6b3f2e4436105d3c702ad8bf272dcafa.ppt

- Количество слайдов: 51

Hampshire Economic Assessment 2013 Update May 2013

Hampshire Economic Assessment 2013 Update May 2013

Hampshire • Facts about Hampshire • Place • Population • Economy • Key sector strengths • Hampshire’s key assets • Main areas of future growth

Hampshire • Facts about Hampshire • Place • Population • Economy • Key sector strengths • Hampshire’s key assets • Main areas of future growth

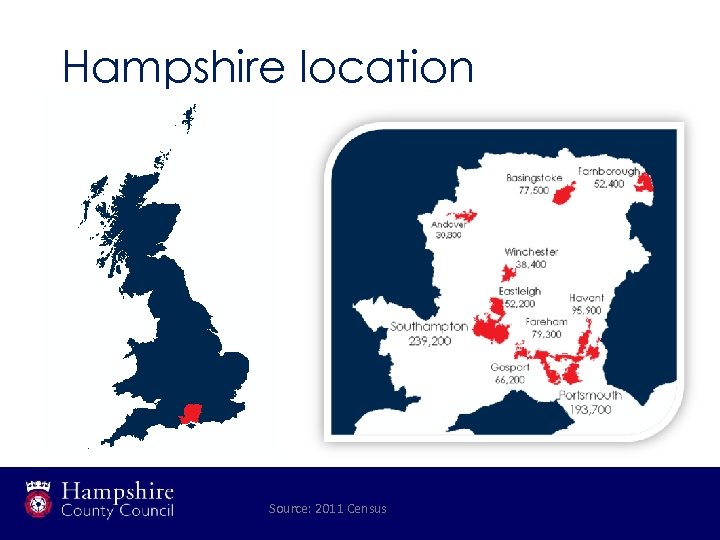

Hampshire location Source: 2011 Census

Hampshire location Source: 2011 Census

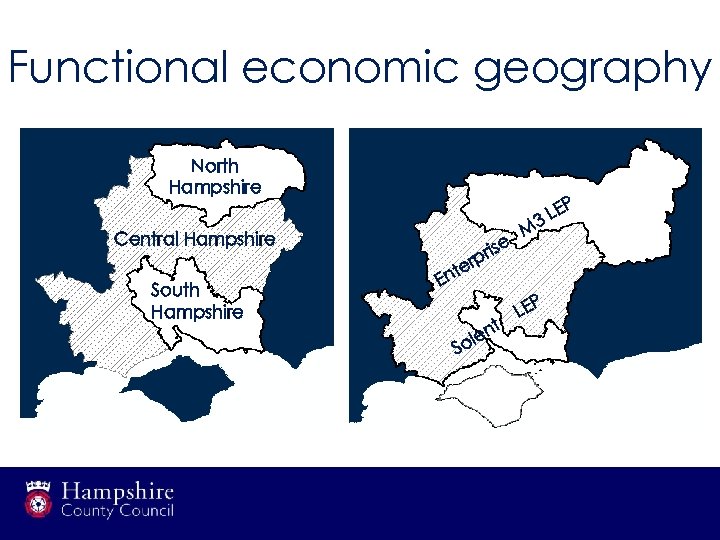

Functional economic geography North Hampshire P Central Hampshire r South Hampshire te En rise p S n ole t E 3 L M P LE

Functional economic geography North Hampshire P Central Hampshire r South Hampshire te En rise p S n ole t E 3 L M P LE

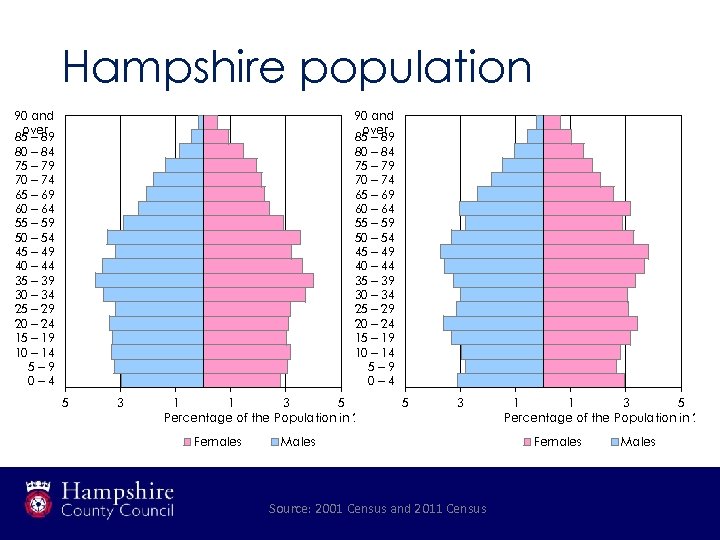

Hampshire population 90 and over 85 ‒ 89 80 ‒ 84 75 ‒ 79 70 ‒ 74 65 ‒ 69 60 ‒ 64 55 ‒ 59 50 ‒ 54 45 ‒ 49 40 ‒ 44 35 ‒ 39 30 ‒ 34 25 ‒ 29 20 ‒ 24 15 ‒ 19 10 ‒ 14 5‒ 9 0‒ 4 5 3 1 1 3 5 Percentage of the Population in 2001 Females 5 3 Males Source: 2001 Census and 2011 Census 1 1 3 5 Percentage of the Population in 2011 Females Males

Hampshire population 90 and over 85 ‒ 89 80 ‒ 84 75 ‒ 79 70 ‒ 74 65 ‒ 69 60 ‒ 64 55 ‒ 59 50 ‒ 54 45 ‒ 49 40 ‒ 44 35 ‒ 39 30 ‒ 34 25 ‒ 29 20 ‒ 24 15 ‒ 19 10 ‒ 14 5‒ 9 0‒ 4 5 3 1 1 3 5 Percentage of the Population in 2001 Females 5 3 Males Source: 2001 Census and 2011 Census 1 1 3 5 Percentage of the Population in 2011 Females Males

