7e60c25a615defcd0b7aa28a7b47d9b5.ppt

- Количество слайдов: 19

Handling Complex Decisions in the Development of New Drugs in Pharmaceutical Firms Cassimon, Engelen and Yordanov FUR XII, LUISS, Roma, Italy, 22 -26 June 2006 © Peter-Jan Engelen

Handling Complex Decisions in the Development of New Drugs in Pharmaceutical Firms Cassimon, Engelen and Yordanov FUR XII, LUISS, Roma, Italy, 22 -26 June 2006 © Peter-Jan Engelen

Valuation of pharma companies n Financial analysts typically split the value of a pharmaceutical company in three building blocks: (i) existing marketed products; (ii) new products in the mid to late stage of development (phase II and III of the clinical testing); (iii) early R&D. Valuation is problematic with current models © Peter-Jan Engelen

Valuation of pharma companies n Financial analysts typically split the value of a pharmaceutical company in three building blocks: (i) existing marketed products; (ii) new products in the mid to late stage of development (phase II and III of the clinical testing); (iii) early R&D. Valuation is problematic with current models © Peter-Jan Engelen

Real option characteristics of projects n Financial option: right (not an obligation) to buy or sell a certain asset at specific moments at a predetermined price n What are real options? þ Recognizing the project itself or certain components as options þ A project is an option, whereby the company obtains the right to all future FOCFs the project generates, in exchange for a predetermined price (investment cost of the project) n Different types of real options þ Growth options, options to delay, etc. © Peter-Jan Engelen

Real option characteristics of projects n Financial option: right (not an obligation) to buy or sell a certain asset at specific moments at a predetermined price n What are real options? þ Recognizing the project itself or certain components as options þ A project is an option, whereby the company obtains the right to all future FOCFs the project generates, in exchange for a predetermined price (investment cost of the project) n Different types of real options þ Growth options, options to delay, etc. © Peter-Jan Engelen

Real option approach to R&D n Benefits of real option approach compared to traditional models: þCan handle operational flexibility with respect to investment decisions • Abandonnement, delay or adjustment of projects, e. g. stop R&D of particular drug þTakes into account the strategic value of a project because of its interdependence with future projects • R&D give option to follow-up projects • Real option models are better suited to value R&D © Peter-Jan Engelen

Real option approach to R&D n Benefits of real option approach compared to traditional models: þCan handle operational flexibility with respect to investment decisions • Abandonnement, delay or adjustment of projects, e. g. stop R&D of particular drug þTakes into account the strategic value of a project because of its interdependence with future projects • R&D give option to follow-up projects • Real option models are better suited to value R&D © Peter-Jan Engelen

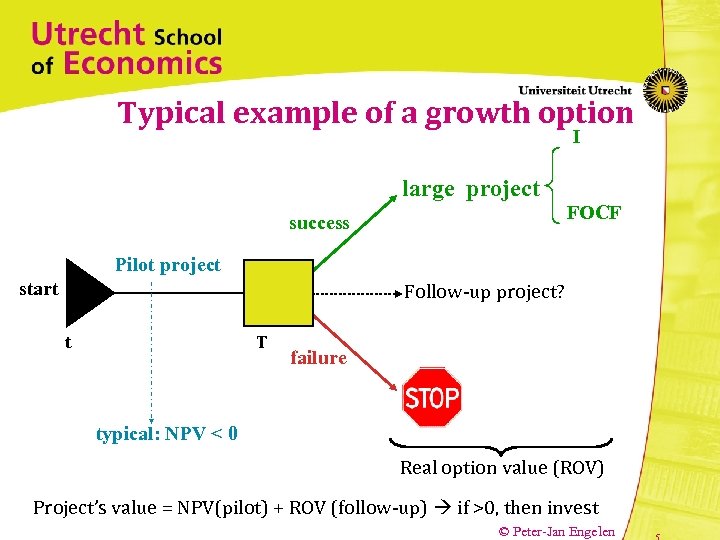

Typical example of a growth option I large project FOCF success Pilot project start Follow-up project? t T failure typical: NPV < 0 Real option value (ROV) Project’s value = NPV(pilot) + ROV (follow-up) if >0, then invest © Peter-Jan Engelen

