46552971d8d88c7330ebb46b5aa4c38b.ppt

- Количество слайдов: 146

GROUP 5

GROUP 5

EPCG SCHEME • The scheme allows import of capital goods for pre production, production and post production • It is allowed at 5% Customs duty subject to an export obligation equivalent to 8 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years reckoned from the date of issuance of license. • Capital goods would be allowed at 0% duty for exports of agricultural products and their value added variants.

EPCG SCHEME • The scheme allows import of capital goods for pre production, production and post production • It is allowed at 5% Customs duty subject to an export obligation equivalent to 8 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years reckoned from the date of issuance of license. • Capital goods would be allowed at 0% duty for exports of agricultural products and their value added variants.

Capital Goods of EPCG Scheme • The capital goods shall include spares, tools, jigs, fixtures, dies and moulds. EPCG license may also be issued for import of components of such capital goods required for assembly or manufacturer of capital goods by the license holder. • Second hand capital goods without any restriction on age may also be imported under the EPCG scheme. • Spares, tools, refectories, catalyst and consumable for the existing and new plant and machinery may also be imported under the EPCG scheme • However, import of motor cars, sports utility vehicles/ all purpose vehicles shall be allowed only to hotels, travel agents, tour operators or tour transport operators whose total foreign exchange earning in current and preceding three licensing years is Rs 1. 5 crores.

Capital Goods of EPCG Scheme • The capital goods shall include spares, tools, jigs, fixtures, dies and moulds. EPCG license may also be issued for import of components of such capital goods required for assembly or manufacturer of capital goods by the license holder. • Second hand capital goods without any restriction on age may also be imported under the EPCG scheme. • Spares, tools, refectories, catalyst and consumable for the existing and new plant and machinery may also be imported under the EPCG scheme • However, import of motor cars, sports utility vehicles/ all purpose vehicles shall be allowed only to hotels, travel agents, tour operators or tour transport operators whose total foreign exchange earning in current and preceding three licensing years is Rs 1. 5 crores.

How to obtain an Import license under EPCG Scheme? • Application in the form given in Appendix 10 A of the Hand Book • Licenses are issued, under this scheme by the director general of foreign trade or his regional officers depending upon the value of the license subject to execution of legal undertaking and bank guarantee • The import licenses issued under this scheme shall be deemed to be valid for the goods already shipped/ arrived provided, the customs duty has not been paid for the goods have not been cleared from the customs

How to obtain an Import license under EPCG Scheme? • Application in the form given in Appendix 10 A of the Hand Book • Licenses are issued, under this scheme by the director general of foreign trade or his regional officers depending upon the value of the license subject to execution of legal undertaking and bank guarantee • The import licenses issued under this scheme shall be deemed to be valid for the goods already shipped/ arrived provided, the customs duty has not been paid for the goods have not been cleared from the customs

EPCG for PROJECTS • An EPCG license can be issued for import of capital goods for supply to projects notified by the Central Board of Excise and Customs under the scheme of project imports • The basic customs duty on imports is 10% • The export obligation for such EPCG licenses would be eight times the duty saved • The duty saved would be the difference between the effective duty under the aforesaid Customs Notification and the concessional duty under the EPCG Scheme

EPCG for PROJECTS • An EPCG license can be issued for import of capital goods for supply to projects notified by the Central Board of Excise and Customs under the scheme of project imports • The basic customs duty on imports is 10% • The export obligation for such EPCG licenses would be eight times the duty saved • The duty saved would be the difference between the effective duty under the aforesaid Customs Notification and the concessional duty under the EPCG Scheme

EPCG for Retail • In case of Retail having 1000 sq meters, the retailer shall fulfill export obligation to 8 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years from date of issue of license

EPCG for Retail • In case of Retail having 1000 sq meters, the retailer shall fulfill export obligation to 8 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years from date of issue of license

EPCG for SSI units • In case of SSI , EPCG allows of capital goods for production at 5 % custom duty subject to an export obligation equivalent to 6 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years reckoned from date of issue of license.

EPCG for SSI units • In case of SSI , EPCG allows of capital goods for production at 5 % custom duty subject to an export obligation equivalent to 6 times of duty saved on capital goods imported under EPCG scheme to be fulfilled over a period of 8 years reckoned from date of issue of license.

EPCG for AGRO • In case of agro, EPCG allows of capital goods for production at 5 % custom duty subject to an export obligation equivalent to 6 times of duty saved on capital goods imported • In the case of EPCG, licenses issued to agro units in the agri export zones, a period of 12 years reckoned from the date of issue of the license would be permitted for the fulfillment of export obligation • The agro units in the agri export zones would also have the facility of moving the capital good (s) imported under the EPCG within the agri export zone

EPCG for AGRO • In case of agro, EPCG allows of capital goods for production at 5 % custom duty subject to an export obligation equivalent to 6 times of duty saved on capital goods imported • In the case of EPCG, licenses issued to agro units in the agri export zones, a period of 12 years reckoned from the date of issue of the license would be permitted for the fulfillment of export obligation • The agro units in the agri export zones would also have the facility of moving the capital good (s) imported under the EPCG within the agri export zone

Technological Upgradation of existing EPCG machinery The conditions governing the Technological Upgradation of the existing capital good are as under: • 5 years from the date of issuance of the license. • The minimum exports made under the old capital good must be 40% of the total export obligation imposed on the first EPCG license • The export obligation would be refixed such that the total export obligation mandated for both the capital goods would be the sum total of 6 times the duty saved on both the capital goods

Technological Upgradation of existing EPCG machinery The conditions governing the Technological Upgradation of the existing capital good are as under: • 5 years from the date of issuance of the license. • The minimum exports made under the old capital good must be 40% of the total export obligation imposed on the first EPCG license • The export obligation would be refixed such that the total export obligation mandated for both the capital goods would be the sum total of 6 times the duty saved on both the capital goods

Conditions and obligations • The export obligation shall be fulfilled by the export of goods capable of being manufactured or produced by the use of the capital goods imported under the scheme • The import of capital goods for creating storage and distribution facilities for products manufactured or services rendered for export by the EPCG license holder would be permitted under the EPCG Scheme • The export obligation under the scheme shall be, over and above, the average level of exports achieved by him in the preceding three licensing years for same and similar products within the overall export obligation period including extended period

Conditions and obligations • The export obligation shall be fulfilled by the export of goods capable of being manufactured or produced by the use of the capital goods imported under the scheme • The import of capital goods for creating storage and distribution facilities for products manufactured or services rendered for export by the EPCG license holder would be permitted under the EPCG Scheme • The export obligation under the scheme shall be, over and above, the average level of exports achieved by him in the preceding three licensing years for same and similar products within the overall export obligation period including extended period

• Export obligation may also be fulfilled by exports of other good(s) manufactured or service(s) provided by the same firm/company or group company/ managed hotel which has the EPCG license • The incremental exports to be fulfilled by the license holder for fulfilling the remaining export obligation can include any combination of exports of the original product/ service and the substitute product (s)/ service (s) • The export obligation under the scheme shall be, in addition to any other export obligation undertaken by the importer, except the export obligation for the same product under Advance License, DFRC, DEPB or Drawback scheme

• Export obligation may also be fulfilled by exports of other good(s) manufactured or service(s) provided by the same firm/company or group company/ managed hotel which has the EPCG license • The incremental exports to be fulfilled by the license holder for fulfilling the remaining export obligation can include any combination of exports of the original product/ service and the substitute product (s)/ service (s) • The export obligation under the scheme shall be, in addition to any other export obligation undertaken by the importer, except the export obligation for the same product under Advance License, DFRC, DEPB or Drawback scheme

• Exports shall be physical exports , in the case of export of computer software, the export obligation shall be determined in accordance with policy but the conditions that exports shall be over and above the average level of exports in the preceding three licensing years shall not apply • Royalty payments received in freely convertible currency and foreign exchange received for R& D services shall also be counted for discharge under the EPCG scheme • Payments received against ‘Counter Sales’ in free foreign exchange through banking channels as per the RBI guidelines shall be counted for fulfillment of export obligation

• Exports shall be physical exports , in the case of export of computer software, the export obligation shall be determined in accordance with policy but the conditions that exports shall be over and above the average level of exports in the preceding three licensing years shall not apply • Royalty payments received in freely convertible currency and foreign exchange received for R& D services shall also be counted for discharge under the EPCG scheme • Payments received against ‘Counter Sales’ in free foreign exchange through banking channels as per the RBI guidelines shall be counted for fulfillment of export obligation

Duty Exemption Scheme/ Duty Remission Schemes Ø Duty Exemption Scheme enables duty free import of inputs required for export production. Ø Duty Remission Scheme enables post export replenishment / remission of duty on inputs used in the export product.

Duty Exemption Scheme/ Duty Remission Schemes Ø Duty Exemption Scheme enables duty free import of inputs required for export production. Ø Duty Remission Scheme enables post export replenishment / remission of duty on inputs used in the export product.

Advance Licence- Duty Exemption Scheme • The scheme commenced around 1982 and was based on the concept of positive balance of trade at the micro level of the company. • The scheme appeared in Appendix 13(C) • The Advance Licence enables the exporters to import material in advance without payment of duty subject to they taking export obligation. • The export is credited and the import is debited like any other accounting process except that the debit and credit does not tally because Credit is always greater than Debit. ( Balance of trade concept)

Advance Licence- Duty Exemption Scheme • The scheme commenced around 1982 and was based on the concept of positive balance of trade at the micro level of the company. • The scheme appeared in Appendix 13(C) • The Advance Licence enables the exporters to import material in advance without payment of duty subject to they taking export obligation. • The export is credited and the import is debited like any other accounting process except that the debit and credit does not tally because Credit is always greater than Debit. ( Balance of trade concept)

• The quantity and type of inputs required to manufacture one unit of export material is listed in the policy and is called Standard Input Output Form (SION). • The inputs are called as ‘Replenish’ materials and the outputs are called as ‘Resultant’ materials. • The advance licence provides a facility to the exporter to first complete his export obligation and import later to replenish the material used in Exports.

• The quantity and type of inputs required to manufacture one unit of export material is listed in the policy and is called Standard Input Output Form (SION). • The inputs are called as ‘Replenish’ materials and the outputs are called as ‘Resultant’ materials. • The advance licence provides a facility to the exporter to first complete his export obligation and import later to replenish the material used in Exports.

The licence holder is expected to achieve positive value addition i. e. Value addition= (FOB Exports – CIF Imports) CIF Imports

The licence holder is expected to achieve positive value addition i. e. Value addition= (FOB Exports – CIF Imports) CIF Imports

Advance Licences are issued to: (i) Manufacturer exporter or Main contractor in case of deemed exports. (ii) Merchant exporter where the merchant exporter agrees to the endorsement of the name(s) of the supporting manufacturer(s) on the relevant DEEC Book and in the case of deemed exports, sub contractor(s) whose name(s) appear in the main contract.

Advance Licences are issued to: (i) Manufacturer exporter or Main contractor in case of deemed exports. (ii) Merchant exporter where the merchant exporter agrees to the endorsement of the name(s) of the supporting manufacturer(s) on the relevant DEEC Book and in the case of deemed exports, sub contractor(s) whose name(s) appear in the main contract.