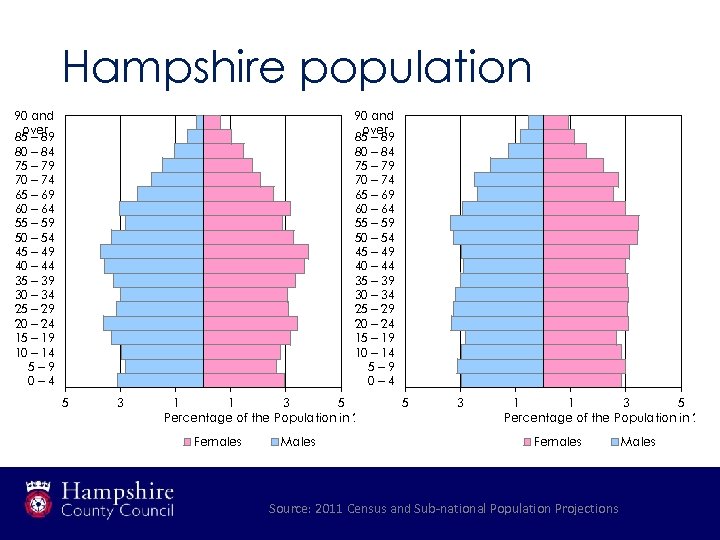

Hampshire population 90 and over 85 ‒ 89 80 ‒ 84 75 ‒ 79 70 ‒ 74 65 ‒ 69 60 ‒ 64 55 ‒ 59 50 ‒ 54 45 ‒ 49 40 ‒ 44 35 ‒ 39 30 ‒ 34 25 ‒ 29 20 ‒ 24 15 ‒ 19 10 ‒ 14 5‒ 9 0‒ 4 5 3 1 1 3 5 Percentage of the Population in 2011 Females Males 5 3 1 1 3 5 Percentage of the Population in 2021 Females Source: 2011 Census and Sub-national Population Projections Males

Hampshire population 90 and over 85 ‒ 89 80 ‒ 84 75 ‒ 79 70 ‒ 74 65 ‒ 69 60 ‒ 64 55 ‒ 59 50 ‒ 54 45 ‒ 49 40 ‒ 44 35 ‒ 39 30 ‒ 34 25 ‒ 29 20 ‒ 24 15 ‒ 19 10 ‒ 14 5‒ 9 0‒ 4 5 3 1 1 3 5 Percentage of the Population in 2011 Females Males 5 3 1 1 3 5 Percentage of the Population in 2021 Females Source: 2011 Census and Sub-national Population Projections Males

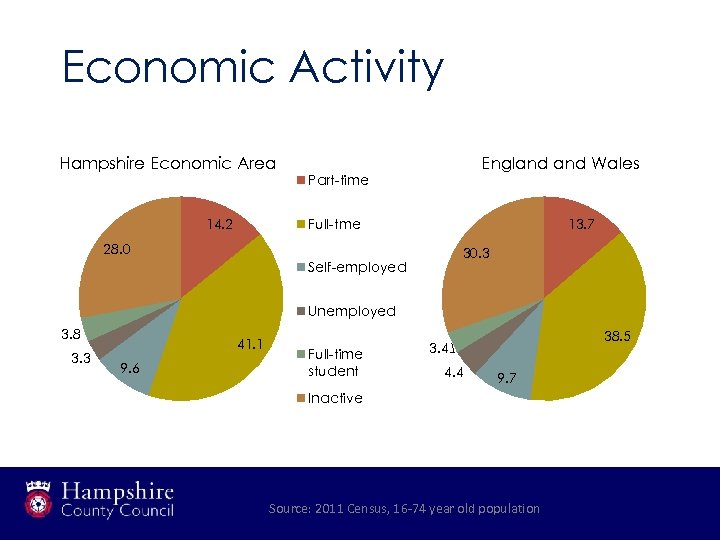

Economic Activity Hampshire Economic Area England Wales Part-time 13. 7 Full-tme 14. 2 28. 0 30. 3 Self-employed Unemployed 3. 8 3. 3 41. 1 9. 6 Full-time student 38. 5 3. 4 4. 4 9. 7 Inactive Source: 2011 Census, 16 -74 year old population

Economic Activity Hampshire Economic Area England Wales Part-time 13. 7 Full-tme 14. 2 28. 0 30. 3 Self-employed Unemployed 3. 8 3. 3 41. 1 9. 6 Full-time student 38. 5 3. 4 4. 4 9. 7 Inactive Source: 2011 Census, 16 -74 year old population

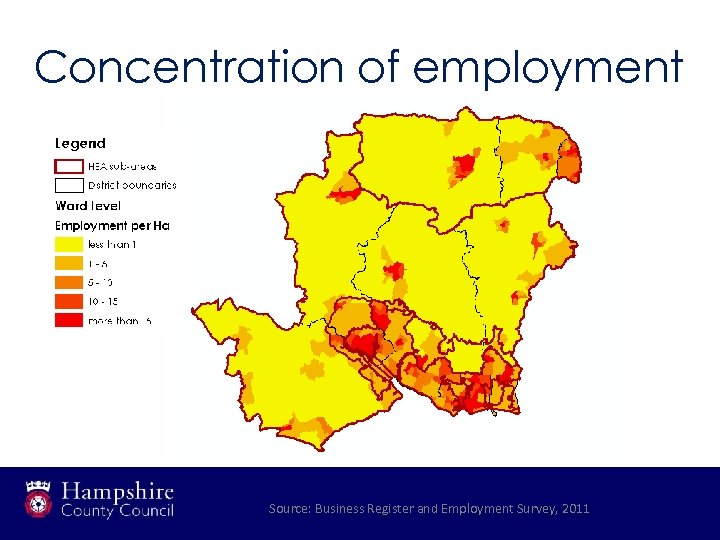

Concentration of employment Source: Business Register and Employment Survey, 2011

Concentration of employment Source: Business Register and Employment Survey, 2011

