8bc447c9f4098fb433c1b3b157121779.ppt

- Количество слайдов: 59

GST Awareness Campaign TRAINING FOR DDOs & LOCAL BODIES ON GST LAW & TDS PROCEDURE 1

GST Awareness Campaign TRAINING FOR DDOs & LOCAL BODIES ON GST LAW & TDS PROCEDURE 1

Presentation Plan Introduction: GST A Game Changer Benefits and Salient Features of GST Registration and Returns Tax Deduction at Source Payments 2

Presentation Plan Introduction: GST A Game Changer Benefits and Salient Features of GST Registration and Returns Tax Deduction at Source Payments 2

What is GST? One Tax For Manufacturing Trading Services ONE NATION: ONE TAX 3

What is GST? One Tax For Manufacturing Trading Services ONE NATION: ONE TAX 3

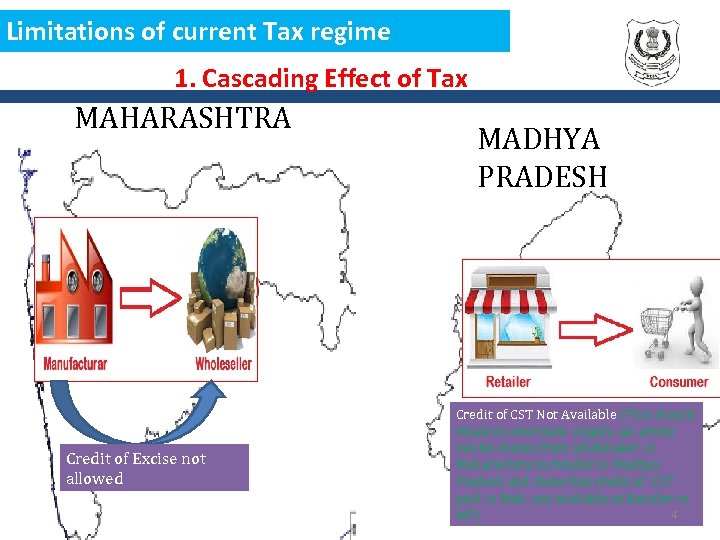

Limitations of current Tax regime 1. Cascading Effect of Tax MAHARASHTRA Credit of Excise not allowed MADHYA PRADESH Credit of CST Not Available (This should relate to interstate supply. An arrow can be shown from wholesaler in Maharashtra to retailer in Madhya Pradesh and show that credit of CST paid in Mah. not available to Retailer in 4 MP)

Limitations of current Tax regime 1. Cascading Effect of Tax MAHARASHTRA Credit of Excise not allowed MADHYA PRADESH Credit of CST Not Available (This should relate to interstate supply. An arrow can be shown from wholesaler in Maharashtra to retailer in Madhya Pradesh and show that credit of CST paid in Mah. not available to Retailer in 4 MP)

Limitations of current Tax regime : 2. Multiple Registrations Central Excise 5

Limitations of current Tax regime : 2. Multiple Registrations Central Excise 5

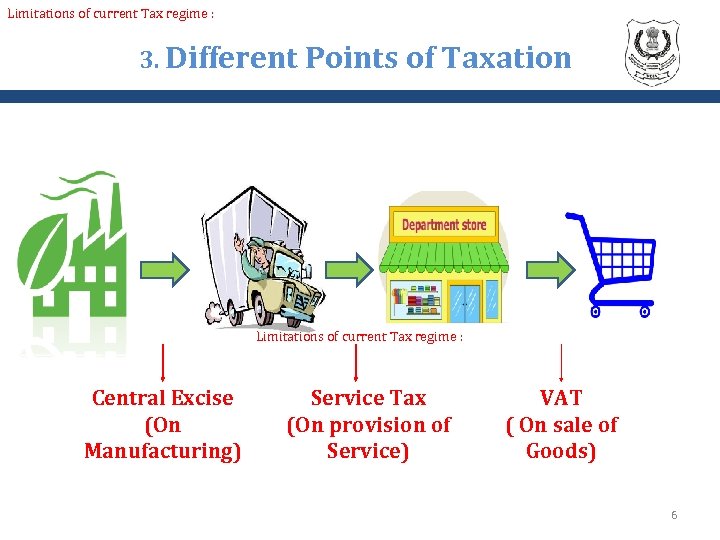

Limitations of current Tax regime : 3. Different Points of Taxation Limitations of current Tax regime : Central Excise (On Manufacturing) Service Tax (On provision of Service) VAT ( On sale of Goods) 6

Limitations of current Tax regime : 3. Different Points of Taxation Limitations of current Tax regime : Central Excise (On Manufacturing) Service Tax (On provision of Service) VAT ( On sale of Goods) 6

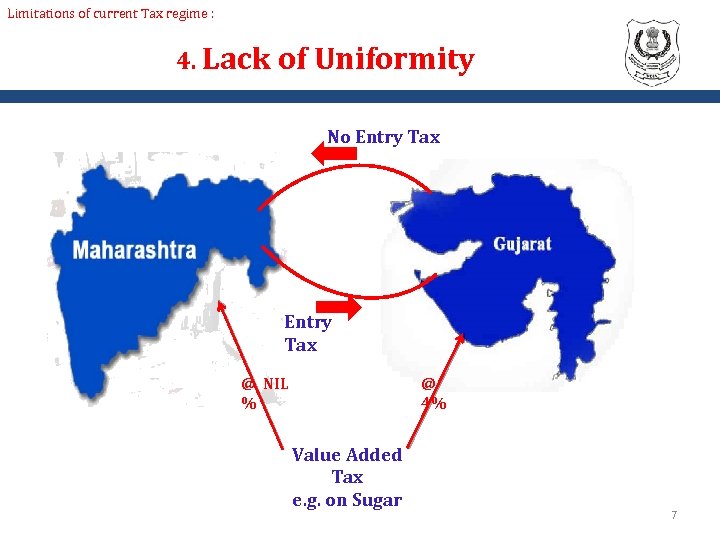

Limitations of current Tax regime : 4. Lack of Uniformity No Entry Tax @ NIL % @ 4% Value Added Tax e. g. on Sugar 7

Limitations of current Tax regime : 4. Lack of Uniformity No Entry Tax @ NIL % @ 4% Value Added Tax e. g. on Sugar 7

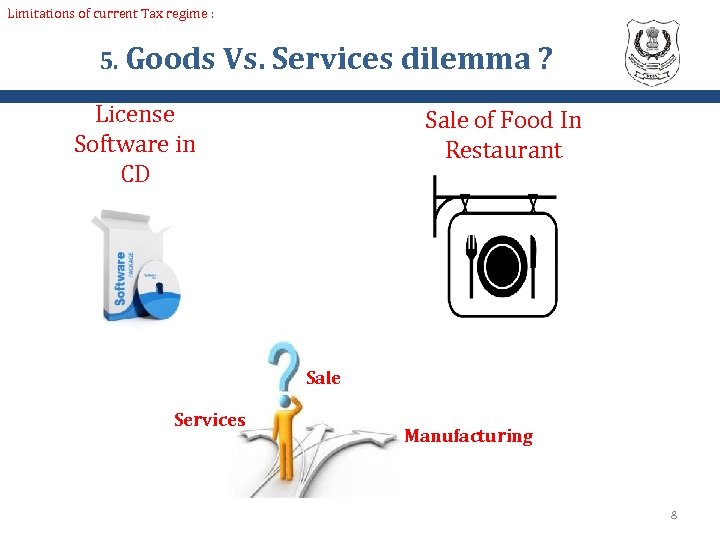

Limitations of current Tax regime : 5. Goods Vs. Services dilemma ? License Software in CD Sale of Food In Restaurant Sale Services Manufacturing 8

Limitations of current Tax regime : 5. Goods Vs. Services dilemma ? License Software in CD Sale of Food In Restaurant Sale Services Manufacturing 8

