8a85bc3dc869ed044edecd149e1db243.ppt

- Количество слайдов: 69

• Group Results 2003

• Group Results 2003

Outline of presentation • Financial Results André Vermeulen • New Clicks Australia Jeff Sher (video) • New Clicks South Africa Trevor Honneysett • Conclusion Trevor Honneysett

Outline of presentation • Financial Results André Vermeulen • New Clicks Australia Jeff Sher (video) • New Clicks South Africa Trevor Honneysett • Conclusion Trevor Honneysett

• Financial Results • André Vermeulen

• Financial Results • André Vermeulen

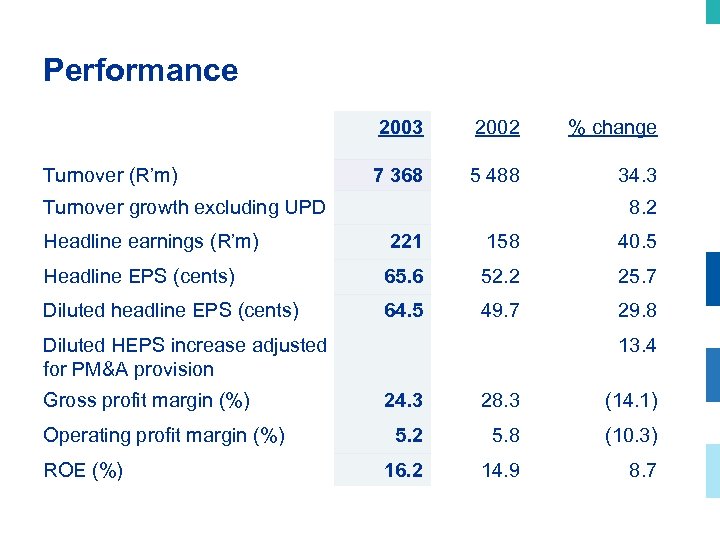

Performance 2003 Turnover (R’m) 2002 % change 7 368 5 488 34. 3 Turnover growth excluding UPD 8. 2 Headline earnings (R’m) 221 158 40. 5 Headline EPS (cents) 65. 6 52. 2 25. 7 Diluted headline EPS (cents) 64. 5 49. 7 29. 8 Diluted HEPS increase adjusted for PM&A provision Gross profit margin (%) Operating profit margin (%) ROE (%) 13. 4 24. 3 28. 3 (14. 1) 5. 2 5. 8 (10. 3) 16. 2 14. 9 8. 7

Performance 2003 Turnover (R’m) 2002 % change 7 368 5 488 34. 3 Turnover growth excluding UPD 8. 2 Headline earnings (R’m) 221 158 40. 5 Headline EPS (cents) 65. 6 52. 2 25. 7 Diluted headline EPS (cents) 64. 5 49. 7 29. 8 Diluted HEPS increase adjusted for PM&A provision Gross profit margin (%) Operating profit margin (%) ROE (%) 13. 4 24. 3 28. 3 (14. 1) 5. 2 5. 8 (10. 3) 16. 2 14. 9 8. 7

Headline earnings per share Undiluted Diluted 70. 3 66. 9 (18. 1) (17. 2) 52. 2 49. 7 16. 3 5. 1 Cost of acquisitions (6. 8) (7. 3) Impact of exchange rate movement (1. 2) At 31 August 2002 previously reported PM&A impairment Restated 31 August 2002 Increased by: Acquisitions Organic growth Decreased by: Impact of share options At 31 August 2003 1. 9 65. 6 64. 5

Headline earnings per share Undiluted Diluted 70. 3 66. 9 (18. 1) (17. 2) 52. 2 49. 7 16. 3 5. 1 Cost of acquisitions (6. 8) (7. 3) Impact of exchange rate movement (1. 2) At 31 August 2002 previously reported PM&A impairment Restated 31 August 2002 Increased by: Acquisitions Organic growth Decreased by: Impact of share options At 31 August 2003 1. 9 65. 6 64. 5

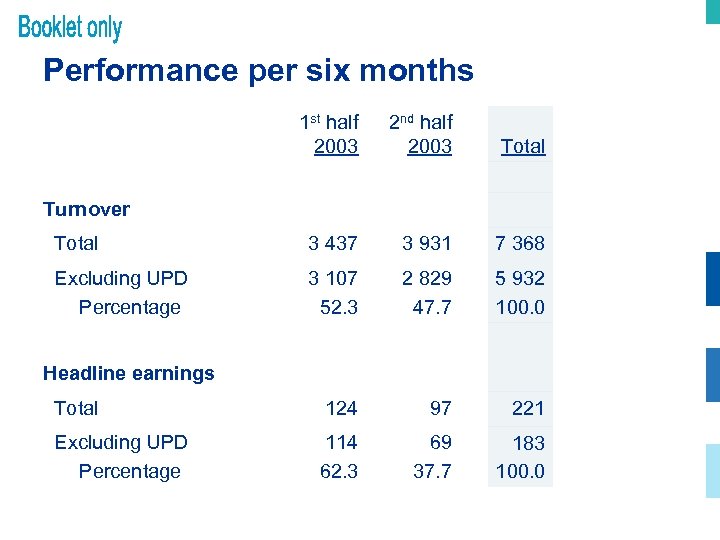

Performance per six months 1 st half 2003 2 nd half 2003 Total 3 437 3 931 7 368 Excluding UPD Percentage 3 107 52. 3 2 829 47. 7 5 932 100. 0 Total 124 97 221 Excluding UPD Percentage 114 62. 3 69 37. 7 183 100. 0 Turnover Headline earnings

Performance per six months 1 st half 2003 2 nd half 2003 Total 3 437 3 931 7 368 Excluding UPD Percentage 3 107 52. 3 2 829 47. 7 5 932 100. 0 Total 124 97 221 Excluding UPD Percentage 114 62. 3 69 37. 7 183 100. 0 Turnover Headline earnings

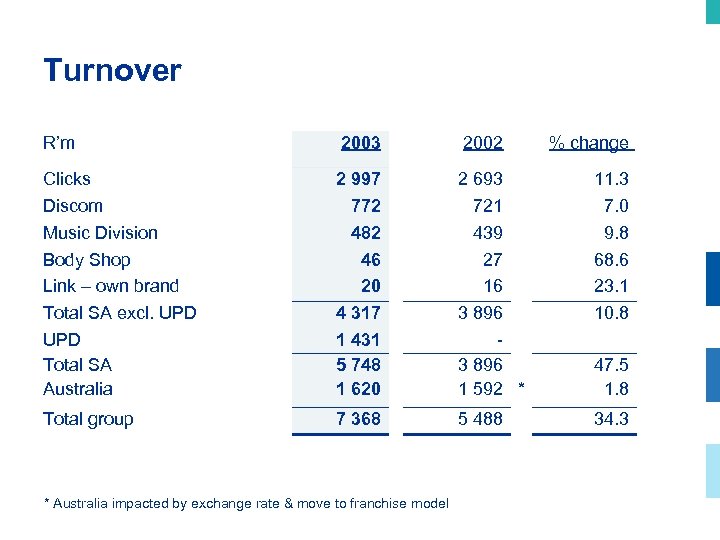

Turnover R’m 2003 2002 Clicks Discom Music Division Body Shop Link – own brand Total SA excl. UPD Total SA Australia 2 997 772 482 46 20 4 317 1 431 5 748 1 620 2 693 721 439 27 16 3 896 1 592 * 11. 3 7. 0 9. 8 68. 6 23. 1 10. 8 Total group 7 368 5 488 34. 3 * Australia impacted by exchange rate & move to franchise model % change 47. 5 1. 8

Turnover R’m 2003 2002 Clicks Discom Music Division Body Shop Link – own brand Total SA excl. UPD Total SA Australia 2 997 772 482 46 20 4 317 1 431 5 748 1 620 2 693 721 439 27 16 3 896 1 592 * 11. 3 7. 0 9. 8 68. 6 23. 1 10. 8 Total group 7 368 5 488 34. 3 * Australia impacted by exchange rate & move to franchise model % change 47. 5 1. 8

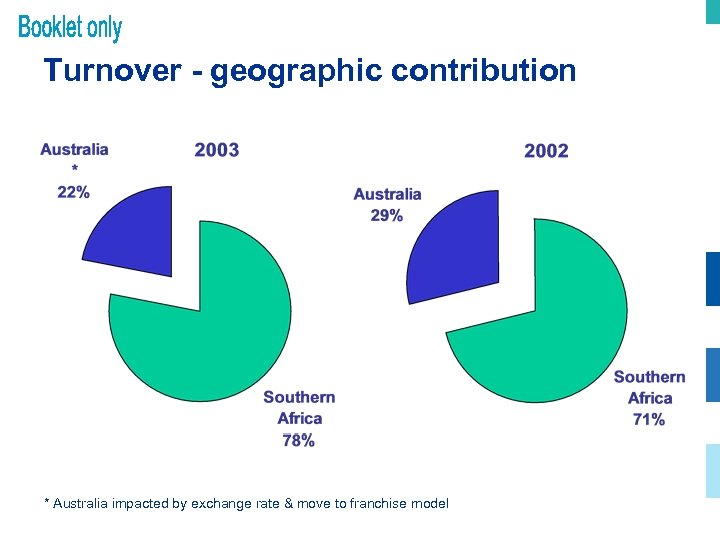

Turnover - geographic contribution * Australia impacted by exchange rate & move to franchise model

Turnover - geographic contribution * Australia impacted by exchange rate & move to franchise model

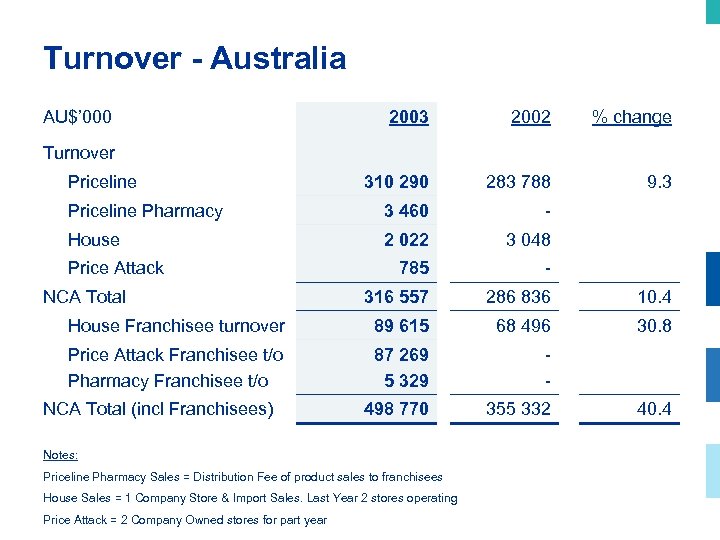

Turnover - Australia AU$’ 000 2003 2002 % change 310 290 283 788 9. 3 Priceline Pharmacy 3 460 - House 2 022 3 048 785 - 316 557 286 836 10. 4 House Franchisee turnover 89 615 68 496 30. 8 Price Attack Franchisee t/o Pharmacy Franchisee t/o 87 269 5 329 - 498 770 355 332 Turnover Priceline Price Attack NCA Total (incl Franchisees) Notes: Priceline Pharmacy Sales = Distribution Fee of product sales to franchisees House Sales = 1 Company Store & Import Sales. Last Year 2 stores operating Price Attack = 2 Company Owned stores for part year 40. 4

Turnover - Australia AU$’ 000 2003 2002 % change 310 290 283 788 9. 3 Priceline Pharmacy 3 460 - House 2 022 3 048 785 - 316 557 286 836 10. 4 House Franchisee turnover 89 615 68 496 30. 8 Price Attack Franchisee t/o Pharmacy Franchisee t/o 87 269 5 329 - 498 770 355 332 Turnover Priceline Price Attack NCA Total (incl Franchisees) Notes: Priceline Pharmacy Sales = Distribution Fee of product sales to franchisees House Sales = 1 Company Store & Import Sales. Last Year 2 stores operating Price Attack = 2 Company Owned stores for part year 40. 4