Typical example of a growth option I large project FOCF success Pilot project start Follow-up project? t T failure typical: NPV < 0 Real option value (ROV) Project’s value = NPV(pilot) + ROV (follow-up) if >0, then invest © Peter-Jan Engelen

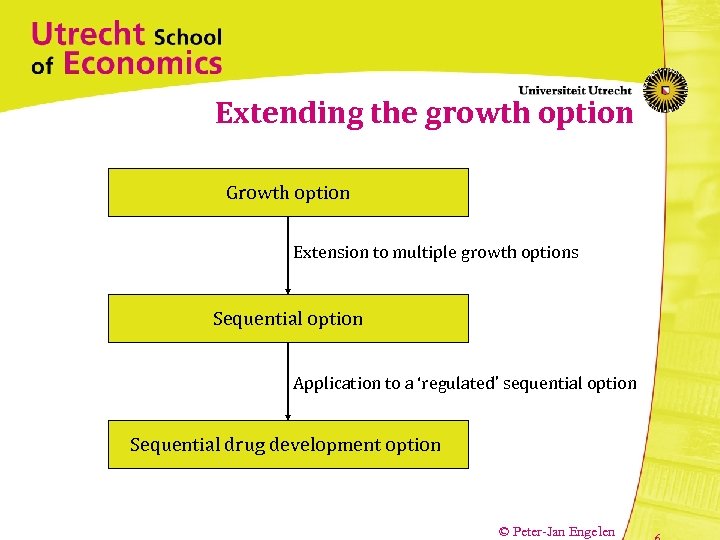

Extending the growth option Growth option Extension to multiple growth options Sequential option Application to a ‘regulated’ sequential option Sequential drug development option © Peter-Jan Engelen

Extending the growth option Growth option Extension to multiple growth options Sequential option Application to a ‘regulated’ sequential option Sequential drug development option © Peter-Jan Engelen

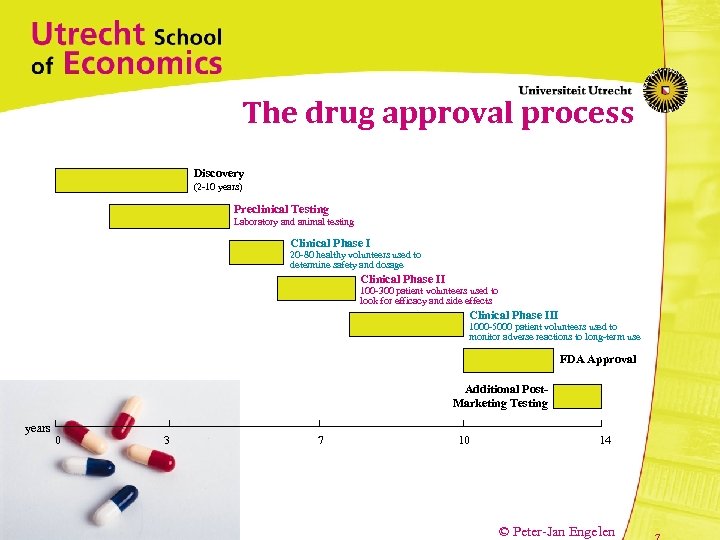

The drug approval process Discovery (2 -10 years) Preclinical Testing Laboratory and animal testing Clinical Phase I 20 -80 healthy volunteers used to determine safety and dosage Clinical Phase II 100 -300 patient volunteers used to look for efficacy and side effects Clinical Phase III 1000 -5000 patient volunteers used to monitor adverse reactions to long-term use FDA Approval Additional Post. Marketing Testing years 0 3 7 10 14 © Peter-Jan Engelen

