9be69b403c097afb33f53a61064ecbe4.ppt

- Количество слайдов: 40

HAMMAR West Midlands Does size matter in procurement?

HAMMAR West Midlands Does size matter in procurement?

Central Housing Investment Consortium Ltd John Fisher – Managing Director CHIC - Partner Ark Housing Consultancy

Central Housing Investment Consortium Ltd John Fisher – Managing Director CHIC - Partner Ark Housing Consultancy

CHIC Presentation 1. Asset Management Market Summary – How we see it 2. Where does size matter? 3. CHIC’s response 4. CHIC in brief 5. A view of the future

CHIC Presentation 1. Asset Management Market Summary – How we see it 2. Where does size matter? 3. CHIC’s response 4. CHIC in brief 5. A view of the future

1. Asset Management Market Summary HOW WE SEE IT

1. Asset Management Market Summary HOW WE SEE IT

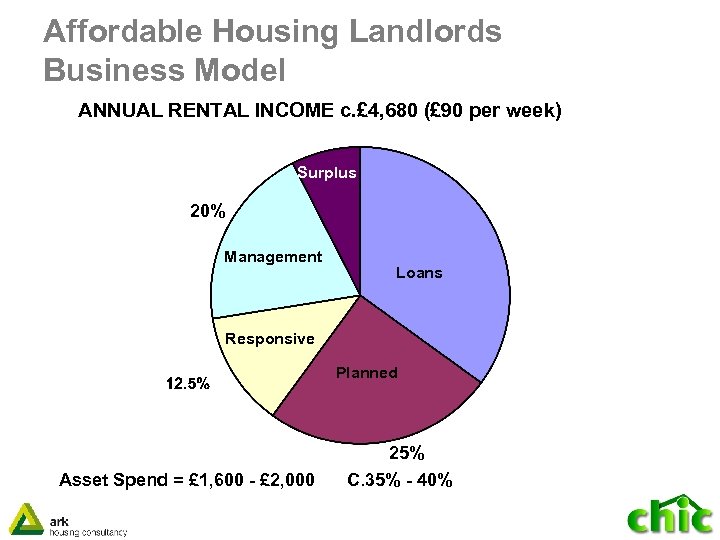

Affordable Housing Landlords Business Model ANNUAL RENTAL INCOME c. £ 4, 680 (£ 90 per week) Surplus 20% Management Loans Responsive Planned 25% Asset Spend = £ 1, 600 - £ 2, 000 C. 35% - 40%

Affordable Housing Landlords Business Model ANNUAL RENTAL INCOME c. £ 4, 680 (£ 90 per week) Surplus 20% Management Loans Responsive Planned 25% Asset Spend = £ 1, 600 - £ 2, 000 C. 35% - 40%

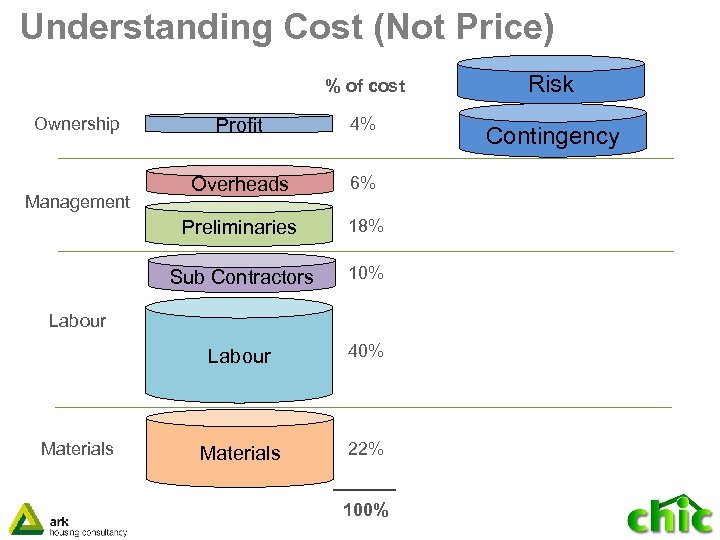

Understanding Cost (Not Price) % of cost 4% Contingency Overheads 6% 18% Sub Contractors 10% Labour Management Profit Preliminaries Ownership Risk 40% Materials 22% Labour Materials 100%

Understanding Cost (Not Price) % of cost 4% Contingency Overheads 6% 18% Sub Contractors 10% Labour Management Profit Preliminaries Ownership Risk 40% Materials 22% Labour Materials 100%

