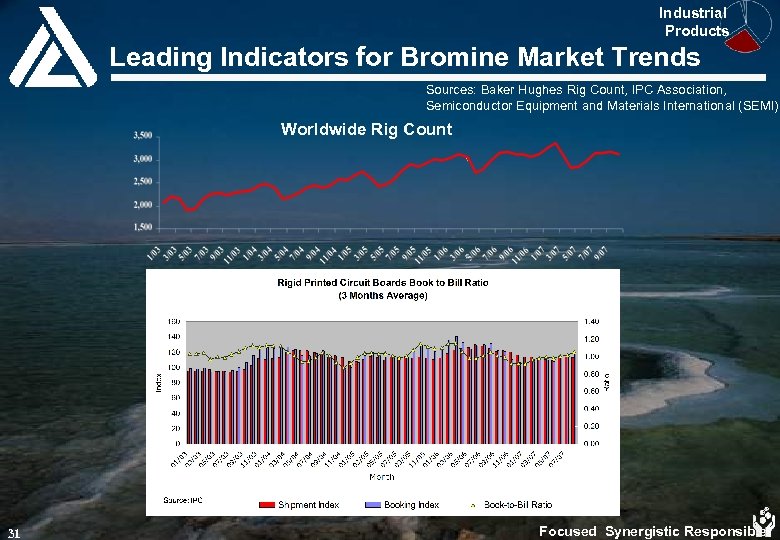

Industrial Products Leading Indicators for Bromine Market Trends Sources: Baker Hughes Rig Count, IPC Association, Semiconductor Equipment and Materials International (SEMI) Worldwide Rig Count 31 Focused Synergistic Responsible

Industrial Products Leading Indicators for Bromine Market Trends Sources: Baker Hughes Rig Count, IPC Association, Semiconductor Equipment and Materials International (SEMI) Worldwide Rig Count 31 Focused Synergistic Responsible

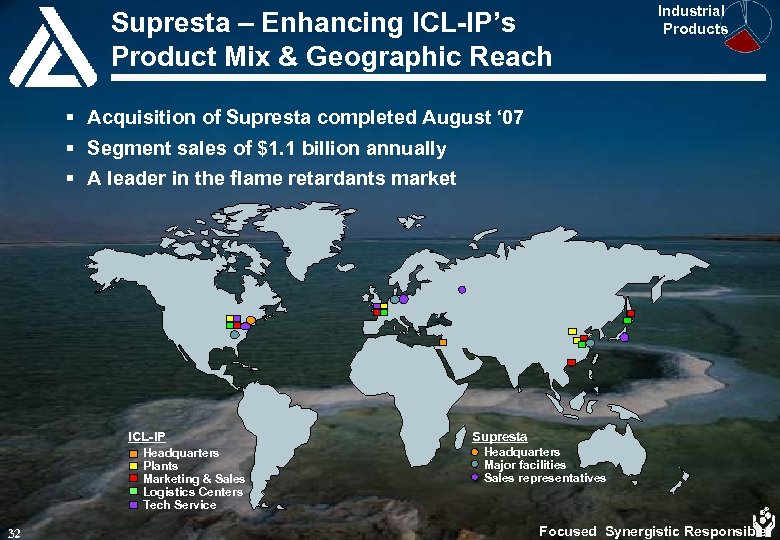

Supresta – Enhancing ICL-IP’s Product Mix & Geographic Reach Industrial Products § Acquisition of Supresta completed August ‘ 07 § Segment sales of $1. 1 billion annually § A leader in the flame retardants market ICL-IP Headquarters Plants Marketing & Sales Logistics Centers Tech Service 32 Supresta Headquarters Major facilities Sales representatives Focused Synergistic Responsible

Supresta – Enhancing ICL-IP’s Product Mix & Geographic Reach Industrial Products § Acquisition of Supresta completed August ‘ 07 § Segment sales of $1. 1 billion annually § A leader in the flame retardants market ICL-IP Headquarters Plants Marketing & Sales Logistics Centers Tech Service 32 Supresta Headquarters Major facilities Sales representatives Focused Synergistic Responsible