Standard Input Output Norms (SION) § Standard Input Output Norms are standard norms which define the amount of inputs required to manufacture a unit of output for export purpose. Input output norms are applicable for the products such as electronics, engineering, chemical, food products including fish and marine products, handicraft, plastic and leather products etc. § SION is notified by DGFT in the Handbook (Vol. 2), 2002 -07 and is approved by its Boards of Directors. An application for modification of existing Standard Input. Output norms may be filed by manufacturer exporter and merchant-exporter.

Standard Input Output Norms (SION) § Standard Input Output Norms are standard norms which define the amount of inputs required to manufacture a unit of output for export purpose. Input output norms are applicable for the products such as electronics, engineering, chemical, food products including fish and marine products, handicraft, plastic and leather products etc. § SION is notified by DGFT in the Handbook (Vol. 2), 2002 -07 and is approved by its Boards of Directors. An application for modification of existing Standard Input. Output norms may be filed by manufacturer exporter and merchant-exporter.

SION (cont……) § The Directorate General of Foreign Trade (DGFT) from time to time issue notifications for fixation or addition of SION for different export products. Fixation of Standard Input Output Norms facilitates issues of Advance Licence to the exporters of the items without any need for referring the same to the Headquarter office of DGFT on repeat basis.

SION (cont……) § The Directorate General of Foreign Trade (DGFT) from time to time issue notifications for fixation or addition of SION for different export products. Fixation of Standard Input Output Norms facilitates issues of Advance Licence to the exporters of the items without any need for referring the same to the Headquarter office of DGFT on repeat basis.

Forms of Advance License § Physical Exports § Intermediate Supplies § Deemed Exports

Forms of Advance License § Physical Exports § Intermediate Supplies § Deemed Exports

Advance Licence for Intermediate Supply Ø Advance Licence may be issued for intermediate supply to a manufacturerexporter for the import of inputs required in the manufacture of goods to be supplied to the ultimate exporter/deemed exporter holding another Advance Licence.

Advance Licence for Intermediate Supply Ø Advance Licence may be issued for intermediate supply to a manufacturerexporter for the import of inputs required in the manufacture of goods to be supplied to the ultimate exporter/deemed exporter holding another Advance Licence.

Advance Licence for Deemed Export Ø Advance Licence can be issued for deemed export to the main contractor for import of inputs required in the manufacture of goods to be supplied to the categories mentioned in `paragraph 10. 2(b), (c), (d), (e), (f) and (g) of the Policy. Ø In addition, in respect of supply of goods to specified projects mentioned in paragraph 10. 2 (d), (e), (f) & (g) of the Policy, an Advance Licence for deemed export can also be availed by the sub-contractor of the main contractor to such project. Such licence for deemed export can also be issued for supplies made to UNO or under the Aid Programme of the United Nations or other multilateral agencies and paid for in foreign exchange.

Advance Licence for Deemed Export Ø Advance Licence can be issued for deemed export to the main contractor for import of inputs required in the manufacture of goods to be supplied to the categories mentioned in `paragraph 10. 2(b), (c), (d), (e), (f) and (g) of the Policy. Ø In addition, in respect of supply of goods to specified projects mentioned in paragraph 10. 2 (d), (e), (f) & (g) of the Policy, an Advance Licence for deemed export can also be availed by the sub-contractor of the main contractor to such project. Such licence for deemed export can also be issued for supplies made to UNO or under the Aid Programme of the United Nations or other multilateral agencies and paid for in foreign exchange.

Advance / Advance Intermediate Authorisation q. An Advance Authorisation / Advance Intermediate Authorisation is issued to allow duty free import of inputs, which are physically incorporated in the export product. In addition, fuel, oil, energy, catalysts etc. which are consumed in the course of their use to obtain the export product, may also be allowed under the scheme.

Advance / Advance Intermediate Authorisation q. An Advance Authorisation / Advance Intermediate Authorisation is issued to allow duty free import of inputs, which are physically incorporated in the export product. In addition, fuel, oil, energy, catalysts etc. which are consumed in the course of their use to obtain the export product, may also be allowed under the scheme.

Annual Advance Licence Manufacturer exporter with export performance of Rs. 1 crore in the preceding year and registered with excise authorities, except for products which are not excisable for which no such registration is required, shall be entitled for Annual Advance License. Export House: This license and/or material imported there under shall not be transferable even after completion of export obligation. Such annual advance license shall be issued with positive value addition without stipulation of minimum value addition. The entitlement under this scheme shall be up to 125% of the average FOB value of export in the preceding licensing year. Imports against this is exempted from payment of Additional customs duty, Special Additional Duty, Anti Dumping Duty, Safeguard duty, if any, in addition to Basic customs duty and surcharge thereon.

Annual Advance Licence Manufacturer exporter with export performance of Rs. 1 crore in the preceding year and registered with excise authorities, except for products which are not excisable for which no such registration is required, shall be entitled for Annual Advance License. Export House: This license and/or material imported there under shall not be transferable even after completion of export obligation. Such annual advance license shall be issued with positive value addition without stipulation of minimum value addition. The entitlement under this scheme shall be up to 125% of the average FOB value of export in the preceding licensing year. Imports against this is exempted from payment of Additional customs duty, Special Additional Duty, Anti Dumping Duty, Safeguard duty, if any, in addition to Basic customs duty and surcharge thereon.

Advance Intermediate License q. This license is granted to a manufacturer exporter for the import of inputs required in the manufacture of goods to be supplied to the ultimate exporter holding an Advance License/Special Imprest License.

Advance Intermediate License q. This license is granted to a manufacturer exporter for the import of inputs required in the manufacture of goods to be supplied to the ultimate exporter holding an Advance License/Special Imprest License.

Special Imprest License § This license is granted for the duty free import of inputs required in the manufacture of goods to be supplied to the ultimate exporter holding an Advance License/Special Imprest License. § Such Special Imprest License is granted for the Duty Free import of inputs required in the manufacture of goods to be supplied to the Eo. Us/units in EPZs/STP/EHTP, holders of license under the EPCG scheme, projects financed by multilateral/bilateral agencies/funds as notified by the Dept. of Economic Affairs, Mo. F, Fertilizer Plants if the supply is made under the procedure of International Competitive Bidding, supply of goods to refineries and projects/purposes for which Mo. F permits import of such goods on zero customs duty.

Special Imprest License § This license is granted for the duty free import of inputs required in the manufacture of goods to be supplied to the ultimate exporter holding an Advance License/Special Imprest License. § Such Special Imprest License is granted for the Duty Free import of inputs required in the manufacture of goods to be supplied to the Eo. Us/units in EPZs/STP/EHTP, holders of license under the EPCG scheme, projects financed by multilateral/bilateral agencies/funds as notified by the Dept. of Economic Affairs, Mo. F, Fertilizer Plants if the supply is made under the procedure of International Competitive Bidding, supply of goods to refineries and projects/purposes for which Mo. F permits import of such goods on zero customs duty.

Duty Free Import Authorisation Scheme (DFIA) • The April 06 version of the Foreign Trade Policy introduced a new scheme known as Duty Free Import Authorisation Scheme (DFIA). It came into force from 1 st May, 2006. • It replaced the Duty Free Replenishment Scheme Certificate (DFRC) • DFIA offers more flexibility than DFRC.

Duty Free Import Authorisation Scheme (DFIA) • The April 06 version of the Foreign Trade Policy introduced a new scheme known as Duty Free Import Authorisation Scheme (DFIA). It came into force from 1 st May, 2006. • It replaced the Duty Free Replenishment Scheme Certificate (DFRC) • DFIA offers more flexibility than DFRC.

DFIA (cont…) • A Duty Free Import Authorization is issued to allow duty free import of inputs which are used in the manufacture of the export product (making normal allowance for wastage), as well as fuel, energy, catalyst etc. which are consumed in the course of their use to obtain the export product.

DFIA (cont…) • A Duty Free Import Authorization is issued to allow duty free import of inputs which are used in the manufacture of the export product (making normal allowance for wastage), as well as fuel, energy, catalyst etc. which are consumed in the course of their use to obtain the export product.

DFIA (cont…. . ) • Duty Free Import Authorisation is issued to a merchant-exporter or manufacturer-exporter for the import of inputs used in the manufacture of goods without payment of basic customs duty, and special additional duty. • However, such inputs shall be subject to the payment of additional customs duty equal to the excise duty at the time of import.

DFIA (cont…. . ) • Duty Free Import Authorisation is issued to a merchant-exporter or manufacturer-exporter for the import of inputs used in the manufacture of goods without payment of basic customs duty, and special additional duty. • However, such inputs shall be subject to the payment of additional customs duty equal to the excise duty at the time of import.

• Duty Free Import Authorisation shall be issued only in respect of export products covered under the SIONs as notified by DGFT. • DFIA shall not be issued in respect of SIONs which are subject to "actual user" condition or where the input is allowed with prior import condition or where the norms allow import of acetic anhydride, ephedrine and pseudo ephedrine in the Handbook (Vol-II).

• Duty Free Import Authorisation shall be issued only in respect of export products covered under the SIONs as notified by DGFT. • DFIA shall not be issued in respect of SIONs which are subject to "actual user" condition or where the input is allowed with prior import condition or where the norms allow import of acetic anhydride, ephedrine and pseudo ephedrine in the Handbook (Vol-II).

• Duty Free Import Authorisation shall be issued for import of inputs, as per SION, having same quality, technical characteristics and specifications as those used in the end product and as indicated in the shipping bills. • The validity of such licences shall be 18 months. DFRC and or the material(s) imported against it shall be freely transferable. • The Duty Free Import Authorisation shall be subject to a minimum value addition of 33% • The export products, which are eligible for modified VAT, shall be eligible for CENVAT credit. However, non excisable, non dutiable or non centrally vatable products, shall be eligible for drawback at the time of exports in lieu of additional customs duty to be paid at the time of imports under the scheme.

• Duty Free Import Authorisation shall be issued for import of inputs, as per SION, having same quality, technical characteristics and specifications as those used in the end product and as indicated in the shipping bills. • The validity of such licences shall be 18 months. DFRC and or the material(s) imported against it shall be freely transferable. • The Duty Free Import Authorisation shall be subject to a minimum value addition of 33% • The export products, which are eligible for modified VAT, shall be eligible for CENVAT credit. However, non excisable, non dutiable or non centrally vatable products, shall be eligible for drawback at the time of exports in lieu of additional customs duty to be paid at the time of imports under the scheme.