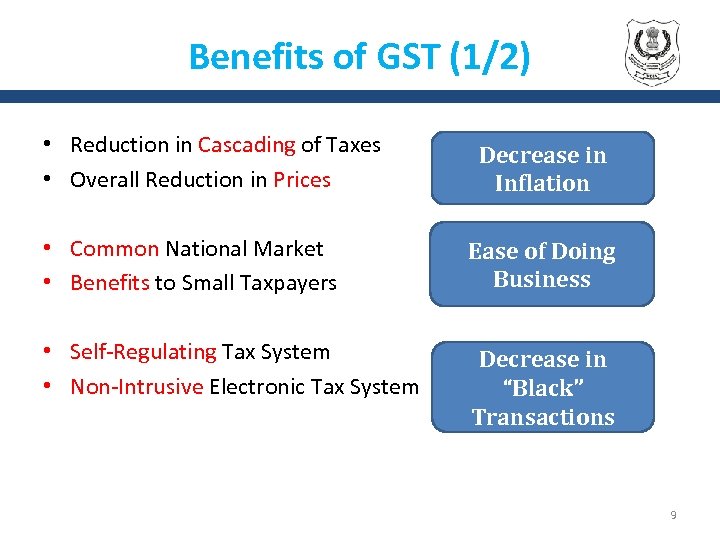

Benefits of GST (1/2) • Reduction in Cascading of Taxes • Overall Reduction in Prices Decrease in Inflation • Common National Market • Benefits to Small Taxpayers Ease of Doing Business • Self-Regulating Tax System • Non-Intrusive Electronic Tax System Decrease in “Black” Transactions 9

Benefits of GST (1/2) • Reduction in Cascading of Taxes • Overall Reduction in Prices Decrease in Inflation • Common National Market • Benefits to Small Taxpayers Ease of Doing Business • Self-Regulating Tax System • Non-Intrusive Electronic Tax System Decrease in “Black” Transactions 9

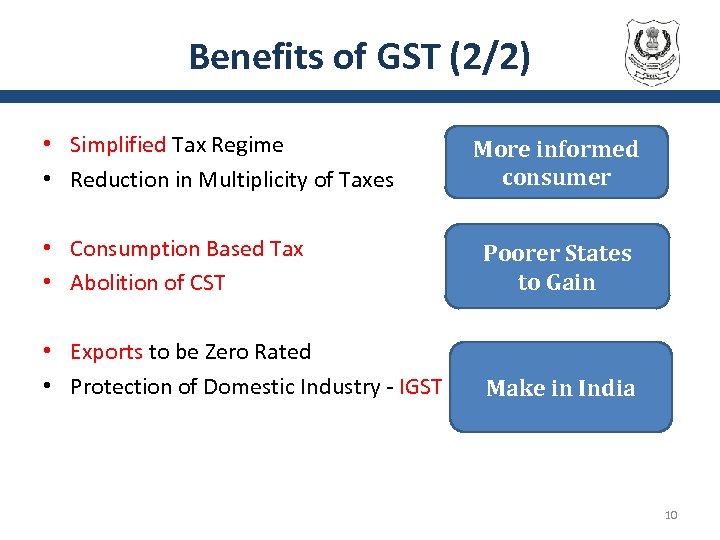

Benefits of GST (2/2) • Simplified Tax Regime • Reduction in Multiplicity of Taxes More informed consumer • Consumption Based Tax • Abolition of CST Poorer States to Gain • Exports to be Zero Rated • Protection of Domestic Industry - IGST Make in India 10

Benefits of GST (2/2) • Simplified Tax Regime • Reduction in Multiplicity of Taxes More informed consumer • Consumption Based Tax • Abolition of CST Poorer States to Gain • Exports to be Zero Rated • Protection of Domestic Industry - IGST Make in India 10

Salient features of GST • The GST would be applicable on the supply of goods or services. • It would be a single GST on any item out of which 50% will go to Central Govt and 50% will go to State Govt / Union Territory. Ø Central tax (CGST) and State tax (SGST) / Union territory tax (UTGST). • The GST would apply on all goods or services or both other than alcoholic liquor for human consumption and five petroleum products. 11

Salient features of GST • The GST would be applicable on the supply of goods or services. • It would be a single GST on any item out of which 50% will go to Central Govt and 50% will go to State Govt / Union Territory. Ø Central tax (CGST) and State tax (SGST) / Union territory tax (UTGST). • The GST would apply on all goods or services or both other than alcoholic liquor for human consumption and five petroleum products. 11

Salient features of GST. . . (contd. ) • Destination based consumption tax Ø The tax would accrue to the State which has jurisdiction over the place of consumption which is also termed as place of supply. Ø Levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. Ø In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer. Ø Exports would be tax-free and imports taxed at the same rate as integrated tax (IGST) levied on inter-State supply of like domestic products 12

Salient features of GST. . . (contd. ) • Destination based consumption tax Ø The tax would accrue to the State which has jurisdiction over the place of consumption which is also termed as place of supply. Ø Levied at all stages right from manufacture up to final consumption with credit of taxes paid at previous stages available as setoff. Ø In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer. Ø Exports would be tax-free and imports taxed at the same rate as integrated tax (IGST) levied on inter-State supply of like domestic products 12

Salient features of GST. . . (contd. ) • Tax payers with an aggregate turnover in a financial year up to Rs. 20 lakhs would be exempt from tax. Ø For special category states specified in Article 279 A, the threshold exemption shall be Rs. 10 lakhs. Ø Tax payers making inter-State supplies or paying tax on reverse charge basis shall not be eligible for threshold exemption. • Small taxpayers with an aggregate turnover in a financial year up to Rs. 75 lakhs shall be eligible for composition levy. 13

Salient features of GST. . . (contd. ) • Tax payers with an aggregate turnover in a financial year up to Rs. 20 lakhs would be exempt from tax. Ø For special category states specified in Article 279 A, the threshold exemption shall be Rs. 10 lakhs. Ø Tax payers making inter-State supplies or paying tax on reverse charge basis shall not be eligible for threshold exemption. • Small taxpayers with an aggregate turnover in a financial year up to Rs. 75 lakhs shall be eligible for composition levy. 13

Salient features of GST. . . (contd. ) • An Integrated GST (IGST) would be levied and collected by the Centre on inter-State supply of goods and services. • HSN code shall be used for classifying the goods under the GST regime. • Taxpayers whose turnover is above Rs. 1. 5 crores but below Rs. 5 crores shall use 2 -digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4 -digit code. • For Services, Service Accounting Codes (SAC) shall be used 14

Salient features of GST. . . (contd. ) • An Integrated GST (IGST) would be levied and collected by the Centre on inter-State supply of goods and services. • HSN code shall be used for classifying the goods under the GST regime. • Taxpayers whose turnover is above Rs. 1. 5 crores but below Rs. 5 crores shall use 2 -digit code and the taxpayers whose turnover is Rs. 5 crores and above shall use 4 -digit code. • For Services, Service Accounting Codes (SAC) shall be used 14

Salient features of GST. . . (contd. ) • Exports and Supplies to SEZs shall be treated as zero-rated supply. No tax is payable on exports but ITC related to the supply shall be refunded to exporters. • Import of goods/services would be subject to IGST in addition to Basic Customs duty. • Laws and procedures for levy and collection of CGST/SGST would be harmonized to the extent possible. 15

Salient features of GST. . . (contd. ) • Exports and Supplies to SEZs shall be treated as zero-rated supply. No tax is payable on exports but ITC related to the supply shall be refunded to exporters. • Import of goods/services would be subject to IGST in addition to Basic Customs duty. • Laws and procedures for levy and collection of CGST/SGST would be harmonized to the extent possible. 15

