e8ea8fccd9aa2068205ef04f14edf81d.ppt

- Количество слайдов: 50

Growing a Healthy Practice: Top 10 Ways to Increase Cash Flow and Reduce Past Due Accounts Presented by: Tracy L. Spears National Consultant – Medical/Healthcare Industry Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner November 18, 2008

Growing a Healthy Practice: Top 10 Ways to Increase Cash Flow and Reduce Past Due Accounts Presented by: Tracy L. Spears National Consultant – Medical/Healthcare Industry Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner November 18, 2008

Tracy Spears Ms. Tracy Spears is a National Consultant for the Medical/Healthcare Industry and Director of Association Business Development for Transworld Systems. She has been consulting with Transworld for nearly 20 years, focusing on health care and medical practices. Ms. Spears presented to the Oklahoma State MGMA Meeting in October 2007 as well as held an MGMA member web cast in April of 2008. She recently presented “ 10 Ways to Maximize Effective Collections” at the National MGMA Annual Conference in San Diego, CA. and was instrumental in developing an A/R software interface for medical practices to increase cash flow and reduce workload. 2

Tracy Spears Ms. Tracy Spears is a National Consultant for the Medical/Healthcare Industry and Director of Association Business Development for Transworld Systems. She has been consulting with Transworld for nearly 20 years, focusing on health care and medical practices. Ms. Spears presented to the Oklahoma State MGMA Meeting in October 2007 as well as held an MGMA member web cast in April of 2008. She recently presented “ 10 Ways to Maximize Effective Collections” at the National MGMA Annual Conference in San Diego, CA. and was instrumental in developing an A/R software interface for medical practices to increase cash flow and reduce workload. 2

Objectives of Presentation § § Develop internal strategies for effectively collecting money Help staff learn what to say to patients in order to motivate them to pay Understand what options are available when accounts are overdue Know when and how to use those options 3

Objectives of Presentation § § Develop internal strategies for effectively collecting money Help staff learn what to say to patients in order to motivate them to pay Understand what options are available when accounts are overdue Know when and how to use those options 3

Collection Challenges Facing Today’s Practices § § § Slow paying patients Slow paying insurance carriers Understaffed Trying to work all accounts systematically, including small balances Familiarity with collection laws 4

Collection Challenges Facing Today’s Practices § § § Slow paying patients Slow paying insurance carriers Understaffed Trying to work all accounts systematically, including small balances Familiarity with collection laws 4

4 Reasons to Collect 1. 2. 3. 4. Accounts depreciate and get harder to collect Complaints increase with time Further medical treatments stop because patient avoids doctor Stressful for the staff and the patient 5

4 Reasons to Collect 1. 2. 3. 4. Accounts depreciate and get harder to collect Complaints increase with time Further medical treatments stop because patient avoids doctor Stressful for the staff and the patient 5

Facts about Collections § Most medical practices wait until an account is 180 days past due before they give it to an agency for collection 6

Facts about Collections § Most medical practices wait until an account is 180 days past due before they give it to an agency for collection 6

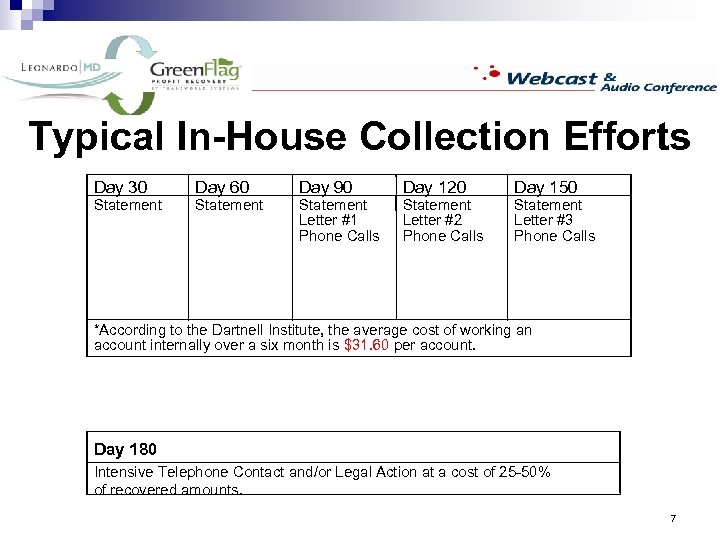

Typical In-House Collection Efforts Day 30 Day 60 Day 90 Day 120 Statement Letter #1 Letter #2 Phone Calls Day 150 Statement Letter #3 Phone Calls *According to the Dartnell Institute, the average cost of working an account internally over a six month is $31. 60 per account. Day 180 Intensive Telephone Contact and/or Legal Action at a cost of 25 -50% - of recovered amounts. 7