The exporter shall be entitled for drawback benefits in respect of any of the duty paid materials, whether imported or indigenous, used in the export product as per the drawback rate fixed by Directorate of Drawback (Ministry of Finance). The drawback shall however be restricted to the duty paid materials not covered under SION. Duty Free Import Authorisation Scheme may be issued in respect of exports for which payments are received in non-convertible currency. Such exports shall, however, be subject to value addition as specified in Appendix-39 of Handbook (Vol. 1)

The exporter shall be entitled for drawback benefits in respect of any of the duty paid materials, whether imported or indigenous, used in the export product as per the drawback rate fixed by Directorate of Drawback (Ministry of Finance). The drawback shall however be restricted to the duty paid materials not covered under SION. Duty Free Import Authorisation Scheme may be issued in respect of exports for which payments are received in non-convertible currency. Such exports shall, however, be subject to value addition as specified in Appendix-39 of Handbook (Vol. 1)

Criteria for obtaining DFIA v. The Authorisation shall be issued on the basis of inputs and export items given under Standard Input and Output Norms (SION). The import entitlement shall be limited to the quantity mentioned in SION. v. Such Authorisation can be issued either to a manufacturer exporter or merchant exporter tied to supporting manufacturer(s) v. A minimum 20% value addition shall be required for issuance of such Authorisation

Criteria for obtaining DFIA v. The Authorisation shall be issued on the basis of inputs and export items given under Standard Input and Output Norms (SION). The import entitlement shall be limited to the quantity mentioned in SION. v. Such Authorisation can be issued either to a manufacturer exporter or merchant exporter tied to supporting manufacturer(s) v. A minimum 20% value addition shall be required for issuance of such Authorisation

Procedure for DFIA v. Once export obligation has been fulfilled, request for transferability of the Authorisation or the inputs imported against it may be made before the Regional Authority. v. Once, transferability is endorsed, the Authorisation holder will be at liberty to transfer the duty free inputs, other than fuel and any other item (s) notified by DGFT for this purpose.

Procedure for DFIA v. Once export obligation has been fulfilled, request for transferability of the Authorisation or the inputs imported against it may be made before the Regional Authority. v. Once, transferability is endorsed, the Authorisation holder will be at liberty to transfer the duty free inputs, other than fuel and any other item (s) notified by DGFT for this purpose.

DFIA Application An application in ‘Aayaat Niryaat Form’ with the import entitlement as per SION, along with documents prescribed in the application form, shall be submitted to the Regional Authority concerned. Applications, where Acetic Anhydride, Ephedrine and Pseudo-ephedrine is required as an input for import and prescribed in SION, shall be filed with the Regional Authorities concerned. Duty free import of spices for export under DFIA scheme shall be permitted only for value addition purposes like crushing/ grounding or sterilization or for manufacture of oils and oleoresins and not for simple cleaning, grading, re-packing etc.

DFIA Application An application in ‘Aayaat Niryaat Form’ with the import entitlement as per SION, along with documents prescribed in the application form, shall be submitted to the Regional Authority concerned. Applications, where Acetic Anhydride, Ephedrine and Pseudo-ephedrine is required as an input for import and prescribed in SION, shall be filed with the Regional Authorities concerned. Duty free import of spices for export under DFIA scheme shall be permitted only for value addition purposes like crushing/ grounding or sterilization or for manufacture of oils and oleoresins and not for simple cleaning, grading, re-packing etc.

Duty Entitlement Passbook Scheme (DEPB) • The objective of Duty Entitlement Passbook Scheme is to neutralize the incidence of Customs duty on the import content of the export product. • The neutralization shall be provided by way of grant of duty credit against the export product.

Duty Entitlement Passbook Scheme (DEPB) • The objective of Duty Entitlement Passbook Scheme is to neutralize the incidence of Customs duty on the import content of the export product. • The neutralization shall be provided by way of grant of duty credit against the export product.

DEPB Scheme In other words, Duty Entitlement Pass Book Scheme is an export incentive scheme. This scheme was notified on 1/4/1997, the DEPB Scheme consisted of (a) Post-export DEPB and (b) Preexport DEPB. The pre-export DEPB scheme was abolished w. e. f. 1/4/2000. Under the post-export DEPB, which is issued after exports, the exporter is given a Duty entitlement Pass Book Scheme at a pre-determined credit on the FOB value. The DEPB rates allows import of any items except the items which are otherwise restricted for imports.

DEPB Scheme In other words, Duty Entitlement Pass Book Scheme is an export incentive scheme. This scheme was notified on 1/4/1997, the DEPB Scheme consisted of (a) Post-export DEPB and (b) Preexport DEPB. The pre-export DEPB scheme was abolished w. e. f. 1/4/2000. Under the post-export DEPB, which is issued after exports, the exporter is given a Duty entitlement Pass Book Scheme at a pre-determined credit on the FOB value. The DEPB rates allows import of any items except the items which are otherwise restricted for imports.

v. The DEPB Rates are applied on the basis of FOB value or value cap whichever is lower. v. The DEPB rate and the value cap shall be applicable as existing on the date of exports as defined in paragraph 15. 15 of Handbook (Vol. 1).

v. The DEPB Rates are applied on the basis of FOB value or value cap whichever is lower. v. The DEPB rate and the value cap shall be applicable as existing on the date of exports as defined in paragraph 15. 15 of Handbook (Vol. 1).

Fixation of DEPB rates • Aayaat Niryaat Form prescribes the form regarding fixation of DEPB rates. All applications for fixation of DEPB rates shall be routed through the concerned Export Promotion Council which shall verify the FOB value of exports as well as the international price of inputs covered under SION. • No exports shall be allowed under DEPB scheme unless the DEPB rate of the concerned export product is notified. • The DEPB Rates are applied on the basis of FOB value or value cap whichever is lower. For example, if the FOB value is Rs. 700/- per piece, and the value cap is Rs. 500/- per piece, the DEPB rate shall be applied on Rs. 500/-.

Fixation of DEPB rates • Aayaat Niryaat Form prescribes the form regarding fixation of DEPB rates. All applications for fixation of DEPB rates shall be routed through the concerned Export Promotion Council which shall verify the FOB value of exports as well as the international price of inputs covered under SION. • No exports shall be allowed under DEPB scheme unless the DEPB rate of the concerned export product is notified. • The DEPB Rates are applied on the basis of FOB value or value cap whichever is lower. For example, if the FOB value is Rs. 700/- per piece, and the value cap is Rs. 500/- per piece, the DEPB rate shall be applied on Rs. 500/-.

• Under the Duty Entitlement Passbook Scheme (DEPB), an exporter may apply for credit, as a specified percentage of FOB value of exports, made in freely convertible currency. • The credit shall be available against such export products and at such rates as may be specified by the Director General of Foreign Trade by way of public notice issued in this behalf, for import of raw materials, intermediates, components, parts, packaging material etc. The holder of Duty Entitlement Passbook Scheme (DEPB) shall have the option to pay additional customs duty, if any, in cash as well.

• Under the Duty Entitlement Passbook Scheme (DEPB), an exporter may apply for credit, as a specified percentage of FOB value of exports, made in freely convertible currency. • The credit shall be available against such export products and at such rates as may be specified by the Director General of Foreign Trade by way of public notice issued in this behalf, for import of raw materials, intermediates, components, parts, packaging material etc. The holder of Duty Entitlement Passbook Scheme (DEPB) shall have the option to pay additional customs duty, if any, in cash as well.

DEPB Scheme • Under the DEPB scheme, an exporter may apply for credit as a specified percentage of FOB value of exports, made in freely convertible currency. The credit shall be available against such products and at such rates as may be specified by DGFT by way of public notice issued in this behalf for import of raw material , intermediates, components, parts packaging materials.

DEPB Scheme • Under the DEPB scheme, an exporter may apply for credit as a specified percentage of FOB value of exports, made in freely convertible currency. The credit shall be available against such products and at such rates as may be specified by DGFT by way of public notice issued in this behalf for import of raw material , intermediates, components, parts packaging materials.

• Validity : The DEPB shall be valid for a period of 12 months from the date of issue. • Transferability: The DEPB and/or the items imported against it are freely transferable. The transfer of DEPB shall however be for import at the port specified in the DEPB which shall be the port from where exports have been made. Imports from a port other than the port of export shall be allowed under TRA facility as per the terms and conditions of the notification issued by Department of Revenue.

• Validity : The DEPB shall be valid for a period of 12 months from the date of issue. • Transferability: The DEPB and/or the items imported against it are freely transferable. The transfer of DEPB shall however be for import at the port specified in the DEPB which shall be the port from where exports have been made. Imports from a port other than the port of export shall be allowed under TRA facility as per the terms and conditions of the notification issued by Department of Revenue.

• Applicability of Drawback: The exports made under the DEPB Scheme shall not be entitled for drawback. However, the additional customs duty paid in cash on inputs under DEPB shall be adjusted as CENVAT Credit or Duty Drawback as per rules framed by the Dept of Revenue. In cases, where the Additional Customs Duty is adjusted from DEPB, no benefit of CENVAT/Drawback shall be admissible.

• Applicability of Drawback: The exports made under the DEPB Scheme shall not be entitled for drawback. However, the additional customs duty paid in cash on inputs under DEPB shall be adjusted as CENVAT Credit or Duty Drawback as per rules framed by the Dept of Revenue. In cases, where the Additional Customs Duty is adjusted from DEPB, no benefit of CENVAT/Drawback shall be admissible.

Documents required for DEPB License • • • IE code certificate copy. RCMC or FIEO Digital key and password (DGFT) Invoice Packing list EP copy Shipping bill Mat receipt Number Letterhead 6 sheets SSI Certificate(Manufacturers only)

Documents required for DEPB License • • • IE code certificate copy. RCMC or FIEO Digital key and password (DGFT) Invoice Packing list EP copy Shipping bill Mat receipt Number Letterhead 6 sheets SSI Certificate(Manufacturers only)

• Exporters are required to use appropriate shipping bills to get benefit under DEPB scheme. • Valid for period of 24 months. • Admissible only after the realisation of export proceeds. • Merchant exporters /Manufacturer Exporter • Can apply within 180 days-from the days of export/Within 90 days from the date of realisation.

• Exporters are required to use appropriate shipping bills to get benefit under DEPB scheme. • Valid for period of 24 months. • Admissible only after the realisation of export proceeds. • Merchant exporters /Manufacturer Exporter • Can apply within 180 days-from the days of export/Within 90 days from the date of realisation.

DGFT Aayaat Niryaat Form section wise of year 2009 - 2014 Index of ANF. docx

DGFT Aayaat Niryaat Form section wise of year 2009 - 2014 Index of ANF. docx

Application for DEPB • An application for grant of credit under DEPB rates may be made to Regional Authority concerned in form ANF 4 G along with prescribed documents. • Agency commission shall be allowed for DEPB entitlement up to 12. 5% of FOB value only. FOB value in free foreign exchange shall be converted into Indian rupees as per exchange rate for exports, notified by Ministry of Finance, as applicable on the date of order of "Let Export" by Customs. • In respect of consignment exports wherein exporter has declared FOB value on a provisional basis, exporter shall be eligible for final assessment of such shipping bill based on actual FOB realized upon sale of such goods in freely convertible currency.

Application for DEPB • An application for grant of credit under DEPB rates may be made to Regional Authority concerned in form ANF 4 G along with prescribed documents. • Agency commission shall be allowed for DEPB entitlement up to 12. 5% of FOB value only. FOB value in free foreign exchange shall be converted into Indian rupees as per exchange rate for exports, notified by Ministry of Finance, as applicable on the date of order of "Let Export" by Customs. • In respect of consignment exports wherein exporter has declared FOB value on a provisional basis, exporter shall be eligible for final assessment of such shipping bill based on actual FOB realized upon sale of such goods in freely convertible currency.

