dd3f72c250a4ee8c4637cac8aa44d3cc.ppt

- Количество слайдов: 42

Hardwood Industry

Hardwood Industry

Three Topics • Current Reality Check • Many Reasons for Optimism • Opportunities for Success

Three Topics • Current Reality Check • Many Reasons for Optimism • Opportunities for Success

Current Market Reality Check: It’s Been a Rough 5 Years

Current Market Reality Check: It’s Been a Rough 5 Years

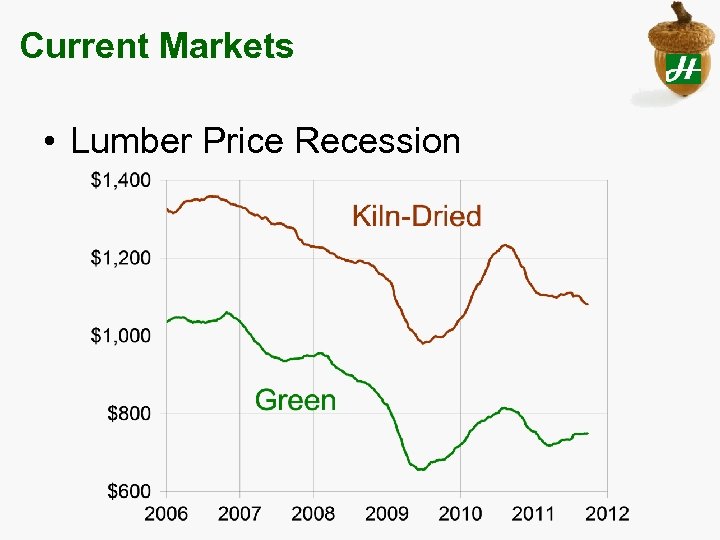

Current Markets • Lumber Price Recession

Current Markets • Lumber Price Recession

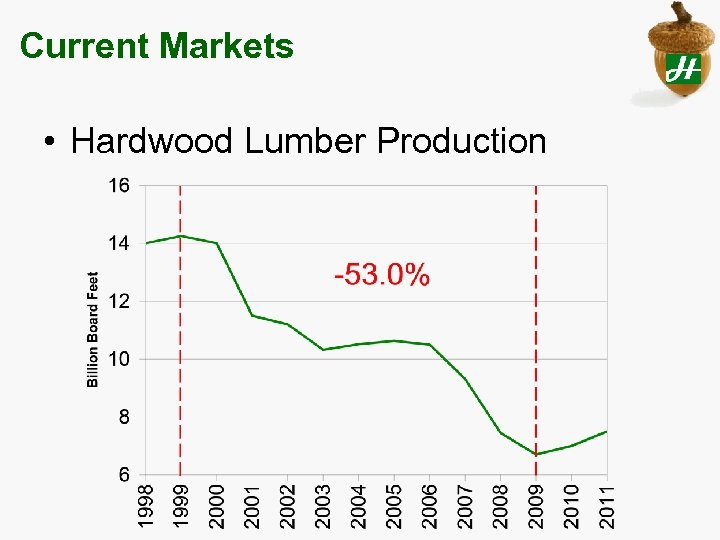

Current Markets • Hardwood Lumber Production

Current Markets • Hardwood Lumber Production

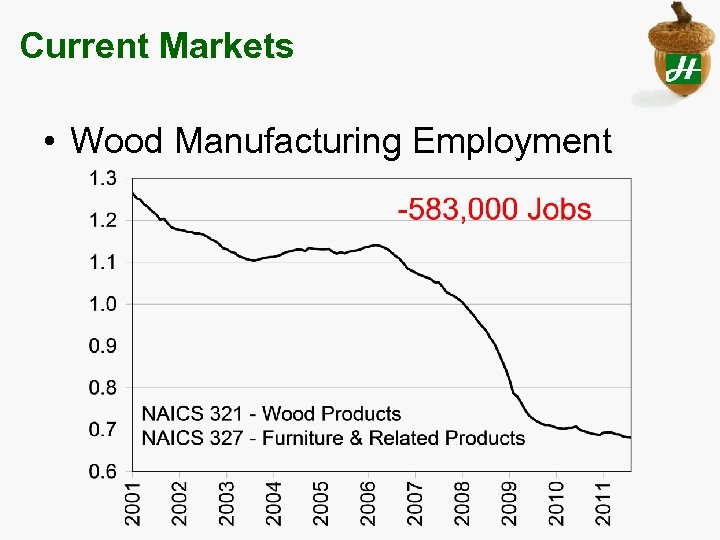

Current Markets • Wood Manufacturing Employment

Current Markets • Wood Manufacturing Employment

Current Markets • Until job markets and economic uncertainty improve…housing will remain depressed. • Until housing markets improve… hardwood industry will remain depressed.

Current Markets • Until job markets and economic uncertainty improve…housing will remain depressed. • Until housing markets improve… hardwood industry will remain depressed.