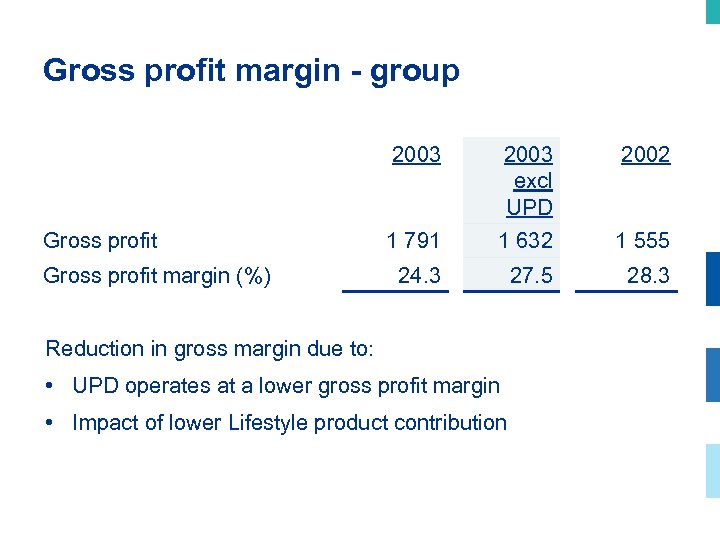

Gross profit margin - group 2003 Gross profit margin (%) 2003 excl UPD 2002 1 791 1 632 1 555 24. 3 27. 5 28. 3 Reduction in gross margin due to: • UPD operates at a lower gross profit margin • Impact of lower Lifestyle product contribution

Gross profit margin - group 2003 Gross profit margin (%) 2003 excl UPD 2002 1 791 1 632 1 555 24. 3 27. 5 28. 3 Reduction in gross margin due to: • UPD operates at a lower gross profit margin • Impact of lower Lifestyle product contribution

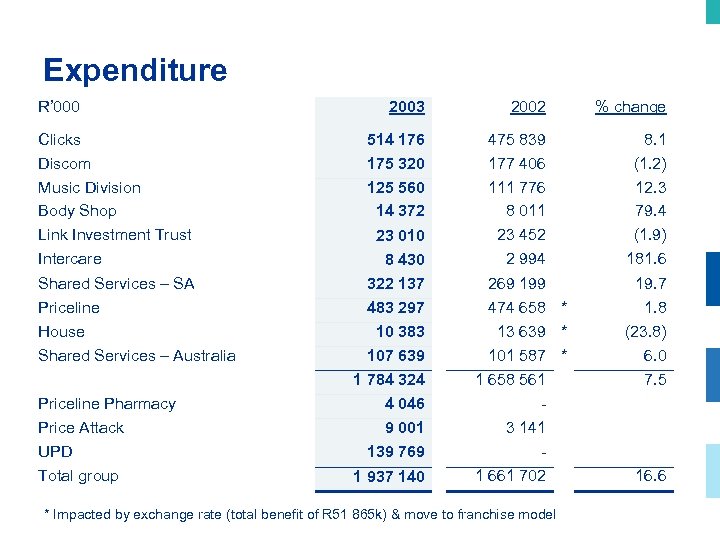

Expenditure R’ 000 2003 2002 % change Clicks Discom 514 176 175 320 475 839 177 406 8. 1 (1. 2) Music Division Body Shop 125 560 14 372 111 776 8 011 12. 3 79. 4 Link Investment Trust Intercare 23 010 8 430 23 452 2 994 (1. 9) 181. 6 Shared Services – SA 322 137 269 19. 7 Priceline 483 297 474 658 * 1. 8 10 383 13 639 * (23. 8) 107 639 101 587 * 6. 0 House Shared Services – Australia 1 784 324 Priceline Pharmacy Price Attack UPD Total group 1 658 561 4 046 9 001 3 141 139 769 - 1 937 140 1 661 702 * Impacted by exchange rate (total benefit of R 51 865 k) & move to franchise model 7. 5 16. 6

Expenditure R’ 000 2003 2002 % change Clicks Discom 514 176 175 320 475 839 177 406 8. 1 (1. 2) Music Division Body Shop 125 560 14 372 111 776 8 011 12. 3 79. 4 Link Investment Trust Intercare 23 010 8 430 23 452 2 994 (1. 9) 181. 6 Shared Services – SA 322 137 269 19. 7 Priceline 483 297 474 658 * 1. 8 10 383 13 639 * (23. 8) 107 639 101 587 * 6. 0 House Shared Services – Australia 1 784 324 Priceline Pharmacy Price Attack UPD Total group 1 658 561 4 046 9 001 3 141 139 769 - 1 937 140 1 661 702 * Impacted by exchange rate (total benefit of R 51 865 k) & move to franchise model 7. 5 16. 6

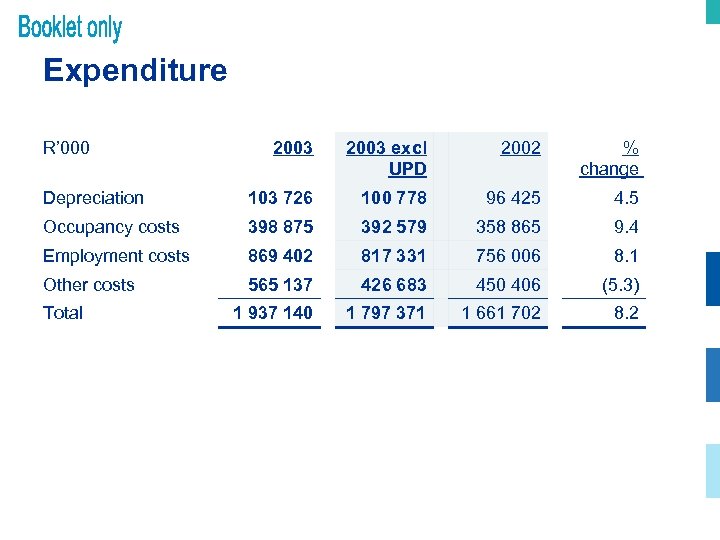

Expenditure R’ 000 2003 excl UPD 2002 % change Depreciation 103 726 100 778 96 425 4. 5 Occupancy costs 398 875 392 579 358 865 9. 4 Employment costs 869 402 817 331 756 006 8. 1 Other costs 565 137 426 683 450 406 (5. 3) 1 937 140 1 797 371 1 661 702 8. 2 Total

Expenditure R’ 000 2003 excl UPD 2002 % change Depreciation 103 726 100 778 96 425 4. 5 Occupancy costs 398 875 392 579 358 865 9. 4 Employment costs 869 402 817 331 756 006 8. 1 Other costs 565 137 426 683 450 406 (5. 3) 1 937 140 1 797 371 1 661 702 8. 2 Total

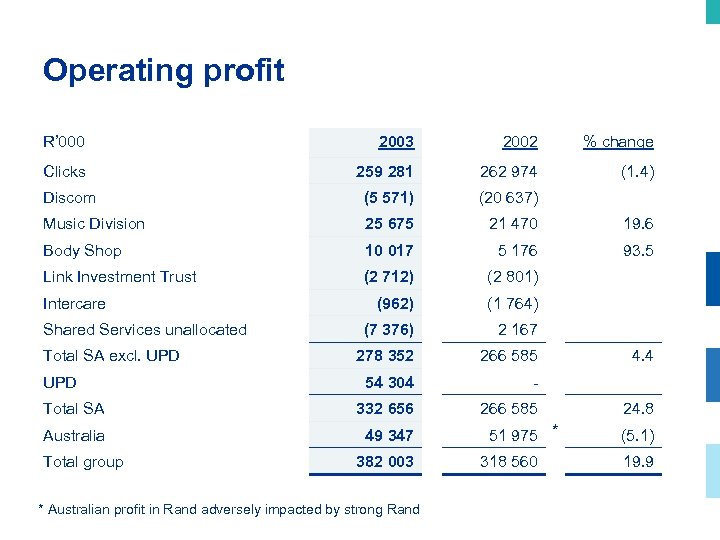

Operating profit R’ 000 2003 2002 % change Clicks 259 281 262 974 (1. 4) Discom (5 571) (20 637) Music Division 25 675 21 470 19. 6 Body Shop 10 017 5 176 93. 5 Link Investment Trust (2 712) (2 801) (962) (1 764) (7 376) 2 167 278 352 266 585 54 304 - Total SA 332 656 266 585 Australia 49 347 Intercare Shared Services unallocated Total SA excl. UPD Total group 382 003 * Australian profit in Rand adversely impacted by strong Rand 51 975 * 318 560 4. 4 24. 8 (5. 1) 19. 9

Operating profit R’ 000 2003 2002 % change Clicks 259 281 262 974 (1. 4) Discom (5 571) (20 637) Music Division 25 675 21 470 19. 6 Body Shop 10 017 5 176 93. 5 Link Investment Trust (2 712) (2 801) (962) (1 764) (7 376) 2 167 278 352 266 585 54 304 - Total SA 332 656 266 585 Australia 49 347 Intercare Shared Services unallocated Total SA excl. UPD Total group 382 003 * Australian profit in Rand adversely impacted by strong Rand 51 975 * 318 560 4. 4 24. 8 (5. 1) 19. 9

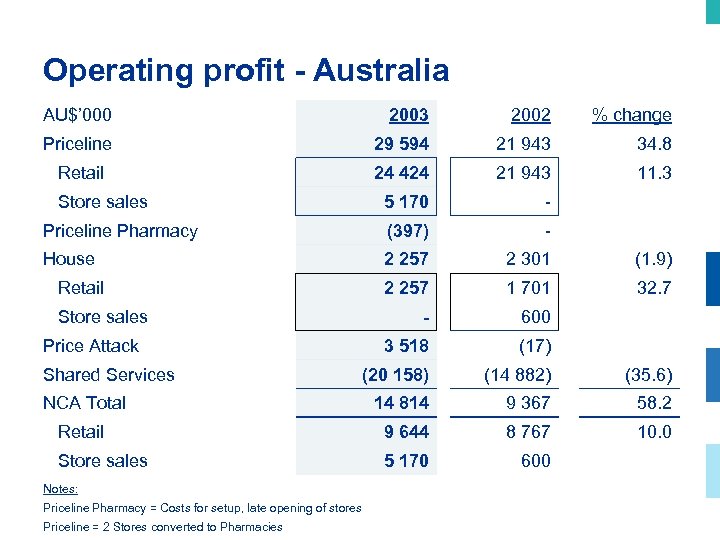

Operating profit - Australia AU$’ 000 2003 2002 % change Priceline 29 594 21 943 34. 8 Retail 24 424 21 943 11. 3 5 170 - Priceline Pharmacy (397) - House 2 257 2 301 (1. 9) 2 257 1 701 32. 7 - 600 3 518 (17) (20 158) (14 882) (35. 6) NCA Total 14 814 9 367 58. 2 Retail 9 644 8 767 10. 0 Store sales 5 170 600 Store sales Retail Store sales Price Attack Shared Services Notes: Priceline Pharmacy = Costs for setup, late opening of stores Priceline = 2 Stores converted to Pharmacies

Operating profit - Australia AU$’ 000 2003 2002 % change Priceline 29 594 21 943 34. 8 Retail 24 424 21 943 11. 3 5 170 - Priceline Pharmacy (397) - House 2 257 2 301 (1. 9) 2 257 1 701 32. 7 - 600 3 518 (17) (20 158) (14 882) (35. 6) NCA Total 14 814 9 367 58. 2 Retail 9 644 8 767 10. 0 Store sales 5 170 600 Store sales Retail Store sales Price Attack Shared Services Notes: Priceline Pharmacy = Costs for setup, late opening of stores Priceline = 2 Stores converted to Pharmacies