DEPB Application Form Appendix

DEPB Application Form Appendix

Re-export of goods imported under DEPB Scheme • In case of return of any exported goods, which has been found defective or unfit for use may be again exported according to the EXIM guidelines as mentioned by the Department of Revenue. • In such cases 98% of the credit amount debited against DEPB for the export of such goods is generated by the concerned Commissioner of Customs in the form of a Certificate, containing the amount generated and the details of the original DEPB. On the basis of certificate, a fresh DEPB is issued by the concerned DGFT Regional Authority. It is important to note that the issued DEPB have the same port of registration and shall be valid for a period equivalent to the balance period available on the date of import of such defective/unfit goods.

Re-export of goods imported under DEPB Scheme • In case of return of any exported goods, which has been found defective or unfit for use may be again exported according to the EXIM guidelines as mentioned by the Department of Revenue. • In such cases 98% of the credit amount debited against DEPB for the export of such goods is generated by the concerned Commissioner of Customs in the form of a Certificate, containing the amount generated and the details of the original DEPB. On the basis of certificate, a fresh DEPB is issued by the concerned DGFT Regional Authority. It is important to note that the issued DEPB have the same port of registration and shall be valid for a period equivalent to the balance period available on the date of import of such defective/unfit goods.

Special Economic Zones in India - An overview of Statutory provisions ©Rajkumar S. Adukia 51

Special Economic Zones in India - An overview of Statutory provisions ©Rajkumar S. Adukia 51

Role of SEZ s In Indian Economy • • To provide internationally competitive environment To increase share in global exports To encourage FDI and enhance GDP To Generate Employment opportunities 52

Role of SEZ s In Indian Economy • • To provide internationally competitive environment To increase share in global exports To encourage FDI and enhance GDP To Generate Employment opportunities 52

Overview • SEZ are delineated duty-free enclaves treated as a foreign territory for the purpose of trade operations, Duties and tariffs • Developed in the public, private or joint sectors, or by the State Governments or any person for manufacture of goods or rendering services or both or as a FTWZ • Import / export operations of the SEZ units on selfcertification basis. • SEZ units have to be a net foreign exchange earner 53

Overview • SEZ are delineated duty-free enclaves treated as a foreign territory for the purpose of trade operations, Duties and tariffs • Developed in the public, private or joint sectors, or by the State Governments or any person for manufacture of goods or rendering services or both or as a FTWZ • Import / export operations of the SEZ units on selfcertification basis. • SEZ units have to be a net foreign exchange earner 53

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India Experience with EPZs - Starting with Kandla in 1965; SEEPZ in 1972, Based on reviews of working, Cochin, Falta, Madras (Chennai) and NOIDA in 1984 and Vizag in 1989 Very limited impact Less than 40% of approvals fructified - Rest cancelled or lapsed - Employed only 0. 01% of labour force FDI was less than 20% of total investment Accounted for less than 4% of exports. Net export much lower as imports were over 60% of exports

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India Experience with EPZs - Starting with Kandla in 1965; SEEPZ in 1972, Based on reviews of working, Cochin, Falta, Madras (Chennai) and NOIDA in 1984 and Vizag in 1989 Very limited impact Less than 40% of approvals fructified - Rest cancelled or lapsed - Employed only 0. 01% of labour force FDI was less than 20% of total investment Accounted for less than 4% of exports. Net export much lower as imports were over 60% of exports

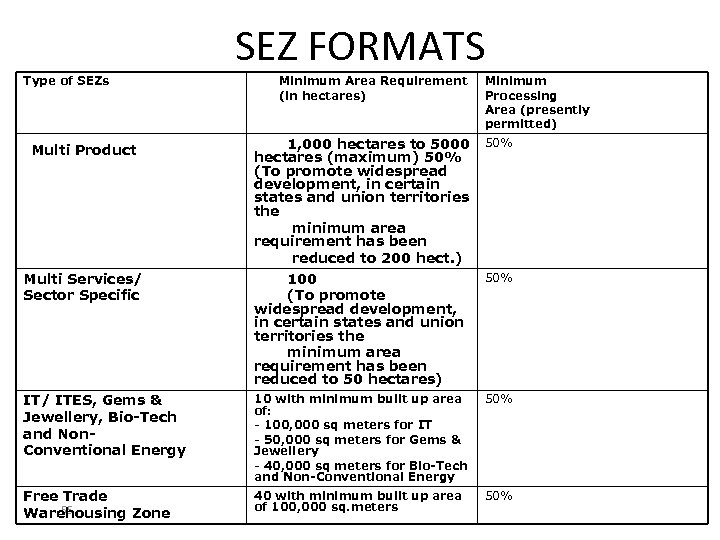

SEZ FORMATS Type of SEZs Minimum Area Requirement (in hectares) Minimum Processing Area (presently permitted) 1, 000 hectares to 5000 hectares (maximum) 50% (To promote widespread development, in certain states and union territories the minimum area requirement has been reduced to 200 hect. ) 100 (To promote widespread development, in certain states and union territories the minimum area requirement has been reduced to 50 hectares) 50% IT/ ITES, Gems & Jewellery, Bio-Tech and Non. Conventional Energy 10 with minimum built up area of: - 100, 000 sq meters for IT - 50, 000 sq meters for Gems & Jewellery - 40, 000 sq meters for Bio-Tech and Non-Conventional Energy 50% Free Trade 55 Warehousing Zone 40 with minimum built up area of 100, 000 sq. meters 50% Multi Product Multi Services/ Sector Specific 50%

SEZ FORMATS Type of SEZs Minimum Area Requirement (in hectares) Minimum Processing Area (presently permitted) 1, 000 hectares to 5000 hectares (maximum) 50% (To promote widespread development, in certain states and union territories the minimum area requirement has been reduced to 200 hect. ) 100 (To promote widespread development, in certain states and union territories the minimum area requirement has been reduced to 50 hectares) 50% IT/ ITES, Gems & Jewellery, Bio-Tech and Non. Conventional Energy 10 with minimum built up area of: - 100, 000 sq meters for IT - 50, 000 sq meters for Gems & Jewellery - 40, 000 sq meters for Bio-Tech and Non-Conventional Energy 50% Free Trade 55 Warehousing Zone 40 with minimum built up area of 100, 000 sq. meters 50% Multi Product Multi Services/ Sector Specific 50%

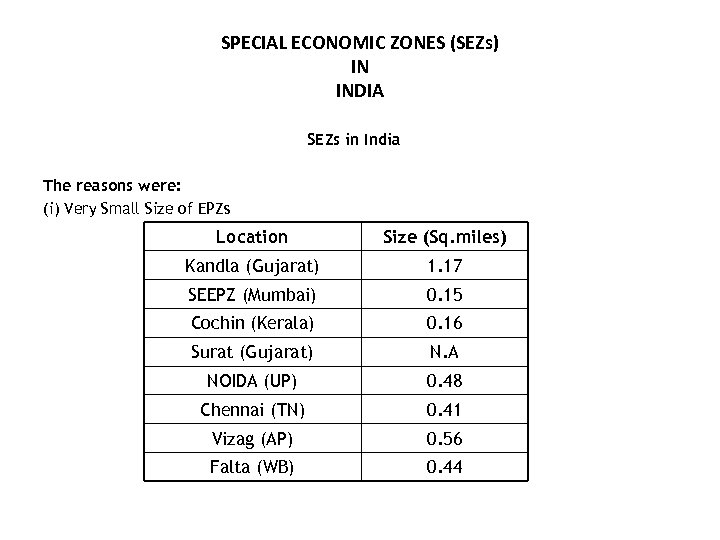

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India The reasons were: (i) Very Small Size of EPZs Location Size (Sq. miles) Kandla (Gujarat) 1. 17 SEEPZ (Mumbai) 0. 15 Cochin (Kerala) 0. 16 Surat (Gujarat) N. A NOIDA (UP) 0. 48 Chennai (TN) 0. 41 Vizag (AP) 0. 56 Falta (WB) 0. 44

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India The reasons were: (i) Very Small Size of EPZs Location Size (Sq. miles) Kandla (Gujarat) 1. 17 SEEPZ (Mumbai) 0. 15 Cochin (Kerala) 0. 16 Surat (Gujarat) N. A NOIDA (UP) 0. 48 Chennai (TN) 0. 41 Vizag (AP) 0. 56 Falta (WB) 0. 44

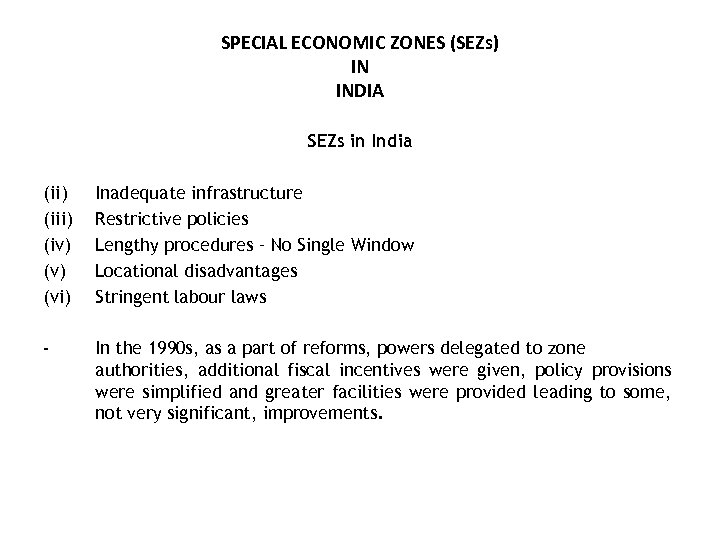

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India (ii) (iv) (vi) Inadequate infrastructure Restrictive policies Lengthy procedures – No Single Window Locational disadvantages Stringent labour laws - In the 1990 s, as a part of reforms, powers delegated to zone authorities, additional fiscal incentives were given, policy provisions were simplified and greater facilities were provided leading to some, not very significant, improvements.

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZs in India (ii) (iv) (vi) Inadequate infrastructure Restrictive policies Lengthy procedures – No Single Window Locational disadvantages Stringent labour laws - In the 1990 s, as a part of reforms, powers delegated to zone authorities, additional fiscal incentives were given, policy provisions were simplified and greater facilities were provided leading to some, not very significant, improvements.