Typical In-House Collection Efforts Day 30 Day 60 Day 90 Day 120 Statement Letter #1 Letter #2 Phone Calls Day 150 Statement Letter #3 Phone Calls *According to the Dartnell Institute, the average cost of working an account internally over a six month is $31. 60 per account. Day 180 Intensive Telephone Contact and/or Legal Action at a cost of 25 -50% - of recovered amounts. 7

Facts about Collections § § § It costs a practice $31. 60 to collect an account after it’s 60 days past due* 90% of the collections budget is spent to collect 10% of past due accounts Delinquent accounts depreciate ½% percent per day** * MGMA resource center **U. S. Department of Commerce study of depreciation of accounts held in-house. 8

Facts about Collections § § § It costs a practice $31. 60 to collect an account after it’s 60 days past due* 90% of the collections budget is spent to collect 10% of past due accounts Delinquent accounts depreciate ½% percent per day** * MGMA resource center **U. S. Department of Commerce study of depreciation of accounts held in-house. 8

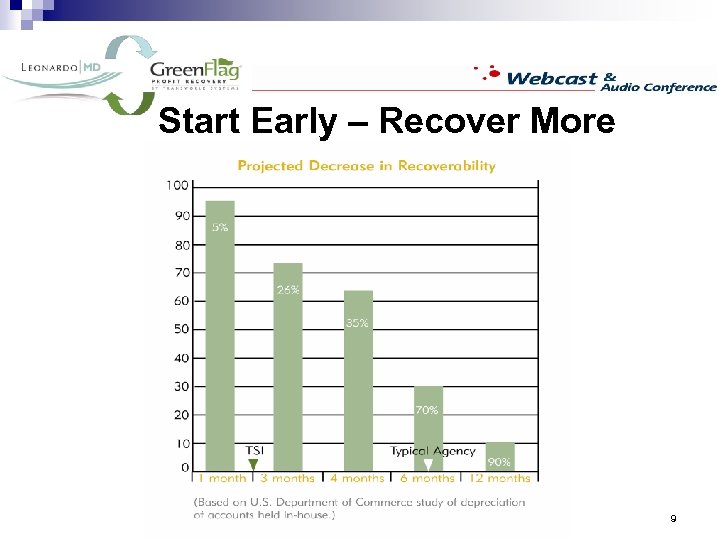

Start Early – Recover More 9

Start Early – Recover More 9

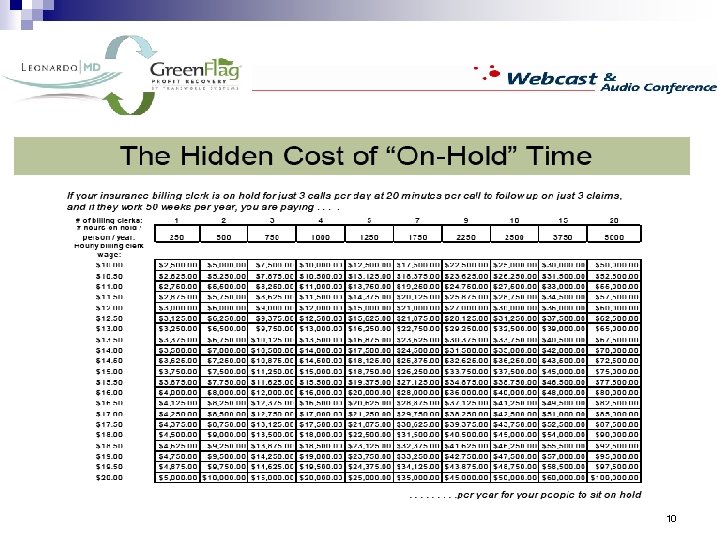

10

10

Facts about Collections § There are over 6, 000 collection agencies operating the United States 11