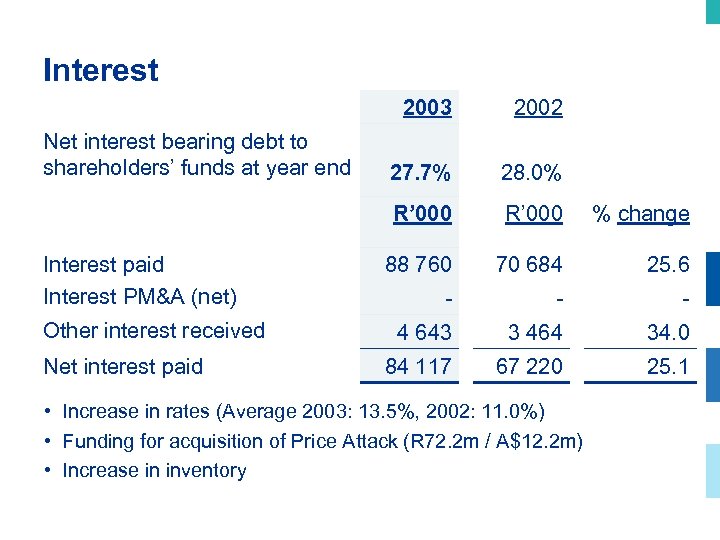

Interest 2003 Interest paid Interest PM&A (net) Other interest received Net interest paid 27. 7% 28. 0% R’ 000 Net interest bearing debt to shareholders’ funds at year end 2002 R’ 000 % change 88 760 70 684 25. 6 - - - 4 643 3 464 34. 0 84 117 67 220 25. 1 • Increase in rates (Average 2003: 13. 5%, 2002: 11. 0%) • Funding for acquisition of Price Attack (R 72. 2 m / A$12. 2 m) • Increase in inventory

Interest 2003 Interest paid Interest PM&A (net) Other interest received Net interest paid 27. 7% 28. 0% R’ 000 Net interest bearing debt to shareholders’ funds at year end 2002 R’ 000 % change 88 760 70 684 25. 6 - - - 4 643 3 464 34. 0 84 117 67 220 25. 1 • Increase in rates (Average 2003: 13. 5%, 2002: 11. 0%) • Funding for acquisition of Price Attack (R 72. 2 m / A$12. 2 m) • Increase in inventory

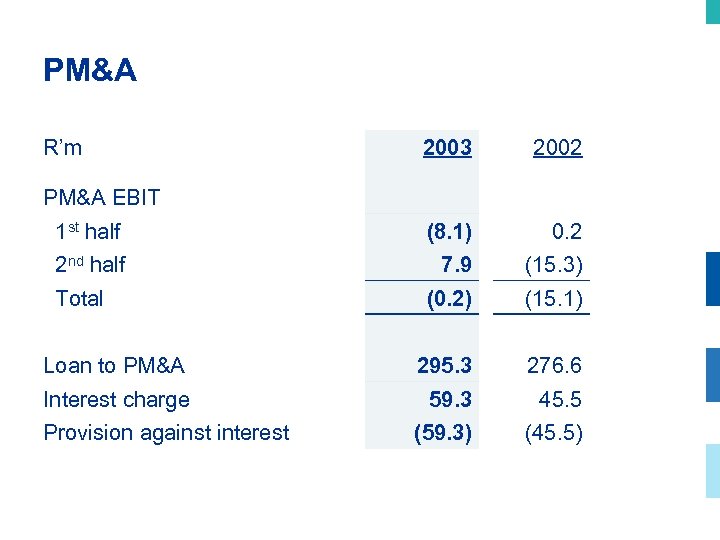

PM&A R’m 2003 2002 1 st half (8. 1) 0. 2 2 nd half 7. 9 (15. 3) (0. 2) (15. 1) Loan to PM&A 295. 3 276. 6 Interest charge 59. 3 45. 5 (59. 3) (45. 5) PM&A EBIT Total Provision against interest

PM&A R’m 2003 2002 1 st half (8. 1) 0. 2 2 nd half 7. 9 (15. 3) (0. 2) (15. 1) Loan to PM&A 295. 3 276. 6 Interest charge 59. 3 45. 5 (59. 3) (45. 5) PM&A EBIT Total Provision against interest

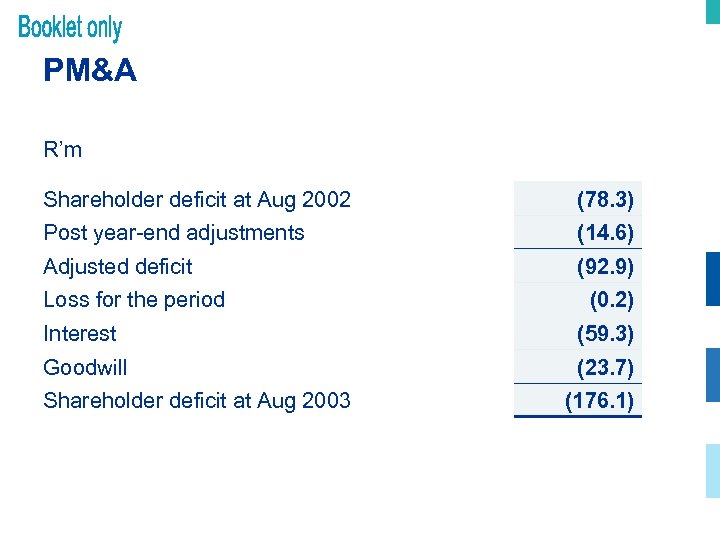

PM&A R’m Shareholder deficit at Aug 2002 (78. 3) Post year-end adjustments (14. 6) Adjusted deficit (92. 9) Loss for the period (0. 2) Interest (59. 3) Goodwill (23. 7) Shareholder deficit at Aug 2003 (176. 1)

PM&A R’m Shareholder deficit at Aug 2002 (78. 3) Post year-end adjustments (14. 6) Adjusted deficit (92. 9) Loss for the period (0. 2) Interest (59. 3) Goodwill (23. 7) Shareholder deficit at Aug 2003 (176. 1)

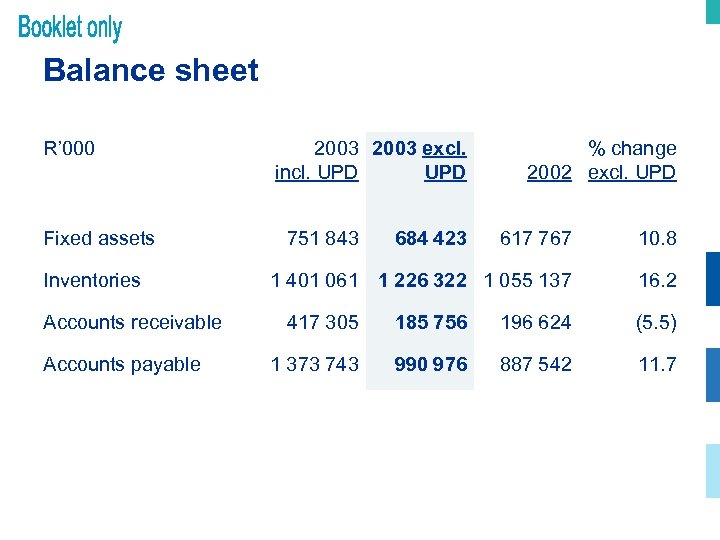

Balance sheet R’ 000 Fixed assets Inventories Accounts receivable Accounts payable 2003 excl. incl. UPD 751 843 684 423 % change 2002 excl. UPD 617 767 10. 8 1 401 061 1 226 322 1 055 137 16. 2 417 305 185 756 196 624 (5. 5) 1 373 743 990 976 887 542 11. 7

Balance sheet R’ 000 Fixed assets Inventories Accounts receivable Accounts payable 2003 excl. incl. UPD 751 843 684 423 % change 2002 excl. UPD 617 767 10. 8 1 401 061 1 226 322 1 055 137 16. 2 417 305 185 756 196 624 (5. 5) 1 373 743 990 976 887 542 11. 7

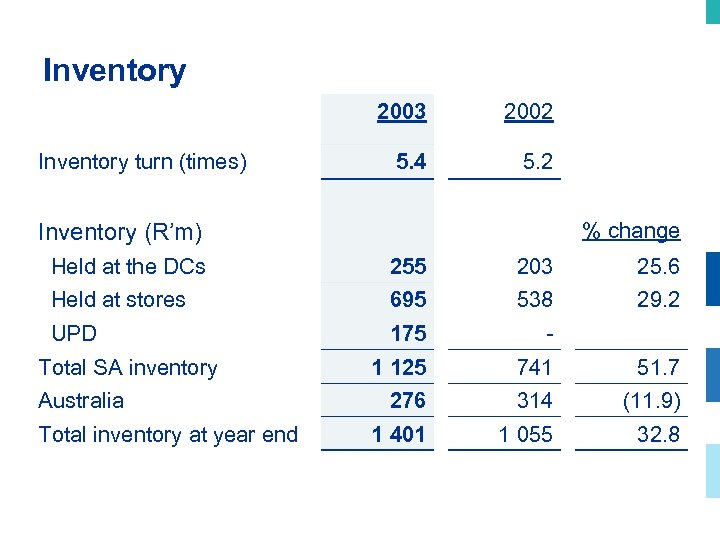

Inventory 2003 Inventory turn (times) 2002 5. 4 5. 2 % change Inventory (R’m) Held at the DCs 255 203 25. 6 Held at stores 695 538 29. 2 UPD 175 - 1 125 741 51. 7 276 314 (11. 9) 1 401 1 055 32. 8 Total SA inventory Australia Total inventory at year end

Inventory 2003 Inventory turn (times) 2002 5. 4 5. 2 % change Inventory (R’m) Held at the DCs 255 203 25. 6 Held at stores 695 538 29. 2 UPD 175 - 1 125 741 51. 7 276 314 (11. 9) 1 401 1 055 32. 8 Total SA inventory Australia Total inventory at year end

Inventory levels • Inventory turn in SA, incl. UPD 5. 3 times • Inventory turn in SA, excl. UPD 4. 5 times (2002: 5. 2) • Inventory turn in Aus 5. 9 times (2002: 5. 1) • Clicks - aggressive & successful promotions • Discom - additional promotions during this period • Body Shop growth - new stores & cosmetics range • DC growth is apportioned to new suppliers • Imports up 57% to R 217 m & landing earlier this year • Music - lower sales & decentralised buying controls

Inventory levels • Inventory turn in SA, incl. UPD 5. 3 times • Inventory turn in SA, excl. UPD 4. 5 times (2002: 5. 2) • Inventory turn in Aus 5. 9 times (2002: 5. 1) • Clicks - aggressive & successful promotions • Discom - additional promotions during this period • Body Shop growth - new stores & cosmetics range • DC growth is apportioned to new suppliers • Imports up 57% to R 217 m & landing earlier this year • Music - lower sales & decentralised buying controls

