d96e54d89e165f65fd57c3112ca1b8da.ppt

- Количество слайдов: 19

GSEC Debt ETF ATLAS INTEGRATED FINANCE LTD

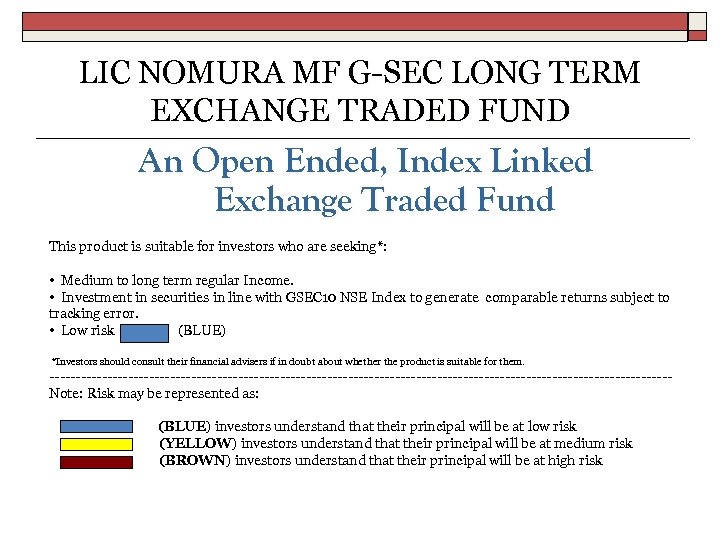

LIC NOMURA MF G-SEC LONG TERM EXCHANGE TRADED FUND An Open Ended, Index Linked Exchange Traded Fund This product is suitable for investors who are seeking*: • Medium to long term regular Income. • Investment in securities in line with GSEC 10 NSE Index to generate comparable returns subject to tracking error. • Low risk (BLUE) *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. -----------------------------------------------------------Note: Risk may be represented as: (BLUE) investors understand that their principal will be at low risk (YELLOW) investors understand that their principal will be at medium risk (BROWN) investors understand that their principal will be at high risk

LIC NOMURA MF G-SEC LONG TERM EXCHANGE TRADED FUND First G-Sec Debt ETF in Asia. First Structured G-Sec Debt Product in India.

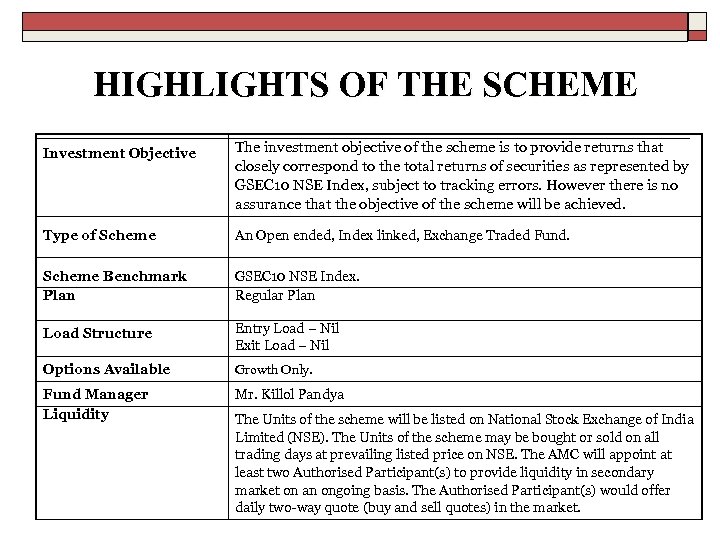

HIGHLIGHTS OF THE SCHEME Investment Objective The investment objective of the scheme is to provide returns that closely correspond to the total returns of securities as represented by GSEC 10 NSE Index, subject to tracking errors. However there is no assurance that the objective of the scheme will be achieved. Type of Scheme An Open ended, Index linked, Exchange Traded Fund. Scheme Benchmark Plan GSEC 10 NSE Index. Regular Plan Load Structure Entry Load – Nil Exit Load – Nil Options Available Growth Only. Fund Manager Liquidity Mr. Killol Pandya The Units of the scheme will be listed on National Stock Exchange of India Limited (NSE). The Units of the scheme may be bought or sold on all trading days at prevailing listed price on NSE. The AMC will appoint at least two Authorised Participant(s) to provide liquidity in secondary market on an ongoing basis. The Authorised Participant(s) would offer daily two-way quote (buy and sell quotes) in the market.