The drug approval process Discovery (2 -10 years) Preclinical Testing Laboratory and animal testing Clinical Phase I 20 -80 healthy volunteers used to determine safety and dosage Clinical Phase II 100 -300 patient volunteers used to look for efficacy and side effects Clinical Phase III 1000 -5000 patient volunteers used to monitor adverse reactions to long-term use FDA Approval Additional Post. Marketing Testing years 0 3 7 10 14 © Peter-Jan Engelen

Opening the R&D black box © Peter-Jan Engelen

Opening the R&D black box © Peter-Jan Engelen

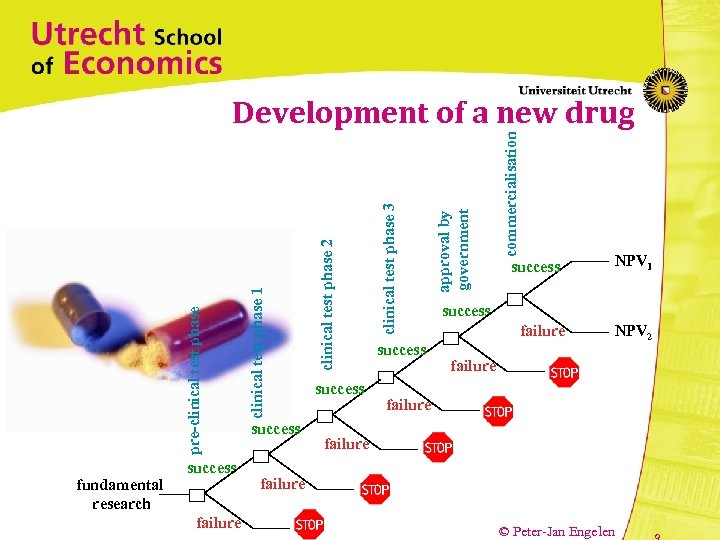

fundamental research success failure success commercialisation approval by government clinical test phase 3 clinical test phase 2 clinical test phase 1 pre-clinical test phase Development of a new drug success NPV 1 success failure NPV 2 failure © Peter-Jan Engelen

fundamental research success failure success commercialisation approval by government clinical test phase 3 clinical test phase 2 clinical test phase 1 pre-clinical test phase Development of a new drug success NPV 1 success failure NPV 2 failure © Peter-Jan Engelen

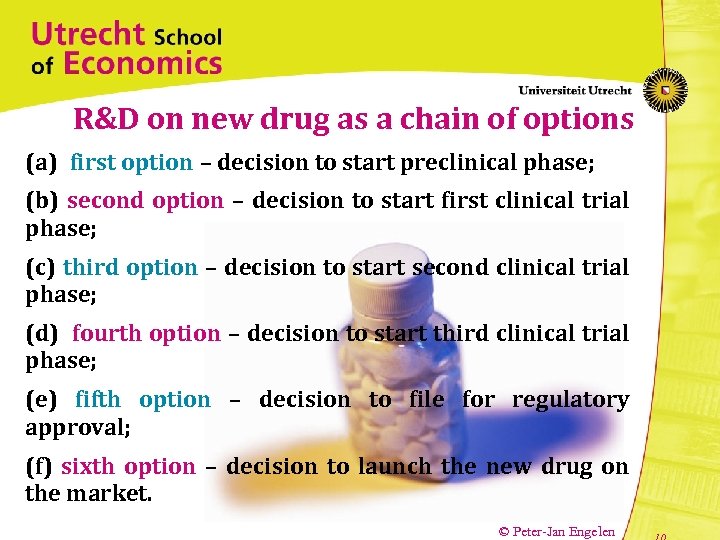

R&D on new drug as a chain of options (a) first option – decision to start preclinical phase; (b) second option – decision to start first clinical trial phase; (c) third option – decision to start second clinical trial phase; (d) fourth option – decision to start third clinical trial phase; (e) fifth option – decision to file for regulatory approval; (f) sixth option – decision to launch the new drug on the market. © Peter-Jan Engelen

