cf31001f9302990712e9dd51c2abf367.ppt

- Количество слайдов: 23

Grupo Energía de Bogotá Results and Key Developments First Six Months of 2013 Investor Conference Call September 3 th 2013 1

Agenda I. Strategy II. Significant developments 1 H 13 III. Investments IV. Consolidated financial results and indicators EEB V. Question and answer session VI. Disclaimer Annex 1. Panoramic view of Grupo Energía de Bogotá Annex 2. Regulated natural monopoly Annex 3. Leadership Market Position 2

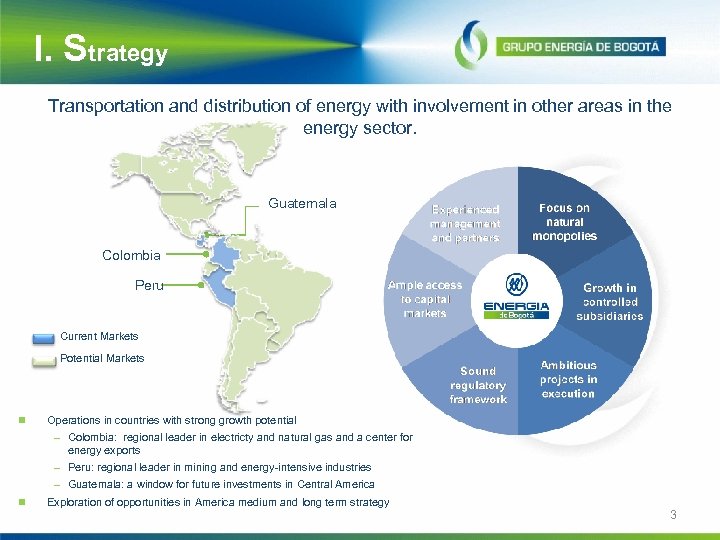

I. Strategy Transportation and distribution of energy with involvement in other areas in the energy sector. Guatemala Colombia Peru Current Markets Potential Markets n Operations in countries with strong growth potential – Colombia: regional leader in electricty and natural gas and a center for energy exports – Peru: regional leader in mining and energy-intensive industries – Guatemala: a window for future investments in Central America n Exploration of opportunities in America medium and long term strategy 3

II. Significant developments § 05. 22. 13. Payment to the minority shareholders of the total dividend declared by the Assembly of shareholders, for a total value of COP 95, 746 billion, corresponding to COP 43. 96 per share. Also be paid COP 153, 929 million to the shareholder, who shall be made another installment the 27. 11. 13 by the same value. § 04. 16. 13. EEB was awarded the UPME-03 -2010 tender, an electric interconnection project that is part of the National Transmission System. It includes the design, acquisition of supplies, construction, operation and maintenance of Chivor II and Norte 230 V Substations and the double circuit line with over 160 Km. This award, valued in USD 101 million. § 04. 18. 13. The Board of Directors authorized management to establish a company in Peru to render engineering services in the natural gas transport and distribution sector and in the electric power sector. § 06. 24. 13. The Board of Directors of EEB, during its session, approved the following decisions: ( • ) to modify the Company’s organizational and personnel structures to support Company’s current realities and its future growth. ( • ) to explore and analyze a series of investment alternatives in the natural gas and electric power transport sectors in Latin America. § 07. 03. 13. EEB was authorized by the Finance and Public Credit Ministry to carry out processes to undertake foreign public credit operations for up to USD 479 million or its equivalent in other currencies, and said resources will be used to partially finance the energy expansion plan in Colombia, Guatemala and Peru during the period comprising 2013 -2017. Likewise, to begin processes to grant guarantees to its affiliates in Guatemala, TRECSA and EEBIS, for up to USD 230 million or its equivalent in other currencies. 4