GST Rates: 0%( on essential items, rice/wheat) 0. 25% unpolished Diamonds/raw gold/silver. 3% Gold and Silver 5%: ( on items of mass consumption ) 12%/18%: (standard rates covering most manufactured items and Services) 28% : ( on Consumer Durable Goods, Pan masala, tobacco and aerated drinks etc) • Basic philosophy behind these rates are that, to the extent possible, the current combined rate of tax levied on individual goods by the Central and the State Governments should be maintained in GST • Uniform GST rate not possible at this stage as luxury goods and goods consumed by poorer sections of society cannot be taxed at the same rate • Rates will be notified by Government on recommendations of GST Council. • • • 16

GST Rates: 0%( on essential items, rice/wheat) 0. 25% unpolished Diamonds/raw gold/silver. 3% Gold and Silver 5%: ( on items of mass consumption ) 12%/18%: (standard rates covering most manufactured items and Services) 28% : ( on Consumer Durable Goods, Pan masala, tobacco and aerated drinks etc) • Basic philosophy behind these rates are that, to the extent possible, the current combined rate of tax levied on individual goods by the Central and the State Governments should be maintained in GST • Uniform GST rate not possible at this stage as luxury goods and goods consumed by poorer sections of society cannot be taxed at the same rate • Rates will be notified by Government on recommendations of GST Council. • • • 16

0% Goods (some examples) • • • • Live animals, trees, plants Fresh meat , fish, milk, vegetables, fruits Cereals Sowing seeds Betel leaves Gur Puffed rice Papad Bread (branded or otherwise) Prasad Non-alcoholic toddy, neera Aquatic feed, poultry feed, cattle feed Indigenous handmade musical instruments 17

0% Goods (some examples) • • • • Live animals, trees, plants Fresh meat , fish, milk, vegetables, fruits Cereals Sowing seeds Betel leaves Gur Puffed rice Papad Bread (branded or otherwise) Prasad Non-alcoholic toddy, neera Aquatic feed, poultry feed, cattle feed Indigenous handmade musical instruments 17

5% Goods • • • • • Cashew nuts Cashew nut in shell (reverse charge) Frozen fish UHT milk Tea and coffee Branded rice, wheat, flour in container Copra Oil seeds Edible oil Khandsari sugar Pizza bread Bread rusk Sweetmeats All ores, coal Medicines and diagnostic kits Cruise ships, ferry boats, barges, shipping vessels Silk yarn and fabric Cotton yarn, cotton fabric 18

5% Goods • • • • • Cashew nuts Cashew nut in shell (reverse charge) Frozen fish UHT milk Tea and coffee Branded rice, wheat, flour in container Copra Oil seeds Edible oil Khandsari sugar Pizza bread Bread rusk Sweetmeats All ores, coal Medicines and diagnostic kits Cruise ships, ferry boats, barges, shipping vessels Silk yarn and fabric Cotton yarn, cotton fabric 18

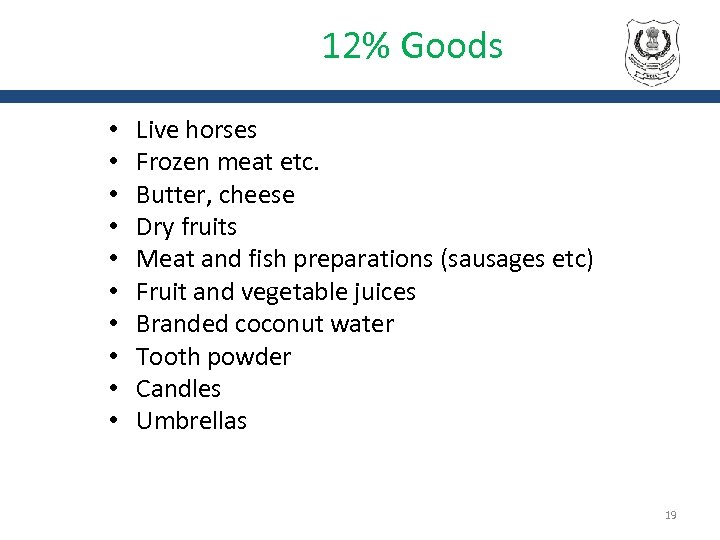

12% Goods • • • Live horses Frozen meat etc. Butter, cheese Dry fruits Meat and fish preparations (sausages etc) Fruit and vegetable juices Branded coconut water Tooth powder Candles Umbrellas 19

12% Goods • • • Live horses Frozen meat etc. Butter, cheese Dry fruits Meat and fish preparations (sausages etc) Fruit and vegetable juices Branded coconut water Tooth powder Candles Umbrellas 19

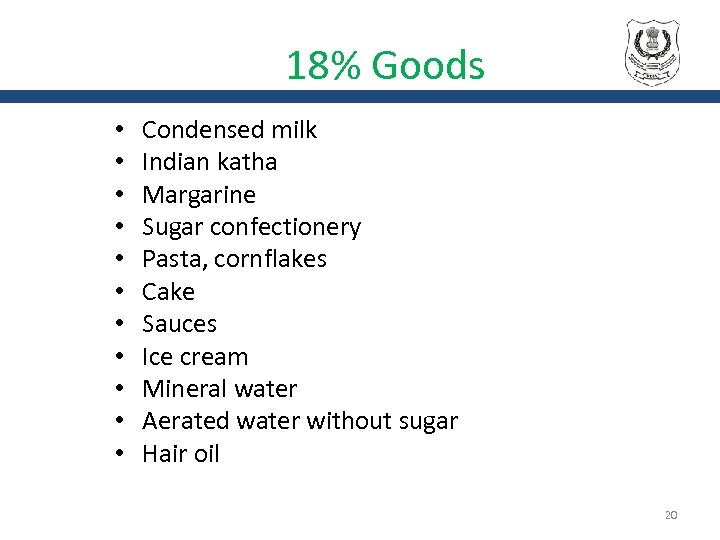

18% Goods • • • Condensed milk Indian katha Margarine Sugar confectionery Pasta, cornflakes Cake Sauces Ice cream Mineral water Aerated water without sugar Hair oil 20

18% Goods • • • Condensed milk Indian katha Margarine Sugar confectionery Pasta, cornflakes Cake Sauces Ice cream Mineral water Aerated water without sugar Hair oil 20

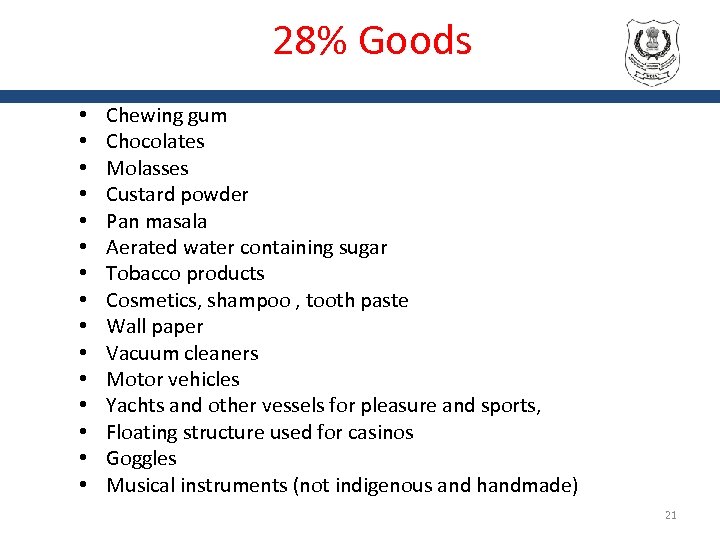

28% Goods • • • • Chewing gum Chocolates Molasses Custard powder Pan masala Aerated water containing sugar Tobacco products Cosmetics, shampoo , tooth paste Wall paper Vacuum cleaners Motor vehicles Yachts and other vessels for pleasure and sports, Floating structure used for casinos Goggles Musical instruments (not indigenous and handmade) 21

28% Goods • • • • Chewing gum Chocolates Molasses Custard powder Pan masala Aerated water containing sugar Tobacco products Cosmetics, shampoo , tooth paste Wall paper Vacuum cleaners Motor vehicles Yachts and other vessels for pleasure and sports, Floating structure used for casinos Goggles Musical instruments (not indigenous and handmade) 21