Facts about Collections § There are over 6, 000 collection agencies operating the United States 11

Facts about Collections § The Fair Debt Collection Practices Act (FDCPA), the primary federal law regulating third party collection agencies, which was enacted in 1977 with the support of ACA, is designed to help protect consumers from unfair and abusive collection practices 12

Facts about Collections § The Fair Debt Collection Practices Act (FDCPA), the primary federal law regulating third party collection agencies, which was enacted in 1977 with the support of ACA, is designed to help protect consumers from unfair and abusive collection practices 12

Facts about Collections § § § Average cost for a traditional agency is 30% According to the ACA International 2008 figures, the average recovery rate for collection agencies is 13. 8% The true cost of collections is the amount of money that is not recovered * ACA International 2008 Survey 13

Facts about Collections § § § Average cost for a traditional agency is 30% According to the ACA International 2008 figures, the average recovery rate for collection agencies is 13. 8% The true cost of collections is the amount of money that is not recovered * ACA International 2008 Survey 13

Facts about Collections Smith’s Practice § $50, 000 § 22% recovery rate § Collect $11, 000 § Agency gets $4, 510 § Practice gets $6, 490 Jones’s Practice § $50, 000 § 10. 8 % recovery rate § Collect $5, 400 § Agency gets $1, 350 § Practice gets $4, 050 Additional Net Income: $2, 440 14

Facts about Collections Smith’s Practice § $50, 000 § 22% recovery rate § Collect $11, 000 § Agency gets $4, 510 § Practice gets $6, 490 Jones’s Practice § $50, 000 § 10. 8 % recovery rate § Collect $5, 400 § Agency gets $1, 350 § Practice gets $4, 050 Additional Net Income: $2, 440 14

Facts about Collections § § § Most money collected by a third party is from the first letter sent to the patient! Working an account internally via phone, has a 10% chance that the call will get through to the patient 90% of malpractice suits are with patients who owe money (hold harmless agreement) 15

Facts about Collections § § § Most money collected by a third party is from the first letter sent to the patient! Working an account internally via phone, has a 10% chance that the call will get through to the patient 90% of malpractice suits are with patients who owe money (hold harmless agreement) 15

Top 10 Ways to Increase Cash Flow and Reduce Past Due Accounts 16

Top 10 Ways to Increase Cash Flow and Reduce Past Due Accounts 16

1. Have a Defined Credit and Collection Policy § Policy gives staff a detailed document that they can stand behind 17

1. Have a Defined Credit and Collection Policy § Policy gives staff a detailed document that they can stand behind 17

What should be included in your policy? § § § Initial office visit or upon admission - What Payment is required Allowable forms of payment: cash, check, money order, and charge card Broken appointment charge and policy Patient is responsible for total charge. We do not look to a third party for payment Medicare - Medicaid, what policy. Established patients only? 18

What should be included in your policy? § § § Initial office visit or upon admission - What Payment is required Allowable forms of payment: cash, check, money order, and charge card Broken appointment charge and policy Patient is responsible for total charge. We do not look to a third party for payment Medicare - Medicaid, what policy. Established patients only? 18

What should be included in your policy? § Office policy on insurance assignment. Full fee due now or just estimated deductible? § Whether or not service fee is charged for filling out more than one insurance form and, if so how much? If doctor "participates", how are those programs handled differently? 19

What should be included in your policy? § Office policy on insurance assignment. Full fee due now or just estimated deductible? § Whether or not service fee is charged for filling out more than one insurance form and, if so how much? If doctor "participates", how are those programs handled differently? 19

What should be included in your policy? § § § Maximum number of payments allowed? Promissory notes or Truth in Lending forms? Interest, billing or service charge - rate and when applied 20

What should be included in your policy? § § § Maximum number of payments allowed? Promissory notes or Truth in Lending forms? Interest, billing or service charge - rate and when applied 20

2. Make Monthly Statements Effective § § Send statements promptly and regularly Do not put aging date at the bottom of the statement 21

2. Make Monthly Statements Effective § § Send statements promptly and regularly Do not put aging date at the bottom of the statement 21