II. Significant developments § § 07. 18. 13 Ecopetrol S. A. announced that will carry out processes tending to sell its investment in Empresa de Energía de Bogotá S. A. E. S. P and thus contribute to financing its investment plan. 15. 08. 13 The Board of Directors of Empresa de Energía de Bogotá, approved EEB’s participation in the stake acquisition process of ISAGEN S. A. ESP § 07. 05. 13 the international risk-rating agency, Standard & Poor´s raised the ranking of TGI’s debt in foreign currency from “BB” to “BBB-” with stable perspective. The foregoing increase took into account the stability of long term income, the natural coverage offered by regulations in force, due in part to the binding effect of part of the tariff to the dollar, the coming on stream of expansion projects and the recent tariff revision and the support of its main shareholder – EEB. • Shareholders Meeting agreed to a capital increase under the mode of capitalization of retained earnings accrued as of December 2012, amounting to USD 62. 2 MM (BBB-; BBB; Baa 3) 01. 04. 13 it issued a bond amounting to USD 320 million (2023 / 4. 375% / 8 x) in the international capital markets (144 A/Reg S). The resources obtained in this operation will allow financing expansion plans from 2013 and 2014, and improve Cálidda’s debt profile. ( BBB-; BBB; - Baa 3) The construction of the main network expansion project was concluded, which increased the distribution capacity of 255 mm to 420 mm pcd warm. The technical report of OSINERGIM to start the implementation of commercial operation is awaited. . In June of 2013 Cálidda had 124, 078 customers and 162, 516 vehicles operate with natural gas in its area of operations. The aim of the company is to reach 455, 000 clients 5 connected to its network in 2016. • • •

II. Significant developments § § 1 H 13 the investment in the project amounts to USD 234 million. 1 H 13, Contugas has more than 2711 enabled clients (with over 12, 600 residential sales and 10. 629 built internal installations pending to be enabled). The contractual obligation is to reach 50, 000 residential 6 years after the Declaration of commerciality that is expected to be given in 1 Q 14. Contugas is in the process of closing a new 6 year bullet-type financing for USD 310 MM. This is a syndicate loan in which Regional and multilateral Banking are participating. Currently Contugas has a bridge loan for up to USD 215 million. This syndicate loan includes resources from Banco de Bogotá, Davivienda and BCP, for a term of up to 18 months with a wide range of rates. 25. 07. 13 Contugas completed the works of the Chincha Operations Center and it began its partial operation. President of Peru, Mr. Ollanta Humala and CEO of Grupo Energía de Bogotá attended the event. The new operational center, among the most modern in Latin America and operated by Contugas, will allow to render natural gas services to residential, commercial and industrial customers in the Province of Chincha, south of Lima. • After one year of negotiations, EMGESA closed the contract with Ecopetrol, whereby it will supply during the next six years, the power required for the production of its wells and production centers located to the east and south of the country. The power in question represents consumption of approximately 5, 614 GWh as of this year and until 2018. 6

II. Significant developments • • • During the first six months of the year, Codensa achieved the lowest physical loss index in the past ten years, reaching 7. 14%. During the first half of 2013, Codensa invested around COP 93. 500 billion, aimed at improving service quality and focused on strengthening infrastructure, maintenance and network expansions. Servicing New Demand: ( • ) In Nueva Esperanza all processes have been performed with ICANH to define management of archeological remains found during excavations § 04. 30. 13. the Company made an international security placement offer under Rule 144ª and Regulation S of the U. S. Securities Act of 1933. On May 7 th 2013, it proceeded with the liquidation and issuance of the bonds, known as “Senior Notes”. The issuance of Bonds amounted to USD 450 MM an issuance price of 99. 002%. It has a 10 -year Bullet amortization and six months coupons paying interest at an annual interest rate of 4. 375%. These resources will be used to prepay outstanding debt and to finance expansion projects § 27. 08. 13 Meeting of shareholders accepted the assignment for the execution of the design, financing, construction, operation and maintenance of transmission line 500 k. V of 900 km long, and its associated substations, project awarded by Proinversion ISA S. A on July 18 th, 2013. Reference investment is USD 413 million and generate estimated annual revenues of $ 41. 5 million. The award is for 30 years from its entry into operation. The management of the project will be headed by REP 7