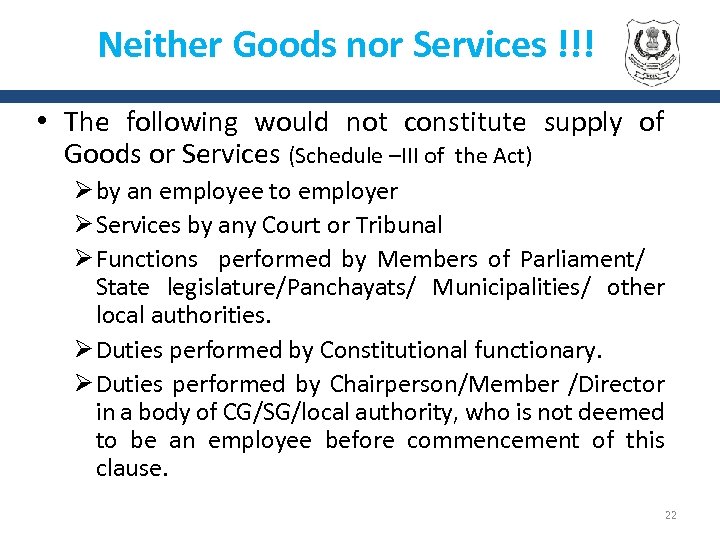

Neither Goods nor Services !!! • The following would not constitute supply of Goods or Services (Schedule –III of the Act) Ø by an employee to employer Ø Services by any Court or Tribunal Ø Functions performed by Members of Parliament/ State legislature/Panchayats/ Municipalities/ other local authorities. Ø Duties performed by Constitutional functionary. Ø Duties performed by Chairperson/Member /Director in a body of CG/SG/local authority, who is not deemed to be an employee before commencement of this clause. 22

Neither Goods nor Services !!! • The following would not constitute supply of Goods or Services (Schedule –III of the Act) Ø by an employee to employer Ø Services by any Court or Tribunal Ø Functions performed by Members of Parliament/ State legislature/Panchayats/ Municipalities/ other local authorities. Ø Duties performed by Constitutional functionary. Ø Duties performed by Chairperson/Member /Director in a body of CG/SG/local authority, who is not deemed to be an employee before commencement of this clause. 22

Neither Goods nor Services !!! (Contd. ) ØFuneral, burial, crematorium/mortuary service, including transportation of deceased ØSale of land ØSale of building[ subject to clause (b) of paragraph 5 of Schedule II) ØActionable claims, other than lottery, betting and gambling 23

Neither Goods nor Services !!! (Contd. ) ØFuneral, burial, crematorium/mortuary service, including transportation of deceased ØSale of land ØSale of building[ subject to clause (b) of paragraph 5 of Schedule II) ØActionable claims, other than lottery, betting and gambling 23

Activities which are supply of Goods/services (Schedule II) • Works Contract -- service • Renting/leasing of land or building -- service • Job Work – treatment/process --- service 24

Activities which are supply of Goods/services (Schedule II) • Works Contract -- service • Renting/leasing of land or building -- service • Job Work – treatment/process --- service 24

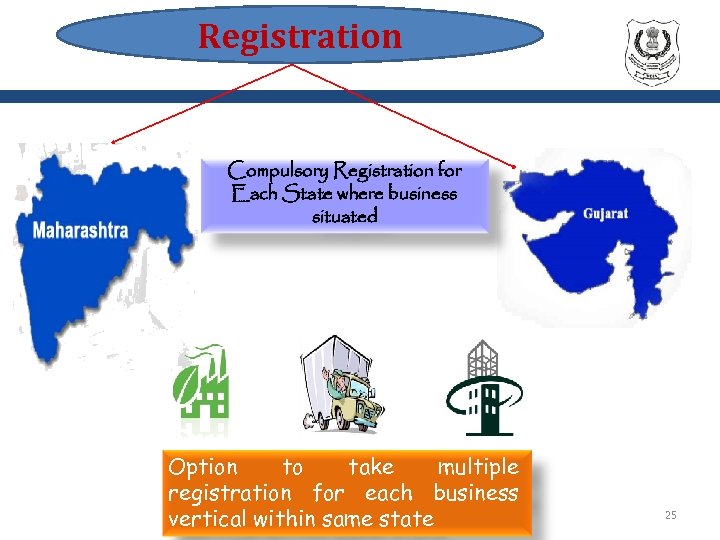

Registration Compulsory Registration for Each State where business situated Option to take multiple registration for each business vertical within same state 25

Registration Compulsory Registration for Each State where business situated Option to take multiple registration for each business vertical within same state 25

Registration (contd. ) • Liability to be registered Ø Every person who is registered under existing indirect laws being subsumed in GST Ø Every person whose turnover in a year exceeds Rs. 20 lakhs ( Rs. Ten lakhs for special category states) Ø Voluntary registration permitted even if no liability. 26

Registration (contd. ) • Liability to be registered Ø Every person who is registered under existing indirect laws being subsumed in GST Ø Every person whose turnover in a year exceeds Rs. 20 lakhs ( Rs. Ten lakhs for special category states) Ø Voluntary registration permitted even if no liability. 26

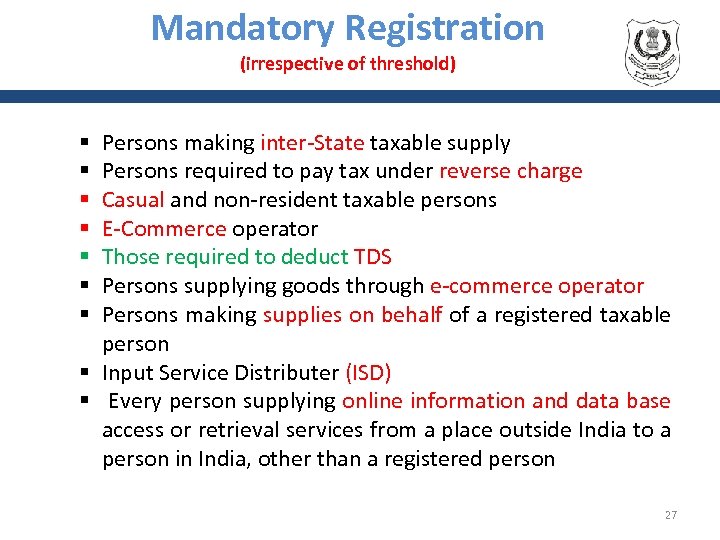

Mandatory Registration (irrespective of threshold) Persons making inter-State taxable supply Persons required to pay tax under reverse charge Casual and non-resident taxable persons E-Commerce operator Those required to deduct TDS Persons supplying goods through e-commerce operator Persons making supplies on behalf of a registered taxable person § Input Service Distributer (ISD) § Every person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person § § § § 27

Mandatory Registration (irrespective of threshold) Persons making inter-State taxable supply Persons required to pay tax under reverse charge Casual and non-resident taxable persons E-Commerce operator Those required to deduct TDS Persons supplying goods through e-commerce operator Persons making supplies on behalf of a registered taxable person § Input Service Distributer (ISD) § Every person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person § § § § 27

