cb4a7258e284ef6fb89e095be630951a.ppt

- Количество слайдов: 23

Growth vs. Value Trading Strategies Global Asset allocation John O’Reilly Sebastian Otero Barba Nikolay Pavlov Franck Violette

AGENDA q. Overview of Value and Growth q. Historical Trends q. Goal and The Approach to that Goal q. The Datasets and Regression Results q. Trading Strategy within a single class (small, mid, large, and all) q. Trading Strategy among All q. Summary BA 453 – Global Asset Allocation & Stock Selection

Overview of Value and Growth and Value are two fundamental approaches: Growth stock represent companies that have demonstrated better than average gains in earnings in recent years and are expected to continue delivering high levels of profit growth. Value Stock represent companies that are currently out of favor in the marketplace and are considered bargain priced. Value stocks are typically priced much lower than stocks of similar companies in the same industry and may include stocks of newer companies with unproven track records. Combining the two styles can help reduce portfolio volatility because each have outperformed the other at different phases of the business cycle. BA 453 – Global Asset Allocation & Stock Selection

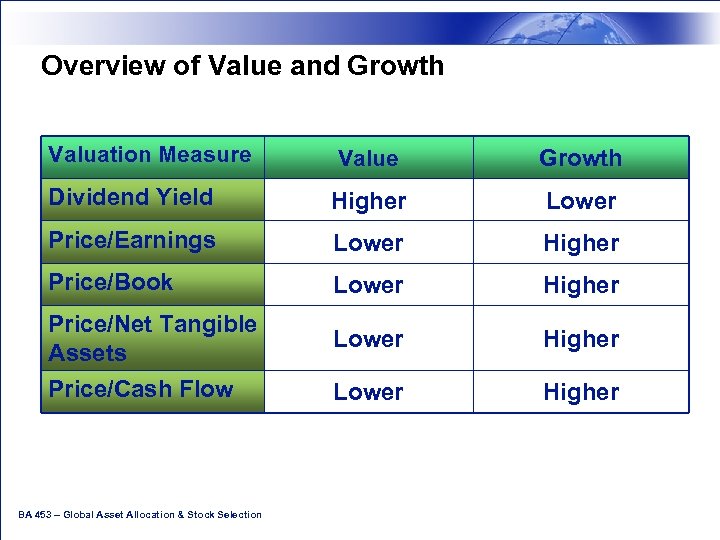

Overview of Value and Growth Valuation Measure Value Growth Dividend Yield Higher Lower Price/Earnings Lower Higher Price/Book Lower Higher Price/Net Tangible Assets Price/Cash Flow BA 453 – Global Asset Allocation & Stock Selection