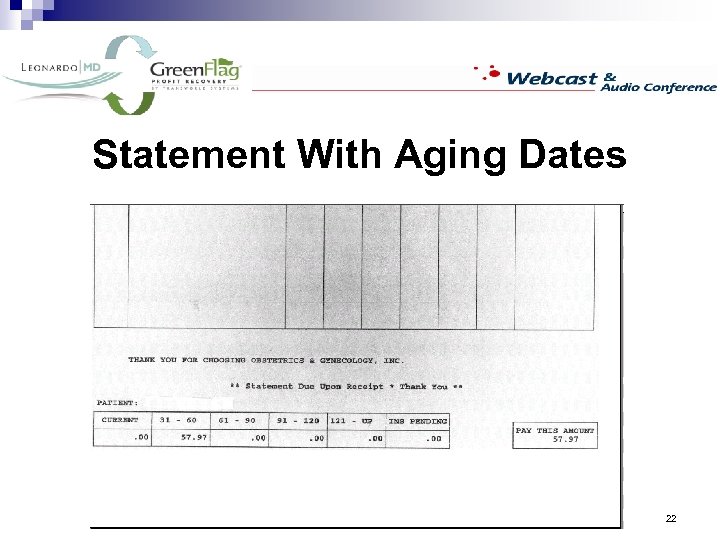

Statement With Aging Dates 22

Statement With Aging Dates 22

Make Monthly Statements Effective § Do put a due date on the statement 23

Make Monthly Statements Effective § Do put a due date on the statement 23

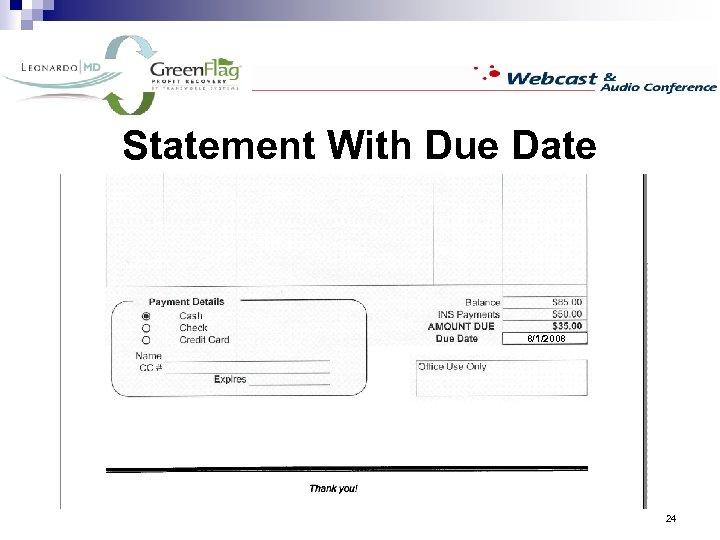

Statement With Due Date 8/1/2008 24

Statement With Due Date 8/1/2008 24

3. Admit & Correct Your Mistakes § If patient has not paid because there is a billing error, admit it and correct it quickly 25

3. Admit & Correct Your Mistakes § If patient has not paid because there is a billing error, admit it and correct it quickly 25

4. Contact Overdue Accounts More Frequently § Contact late paying patients every 10 -14 days 26

4. Contact Overdue Accounts More Frequently § Contact late paying patients every 10 -14 days 26

5. Use “Address Service Requested” § Put address service requested on all correspondence sent to patients 27

5. Use “Address Service Requested” § Put address service requested on all correspondence sent to patients 27

6. Use Your Aging Sheet, Not Your Feelings § Stand by your policy 28

6. Use Your Aging Sheet, Not Your Feelings § Stand by your policy 28

7. Make Sure Your Staff is Well Trained § Even experienced staff members can get jaded when dealing with past due accounts 29

7. Make Sure Your Staff is Well Trained § Even experienced staff members can get jaded when dealing with past due accounts 29