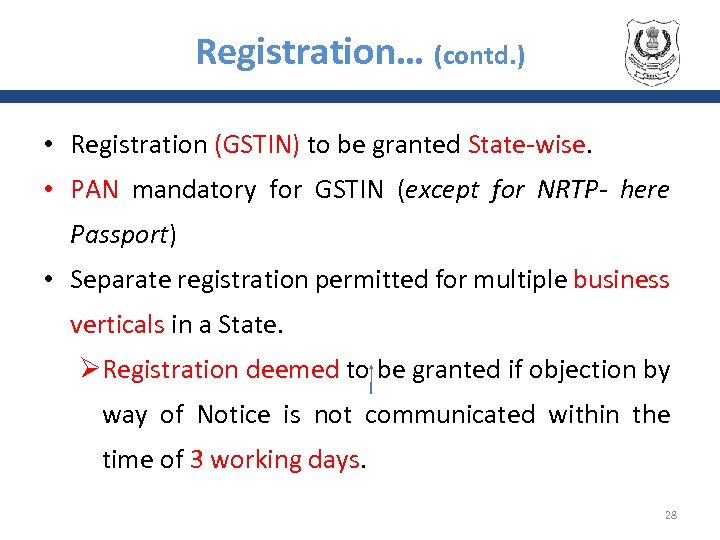

Registration… (contd. ) • Registration (GSTIN) to be granted State-wise. • PAN mandatory for GSTIN (except for NRTP- here Passport) • Separate registration permitted for multiple business verticals in a State. ØRegistration deemed to be granted if objection by way of Notice is not communicated within the time of 3 working days. 28

Registration… (contd. ) • Registration (GSTIN) to be granted State-wise. • PAN mandatory for GSTIN (except for NRTP- here Passport) • Separate registration permitted for multiple business verticals in a State. ØRegistration deemed to be granted if objection by way of Notice is not communicated within the time of 3 working days. 28

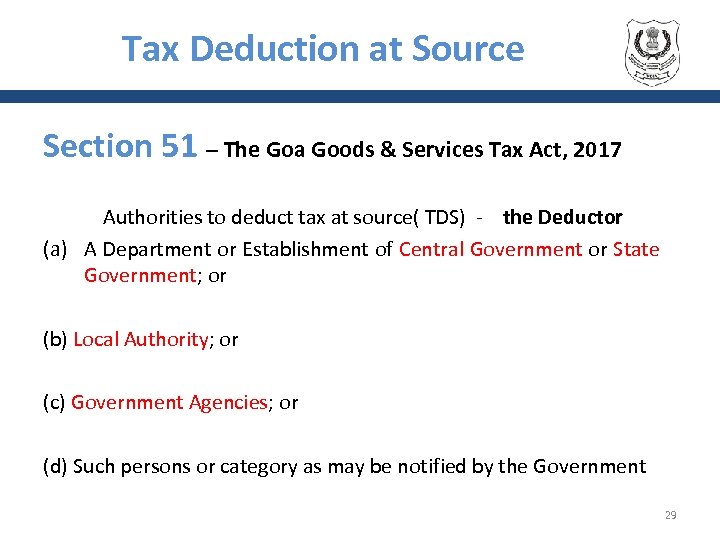

Tax Deduction at Source Section 51 – The Goa Goods & Services Tax Act, 2017 Authorities to deduct tax at source( TDS) - the Deductor (a) A Department or Establishment of Central Government or State Government; or (b) Local Authority; or (c) Government Agencies; or (d) Such persons or category as may be notified by the Government 29

Tax Deduction at Source Section 51 – The Goa Goods & Services Tax Act, 2017 Authorities to deduct tax at source( TDS) - the Deductor (a) A Department or Establishment of Central Government or State Government; or (b) Local Authority; or (c) Government Agencies; or (d) Such persons or category as may be notified by the Government 29

Tax Deduction at Source… cont. • No TDS if location of supplier and place of supply is in a State or UT which is different from the State or UT of registration of recipient. 30

Tax Deduction at Source… cont. • No TDS if location of supplier and place of supply is in a State or UT which is different from the State or UT of registration of recipient. 30

TDS RATE – 1 % + 1 % • to deduct tax at the rate of 1% from the payment made or credited to the suppliers (hereafter in this section referred as “the Deductee”) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees. 31

TDS RATE – 1 % + 1 % • to deduct tax at the rate of 1% from the payment made or credited to the suppliers (hereafter in this section referred as “the Deductee”) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees. 31

TDS -- 2 % (TOTAL) • 1 % SGST + 1 % CGST TOTAL TDS -- 2% 32

TDS -- 2 % (TOTAL) • 1 % SGST + 1 % CGST TOTAL TDS -- 2% 32

Returns Process under GST 33

Returns Process under GST 33

RETURNS. . . . ? 34

RETURNS. . . . ? 34

Why Returns? • Means of compliance verification • Mode for transfer of information to tax administration • To declare tax liability for a given period • Providing necessary inputs for taking policy decision 35

Why Returns? • Means of compliance verification • Mode for transfer of information to tax administration • To declare tax liability for a given period • Providing necessary inputs for taking policy decision 35

Features of Tax Returns in GST Ø Based on transactions – Invoice based ØDesigned for system based matching of Input Tax Credit and other details (import, export etc. ) Ø Auto-population from details of outward supplies Ø Auto-reversal of ITC in case of mismatch Ø Concepts of ledgers – cash, ITC and liability Ø No revised returns – changes through amendments rectifications and reported in the return for the month in which error detected to original details 36

Features of Tax Returns in GST Ø Based on transactions – Invoice based ØDesigned for system based matching of Input Tax Credit and other details (import, export etc. ) Ø Auto-population from details of outward supplies Ø Auto-reversal of ITC in case of mismatch Ø Concepts of ledgers – cash, ITC and liability Ø No revised returns – changes through amendments rectifications and reported in the return for the month in which error detected to original details 36

GST Returns: GSTR 1 • Statement of Outward Supplies ØWhat information? ØBasic details To be filed by 10 th of the next month- can be easily done by a computer ØInvoice level details ; GSTIN of recipient ØInvoice details – Number, date, HSN/SAC, …. Value, Taxable value…. POS ØTax – IGST, CGST, SGST/UTGST – Rate and Tax amount • What is not required to be uploaded? Ø Invoice level information for B 2 C invoice < Rs. 2. 5 lacs ØConsolidated information of all B 2 C supplies sufficient ØHSN/SAC …. . < Rs. 1. 5 crore 37

GST Returns: GSTR 1 • Statement of Outward Supplies ØWhat information? ØBasic details To be filed by 10 th of the next month- can be easily done by a computer ØInvoice level details ; GSTIN of recipient ØInvoice details – Number, date, HSN/SAC, …. Value, Taxable value…. POS ØTax – IGST, CGST, SGST/UTGST – Rate and Tax amount • What is not required to be uploaded? Ø Invoice level information for B 2 C invoice < Rs. 2. 5 lacs ØConsolidated information of all B 2 C supplies sufficient ØHSN/SAC …. . < Rs. 1. 5 crore 37

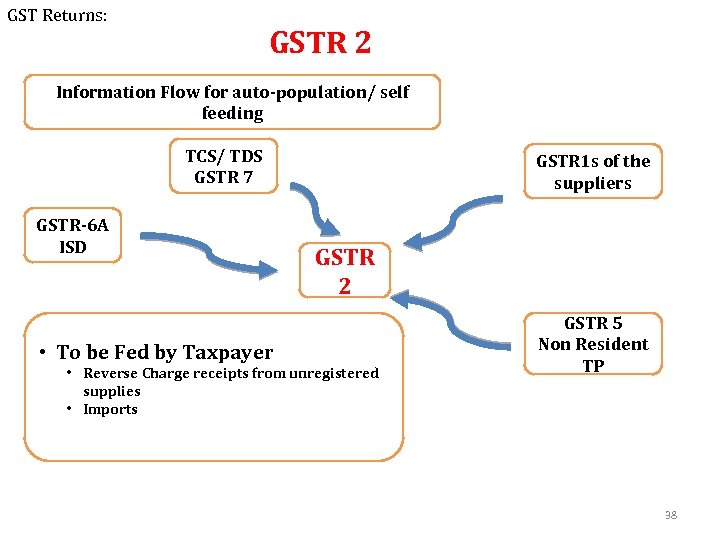

GST Returns: GSTR 2 Information Flow for auto-population/ self feeding TCS/ TDS GSTR 7 GSTR-6 A ISD GSTR 1 s of the suppliers GSTR 2 • To be Fed by Taxpayer • Reverse Charge receipts from unregistered supplies • Imports GSTR 5 Non Resident TP 38