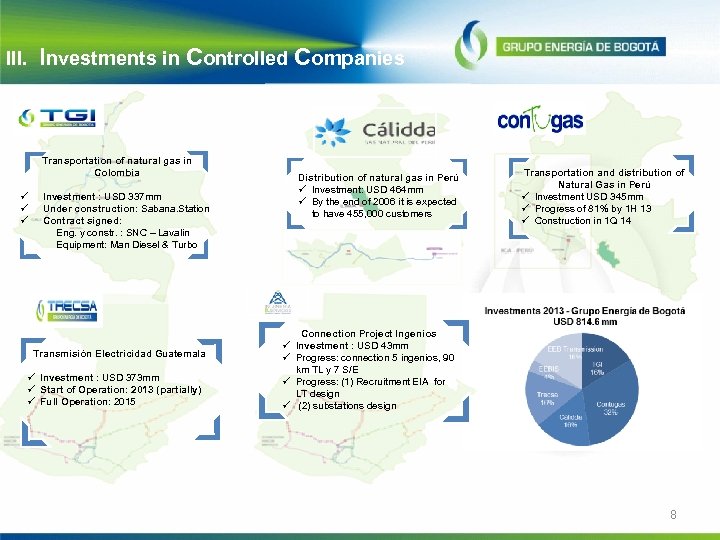

III. Investments in Controlled Companies Transportation of natural gas in Colombia ü ü ü Investment : USD 337 mm Under construction: Sabana. Station Contract signed: Eng. y constr. : SNC – Lavalin Equipment: Man Diesel & Turbo Transmisión Electricidad Guatemala ü Investment : USD 373 mm ü Start of Operation: 2013 (partially) ü Full Operation: 2015 Distribution of natural gas in Perú ü Investment: USD 464 mm ü By the end of 2006 it is expected to have 455, 000 customers Transportation and distribution of Natural Gas in Perú ü Investment USD 345 mm ü Progress of 81% by 1 H 13 ü Construction in 1 Q 14 Connection Project Ingenios ü Investment : USD 43 mm ü Progress: connection 5 ingenios, 90 km TL y 7 S/E ü Progress: (1) Recruitment EIA for LT design ü (2) substations design 8

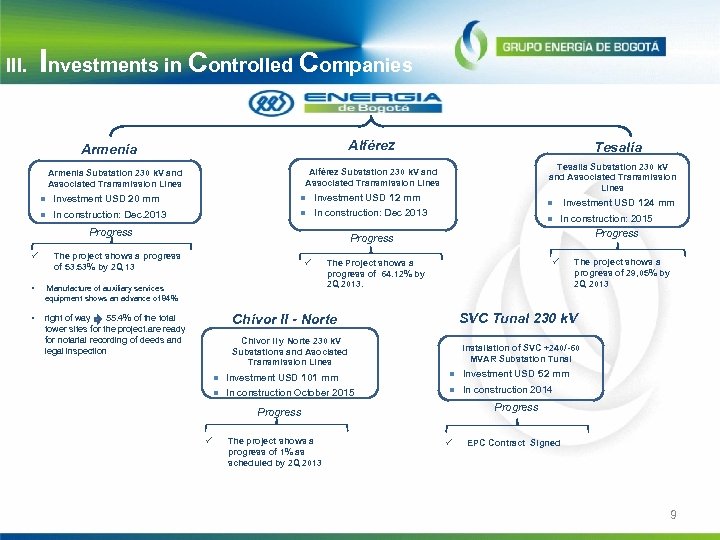

Investments in Controlled Companies III. Alférez Armenia n Investment USD 20 mm n Investment USD 12 mm n In construction: Dec. 2013 n In construction: Dec 2013 Progress • Tesalia Substation 230 k. V and Associated Transmission Lines Alférez Substation 230 k. V and Associated Transmission Lines Armenia Substation 230 k. V and Associated Transmission Lines ü Tesalia n n ü Manufacture of auxiliary services In construction: 2015 Progress The project shows a progress of 53. 53% by 2 Q 13 Investment USD 124 mm ü The Project shows a progress of 64. 12% by 2 Q 2013. The project shows a progress of 29, 05% by 2 Q 2013 equipment shows an advance of 84% • SVC Tunal 230 k. V Chivor II - Norte right of way 55. 4% of the total tower sites for the project. are ready for notarial recording of deeds and legal inspection Chivor II y Norte 230 k. V Substations and Asociated Transmission Lines Installation of SVC +240/-60 MVAR Substation Tunal n Investment USD 101 mm n Investment USD 52 mm n In construction October 2015 n In construction 2014 Progress ü The project shows a progress of 1% as scheduled by 2 Q 2013 ü EPC Contract Signed 9