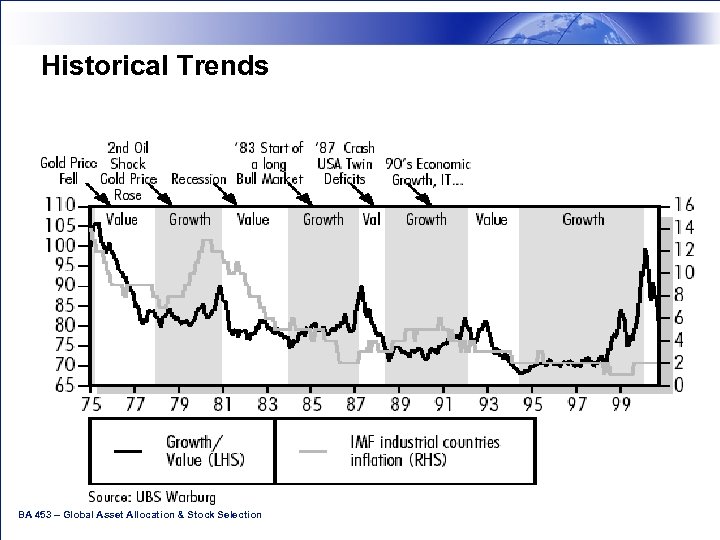

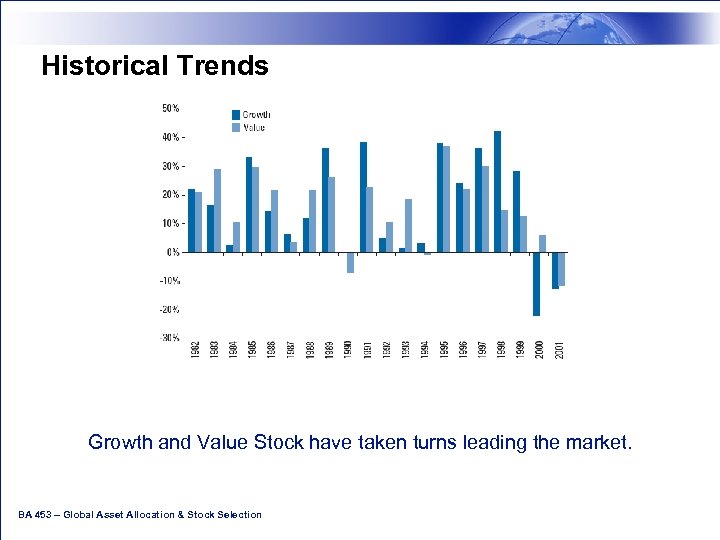

Historical Trends BA 453 – Global Asset Allocation & Stock Selection

Historical Trends Growth and Value Stock have taken turns leading the market. BA 453 – Global Asset Allocation & Stock Selection

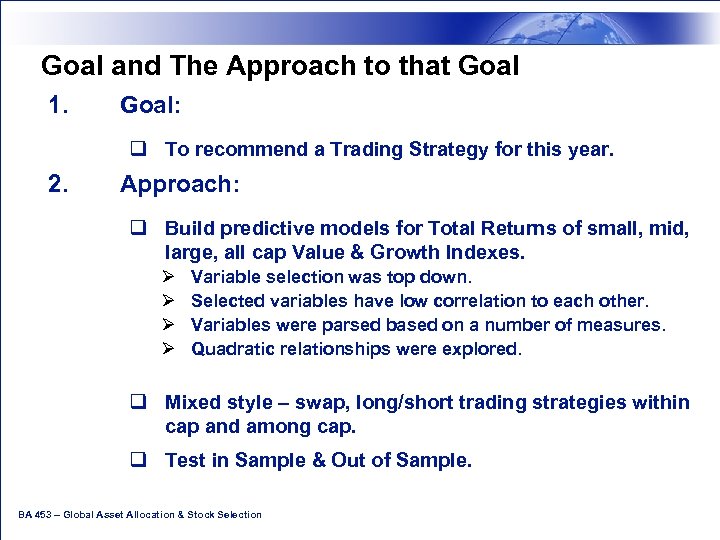

Goal and The Approach to that Goal 1. Goal: q To recommend a Trading Strategy for this year. 2. Approach: q Build predictive models for Total Returns of small, mid, large, all cap Value & Growth Indexes. Ø Ø Variable selection was top down. Selected variables have low correlation to each other. Variables were parsed based on a number of measures. Quadratic relationships were explored. q Mixed style – swap, long/short trading strategies within cap and among cap. q Test in Sample & Out of Sample. BA 453 – Global Asset Allocation & Stock Selection

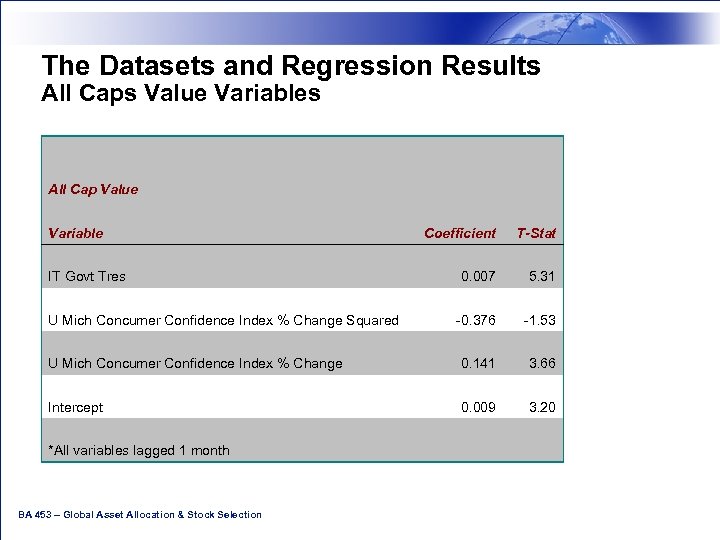

The Datasets and Regression Results All Caps Value Variables All Cap Value Coefficient T-Stat 0. 007 5. 31 -0. 376 -1. 53 U Mich Concumer Confidence Index % Change 0. 141 3. 66 Intercept 0. 009 3. 20 Variable IT Govt Tres U Mich Concumer Confidence Index % Change Squared *All variables lagged 1 month BA 453 – Global Asset Allocation & Stock Selection

