35c6f2f56c8784248f466414e97eef45.ppt

- Количество слайдов: 20

® Half-Yearly Review 2011 Six months ended 31 December 2010

® Half-Yearly Review 2011 Six months ended 31 December 2010

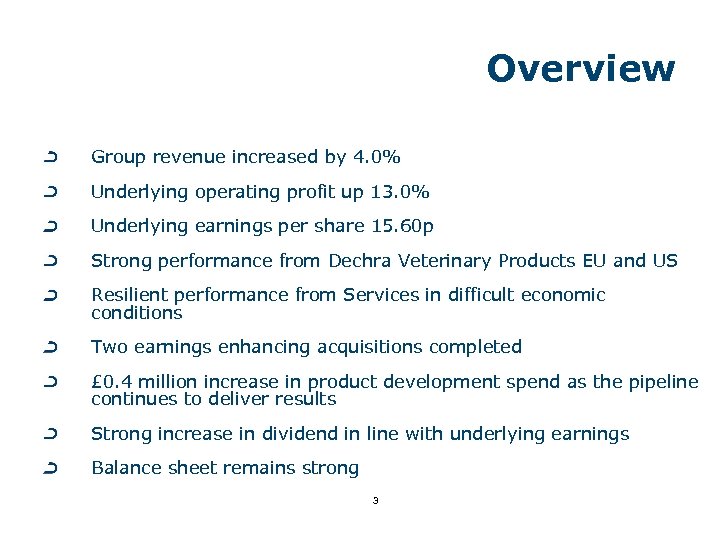

Overview Group revenue increased by 4. 0% Underlying operating profit up 13. 0% Underlying earnings per share 15. 60 p Strong performance from Dechra Veterinary Products EU and US Resilient performance from Services in difficult economic conditions Two earnings enhancing acquisitions completed £ 0. 4 million increase in product development spend as the pipeline continues to deliver results Strong increase in dividend in line with underlying earnings Balance sheet remains strong 3

Overview Group revenue increased by 4. 0% Underlying operating profit up 13. 0% Underlying earnings per share 15. 60 p Strong performance from Dechra Veterinary Products EU and US Resilient performance from Services in difficult economic conditions Two earnings enhancing acquisitions completed £ 0. 4 million increase in product development spend as the pipeline continues to deliver results Strong increase in dividend in line with underlying earnings Balance sheet remains strong 3

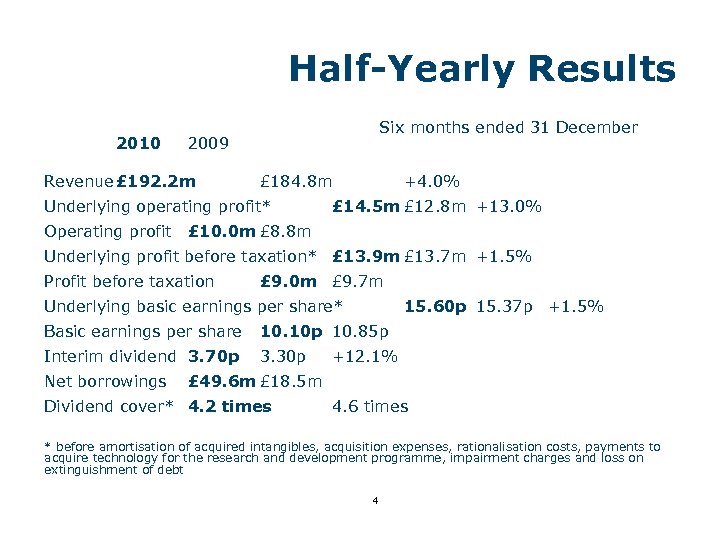

Half-Yearly Results 2010 Six months ended 31 December 2009 Revenue £ 192. 2 m £ 184. 8 m Underlying operating profit* Operating profit +4. 0% £ 14. 5 m £ 12. 8 m +13. 0% £ 10. 0 m £ 8. 8 m Underlying profit before taxation* £ 13. 9 m £ 13. 7 m +1. 5% Profit before taxation £ 9. 0 m £ 9. 7 m Underlying basic earnings per share* 15. 60 p 15. 37 p +1. 5% Basic earnings per share 10. 10 p 10. 85 p Interim dividend 3. 70 p 3. 30 p Net borrowings +12. 1% £ 49. 6 m £ 18. 5 m Dividend cover* 4. 2 times 4. 6 times * before amortisation of acquired intangibles, acquisition expenses, rationalisation costs, payments to acquire technology for the research and development programme, impairment charges and loss on extinguishment of debt 4