GST Returns: GSTR 2 Information Flow for auto-population/ self feeding TCS/ TDS GSTR 7 GSTR-6 A ISD GSTR 1 s of the suppliers GSTR 2 • To be Fed by Taxpayer • Reverse Charge receipts from unregistered supplies • Imports GSTR 5 Non Resident TP 38

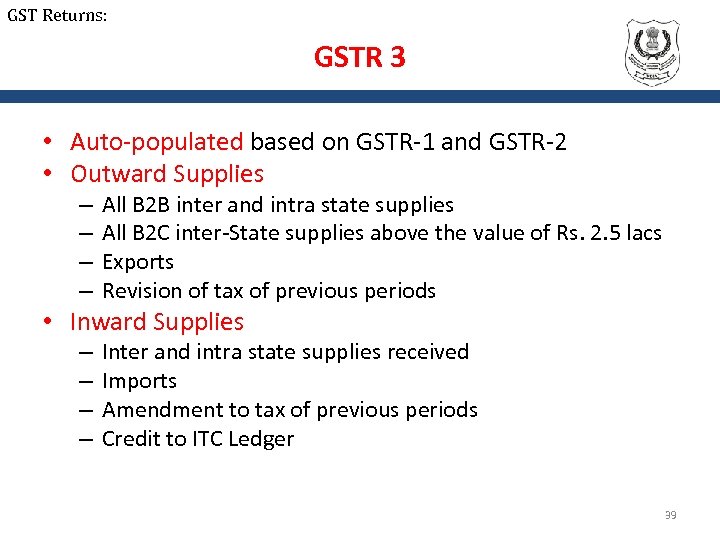

GST Returns: GSTR 3 • Auto-populated based on GSTR-1 and GSTR-2 • Outward Supplies – – All B 2 B inter and intra state supplies All B 2 C inter-State supplies above the value of Rs. 2. 5 lacs Exports Revision of tax of previous periods • Inward Supplies – – Inter and intra state supplies received Imports Amendment to tax of previous periods Credit to ITC Ledger 39

GST Returns: GSTR 3 • Auto-populated based on GSTR-1 and GSTR-2 • Outward Supplies – – All B 2 B inter and intra state supplies All B 2 C inter-State supplies above the value of Rs. 2. 5 lacs Exports Revision of tax of previous periods • Inward Supplies – – Inter and intra state supplies received Imports Amendment to tax of previous periods Credit to ITC Ledger 39

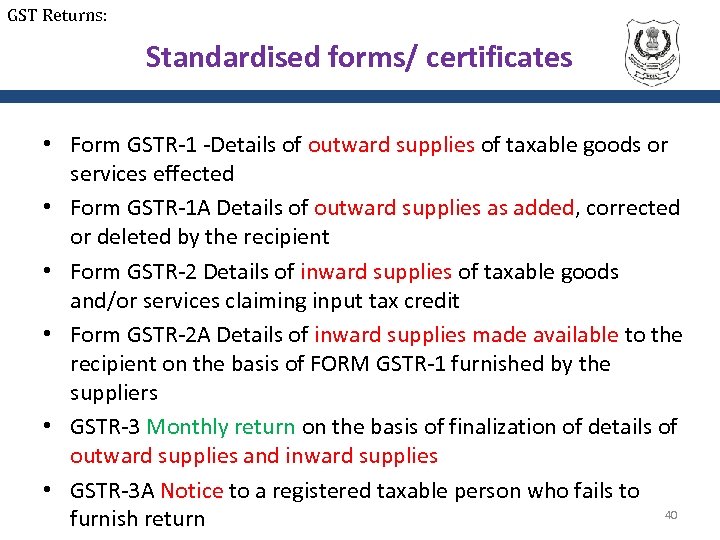

GST Returns: Standardised forms/ certificates • Form GSTR-1 -Details of outward supplies of taxable goods or services effected • Form GSTR-1 A Details of outward supplies as added, corrected or deleted by the recipient • Form GSTR-2 Details of inward supplies of taxable goods and/or services claiming input tax credit • Form GSTR-2 A Details of inward supplies made available to the recipient on the basis of FORM GSTR-1 furnished by the suppliers • GSTR-3 Monthly return on the basis of finalization of details of outward supplies and inward supplies • GSTR-3 A Notice to a registered taxable person who fails to 40 furnish return

GST Returns: Standardised forms/ certificates • Form GSTR-1 -Details of outward supplies of taxable goods or services effected • Form GSTR-1 A Details of outward supplies as added, corrected or deleted by the recipient • Form GSTR-2 Details of inward supplies of taxable goods and/or services claiming input tax credit • Form GSTR-2 A Details of inward supplies made available to the recipient on the basis of FORM GSTR-1 furnished by the suppliers • GSTR-3 Monthly return on the basis of finalization of details of outward supplies and inward supplies • GSTR-3 A Notice to a registered taxable person who fails to 40 furnish return

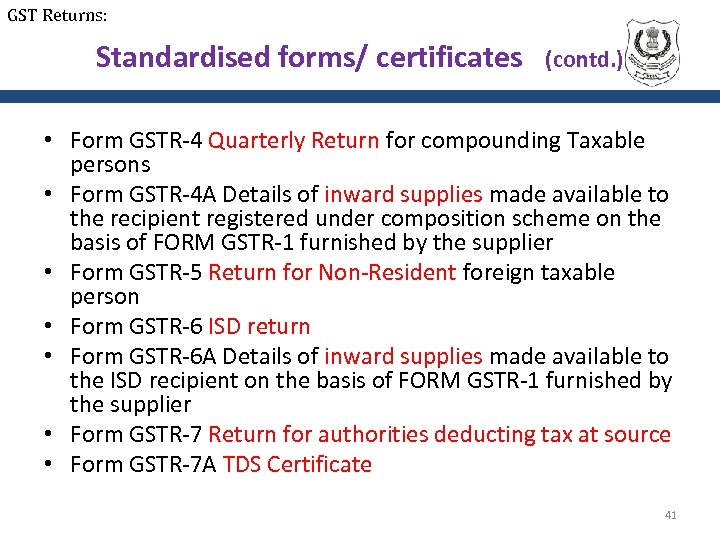

GST Returns: Standardised forms/ certificates (contd. ) • Form GSTR-4 Quarterly Return for compounding Taxable persons • Form GSTR-4 A Details of inward supplies made available to the recipient registered under composition scheme on the basis of FORM GSTR-1 furnished by the supplier • Form GSTR-5 Return for Non-Resident foreign taxable person • Form GSTR-6 ISD return • Form GSTR-6 A Details of inward supplies made available to the ISD recipient on the basis of FORM GSTR-1 furnished by the supplier • Form GSTR-7 Return for authorities deducting tax at source • Form GSTR-7 A TDS Certificate 41

GST Returns: Standardised forms/ certificates (contd. ) • Form GSTR-4 Quarterly Return for compounding Taxable persons • Form GSTR-4 A Details of inward supplies made available to the recipient registered under composition scheme on the basis of FORM GSTR-1 furnished by the supplier • Form GSTR-5 Return for Non-Resident foreign taxable person • Form GSTR-6 ISD return • Form GSTR-6 A Details of inward supplies made available to the ISD recipient on the basis of FORM GSTR-1 furnished by the supplier • Form GSTR-7 Return for authorities deducting tax at source • Form GSTR-7 A TDS Certificate 41