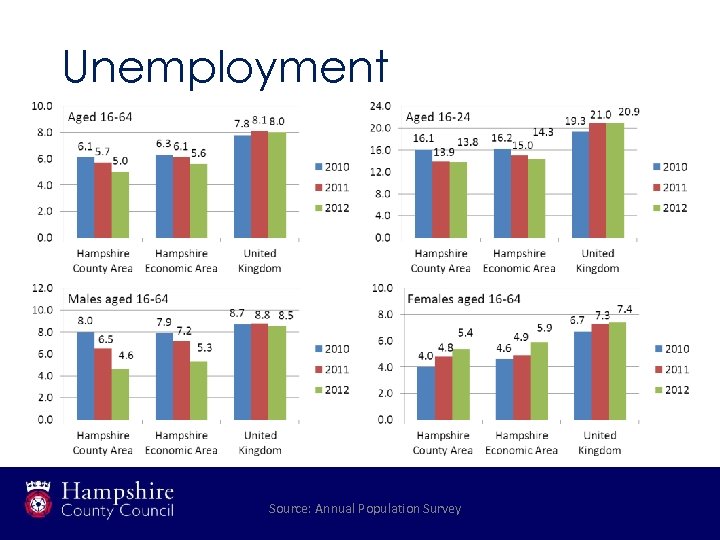

Unemployment Source: Annual Population Survey

Unemployment Source: Annual Population Survey

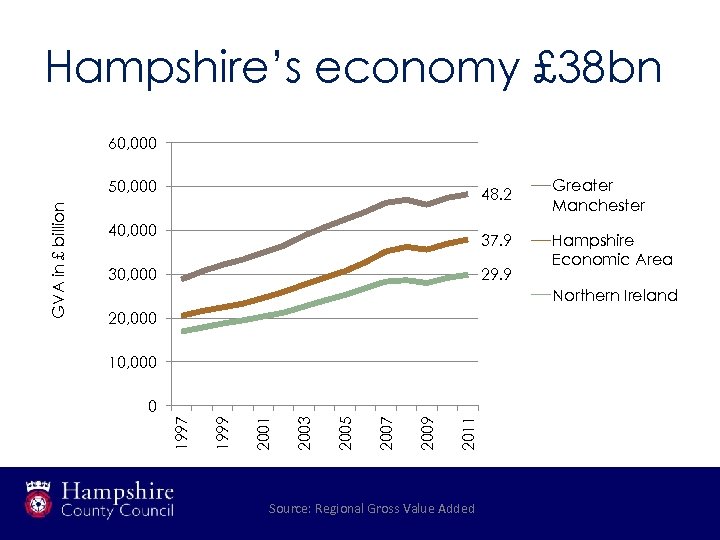

Hampshire’s economy £ 38 bn 60, 000 48. 2 40, 000 37. 9 29. 9 30, 000 Greater Manchester Hampshire Economic Area Northern Ireland 20, 000 10, 000 2011 2009 2007 2005 2003 2001 1999 0 1997 GVA in £ billion 50, 000 Source: Regional Gross Value Added

Hampshire’s economy £ 38 bn 60, 000 48. 2 40, 000 37. 9 29. 9 30, 000 Greater Manchester Hampshire Economic Area Northern Ireland 20, 000 10, 000 2011 2009 2007 2005 2003 2001 1999 0 1997 GVA in £ billion 50, 000 Source: Regional Gross Value Added

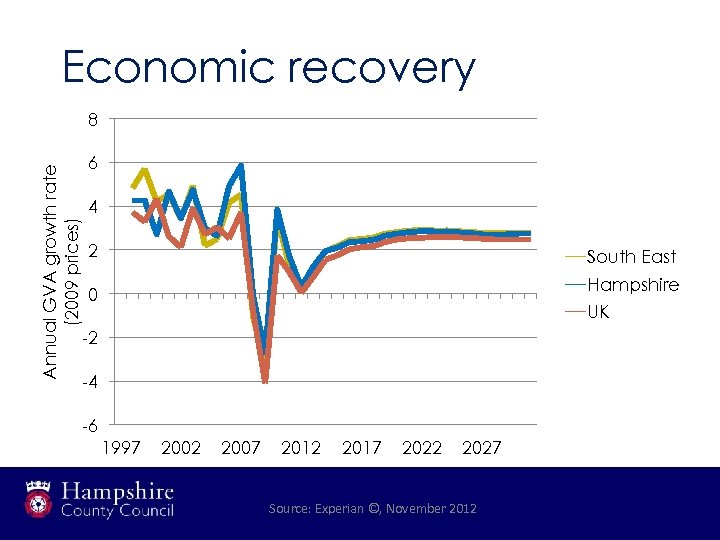

Economic recovery Annual GVA growth rate (2009 prices) 8 6 4 2 South East Hampshire 0 UK -2 -4 -6 1997 2002 2007 2012 2017 2022 2027 Source: Experian ©, November 2012

Economic recovery Annual GVA growth rate (2009 prices) 8 6 4 2 South East Hampshire 0 UK -2 -4 -6 1997 2002 2007 2012 2017 2022 2027 Source: Experian ©, November 2012

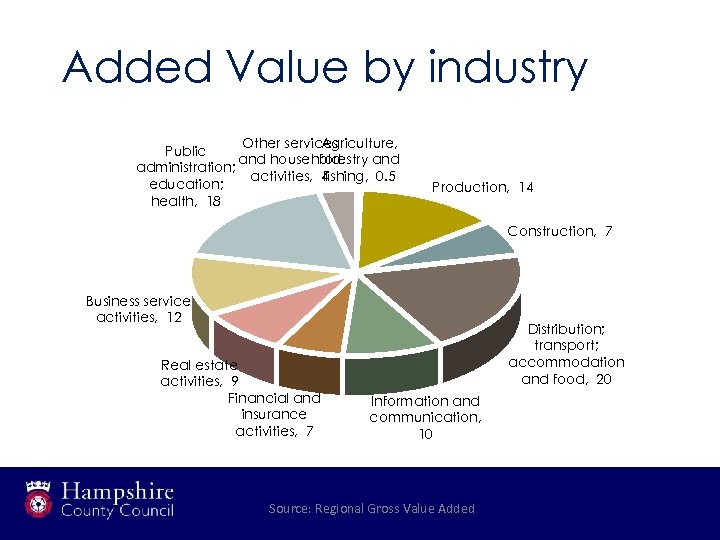

Added Value by industry Other services Agriculture, Public and household forestry and administration; activities, 4 fishing, 0. 5 education; health, 18 Production, 14 Construction, 7 Business service activities, 12 Real estate activities, 9 Financial and insurance activities, 7 Distribution; transport; accommodation and food, 20 Information and communication, 10 Source: Regional Gross Value Added

Added Value by industry Other services Agriculture, Public and household forestry and administration; activities, 4 fishing, 0. 5 education; health, 18 Production, 14 Construction, 7 Business service activities, 12 Real estate activities, 9 Financial and insurance activities, 7 Distribution; transport; accommodation and food, 20 Information and communication, 10 Source: Regional Gross Value Added

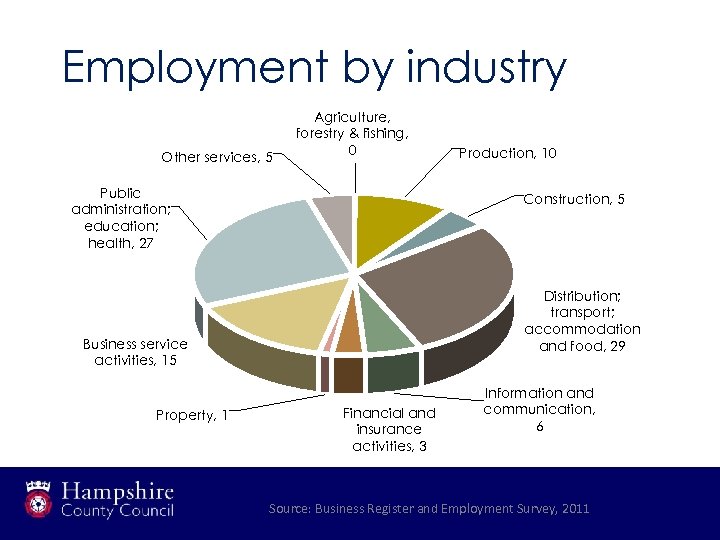

Employment by industry Other services, 5 Agriculture, forestry & fishing, 0 Public administration; education; health, 27 Construction, 5 Distribution; transport; accommodation and food, 29 Business service activities, 15 Property, 1 Production, 10 Financial and insurance activities, 3 Information and communication, 6 Source: Business Register and Employment Survey, 2011