Half-Yearly Results 2010 Six months ended 31 December 2009 Revenue £ 192. 2 m £ 184. 8 m Underlying operating profit* Operating profit +4. 0% £ 14. 5 m £ 12. 8 m +13. 0% £ 10. 0 m £ 8. 8 m Underlying profit before taxation* £ 13. 9 m £ 13. 7 m +1. 5% Profit before taxation £ 9. 0 m £ 9. 7 m Underlying basic earnings per share* 15. 60 p 15. 37 p +1. 5% Basic earnings per share 10. 10 p 10. 85 p Interim dividend 3. 70 p 3. 30 p Net borrowings +12. 1% £ 49. 6 m £ 18. 5 m Dividend cover* 4. 2 times 4. 6 times * before amortisation of acquired intangibles, acquisition expenses, rationalisation costs, payments to acquire technology for the research and development programme, impairment charges and loss on extinguishment of debt 4

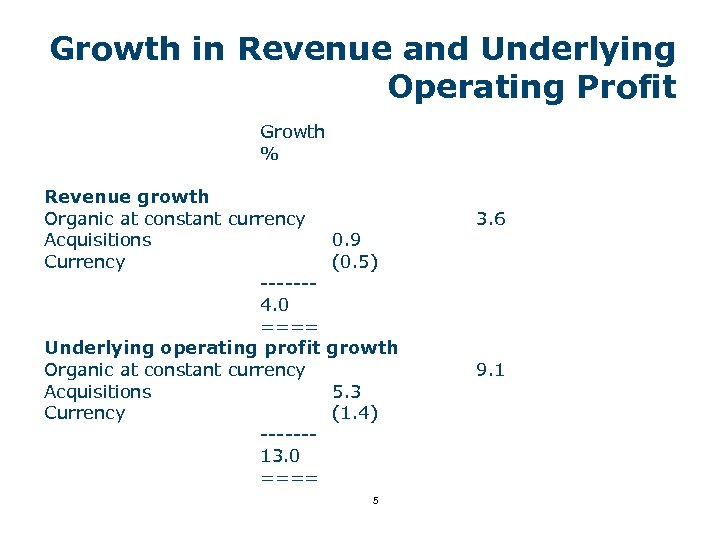

Growth in Revenue and Underlying Operating Profit Growth % Revenue growth Organic at constant currency Acquisitions Currency ------4. 0 ==== Underlying operating profit Organic at constant currency Acquisitions Currency ------13. 0 ==== 0. 9 (0. 5) growth 5. 3 (1. 4) 5 3. 6 9. 1

Growth in Revenue and Underlying Operating Profit Growth % Revenue growth Organic at constant currency Acquisitions Currency ------4. 0 ==== Underlying operating profit Organic at constant currency Acquisitions Currency ------13. 0 ==== 0. 9 (0. 5) growth 5. 3 (1. 4) 5 3. 6 9. 1

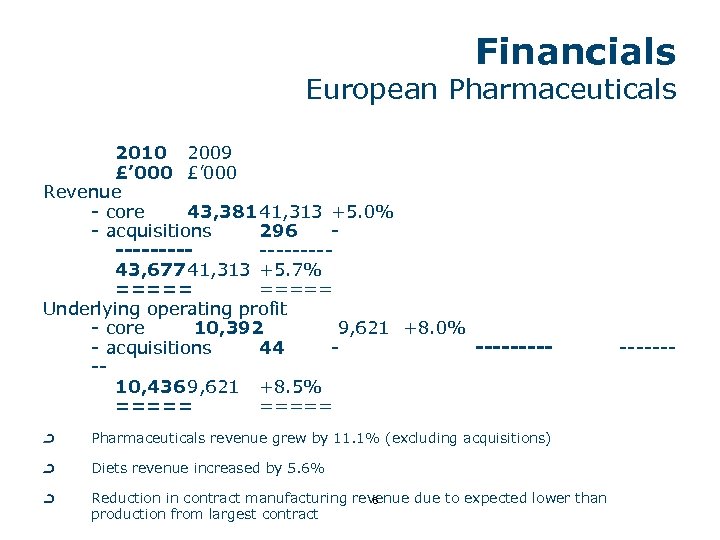

Financials European Pharmaceuticals 2010 2009 £’ 000 Revenue - core 43, 38141, 313 +5. 0% - acquisitions 296 --------43, 67741, 313 +5. 7% ===== Underlying operating profit - core 10, 392 9, 621 +8. 0% - acquisitions 44 -----10, 4369, 621 +8. 5% ===== Pharmaceuticals revenue grew by 11. 1% (excluding acquisitions) Diets revenue increased by 5. 6% Reduction in contract manufacturing revenue due to expected lower than 6 production from largest contract -------