R&D on new drug as a chain of options (a) first option – decision to start preclinical phase; (b) second option – decision to start first clinical trial phase; (c) third option – decision to start second clinical trial phase; (d) fourth option – decision to start third clinical trial phase; (e) fifth option – decision to file for regulatory approval; (f) sixth option – decision to launch the new drug on the market. © Peter-Jan Engelen

How to value this chain of real options? n Chain of real options in drug development can be seen as a case of compound option models n Geske (1979) – 2 -fold compound option (option on an option) n R&D of new drug – 6 -fold compound option n We use the extended n-fold compound option model of Cassimon et al. (2004) n Programmed in Matlab © Peter-Jan Engelen

How to value this chain of real options? n Chain of real options in drug development can be seen as a case of compound option models n Geske (1979) – 2 -fold compound option (option on an option) n R&D of new drug – 6 -fold compound option n We use the extended n-fold compound option model of Cassimon et al. (2004) n Programmed in Matlab © Peter-Jan Engelen

Case-study Xandee Biochemical, Ltd. © Peter-Jan Engelen

Case-study Xandee Biochemical, Ltd. © Peter-Jan Engelen

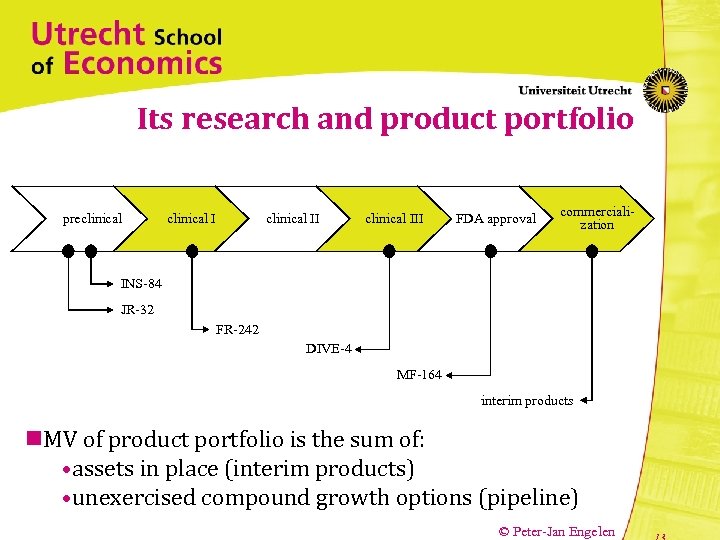

Its research and product portfolio preclinical III FDA approval commercialization INS-84 JR-32 FR-242 DIVE-4 MF-164 interim products n. MV of product portfolio is the sum of: • assets in place (interim products) • unexercised compound growth options (pipeline) © Peter-Jan Engelen

Its research and product portfolio preclinical III FDA approval commercialization INS-84 JR-32 FR-242 DIVE-4 MF-164 interim products n. MV of product portfolio is the sum of: • assets in place (interim products) • unexercised compound growth options (pipeline) © Peter-Jan Engelen