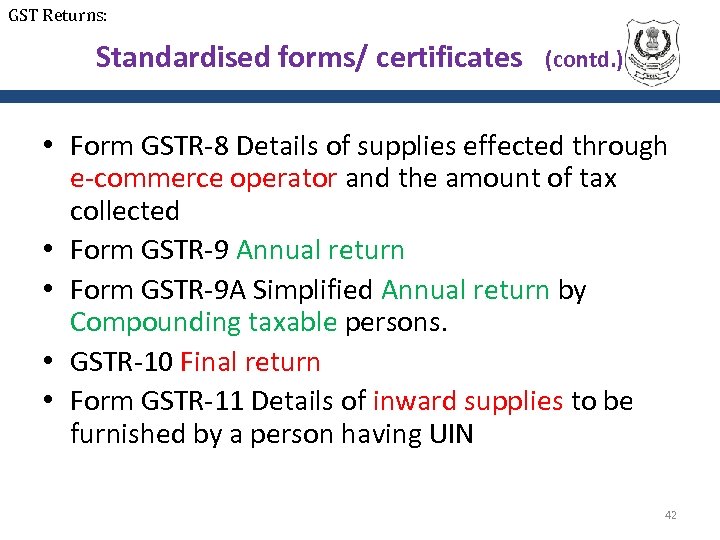

GST Returns: Standardised forms/ certificates (contd. ) • Form GSTR-8 Details of supplies effected through e-commerce operator and the amount of tax collected • Form GSTR-9 Annual return • Form GSTR-9 A Simplified Annual return by Compounding taxable persons. • GSTR-10 Final return • Form GSTR-11 Details of inward supplies to be furnished by a person having UIN 42

GST Returns: Standardised forms/ certificates (contd. ) • Form GSTR-8 Details of supplies effected through e-commerce operator and the amount of tax collected • Form GSTR-9 Annual return • Form GSTR-9 A Simplified Annual return by Compounding taxable persons. • GSTR-10 Final return • Form GSTR-11 Details of inward supplies to be furnished by a person having UIN 42

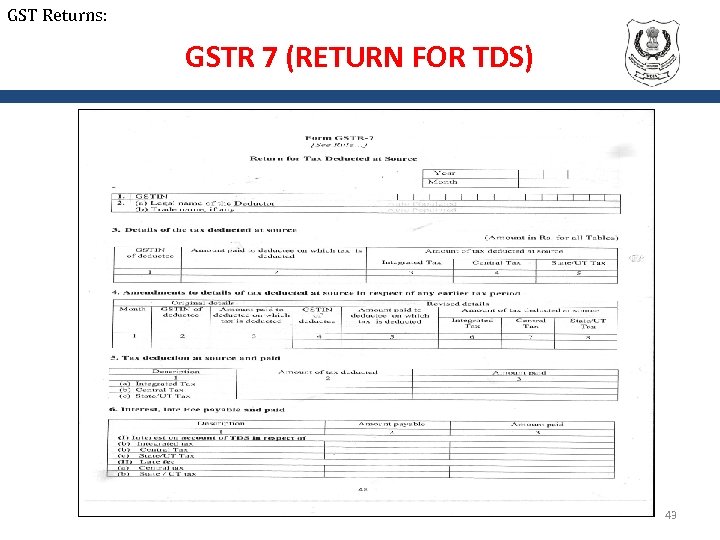

GST Returns: GSTR 7 (RETURN FOR TDS) 43

GST Returns: GSTR 7 (RETURN FOR TDS) 43

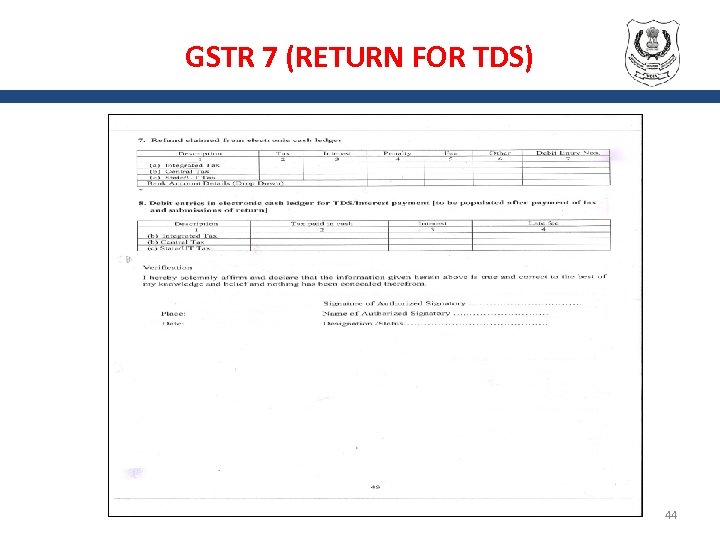

GSTR 7 (RETURN FOR TDS) 44

GSTR 7 (RETURN FOR TDS) 44

contents of TDS Returns - GSTR - 7 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. GSTIN Name of the Deductor Details of the tax deducted at source – GSTIN, Amt. paid, Tax Amendments to details of tax deducted at source in respect of any earlier tax period Tax deducted at source and paid (SGST & CGST or IGST) Interest, late Fee payable and paid. Refund claimed from electronic cash ledger. Debit entries in electronic cash ledger for TDS/ Interest payment (to be populated after payment of tax and submissions of returns) Verification Signature of Authorized Signatory. 45

contents of TDS Returns - GSTR - 7 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. GSTIN Name of the Deductor Details of the tax deducted at source – GSTIN, Amt. paid, Tax Amendments to details of tax deducted at source in respect of any earlier tax period Tax deducted at source and paid (SGST & CGST or IGST) Interest, late Fee payable and paid. Refund claimed from electronic cash ledger. Debit entries in electronic cash ledger for TDS/ Interest payment (to be populated after payment of tax and submissions of returns) Verification Signature of Authorized Signatory. 45

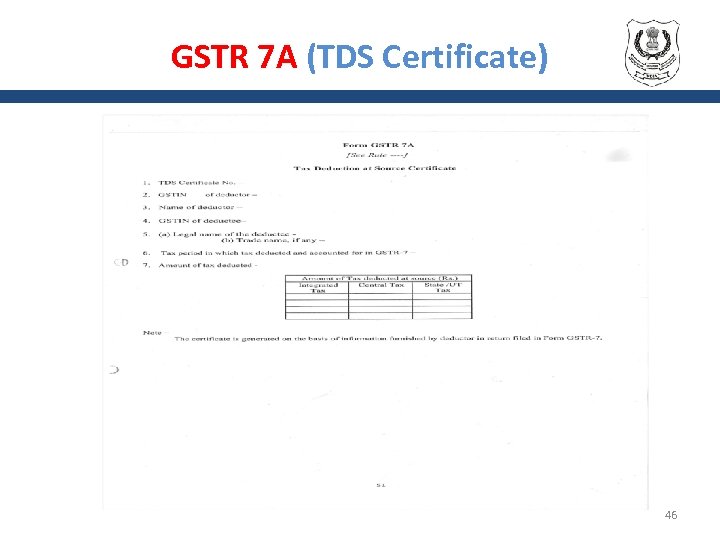

GSTR 7 A (TDS Certificate) 46

GSTR 7 A (TDS Certificate) 46

contents of TDS Cert. GSTR 7 A 1. 2. 3. 4. 5. 6. TDS Certificate No. GSTIN of Deductor. Name of Deductor. GSTIN of Deductee. Name of the Deductee. Tax period in which tax deducted and accounted for GSTR- 7. 7. Amount of tax deducted 47

contents of TDS Cert. GSTR 7 A 1. 2. 3. 4. 5. 6. TDS Certificate No. GSTIN of Deductor. Name of Deductor. GSTIN of Deductee. Name of the Deductee. Tax period in which tax deducted and accounted for GSTR- 7. 7. Amount of tax deducted 47

GST Returns: Provisions of TDS…. cont. • Time limit to furnish such certificate & penalty thereof: Ø within 5 days of crediting the amount to the appropriate Government. Ø If failed to furnish, he shall be liable to pay a late fee, a sum of Rs. 100 / day from the day after the expiry of 5 day period until the failure is rectified. Ø Amount of late fee payable shall not exceed Rs. 5, 000/-. [Section 51 (4)] 48

GST Returns: Provisions of TDS…. cont. • Time limit to furnish such certificate & penalty thereof: Ø within 5 days of crediting the amount to the appropriate Government. Ø If failed to furnish, he shall be liable to pay a late fee, a sum of Rs. 100 / day from the day after the expiry of 5 day period until the failure is rectified. Ø Amount of late fee payable shall not exceed Rs. 5, 000/-. [Section 51 (4)] 48

Provisions of TDS…. cont. • Claiming credit of TDS: Ø Amount of TDS to be reflected in return of deductor. Ø Deductee shall claim credit, in his electronic cash ledger, of the amount of TDS. • Interest liability on deductor: Ø If any deductor fails to pay amount of TDS, he shall be liable to pay: ü Interest in accordance with the provisions of section 50 and ü The amount of tax deducted.