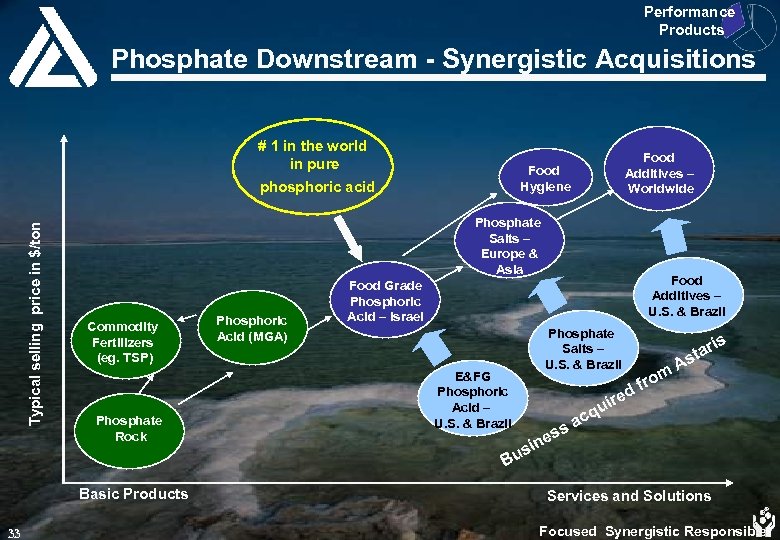

Performance Products Phosphate Downstream - Synergistic Acquisitions # 1 in the world in pure Typical selling price in $/ton phosphoric acid Phosphate Salts – Europe & Asia Commodity Fertilizers (eg. TSP) Phosphate Rock Basic Products 33 Food Additives – Worldwide Food Hygiene Phosphoric Acid (MGA) Food Additives – U. S. & Brazil Food Grade Phosphoric Acid – Israel E&FG Phosphoric Acid – U. S. & Brazil Phosphate Salts – U. S. & Brazil is m ro df r sta A e ir qu c a ss e in s Bu Services and Solutions Focused Synergistic Responsible

Performance Products Phosphate Downstream - Synergistic Acquisitions # 1 in the world in pure Typical selling price in $/ton phosphoric acid Phosphate Salts – Europe & Asia Commodity Fertilizers (eg. TSP) Phosphate Rock Basic Products 33 Food Additives – Worldwide Food Hygiene Phosphoric Acid (MGA) Food Additives – U. S. & Brazil Food Grade Phosphoric Acid – Israel E&FG Phosphoric Acid – U. S. & Brazil Phosphate Salts – U. S. & Brazil is m ro df r sta A e ir qu c a ss e in s Bu Services and Solutions Focused Synergistic Responsible

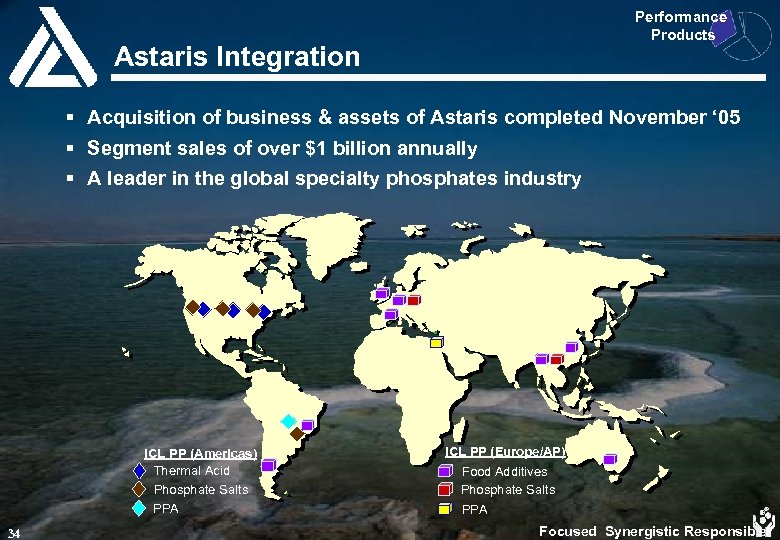

Performance Products Astaris Integration § Acquisition of business & assets of Astaris completed November ‘ 05 § Segment sales of over $1 billion annually § A leader in the global specialty phosphates industry ICL PP (Americas) Thermal Acid Phosphate Salts PPA 34 ICL PP (Europe/AP) Food Additives Phosphate Salts PPA Focused Synergistic Responsible