Employment by industry Other services, 5 Agriculture, forestry & fishing, 0 Public administration; education; health, 27 Construction, 5 Distribution; transport; accommodation and food, 29 Business service activities, 15 Property, 1 Production, 10 Financial and insurance activities, 3 Information and communication, 6 Source: Business Register and Employment Survey, 2011

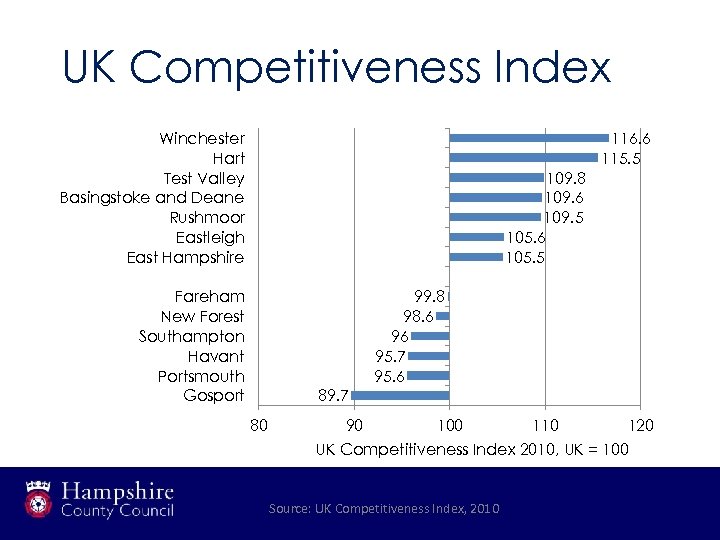

Competitiveness • • • Hampshire located in the most competitive region World class knowledge-base institutions Excellent communications infrastructure High economic activity Diverse economy Strong skills base Low levels of crime High quality of live 5 Hampshire districts in top 20% most competitive Source: UK Competitiveness Index, 2010

Competitiveness • • • Hampshire located in the most competitive region World class knowledge-base institutions Excellent communications infrastructure High economic activity Diverse economy Strong skills base Low levels of crime High quality of live 5 Hampshire districts in top 20% most competitive Source: UK Competitiveness Index, 2010

UK Competitiveness Index Winchester Hart Test Valley Basingstoke and Deane Rushmoor Eastleigh East Hampshire 116. 6 115. 5 109. 8 109. 6 109. 5 105. 6 105. 5 Fareham New Forest Southampton Havant Portsmouth Gosport 99. 8 98. 6 96 95. 7 95. 6 89. 7 80 90 100 110 120 UK Competitiveness Index 2010, UK = 100 Source: UK Competitiveness Index, 2010

UK Competitiveness Index Winchester Hart Test Valley Basingstoke and Deane Rushmoor Eastleigh East Hampshire 116. 6 115. 5 109. 8 109. 6 109. 5 105. 6 105. 5 Fareham New Forest Southampton Havant Portsmouth Gosport 99. 8 98. 6 96 95. 7 95. 6 89. 7 80 90 100 110 120 UK Competitiveness Index 2010, UK = 100 Source: UK Competitiveness Index, 2010

Resilience of the local economy Enterprise M 3, a Local Enterprise Partnership which covers the north area of Hampshire and part of Surrey, is ranked 1 st for resilience, out of 39 areas. The area is more able to withstand respond to economic shocks in the external environment than any other area in England.

Resilience of the local economy Enterprise M 3, a Local Enterprise Partnership which covers the north area of Hampshire and part of Surrey, is ranked 1 st for resilience, out of 39 areas. The area is more able to withstand respond to economic shocks in the external environment than any other area in England.

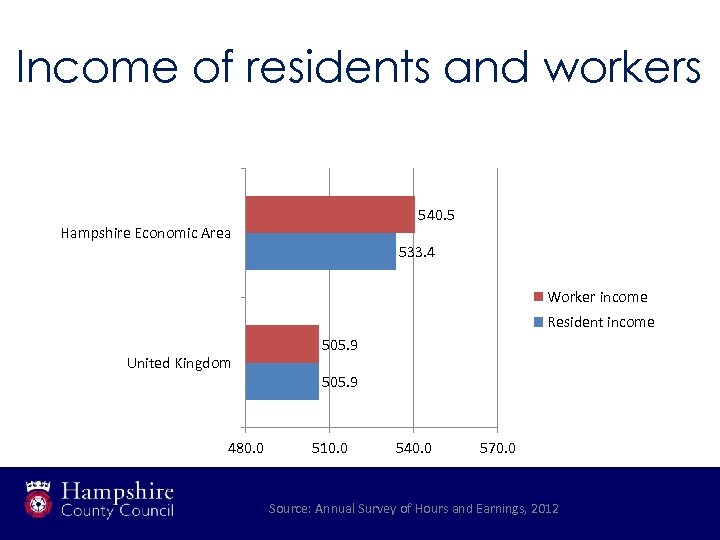

Income of residents and workers 540. 5 Hampshire Economic Area 533. 4 Worker income Resident income United Kingdom 480. 0 505. 9 510. 0 540. 0 570. 0 Source: Annual Survey of Hours and Earnings, 2012

Income of residents and workers 540. 5 Hampshire Economic Area 533. 4 Worker income Resident income United Kingdom 480. 0 505. 9 510. 0 540. 0 570. 0 Source: Annual Survey of Hours and Earnings, 2012