Financials European Pharmaceuticals 2010 2009 £’ 000 Revenue - core 43, 38141, 313 +5. 0% - acquisitions 296 --------43, 67741, 313 +5. 7% ===== Underlying operating profit - core 10, 392 9, 621 +8. 0% - acquisitions 44 -----10, 4369, 621 +8. 5% ===== Pharmaceuticals revenue grew by 11. 1% (excluding acquisitions) Diets revenue increased by 5. 6% Reduction in contract manufacturing revenue due to expected lower than 6 production from largest contract -------

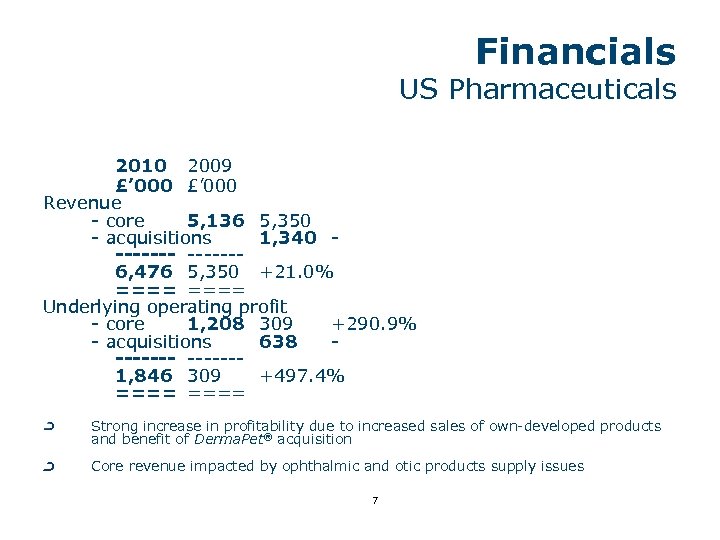

Financials US Pharmaceuticals 2010 2009 £’ 000 Revenue - core 5, 136 5, 350 - acquisitions 1, 340 -------6, 476 5, 350 +21. 0% ==== Underlying operating profit - core 1, 208 309 +290. 9% - acquisitions 638 -------1, 846 309 +497. 4% ==== Strong increase in profitability due to increased sales of own-developed products and benefit of Derma. Pet® acquisition Core revenue impacted by ophthalmic and otic products supply issues 7

Financials US Pharmaceuticals 2010 2009 £’ 000 Revenue - core 5, 136 5, 350 - acquisitions 1, 340 -------6, 476 5, 350 +21. 0% ==== Underlying operating profit - core 1, 208 309 +290. 9% - acquisitions 638 -------1, 846 309 +497. 4% ==== Strong increase in profitability due to increased sales of own-developed products and benefit of Derma. Pet® acquisition Core revenue impacted by ophthalmic and otic products supply issues 7