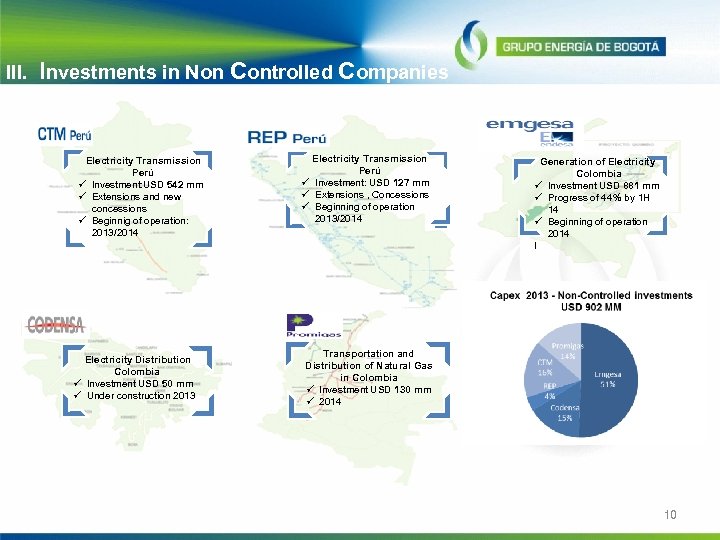

III. Investments in Non Controlled Companies Electricity Transmission Perú ü Investment: USD 542 mm ü Extensions and new concessions ü Beginnig of operation: 2013/2014 Electricity Distribution Colombia ü Investment USD 50 mm ü Under construction 2013 Electricity Transmission Perú ü Investment: USD 127 mm ü Extensions , Concessions ü Beginning of operation 2013/2014 Generation of Electricity Colombia ü Investment USD 881 mm ü Progress of 44% by 1 H 14 ü Beginning of operation 2014 I Transportation and Distribution of Natural Gas in Colombia ü Investment USD 130 mm ü 2014 10

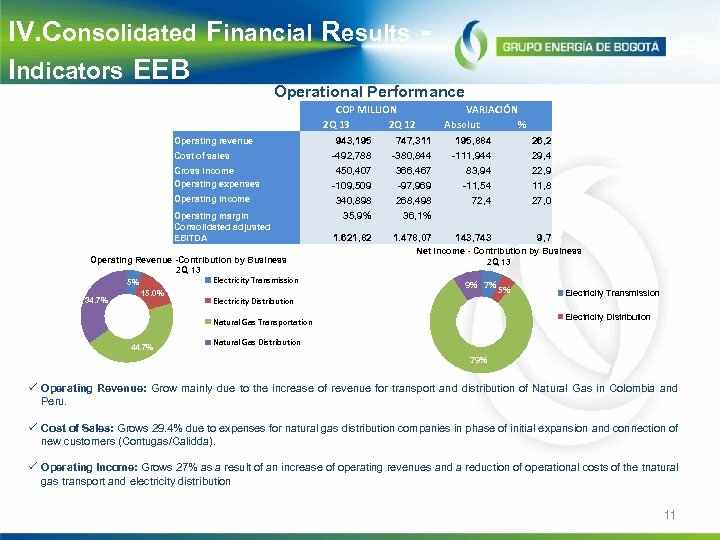

IV. Consolidated Financial Results Indicators EEB Operational Performance COP MILLION 2 Q 13 2 Q 12 Operating revenue Cost of sales Gross income Operating expenses Operating income Operating margin Consolidated adjusted EBITDA Operating Revenue -Contribution by Business 2 Q 13 Electricity Transmission 5% 34. 7% 15. 0% Electricity Distribution VARIACIÓN Absolut % 943, 195 -492, 788 450, 407 -109, 509 340, 898 35, 9% 747, 311 -380, 844 366, 467 -97, 969 268, 498 36, 1% 195, 884 -111, 944 83, 94 -11, 54 72, 4 1. 621, 82 1. 478, 07 143, 743 9, 7 Net Income - Contribution by Business 2 Q 13 9% 7% 5% Electricity Transmission Electricity Distribution Natural Gas Transportation 44. 7% 26, 2 29, 4 22, 9 11, 8 27, 0 Natural Gas Distribution 79% ü Operating Revenue: Grow mainly due to the increase of revenue for transport and distribution of Natural Gas in Colombia and Peru. ü Cost of Sales: Grows 29. 4% due to expenses for natural gas distribution companies in phase of initial expansion and connection of new customers (Contugas/Calidda). ü Operating Income: Grows 27% as a result of an increase of operating revenues and a reduction of operational costs of the tnatural gas transport and electricity distribution 11