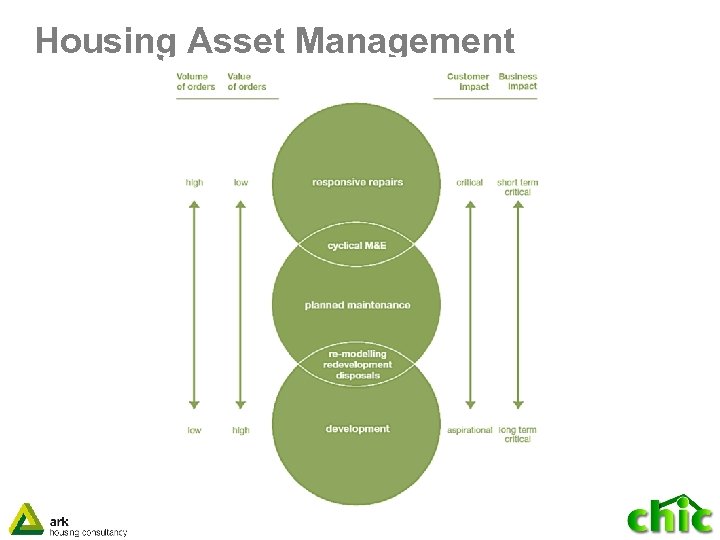

Housing Asset Management

Housing Asset Management

Responsive / Cyclical

Responsive / Cyclical

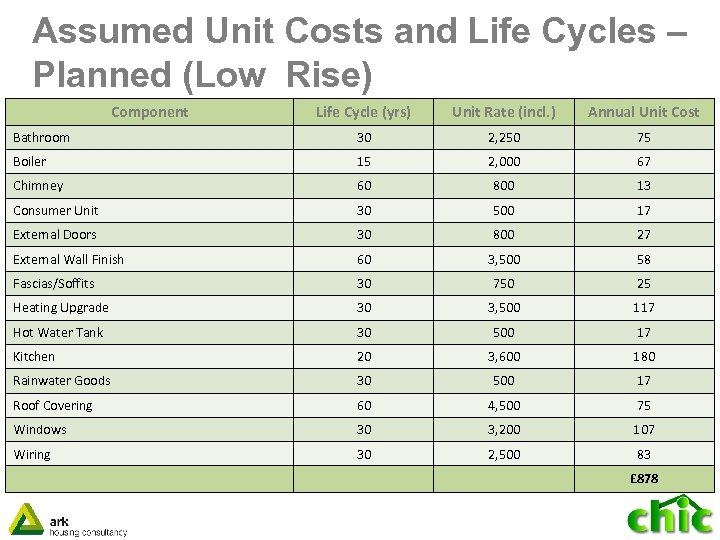

Assumed Unit Costs and Life Cycles – Planned (Low Rise) Component Life Cycle (yrs) Unit Rate (incl. ) Annual Unit Cost Bathroom 30 2, 250 75 Boiler 15 2, 000 67 Chimney 60 800 13 Consumer Unit 30 500 17 External Doors 30 800 27 External Wall Finish 60 3, 500 58 Fascias/Soffits 30 750 25 Heating Upgrade 30 3, 500 117 Hot Water Tank 30 500 17 Kitchen 20 3, 600 180 Rainwater Goods 30 500 17 Roof Covering 60 4, 500 75 Windows 30 3, 200 107 Wiring 30 2, 500 83 £ 878

Assumed Unit Costs and Life Cycles – Planned (Low Rise) Component Life Cycle (yrs) Unit Rate (incl. ) Annual Unit Cost Bathroom 30 2, 250 75 Boiler 15 2, 000 67 Chimney 60 800 13 Consumer Unit 30 500 17 External Doors 30 800 27 External Wall Finish 60 3, 500 58 Fascias/Soffits 30 750 25 Heating Upgrade 30 3, 500 117 Hot Water Tank 30 500 17 Kitchen 20 3, 600 180 Rainwater Goods 30 500 17 Roof Covering 60 4, 500 75 Windows 30 3, 200 107 Wiring 30 2, 500 83 £ 878

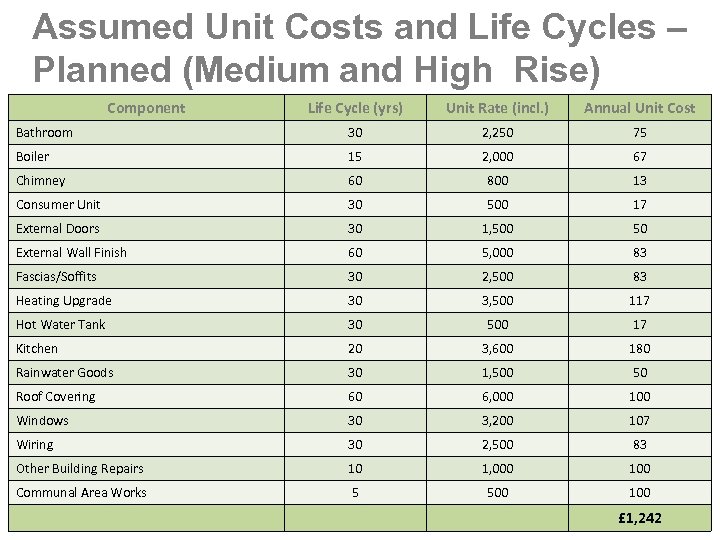

Assumed Unit Costs and Life Cycles – Planned (Medium and High Rise) Component Life Cycle (yrs) Unit Rate (incl. ) Annual Unit Cost Bathroom 30 2, 250 75 Boiler 15 2, 000 67 Chimney 60 800 13 Consumer Unit 30 500 17 External Doors 30 1, 500 50 External Wall Finish 60 5, 000 83 Fascias/Soffits 30 2, 500 83 Heating Upgrade 30 3, 500 117 Hot Water Tank 30 500 17 Kitchen 20 3, 600 180 Rainwater Goods 30 1, 500 50 Roof Covering 60 6, 000 100 Windows 30 3, 200 107 Wiring 30 2, 500 83 Other Building Repairs 10 1, 000 100 Communal Area Works 5 500 100 £ 1, 242

Assumed Unit Costs and Life Cycles – Planned (Medium and High Rise) Component Life Cycle (yrs) Unit Rate (incl. ) Annual Unit Cost Bathroom 30 2, 250 75 Boiler 15 2, 000 67 Chimney 60 800 13 Consumer Unit 30 500 17 External Doors 30 1, 500 50 External Wall Finish 60 5, 000 83 Fascias/Soffits 30 2, 500 83 Heating Upgrade 30 3, 500 117 Hot Water Tank 30 500 17 Kitchen 20 3, 600 180 Rainwater Goods 30 1, 500 50 Roof Covering 60 6, 000 100 Windows 30 3, 200 107 Wiring 30 2, 500 83 Other Building Repairs 10 1, 000 100 Communal Area Works 5 500 100 £ 1, 242