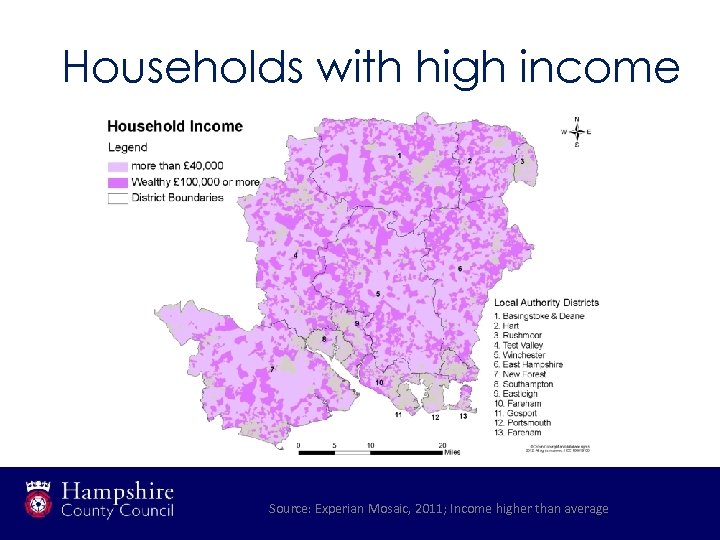

Households with high income Source: Experian Mosaic, 2011; Income higher than average

Households with high income Source: Experian Mosaic, 2011; Income higher than average

Business population • More than 73, 000 businesses • Majority are micro, small and medium enterprises • Around 320 businesses are large employers (250+) Source: UK Business, 2012

Business population • More than 73, 000 businesses • Majority are micro, small and medium enterprises • Around 320 businesses are large employers (250+) Source: UK Business, 2012

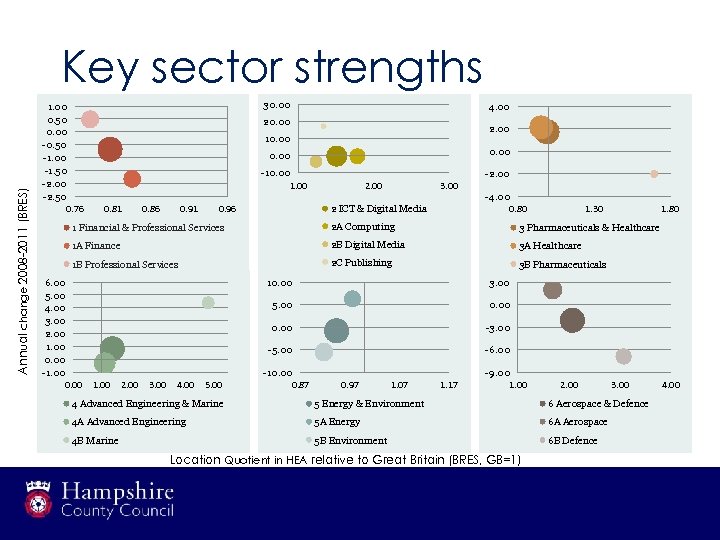

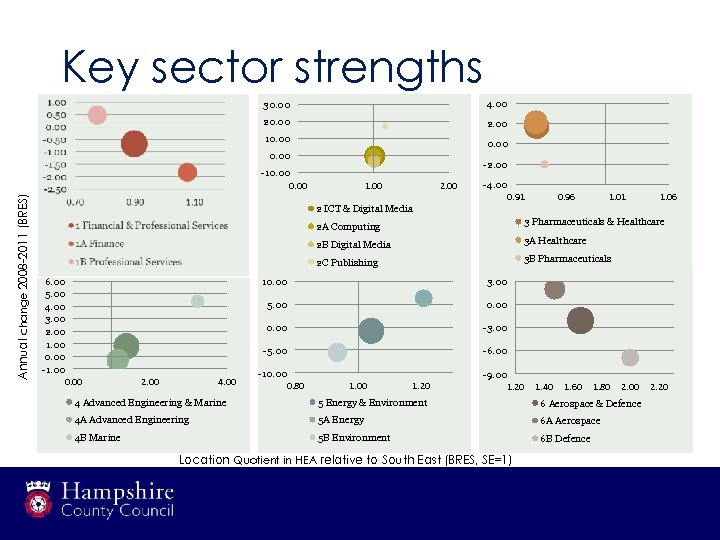

Key sector strengths • • • Financial and professional services ICT and Digital Media Pharmaceuticals & Healthcare Advanced Engineering & Marine Energy & Environment Aerospace & Defence

Key sector strengths • • • Financial and professional services ICT and Digital Media Pharmaceuticals & Healthcare Advanced Engineering & Marine Energy & Environment Aerospace & Defence

Annual change 2008 -2011 (BRES) Key sector strengths 1. 00 0. 50 0. 00 -0. 50 -1. 00 -1. 50 -2. 00 -2. 50 0. 76 30. 00 4. 00 20. 00 2. 00 10. 00 -10. 00 1. 00 0. 81 0. 86 0. 91 0. 96 2. 00 3. 00 2 ICT & Digital Media -2. 00 -4. 00 0. 80 1. 30 1. 80 1 Financial & Professional Services 2 A Computing 3 Pharmaceuticals & Healthcare 1 A Finance 2 B Digital Media 3 A Healthcare 1 B Professional Services 2 C Publishing 3 B Pharmaceuticals 6. 00 5. 00 4. 00 3. 00 2. 00 1. 00 0. 00 -1. 00 0. 00 10. 00 5. 00 3. 00 4. 00 5. 00 -3. 00 -5. 00 2. 00 0. 00 1. 00 3. 00 -6. 00 -10. 00 0. 87 0. 97 1. 07 1. 17 -9. 00 1. 00 2. 00 3. 00 4 Advanced Engineering & Marine 5 Energy & Environment 6 Aerospace & Defence 4 A Advanced Engineering 5 A Energy 6 A Aerospace 4 B Marine 5 B Environment 6 B Defence Location Quotient in HEA relative to Great Britain (BRES, GB=1) 4. 00

Annual change 2008 -2011 (BRES) Key sector strengths 1. 00 0. 50 0. 00 -0. 50 -1. 00 -1. 50 -2. 00 -2. 50 0. 76 30. 00 4. 00 20. 00 2. 00 10. 00 -10. 00 1. 00 0. 81 0. 86 0. 91 0. 96 2. 00 3. 00 2 ICT & Digital Media -2. 00 -4. 00 0. 80 1. 30 1. 80 1 Financial & Professional Services 2 A Computing 3 Pharmaceuticals & Healthcare 1 A Finance 2 B Digital Media 3 A Healthcare 1 B Professional Services 2 C Publishing 3 B Pharmaceuticals 6. 00 5. 00 4. 00 3. 00 2. 00 1. 00 0. 00 -1. 00 0. 00 10. 00 5. 00 3. 00 4. 00 5. 00 -3. 00 -5. 00 2. 00 0. 00 1. 00 3. 00 -6. 00 -10. 00 0. 87 0. 97 1. 07 1. 17 -9. 00 1. 00 2. 00 3. 00 4 Advanced Engineering & Marine 5 Energy & Environment 6 Aerospace & Defence 4 A Advanced Engineering 5 A Energy 6 A Aerospace 4 B Marine 5 B Environment 6 B Defence Location Quotient in HEA relative to Great Britain (BRES, GB=1) 4. 00