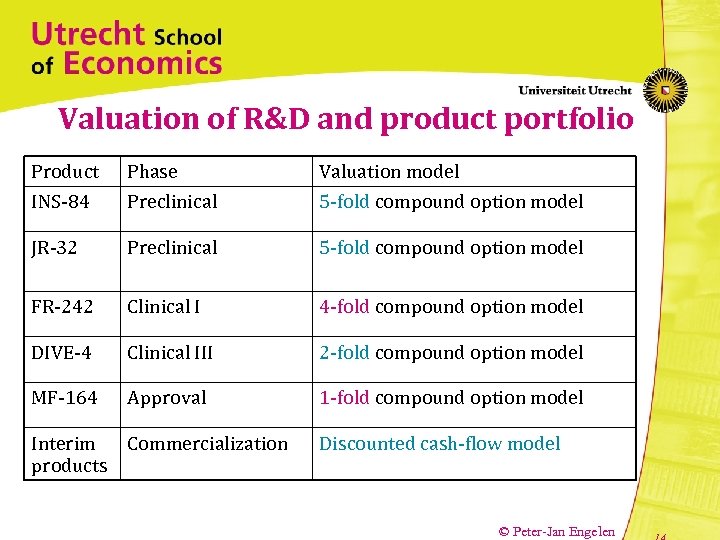

Valuation of R&D and product portfolio Product INS-84 Phase Preclinical Valuation model 5 -fold compound option model JR-32 Preclinical 5 -fold compound option model FR-242 Clinical I 4 -fold compound option model DIVE-4 Clinical III 2 -fold compound option model MF-164 Approval 1 -fold compound option model Interim Commercialization products Discounted cash-flow model © Peter-Jan Engelen

Valuation of R&D and product portfolio Product INS-84 Phase Preclinical Valuation model 5 -fold compound option model JR-32 Preclinical 5 -fold compound option model FR-242 Clinical I 4 -fold compound option model DIVE-4 Clinical III 2 -fold compound option model MF-164 Approval 1 -fold compound option model Interim Commercialization products Discounted cash-flow model © Peter-Jan Engelen

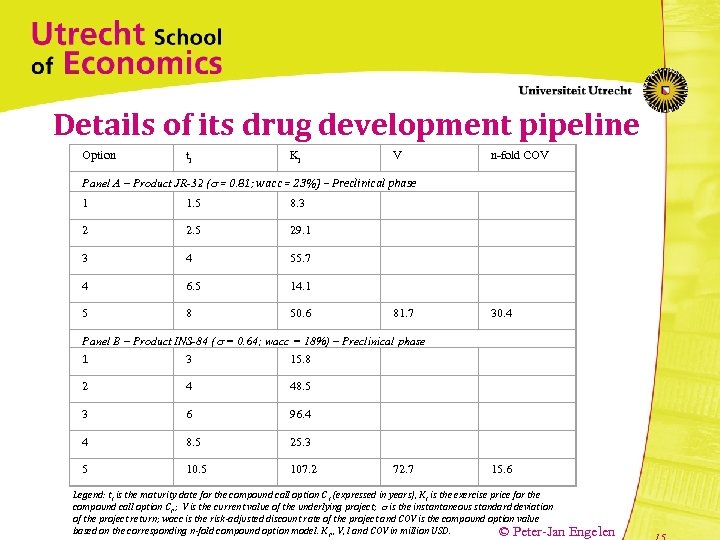

Details of its drug development pipeline Option ti Ki V n-fold COV Panel A – Product JR-32 ( = 0. 81; wacc = 23%) – Preclinical phase 1 1. 5 8. 3 2 2. 5 29. 1 3 4 55. 7 4 6. 5 14. 1 5 8 50. 6 81. 7 30. 4 Panel B – Product INS-84 ( = 0. 64; wacc = 18%) – Preclinical phase 3 15. 8 1 2 4 48. 5 3 6 96. 4 4 8. 5 25. 3 5 107. 2 72. 7 15. 6 Legend: t i is the maturity date for the compound call option C i (expressed in years), K i is the exercise price for the compound call option C i, ; V is the current value of the underlying project; is the instantaneous standard deviation of the project return; wacc is the risk-adjusted discount rate of the project and COV is the compound option value based on the corresponding n-fold compound option model. K i, , V, I and COV in million USD. © Peter-Jan Engelen

Details of its drug development pipeline Option ti Ki V n-fold COV Panel A – Product JR-32 ( = 0. 81; wacc = 23%) – Preclinical phase 1 1. 5 8. 3 2 2. 5 29. 1 3 4 55. 7 4 6. 5 14. 1 5 8 50. 6 81. 7 30. 4 Panel B – Product INS-84 ( = 0. 64; wacc = 18%) – Preclinical phase 3 15. 8 1 2 4 48. 5 3 6 96. 4 4 8. 5 25. 3 5 107. 2 72. 7 15. 6 Legend: t i is the maturity date for the compound call option C i (expressed in years), K i is the exercise price for the compound call option C i, ; V is the current value of the underlying project; is the instantaneous standard deviation of the project return; wacc is the risk-adjusted discount rate of the project and COV is the compound option value based on the corresponding n-fold compound option model. K i, , V, I and COV in million USD. © Peter-Jan Engelen