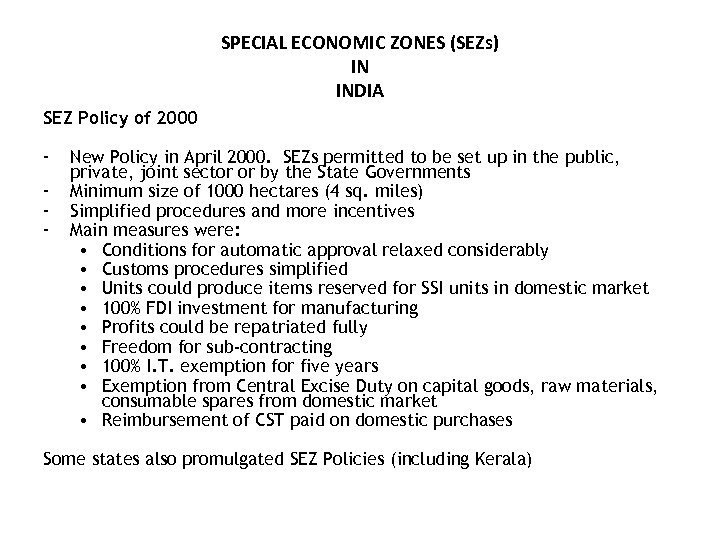

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZ Policy of 2000 - New Policy in April 2000. SEZs permitted to be set up in the public, private, joint sector or by the State Governments Minimum size of 1000 hectares (4 sq. miles) Simplified procedures and more incentives Main measures were: • Conditions for automatic approval relaxed considerably • Customs procedures simplified • Units could produce items reserved for SSI units in domestic market • 100% FDI investment for manufacturing • Profits could be repatriated fully • Freedom for sub-contracting • 100% I. T. exemption for five years • Exemption from Central Excise Duty on capital goods, raw materials, consumable spares from domestic market • Reimbursement of CST paid on domestic purchases Some states also promulgated SEZ Policies (including Kerala)

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA SEZ Policy of 2000 - New Policy in April 2000. SEZs permitted to be set up in the public, private, joint sector or by the State Governments Minimum size of 1000 hectares (4 sq. miles) Simplified procedures and more incentives Main measures were: • Conditions for automatic approval relaxed considerably • Customs procedures simplified • Units could produce items reserved for SSI units in domestic market • 100% FDI investment for manufacturing • Profits could be repatriated fully • Freedom for sub-contracting • 100% I. T. exemption for five years • Exemption from Central Excise Duty on capital goods, raw materials, consumable spares from domestic market • Reimbursement of CST paid on domestic purchases Some states also promulgated SEZ Policies (including Kerala)

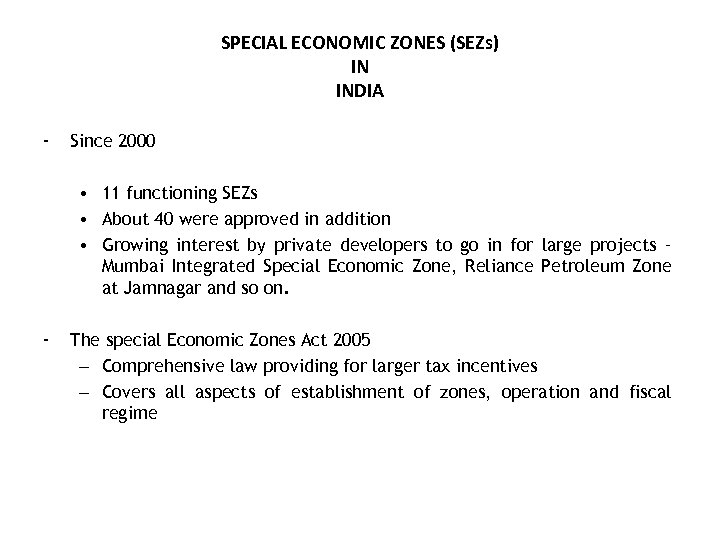

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA - Since 2000 • 11 functioning SEZs • About 40 were approved in addition • Growing interest by private developers to go in for large projects – Mumbai Integrated Special Economic Zone, Reliance Petroleum Zone at Jamnagar and so on. - The special Economic Zones Act 2005 – Comprehensive law providing for larger tax incentives – Covers all aspects of establishment of zones, operation and fiscal regime

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA - Since 2000 • 11 functioning SEZs • About 40 were approved in addition • Growing interest by private developers to go in for large projects – Mumbai Integrated Special Economic Zone, Reliance Petroleum Zone at Jamnagar and so on. - The special Economic Zones Act 2005 – Comprehensive law providing for larger tax incentives – Covers all aspects of establishment of zones, operation and fiscal regime

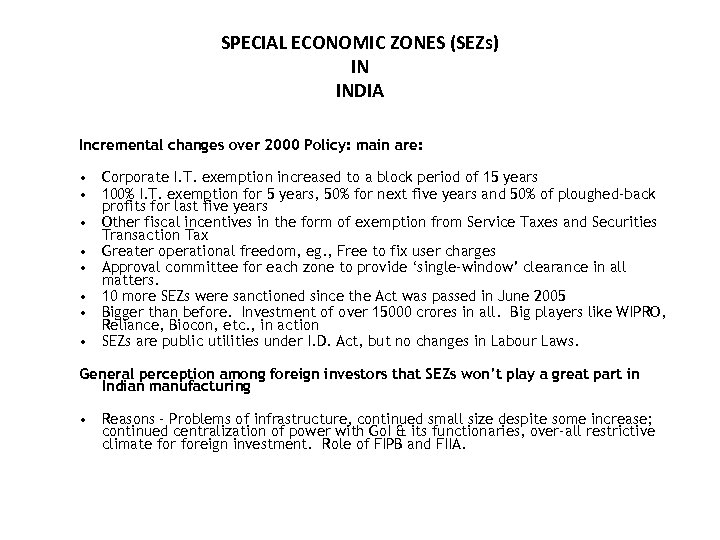

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA Incremental changes over 2000 Policy: main are: • Corporate I. T. exemption increased to a block period of 15 years • 100% I. T. exemption for 5 years, 50% for next five years and 50% of ploughed-back profits for last five years • Other fiscal incentives in the form of exemption from Service Taxes and Securities Transaction Tax • Greater operational freedom, eg. , Free to fix user charges • Approval committee for each zone to provide ‘single-window’ clearance in all matters. • 10 more SEZs were sanctioned since the Act was passed in June 2005 • Bigger than before. Investment of over 15000 crores in all. Big players like WIPRO, Reliance, Biocon, etc. , in action • SEZs are public utilities under I. D. Act, but no changes in Labour Laws. General perception among foreign investors that SEZs won’t play a great part in Indian manufacturing • Reasons – Problems of infrastructure, continued small size despite some increase; continued centralization of power with Go. I & its functionaries, over-all restrictive climate foreign investment. Role of FIPB and FIIA.

SPECIAL ECONOMIC ZONES (SEZs) IN INDIA Incremental changes over 2000 Policy: main are: • Corporate I. T. exemption increased to a block period of 15 years • 100% I. T. exemption for 5 years, 50% for next five years and 50% of ploughed-back profits for last five years • Other fiscal incentives in the form of exemption from Service Taxes and Securities Transaction Tax • Greater operational freedom, eg. , Free to fix user charges • Approval committee for each zone to provide ‘single-window’ clearance in all matters. • 10 more SEZs were sanctioned since the Act was passed in June 2005 • Bigger than before. Investment of over 15000 crores in all. Big players like WIPRO, Reliance, Biocon, etc. , in action • SEZs are public utilities under I. D. Act, but no changes in Labour Laws. General perception among foreign investors that SEZs won’t play a great part in Indian manufacturing • Reasons – Problems of infrastructure, continued small size despite some increase; continued centralization of power with Go. I & its functionaries, over-all restrictive climate foreign investment. Role of FIPB and FIIA.

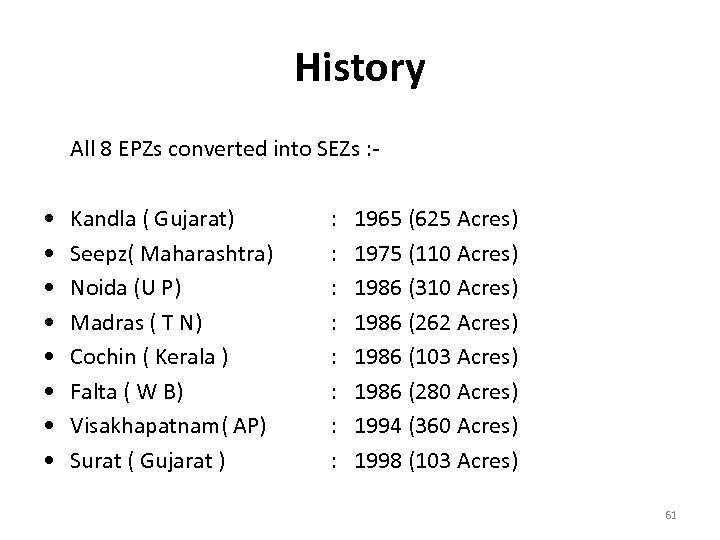

History All 8 EPZs converted into SEZs : - • • Kandla ( Gujarat) Seepz( Maharashtra) Noida (U P) Madras ( T N) Cochin ( Kerala ) Falta ( W B) Visakhapatnam( AP) Surat ( Gujarat ) : 1965 (625 Acres) : 1975 (110 Acres) : 1986 (310 Acres) : 1986 (262 Acres) : 1986 (103 Acres) : 1986 (280 Acres) : 1994 (360 Acres) : 1998 (103 Acres) 61

History All 8 EPZs converted into SEZs : - • • Kandla ( Gujarat) Seepz( Maharashtra) Noida (U P) Madras ( T N) Cochin ( Kerala ) Falta ( W B) Visakhapatnam( AP) Surat ( Gujarat ) : 1965 (625 Acres) : 1975 (110 Acres) : 1986 (310 Acres) : 1986 (262 Acres) : 1986 (103 Acres) : 1986 (280 Acres) : 1994 (360 Acres) : 1998 (103 Acres) 61

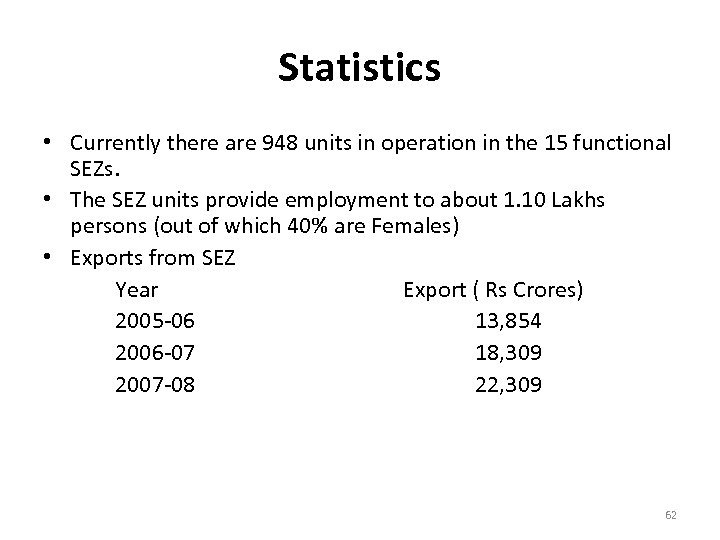

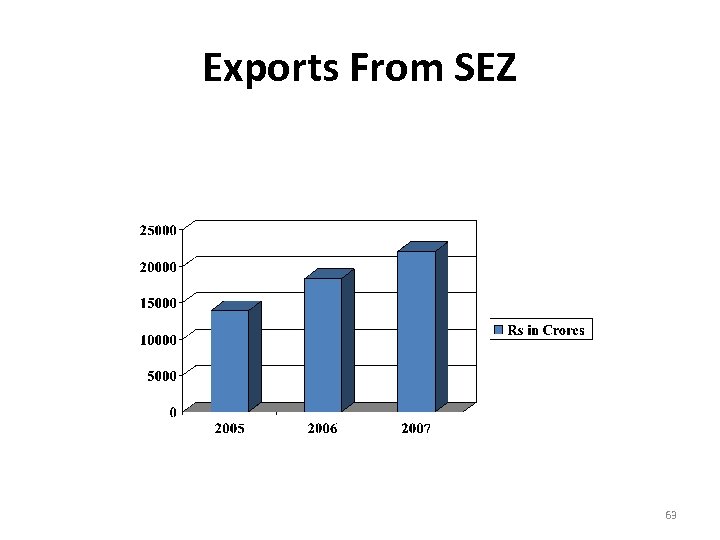

Statistics • Currently there are 948 units in operation in the 15 functional SEZs. • The SEZ units provide employment to about 1. 10 Lakhs persons (out of which 40% are Females) • Exports from SEZ Year Export ( Rs Crores) 2005 -06 13, 854 2006 -07 18, 309 2007 -08 22, 309 62