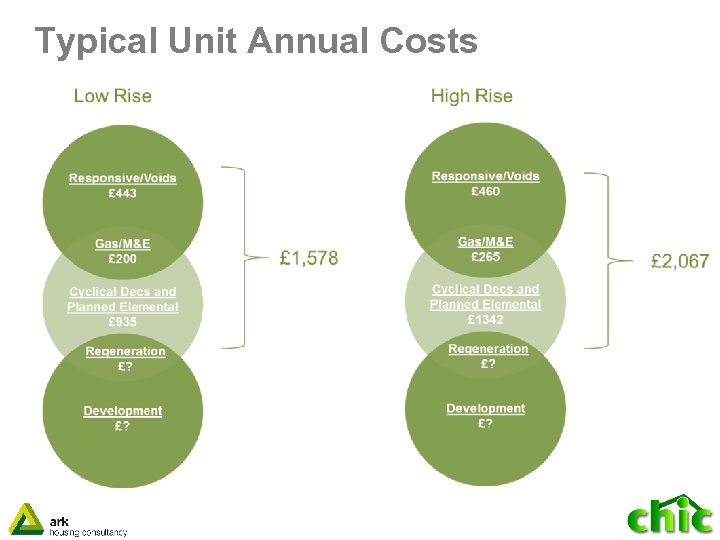

Typical Unit Annual Costs

Typical Unit Annual Costs

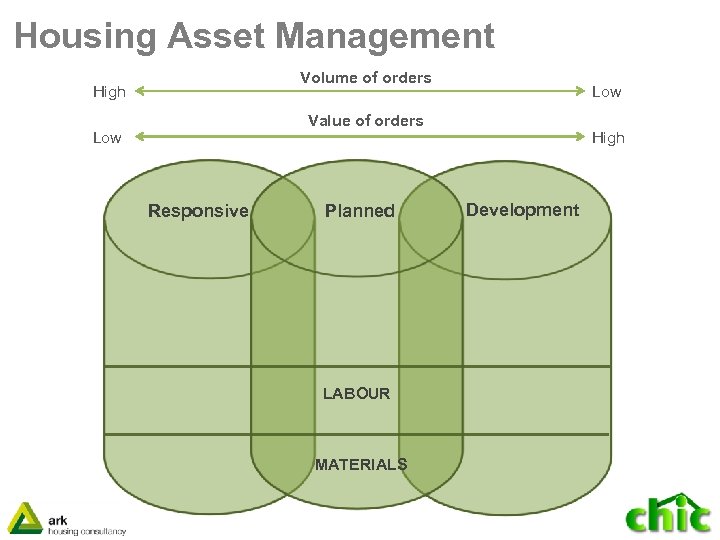

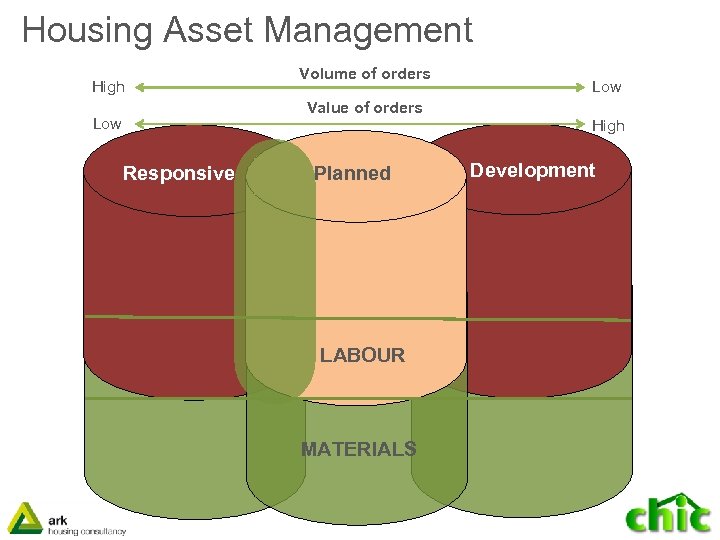

Housing Asset Management Volume of orders High Low Value of orders Low Responsive Planned LABOUR MATERIALS High Development

Housing Asset Management Volume of orders High Low Value of orders Low Responsive Planned LABOUR MATERIALS High Development

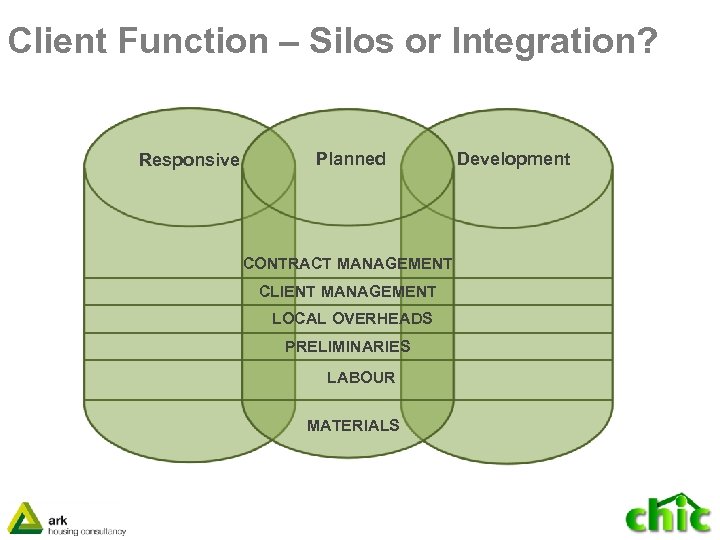

Client Function – Silos or Integration? Responsive Planned CONTRACT MANAGEMENT CLIENT MANAGEMENT LOCAL OVERHEADS PRELIMINARIES LABOUR MATERIALS Development

Client Function – Silos or Integration? Responsive Planned CONTRACT MANAGEMENT CLIENT MANAGEMENT LOCAL OVERHEADS PRELIMINARIES LABOUR MATERIALS Development