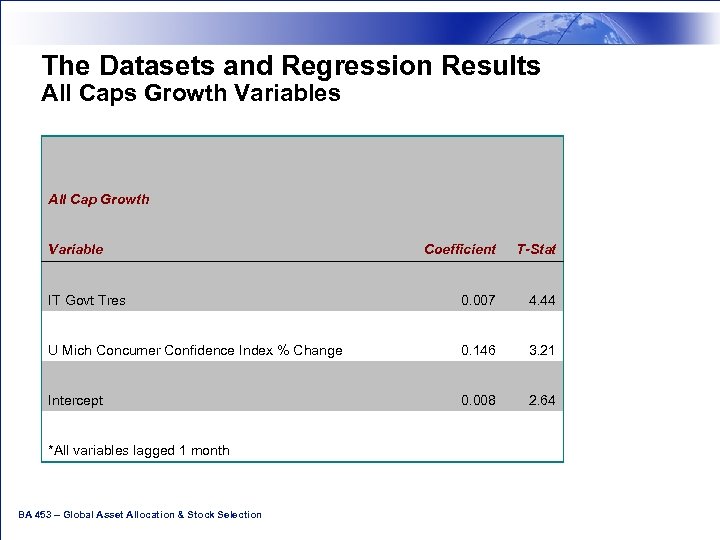

The Datasets and Regression Results All Caps Growth Variables All Cap Growth Coefficient T-Stat IT Govt Tres 0. 007 4. 44 U Mich Concumer Confidence Index % Change 0. 146 3. 21 Intercept 0. 008 2. 64 Variable *All variables lagged 1 month BA 453 – Global Asset Allocation & Stock Selection

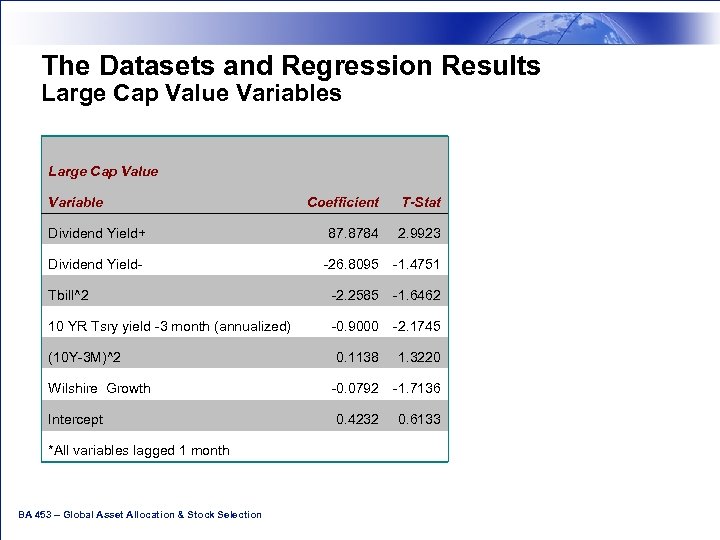

The Datasets and Regression Results Large Cap Value Variables Large Cap Value Coefficient T-Stat Dividend Yield+ 87. 8784 2. 9923 Dividend Yield- -26. 8095 -1. 4751 Tbill^2 -2. 2585 -1. 6462 10 YR Tsry yield -3 month (annualized) -0. 9000 -2. 1745 0. 1138 1. 3220 -0. 0792 -1. 7136 0. 4232 0. 6133 Variable (10 Y-3 M)^2 Wilshire Growth Intercept *All variables lagged 1 month BA 453 – Global Asset Allocation & Stock Selection