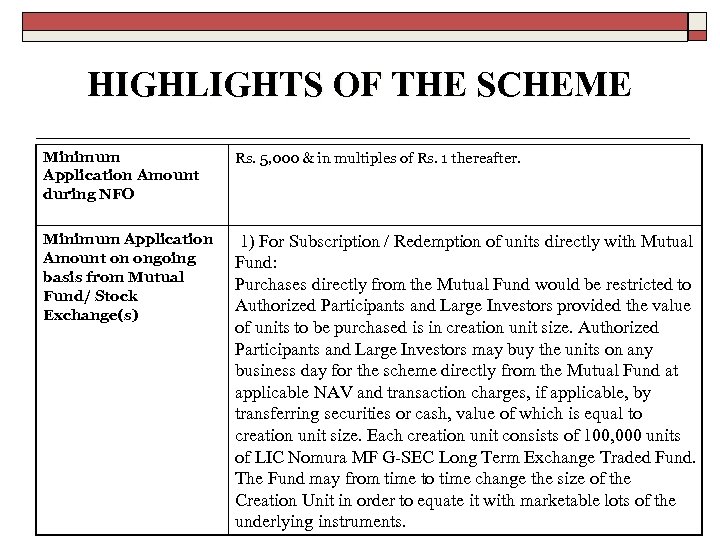

HIGHLIGHTS OF THE SCHEME Minimum Application Amount during NFO Rs. 5, 000 & in multiples of Rs. 1 thereafter. Minimum Application Amount on ongoing basis from Mutual Fund/ Stock Exchange(s) 1) For Subscription / Redemption of units directly with Mutual Fund: Purchases directly from the Mutual Fund would be restricted to Authorized Participants and Large Investors provided the value of units to be purchased is in creation unit size. Authorized Participants and Large Investors may buy the units on any business day for the scheme directly from the Mutual Fund at applicable NAV and transaction charges, if applicable, by transferring securities or cash, value of which is equal to creation unit size. Each creation unit consists of 100, 000 units of LIC Nomura MF G-SEC Long Term Exchange Traded Fund. The Fund may from time to time change the size of the Creation Unit in order to equate it with marketable lots of the underlying instruments.

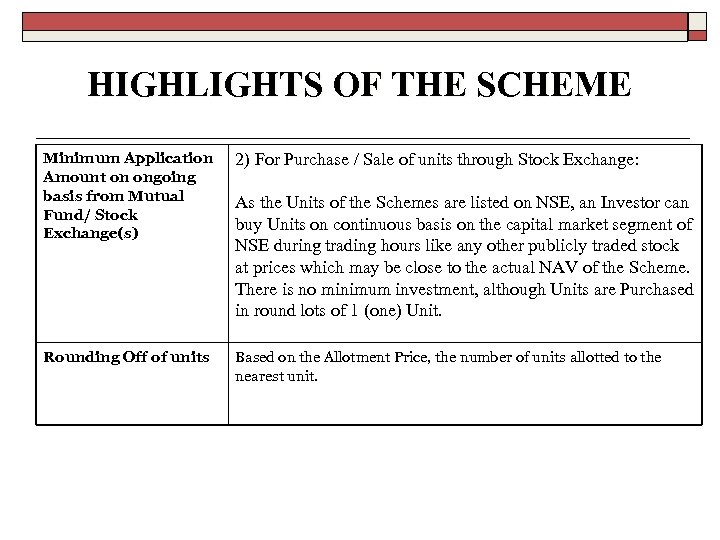

HIGHLIGHTS OF THE SCHEME Minimum Application Amount on ongoing basis from Mutual Fund/ Stock Exchange(s) 2) For Purchase / Sale of units through Stock Exchange: Rounding Off of units Based on the Allotment Price, the number of units allotted to the nearest unit. As the Units of the Schemes are listed on NSE, an Investor can buy Units on continuous basis on the capital market segment of NSE during trading hours like any other publicly traded stock at prices which may be close to the actual NAV of the Scheme. There is no minimum investment, although Units are Purchased in round lots of 1 (one) Unit.