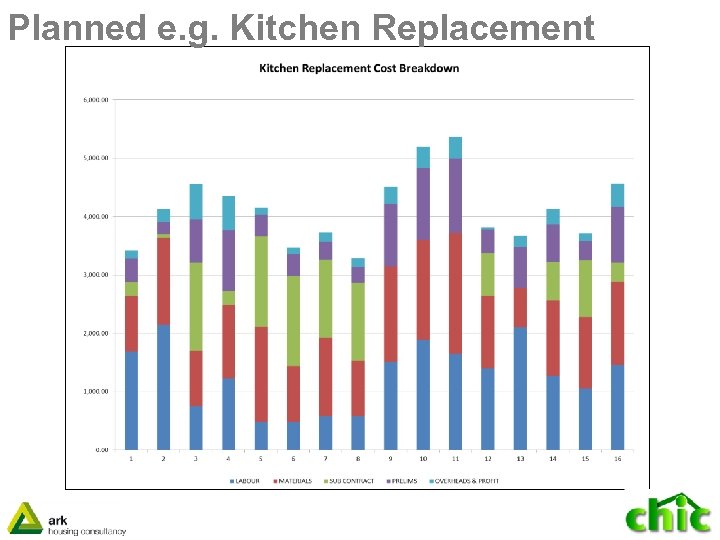

Planned e. g. Kitchen Replacement

Planned e. g. Kitchen Replacement

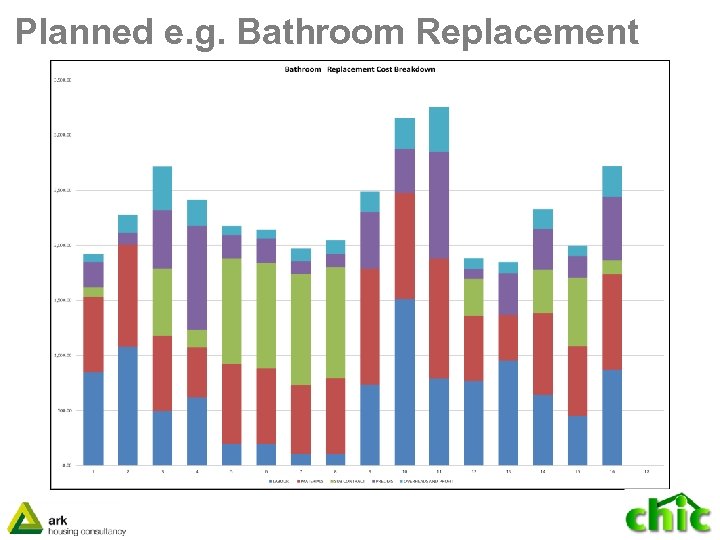

Planned e. g. Bathroom Replacement

Planned e. g. Bathroom Replacement

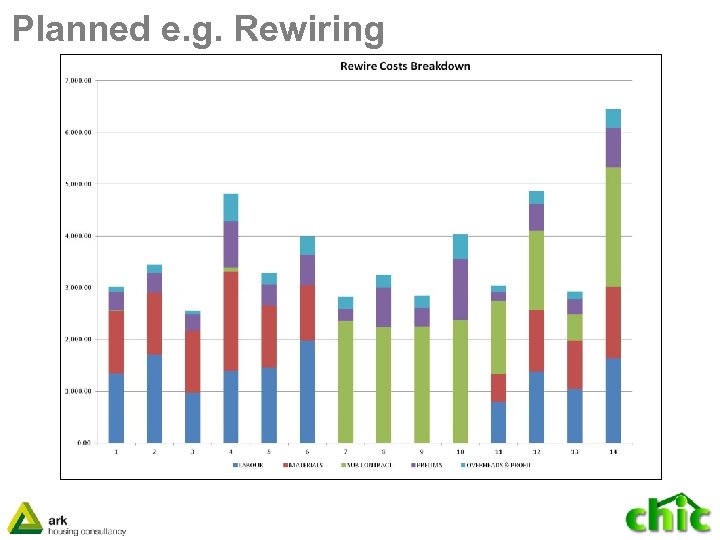

Planned e. g. Rewiring

Planned e. g. Rewiring

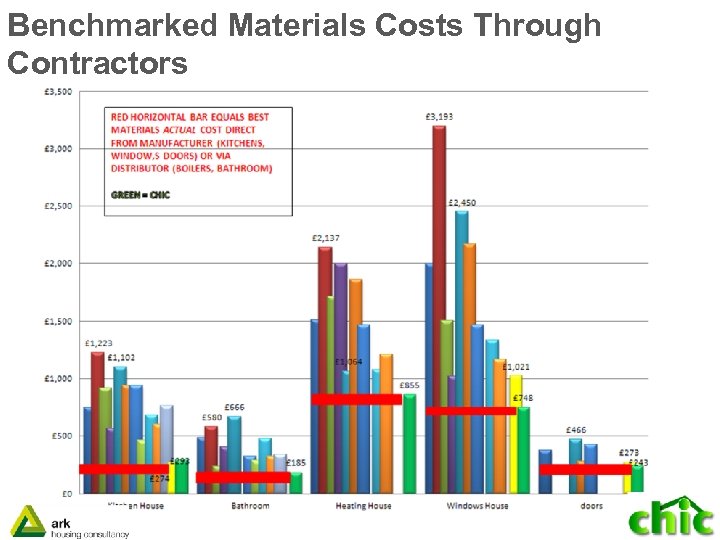

Benchmarked Materials Costs Through Contractors

Benchmarked Materials Costs Through Contractors

3 Big Spend Items § People (50 -60%) § Materials (20 -50%) § Vehicles (10%)

3 Big Spend Items § People (50 -60%) § Materials (20 -50%) § Vehicles (10%)

Contractor Order Book § Any business needs to know what it needs to deliver § Order book is king § How good is your AMS?

Contractor Order Book § Any business needs to know what it needs to deliver § Order book is king § How good is your AMS?

Good strategic planning – avoids the wheels falling off…

Good strategic planning – avoids the wheels falling off…

Procurement Solutions § Is procurement a FUNCTION or a CAPABILITY? § Does the plan drive the delivery solution or procurement drive the plan? § Stage 4 of Planning Process = Order book § Test – sustainable order book for constant volumes?

Procurement Solutions § Is procurement a FUNCTION or a CAPABILITY? § Does the plan drive the delivery solution or procurement drive the plan? § Stage 4 of Planning Process = Order book § Test – sustainable order book for constant volumes?

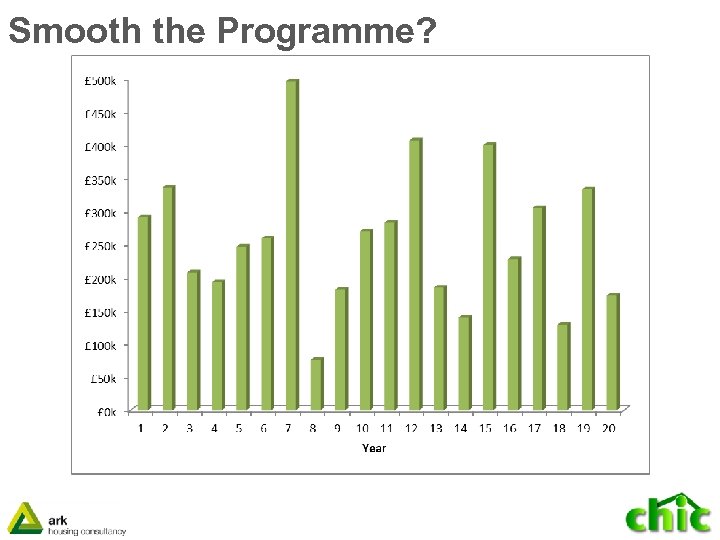

Smooth the Programme?

Smooth the Programme?

Where does size matter? Assumption: ‘Size’ means more than one RP working alone

Where does size matter? Assumption: ‘Size’ means more than one RP working alone

Housing Asset Management Volume of orders High Low Value of orders Low Responsive Planned LABOUR MATERIALS High Development

Housing Asset Management Volume of orders High Low Value of orders Low Responsive Planned LABOUR MATERIALS High Development