Key sector strengths 30. 00 4. 00 20. 00 2. 00 10. 00 -2. 00 Annual change 2008 -2011 (BRES) -10. 00 1. 00 2. 00 -4. 00 0. 91 0. 96 1. 01 1. 06 2 ICT & Digital Media 2 A Computing 2 B Digital Media 3 A Healthcare 2 C Publishing 6. 00 5. 00 4. 00 3. 00 2. 00 1. 00 0. 00 -1. 00 0. 00 3 Pharmaceuticals & Healthcare 3 B Pharmaceuticals 10. 00 5. 00 -3. 00 -5. 00 4. 00 0. 00 2. 00 3. 00 -6. 00 -10. 00 0. 80 1. 00 1. 20 -9. 00 1. 20 1. 40 1. 60 1. 80 2. 00 4 Advanced Engineering & Marine 5 Energy & Environment 6 Aerospace & Defence 4 A Advanced Engineering 5 A Energy 6 A Aerospace 4 B Marine 5 B Environment 6 B Defence Location Quotient in HEA relative to South East (BRES, SE=1) 2. 20

Key sector strengths 30. 00 4. 00 20. 00 2. 00 10. 00 -2. 00 Annual change 2008 -2011 (BRES) -10. 00 1. 00 2. 00 -4. 00 0. 91 0. 96 1. 01 1. 06 2 ICT & Digital Media 2 A Computing 2 B Digital Media 3 A Healthcare 2 C Publishing 6. 00 5. 00 4. 00 3. 00 2. 00 1. 00 0. 00 -1. 00 0. 00 3 Pharmaceuticals & Healthcare 3 B Pharmaceuticals 10. 00 5. 00 -3. 00 -5. 00 4. 00 0. 00 2. 00 3. 00 -6. 00 -10. 00 0. 80 1. 00 1. 20 -9. 00 1. 20 1. 40 1. 60 1. 80 2. 00 4 Advanced Engineering & Marine 5 Energy & Environment 6 Aerospace & Defence 4 A Advanced Engineering 5 A Energy 6 A Aerospace 4 B Marine 5 B Environment 6 B Defence Location Quotient in HEA relative to South East (BRES, SE=1) 2. 20

Financial & Professional Services • • 25, 000 jobs Around 1, 600 businesses £ 3. 9 billion gross value added Proximity to London

Financial & Professional Services • • 25, 000 jobs Around 1, 600 businesses £ 3. 9 billion gross value added Proximity to London

Financial & Professional Services • 28, 800 jobs • Around 7, 700 businesses • £ 2 billion gross value added

Financial & Professional Services • 28, 800 jobs • Around 7, 700 businesses • £ 2 billion gross value added

ICT & Digital Media • 30, 500 jobs • Around 4, 500 businesses • £ 2. 2 billion gross value added

ICT & Digital Media • 30, 500 jobs • Around 4, 500 businesses • £ 2. 2 billion gross value added

ICT & Digital Media • • 18, 400 jobs Around 1, 800 businesses £ 1. 9 billion gross value added Southampton Solent University

ICT & Digital Media • • 18, 400 jobs Around 1, 800 businesses £ 1. 9 billion gross value added Southampton Solent University

ICT & Digital Media - Publishing • 4, 800 jobs • Around 300 businesses • £ 310 million gross value added

ICT & Digital Media - Publishing • 4, 800 jobs • Around 300 businesses • £ 310 million gross value added

Pharmaceuticals & Healthcare • 7, 500 jobs • Around 200 businesses • £ 580 million gross value added

Pharmaceuticals & Healthcare • 7, 500 jobs • Around 200 businesses • £ 580 million gross value added

Pharmaceuticals & Healthcare • • • 79, 100 jobs Around 3, 600 businesses £ 1. 9 billion gross value added Southampton Hospitals Portsmouth Hospitals Private healthcare providers

Pharmaceuticals & Healthcare • • • 79, 100 jobs Around 3, 600 businesses £ 1. 9 billion gross value added Southampton Hospitals Portsmouth Hospitals Private healthcare providers

Advanced Engineering & Marine • • 31, 300 jobs Around 3, 400 businesses £ 1. 8 billion gross value added Solent Enterprise Zone

Advanced Engineering & Marine • • 31, 300 jobs Around 3, 400 businesses £ 1. 8 billion gross value added Solent Enterprise Zone

Advanced Engineering & Marine • • • 27, 000 jobs Around 1, 300 businesses £ 2. 1 billion gross value added Port of Southampton Portsmouth Naval Base National Oceanography Centre

Advanced Engineering & Marine • • • 27, 000 jobs Around 1, 300 businesses £ 2. 1 billion gross value added Port of Southampton Portsmouth Naval Base National Oceanography Centre

Energy & Environment • • 6, 700 jobs Around 200 businesses £ 1. 2 billion gross value added Energy recovery facilities

Energy & Environment • • 6, 700 jobs Around 200 businesses £ 1. 2 billion gross value added Energy recovery facilities

Energy & Environment • • • 8, 400 jobs Around 700 businesses £ 600 million gross value added High recycling & energy recovery Low landfilled waste

Energy & Environment • • • 8, 400 jobs Around 700 businesses £ 600 million gross value added High recycling & energy recovery Low landfilled waste

Aerospace & Defence • • 10, 600 jobs Around 200 businesses £ 990 million gross value added Farnborough Air Show

Aerospace & Defence • • 10, 600 jobs Around 200 businesses £ 990 million gross value added Farnborough Air Show

Aerospace & Defence • • • 7, 200 jobs Around 50 businesses £ 350 million gross value added Strong MOD presence Portsmouth Naval Base

Aerospace & Defence • • • 7, 200 jobs Around 50 businesses £ 350 million gross value added Strong MOD presence Portsmouth Naval Base