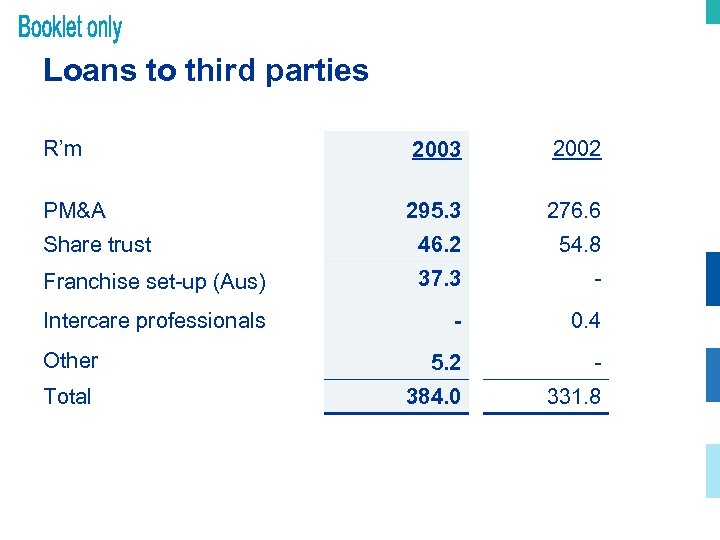

Loans to third parties R’m 2003 2002 PM&A 295. 3 276. 6 Share trust 46. 2 54. 8 Franchise set-up (Aus) 37. 3 - Intercare professionals - 0. 4 Other 5. 2 - Total 384. 0 331. 8

Loans to third parties R’m 2003 2002 PM&A 295. 3 276. 6 Share trust 46. 2 54. 8 Franchise set-up (Aus) 37. 3 - Intercare professionals - 0. 4 Other 5. 2 - Total 384. 0 331. 8

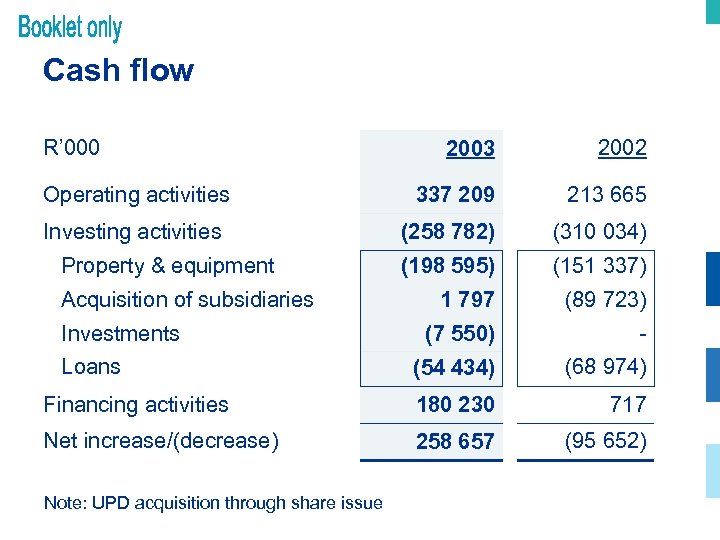

Cash flow R’ 000 2003 2002 337 209 213 665 (258 782) (310 034) (198 595) (151 337) 1 797 (89 723) (7 550) - (54 434) (68 974) Financing activities 180 230 717 Net increase/(decrease) 258 657 (95 652) Operating activities Investing activities Property & equipment Acquisition of subsidiaries Investments Loans Note: UPD acquisition through share issue

Cash flow R’ 000 2003 2002 337 209 213 665 (258 782) (310 034) (198 595) (151 337) 1 797 (89 723) (7 550) - (54 434) (68 974) Financing activities 180 230 717 Net increase/(decrease) 258 657 (95 652) Operating activities Investing activities Property & equipment Acquisition of subsidiaries Investments Loans Note: UPD acquisition through share issue

• New Clicks Australia • Jeff Sher

• New Clicks Australia • Jeff Sher

New Clicks Australia – Review • Shared service capability now in place • Franchise skills developing • Successful integration of Price Attack • Formulated & started to roll out pharmacy model • New management structure – ASF/OMF • Restructured to meet future growth • Leading the way in haircare, homeware & healthcare

New Clicks Australia – Review • Shared service capability now in place • Franchise skills developing • Successful integration of Price Attack • Formulated & started to roll out pharmacy model • New management structure – ASF/OMF • Restructured to meet future growth • Leading the way in haircare, homeware & healthcare

New Clicks Australia – The new way 1. Selling of stores: – Non-performers converted to Pharmacy – Franchisees who do not meet compliance standards - managed – Buying & selling now part of the business – Not limited to Priceline 2. Profit centres: – Marketing services – Store development

New Clicks Australia – The new way 1. Selling of stores: – Non-performers converted to Pharmacy – Franchisees who do not meet compliance standards - managed – Buying & selling now part of the business – Not limited to Priceline 2. Profit centres: – Marketing services – Store development

New Clicks Australia – Behind the numbers • One-off costs quite significant for pharmacy & completion of Price Attack acquisition • Anomalies in the House performance • Pharmacy development • Reallocation of costs to meet demands of franchise business

New Clicks Australia – Behind the numbers • One-off costs quite significant for pharmacy & completion of Price Attack acquisition • Anomalies in the House performance • Pharmacy development • Reallocation of costs to meet demands of franchise business

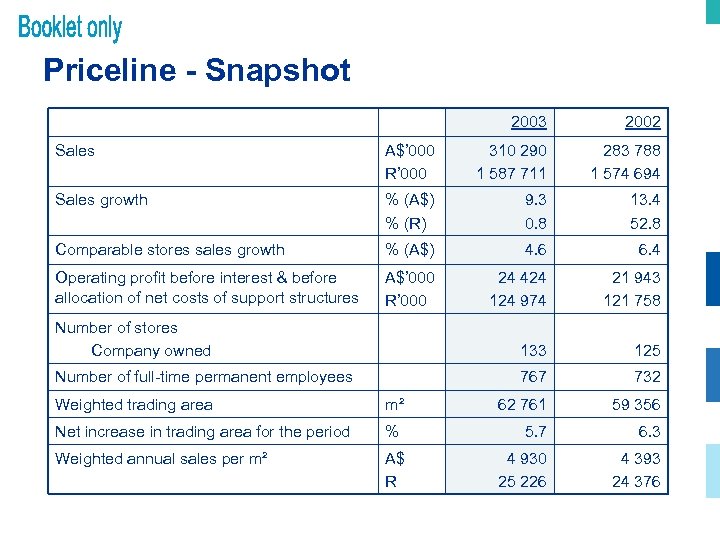

Priceline - Snapshot 2003 2002 Sales A$’ 000 R’ 000 310 290 1 587 711 283 788 1 574 694 Sales growth % (A$) % (R) 9. 3 0. 8 13. 4 52. 8 Comparable stores sales growth % (A$) 4. 6 6. 4 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 24 424 124 974 21 943 121 758 Number of stores Company owned 133 125 Number of full-time permanent employees 767 732 Weighted trading area m² 62 761 59 356 Net increase in trading area for the period % 5. 7 6. 3 Weighted annual sales per m² A$ R 4 930 25 226 4 393 24 376

Priceline - Snapshot 2003 2002 Sales A$’ 000 R’ 000 310 290 1 587 711 283 788 1 574 694 Sales growth % (A$) % (R) 9. 3 0. 8 13. 4 52. 8 Comparable stores sales growth % (A$) 4. 6 6. 4 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 24 424 124 974 21 943 121 758 Number of stores Company owned 133 125 Number of full-time permanent employees 767 732 Weighted trading area m² 62 761 59 356 Net increase in trading area for the period % 5. 7 6. 3 Weighted annual sales per m² A$ R 4 930 25 226 4 393 24 376

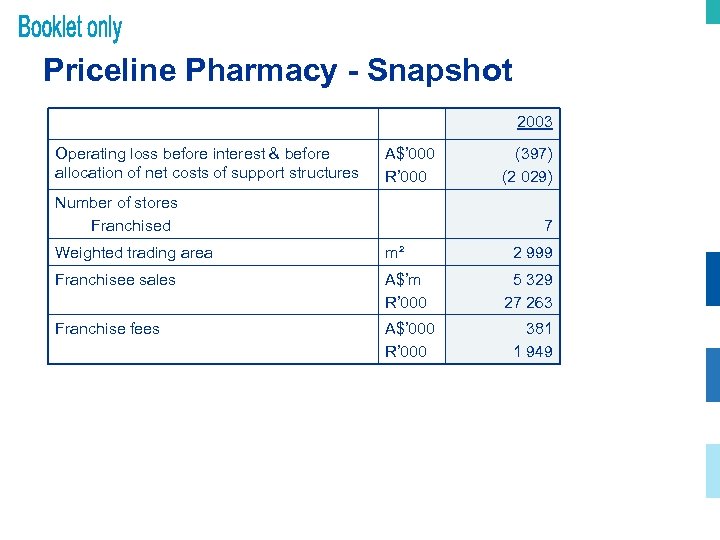

Priceline Pharmacy - Snapshot 2003 Operating loss before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised (397) (2 029) 7 Weighted trading area m² 2 999 Franchisee sales A$’m R’ 000 5 329 27 263 Franchise fees A$’ 000 R’ 000 381 1 949

Priceline Pharmacy - Snapshot 2003 Operating loss before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised (397) (2 029) 7 Weighted trading area m² 2 999 Franchisee sales A$’m R’ 000 5 329 27 263 Franchise fees A$’ 000 R’ 000 381 1 949

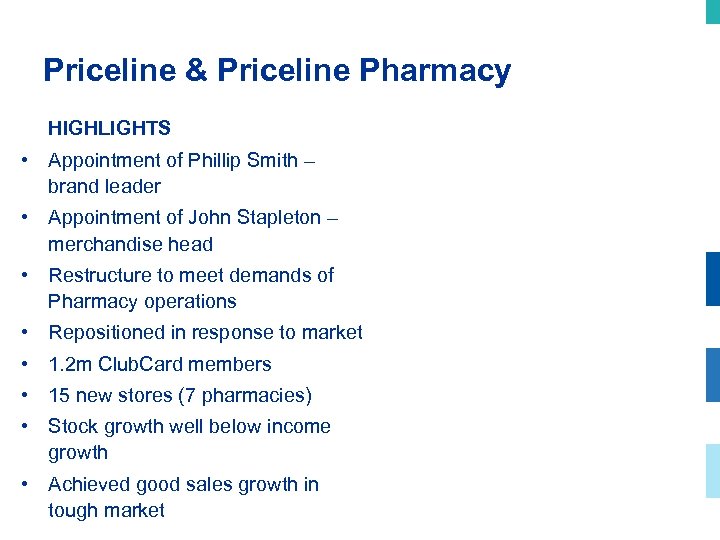

Priceline & Priceline Pharmacy HIGHLIGHTS • Appointment of Phillip Smith – brand leader • Appointment of John Stapleton – merchandise head • Restructure to meet demands of Pharmacy operations • Repositioned in response to market • 1. 2 m Club. Card members • 15 new stores (7 pharmacies) • Stock growth well below income growth • Achieved good sales growth in tough market

Priceline & Priceline Pharmacy HIGHLIGHTS • Appointment of Phillip Smith – brand leader • Appointment of John Stapleton – merchandise head • Restructure to meet demands of Pharmacy operations • Repositioned in response to market • 1. 2 m Club. Card members • 15 new stores (7 pharmacies) • Stock growth well below income growth • Achieved good sales growth in tough market