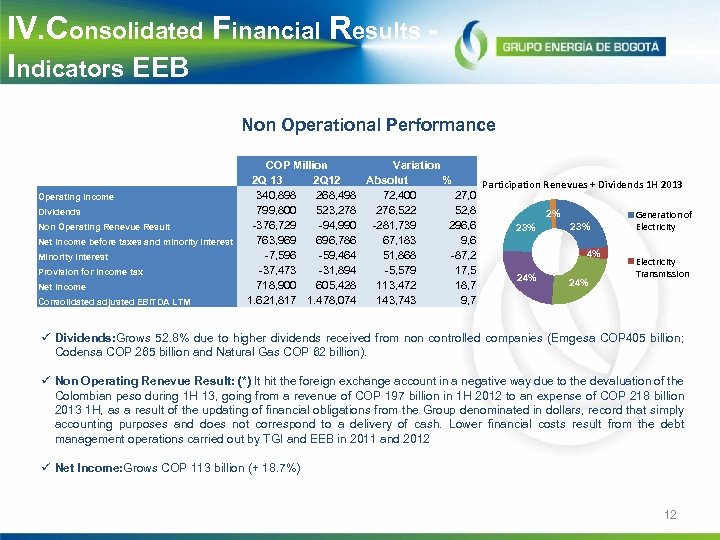

IV. Consolidated Financial Results Indicators EEB Non Operational Performance Operating income Dividends Non Operating Renevue Result Net income before taxes and minority interest Minority interest Provision for income tax Net income Consolidated adjusted EBITDA LTM COP Million Variation 2 Q 13 2 Q 12 Absolut % Participation Renevues + Dividends 1 H 2013 340, 898 268, 498 72, 400 27, 0 799, 800 523, 278 276, 522 52, 8 2% Generation of -376, 729 -94, 990 -281, 739 296, 6 23% Electricity 23% 763, 969 696, 786 67, 183 9, 6 4% -7, 596 -59, 464 51, 868 -87, 2 Electricity -37, 473 -31, 894 -5, 579 17, 5 Transmission 24% 718, 900 605, 428 113, 472 18, 7 1. 621, 817 1. 478, 074 143, 743 9, 7 ü Dividends: Grows 52. 8% due to higher dividends received from non controlled companies (Emgesa COP 405 billion; Codensa COP 265 billion and Natural Gas COP 62 billion). ü Non Operating Renevue Result: (*) It hit the foreign exchange account in a negative way due to the devaluation of the Colombian peso during 1 H 13, going from a revenue of COP 197 billion in 1 H 2012 to an expense of COP 218 billion 2013 1 H, as a result of the updating of financial obligations from the Group denominated in dollars, record that simply accounting purposes and does not correspond to a delivery of cash. Lower financial costs result from the debt management operations carried out by TGI and EEB in 2011 and 2012 ü Net Income: Grows COP 113 billion (+ 18. 7%) 12

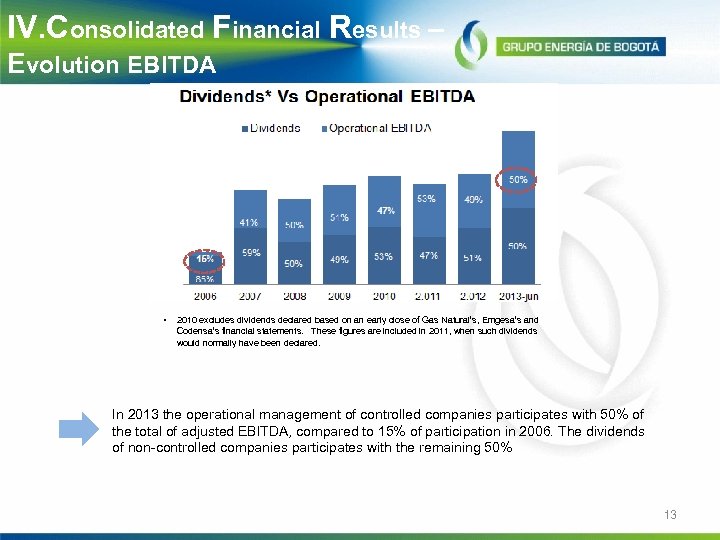

IV. Consolidated Financial Results – Evolution EBITDA • 2010 excludes dividends declared based on an early close of Gas Natural’s, Emgesa’s and Codensa’s financial statements. These figures are included in 2011, when such dividends would normally have been declared. In 2013 the operational management of controlled companies participates with 50% of the total of adjusted EBITDA, compared to 15% of participation in 2006. The dividends of non-controlled companies participates with the remaining 50% 13