Statistics • Currently there are 948 units in operation in the 15 functional SEZs. • The SEZ units provide employment to about 1. 10 Lakhs persons (out of which 40% are Females) • Exports from SEZ Year Export ( Rs Crores) 2005 -06 13, 854 2006 -07 18, 309 2007 -08 22, 309 62

Exports From SEZ 63

Exports From SEZ 63

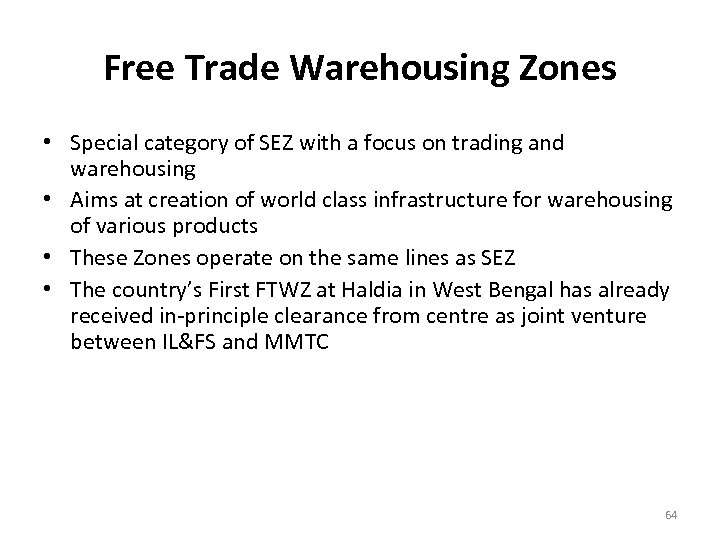

Free Trade Warehousing Zones • Special category of SEZ with a focus on trading and warehousing • Aims at creation of world class infrastructure for warehousing of various products • These Zones operate on the same lines as SEZ • The country’s First FTWZ at Haldia in West Bengal has already received in-principle clearance from centre as joint venture between IL&FS and MMTC 64

Free Trade Warehousing Zones • Special category of SEZ with a focus on trading and warehousing • Aims at creation of world class infrastructure for warehousing of various products • These Zones operate on the same lines as SEZ • The country’s First FTWZ at Haldia in West Bengal has already received in-principle clearance from centre as joint venture between IL&FS and MMTC 64

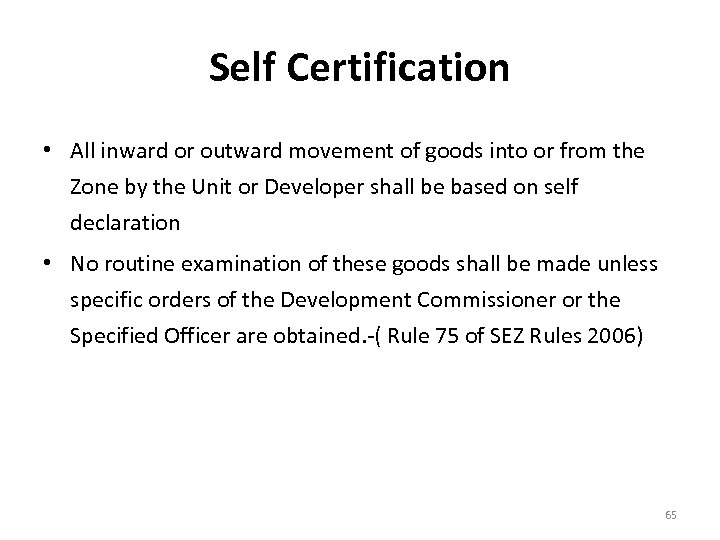

Self Certification • All inward or outward movement of goods into or from the Zone by the Unit or Developer shall be based on self declaration • No routine examination of these goods shall be made unless specific orders of the Development Commissioner or the Specified Officer are obtained. -( Rule 75 of SEZ Rules 2006) 65

Self Certification • All inward or outward movement of goods into or from the Zone by the Unit or Developer shall be based on self declaration • No routine examination of these goods shall be made unless specific orders of the Development Commissioner or the Specified Officer are obtained. -( Rule 75 of SEZ Rules 2006) 65

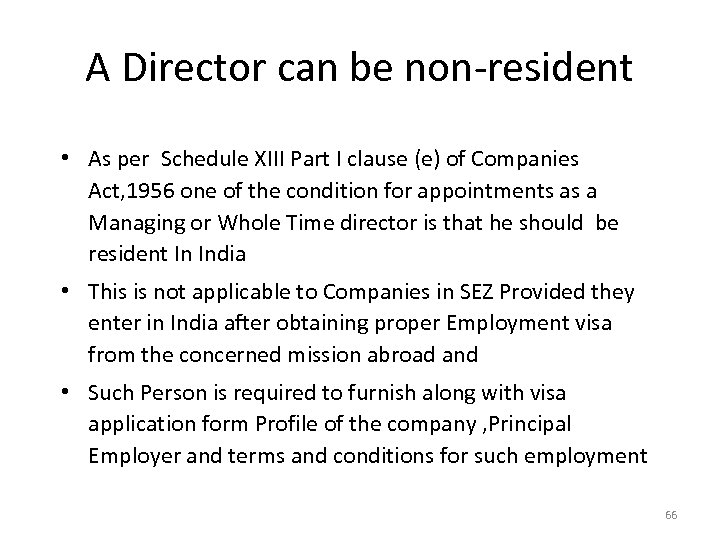

A Director can be non-resident • As per Schedule XIII Part I clause (e) of Companies Act, 1956 one of the condition for appointments as a Managing or Whole Time director is that he should be resident In India • This is not applicable to Companies in SEZ Provided they enter in India after obtaining proper Employment visa from the concerned mission abroad and • Such Person is required to furnish along with visa application form Profile of the company , Principal Employer and terms and conditions for such employment 66

A Director can be non-resident • As per Schedule XIII Part I clause (e) of Companies Act, 1956 one of the condition for appointments as a Managing or Whole Time director is that he should be resident In India • This is not applicable to Companies in SEZ Provided they enter in India after obtaining proper Employment visa from the concerned mission abroad and • Such Person is required to furnish along with visa application form Profile of the company , Principal Employer and terms and conditions for such employment 66

Laws applicable 67

Laws applicable 67

Laws applicable to SEZ • Concept of SEZ was first introduced in EXIM Policy ( now termed as Foreign Trade policy) announced on 31 st March 2000 by Government of India • Chapter 7 of Foreign Trade policy and Chapter 7 of Handbook of procedures ( as amended on 07/04/2006 w. e. f 01 -04 -2006) state that policy relating to SEZ is governed by SEZ 2005 and rules framed there under • The SEZ Act 2005 and SEZ Rules, 2006 came into effect from 10 th February 2006 68

Laws applicable to SEZ • Concept of SEZ was first introduced in EXIM Policy ( now termed as Foreign Trade policy) announced on 31 st March 2000 by Government of India • Chapter 7 of Foreign Trade policy and Chapter 7 of Handbook of procedures ( as amended on 07/04/2006 w. e. f 01 -04 -2006) state that policy relating to SEZ is governed by SEZ 2005 and rules framed there under • The SEZ Act 2005 and SEZ Rules, 2006 came into effect from 10 th February 2006 68

Laws applicable to SEZ • Foreign trade (Development and Regulation) Act, 1992 • Foreign Exchange Management Act, 1999 • Special Economic Zones Act, 2005 • Special Economic Zones Rules, 2006 Note: An amendment has been made in the Special Economic Zones Rules by way of -The Special economic Zones (Amendment) Rules, 2006 which came into force on 10. 08. 2006 69

Laws applicable to SEZ • Foreign trade (Development and Regulation) Act, 1992 • Foreign Exchange Management Act, 1999 • Special Economic Zones Act, 2005 • Special Economic Zones Rules, 2006 Note: An amendment has been made in the Special Economic Zones Rules by way of -The Special economic Zones (Amendment) Rules, 2006 which came into force on 10. 08. 2006 69

State SEZ Policy Ø Some States have also come out with their own SEZ Policy and /or SEZ Act Ø SEZ Policy Provide inter alia provide for • Exemption from state sales tax /VAT and other state levies • Exemption from electricity duty • Single window approval for state level clearances • Declaration of Development Commissioner as Labour Commissioner under the Industrial Disputes Act. • Simplification of returns and inspection systems. 70

State SEZ Policy Ø Some States have also come out with their own SEZ Policy and /or SEZ Act Ø SEZ Policy Provide inter alia provide for • Exemption from state sales tax /VAT and other state levies • Exemption from electricity duty • Single window approval for state level clearances • Declaration of Development Commissioner as Labour Commissioner under the Industrial Disputes Act. • Simplification of returns and inspection systems. 70

Tax Framework 71

Tax Framework 71

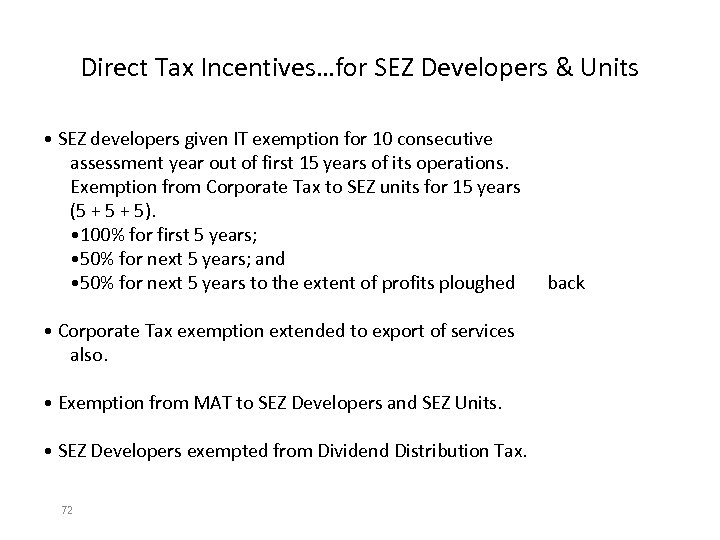

Direct Tax Incentives…for SEZ Developers & Units • SEZ developers given IT exemption for 10 consecutive assessment year out of first 15 years of its operations. Exemption from Corporate Tax to SEZ units for 15 years (5 + 5). • 100% for first 5 years; • 50% for next 5 years; and • 50% for next 5 years to the extent of profits ploughed • Corporate Tax exemption extended to export of services also. • Exemption from MAT to SEZ Developers and SEZ Units. • SEZ Developers exempted from Dividend Distribution Tax. 72 back