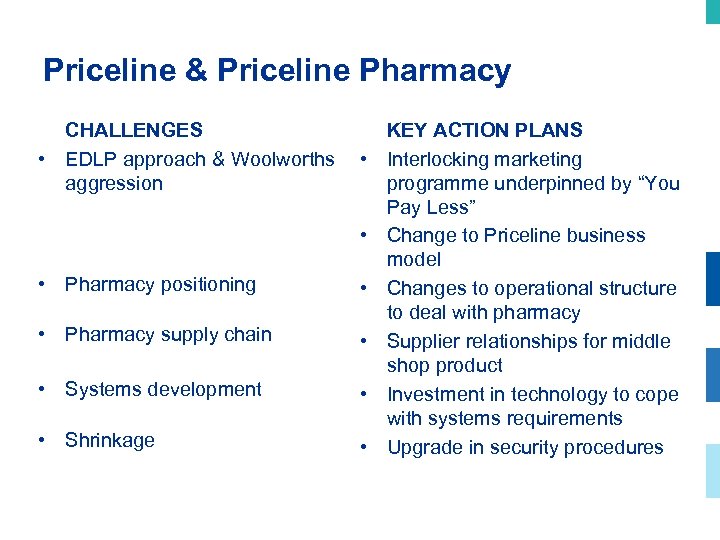

Priceline & Priceline Pharmacy CHALLENGES • EDLP approach & Woolworths aggression • • • Pharmacy positioning • • Pharmacy supply chain • • Systems development • • Shrinkage • KEY ACTION PLANS Interlocking marketing programme underpinned by “You Pay Less” Change to Priceline business model Changes to operational structure to deal with pharmacy Supplier relationships for middle shop product Investment in technology to cope with systems requirements Upgrade in security procedures

Priceline & Priceline Pharmacy CHALLENGES • EDLP approach & Woolworths aggression • • • Pharmacy positioning • • Pharmacy supply chain • • Systems development • • Shrinkage • KEY ACTION PLANS Interlocking marketing programme underpinned by “You Pay Less” Change to Priceline business model Changes to operational structure to deal with pharmacy Supplier relationships for middle shop product Investment in technology to cope with systems requirements Upgrade in security procedures

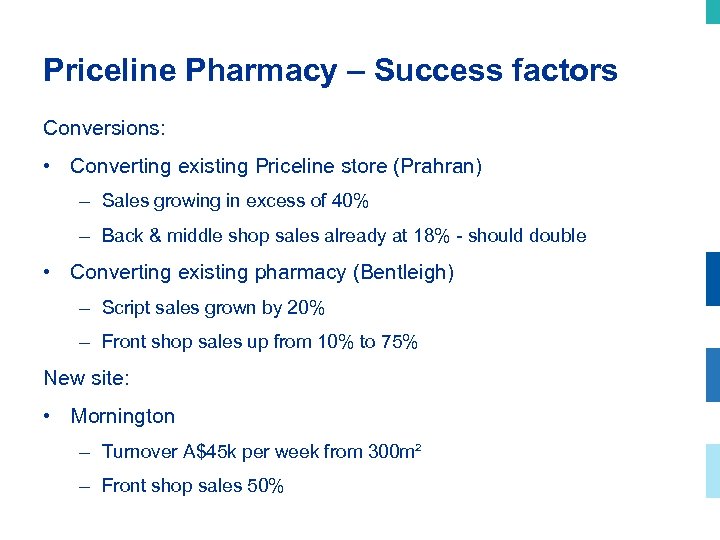

Priceline Pharmacy – Success factors Conversions: • Converting existing Priceline store (Prahran) – Sales growing in excess of 40% – Back & middle shop sales already at 18% - should double • Converting existing pharmacy (Bentleigh) – Script sales grown by 20% – Front shop sales up from 10% to 75% New site: • Mornington – Turnover A$45 k per week from 300 m² – Front shop sales 50%

Priceline Pharmacy – Success factors Conversions: • Converting existing Priceline store (Prahran) – Sales growing in excess of 40% – Back & middle shop sales already at 18% - should double • Converting existing pharmacy (Bentleigh) – Script sales grown by 20% – Front shop sales up from 10% to 75% New site: • Mornington – Turnover A$45 k per week from 300 m² – Front shop sales 50%

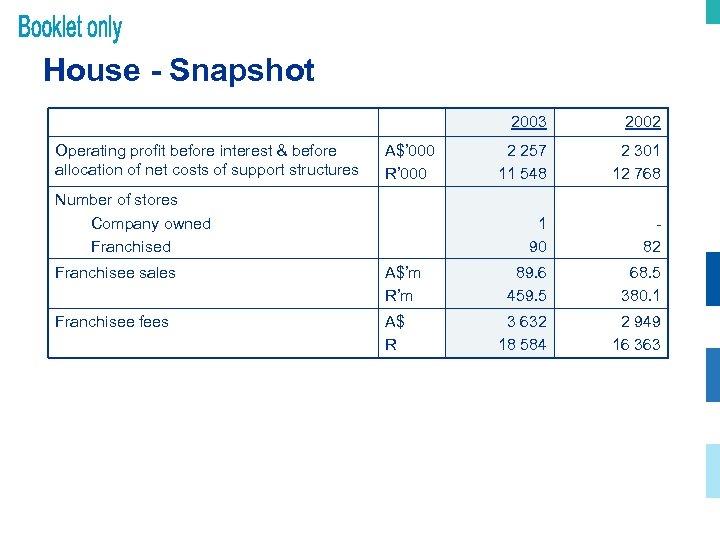

House - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures Number of stores Company owned Franchisee sales A$’m R’m Franchisee fees A$ R 2 257 11 548 2 301 12 768 1 90 A$’ 000 R’ 000 2002 82 89. 6 459. 5 68. 5 380. 1 3 632 18 584 2 949 16 363

House - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures Number of stores Company owned Franchisee sales A$’m R’m Franchisee fees A$ R 2 257 11 548 2 301 12 768 1 90 A$’ 000 R’ 000 2002 82 89. 6 459. 5 68. 5 380. 1 3 632 18 584 2 949 16 363

House • • • HIGHLIGHTS Brand Repositioning – Inspirational Homewares Appointment of Simon Dryden & a restructured brand team Developed a Local area marketing approach Developed strategic Supplier relationships enhancements to other income to follow Achieved 23% growth in Franchise fees Won National Award for Retail Excellence

House • • • HIGHLIGHTS Brand Repositioning – Inspirational Homewares Appointment of Simon Dryden & a restructured brand team Developed a Local area marketing approach Developed strategic Supplier relationships enhancements to other income to follow Achieved 23% growth in Franchise fees Won National Award for Retail Excellence

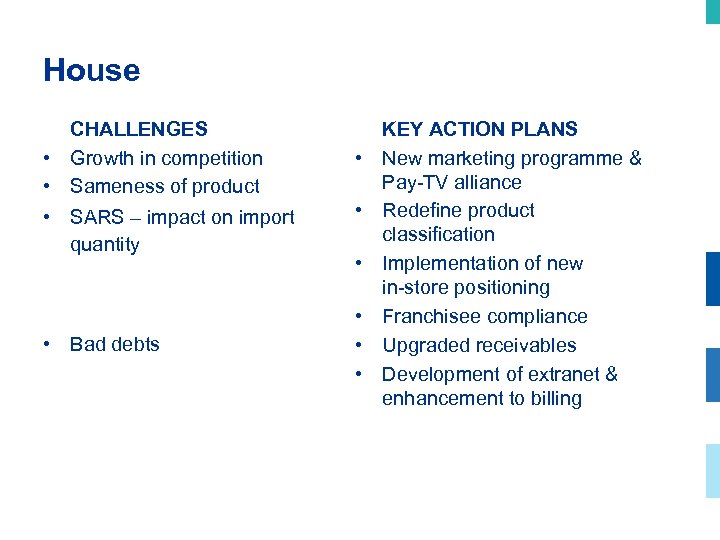

House CHALLENGES • Growth in competition • Sameness of product • SARS – impact on import quantity • Bad debts • • • KEY ACTION PLANS New marketing programme & Pay-TV alliance Redefine product classification Implementation of new in-store positioning Franchisee compliance Upgraded receivables Development of extranet & enhancement to billing

House CHALLENGES • Growth in competition • Sameness of product • SARS – impact on import quantity • Bad debts • • • KEY ACTION PLANS New marketing programme & Pay-TV alliance Redefine product classification Implementation of new in-store positioning Franchisee compliance Upgraded receivables Development of extranet & enhancement to billing

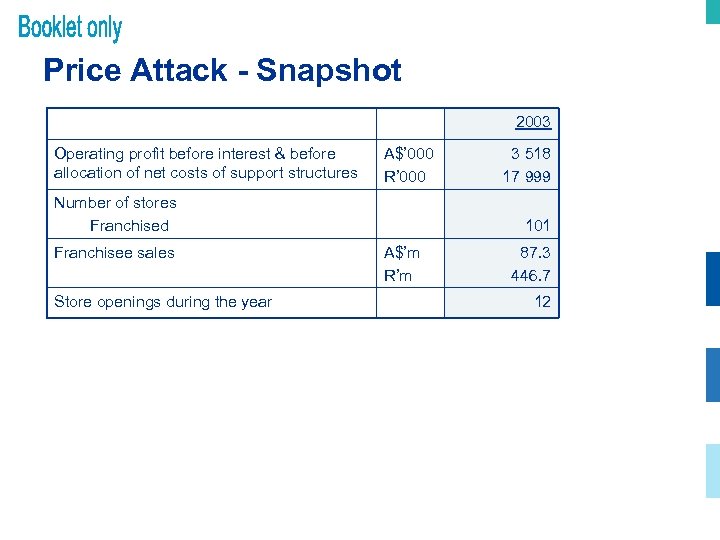

Price Attack - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised Franchisee sales Store openings during the year 3 518 17 999 101 A$’m R’m 87. 3 446. 7 12

Price Attack - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised Franchisee sales Store openings during the year 3 518 17 999 101 A$’m R’m 87. 3 446. 7 12

Price Attack • • • HIGHLIGHTS Successful integration into business Resolved all franchise agreements Appointed Carmelo Francese as the new brand leader Resolved Master Franchisee in Western Australia Adopted a Marketing focus Overcome supplier & franchisee scepticism

Price Attack • • • HIGHLIGHTS Successful integration into business Resolved all franchise agreements Appointed Carmelo Francese as the new brand leader Resolved Master Franchisee in Western Australia Adopted a Marketing focus Overcome supplier & franchisee scepticism

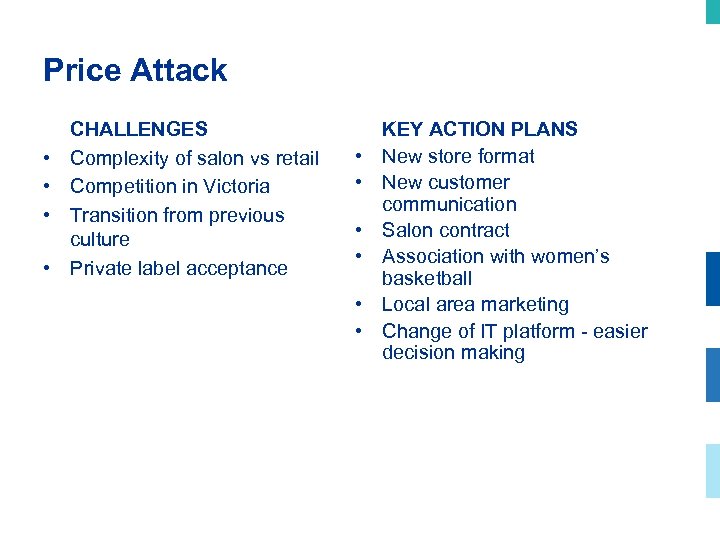

Price Attack • • CHALLENGES Complexity of salon vs retail Competition in Victoria Transition from previous culture Private label acceptance • • • KEY ACTION PLANS New store format New customer communication Salon contract Association with women’s basketball Local area marketing Change of IT platform - easier decision making

Price Attack • • CHALLENGES Complexity of salon vs retail Competition in Victoria Transition from previous culture Private label acceptance • • • KEY ACTION PLANS New store format New customer communication Salon contract Association with women’s basketball Local area marketing Change of IT platform - easier decision making

Shared Services • • • HIGHLIGHTS Store development & marketing services shift to nil cost Development of franchise skills JDA first phase completed Developed an Integrated IT pharmacy solution Realigned costs from the centre to brands • • CHALLENGES Moving from cost centre to profit generation Growth in staff numbers to deal with franchise capability Getting expense allocations right with diversity of business models Office accommodation