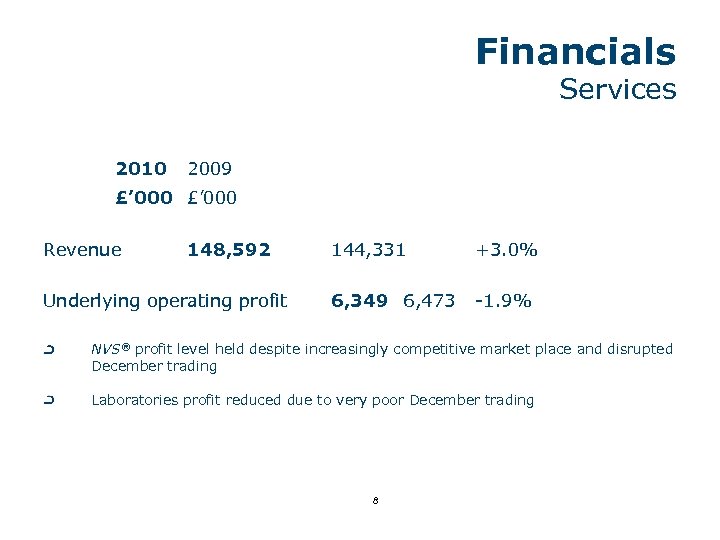

Financials Services 2010 2009 £’ 000 Revenue 148, 592 Underlying operating profit 144, 331 +3. 0% 6, 349 6, 473 -1. 9% NVS® profit level held despite increasingly competitive market place and disrupted December trading Laboratories profit reduced due to very poor December trading 8

Financials Services 2010 2009 £’ 000 Revenue 148, 592 Underlying operating profit 144, 331 +3. 0% 6, 349 6, 473 -1. 9% NVS® profit level held despite increasingly competitive market place and disrupted December trading Laboratories profit reduced due to very poor December trading 8

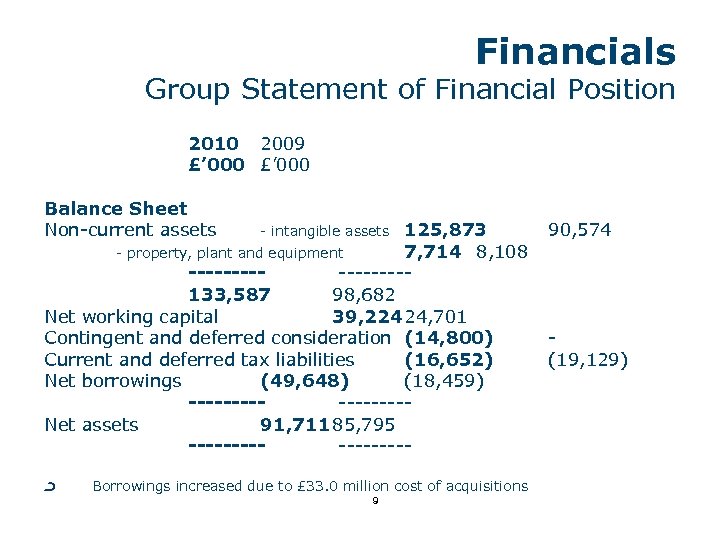

Financials Group Statement of Financial Position 2010 2009 £’ 000 Balance Sheet Non-current assets 125, 873 - property, plant and equipment 7, 714 8, 108 --------133, 587 98, 682 Net working capital 39, 22424, 701 Contingent and deferred consideration (14, 800) Current and deferred tax liabilities (16, 652) Net borrowings (49, 648) (18, 459) --------Net assets 91, 71185, 795 --------- intangible assets Borrowings increased due to £ 33. 0 million cost of acquisitions 9 90, 574 (19, 129)

Financials Group Statement of Financial Position 2010 2009 £’ 000 Balance Sheet Non-current assets 125, 873 - property, plant and equipment 7, 714 8, 108 --------133, 587 98, 682 Net working capital 39, 22424, 701 Contingent and deferred consideration (14, 800) Current and deferred tax liabilities (16, 652) Net borrowings (49, 648) (18, 459) --------Net assets 91, 71185, 795 --------- intangible assets Borrowings increased due to £ 33. 0 million cost of acquisitions 9 90, 574 (19, 129)