Performance Products Astaris Integration § Acquisition of business & assets of Astaris completed November ‘ 05 § Segment sales of over $1 billion annually § A leader in the global specialty phosphates industry ICL PP (Americas) Thermal Acid Phosphate Salts PPA 34 ICL PP (Europe/AP) Food Additives Phosphate Salts PPA Focused Synergistic Responsible

Financials

Financials

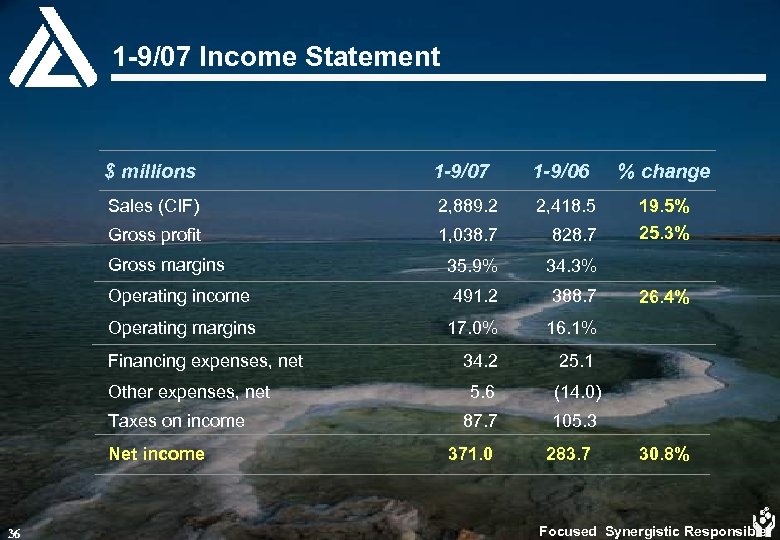

1 -9/07 Income Statement $ millions 1 -9/07 1 -9/06 % change Sales (CIF) 2, 889. 2 2, 418. 5 Gross profit 1, 038. 7 828. 7 19. 5% 25. 3% 35. 9% 34. 3% Operating income 491. 2 388. 7 Operating margins 17. 0% 16. 1% 34. 2 25. 1 5. 6 (14. 0) 87. 7 105. 3 Gross margins Financing expenses, net Other expenses, net Taxes on income Net income 36 371. 0 283. 7 26. 4% 30. 8% Focused Synergistic Responsible

1 -9/07 Income Statement $ millions 1 -9/07 1 -9/06 % change Sales (CIF) 2, 889. 2 2, 418. 5 Gross profit 1, 038. 7 828. 7 19. 5% 25. 3% 35. 9% 34. 3% Operating income 491. 2 388. 7 Operating margins 17. 0% 16. 1% 34. 2 25. 1 5. 6 (14. 0) 87. 7 105. 3 Gross margins Financing expenses, net Other expenses, net Taxes on income Net income 36 371. 0 283. 7 26. 4% 30. 8% Focused Synergistic Responsible