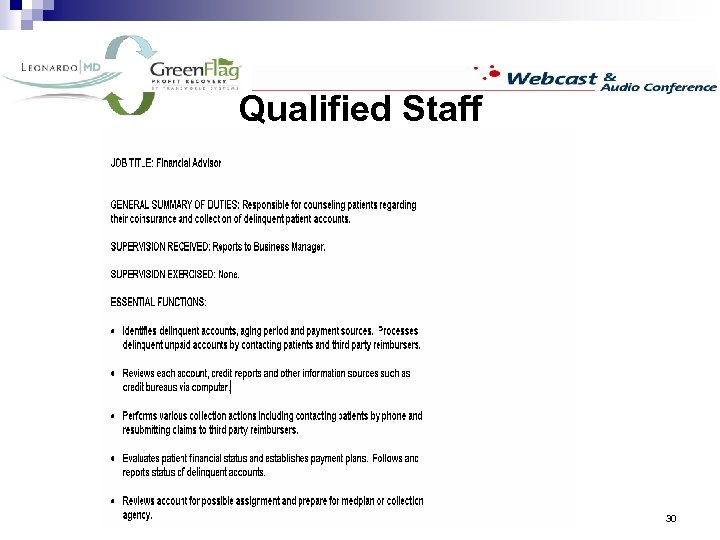

Qualified Staff 30

Qualified Staff 30

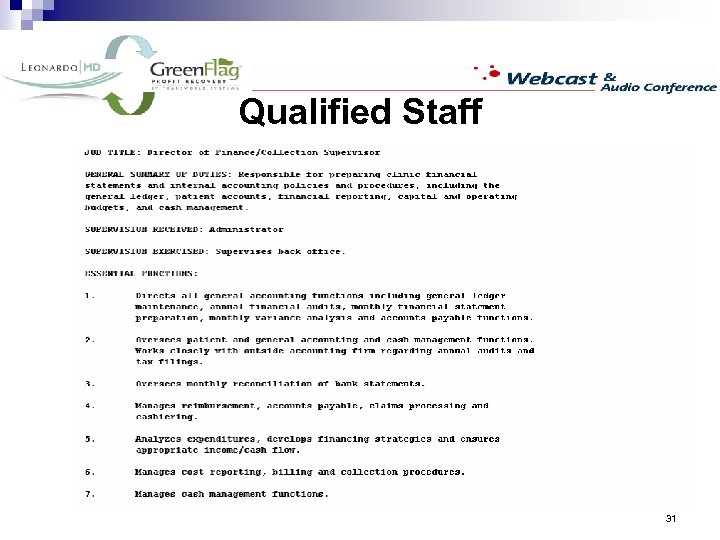

Qualified Staff 31

Qualified Staff 31

How to Talk to Patients: Asking for Payment What you should not say: § “How much can you pay? ” § “When can you pay? ” § “Can you pay something? ” 32

How to Talk to Patients: Asking for Payment What you should not say: § “How much can you pay? ” § “When can you pay? ” § “Can you pay something? ” 32

How to Talk to Patients: Asking for Payment What you should say: § “How much are you short? ” § “Will you be in today or tomorrow? ” § “Will you be paying by cash, check or credit card? ” 33

How to Talk to Patients: Asking for Payment What you should say: § “How much are you short? ” § “Will you be in today or tomorrow? ” § “Will you be paying by cash, check or credit card? ” 33

How to Talk to Patients: Asking for Payment § § § Empathize with patient’s situation Remind them of their obligation to pay Get commitment for payment 34

How to Talk to Patients: Asking for Payment § § § Empathize with patient’s situation Remind them of their obligation to pay Get commitment for payment 34

How to Talk to Patients: Asking for Payment § § Convert outstanding balance to a time frame Arrange for bi-monthly payment arrangements 35

How to Talk to Patients: Asking for Payment § § Convert outstanding balance to a time frame Arrange for bi-monthly payment arrangements 35

8. Know the Warning Signs of Troubled Accounts § § Account is 45 -60 days past due Phone has been disconnected or changed to “unlisted” Partial payments are smaller and sent with less regularity Patient says he or she won’t pay 36

8. Know the Warning Signs of Troubled Accounts § § Account is 45 -60 days past due Phone has been disconnected or changed to “unlisted” Partial payments are smaller and sent with less regularity Patient says he or she won’t pay 36

9. Know Your Collection Options § § § Status quo Write the account off Attorney Small Claims Court Use a third party 37

9. Know Your Collection Options § § § Status quo Write the account off Attorney Small Claims Court Use a third party 37

What Are Your Third-Party Options? Collection Agency § Percentage collections agency § Flat fee collections agency 38

What Are Your Third-Party Options? Collection Agency § Percentage collections agency § Flat fee collections agency 38