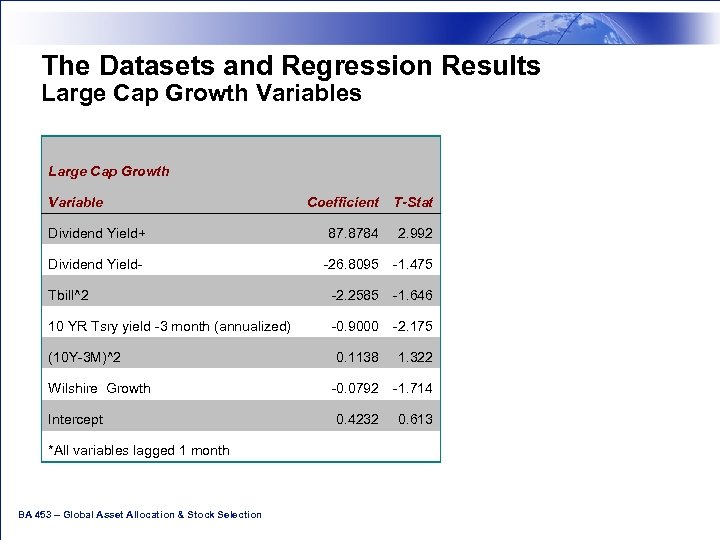

The Datasets and Regression Results Large Cap Growth Variables Large Cap Growth Coefficient T-Stat Dividend Yield+ 87. 8784 2. 992 Dividend Yield- -26. 8095 -1. 475 Tbill^2 -2. 2585 -1. 646 10 YR Tsry yield -3 month (annualized) -0. 9000 -2. 175 0. 1138 1. 322 -0. 0792 -1. 714 0. 4232 0. 613 Variable (10 Y-3 M)^2 Wilshire Growth Intercept *All variables lagged 1 month BA 453 – Global Asset Allocation & Stock Selection

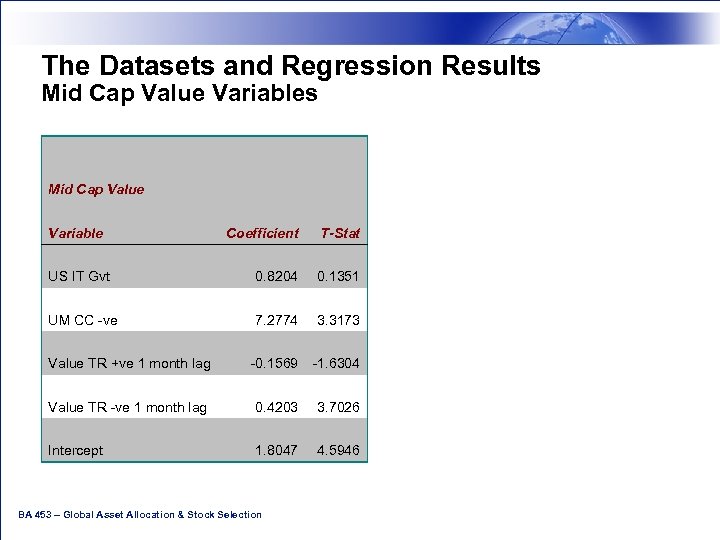

The Datasets and Regression Results Mid Cap Value Variables Mid Cap Value Coefficient T-Stat US IT Gvt 0. 8204 0. 1351 UM CC -ve 7. 2774 3. 3173 Value TR +ve 1 month lag -0. 1569 -1. 6304 Value TR -ve 1 month lag 0. 4203 3. 7026 Intercept 1. 8047 4. 5946 Variable BA 453 – Global Asset Allocation & Stock Selection