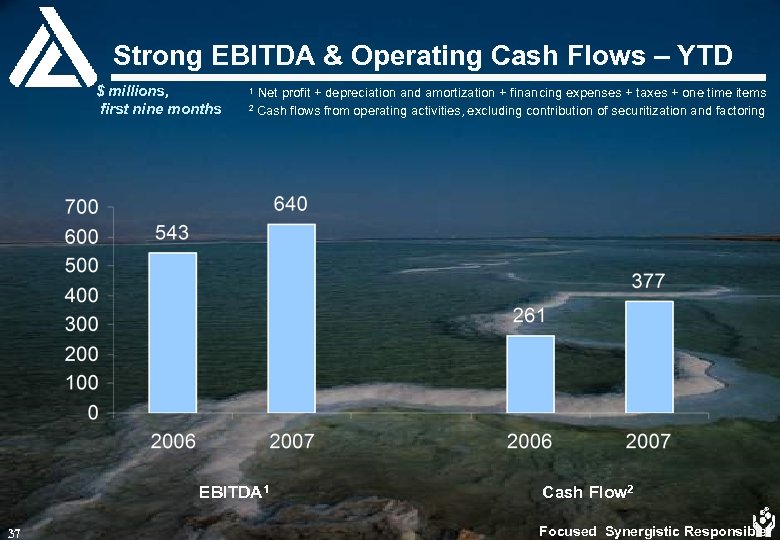

Strong EBITDA & Operating Cash Flows – YTD $ millions, first nine months 1 Net profit + depreciation and amortization + financing expenses + taxes + one time items flows from operating activities, excluding contribution of securitization and factoring 2 Cash EBITDA 1 37 Cash Flow 2 Focused Synergistic Responsible

Strong EBITDA & Operating Cash Flows – YTD $ millions, first nine months 1 Net profit + depreciation and amortization + financing expenses + taxes + one time items flows from operating activities, excluding contribution of securitization and factoring 2 Cash EBITDA 1 37 Cash Flow 2 Focused Synergistic Responsible

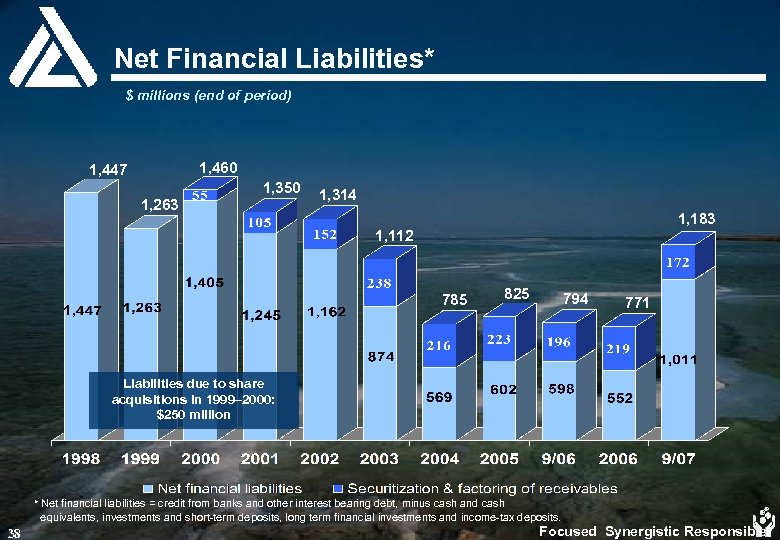

Net Financial Liabilities* $ millions (end of period) 1, 460 1, 447 1, 350 1, 263 1, 314 1, 183 1, 112 785 825 794 771 Liabilities due to share acquisitions in 1999– 2000: $250 million * Net financial liabilities = credit from banks and other interest bearing debt, minus cash and cash equivalents, investments and short-term deposits, long term financial investments and income-tax deposits. 38 Focused Synergistic Responsible

Net Financial Liabilities* $ millions (end of period) 1, 460 1, 447 1, 350 1, 263 1, 314 1, 183 1, 112 785 825 794 771 Liabilities due to share acquisitions in 1999– 2000: $250 million * Net financial liabilities = credit from banks and other interest bearing debt, minus cash and cash equivalents, investments and short-term deposits, long term financial investments and income-tax deposits. 38 Focused Synergistic Responsible