Many Reasons for Optimism

Many Reasons for Optimism

U. S. Still the Leader • 34% of funds spent on R&D. • 47% of engineering degrees 25 -39 by women. • 30 Nobel prizes in science and economic in last 20 years. China – just one. • 72% of oil needs up from 50% 10 years ago. • 8 of top 10 universities, China-0

U. S. Still the Leader • 34% of funds spent on R&D. • 47% of engineering degrees 25 -39 by women. • 30 Nobel prizes in science and economic in last 20 years. China – just one. • 72% of oil needs up from 50% 10 years ago. • 8 of top 10 universities, China-0

Reasons for Optimism • Housing starts low but stable • New home sales low but stable • Sept existing home sales 34% higher than the low point of July 2010

Reasons for Optimism • Housing starts low but stable • New home sales low but stable • Sept existing home sales 34% higher than the low point of July 2010

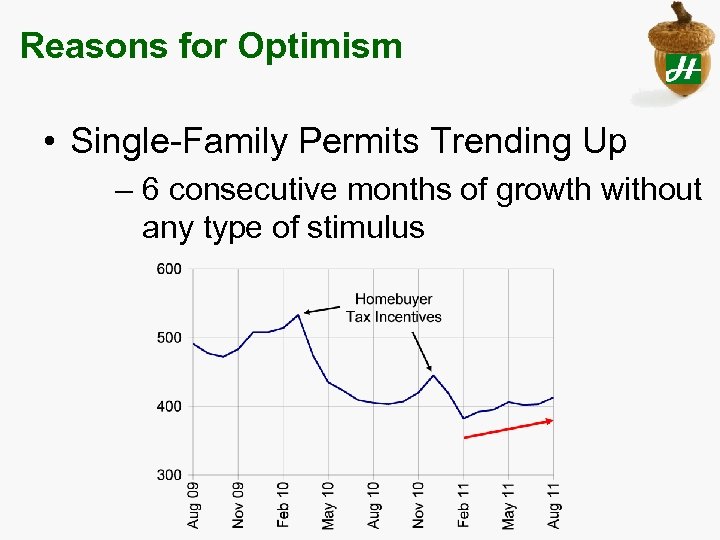

Reasons for Optimism • Single-Family Permits Trending Up – 6 consecutive months of growth without any type of stimulus

Reasons for Optimism • Single-Family Permits Trending Up – 6 consecutive months of growth without any type of stimulus