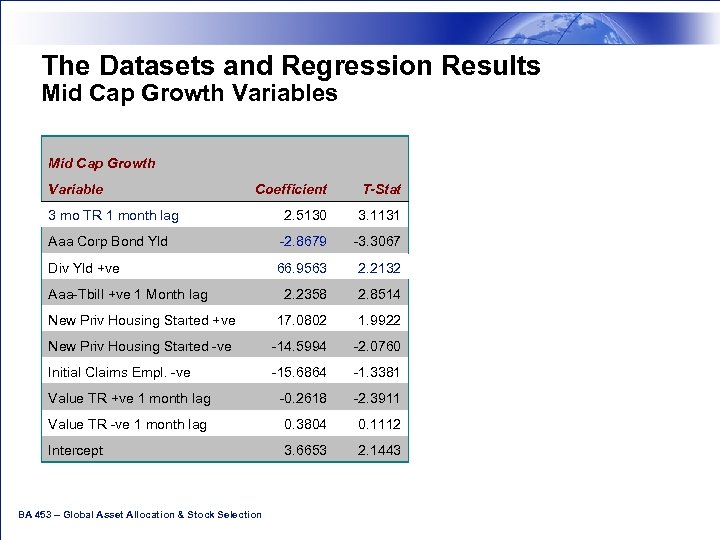

The Datasets and Regression Results Mid Cap Growth Variables Mid Cap Growth Coefficient T-Stat 2. 5130 3. 1131 Aaa Corp Bond Yld -2. 8679 -3. 3067 Div Yld +ve 66. 9563 2. 2132 2. 2358 2. 8514 New Priv Housing Started +ve 17. 0802 1. 9922 New Priv Housing Started -ve -14. 5994 -2. 0760 Initial Claims Empl. -ve -15. 6864 -1. 3381 Value TR +ve 1 month lag -0. 2618 -2. 3911 Value TR -ve 1 month lag 0. 3804 0. 1112 Intercept 3. 6653 2. 1443 Variable 3 mo TR 1 month lag Aaa-Tbill +ve 1 Month lag BA 453 – Global Asset Allocation & Stock Selection

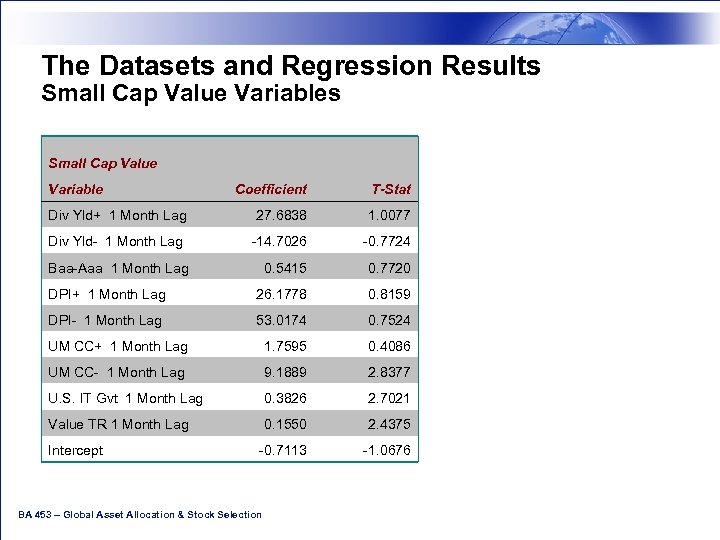

The Datasets and Regression Results Small Cap Value Variables Small Cap Value Coefficient T-Stat Div Yld+ 1 Month Lag 27. 6838 1. 0077 Div Yld- 1 Month Lag -14. 7026 -0. 7724 0. 5415 0. 7720 DPI+ 1 Month Lag 26. 1778 0. 8159 DPI- 1 Month Lag 53. 0174 0. 7524 UM CC+ 1 Month Lag 1. 7595 0. 4086 UM CC- 1 Month Lag 9. 1889 2. 8377 U. S. IT Gvt 1 Month Lag 0. 3826 2. 7021 Value TR 1 Month Lag 0. 1550 2. 4375 -0. 7113 -1. 0676 Variable Baa-Aaa 1 Month Lag Intercept BA 453 – Global Asset Allocation & Stock Selection

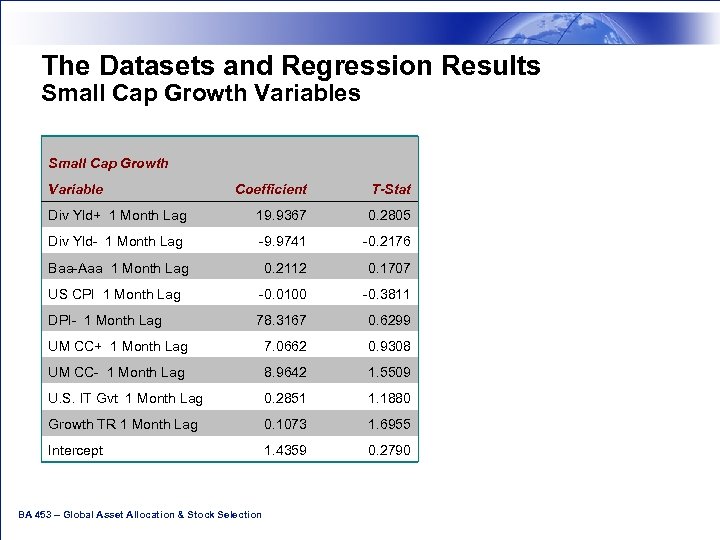

The Datasets and Regression Results Small Cap Growth Variable Coefficient T-Stat Div Yld+ 1 Month Lag 19. 9367 0. 2805 Div Yld- 1 Month Lag -9. 9741 -0. 2176 Baa-Aaa 1 Month Lag 0. 2112 0. 1707 US CPI 1 Month Lag -0. 0100 -0. 3811 DPI- 1 Month Lag 78. 3167 0. 6299 UM CC+ 1 Month Lag 7. 0662 0. 9308 UM CC- 1 Month Lag 8. 9642 1. 5509 U. S. IT Gvt 1 Month Lag 0. 2851 1. 1880 Growth TR 1 Month Lag 0. 1073 1. 6955 Intercept 1. 4359 0. 2790 BA 453 – Global Asset Allocation & Stock Selection