Shared Services • • • HIGHLIGHTS Store development & marketing services shift to nil cost Development of franchise skills JDA first phase completed Developed an Integrated IT pharmacy solution Realigned costs from the centre to brands • • CHALLENGES Moving from cost centre to profit generation Growth in staff numbers to deal with franchise capability Getting expense allocations right with diversity of business models Office accommodation

New Clicks Australia – The year ahead • Restructured – governance in place • No additional funding required – store sale methodology • Priceline positioning • Store growth in pharmacy • House marketing • Price Attack – Victoria solution • Systems development – Franchise • Enhance capability – reduce costs

New Clicks Australia – The year ahead • Restructured – governance in place • No additional funding required – store sale methodology • Priceline positioning • Store growth in pharmacy • House marketing • Price Attack – Victoria solution • Systems development – Franchise • Enhance capability – reduce costs

• New Clicks South Africa • Trevor Honneysett

• New Clicks South Africa • Trevor Honneysett

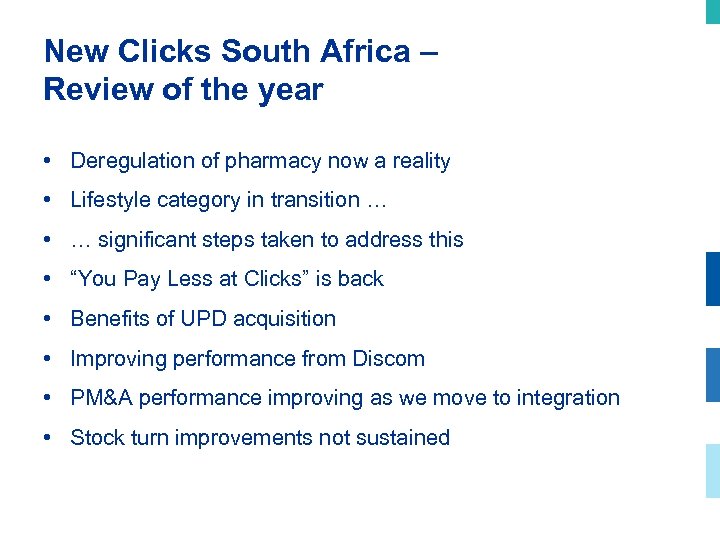

New Clicks South Africa – Review of the year • Deregulation of pharmacy now a reality • Lifestyle category in transition … • … significant steps taken to address this • “You Pay Less at Clicks” is back • Benefits of UPD acquisition • Improving performance from Discom • PM&A performance improving as we move to integration • Stock turn improvements not sustained

New Clicks South Africa – Review of the year • Deregulation of pharmacy now a reality • Lifestyle category in transition … • … significant steps taken to address this • “You Pay Less at Clicks” is back • Benefits of UPD acquisition • Improving performance from Discom • PM&A performance improving as we move to integration • Stock turn improvements not sustained

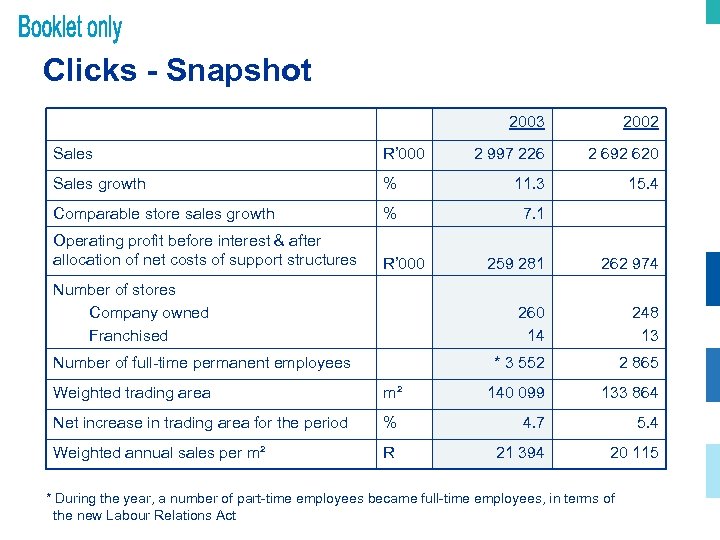

Clicks - Snapshot 2003 2002 2 997 226 2 692 620 15. 4 Sales R’ 000 Sales growth % 11. 3 Comparable store sales growth % 7. 1 Operating profit before interest & after allocation of net costs of support structures R’ 000 248 13 * 3 552 Number of full-time permanent employees 262 974 260 14 Number of stores Company owned Franchised 259 281 2 865 Weighted trading area m² 140 099 133 864 Net increase in trading area for the period % 4. 7 5. 4 Weighted annual sales per m² R 21 394 20 115 * During the year, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act

Clicks - Snapshot 2003 2002 2 997 226 2 692 620 15. 4 Sales R’ 000 Sales growth % 11. 3 Comparable store sales growth % 7. 1 Operating profit before interest & after allocation of net costs of support structures R’ 000 248 13 * 3 552 Number of full-time permanent employees 262 974 260 14 Number of stores Company owned Franchised 259 281 2 865 Weighted trading area m² 140 099 133 864 Net increase in trading area for the period % 4. 7 5. 4 Weighted annual sales per m² R 21 394 20 115 * During the year, a number of part-time employees became full-time employees, in terms of the new Labour Relations Act

Clicks • • HIGHLIGHTS Pharmacy now a reality PM&A integration started PM&A showing ongoing improvement Brand decision for pharmacy taken – Clicks Focused leadership team Integrated merchandising team FMCG & Beauty continue to do well

Clicks • • HIGHLIGHTS Pharmacy now a reality PM&A integration started PM&A showing ongoing improvement Brand decision for pharmacy taken – Clicks Focused leadership team Integrated merchandising team FMCG & Beauty continue to do well

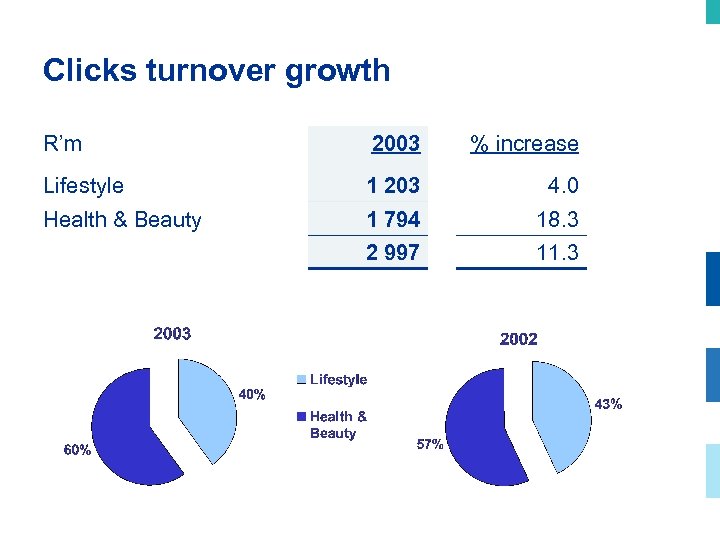

Clicks turnover growth R’m 2003 % increase Lifestyle 1 203 4. 0 Health & Beauty 1 794 18. 3 2 997 11. 3

Clicks turnover growth R’m 2003 % increase Lifestyle 1 203 4. 0 Health & Beauty 1 794 18. 3 2 997 11. 3

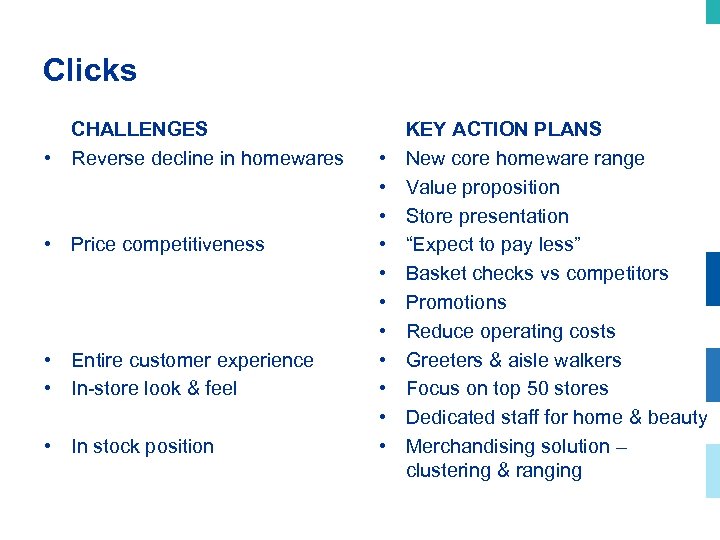

Clicks CHALLENGES • Reverse decline in homewares • Price competitiveness • Entire customer experience • In-store look & feel • In stock position • • • KEY ACTION PLANS New core homeware range Value proposition Store presentation “Expect to pay less” Basket checks vs competitors Promotions Reduce operating costs Greeters & aisle walkers Focus on top 50 stores Dedicated staff for home & beauty Merchandising solution – clustering & ranging

Clicks CHALLENGES • Reverse decline in homewares • Price competitiveness • Entire customer experience • In-store look & feel • In stock position • • • KEY ACTION PLANS New core homeware range Value proposition Store presentation “Expect to pay less” Basket checks vs competitors Promotions Reduce operating costs Greeters & aisle walkers Focus on top 50 stores Dedicated staff for home & beauty Merchandising solution – clustering & ranging

Pharmacy HIGHLIGHTS • Multifunctional, implementation team set up • Key legislation in place • Product & pricing benefits through UPD • Better buying discipline • Centralised pricing • Reduced staff costs • • Improved shrinkage Professional training Disease management Promotions

Pharmacy HIGHLIGHTS • Multifunctional, implementation team set up • Key legislation in place • Product & pricing benefits through UPD • Better buying discipline • Centralised pricing • Reduced staff costs • • Improved shrinkage Professional training Disease management Promotions

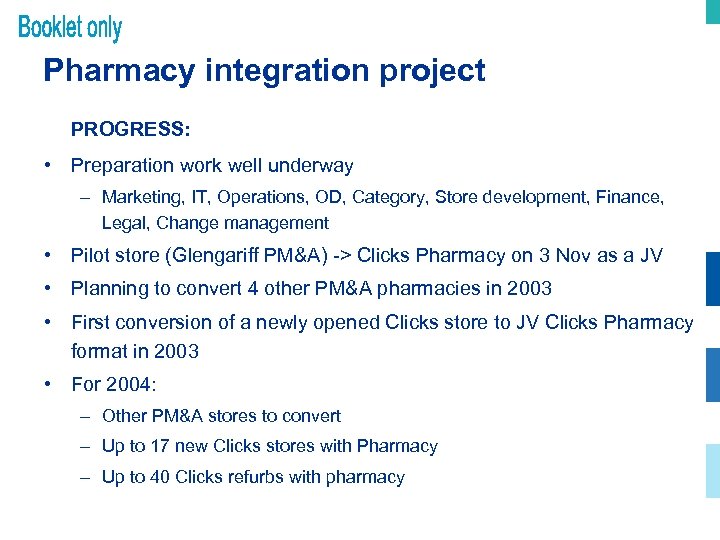

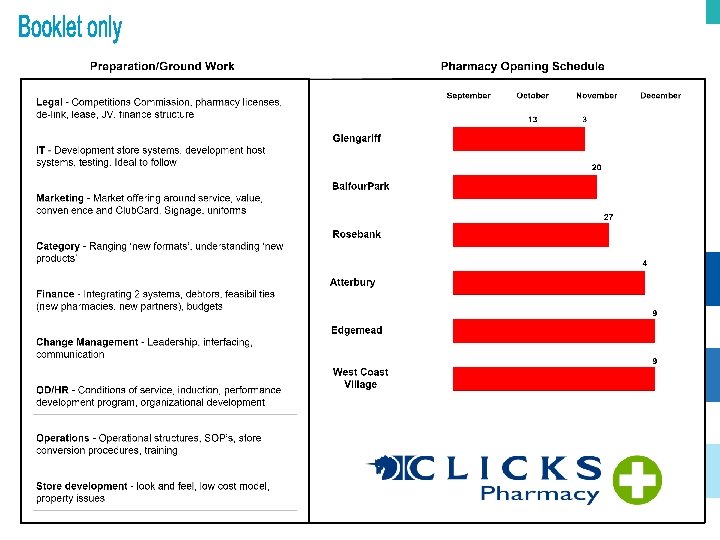

Pharmacy integration project PROGRESS: • Preparation work well underway – Marketing, IT, Operations, OD, Category, Store development, Finance, Legal, Change management • Pilot store (Glengariff PM&A) -> Clicks Pharmacy on 3 Nov as a JV • Planning to convert 4 other PM&A pharmacies in 2003 • First conversion of a newly opened Clicks store to JV Clicks Pharmacy format in 2003 • For 2004: – Other PM&A stores to convert – Up to 17 new Clicks stores with Pharmacy – Up to 40 Clicks refurbs with pharmacy