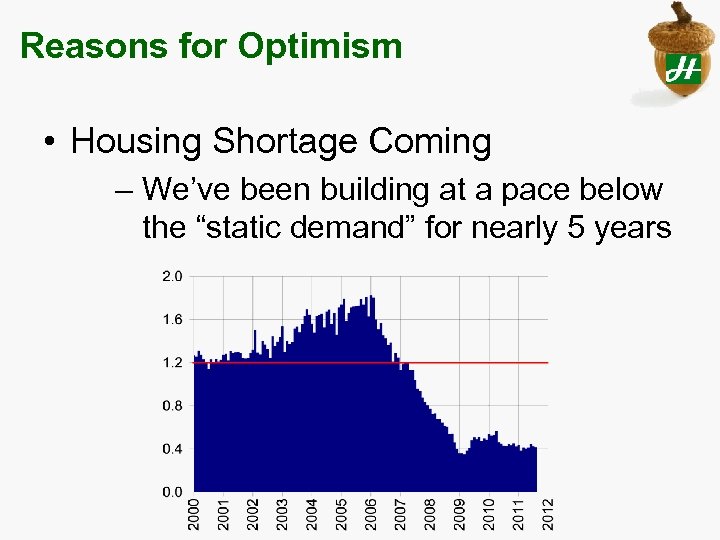

Reasons for Optimism • Housing Shortage Coming – We’ve been building at a pace below the “static demand” for nearly 5 years

Reasons for Optimism • Housing Shortage Coming – We’ve been building at a pace below the “static demand” for nearly 5 years

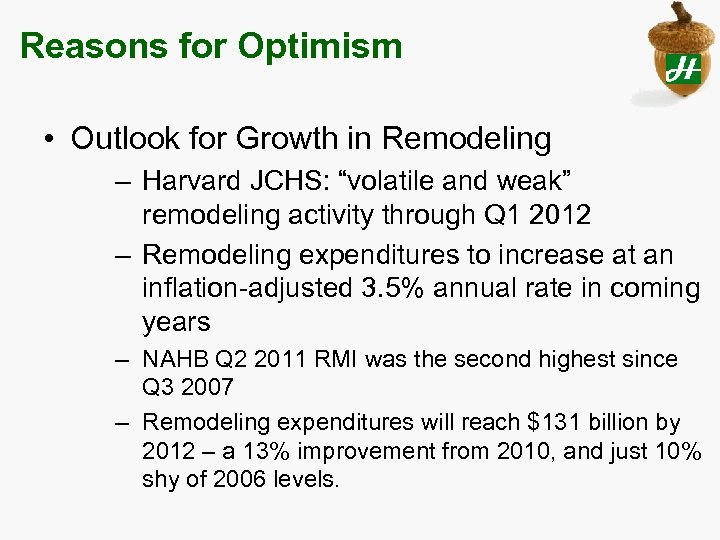

Reasons for Optimism • Outlook for Growth in Remodeling – Harvard JCHS: “volatile and weak” remodeling activity through Q 1 2012 – Remodeling expenditures to increase at an inflation-adjusted 3. 5% annual rate in coming years – NAHB Q 2 2011 RMI was the second highest since Q 3 2007 – Remodeling expenditures will reach $131 billion by 2012 – a 13% improvement from 2010, and just 10% shy of 2006 levels.

Reasons for Optimism • Outlook for Growth in Remodeling – Harvard JCHS: “volatile and weak” remodeling activity through Q 1 2012 – Remodeling expenditures to increase at an inflation-adjusted 3. 5% annual rate in coming years – NAHB Q 2 2011 RMI was the second highest since Q 3 2007 – Remodeling expenditures will reach $131 billion by 2012 – a 13% improvement from 2010, and just 10% shy of 2006 levels.

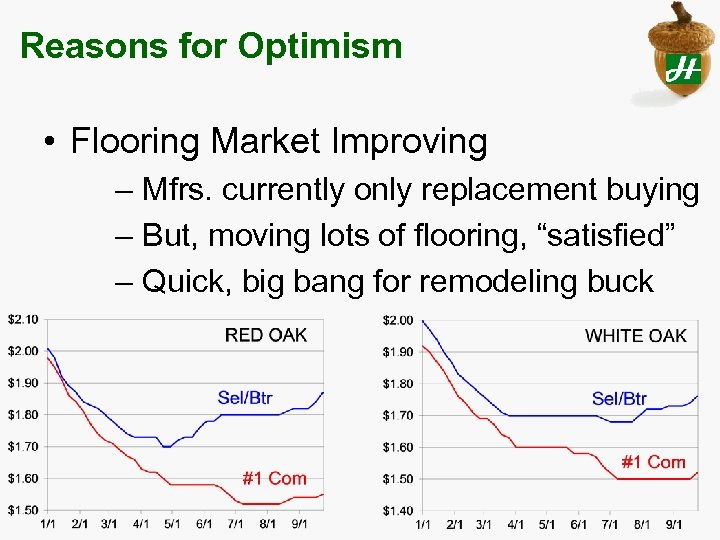

Reasons for Optimism • Flooring Market Improving – Mfrs. currently only replacement buying – But, moving lots of flooring, “satisfied” – Quick, big bang for remodeling buck