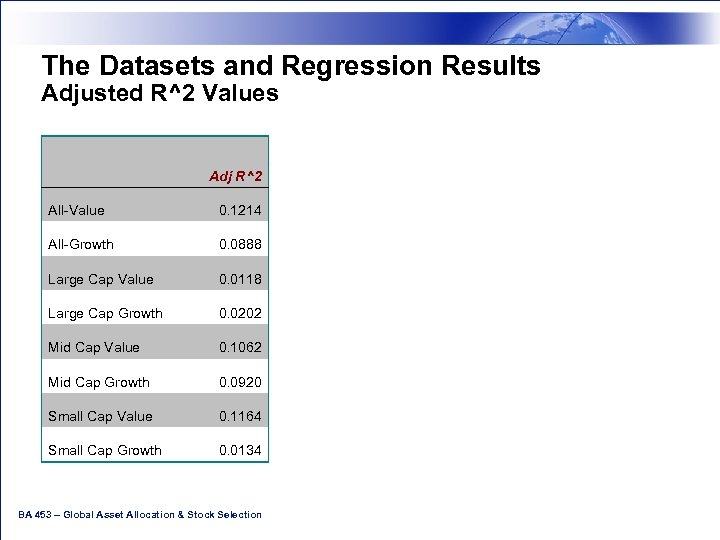

The Datasets and Regression Results Adjusted R^2 Values Adj R^2 All-Value 0. 1214 All-Growth 0. 0888 Large Cap Value 0. 0118 Large Cap Growth 0. 0202 Mid Cap Value 0. 1062 Mid Cap Growth 0. 0920 Small Cap Value 0. 1164 Small Cap Growth 0. 0134 BA 453 – Global Asset Allocation & Stock Selection

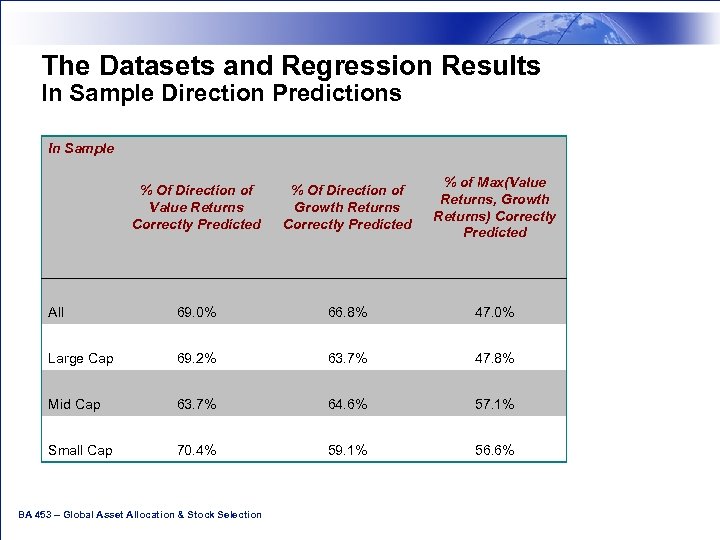

The Datasets and Regression Results In Sample Direction Predictions In Sample % Of Direction of Value Returns Correctly Predicted % Of Direction of Growth Returns Correctly Predicted % of Max(Value Returns, Growth Returns) Correctly Predicted All 69. 0% 66. 8% 47. 0% Large Cap 69. 2% 63. 7% 47. 8% Mid Cap 63. 7% 64. 6% 57. 1% Small Cap 70. 4% 59. 1% 56. 6% BA 453 – Global Asset Allocation & Stock Selection