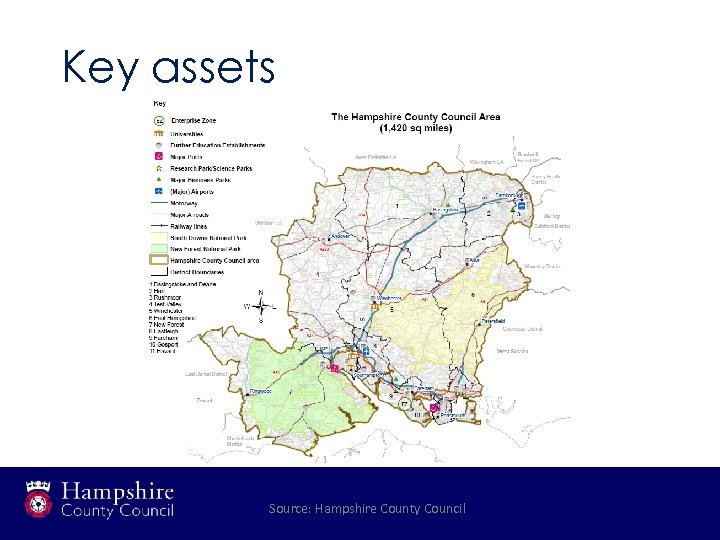

Key assets Source: Hampshire County Council

Key assets Source: Hampshire County Council

Tourism • • 4. 1 million staying and 33. 3 million day visitors Turnover of £ 2. 8 billion 60, 500 employed in tourism related jobs Rich accommodation, shopping, food and drink, attractions and entertainment offer • 2 National Parks cover around 30% of the area

Tourism • • 4. 1 million staying and 33. 3 million day visitors Turnover of £ 2. 8 billion 60, 500 employed in tourism related jobs Rich accommodation, shopping, food and drink, attractions and entertainment offer • 2 National Parks cover around 30% of the area

Value of Tourism • • Hampshire Dorset West Sussex Berkshire Surrey Wiltshire Isle of Wight £ 1, 991 million £ 1, 366 million £ 917 million £ 810 million £ 781 million £ 681 million £ 442 million

Value of Tourism • • Hampshire Dorset West Sussex Berkshire Surrey Wiltshire Isle of Wight £ 1, 991 million £ 1, 366 million £ 917 million £ 810 million £ 781 million £ 681 million £ 442 million

Tourism – tourist attractions • Paulton’s Park, Romsey • Portsmouth Historic Dockyard 532, 000 • Marwell Zoo, Winchester • Royal Victoria Country Park, Netley 500, 000 • Spinnaker Tower, Portsmouth • Beaulieu, New Forest • Queen Elizabeth Country Park, Horndean 344, 000 • Winchester Cathedral • Itchen Valley Country Park, Eastleigh 236, 000 550, 000 530, 000 390, 000 352, 000 331, 000

Tourism – tourist attractions • Paulton’s Park, Romsey • Portsmouth Historic Dockyard 532, 000 • Marwell Zoo, Winchester • Royal Victoria Country Park, Netley 500, 000 • Spinnaker Tower, Portsmouth • Beaulieu, New Forest • Queen Elizabeth Country Park, Horndean 344, 000 • Winchester Cathedral • Itchen Valley Country Park, Eastleigh 236, 000 550, 000 530, 000 390, 000 352, 000 331, 000

Tourism - events • • • Farnborough Air Show 209, 000 Goodwood Festival of Speed 181, 000 Goodwood Revival 146, 000 Southampton Boat Show 110, 000 New Forest and Hampshire County Show 104, 000 • Isle of Wight Festival 55, 000 • Beaulieu Autojumble 38, 000

Tourism - events • • • Farnborough Air Show 209, 000 Goodwood Festival of Speed 181, 000 Goodwood Revival 146, 000 Southampton Boat Show 110, 000 New Forest and Hampshire County Show 104, 000 • Isle of Wight Festival 55, 000 • Beaulieu Autojumble 38, 000

Tourism – sport events • • • Cowes Week Sailing Regatta Premiership Football at Southampton FC League One Football at Portsmouth FC Ageas Bowl Home of Hampshire Cricket Club Fly-fishing on the world famous River Test British Touring Cars Championship at Thruxton Circuit • 2015 Rugby World Cup at St Mary’s Stadium (tbc)

Tourism – sport events • • • Cowes Week Sailing Regatta Premiership Football at Southampton FC League One Football at Portsmouth FC Ageas Bowl Home of Hampshire Cricket Club Fly-fishing on the world famous River Test British Touring Cars Championship at Thruxton Circuit • 2015 Rugby World Cup at St Mary’s Stadium (tbc)

Port of Southampton • • Provides 5, 100 direct jobs Turnover of £ 772 million 151, 400 turnover per employee 1 st UK port by cruise passengers 4 th UK port by total tonnage 11 th EU port by containers handled Base for a range of business activities

Port of Southampton • • Provides 5, 100 direct jobs Turnover of £ 772 million 151, 400 turnover per employee 1 st UK port by cruise passengers 4 th UK port by total tonnage 11 th EU port by containers handled Base for a range of business activities

Southampton Airport • • Provides 200 direct jobs 45, 700 aircraft movements 1. 8 million passengers 132 tonnes of cargo Close to M 3 and M 27 motorway Southampton Airport Parkway 18 th busiest airport in the UK Bournemouth, Gatwick, Heathrow

Southampton Airport • • Provides 200 direct jobs 45, 700 aircraft movements 1. 8 million passengers 132 tonnes of cargo Close to M 3 and M 27 motorway Southampton Airport Parkway 18 th busiest airport in the UK Bournemouth, Gatwick, Heathrow

Defence • • • 12 key army, RAF and navy bases 26, 100 military and civilian personnel 5, 000 jobs associated with sub-contracting £ 820 million spend on salaries More than 10, 000 hectares of defence land 300 aerospace and defence businesses

Defence • • • 12 key army, RAF and navy bases 26, 100 military and civilian personnel 5, 000 jobs associated with sub-contracting £ 820 million spend on salaries More than 10, 000 hectares of defence land 300 aerospace and defence businesses

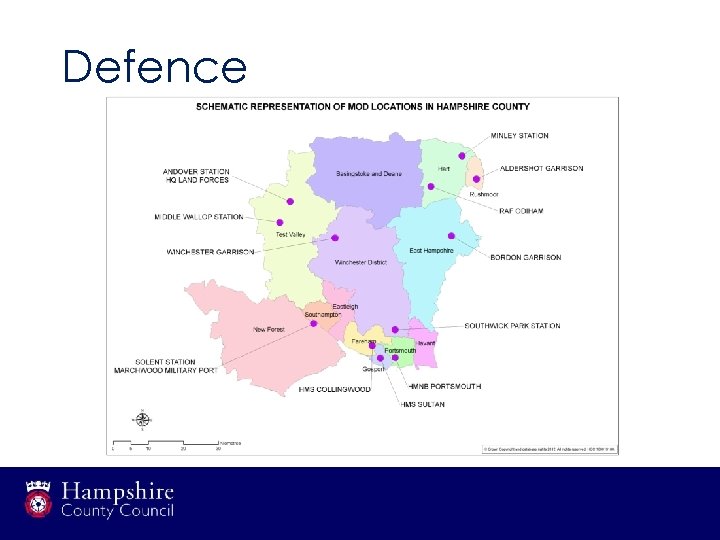

Defence

Defence

Higher Education • • 4 universities 69, 000 students, 17, 600 staff 12, 100 international students Income of £ 766 million Southampton Science Park U 2 B collaboration 40% graduate retention Over 20 further education colleges