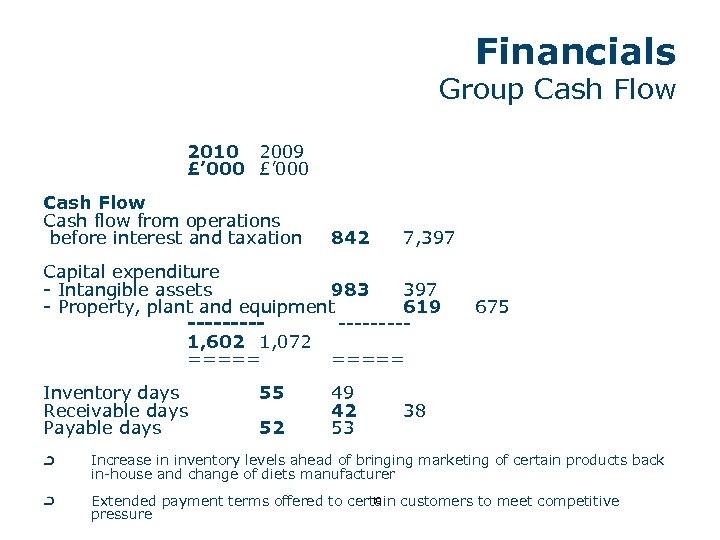

Financials Group Cash Flow 2010 2009 £’ 000 Cash Flow Cash flow from operations before interest and taxation 842 7, 397 Capital expenditure - Intangible assets 983 397 - Property, plant and equipment 619 --------1, 602 1, 072 ===== Inventory days Receivable days Payable days 55 52 49 42 53 675 38 Increase in inventory levels ahead of bringing marketing of certain products back in-house and change of diets manufacturer 10 Extended payment terms offered to certain customers to meet competitive pressure

Financials Group Cash Flow 2010 2009 £’ 000 Cash Flow Cash flow from operations before interest and taxation 842 7, 397 Capital expenditure - Intangible assets 983 397 - Property, plant and equipment 619 --------1, 602 1, 072 ===== Inventory days Receivable days Payable days 55 52 49 42 53 675 38 Increase in inventory levels ahead of bringing marketing of certain products back in-house and change of diets manufacturer 10 Extended payment terms offered to certain customers to meet competitive pressure

Acquisition - Derma. Pet Total potential consideration US$64. 0 million Funded by refinancing debt facility Accelerates presence and scale of our US operation Further strengthens the Group’s dermatological portfolio Cost synergies identified and being delivered in H 2 Opportunity to increase EU sales Will be materially earnings enhancing in first full year 11

Acquisition - Derma. Pet Total potential consideration US$64. 0 million Funded by refinancing debt facility Accelerates presence and scale of our US operation Further strengthens the Group’s dermatological portfolio Cost synergies identified and being delivered in H 2 Opportunity to increase EU sales Will be materially earnings enhancing in first full year 11

Acquisition - Genitrix® Total potential consideration £ 6. 4 million Funded from existing cash resources Increases UK portfolio of veterinary products Significant cost synergies identified and being delivered in H 2 Recently approved UK product Libromide® being taken through Mutual Recognition Will be earnings enhancing in first full year 12

Acquisition - Genitrix® Total potential consideration £ 6. 4 million Funded from existing cash resources Increases UK portfolio of veterinary products Significant cost synergies identified and being delivered in H 2 Recently approved UK product Libromide® being taken through Mutual Recognition Will be earnings enhancing in first full year 12

Product Development Vetoryl® approved in Japan Equidone® approved in USA Two generics approved in the UK Progress made on pipeline New opportunities being explored Organic ‘Specific®’ range launch imminent 13

Product Development Vetoryl® approved in Japan Equidone® approved in USA Two generics approved in the UK Progress made on pipeline New opportunities being explored Organic ‘Specific®’ range launch imminent 13

European Pharmaceuticals Review Dechra Veterinary Products EU Overall veterinary product growth of 8. 0% Both pharma and diets outperforming markets New EU market opportunities; Belgium and Germany Contracts completed for Specific to be marketed in USA and South Korea Dales® Manufacturing Application to achieve FDA compliance at ‘Dales’ ongoing Fuciderm® Gel and Canaural® now manufactured at Dales 14

European Pharmaceuticals Review Dechra Veterinary Products EU Overall veterinary product growth of 8. 0% Both pharma and diets outperforming markets New EU market opportunities; Belgium and Germany Contracts completed for Specific to be marketed in USA and South Korea Dales® Manufacturing Application to achieve FDA compliance at ‘Dales’ ongoing Fuciderm® Gel and Canaural® now manufactured at Dales 14

US Pharmaceuticals Review Dechra Veterinary Products US Equidone launched Sales and marketing teams strengthened Vetoryl not yet fulfilling its potential Supply issues on otic and ophthalmic products detract from strong performance 15

US Pharmaceuticals Review Dechra Veterinary Products US Equidone launched Sales and marketing teams strengthened Vetoryl not yet fulfilling its potential Supply issues on otic and ophthalmic products detract from strong performance 15

Services Review NVS Operating efficiencies gained Integrated ERP system go live planned for April 2011 Laboratories Result affected by poor December performance Largest client retained following tender 16