Pharmacy integration project PROGRESS: • Preparation work well underway – Marketing, IT, Operations, OD, Category, Store development, Finance, Legal, Change management • Pilot store (Glengariff PM&A) -> Clicks Pharmacy on 3 Nov as a JV • Planning to convert 4 other PM&A pharmacies in 2003 • First conversion of a newly opened Clicks store to JV Clicks Pharmacy format in 2003 • For 2004: – Other PM&A stores to convert – Up to 17 new Clicks stores with Pharmacy – Up to 40 Clicks refurbs with pharmacy

Pharmacy CHALLENGES • Sales & profit growth • Stock turn too slow • Integration of pharmacy systems • Relationship with funders • Relationship with doctors • • KEY ACTION PLANS Integration into Clicks Category management/buying In store promotions Generic substitution Phase-out of Link. Max Focus on ICU stores Integration of IT platform • Medical aids • Build relationships with doctors • Sustain relationship with government

Pharmacy CHALLENGES • Sales & profit growth • Stock turn too slow • Integration of pharmacy systems • Relationship with funders • Relationship with doctors • • KEY ACTION PLANS Integration into Clicks Category management/buying In store promotions Generic substitution Phase-out of Link. Max Focus on ICU stores Integration of IT platform • Medical aids • Build relationships with doctors • Sustain relationship with government

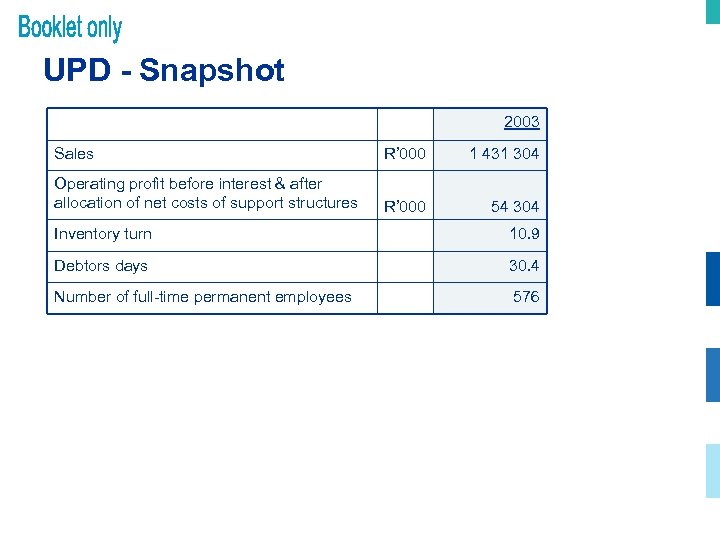

UPD - Snapshot 2003 Sales R’ 000 1 431 304 Operating profit before interest & after allocation of net costs of support structures R’ 000 54 304 Inventory turn 10. 9 Debtors days 30. 4 Number of full-time permanent employees 576

UPD - Snapshot 2003 Sales R’ 000 1 431 304 Operating profit before interest & after allocation of net costs of support structures R’ 000 54 304 Inventory turn 10. 9 Debtors days 30. 4 Number of full-time permanent employees 576

UPD HIGHLIGHTS • Acquisition smoothly integrated • Growth in turnover from PM&A & independent pharmacies • Retained most independent pharmacy customers • Clicks pricing on top FMCG lines available to wider customer base • Standardised terms on FMCG suppliers • Solid profit performance enhanced by sound working capital & cost management

UPD HIGHLIGHTS • Acquisition smoothly integrated • Growth in turnover from PM&A & independent pharmacies • Retained most independent pharmacy customers • Clicks pricing on top FMCG lines available to wider customer base • Standardised terms on FMCG suppliers • Solid profit performance enhanced by sound working capital & cost management

UPD CHALLENGES • Two franchise models in the group • Increase turnover from Link • Continue to add value to third party customers KEY ACTION PLANS • Simplify Multicare offering • Develop Link offering as premium banner • Develop programmes to enhance Link pharmacy loyalty to UPD • Concentrate on bringing Clicks pricing to wider customer base

UPD CHALLENGES • Two franchise models in the group • Increase turnover from Link • Continue to add value to third party customers KEY ACTION PLANS • Simplify Multicare offering • Develop Link offering as premium banner • Develop programmes to enhance Link pharmacy loyalty to UPD • Concentrate on bringing Clicks pricing to wider customer base

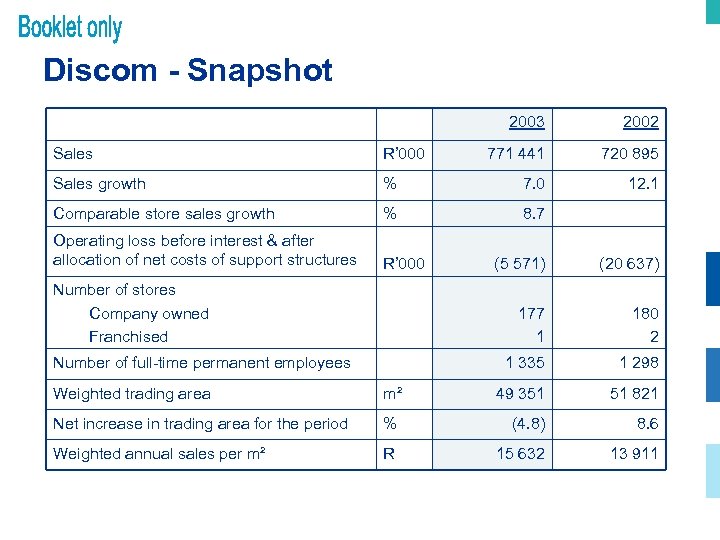

Discom - Snapshot 2003 2002 771 441 720 895 12. 1 Sales R’ 000 Sales growth % 7. 0 Comparable store sales growth % 8. 7 Operating loss before interest & after allocation of net costs of support structures R’ 000 180 2 1 335 Number of full-time permanent employees (20 637) 177 1 Number of stores Company owned Franchised (5 571) 1 298 Weighted trading area m² 49 351 51 821 Net increase in trading area for the period % (4. 8) 8. 6 Weighted annual sales per m² R 15 632 13 911

Discom - Snapshot 2003 2002 771 441 720 895 12. 1 Sales R’ 000 Sales growth % 7. 0 Comparable store sales growth % 8. 7 Operating loss before interest & after allocation of net costs of support structures R’ 000 180 2 1 335 Number of full-time permanent employees (20 637) 177 1 Number of stores Company owned Franchised (5 571) 1 298 Weighted trading area m² 49 351 51 821 Net increase in trading area for the period % (4. 8) 8. 6 Weighted annual sales per m² R 15 632 13 911

Discom HIGHLIGHTS • Ongoing differentiation from Clicks • Three hair salons opened • Strong growth in ‘dry hair’ market • Introduction of private label • Bolstered leadership team • Dedicated category leadership

Discom HIGHLIGHTS • Ongoing differentiation from Clicks • Three hair salons opened • Strong growth in ‘dry hair’ market • Introduction of private label • Bolstered leadership team • Dedicated category leadership

Discom CHALLENGES KEY ACTION PLANS • Decline in homewares business • Improvement in lifestyle – currently being evidenced • Return to profitability • Entrench dominant position in African beauty & hair care • Improve margin through a stronger lifestyle & import programme • Procure new store locations • Implement POSware platform & merchandise planning

Discom CHALLENGES KEY ACTION PLANS • Decline in homewares business • Improvement in lifestyle – currently being evidenced • Return to profitability • Entrench dominant position in African beauty & hair care • Improve margin through a stronger lifestyle & import programme • Procure new store locations • Implement POSware platform & merchandise planning

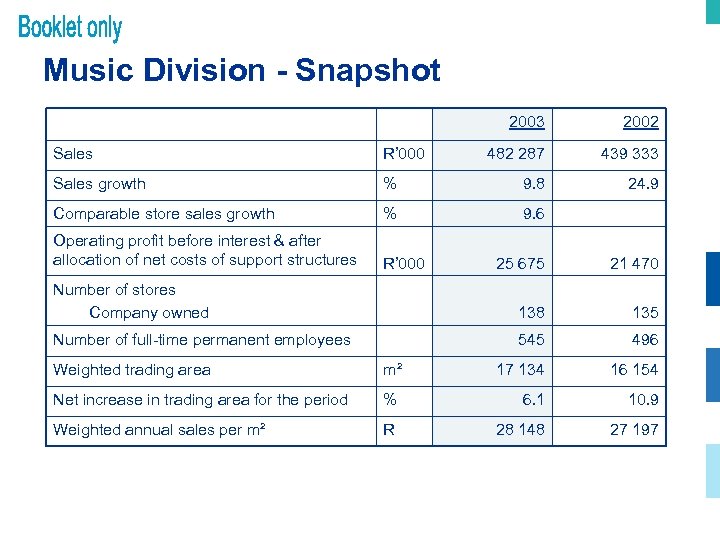

Music Division - Snapshot 2003 2002 482 287 439 333 24. 9 Sales R’ 000 Sales growth % 9. 8 Comparable store sales growth % 9. 6 Operating profit before interest & after allocation of net costs of support structures R’ 000 25 675 21 470 Number of stores Company owned 138 135 Number of full-time permanent employees 545 496 Weighted trading area m² 17 134 16 154 Net increase in trading area for the period % 6. 1 10. 9 Weighted annual sales per m² R 28 148 27 197

Music Division - Snapshot 2003 2002 482 287 439 333 24. 9 Sales R’ 000 Sales growth % 9. 8 Comparable store sales growth % 9. 6 Operating profit before interest & after allocation of net costs of support structures R’ 000 25 675 21 470 Number of stores Company owned 138 135 Number of full-time permanent employees 545 496 Weighted trading area m² 17 134 16 154 Net increase in trading area for the period % 6. 1 10. 9 Weighted annual sales per m² R 28 148 27 197

Music Division HIGHLIGHTS • Market share growth despite slowdown in national music sales • Strong growth in DVD sales • Popularity of local artists • Major growth opportunity in gaming & DVD

Music Division HIGHLIGHTS • Market share growth despite slowdown in national music sales • Strong growth in DVD sales • Popularity of local artists • Major growth opportunity in gaming & DVD

Music Division CHALLENGES • Maturity of CD format • Global decline in CD sales KEY ACTION PLANS • Repositioning from music to broader entertainment products • Piracy & downloads – 70 stores by December • Shrinkage – Branded lifestyle accessory range • Eliminating redundant stock • POSware retail store system implemented by March 2004 • Major marketing drive for Christmas • Store plans: 7 new stores, 7 stores relocated / revamped