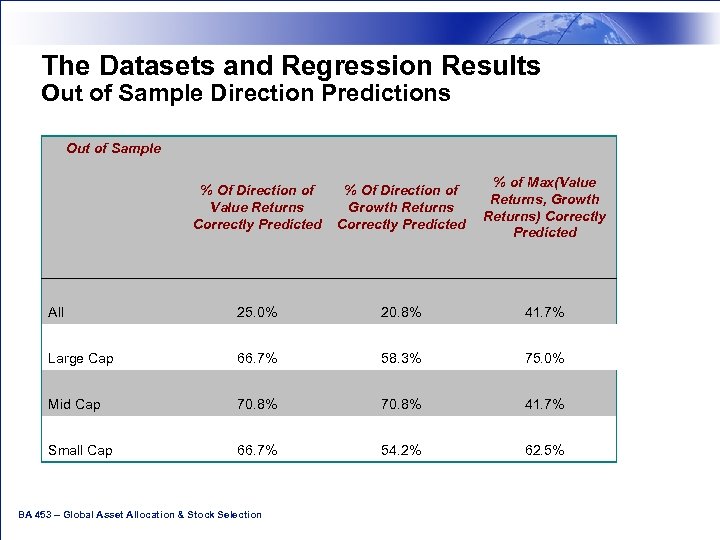

The Datasets and Regression Results Out of Sample Direction Predictions Out of Sample % Of Direction of Value Returns Correctly Predicted % Of Direction of Growth Returns Correctly Predicted % of Max(Value Returns, Growth Returns) Correctly Predicted All 25. 0% 20. 8% 41. 7% Large Cap 66. 7% 58. 3% 75. 0% Mid Cap 70. 8% 41. 7% Small Cap 66. 7% 54. 2% 62. 5% BA 453 – Global Asset Allocation & Stock Selection

Trading Strategy within a single class (small, mid, large, and all) q. If the predicted growth and value return is less than the 30 Day T-Bill return, put 100% in T-Bills. q. If the predicted growth or value return is greater than the 30 Day T-Bill return put 100% in either growth or value depending on which has the highest predicted return q. Compare with buying and holding 100% value. q. Compare with buying and holding 100% growth. BA 453 – Global Asset Allocation & Stock Selection

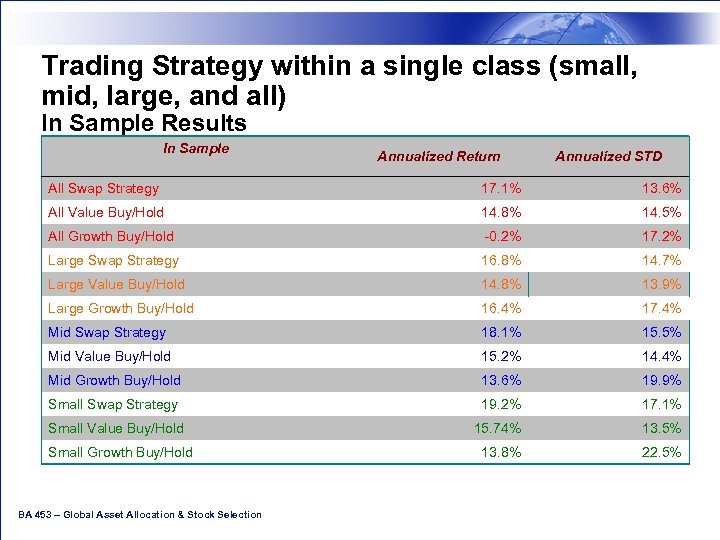

Trading Strategy within a single class (small, mid, large, and all) In Sample Results In Sample Annualized Return Annualized STD All Swap Strategy 17. 1% 13. 6% All Value Buy/Hold 14. 8% 14. 5% All Growth Buy/Hold -0. 2% 17. 2% Large Swap Strategy 16. 8% 14. 7% Large Value Buy/Hold 14. 8% 13. 9% Large Growth Buy/Hold 16. 4% 17. 4% Mid Swap Strategy 18. 1% 15. 5% Mid Value Buy/Hold 15. 2% 14. 4% Mid Growth Buy/Hold 13. 6% 19. 9% Small Swap Strategy 19. 2% 17. 1% Small Value Buy/Hold 15. 74% 13. 5% 13. 8% 22. 5% Small Growth Buy/Hold BA 453 – Global Asset Allocation & Stock Selection