Reasons for Optimism • Flooring Market Improving – Mfrs. currently only replacement buying – But, moving lots of flooring, “satisfied” – Quick, big bang for remodeling buck

Reasons for Optimism • Railroad Tie Demand Strong – RTA: Crosstie shipments: +5. 1% in 2011 -0. 7% in 2012 +4. 0% in 2013 +4. 1% in 2014 – American Assoc. of Railroads: Carload volume up 1. 7% ytd Container volume up 5. 5% ytd

Reasons for Optimism • Railroad Tie Demand Strong – RTA: Crosstie shipments: +5. 1% in 2011 -0. 7% in 2012 +4. 0% in 2013 +4. 1% in 2014 – American Assoc. of Railroads: Carload volume up 1. 7% ytd Container volume up 5. 5% ytd

Reasons for Optimism • Low KD Inventories • Barriers to Production Increases – Loggers and log supply – Credit availability – Workers – ~ 50% sawmill capacity reduction (? ) • 1 to 2% demand bump will drive up lumber prices and demand for logs

Reasons for Optimism • Low KD Inventories • Barriers to Production Increases – Loggers and log supply – Credit availability – Workers – ~ 50% sawmill capacity reduction (? ) • 1 to 2% demand bump will drive up lumber prices and demand for logs

Reasons for Optimism • Global Supply Decreasing – ITTO: Hardwood log production down 5%, lumber down 4% since 2006 – China log deficit will reach 180 mil. M 3 by 2015 – Indian plants running below capacity – Widespread sawmill closures in Africa – Legality movement will reduce wood supplies from some SE Asian countries

Reasons for Optimism • Global Supply Decreasing – ITTO: Hardwood log production down 5%, lumber down 4% since 2006 – China log deficit will reach 180 mil. M 3 by 2015 – Indian plants running below capacity – Widespread sawmill closures in Africa – Legality movement will reduce wood supplies from some SE Asian countries

Reasons for Optimism • Exports – China Will Come Back in Spring – Lumber inventories will be thinned out – Government announced plans to increase furniture exports 12% annually during next 5 years – Building furniture manufacturing centers in the North and West China – Building 10 million low-priced units

Reasons for Optimism • Exports – China Will Come Back in Spring – Lumber inventories will be thinned out – Government announced plans to increase furniture exports 12% annually during next 5 years – Building furniture manufacturing centers in the North and West China – Building 10 million low-priced units

Reasons for Optimism • Mexican Market Strong – 36% of imported American hardwoods in Red Oak and Poplar – Manufacturers winning back production from China – Easy to ship relative to other markets (no phyto certificate required)

Reasons for Optimism • Mexican Market Strong – 36% of imported American hardwoods in Red Oak and Poplar – Manufacturers winning back production from China – Easy to ship relative to other markets (no phyto certificate required)

Reasons for Optimism • Some Manufacturing Coming Back to U. S. – Georgia Chopsticks, Americus, GA – Lincolnton Furniture, Lincolnton, NC – Ebonite International, Hopkinsville, KY – Jasper Home, High Point, NC – Folio 21, High Point, NC (new) – Conover Chair, Conover, NC (revived)

Reasons for Optimism • Some Manufacturing Coming Back to U. S. – Georgia Chopsticks, Americus, GA – Lincolnton Furniture, Lincolnton, NC – Ebonite International, Hopkinsville, KY – Jasper Home, High Point, NC – Folio 21, High Point, NC (new) – Conover Chair, Conover, NC (revived)

Reasons for Optimism • U. S. Has Largest Supply of Sustainable Temperate Hardwoods in World – Growing importance of “legal sourcing” – EU Timber Regulation looks like it will accept U. S. hardwoods as “low risk” – LCA studies will favor American hardwoods