Services Review NVS Operating efficiencies gained Integrated ERP system go live planned for April 2011 Laboratories Result affected by poor December performance Largest client retained following tender 16

Outlook International pharmaceutical and diets businesses delivering good growth Strong growth in own products underpins Group strategy General economic weakness resulting in competitive markets New products and in-house marketing of our own products will enhance growth Cost synergies will be delivered from recent acquisitions Strong product development pipeline Our strategy will continue to deliver shareholder value 17

Outlook International pharmaceutical and diets businesses delivering good growth Strong growth in own products underpins Group strategy General economic weakness resulting in competitive markets New products and in-house marketing of our own products will enhance growth Cost synergies will be delivered from recent acquisitions Strong product development pipeline Our strategy will continue to deliver shareholder value 17

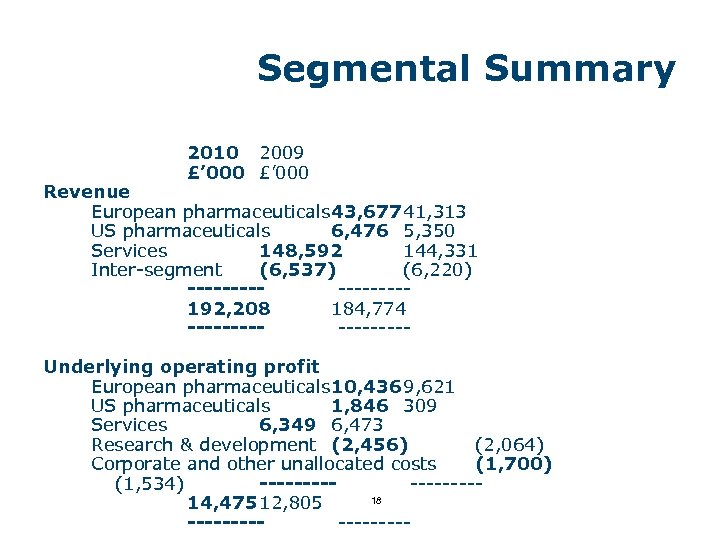

Segmental Summary 2010 2009 £’ 000 Revenue European pharmaceuticals 43, 67741, 313 US pharmaceuticals 6, 476 5, 350 Services 148, 592 144, 331 Inter-segment (6, 537) (6, 220) --------192, 208 184, 774 --------Underlying operating profit European pharmaceuticals 10, 4369, 621 US pharmaceuticals 1, 846 309 Services 6, 349 6, 473 Research & development (2, 456) (2, 064) Corporate and other unallocated costs (1, 700) (1, 534) --------18 14, 47512, 805 ---------

Segmental Summary 2010 2009 £’ 000 Revenue European pharmaceuticals 43, 67741, 313 US pharmaceuticals 6, 476 5, 350 Services 148, 592 144, 331 Inter-segment (6, 537) (6, 220) --------192, 208 184, 774 --------Underlying operating profit European pharmaceuticals 10, 4369, 621 US pharmaceuticals 1, 846 309 Services 6, 349 6, 473 Research & development (2, 456) (2, 064) Corporate and other unallocated costs (1, 700) (1, 534) --------18 14, 47512, 805 ---------

Trademarks of the Dechra Group of companies appear throughout this document in italics. Dechra and the Dechra ‘D’ logo are registered Trademarks of Dechra Pharmaceuticals PLC. The Malaseb Trademark is used under licence from Dermcare-Vet Pty. Ltd. Forward-Looking Statements This document contains certain forward-looking statements. The forward-looking statements reflect the knowledge and information available to the Company during the preparation and up to the publication of this document. By their very nature, these statements depend upon circumstances and relate to events that may occur in the future thereby involving a degree of uncertainty. Therefore, nothing in this document should be construed as a profit forecast by the Company. 19

Trademarks of the Dechra Group of companies appear throughout this document in italics. Dechra and the Dechra ‘D’ logo are registered Trademarks of Dechra Pharmaceuticals PLC. The Malaseb Trademark is used under licence from Dermcare-Vet Pty. Ltd. Forward-Looking Statements This document contains certain forward-looking statements. The forward-looking statements reflect the knowledge and information available to the Company during the preparation and up to the publication of this document. By their very nature, these statements depend upon circumstances and relate to events that may occur in the future thereby involving a degree of uncertainty. Therefore, nothing in this document should be construed as a profit forecast by the Company. 19

20

20