Provisions of TDS…. cont. • Claiming credit of TDS: Ø Amount of TDS to be reflected in return of deductor. Ø Deductee shall claim credit, in his electronic cash ledger, of the amount of TDS. • Interest liability on deductor: Ø If any deductor fails to pay amount of TDS, he shall be liable to pay: ü Interest in accordance with the provisions of section 50 and ü The amount of tax deducted.

Payment 50

Payment 50

Modes of Payment under GST • Payment of tax, interest, penalty, fee or any other amounts can be made: i. Through internet banking including by using credit card (CC) /debit cards (DC) (Mode I). ii. Over The Counter-OTC (Limit Rs. 10, 000/- ( Mode II). iii. Through National Electronic Fund Transfer (NEFT) / Real Time Gross Settlement (RTGS) ( Mode III). 51

Modes of Payment under GST • Payment of tax, interest, penalty, fee or any other amounts can be made: i. Through internet banking including by using credit card (CC) /debit cards (DC) (Mode I). ii. Over The Counter-OTC (Limit Rs. 10, 000/- ( Mode II). iii. Through National Electronic Fund Transfer (NEFT) / Real Time Gross Settlement (RTGS) ( Mode III). 51

Maintenance of Taxpayer wise Electronic Ledgers • There shall be 3 running electronic ledgers maintained on the dashboard of taxpayer by GSTN on its portal i. e. i. Tax Liability ledger: Liabilities of a taxable person in form of tax, interest, fee & penalty towards CGST, SGST & IGST is recorded and maintained in this ledger. ii. ITC ledger: ITC as self-assessed in the return shall be credited to his electronic credit ledger in the first instance. It will have details on ITC claimed & utilized for CGST, SGST & IGST. iii. Cash ledger: Any amount deposited to the account of the concerned Government (CGST, SGST & IGST) shall be credited to the electronic cash ledger of such person. 52

Maintenance of Taxpayer wise Electronic Ledgers • There shall be 3 running electronic ledgers maintained on the dashboard of taxpayer by GSTN on its portal i. e. i. Tax Liability ledger: Liabilities of a taxable person in form of tax, interest, fee & penalty towards CGST, SGST & IGST is recorded and maintained in this ledger. ii. ITC ledger: ITC as self-assessed in the return shall be credited to his electronic credit ledger in the first instance. It will have details on ITC claimed & utilized for CGST, SGST & IGST. iii. Cash ledger: Any amount deposited to the account of the concerned Government (CGST, SGST & IGST) shall be credited to the electronic cash ledger of such person. 52

Maintenance of Taxpayer wise Electronic Ledgers • Details in these ledgers will get auto populated from the returns filed. • Both the ITC ledgers and the cash ledger will be utilized by the taxpayer for discharging the tax liabilities of the returns and others liabilities arising out of Demand / Appeal Orders. • These ledgers would be updated in real time on an activity / action by the taxpayer in connection with these ledgers. 53

Maintenance of Taxpayer wise Electronic Ledgers • Details in these ledgers will get auto populated from the returns filed. • Both the ITC ledgers and the cash ledger will be utilized by the taxpayer for discharging the tax liabilities of the returns and others liabilities arising out of Demand / Appeal Orders. • These ledgers would be updated in real time on an activity / action by the taxpayer in connection with these ledgers. 53

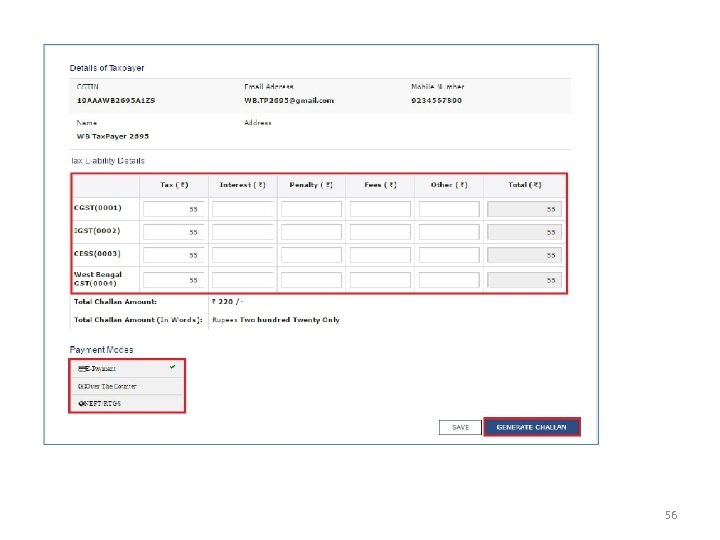

Format of Challan • Electronically generated Challan from GSTN for all 3 modes. • Contains a unique 14 -digit Common Portal Identification Number (CPIN). • Who can generate Challan? Ø Taxpayer Ø His authorized representative Ø Departmental officers (e. g. enforcement activity) Ø Any other person paying on behalf of taxpayer • Certain key details of the challan like name, address, email, GSTIN of payer to be auto-populated. • Single challan for payment of all four types of taxes. 54

Format of Challan • Electronically generated Challan from GSTN for all 3 modes. • Contains a unique 14 -digit Common Portal Identification Number (CPIN). • Who can generate Challan? Ø Taxpayer Ø His authorized representative Ø Departmental officers (e. g. enforcement activity) Ø Any other person paying on behalf of taxpayer • Certain key details of the challan like name, address, email, GSTIN of payer to be auto-populated. • Single challan for payment of all four types of taxes. 54

Basic Features Payment Process • Challan is editable before finalization. Ø However once finalised, can’t be edited. • Time of payment: from 00: 00 hrs. to 20: 00 hrs. • System of electronic cash ledger on GSTN Portal for each taxpayer. 55

Basic Features Payment Process • Challan is editable before finalization. Ø However once finalised, can’t be edited. • Time of payment: from 00: 00 hrs. to 20: 00 hrs. • System of electronic cash ledger on GSTN Portal for each taxpayer. 55

56

56

Resource Material- Links • http: //www. cbec. gov. in/htdocs-cbec/gst/gst • http: //www. cbec. gov. in/htdocscbec/migration-to-gst. . . for migration related information • https: //www. gst. gov. in/ • http: //www. gstn. org/ • http: //tutorial. gst. gov. in 57

Resource Material- Links • http: //www. cbec. gov. in/htdocs-cbec/gst/gst • http: //www. cbec. gov. in/htdocscbec/migration-to-gst. . . for migration related information • https: //www. gst. gov. in/ • http: //www. gstn. org/ • http: //tutorial. gst. gov. in 57

Help lines • www. gst. gov. in ØHelpline number: 0124 -4688999 Øhelpdesk@gst. gov. in • www. aces. gov. in : for migration of existing assessees and getting provisional ID & Password • cbecmitra. helpdesk@icegate. gov. in : for migration issues ØHelpline toll free number: 1800 -1200 -232 • CBEC GST Mobile App at Google Play Store 58

Help lines • www. gst. gov. in ØHelpline number: 0124 -4688999 Øhelpdesk@gst. gov. in • www. aces. gov. in : for migration of existing assessees and getting provisional ID & Password • cbecmitra. helpdesk@icegate. gov. in : for migration issues ØHelpline toll free number: 1800 -1200 -232 • CBEC GST Mobile App at Google Play Store 58

59

59