Reasons for Optimism • U. S. Has Largest Supply of Sustainable Temperate Hardwoods in World – Growing importance of “legal sourcing” – EU Timber Regulation looks like it will accept U. S. hardwoods as “low risk” – LCA studies will favor American hardwoods

Opportunities for Success: For SCFA For Landowners For Producers

Opportunities for Success: For SCFA For Landowners For Producers

Strategies for SCFA • Pressure Administration to Sell More Timber – 80% reduction in harvests since late 1980 s – For the health of the industry and the forest – 16 National Forests in AL, GA, SC, FL, NC. – 49. 8 billion board feet of hardwood sawtimber in 12 surrounding states

Strategies for SCFA • Pressure Administration to Sell More Timber – 80% reduction in harvests since late 1980 s – For the health of the industry and the forest – 16 National Forests in AL, GA, SC, FL, NC. – 49. 8 billion board feet of hardwood sawtimber in 12 surrounding states

Strategies for TFA • Encourage USFS to Proactively Sell the Hardwood “Sustainability Story” – Failure to do so was identified as a key barrier to industry success at the 2010 Hardwood Leaders Forum – Southern FIA in Knoxville – Director Bill Burkman has indicated some support for doing so – USDA may be coming around

Strategies for TFA • Encourage USFS to Proactively Sell the Hardwood “Sustainability Story” – Failure to do so was identified as a key barrier to industry success at the 2010 Hardwood Leaders Forum – Southern FIA in Knoxville – Director Bill Burkman has indicated some support for doing so – USDA may be coming around

Strategies for TFA • USDA’s “National Report on Sustainable Forests— 2010” – Relationship between harvesting and sustainability is positive – Markets and management keep forests in forests – Healthy forest industry tied with sustained production of environmental, economic and social benefits

Strategies for TFA • USDA’s “National Report on Sustainable Forests— 2010” – Relationship between harvesting and sustainability is positive – Markets and management keep forests in forests – Healthy forest industry tied with sustained production of environmental, economic and social benefits

Strategies for TFA • Push for National Certification (? ) – By USDA? – Markets will increasingly be closed to non-certified wood products – Australia is currently working on most restrictive illegal logging bill • Will require verified legal certification • 80% of imported hardwood is White Oak

Strategies for TFA • Push for National Certification (? ) – By USDA? – Markets will increasingly be closed to non-certified wood products – Australia is currently working on most restrictive illegal logging bill • Will require verified legal certification • 80% of imported hardwood is White Oak

Strategies for TFA • Partner with Other Organizations – Key recommendation of HLF – Find a supporting role – Focus on doing one thing better than all other organizations – Be willing to work outside the state on issues that ultimately benefit state’s forests and industry

Strategies for TFA • Partner with Other Organizations – Key recommendation of HLF – Find a supporting role – Focus on doing one thing better than all other organizations – Be willing to work outside the state on issues that ultimately benefit state’s forests and industry

Strategies for TFA • Possible Partnerships…. . – Hardwood Federation – NEW Federal Forest Resource Coalition – United Hardwood Promotion – Hardwood Check-off

Strategies for TFA • Possible Partnerships…. . – Hardwood Federation – NEW Federal Forest Resource Coalition – United Hardwood Promotion – Hardwood Check-off

Strategies for Landowners • Sell Timber – Even at below-desired prices – Timber prices should fluctuate with markets for wood products – Holding timber off the market • artificially inflates log prices • drives out of business the companies you eventually want as buyers • limits long-term market options

Strategies for Landowners • Sell Timber – Even at below-desired prices – Timber prices should fluctuate with markets for wood products – Holding timber off the market • artificially inflates log prices • drives out of business the companies you eventually want as buyers • limits long-term market options

Strategies for Landowners • Certification – Group or individual – Will give market access advantage at some point – May give payback in higher timber prices now or down the road

Strategies for Landowners • Certification – Group or individual – Will give market access advantage at some point – May give payback in higher timber prices now or down the road

Strategies for Landowners • Tap into new markets – Bio-fuels/pellets – Need to replace lost pulp/paper demand – Offers potential to pay for thinning, intermediate management – Potential to increase total timber sale revenue