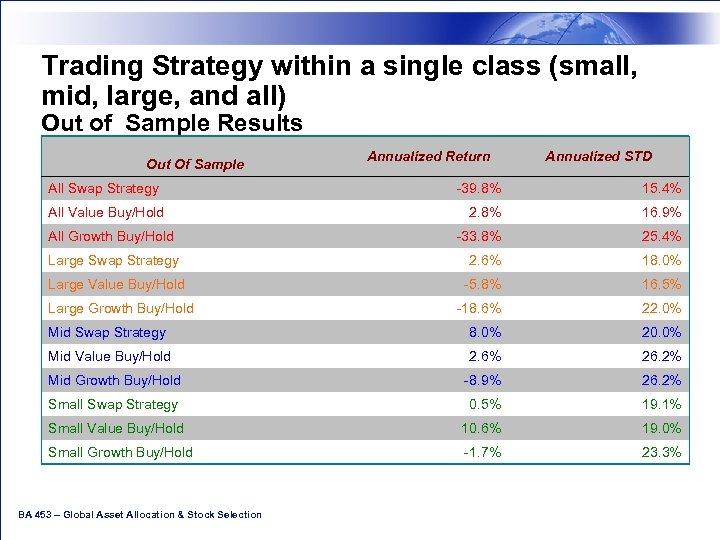

Trading Strategy within a single class (small, mid, large, and all) Out of Sample Results Out Of Sample All Swap Strategy Annualized Return Annualized STD -39. 8% 15. 4% 2. 8% 16. 9% -33. 8% 25. 4% Large Swap Strategy 2. 6% 18. 0% Large Value Buy/Hold -5. 8% 16. 5% -18. 6% 22. 0% Mid Swap Strategy 8. 0% 20. 0% Mid Value Buy/Hold 2. 6% 26. 2% Mid Growth Buy/Hold -8. 9% 26. 2% Small Swap Strategy 0. 5% 19. 1% Small Value Buy/Hold 10. 6% 19. 0% Small Growth Buy/Hold -1. 7% 23. 3% All Value Buy/Hold All Growth Buy/Hold Large Growth Buy/Hold BA 453 – Global Asset Allocation & Stock Selection

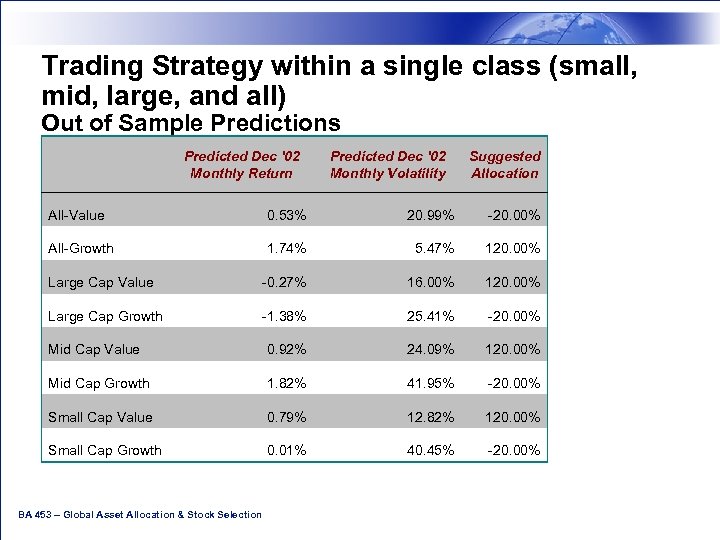

Trading Strategy within a single class (small, mid, large, and all) Out of Sample Predictions Predicted Dec '02 Monthly Return Predicted Dec '02 Monthly Volatility Suggested Allocation All-Value 0. 53% 20. 99% -20. 00% All-Growth 1. 74% 5. 47% 120. 00% Large Cap Value -0. 27% 16. 00% 120. 00% Large Cap Growth -1. 38% 25. 41% -20. 00% Mid Cap Value 0. 92% 24. 09% 120. 00% Mid Cap Growth 1. 82% 41. 95% -20. 00% Small Cap Value 0. 79% 12. 82% 120. 00% Small Cap Growth 0. 01% 40. 45% -20. 00% BA 453 – Global Asset Allocation & Stock Selection

Summary q. Value versus Growth performance varies across capitalizations. q. Implementing a simple trading strategy created larger in sample returns than buying and holding value or growth, but with higher volatility than value. q. Better In Sample predictions than Out of Sample due to different market patterns in the late 90’s. Models prediction estimated to be representative for current market conditions. q. A more complex trading strategy can be implemented by rebalancing a portfolio each period by using the expected returns and volatility during the next period for each asset class. BA 453 – Global Asset Allocation & Stock Selection

cb4a7258e284ef6fb89e095be630951a.ppt