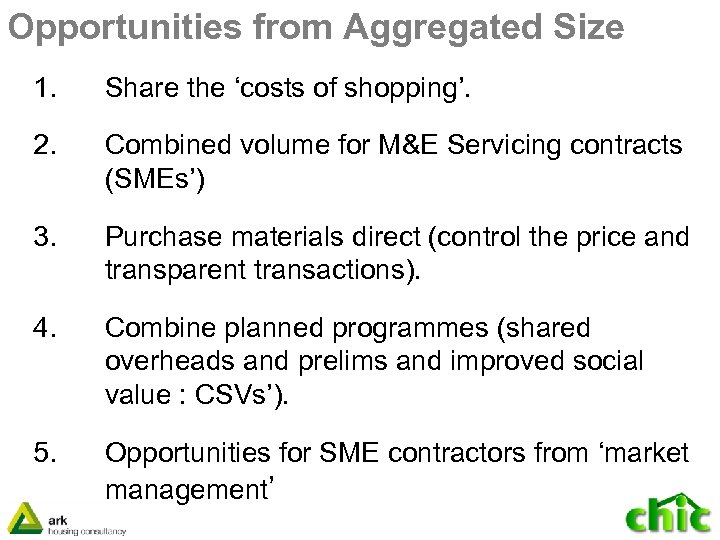

Opportunities from Aggregated Size 1. Share the ‘costs of shopping’. 2. Combined volume for M&E Servicing contracts (SMEs’) 3. Purchase materials direct (control the price and transparent transactions). 4. Combine planned programmes (shared overheads and prelims and improved social value : CSVs’). 5. Opportunities for SME contractors from ‘market management’

Opportunities from Aggregated Size 1. Share the ‘costs of shopping’. 2. Combined volume for M&E Servicing contracts (SMEs’) 3. Purchase materials direct (control the price and transparent transactions). 4. Combine planned programmes (shared overheads and prelims and improved social value : CSVs’). 5. Opportunities for SME contractors from ‘market management’

CHIC’S RESPONSE

CHIC’S RESPONSE

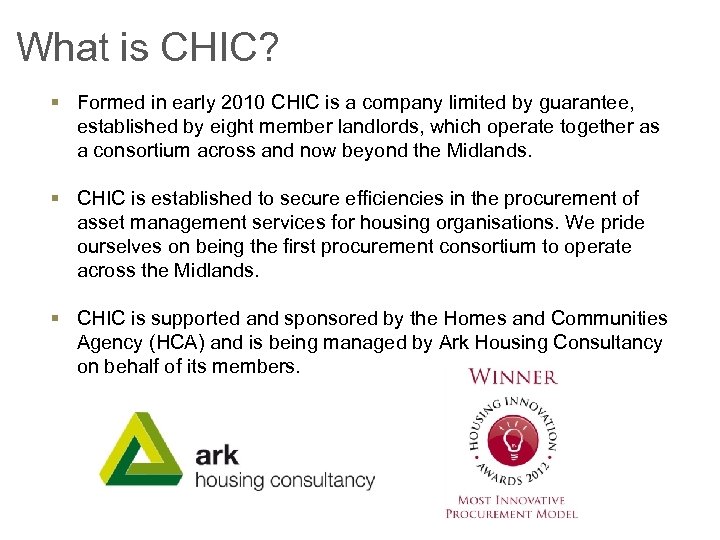

What is CHIC? § Formed in early 2010 CHIC is a company limited by guarantee, established by eight member landlords, which operate together as a consortium across and now beyond the Midlands. § CHIC is established to secure efficiencies in the procurement of asset management services for housing organisations. We pride ourselves on being the first procurement consortium to operate across the Midlands. § CHIC is supported and sponsored by the Homes and Communities Agency (HCA) and is being managed by Ark Housing Consultancy on behalf of its members.

What is CHIC? § Formed in early 2010 CHIC is a company limited by guarantee, established by eight member landlords, which operate together as a consortium across and now beyond the Midlands. § CHIC is established to secure efficiencies in the procurement of asset management services for housing organisations. We pride ourselves on being the first procurement consortium to operate across the Midlands. § CHIC is supported and sponsored by the Homes and Communities Agency (HCA) and is being managed by Ark Housing Consultancy on behalf of its members.

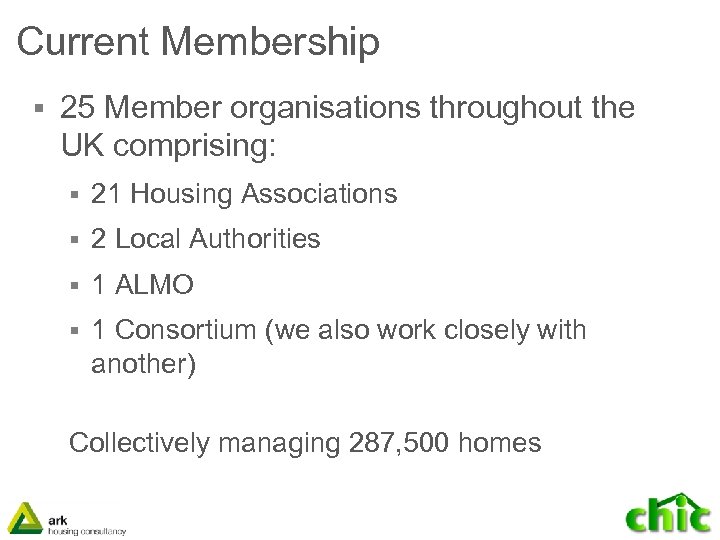

Current Membership § 25 Member organisations throughout the UK comprising: § 21 Housing Associations § 2 Local Authorities § 1 ALMO § 1 Consortium (we also work closely with another) Collectively managing 287, 500 homes

Current Membership § 25 Member organisations throughout the UK comprising: § 21 Housing Associations § 2 Local Authorities § 1 ALMO § 1 Consortium (we also work closely with another) Collectively managing 287, 500 homes

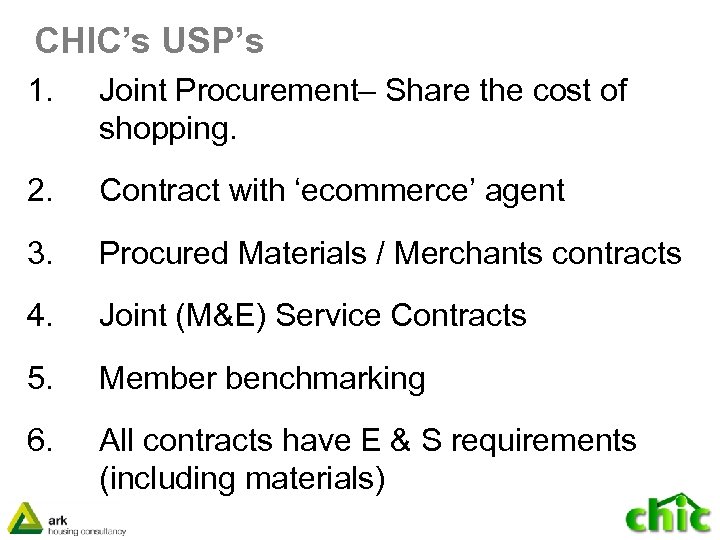

CHIC’s USP’s 1. Joint Procurement– Share the cost of shopping. 2. Contract with ‘ecommerce’ agent 3. Procured Materials / Merchants contracts 4. Joint (M&E) Service Contracts 5. Member benchmarking 6. All contracts have E & S requirements (including materials)