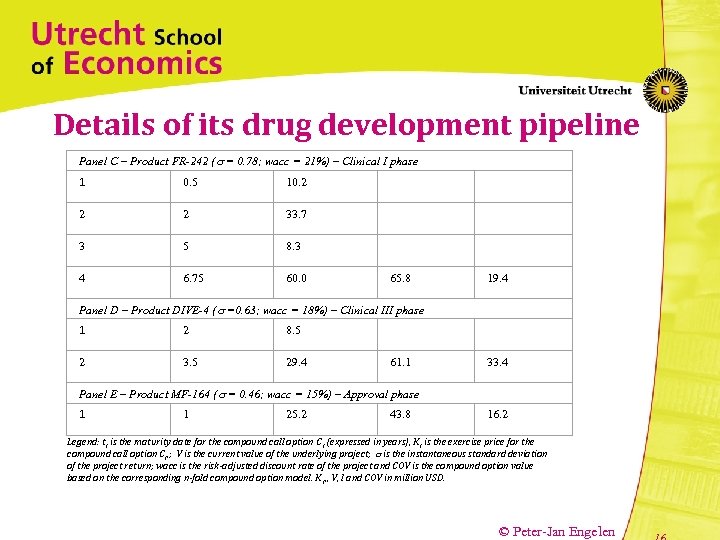

Details of its drug development pipeline Panel C – Product FR-242 ( = 0. 78; wacc = 21%) – Clinical I phase 1 0. 5 10. 2 2 2 33. 7 3 5 8. 3 4 6. 75 60. 0 65. 8 19. 4 Panel D – Product DIVE-4 ( =0. 63; wacc = 18%) – Clinical III phase 1 2 8. 5 2 3. 5 29. 4 61. 1 33. 4 Panel E – Product MF-164 ( = 0. 46; wacc = 15%) – Approval phase 1 1 25. 2 43. 8 16. 2 Legend: t i is the maturity date for the compound call option C i (expressed in years), K i is the exercise price for the compound call option C i, ; V is the current value of the underlying project; is the instantaneous standard deviation of the project return; wacc is the risk-adjusted discount rate of the project and COV is the compound option value based on the corresponding n-fold compound option model. K i, , V, I and COV in million USD. © Peter-Jan Engelen

Details of its drug development pipeline Panel C – Product FR-242 ( = 0. 78; wacc = 21%) – Clinical I phase 1 0. 5 10. 2 2 2 33. 7 3 5 8. 3 4 6. 75 60. 0 65. 8 19. 4 Panel D – Product DIVE-4 ( =0. 63; wacc = 18%) – Clinical III phase 1 2 8. 5 2 3. 5 29. 4 61. 1 33. 4 Panel E – Product MF-164 ( = 0. 46; wacc = 15%) – Approval phase 1 1 25. 2 43. 8 16. 2 Legend: t i is the maturity date for the compound call option C i (expressed in years), K i is the exercise price for the compound call option C i, ; V is the current value of the underlying project; is the instantaneous standard deviation of the project return; wacc is the risk-adjusted discount rate of the project and COV is the compound option value based on the corresponding n-fold compound option model. K i, , V, I and COV in million USD. © Peter-Jan Engelen