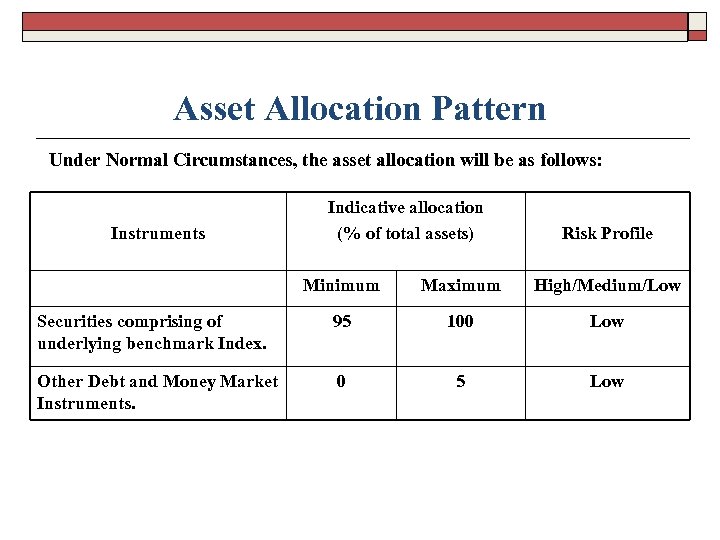

Asset Allocation Pattern Under Normal Circumstances, the asset allocation will be as follows: Instruments Indicative allocation (% of total assets) Risk Profile Minimum Maximum High/Medium/Low Securities comprising of underlying benchmark Index. 95 100 Low Other Debt and Money Market Instruments. 0 5 Low

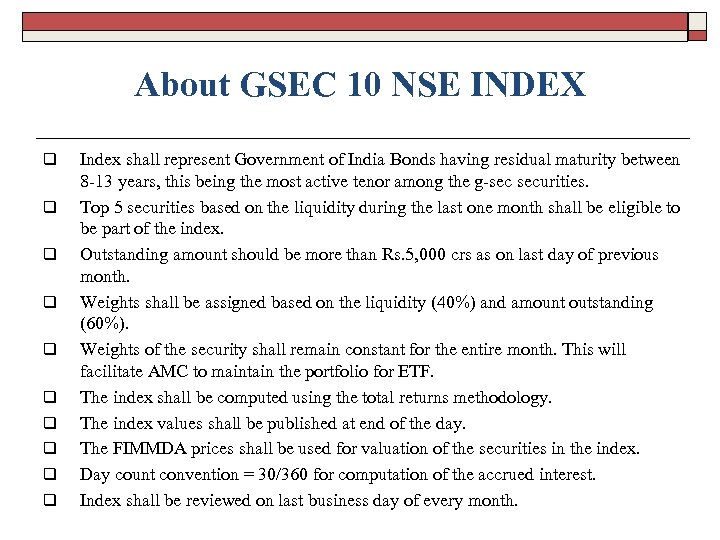

About GSEC 10 NSE INDEX q q q q q Index shall represent Government of India Bonds having residual maturity between 8 -13 years, this being the most active tenor among the g-sec securities. Top 5 securities based on the liquidity during the last one month shall be eligible to be part of the index. Outstanding amount should be more than Rs. 5, 000 crs as on last day of previous month. Weights shall be assigned based on the liquidity (40%) and amount outstanding (60%). Weights of the security shall remain constant for the entire month. This will facilitate AMC to maintain the portfolio for ETF. The index shall be computed using the total returns methodology. The index values shall be published at end of the day. The FIMMDA prices shall be used for valuation of the securities in the index. Day count convention = 30/360 for computation of the accrued interest. Index shall be reviewed on last business day of every month.