CHIC’s USP’s 1. Joint Procurement– Share the cost of shopping. 2. Contract with ‘ecommerce’ agent 3. Procured Materials / Merchants contracts 4. Joint (M&E) Service Contracts 5. Member benchmarking 6. All contracts have E & S requirements (including materials)

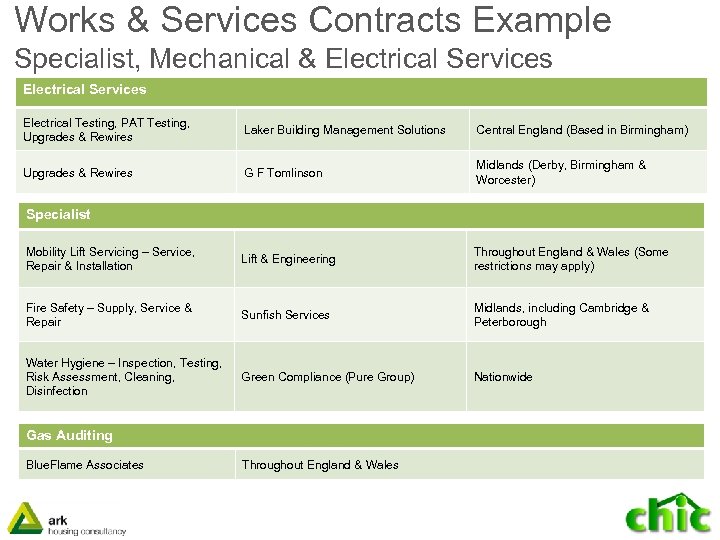

Works & Services Contracts Example Specialist, Mechanical & Electrical Services Electrical Testing, PAT Testing, Upgrades & Rewires Laker Building Management Solutions Central England (Based in Birmingham) Upgrades & Rewires G F Tomlinson Midlands (Derby, Birmingham & Worcester) Mobility Lift Servicing – Service, Repair & Installation Lift & Engineering Throughout England & Wales (Some restrictions may apply) Fire Safety – Supply, Service & Repair Sunfish Services Midlands, including Cambridge & Peterborough Water Hygiene – Inspection, Testing, Risk Assessment, Cleaning, Disinfection Green Compliance (Pure Group) Nationwide Specialist Gas Auditing Blue. Flame Associates Throughout England & Wales

Works & Services Contracts Example Specialist, Mechanical & Electrical Services Electrical Testing, PAT Testing, Upgrades & Rewires Laker Building Management Solutions Central England (Based in Birmingham) Upgrades & Rewires G F Tomlinson Midlands (Derby, Birmingham & Worcester) Mobility Lift Servicing – Service, Repair & Installation Lift & Engineering Throughout England & Wales (Some restrictions may apply) Fire Safety – Supply, Service & Repair Sunfish Services Midlands, including Cambridge & Peterborough Water Hygiene – Inspection, Testing, Risk Assessment, Cleaning, Disinfection Green Compliance (Pure Group) Nationwide Specialist Gas Auditing Blue. Flame Associates Throughout England & Wales

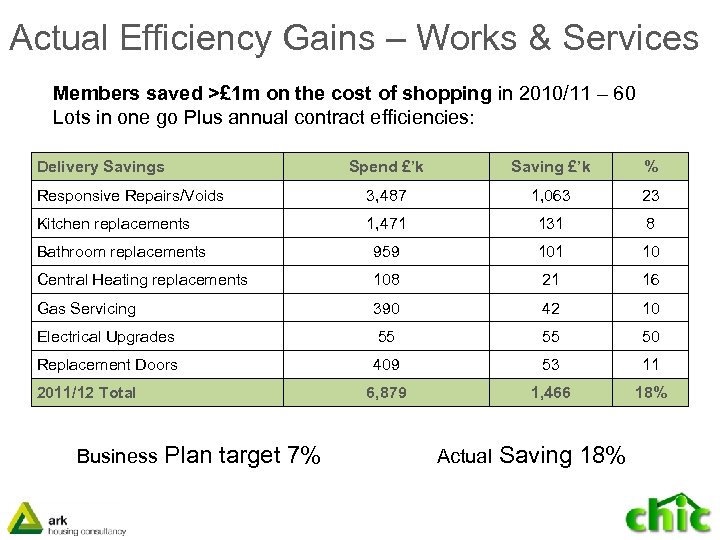

Actual Efficiency Gains – Works & Services Members saved >£ 1 m on the cost of shopping in 2010/11 – 60 Lots in one go Plus annual contract efficiencies: Delivery Savings Spend £’k Saving £’k % Responsive Repairs/Voids 3, 487 1, 063 23 Kitchen replacements 1, 471 131 8 Bathroom replacements 959 101 10 Central Heating replacements 108 21 16 Gas Servicing 390 42 10 Electrical Upgrades 55 55 50 Replacement Doors 409 53 11 6, 879 1, 466 18% 2011/12 Total Business Plan target 7% Actual Saving 18%

Actual Efficiency Gains – Works & Services Members saved >£ 1 m on the cost of shopping in 2010/11 – 60 Lots in one go Plus annual contract efficiencies: Delivery Savings Spend £’k Saving £’k % Responsive Repairs/Voids 3, 487 1, 063 23 Kitchen replacements 1, 471 131 8 Bathroom replacements 959 101 10 Central Heating replacements 108 21 16 Gas Servicing 390 42 10 Electrical Upgrades 55 55 50 Replacement Doors 409 53 11 6, 879 1, 466 18% 2011/12 Total Business Plan target 7% Actual Saving 18%