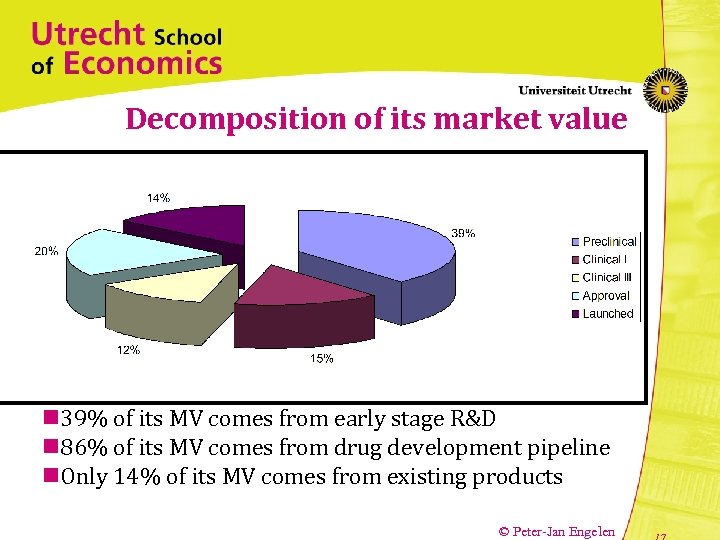

Decomposition of its market value n 39% of its MV comes from early stage R&D n 86% of its MV comes from drug development pipeline n. Only 14% of its MV comes from existing products © Peter-Jan Engelen

Decomposition of its market value n 39% of its MV comes from early stage R&D n 86% of its MV comes from drug development pipeline n. Only 14% of its MV comes from existing products © Peter-Jan Engelen

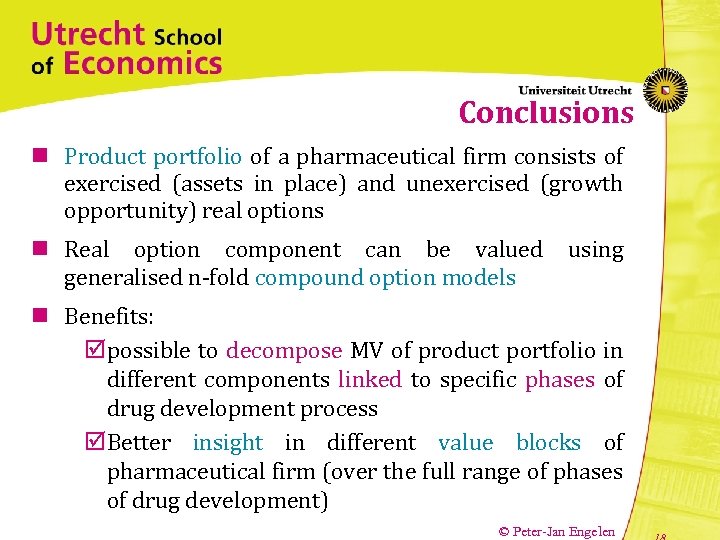

Conclusions n Product portfolio of a pharmaceutical firm consists of exercised (assets in place) and unexercised (growth opportunity) real options n Real option component can be valued generalised n-fold compound option models using n Benefits: þpossible to decompose MV of product portfolio in different components linked to specific phases of drug development process þBetter insight in different value blocks of pharmaceutical firm (over the full range of phases of drug development) © Peter-Jan Engelen

Conclusions n Product portfolio of a pharmaceutical firm consists of exercised (assets in place) and unexercised (growth opportunity) real options n Real option component can be valued generalised n-fold compound option models using n Benefits: þpossible to decompose MV of product portfolio in different components linked to specific phases of drug development process þBetter insight in different value blocks of pharmaceutical firm (over the full range of phases of drug development) © Peter-Jan Engelen

Contact information If you have … • comments or suggestions, • proposals for research collaboration, or • proposals for consulting work, … please contact us at: p. engelen@econ. uu. nl Peter-Jan Engelen Utrecht University, Vredenburg 138 3511 BG Utrecht, Netherlands © Peter-Jan Engelen

Contact information If you have … • comments or suggestions, • proposals for research collaboration, or • proposals for consulting work, … please contact us at: p. engelen@econ. uu. nl Peter-Jan Engelen Utrecht University, Vredenburg 138 3511 BG Utrecht, Netherlands © Peter-Jan Engelen