What to Look for in a Third-Party § § § Proper Accreditation/Licensed Reputable Experienced Easy to do business with Partners with key professional associations 39

What to Look for in a Third-Party § § § Proper Accreditation/Licensed Reputable Experienced Easy to do business with Partners with key professional associations 39

Disadvantages to using a Third-Party § § High cost Alienating the patient Losing control of account Already invested a lot of work to win the account over 40

Disadvantages to using a Third-Party § § High cost Alienating the patient Losing control of account Already invested a lot of work to win the account over 40

Advantages to using a Third-Party § § § A third party gets the patient’s attention and makes an immediate impact Implications for patient’s credit record Removes doctor from position of “bad guy” 41

Advantages to using a Third-Party § § § A third party gets the patient’s attention and makes an immediate impact Implications for patient’s credit record Removes doctor from position of “bad guy” 41

10. Remember: Have realistic expectations of your accounts receivable program. 42

10. Remember: Have realistic expectations of your accounts receivable program. 42

Useful Resource Links: The Association of Credit and Collection Professionals (American Collectors Association) http: //www. acainternational. org/default. aspx n The Fair Debt Collection Practices Act http: //www. ftc. gov/os/statutes/fdcpact. htm n National Better Business Bureau http: //bbb. org n US Chamber of Commerce http: //www. uschamber. com/default n MGMA resource center http: //mgma. com/resources/ n 43

Useful Resource Links: The Association of Credit and Collection Professionals (American Collectors Association) http: //www. acainternational. org/default. aspx n The Fair Debt Collection Practices Act http: //www. ftc. gov/os/statutes/fdcpact. htm n National Better Business Bureau http: //bbb. org n US Chamber of Commerce http: //www. uschamber. com/default n MGMA resource center http: //mgma. com/resources/ n 43

“GLI”: Green. Flag/Leonardo. MD Interface Leonardo. MD & Transworld Systems share a common objective to deliver greater value to medical practices seeking a more efficient collection process. Our collaboration has produced an interface that minimizes internal efforts and reduces billing expenses for our mutual customers. The “GLI” is a seamless interface that eases the process of identifying and submitting delinquent accounts for outside collection activity. It also allows the user to stop outside collection activity when payment is received…all from within the Leonardo. MD client portal. 44

“GLI”: Green. Flag/Leonardo. MD Interface Leonardo. MD & Transworld Systems share a common objective to deliver greater value to medical practices seeking a more efficient collection process. Our collaboration has produced an interface that minimizes internal efforts and reduces billing expenses for our mutual customers. The “GLI” is a seamless interface that eases the process of identifying and submitting delinquent accounts for outside collection activity. It also allows the user to stop outside collection activity when payment is received…all from within the Leonardo. MD client portal. 44

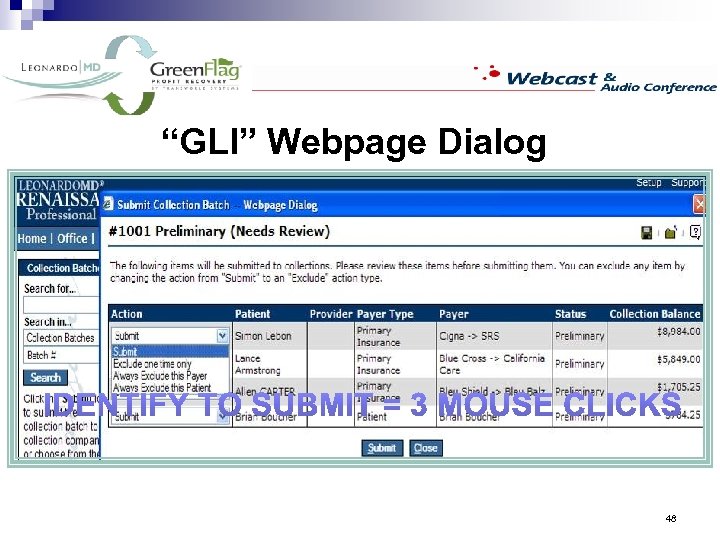

“GLI”: Green. Flag/Leonardo. MD Interface How does it work? 1. The practice determines outside collections parameters based on amount, age, and type of delinquent balances they want the interface to identify for possible outside collection activity. 2. The “GLI” then generates a dialog box of identified Delinquent Patient Balances and/or Insurance Claims. The client reviews these accounts and determines which accounts to submit or exclude from outside collection activity. 3. When Payments are Posted in the Leononard. MD Client Portal they are automatically reported to Green. Flag to stop or suspend collection activity. 45