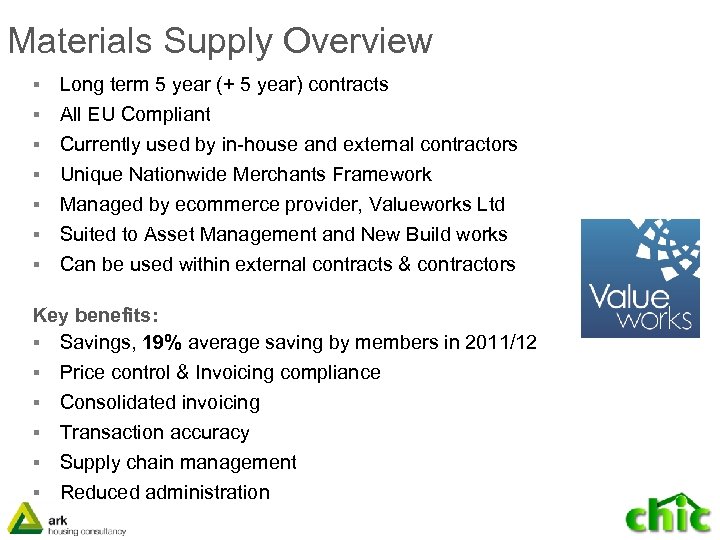

Materials Supply Overview Long term 5 year (+ 5 year) contracts § All EU Compliant § § § Currently used by in-house and external contractors Unique Nationwide Merchants Framework Managed by ecommerce provider, Valueworks Ltd Suited to Asset Management and New Build works Can be used within external contracts & contractors Key benefits: § Savings, 19% average saving by members in 2011/12 § Price control & Invoicing compliance § Consolidated invoicing § Transaction accuracy § Supply chain management § Reduced administration

Materials Supply Overview Long term 5 year (+ 5 year) contracts § All EU Compliant § § § Currently used by in-house and external contractors Unique Nationwide Merchants Framework Managed by ecommerce provider, Valueworks Ltd Suited to Asset Management and New Build works Can be used within external contracts & contractors Key benefits: § Savings, 19% average saving by members in 2011/12 § Price control & Invoicing compliance § Consolidated invoicing § Transaction accuracy § Supply chain management § Reduced administration

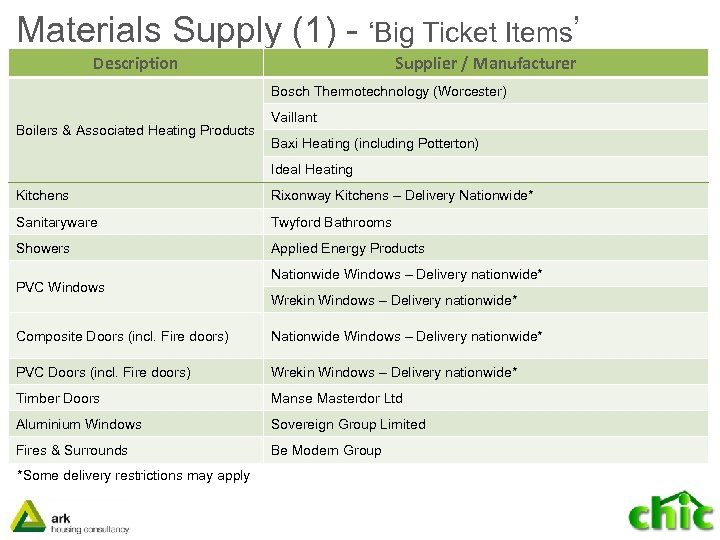

Materials Supply (1) - ‘Big Ticket Items’ Description Supplier / Manufacturer Bosch Thermotechnology (Worcester) Boilers & Associated Heating Products Vaillant Baxi Heating (including Potterton) Ideal Heating Kitchens Rixonway Kitchens – Delivery Nationwide* Sanitaryware Twyford Bathrooms Showers Applied Energy Products PVC Windows Nationwide Windows – Delivery nationwide* Wrekin Windows – Delivery nationwide* Composite Doors (incl. Fire doors) Nationwide Windows – Delivery nationwide* PVC Doors (incl. Fire doors) Wrekin Windows – Delivery nationwide* Timber Doors Manse Masterdor Ltd Aluminium Windows Sovereign Group Limited Fires & Surrounds Be Modern Group *Some delivery restrictions may apply

Materials Supply (1) - ‘Big Ticket Items’ Description Supplier / Manufacturer Bosch Thermotechnology (Worcester) Boilers & Associated Heating Products Vaillant Baxi Heating (including Potterton) Ideal Heating Kitchens Rixonway Kitchens – Delivery Nationwide* Sanitaryware Twyford Bathrooms Showers Applied Energy Products PVC Windows Nationwide Windows – Delivery nationwide* Wrekin Windows – Delivery nationwide* Composite Doors (incl. Fire doors) Nationwide Windows – Delivery nationwide* PVC Doors (incl. Fire doors) Wrekin Windows – Delivery nationwide* Timber Doors Manse Masterdor Ltd Aluminium Windows Sovereign Group Limited Fires & Surrounds Be Modern Group *Some delivery restrictions may apply