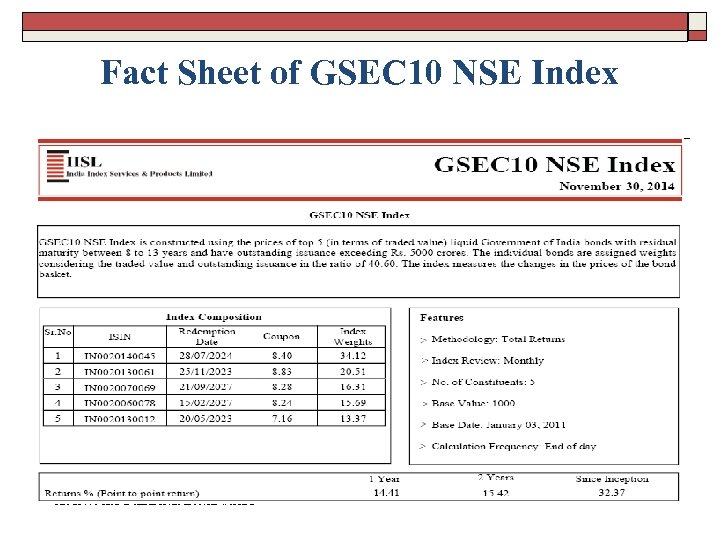

Fact Sheet of GSEC 10 NSE Index * The above data is taken from the NSE website.

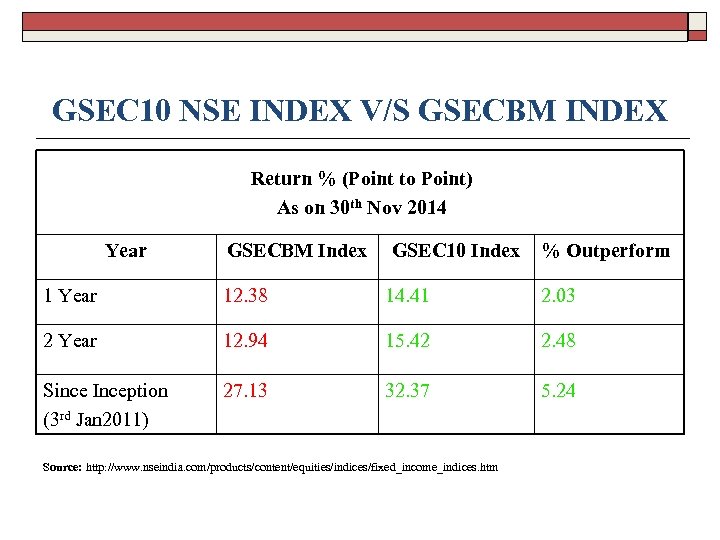

GSEC 10 NSE INDEX V/S GSECBM INDEX Return % (Point to Point) As on 30 th Nov 2014 Year GSECBM Index GSEC 10 Index % Outperform 1 Year 12. 38 14. 41 2. 03 2 Year 12. 94 15. 42 2. 48 Since Inception (3 rd Jan 2011) 27. 13 32. 37 5. 24 Source: http: //www. nseindia. com/products/content/equities/indices/fixed_income_indices. htm