“GLI”: Green. Flag/Leonardo. MD Interface How does it work? 1. The practice determines outside collections parameters based on amount, age, and type of delinquent balances they want the interface to identify for possible outside collection activity. 2. The “GLI” then generates a dialog box of identified Delinquent Patient Balances and/or Insurance Claims. The client reviews these accounts and determines which accounts to submit or exclude from outside collection activity. 3. When Payments are Posted in the Leononard. MD Client Portal they are automatically reported to Green. Flag to stop or suspend collection activity. 45

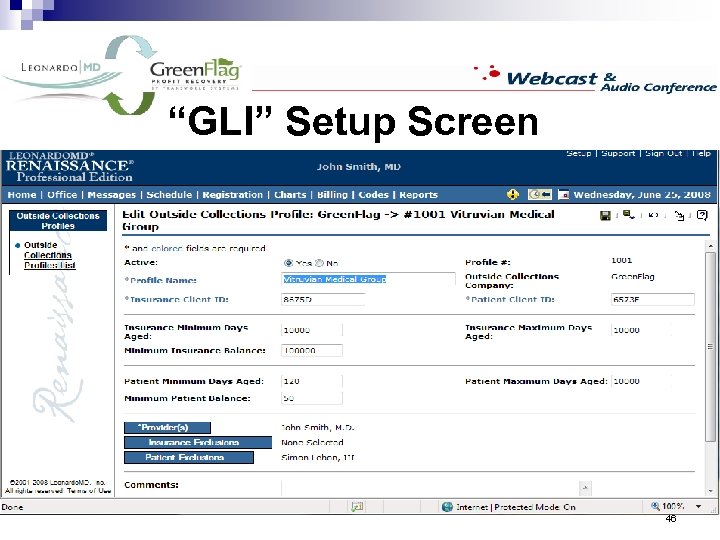

“GLI” Setup Screen 46

“GLI” Setup Screen 46

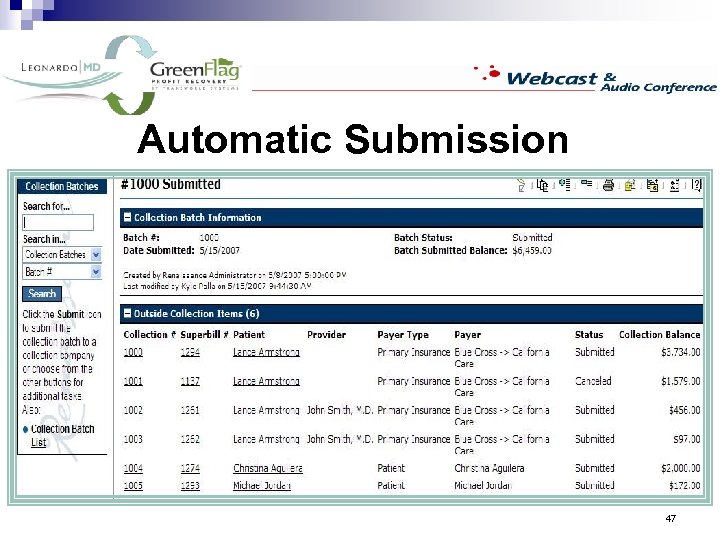

Automatic Submission 47

Automatic Submission 47

“GLI” Webpage Dialog 48

“GLI” Webpage Dialog 48

Thank you. Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner November 18, 2008

Thank you. Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner November 18, 2008

Questions? Contact: Roy J. Gustafson 281 -480 -1977 ext. 6 roy. gustafson@transworldsystems. com or web. transworldsystems. com/leonardomd Profit Recovery Consultant – Medical/Healthcare Industry Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner 50

Questions? Contact: Roy J. Gustafson 281 -480 -1977 ext. 6 roy. gustafson@transworldsystems. com or web. transworldsystems. com/leonardomd Profit Recovery Consultant – Medical/Healthcare Industry Transworld Systems Inc. provider of Green. Flag. SM Profit Recovery Services An MGMA Admini. Serve Partner 50