Music Division CHALLENGES • Maturity of CD format • Global decline in CD sales KEY ACTION PLANS • Repositioning from music to broader entertainment products • Piracy & downloads – 70 stores by December • Shrinkage – Branded lifestyle accessory range • Eliminating redundant stock • POSware retail store system implemented by March 2004 • Major marketing drive for Christmas • Store plans: 7 new stores, 7 stores relocated / revamped

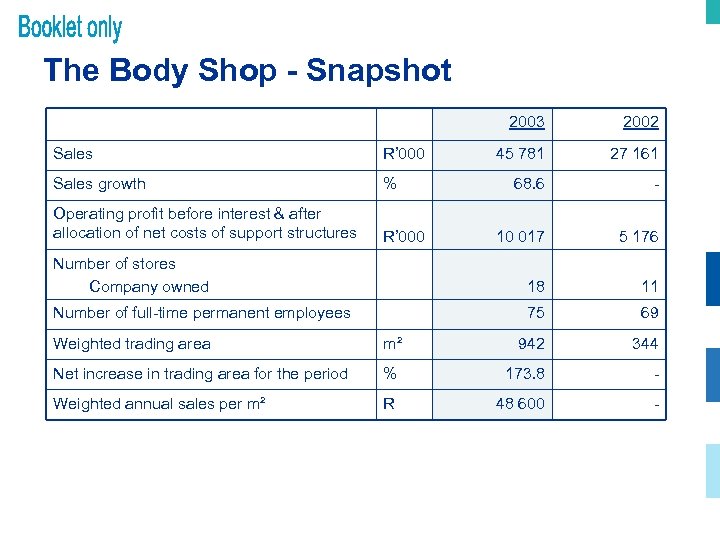

The Body Shop - Snapshot 2003 2002 45 781 27 161 68. 6 - 10 017 5 176 Number of stores Company owned 18 11 Number of full-time permanent employees 75 69 Sales R’ 000 Sales growth % Operating profit before interest & after allocation of net costs of support structures R’ 000 Weighted trading area m² 942 344 Net increase in trading area for the period % 173. 8 - Weighted annual sales per m² R 48 600 -

The Body Shop - Snapshot 2003 2002 45 781 27 161 68. 6 - 10 017 5 176 Number of stores Company owned 18 11 Number of full-time permanent employees 75 69 Sales R’ 000 Sales growth % Operating profit before interest & after allocation of net costs of support structures R’ 000 Weighted trading area m² 942 344 Net increase in trading area for the period % 173. 8 - Weighted annual sales per m² R 48 600 -

The Body Shop HIGHLIGHTS • Strong sales growth • Increased number of stores nationally to 18 • Stock turn improves to 5. 8 • Piloted first Body Shop in a Clicks store - Tableview

The Body Shop HIGHLIGHTS • Strong sales growth • Increased number of stores nationally to 18 • Stock turn improves to 5. 8 • Piloted first Body Shop in a Clicks store - Tableview

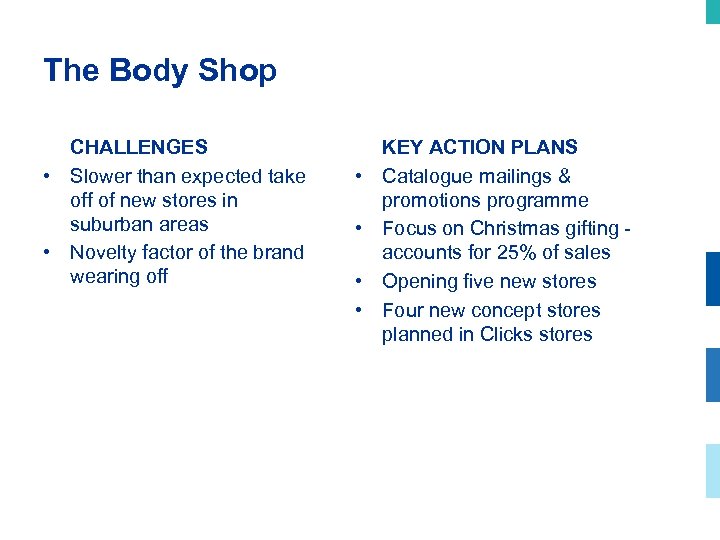

The Body Shop CHALLENGES • Slower than expected take off of new stores in suburban areas • Novelty factor of the brand wearing off • • KEY ACTION PLANS Catalogue mailings & promotions programme Focus on Christmas gifting accounts for 25% of sales Opening five new stores Four new concept stores planned in Clicks stores

The Body Shop CHALLENGES • Slower than expected take off of new stores in suburban areas • Novelty factor of the brand wearing off • • KEY ACTION PLANS Catalogue mailings & promotions programme Focus on Christmas gifting accounts for 25% of sales Opening five new stores Four new concept stores planned in Clicks stores

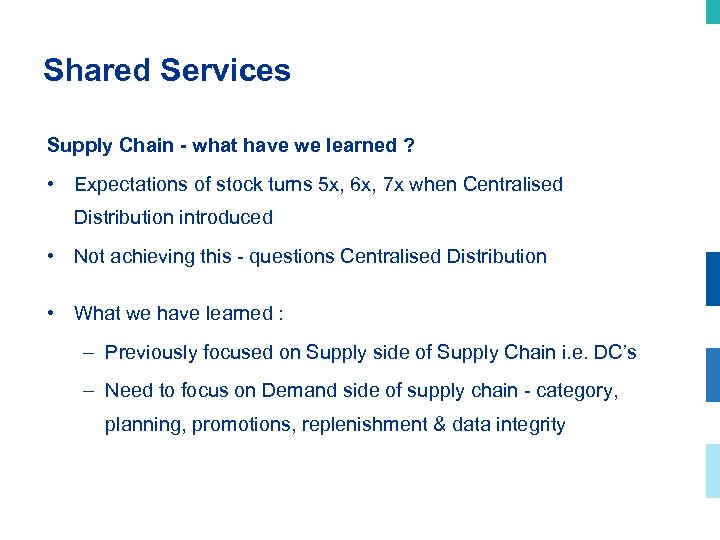

Shared Services Supply Chain - what have we learned ? • Expectations of stock turns 5 x, 6 x, 7 x when Centralised Distribution introduced • Not achieving this - questions Centralised Distribution • What we have learned : – Previously focused on Supply side of Supply Chain i. e. DC’s – Need to focus on Demand side of supply chain - category, planning, promotions, replenishment & data integrity

Shared Services Supply Chain - what have we learned ? • Expectations of stock turns 5 x, 6 x, 7 x when Centralised Distribution introduced • Not achieving this - questions Centralised Distribution • What we have learned : – Previously focused on Supply side of Supply Chain i. e. DC’s – Need to focus on Demand side of supply chain - category, planning, promotions, replenishment & data integrity

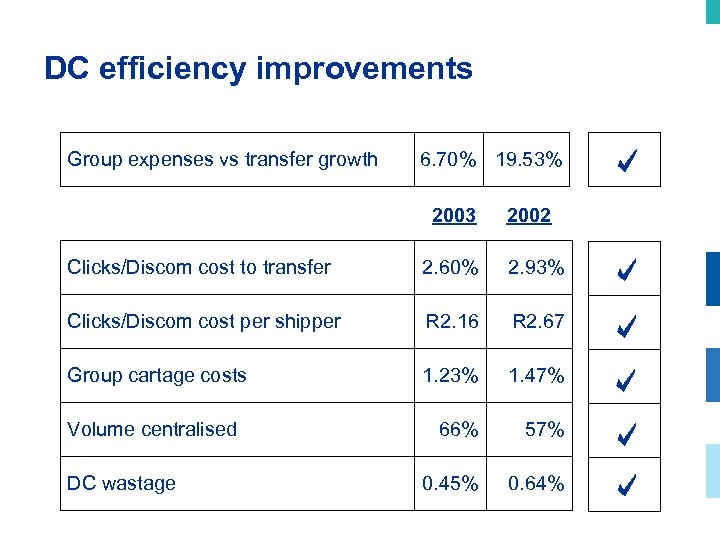

DC efficiency improvements Group expenses vs transfer growth 6. 70% 19. 53% 2003 2002 Clicks/Discom cost to transfer 2. 60% 2. 93% Clicks/Discom cost per shipper R 2. 16 R 2. 67 Group cartage costs 1. 23% 1. 47% 66% 57% 0. 45% 0. 64% Volume centralised DC wastage

DC efficiency improvements Group expenses vs transfer growth 6. 70% 19. 53% 2003 2002 Clicks/Discom cost to transfer 2. 60% 2. 93% Clicks/Discom cost per shipper R 2. 16 R 2. 67 Group cartage costs 1. 23% 1. 47% 66% 57% 0. 45% 0. 64% Volume centralised DC wastage

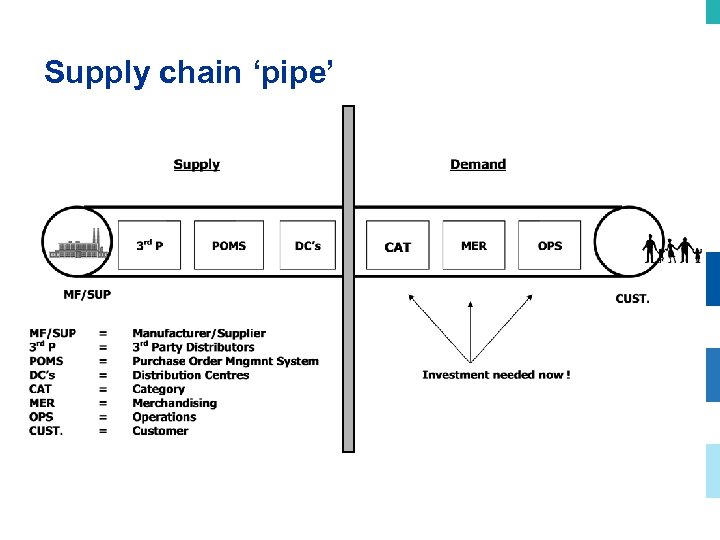

Supply chain ‘pipe’

Supply chain ‘pipe’

Supply chain – ‘demand’ side • Address physical store layout, merchandise promotion, ranging • Implemented merchandise planning from JDA for lifestyle category • Benefits already evident

Supply chain – ‘demand’ side • Address physical store layout, merchandise promotion, ranging • Implemented merchandise planning from JDA for lifestyle category • Benefits already evident

New Clicks South Africa – The year ahead • Roll-out & bedding down of pharmacies • Continued focus on Lifestyle category • Implementation of financial systems to improve speed & quality of information • Focus on stock distribution & management systems • Continued focus on expense control – alignment of size of shared services platform to the business

New Clicks South Africa – The year ahead • Roll-out & bedding down of pharmacies • Continued focus on Lifestyle category • Implementation of financial systems to improve speed & quality of information • Focus on stock distribution & management systems • Continued focus on expense control – alignment of size of shared services platform to the business

Summary of year ahead • SA & Australia managed autonomously • Pharmacy proving itself in Australia – expanded opportunity for growth • Australia well positioned in a competitive market • Pharmacy implementation in SA • Emergence of Clicks as a pre-eminent healthcare brand • UPD integral to healthcare plans • Ongoing turnaround in Discom • Continued focus on improvement of stock turns

Summary of year ahead • SA & Australia managed autonomously • Pharmacy proving itself in Australia – expanded opportunity for growth • Australia well positioned in a competitive market • Pharmacy implementation in SA • Emergence of Clicks as a pre-eminent healthcare brand • UPD integral to healthcare plans • Ongoing turnaround in Discom • Continued focus on improvement of stock turns

• Questions ?

• Questions ?

• Thank You

• Thank You