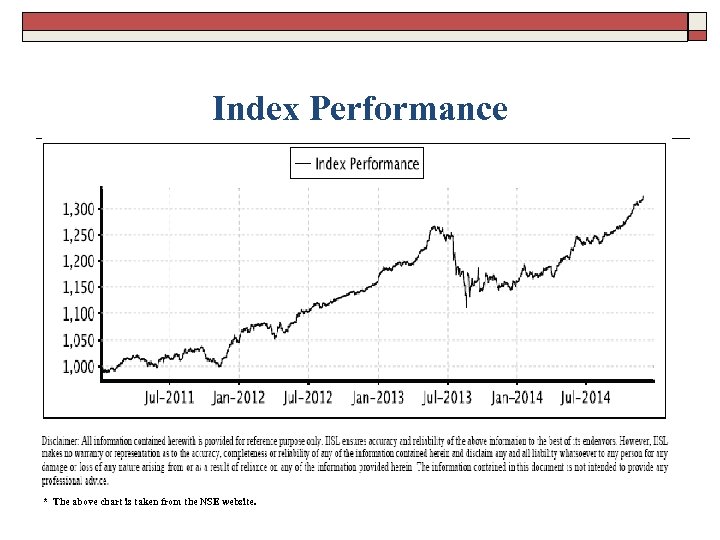

Index Performance * The above chart is taken from the NSE website.

Who Can Invest? 1. 2. 3. 4. 5. 6. 7. 8. Banks Insurance Companies FIIs/NRIs Provident Funds/Pension Funds Corporate Treasuries Charitable Trusts Public Sector Units Individuals

Advantage q q q Perpetual Buying and selling flexibility Tax efficiency Market exposure and diversification Transparency Lower Expense Ratios

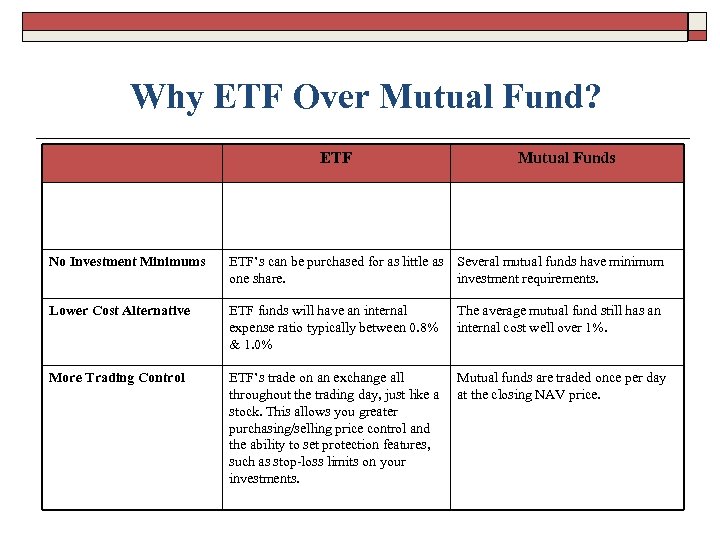

Why ETF Over Mutual Fund? ETF Mutual Funds No Investment Minimums ETF’s can be purchased for as little as Several mutual funds have minimum one share. investment requirements. Lower Cost Alternative ETF funds will have an internal expense ratio typically between 0. 8% & 1. 0% The average mutual fund still has an internal cost well over 1%. More Trading Control ETF’s trade on an exchange all throughout the trading day, just like a stock. This allows you greater purchasing/selling price control and the ability to set protection features, such as stop-loss limits on your investments. Mutual funds are traded once per day at the closing NAV price.

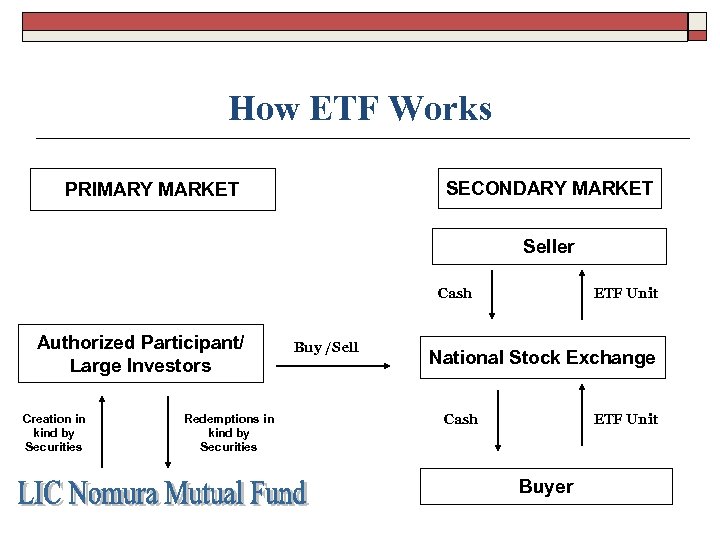

How ETF Works SECONDARY MARKET PRIMARY MARKET Seller Cash Authorized Participant/ Large Investors Creation in kind by Securities Redemptions in kind by Securities Buy /Sell ETF Unit National Stock Exchange Cash ETF Unit Buyer