Strategies for Landowners • Tap into new markets – Bio-fuels/pellets – Need to replace lost pulp/paper demand – Offers potential to pay for thinning, intermediate management – Potential to increase total timber sale revenue

Strategies for Companies • Expand exports – 50% of #1/Btr lumber produced sold into foreign markets – Only grade lumber growth market for next few years – Getting easier for small companies to directly export – Assistance available through AHEC and US Dept of Commerce (Trade. gov)

Strategies for Companies • Expand exports – 50% of #1/Btr lumber produced sold into foreign markets – Only grade lumber growth market for next few years – Getting easier for small companies to directly export – Assistance available through AHEC and US Dept of Commerce (Trade. gov)

Strategies for Companies • Give export customers what they want – Fixed widths – Fixed lengths – Metric thicknesses • Half of the world’s consumers of hardwood grade lumber want a product most U. S. companies are unable or unwilling to make!

Strategies for Companies • Give export customers what they want – Fixed widths – Fixed lengths – Metric thicknesses • Half of the world’s consumers of hardwood grade lumber want a product most U. S. companies are unable or unwilling to make!

Strategies for Companies • Diversify markets – Export markets are fickle – Forego short-term gains to build broader customer base – Look to emerging markets • India • Turkey

Strategies for Companies • Diversify markets – Export markets are fickle – Forego short-term gains to build broader customer base – Look to emerging markets • India • Turkey

Strategies for Companies • Consider Certification – Even if timber supplies and ROI are lacking – Noah built the ark when it was still sunny – Difficult process to navigate under pressure – LEED is flirting with opening up credits for SFI, PEFC

Strategies for Companies • Consider Certification – Even if timber supplies and ROI are lacking – Noah built the ark when it was still sunny – Difficult process to navigate under pressure – LEED is flirting with opening up credits for SFI, PEFC

Strategies for Companies • Grow online marketing – Reach foreign buyers 24/7 – Increase reach, reduce costs • Hardwood Review. com – Wood. Logics™ buyer/seller tool – Prospecting database – Market intelligence, trade data – Price histories/forecasts

Strategies for Companies • Grow online marketing – Reach foreign buyers 24/7 – Increase reach, reduce costs • Hardwood Review. com – Wood. Logics™ buyer/seller tool – Prospecting database – Market intelligence, trade data – Price histories/forecasts

Issues to Watch

Issues to Watch

Issues to Watch • Hardwood Check-off – Currently in review by USDA – Will publish sometime this fall – 60 -day comment period – Additional USDA revisions – Industry vote expected in March/April

Issues to Watch • Hardwood Check-off – Currently in review by USDA – Will publish sometime this fall – 60 -day comment period – Additional USDA revisions – Industry vote expected in March/April

Issues to Watch • Lacey Act – Supporting by many in hardwood industry for jobs and price protection – Gibson incident has divided industry into two camps: • Re-open Lacey Act for revisions • Don’t re-open…at least not yet

Issues to Watch • Lacey Act – Supporting by many in hardwood industry for jobs and price protection – Gibson incident has divided industry into two camps: • Re-open Lacey Act for revisions • Don’t re-open…at least not yet

Summary

Summary

Summary • Markets will remain tough for 1 -2 more years, but likely get no worse • Production is stable, somewhat restricted…good for prices in a supply driven market • Small demand increases = big impacts • Long-term demand outlook good, especially export demand

Summary • Markets will remain tough for 1 -2 more years, but likely get no worse • Production is stable, somewhat restricted…good for prices in a supply driven market • Small demand increases = big impacts • Long-term demand outlook good, especially export demand

Summary • Industry is smaller, smarter, more nimble • Industry is more willing to produce to demand • Sustainability and size of hardwood resource positions U. S. very well for global growth in years ahead • Best time to get ready is now!

Summary • Industry is smaller, smarter, more nimble • Industry is more willing to produce to demand • Sustainability and size of hardwood resource positions U. S. very well for global growth in years ahead • Best time to get ready is now!