Higher Education • • 4 universities 69, 000 students, 17, 600 staff 12, 100 international students Income of £ 766 million Southampton Science Park U 2 B collaboration 40% graduate retention Over 20 further education colleges

Foreign business in the region North America, 74 Middle East a n d Asia , 25

Foreign business in the region North America, 74 Middle East a n d Asia , 25

Foreign business in the region • • • • • United States Media France Veolia Germany Japan Switzerland Netherlands Getronics Sweden Mast Denmark Canada Finland Italy Norway Hong Kong Australia China Oman Portugal Other 70 Boeing Defence, BAT, Cooper. Vision, Estee Lauder, Virgin 13 AXA Winterthur, BNP Paribas, Vector Aerospace, 13 10 7 6 Capricorn Automotive, Gist, Linde, Merck, SPI Lasers Fujitsu, MOL, Murata, Sony, Sumika Polymer Compounds Zurich Insurance, Fischer Connectors, Ineos Oside, Swatch Gemalto, Green Marine, NMT International Shipping, 6 Saab Seaeye, Skandia Life, Wallenius Wilhelmsen, Selden 5 4 4 3 2 2 10 Desmi Ro-Clean, Pentalver Transport, Vestas, Viking Arquiva, Gennum, Peer 1, Sun Life Financial Huhtamaki, Kine, Nokia Siemens, Wartsila Agustawestland, Bluerock Consulting, Polimeri, Prysmian Aker Solutions, Hydroid, Kingsberg Maritime, Solent Towage Conde, Multitone Electronics, OOCL Absolute Distributors, Wightlink Huawei Technologies, Lenovo Technology B-N Group Britten Norman, Zawawi Family Britten Norman Critical Software Technologies, Vitacress Salads Austria, Belgium, India, Ireland, Israel, Luxembourg, Malaysia, Singapore, Taiwan, UAE

Foreign business in the region • • • • • United States Media France Veolia Germany Japan Switzerland Netherlands Getronics Sweden Mast Denmark Canada Finland Italy Norway Hong Kong Australia China Oman Portugal Other 70 Boeing Defence, BAT, Cooper. Vision, Estee Lauder, Virgin 13 AXA Winterthur, BNP Paribas, Vector Aerospace, 13 10 7 6 Capricorn Automotive, Gist, Linde, Merck, SPI Lasers Fujitsu, MOL, Murata, Sony, Sumika Polymer Compounds Zurich Insurance, Fischer Connectors, Ineos Oside, Swatch Gemalto, Green Marine, NMT International Shipping, 6 Saab Seaeye, Skandia Life, Wallenius Wilhelmsen, Selden 5 4 4 3 2 2 10 Desmi Ro-Clean, Pentalver Transport, Vestas, Viking Arquiva, Gennum, Peer 1, Sun Life Financial Huhtamaki, Kine, Nokia Siemens, Wartsila Agustawestland, Bluerock Consulting, Polimeri, Prysmian Aker Solutions, Hydroid, Kingsberg Maritime, Solent Towage Conde, Multitone Electronics, OOCL Absolute Distributors, Wightlink Huawei Technologies, Lenovo Technology B-N Group Britten Norman, Zawawi Family Britten Norman Critical Software Technologies, Vitacress Salads Austria, Belgium, India, Ireland, Israel, Luxembourg, Malaysia, Singapore, Taiwan, UAE

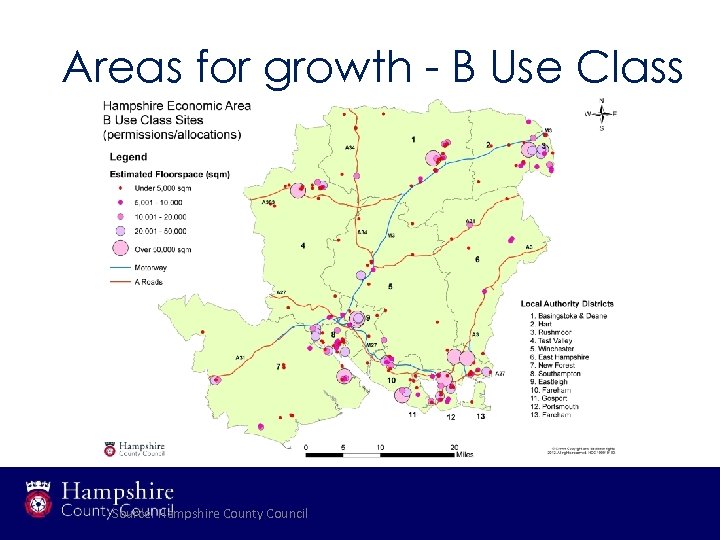

Areas for growth - B Use Class Source: Hampshire County Council

Areas for growth - B Use Class Source: Hampshire County Council

Areas for growth - retail Source: Hampshire County Council

Areas for growth - retail Source: Hampshire County Council

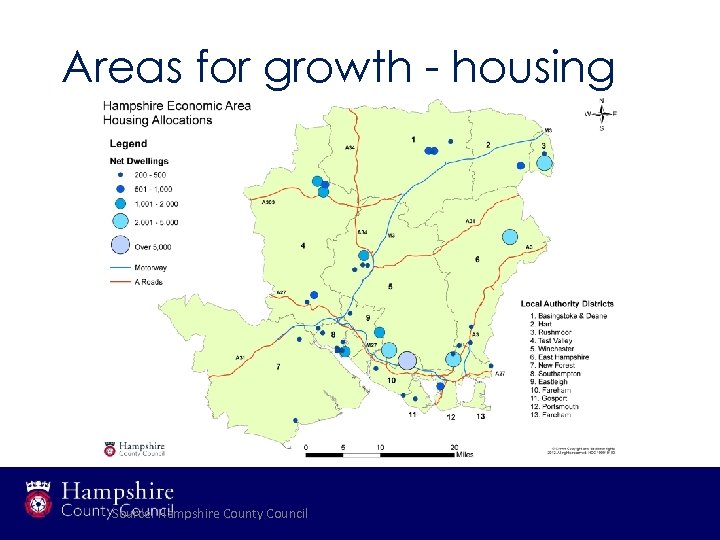

Areas for growth - housing Source: Hampshire County Council

Areas for growth - housing Source: Hampshire County Council