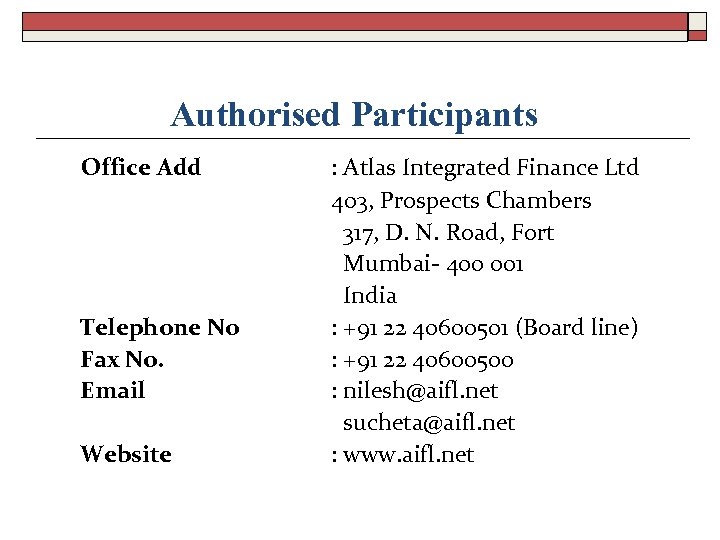

Authorised Participants Office Add Telephone No Fax No. Email Website : Atlas Integrated Finance Ltd 403, Prospects Chambers 317, D. N. Road, Fort Mumbai- 400 001 India : +91 22 40600501 (Board line) : +91 22 40600500 : nilesh@aifl. net sucheta@aifl. net : www. aifl. net

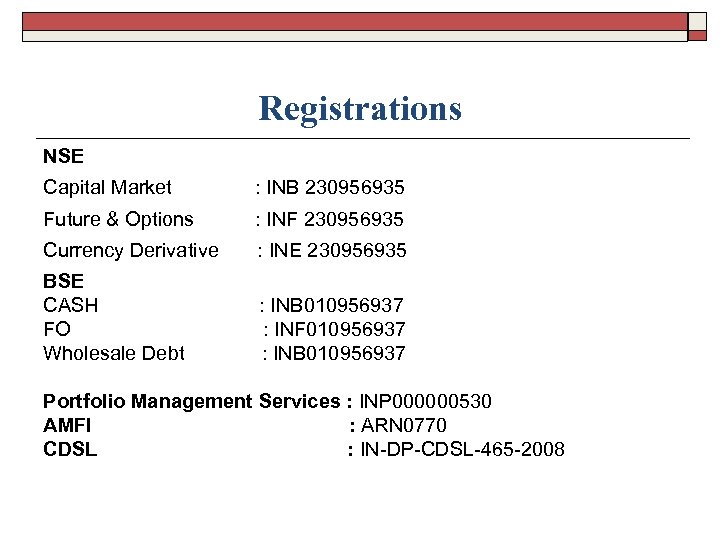

Registrations NSE Capital Market : INB 230956935 Future & Options : INF 230956935 Currency Derivative : INE 230956935 BSE CASH FO Wholesale Debt : INB 010956937 : INF 010956937 : INB 010956937 Portfolio Management Services : INP 000000530 AMFI : ARN 0770 CDSL : IN-DP-CDSL-465 -2008

Disclaimer o Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

d96e54d89e165f65fd57c3112ca1b8da.ppt