Direct Tax Incentives…for SEZ Developers & Units • SEZ developers given IT exemption for 10 consecutive assessment year out of first 15 years of its operations. Exemption from Corporate Tax to SEZ units for 15 years (5 + 5). • 100% for first 5 years; • 50% for next 5 years; and • 50% for next 5 years to the extent of profits ploughed • Corporate Tax exemption extended to export of services also. • Exemption from MAT to SEZ Developers and SEZ Units. • SEZ Developers exempted from Dividend Distribution Tax. 72 back

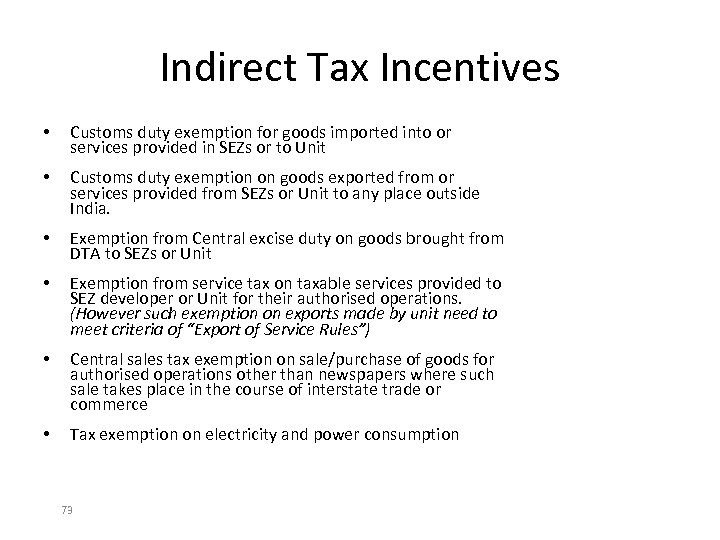

Indirect Tax Incentives • Customs duty exemption for goods imported into or services provided in SEZs or to Unit • Customs duty exemption on goods exported from or services provided from SEZs or Unit to any place outside India. • Exemption from Central excise duty on goods brought from DTA to SEZs or Unit • Exemption from service tax on taxable services provided to SEZ developer or Unit for their authorised operations. (However such exemption on exports made by unit need to meet criteria of “Export of Service Rules”) • Central sales tax exemption on sale/purchase of goods for authorised operations other than newspapers where such sale takes place in the course of interstate trade or commerce • Tax exemption on electricity and power consumption 73

Indirect Tax Incentives • Customs duty exemption for goods imported into or services provided in SEZs or to Unit • Customs duty exemption on goods exported from or services provided from SEZs or Unit to any place outside India. • Exemption from Central excise duty on goods brought from DTA to SEZs or Unit • Exemption from service tax on taxable services provided to SEZ developer or Unit for their authorised operations. (However such exemption on exports made by unit need to meet criteria of “Export of Service Rules”) • Central sales tax exemption on sale/purchase of goods for authorised operations other than newspapers where such sale takes place in the course of interstate trade or commerce • Tax exemption on electricity and power consumption 73

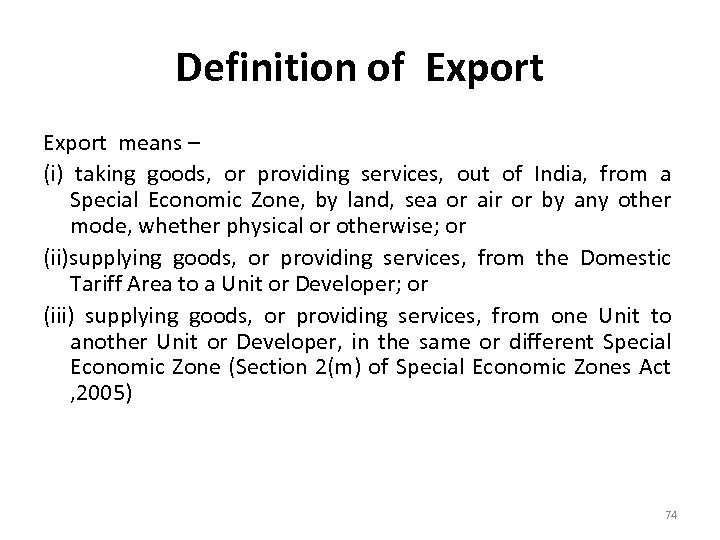

Definition of Export means – (i) taking goods, or providing services, out of India, from a Special Economic Zone, by land, sea or air or by any other mode, whether physical or otherwise; or (ii)supplying goods, or providing services, from the Domestic Tariff Area to a Unit or Developer; or (iii) supplying goods, or providing services, from one Unit to another Unit or Developer, in the same or different Special Economic Zone (Section 2(m) of Special Economic Zones Act , 2005) 74

Definition of Export means – (i) taking goods, or providing services, out of India, from a Special Economic Zone, by land, sea or air or by any other mode, whether physical or otherwise; or (ii)supplying goods, or providing services, from the Domestic Tariff Area to a Unit or Developer; or (iii) supplying goods, or providing services, from one Unit to another Unit or Developer, in the same or different Special Economic Zone (Section 2(m) of Special Economic Zones Act , 2005) 74

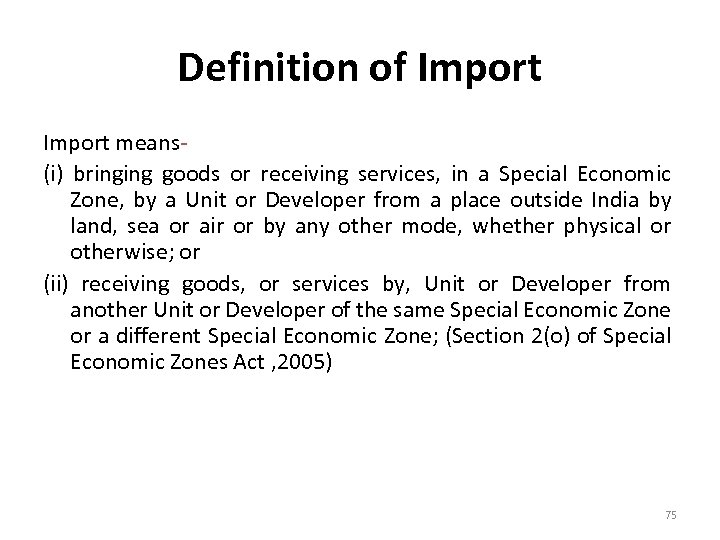

Definition of Import means(i) bringing goods or receiving services, in a Special Economic Zone, by a Unit or Developer from a place outside India by land, sea or air or by any other mode, whether physical or otherwise; or (ii) receiving goods, or services by, Unit or Developer from another Unit or Developer of the same Special Economic Zone or a different Special Economic Zone; (Section 2(o) of Special Economic Zones Act , 2005) 75

Definition of Import means(i) bringing goods or receiving services, in a Special Economic Zone, by a Unit or Developer from a place outside India by land, sea or air or by any other mode, whether physical or otherwise; or (ii) receiving goods, or services by, Unit or Developer from another Unit or Developer of the same Special Economic Zone or a different Special Economic Zone; (Section 2(o) of Special Economic Zones Act , 2005) 75

Administrative set up for SEZs 76

Administrative set up for SEZs 76

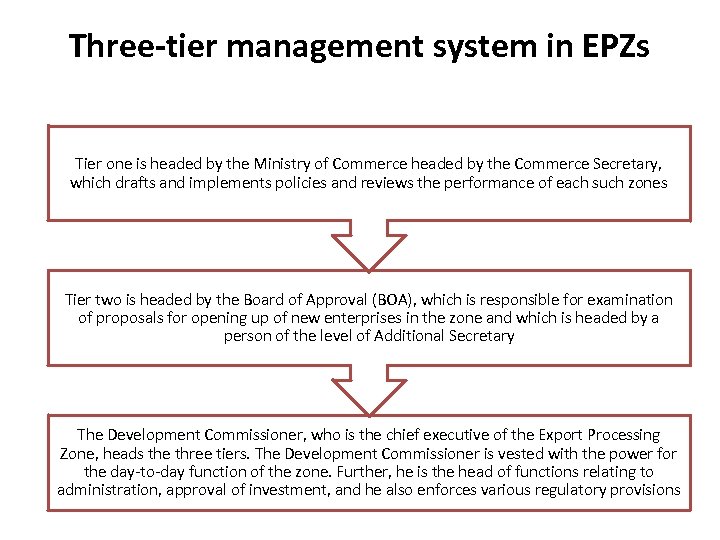

Administrative set up for SEZs 1) 2) 3) Board of approval is apex body in department Each Zone is headed by Development Commissioner who is also heading approval committee Approval Committee at the Zonal Level dealing with approval of units in SEZ and other related issues 77

Administrative set up for SEZs 1) 2) 3) Board of approval is apex body in department Each Zone is headed by Development Commissioner who is also heading approval committee Approval Committee at the Zonal Level dealing with approval of units in SEZ and other related issues 77

Board of approval • Board has the duty to promote and ensure orderly development of SEZ • Special secretary to Government of India in Ministry of Commerce and industry, Department of Commerce is chairperson of Board • It consists of 18 members and a nominee of each state government concerned ( Notification No SO(195(E) dated 10/02/2006 and 314(E) dated 13/03/2006) 78

Board of approval • Board has the duty to promote and ensure orderly development of SEZ • Special secretary to Government of India in Ministry of Commerce and industry, Department of Commerce is chairperson of Board • It consists of 18 members and a nominee of each state government concerned ( Notification No SO(195(E) dated 10/02/2006 and 314(E) dated 13/03/2006) 78

Address of Board of approval Board of Approval SEZ Section Department of Commerce Ministry of Commerce and Industry Udyog Bhavan New Delhi – 110011 79

Address of Board of approval Board of Approval SEZ Section Department of Commerce Ministry of Commerce and Industry Udyog Bhavan New Delhi – 110011 79

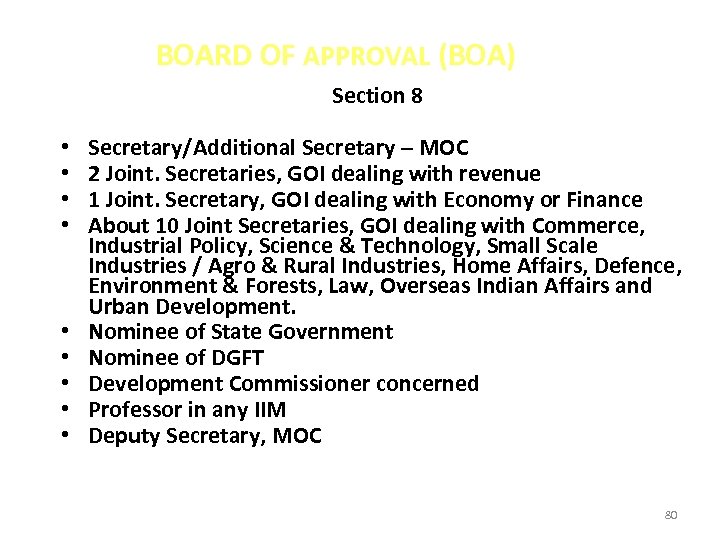

BOARD OF APPROVAL (BOA) Section 8 • • • Secretary/Additional Secretary – MOC 2 Joint. Secretaries, GOI dealing with revenue 1 Joint. Secretary, GOI dealing with Economy or Finance About 10 Joint Secretaries, GOI dealing with Commerce, Industrial Policy, Science & Technology, Small Scale Industries / Agro & Rural Industries, Home Affairs, Defence, Environment & Forests, Law, Overseas Indian Affairs and Urban Development. Nominee of State Government Nominee of DGFT Development Commissioner concerned Professor in any IIM Deputy Secretary, MOC 80