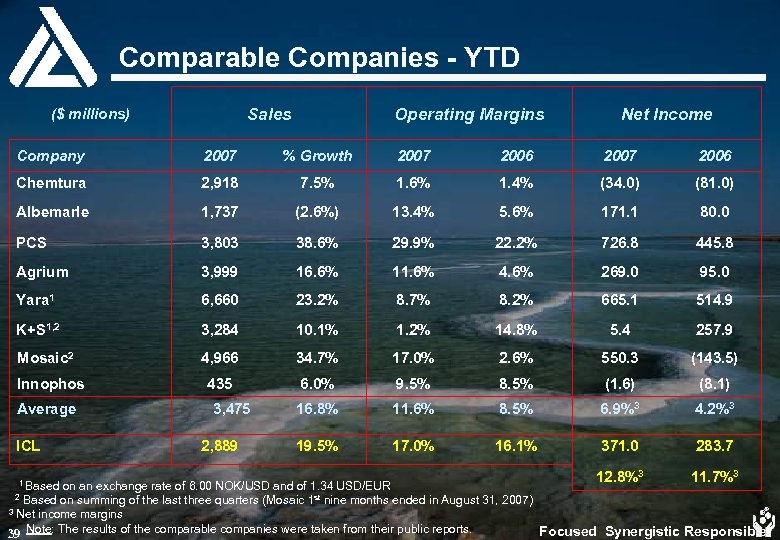

Comparable Companies - YTD Sales ($ millions) Operating Margins Net Income Company 2007 % Growth 2007 2006 Chemtura 2, 918 7. 5% 1. 6% 1. 4% (34. 0) (81. 0) Albemarle 1, 737 (2. 6%) 13. 4% 5. 6% 171. 1 80. 0 PCS 3, 803 38. 6% 29. 9% 22. 2% 726. 8 445. 8 Agrium 3, 999 16. 6% 11. 6% 4. 6% 269. 0 95. 0 Yara 1 6, 660 23. 2% 8. 7% 8. 2% 665. 1 514. 9 K+S 1, 2 3, 284 10. 1% 1. 2% 14. 8% 5. 4 257. 9 Mosaic 2 4, 966 34. 7% 17. 0% 2. 6% 550. 3 (143. 5) 435 6. 0% 9. 5% 8. 5% (1. 6) (8. 1) 16. 8% 11. 6% 8. 5% 6. 9%3 4. 2%3 19. 5% 17. 0% 16. 1% 371. 0 283. 7 12. 8%3 11. 7%3 Innophos Average ICL 1 Based 3, 475 2, 889 on an exchange rate of 6. 00 NOK/USD and of 1. 34 USD/EUR 2 Based on summing of the last three quarters (Mosaic 1 st nine months ended in August 31, 2007) 3 Net income margins Focused Synergistic Responsible 39 Note: The results of the comparable companies were taken from their public reports.

Comparable Companies - YTD Sales ($ millions) Operating Margins Net Income Company 2007 % Growth 2007 2006 Chemtura 2, 918 7. 5% 1. 6% 1. 4% (34. 0) (81. 0) Albemarle 1, 737 (2. 6%) 13. 4% 5. 6% 171. 1 80. 0 PCS 3, 803 38. 6% 29. 9% 22. 2% 726. 8 445. 8 Agrium 3, 999 16. 6% 11. 6% 4. 6% 269. 0 95. 0 Yara 1 6, 660 23. 2% 8. 7% 8. 2% 665. 1 514. 9 K+S 1, 2 3, 284 10. 1% 1. 2% 14. 8% 5. 4 257. 9 Mosaic 2 4, 966 34. 7% 17. 0% 2. 6% 550. 3 (143. 5) 435 6. 0% 9. 5% 8. 5% (1. 6) (8. 1) 16. 8% 11. 6% 8. 5% 6. 9%3 4. 2%3 19. 5% 17. 0% 16. 1% 371. 0 283. 7 12. 8%3 11. 7%3 Innophos Average ICL 1 Based 3, 475 2, 889 on an exchange rate of 6. 00 NOK/USD and of 1. 34 USD/EUR 2 Based on summing of the last three quarters (Mosaic 1 st nine months ended in August 31, 2007) 3 Net income margins Focused Synergistic Responsible 39 Note: The results of the comparable companies were taken from their public reports.

Conclusion ü Multi-national company ü Vast access to natural resources ü Sustainable low cost position high margins ü Growing revenues and substantial profitability ü Strong cash flows and high dividend yield ü Potential cost reduction pending availability of natural gas ü Focused synergistic growth strategy 40 Focused Synergistic Responsible

Conclusion ü Multi-national company ü Vast access to natural resources ü Sustainable low cost position high margins ü Growing revenues and substantial profitability ü Strong cash flows and high dividend yield ü Potential cost reduction pending availability of natural gas ü Focused synergistic growth strategy 40 Focused Synergistic Responsible

Thank You Visit us at: www. icl-group. com

Thank You Visit us at: www. icl-group. com