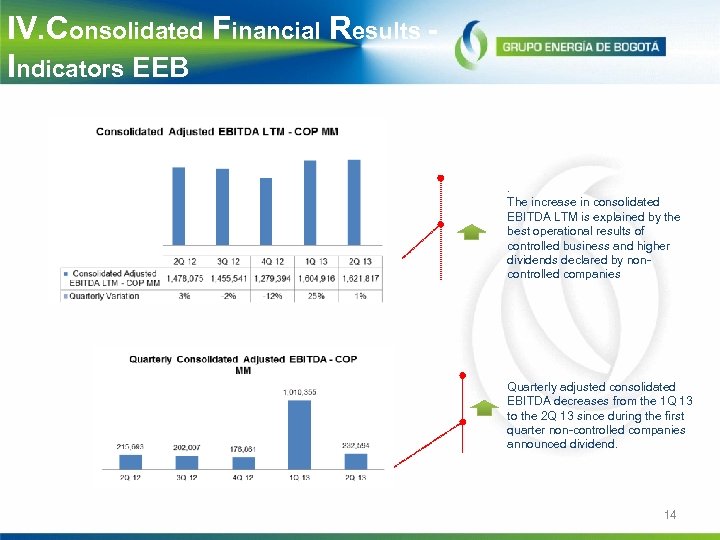

IV. Consolidated Financial Results Indicators EEB . The increase in consolidated EBITDA LTM is explained by the best operational results of controlled business and higher dividends declared by non- controlled companies Quarterly adjusted consolidated EBITDA decreases from the 1 Q 13 to the 2 Q 13 since during the first quarter non-controlled companies announced dividend. 14

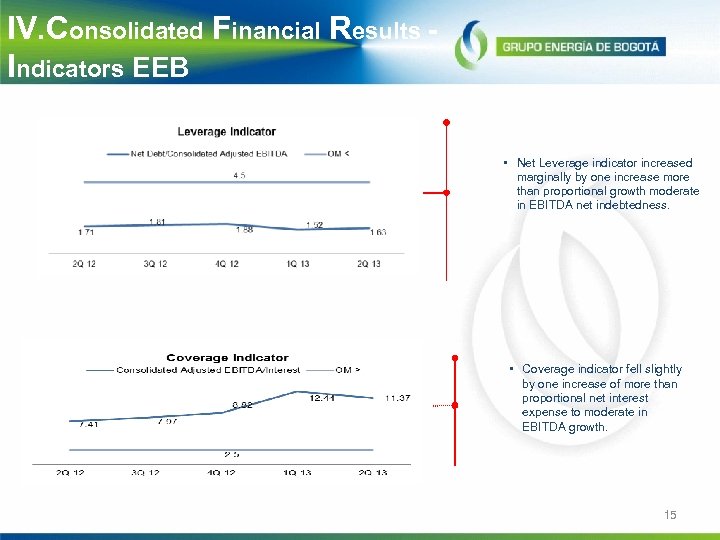

IV. Consolidated Financial Results Indicators EEB • Net Leverage indicator increased marginally by one increase more than proportional growth moderate in EBITDA net indebtedness. • Coverage indicator fell slightly by one increase of more than proportional net interest expense to moderate in EBITDA growth. 15