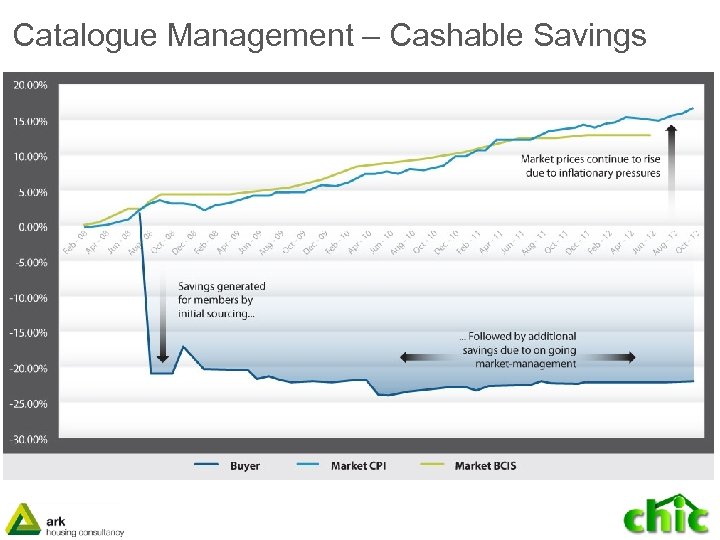

Catalogue Management – Cashable Savings

Catalogue Management – Cashable Savings

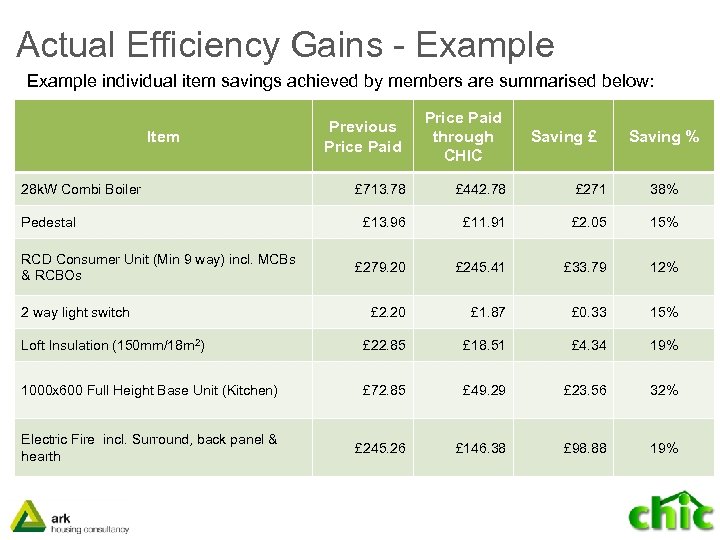

Actual Efficiency Gains - Example individual item savings achieved by members are summarised below: Item 28 k. W Combi Boiler Previous Price Paid through CHIC Saving £ Saving % £ 713. 78 £ 442. 78 £ 271 38% £ 13. 96 £ 11. 91 £ 2. 05 15% £ 279. 20 £ 245. 41 £ 33. 79 12% £ 2. 20 £ 1. 87 £ 0. 33 15% Loft Insulation (150 mm/18 m 2) £ 22. 85 £ 18. 51 £ 4. 34 19% 1000 x 600 Full Height Base Unit (Kitchen) £ 72. 85 £ 49. 29 £ 23. 56 32% Electric Fire incl. Surround, back panel & hearth £ 245. 26 £ 146. 38 £ 98. 88 19% Pedestal RCD Consumer Unit (Min 9 way) incl. MCBs & RCBOs 2 way light switch

Actual Efficiency Gains - Example individual item savings achieved by members are summarised below: Item 28 k. W Combi Boiler Previous Price Paid through CHIC Saving £ Saving % £ 713. 78 £ 442. 78 £ 271 38% £ 13. 96 £ 11. 91 £ 2. 05 15% £ 279. 20 £ 245. 41 £ 33. 79 12% £ 2. 20 £ 1. 87 £ 0. 33 15% Loft Insulation (150 mm/18 m 2) £ 22. 85 £ 18. 51 £ 4. 34 19% 1000 x 600 Full Height Base Unit (Kitchen) £ 72. 85 £ 49. 29 £ 23. 56 32% Electric Fire incl. Surround, back panel & hearth £ 245. 26 £ 146. 38 £ 98. 88 19% Pedestal RCD Consumer Unit (Min 9 way) incl. MCBs & RCBOs 2 way light switch

So Does Size Matter? Yes…. But § Programme planning is key (sustained order book = continuity for workforce) § Understand the detail (cost, not price) § Be prepared to do it differently (materials vs, labour / joint contracts) § Commitment for Employment and Skills Strategy

So Does Size Matter? Yes…. But § Programme planning is key (sustained order book = continuity for workforce) § Understand the detail (cost, not price) § Be prepared to do it differently (materials vs, labour / joint contracts) § Commitment for Employment and Skills Strategy

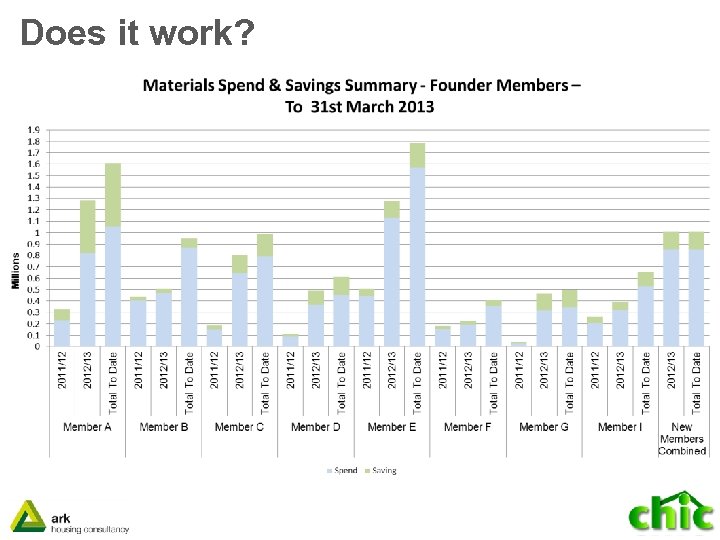

Does it work?

Does it work?

A VIEW OF THE FUTURE

A VIEW OF THE FUTURE

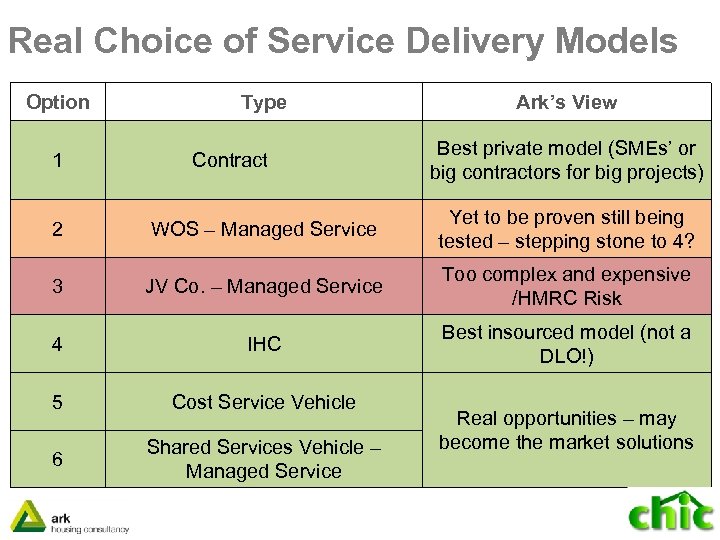

Real Choice of Service Delivery Models Option 1 Type Contract Ark’s View Best private model (SMEs’ or big contractors for big projects) 2 WOS – Managed Service Yet to be proven still being tested – stepping stone to 4? 3 JV Co. – Managed Service Too complex and expensive /HMRC Risk 4 IHC Best insourced model (not a DLO!) 5 Cost Service Vehicle 6 Shared Services Vehicle – Managed Service Real opportunities – may become the market solutions

Real Choice of Service Delivery Models Option 1 Type Contract Ark’s View Best private model (SMEs’ or big contractors for big projects) 2 WOS – Managed Service Yet to be proven still being tested – stepping stone to 4? 3 JV Co. – Managed Service Too complex and expensive /HMRC Risk 4 IHC Best insourced model (not a DLO!) 5 Cost Service Vehicle 6 Shared Services Vehicle – Managed Service Real opportunities – may become the market solutions

Materials Procured Direct Shared Costs of Shopping

Materials Procured Direct Shared Costs of Shopping