BOARD OF APPROVAL (BOA) Section 8 • • • Secretary/Additional Secretary – MOC 2 Joint. Secretaries, GOI dealing with revenue 1 Joint. Secretary, GOI dealing with Economy or Finance About 10 Joint Secretaries, GOI dealing with Commerce, Industrial Policy, Science & Technology, Small Scale Industries / Agro & Rural Industries, Home Affairs, Defence, Environment & Forests, Law, Overseas Indian Affairs and Urban Development. Nominee of State Government Nominee of DGFT Development Commissioner concerned Professor in any IIM Deputy Secretary, MOC 80

Approvals for Special economic zones Up to the end of October, 2008 the Board of Approval has given formal approval to 237 special economic zones and in principle approval to 166 special economic zones. 81

Approvals for Special economic zones Up to the end of October, 2008 the Board of Approval has given formal approval to 237 special economic zones and in principle approval to 166 special economic zones. 81

NEW CAP ON SEZs • The empowered Group of Ministers on Special Economic Zones, headed by the Defence Minister, Mr Pranab Mukherjee, decided on 23. 08. 2006 to remove the existing cap on the number of SEZs that can be established within the country. • Decided that approvals for new SEZs would resume only after 75 SEZs were made operational 82

NEW CAP ON SEZs • The empowered Group of Ministers on Special Economic Zones, headed by the Defence Minister, Mr Pranab Mukherjee, decided on 23. 08. 2006 to remove the existing cap on the number of SEZs that can be established within the country. • Decided that approvals for new SEZs would resume only after 75 SEZs were made operational 82

Approval Committee • Every SEZ has one approval committee • Approval Committee has 9 members • Development commissioner is Chairperson of Approval Committee 83

Approval Committee • Every SEZ has one approval committee • Approval Committee has 9 members • Development commissioner is Chairperson of Approval Committee 83

Monitoring of performance 84

Monitoring of performance 84

Performance reports- Rule 22(3) and (4) • The unit shall submit Annual performance reports in Form I to the development commissioner • The Developer shall submit Quarterly Report on import and procurement of goods from the Domestic Tariff Area, utilization of the same and the stock in hand, in Form E to the Development Commissioner and the Specified Officer Development Commissioner shall place both Form I and E before the Approval Committee 85

Performance reports- Rule 22(3) and (4) • The unit shall submit Annual performance reports in Form I to the development commissioner • The Developer shall submit Quarterly Report on import and procurement of goods from the Domestic Tariff Area, utilization of the same and the stock in hand, in Form E to the Development Commissioner and the Specified Officer Development Commissioner shall place both Form I and E before the Approval Committee 85

Monitoring of performance • Performance of the Unit shall be monitored by the Approval Committee as per the guidelines given in Annexure appended to the rules. • In case the Approval Committee come to the conclusion that a Unit has not Ø achieved positive Net Foreign Exchange Earning Ø failed to abide by any of the terms and conditions of the Letter of Approval or Bond-cum-Legal Undertaking • the said Unit shall be liable for penal action under the provisions of the Foreign Trade (Development and Regulation) Act, 1992 ( Rule 54 of SEZ Rules 2006) 86

Monitoring of performance • Performance of the Unit shall be monitored by the Approval Committee as per the guidelines given in Annexure appended to the rules. • In case the Approval Committee come to the conclusion that a Unit has not Ø achieved positive Net Foreign Exchange Earning Ø failed to abide by any of the terms and conditions of the Letter of Approval or Bond-cum-Legal Undertaking • the said Unit shall be liable for penal action under the provisions of the Foreign Trade (Development and Regulation) Act, 1992 ( Rule 54 of SEZ Rules 2006) 86

Sub Contracting 87

Sub Contracting 87

Sub Contracting-Rule 41 • A Unit, may subcontract a part of its production or any production process, to Ø a unit(s) in the Domestic Tariff Area or Ø in a Special Economic Zone or Ø Export Oriented Unit or Ø a unit in Electronic Hardware Technology Park or Ø Software Technology Park unit or Ø Bio-technology Park unit with prior permission of the Specified Officer to be given on an annual basis 88

Sub Contracting-Rule 41 • A Unit, may subcontract a part of its production or any production process, to Ø a unit(s) in the Domestic Tariff Area or Ø in a Special Economic Zone or Ø Export Oriented Unit or Ø a unit in Electronic Hardware Technology Park or Ø Software Technology Park unit or Ø Bio-technology Park unit with prior permission of the Specified Officer to be given on an annual basis 88

Conditions for sub-contracting –Rule 41 (a) the finished goods requiring further processing or semifinished goods including studded jewellery, taken outside the Special Economic Zone for sub-contracting shall be brought back into Unit within 120 days or extended time (b) Wastage shall be permitted as per the wastage norms admissible under the Foreign Trade Policy read with the Handbook of Procedures (c) the value of the sub-contracted production of a Unit in any financial year shall not exceed the value of goods produced by the Unit within its own premises in the immediately preceding financial year: 89

Conditions for sub-contracting –Rule 41 (a) the finished goods requiring further processing or semifinished goods including studded jewellery, taken outside the Special Economic Zone for sub-contracting shall be brought back into Unit within 120 days or extended time (b) Wastage shall be permitted as per the wastage norms admissible under the Foreign Trade Policy read with the Handbook of Procedures (c) the value of the sub-contracted production of a Unit in any financial year shall not exceed the value of goods produced by the Unit within its own premises in the immediately preceding financial year: 89

Conditions for sub-contracting abroad –Rule 41(2) (a) sub-contracting charges shall be declared in the export declaration forms and invoices and other related documents; (b) the export proceeds shall be fully repatriated in favour of the Unit. 90

Conditions for sub-contracting abroad –Rule 41(2) (a) sub-contracting charges shall be declared in the export declaration forms and invoices and other related documents; (b) the export proceeds shall be fully repatriated in favour of the Unit. 90

Conditions -Sub-contracting for Domestic Tariff Area unit for export. Rule 43 (a) all the raw material including semi-finished goods and consumables including fuel shall be supplied by Domestic Tariff Area exporter; (b) finished goods shall be exported directly by the Unit on behalf of the Domestic Tariff Area exporter (c) export document shall be jointly in the name of Domestic Tariff Area exporter and the Unit (d) the Domestic Tariff Area exporter shall be eligible for refund of duty paid on the inputs by way of brand rate of duty drawback 91

Conditions -Sub-contracting for Domestic Tariff Area unit for export. Rule 43 (a) all the raw material including semi-finished goods and consumables including fuel shall be supplied by Domestic Tariff Area exporter; (b) finished goods shall be exported directly by the Unit on behalf of the Domestic Tariff Area exporter (c) export document shall be jointly in the name of Domestic Tariff Area exporter and the Unit (d) the Domestic Tariff Area exporter shall be eligible for refund of duty paid on the inputs by way of brand rate of duty drawback 91

Exit of Units • The SEZ Unit may opt out of Special Economic Zone with the approval of the Development Commissioner • Such exit shall be subject to payment of applicable duties on the imported or indigenous capital goods, raw materials, components, consumables , spares and finished goods in stock • If the unit has not achieved positive Net Foreign Exchange, the exit shall be subject to penalty that may be imposed under the Foreign Trade (Development and Regulation), Act, 1992 • The Unit shall continue to be treated a unit till the date of final exit. (Rule 74 of Special Economic Zones, 2006) 92

Exit of Units • The SEZ Unit may opt out of Special Economic Zone with the approval of the Development Commissioner • Such exit shall be subject to payment of applicable duties on the imported or indigenous capital goods, raw materials, components, consumables , spares and finished goods in stock • If the unit has not achieved positive Net Foreign Exchange, the exit shall be subject to penalty that may be imposed under the Foreign Trade (Development and Regulation), Act, 1992 • The Unit shall continue to be treated a unit till the date of final exit. (Rule 74 of Special Economic Zones, 2006) 92

Regulatory Framework – An overview SPECIFIC CONDITIONS: • Land in SEZ cannot be sold • Development Commissioner to demarcate processing area –subsequent to which proposals for setting up of units will be entertained • Only units with valid Letter of Approval from Development Commissioner can set up operations • Land may be allotted for development of infrastructure facilities for use by Units - specific approval may be obtained for lease of land for creation of facilities such as canteen, PCOs, first aid centres, creche, etc for exclusive use of unit • Only authorised persons with identity cards permitted to enter processing area 93

Regulatory Framework – An overview SPECIFIC CONDITIONS: • Land in SEZ cannot be sold • Development Commissioner to demarcate processing area –subsequent to which proposals for setting up of units will be entertained • Only units with valid Letter of Approval from Development Commissioner can set up operations • Land may be allotted for development of infrastructure facilities for use by Units - specific approval may be obtained for lease of land for creation of facilities such as canteen, PCOs, first aid centres, creche, etc for exclusive use of unit • Only authorised persons with identity cards permitted to enter processing area 93

Facts & Figures of SEZs as per 2008/2009 SEZ Export Growth Rises 36 Percent to Rs 904 Billion in FY 2008 -09 (Exports from special economic zones (SEZs) in the country have increased from Rs 66, 638 crore in 2007 -08 to Rs 90, 416 crore in 200809, registering a growth of 36 per cent. ) 1. 2. A total of 91 SEZs are making exports. Out of this 43 are IT/ITES and 13 multi product while 35 others are sector specific SEZs. The number of units in these SEZs total 2, 263. Special economic zones have provided employment to 3. 87 lakh persons on the whole, out of which 2. 53 lakh jobs are incremental employment generated after February 2006 when the SEZ Act has come into force, the release noted. 4. New generation SEZs, the release said, have created a tremendous local area impact in terms of direct employment, emergence of new activities, changes in consumption pattern and social life, human development facilities(such as for education, healthcare) etc, it added.

Facts & Figures of SEZs as per 2008/2009 SEZ Export Growth Rises 36 Percent to Rs 904 Billion in FY 2008 -09 (Exports from special economic zones (SEZs) in the country have increased from Rs 66, 638 crore in 2007 -08 to Rs 90, 416 crore in 200809, registering a growth of 36 per cent. ) 1. 2. A total of 91 SEZs are making exports. Out of this 43 are IT/ITES and 13 multi product while 35 others are sector specific SEZs. The number of units in these SEZs total 2, 263. Special economic zones have provided employment to 3. 87 lakh persons on the whole, out of which 2. 53 lakh jobs are incremental employment generated after February 2006 when the SEZ Act has come into force, the release noted. 4. New generation SEZs, the release said, have created a tremendous local area impact in terms of direct employment, emergence of new activities, changes in consumption pattern and social life, human development facilities(such as for education, healthcare) etc, it added.