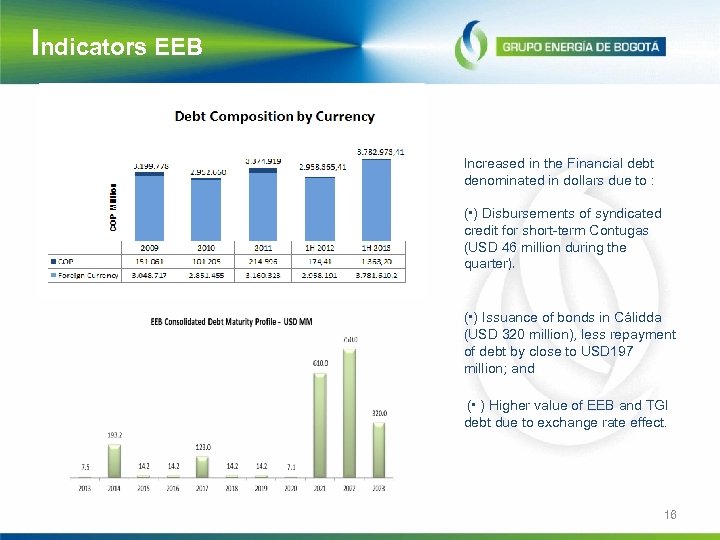

Indicators EEB Increased in the Financial debt denominated in dollars due to : ( ) Disbursements of syndicated credit for short-term Contugas (USD 46 million during the quarter). ( ) Issuance of bonds in Cálidda (USD 320 million), less repayment of debt by close to USD 197 million; and ( ) Higher value of EEB and TGI debt due to exchange rate effect. 16

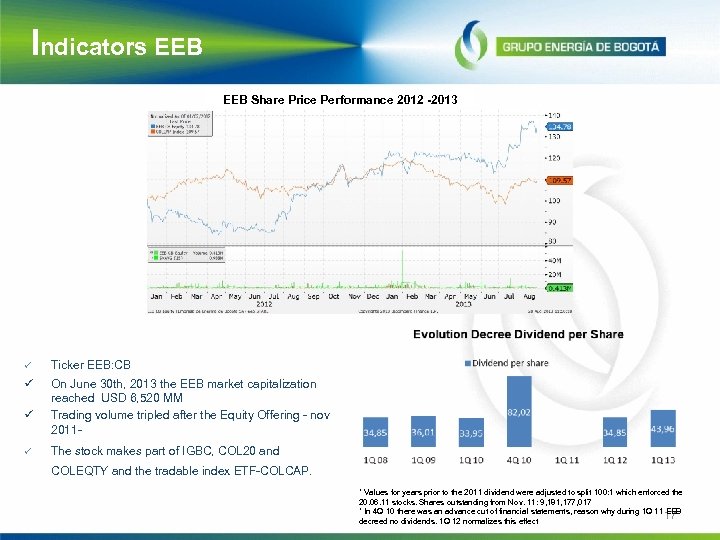

Indicators EEB Share Price Performance 2012 -2013 ü Ticker EEB: CB ü On June 30 th, 2013 the EEB market capitalization reached USD 6, 520 MM Trading volume tripled after the Equity Offering - nov 2011 - ü ü The stock makes part of IGBC, COL 20 and COLEQTY and the tradable index ETF-COLCAP. * Values for years prior to the 2011 dividend were adjusted to split 100: 1 which enforced the 20. 06. 11 stocks. Shares outstanding from Nov. 11: 9, 181, 177, 017 * In 4 Q 10 there was an advance cut of financial statements, reason why during 1 Q 11 EEB 17 decreed no dividends. 1 Q 12 normalizes this effect

Agenda I. Strategy II. Significant developments 1 H 13 III. Investments IV. Consolidated financial results and indicators EEB V. Question and answer session VI. Disclaimer Annex 1. Panoramic view of Grupo Energía de Bogotá Annex 2. Regulated natural monopoly Annex 3. Leadership Market Position 18

Thank you § Additional information ─ WEB page / Investor relations http: //www. eeb. com. co/? idcategoria=3247 ─ Página WEB / Relación inversionistas http: //www. eeb. com. co/? idcategoria=628 ─ Antonio Angarita ─ aangarita@eeb. com. co +571 326 8000 ext 1546 ─ Rafael Andrés Salamanca rsalamanca@eeb. com. co +571 326 8000 ext 1675 19

Disclaimer The information provided herein is for informational and illustrative purposes only and is not, and does not seek to be, a source of legal or financial advice on any subject. This information does not constitute an offer of any sort and is subject to change without notice. EEB expressly disclaims any responsibility for actions taken or not taken based on this information. EEB does not accept any responsibility for losses that might result from the execution of the proposals or recommendations presented. EEB is not responsible for any content that may originate with third parties. EEB may have provided, or might provide in the future, information that is inconsistent with the information herein presented. 20

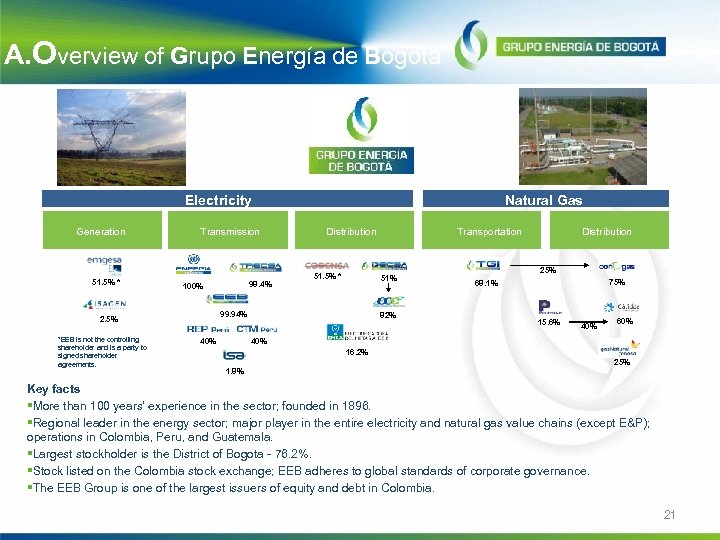

A. Overview of Grupo Energía de Bogotá Electricity Generation 51. 5% * Transmission 100% Distribution 51. 5% * Transportation 51% 99. 94% 2. 5% *EEB is not the controlling shareholder and is a party to signed shareholder agreements. 98. 4% Natural Gas 82% Distribution 25% 75% 68. 1% 15. 6% 40% 60% 40% 16. 2% 1. 8% 25% Key facts §More than 100 years’ experience in the sector; founded in 1896. §Regional leader in the energy sector; major player in the entire electricity and natural gas value chains (except E&P); operations in Colombia, Peru, and Guatemala. §Largest stockholder is the District of Bogota - 76. 2%. §Stock listed on the Colombia stock exchange; EEB adheres to global standards of corporate governance. §The EEB Group is one of the largest issuers of equity and debt in Colombia. 21

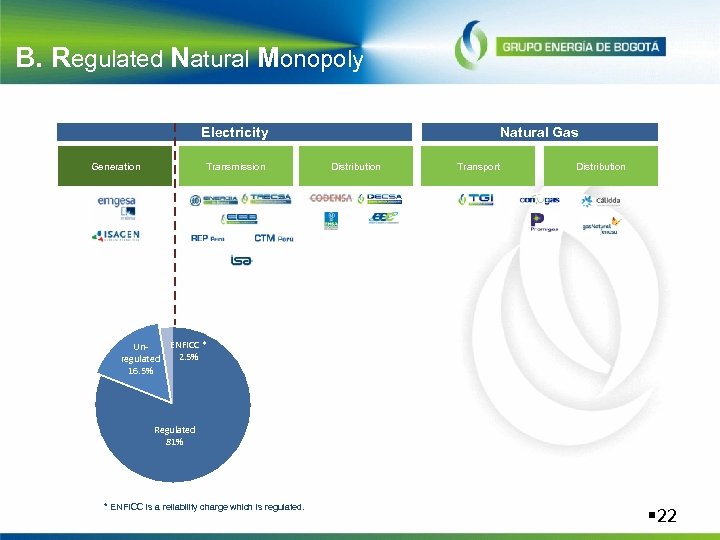

B. Regulated Natural Monopoly Electricity Generation Transmission Unregulated 16. 5% Natural Gas Distribution Transport Distribution ENFICC * 2. 5% Regulated 81% * ENFICC is a reliability charge which is regulated. § 22

C. Leadership Market Position # 1 Colombia Electricity distribution Market share (%) (Kwh) Electricity transmission Market share (%) (Km of lines) # 2 Colombia Gas transportation # 1 Colombia # 2 Colombia 20. 6% Electricity transmission Market share (%) (Km of 220 -138 k. V lines ) 59. 0% Market share (%) (Average volume transported) 88. 4% 8. 0% Electricity generation Market share (%) (Generation) Market share (%) (No. clients) 26. 6% # 1 Colombia Gas distribution # 1 Peru 60. 0% # 1 Peru Gas distribution Market share (%) (No. clients) 100. 0% 23

cf31001f9302990712e9dd51c2abf367.ppt